What’s 🔥 in Enterprise IT/VC #450

ARRmageddon: The New Bar for AI Startups - faster than ever and bigger - choices to make as a founder...

There were a few charts published this week which summarize the state of the world quite well.

Agents, agents and more agents

First let’s start with YC - agents, agents, and more agents which now comprise of almost 50% of all startups in the latest batch.

ARR as leading metric for startups versus other proxies

Next up is the only metric that investors are talking about - ARR. Yes, lots of questions on what is actually annual recurring etc but the idea of users and time spent etc are all replaced with plain revenue.

This ties in nicely with what Patrick Collison’s post from earlier this week.

Since every startup is pretty much using Stripe, one could conclue a huge part of this growth comes from startups charging earlier and growing faster.

The new ARR bar for AI startups

Olivia Moore from a16z followed up with a deeper dive on revenue metrics:

These numbers are insane for sure especially when $0 to $1M ARR in 12 months was a high bar just a few years ago with Triple, Triple, Double, Double as a standard SaaS metric. But don’t fret as M1 stands for the first month you monetize.

You still have time to build the right way, but don’t take too long. I worry that the days of Clay (a boldstart portfolio co) like growth will disappear as folks won’t have the patience needed if a company takes 6 years before exploding and finding its Mojo (more from What’s 🔥 #430 on Clay’s 7 Year overnight success story.

More on the new ARR bar from an earlier post 6 months ago:

What’s 🔥 in Enterprise IT/VC #424

One other thought - on the “executing mad” side of the world, the elusive Triple-Triple-Double-Double used to be the gold standard for SaaS startups. My friend Neeraj Agrawal from Battery Ventures coined this term back in March 2015 - here’s the original post if interested. But based on the data points below, those days seem to be long over - perhaps we should have a new term for AI startups. I believe we’re entering the world of Quintuple-Quadruple-Triple-Double or QQTD or will it be QQ?? as we don’t know how strong the lock-in effects are and it’s too early to determine churn.

Here are a few words of advice for all of those founders who have raised their Inception/seed rounds and moving to Series A👇🏼:

As always, don’t just blindly over rotate to the zeitgeist because everyone is talking about it - do things your own way, but whatever you do, don’t get caught in the middle!

