What’s 🔥 in Enterprise IT/VC #424

SaaS T2D3 (Triple-Triple-Double-Double) over for now? Do we have a new AI bar - QQTD(Quintuple-Quadruple-Triple-Double) or QQ?? as we don't know if this is sustainable

I’m back from a long week in London visiting portfolio companies, meeting new founders, and speaking at a VC Summit hosted by one of our LPs, Vintage Investment Partners. The overall mood was electric 🔌 and when hanging with some of my peers in the VC industry, the question of insane valuations kept coming up. Are these sustainable and are they real? Or did we not learn from ZIRP?

Before sharing my thoughts, let's begin with an image from the streets of London – could there be a more perfect city to get you in the holiday spirit?

Speaking of the holiday spirit, let’s all be thankful for ServiceTitan’s IPO! This may be the holiday gift we all needed heading into 2025 - the 10X NTM multiple for a company losing money 🤔.

The lack of liquidity is a topic we certainly hit on the “State of Seed Panel” at the Vintage Summit. I believe this is me going down the rabbit hole discussing the barbell-ification of Inception rounds or seed, a topic I’ve written about extensively.

Either you have first-time founders who want to raise as little as possible to get started like a CrewAI in our portfolio - initial round of $2M before raising a total of $18M including the most recent Series A. Or you have second- and third-time founders raising, well, as much as they can to an extent - let’s call this the jumbo-ification of Inception with rounds >$10M and upwards of $20M+.

Smaller seed firms need to clearly pick a swim lane- do I compete on small rounds only or go head-to-head with the multistage firms leading these $8-10-20M rounds? Well, you know my answer - if you have the will and brand and experience, then by all means you should compete with the larger funds and back those second and third timers…as long as you think the valuation premium at Inception leads to that elusive, HUGE multi-fund returning outcome. If interested in deeper thoughts on this topic, check out the recent podcast I did on Turpentine VC with Erik Torenburg.

While not the destination and just part of the journey, the question on many founders’ and investors’ minds is are these massive A round valuations insane or justified and why are they happening? At the end of the day, it comes to down to belief - what is the evidence at this stage that will allow me to believe the outcomes 10+ years from now will be Ginormous - it’s either the people or the execution and when it’s both, then holy cow.

Since multistage firms are moving earlier and earlier in the lifecycle and aggressively racing to be first on the cap table, they can just come in at the A which is still early and pay up. Just look at the “bonkers” valuations from Pete Walker.

Whether this all becomes true in terms of real DPI and 100x liquidity is a question we will all have to learn over the next 5 to 10 years.

One other thought - on the “executing mad” side of the world, the elusive Triple-Triple-Double-Double used to be the gold standard for SaaS startups. My friend Neeraj Agrawal from Battery Ventures coined this term back in March 2015 - here’s the original post if interested. But based on the data points below, those days seem to be long over - perhaps we should have a new term for AI startups. I believe we’re entering the world of Quintuple-Quadruple-Triple-Double or QQTD or will it be QQ?? as we don’t know how strong the lock-in effects are and it’s too early to determine churn.

For example - growth "📈 but how sustainable? Bolt apparently getting term sheets at $1B post…

Or…

Or Anysphere - from $0-$4M-$48M in one of most competitive spaces for AI Coding Assistants

However, Cursor has become one of the most popular. Its developer, Anysphere, has seen its revenue grow from $4 million annualized recurring revenue (ARR) in April to $4 million a month as of last month, according to a person with direct knowledge of the company’s financials. The company is experiencing faster user adoption and growth compared to other coding assistant providers, another person said. (TechCrunch)Who’s right? IMO, this is the biggest question in venture - will these massive forward multiples be justified?

If 👇🏼 is true, how much of this 💰 is captured by startups - if AI is just eating into existing SaaS that's nice and a titanic reshuffling of revenue between cloud software companies, but if what Michael Dell says becomes reality, if agents can eat into labor, then we have a massive 📈 ahead.

Here’s an example - could agentic workflows and AI truly capture some of this labor value in cybersecurity (from Morgan Stanley December cybersecurity report)

Math is $374B of personnel spend for cybersecurity professionals globally of which 20-40% could be automated which means $75-150B of value and assuming 30% capture of productivity gain from AI equals $30B alone 🤯! Now multiply this across a number of industries and you get what Michael Dell is talking about.

Here’s more data to get you 🔥 up for an exciting 2025.

According to Morgan Stanley, the ROI from GenAI is real and even stronger the larger the company!

CrewAI shares some data here as well confirming the above - larger enterprises are moving faster and have 23% more cases already in production using the CrewAI framework! The urgency is there for agents!