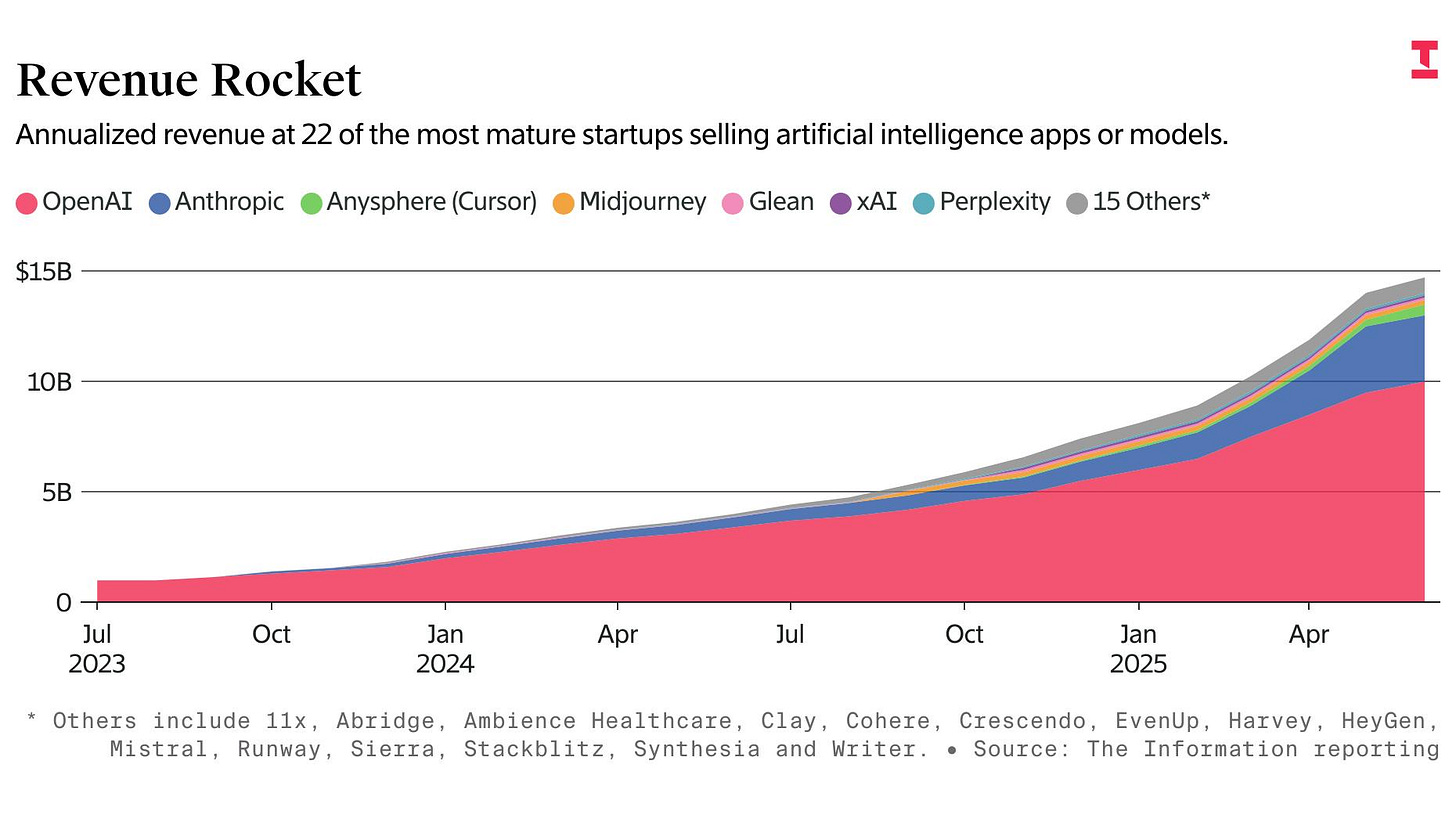

$15B for AI Native Startups

👇🏼 this eye popping chart from The Information is the opportunity ahead. We’ve never seen growth rates maintain at a scale like this ever in history as leaders like OpenAI are still doubling revenue from $5B to $10B 🤯 (FT).

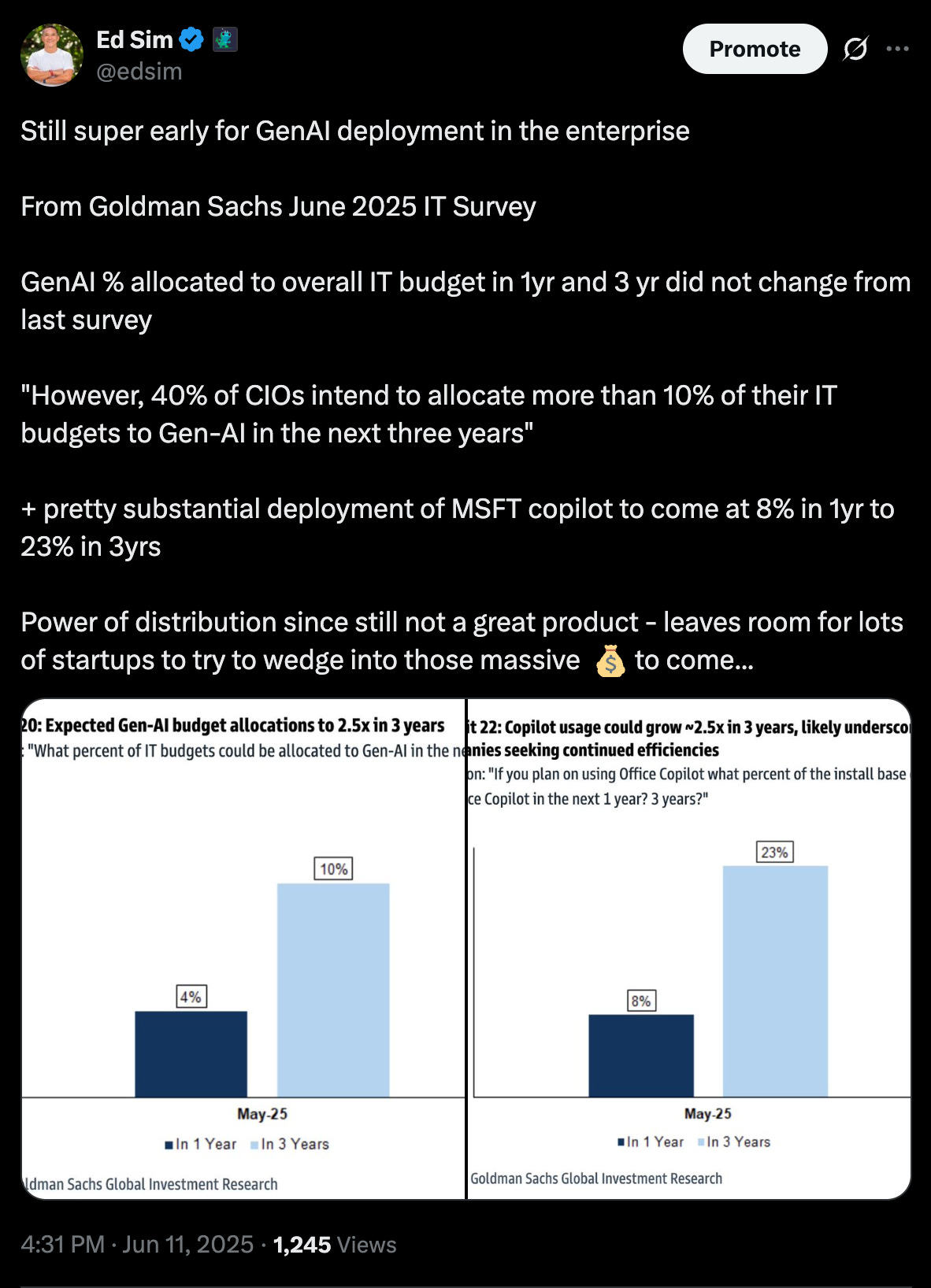

Expected GenAI IT budget allocation to grow 2.5x to 10% in next 3 years (Goldman Sachs)

Keep building 🏗️ as it’s still super early, especially in the enterprise and a reminder that some of the early winners today may not be the winners of tomorrow.

As always, 🙏🏻 for reading and please share with your friends and colleagues.

Scaling Startups

#💯

#🎯 comes in various shapes and sizes and different for different stages but “power” sums it up well - listen below 👇🏻

#👌🏼

#Jensen from Nvidia talks about it, the obsession and the pain, part of the founder journey to success

#👀 need to find right level of process as you scale, but 💯 less meetings better if folks can keep shipping and building and stay on same page - action>words and decks

#must read - Sam Altman’s latest essay - The Gentle Singularity

We (the whole industry, not just OpenAI) are building a brain for the world. It will be extremely personalized and easy for everyone to use; we will be limited by good ideas. For a long time, technical people in the startup industry have made fun of “the idea guys”; people who had an idea and were looking for a team to build it. It now looks to me like they are about to have their day in the sun.

Enterprise Tech

#Databricks in AI data infra market still maintaining solid growth at 50% YoY with expected ARR to hit $3.7B by July - not pure AI ARR like OpenAI but super impressive and will be an outstanding IPO to come (CNBC). Company has 8,000 employees which gives it an ARR/Headcount of $462,500

Databricks, a data analytics software vendor, said on Wednesday that it expects to generate $3.7 billion in annualized revenue by July, with year-over-year growth of 50%.

CFO Dave Conte delivered the numbers at a briefing for investors and analysts tied to the company’s Data and AI Summit in San Francisco on Wednesday. Growth in the October quarter was 60%, Databricks said in late 2024.

Databricks is one of the most highly valued tech startups, announcing in December that it raised $10 billion at a $62 billion valuation. Snowflake, its closest public market competitor, has a market cap of about $70 billion on annualized revenue of just over $4 billion, based on its latest quarter.

Databricks had $2.6 billion in revenue in its fiscal year that ended in January, with a net retention rate exceeding 140%, unchanged from last year. In the first quarter of the new fiscal year, nearly 50 of Databricks’ 15,000-plus customers were spending over $10 million annually, Conte said.#love this from Linear founder Karri Saarinen who just raised a new round at $1.25B led by Accel - build your own way, create your own playbook, a mantra I keep repeating like in last week’s issue

I believe that building companies is a kind of craft. You’re creating something one of a kind. It’s shaped by a very specific group of people, in a very specific moment in time. You can never really replicate that or manufacture it again. And for most founders, it will be the only company you’ll ever build. That makes how you build just as important as what you build. Therefore, the way you craft should be important to you, and not just a means to an end.

Across the industry, there’s a tendency to pattern-match successful companies and rely on templates, playbooks and benchmarks. While it’s not completely wrong, trying to fit a mold often means missing out on truly unique opportunities.

I’m glad we’ve been able to resist fitting the mold. I’m glad we’ve resisted “best practices.”

We’ve built Linear without running a single A/B test and without chasing metrics or looking to data for answers. We didn’t do SEO and growth hacks. We’ve grown the team slowly and intentionally. Linear operates profitably and remotely. We built strong technical foundations before finding product-market fit.

#Glean is an absolutely amazing company and just raised at $7.2B valuation 🤯 - just a reminder it’s built differently than a Cursor, for example, which is all bottoms up to enterprise with 60 employees and $500M ARR versus $100M ARR and 850 people for Glean

True top-down enterprise sales is expensive!

#if you don’t just want to be another CRUD database so everyone else’s agents can use your data, just block them - that’s what Salesforce is doing on its Slack API preventing Glean and others…(Reuters)

Salesforce in its May statement said it was "reinforcing safeguards around how data accessed via Slack APIs can be stored, used, and shared."

An API, or application programming interface, enables standardized communication, exchange of data and functionality between different software components or applications.

Since the Salesforce change, Glean and other applications can no longer index, copy or store the data they access via the Slack API on a long-term basis, The Information said.

Glean said the changes will prevent customers from adding Slack data to their Glean search index or knowledge graph, thereby "hampering your ability to use your data with your chosen enterprise AI platform," according to the report, which cited an email intended for Glean customers.#agents working together like cellular organisms - from John Foley at Zettabytes in a Q&A with Agentuity co-founder Jeff Haynie (a boldstart port co)

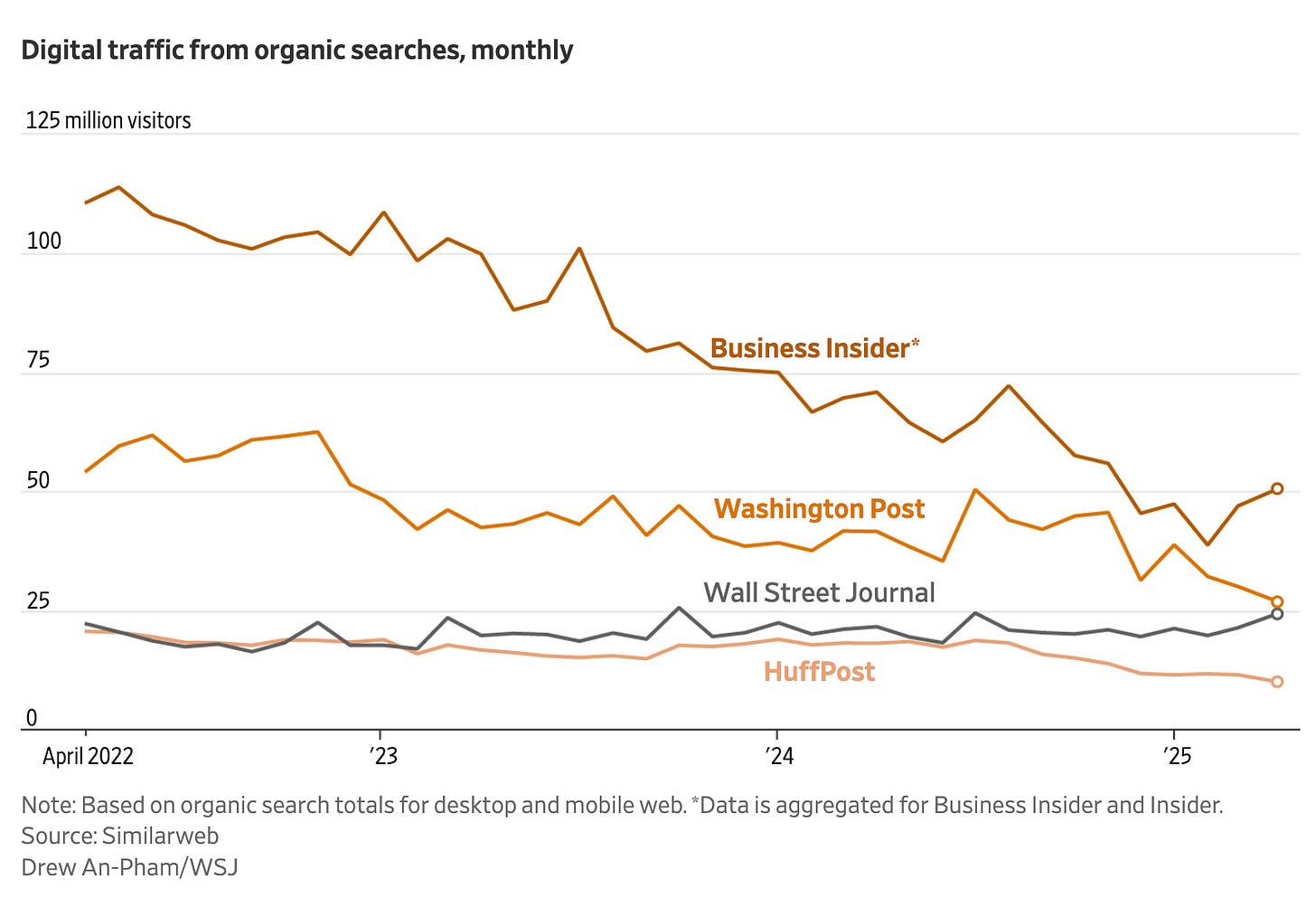

We’re going to have billions and eventually trillions of agents on the Internet that will be acting semi and fully autonomously and working together. That will look like cellular organisms, where they will be evolving, learning, building new skills and infrastructure. We think you need an agent-native cloud to support that infrastructure and those types of tools.#amazing how quickly traffic has 📉 from impact of AI becoming answer engines versus link providers

#the war for talent continues to escalate with Zuck personally leading the charge to catch up on AI - important to have a mission that new hires believe in - missionaries not mercenaries but this keeps escalating

#which leads to Meta’s $14B investment/purchase to avoid regulation of Scale AI to have Alexandr Wang lead Meta’s efforts to build Superintelligence (CNBC)

#Cursor’s tech stack from founder interview with Gergely

#crypto is back in a big way and the enterprises are coming

#crypto can’t scale without better security so super 🔥 up for Hypernative’s $40M Series B (we’re a proud partner from Inception) to be the real-time security layer for crypto

More from Gal Sagie, co-founder and CEO, below along with the announcement!

We just raised a $40M Series B at Hypernative.

We have hit milestones before - but this one feels different. Why?

Because Web3 is moving faster than any tech shift we’ve seen. And if it’s going to fulfil its promise, we must secure it.

Two years ago, we ran Ethereum’s transaction history through an ML model. The result? A system that could predict 98% of hacks - minutes before they happened.

That idea became Hypernative: the real-time security layer now protecting $100B+ in assets and over 200 projects. Without it, $2B+ could’ve been lost.

With this new round, we’re expanding:

→ Payment fraud detection and wallet-level transaction protection

→ Smarter, faster AI models

→ Scaling our team to meet growing demand#Runtime interview with Amazon Chief Security Officer Steve Schmidt - covers a ton of ground - Schmidt discussed the frequency and style of the attacks Amazon fends off every day, the capabilities that cybersecurity defenders can bring to bear thanks to generative AI, and the potential that machine-generated code could lead to the rise of a new class of software vulnerabilities.

#Schmidt definitely needs Snyk - big news this week as now added to official Cursor MCP Directory and is currently only security scanning service

#the magic is in the productivity gains - don’t want terrible customer support for hard earned customers

Markets

#are we back? Chime IPO (fintech) up 37% on first day of trading - down round from last funding at $25B post with IPO pricing at $11.6B but great to see the demand from institutional buyers hungry for new offerings (CNBC)

#for those on the cusp, great post from the CFO of Monday.com on what it takes to IPO and the journey and learnings from the process from Only CFO

Today, with IPO markets slowly reopening, and estimates suggesting that businesses need at least $500M+ in ARR to justify a $5B valuation, the bar has never been higher. The expectations are evolving. Unlike the Covid-era boom, public investors now demand operational efficiency, not just rapid growth –– which can be especially tough with the macroeconomic climate and volatile market still jittery with tariffs. For any CFO preparing to take their company public in this new environment, here are a few lessons that shaped our journey — and that I believe are critical for success.