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#👇🏼 must read - The Nvidia Way by Tae Kim - some great anecdotes and big bets made while avoiding bankruptcy many times

#💯

#great summary of what LPs (Limited Partners) who invest in venture funds

#what’s trending with YC and a16z - FWIW, as Inception investors we don’t presume to see the future - we need the technical founders to tell us what they see, usually born out of many years of pain that they finally decide to automate - seeing lots of amazing founders now…

#features that are remembered deliver are fun and delightful - Rahul from Superhuman (a portfolio co) shares how to build these

Enterprise Tech

#👇🏼 what’s ahead for LLMs from Ilya - watch this video

#pretty insane demo of Google Gemini 2.0

#must read for anyone building AI into their apps…how to do AI product management to maximize results and also prototype and test without engineers - click below for full post

#ways to price your AI Agents - FWIW Kustomer, a portfolio co, went to full “work-based pricing” with a price per conversation model - I still think way too early to tell what wins and will vary by industry and some of it becomes difficult to track like charging on a percentage of how much you save for someone…

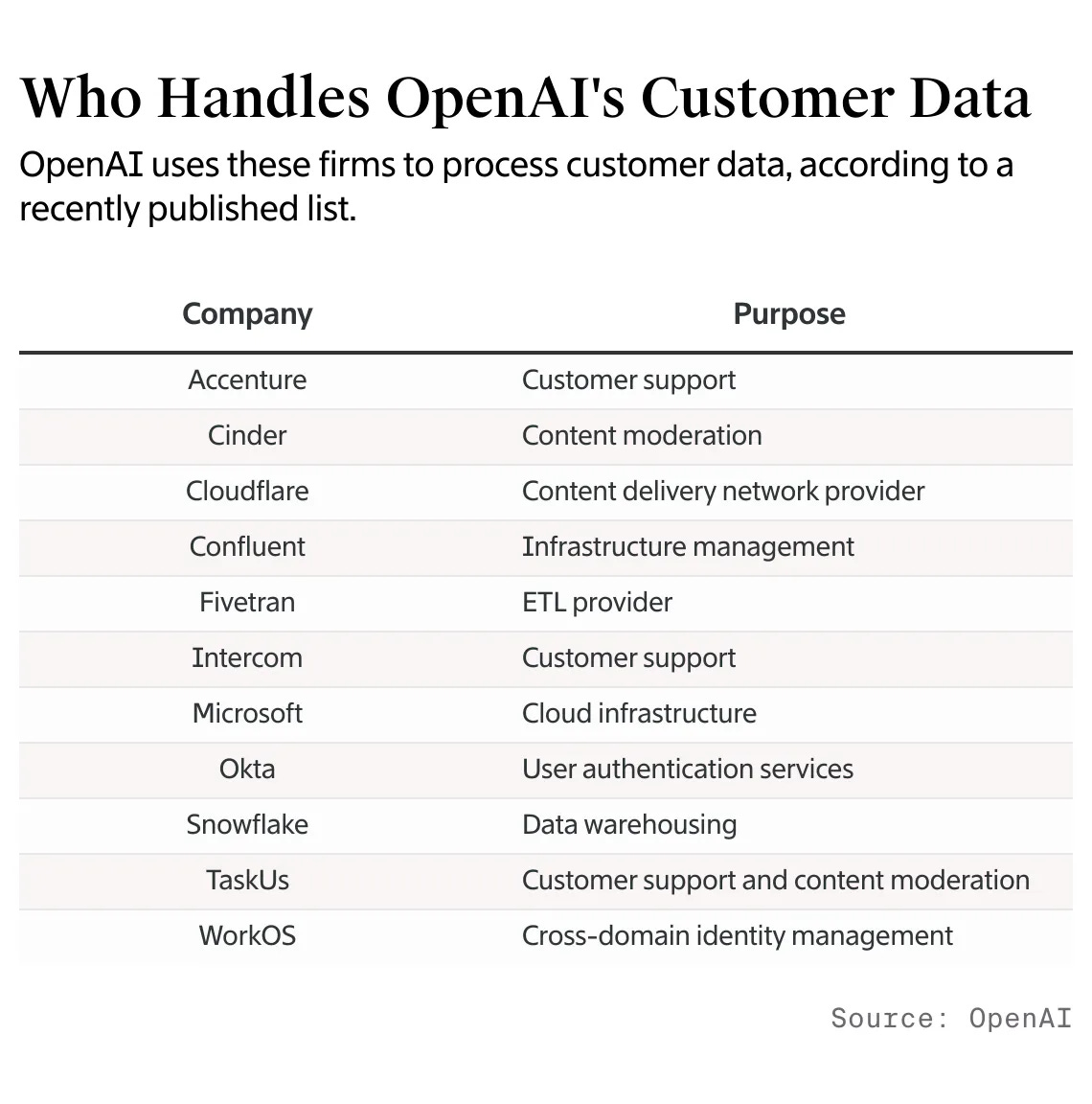

#OpenAI’s infra providers (The Information)

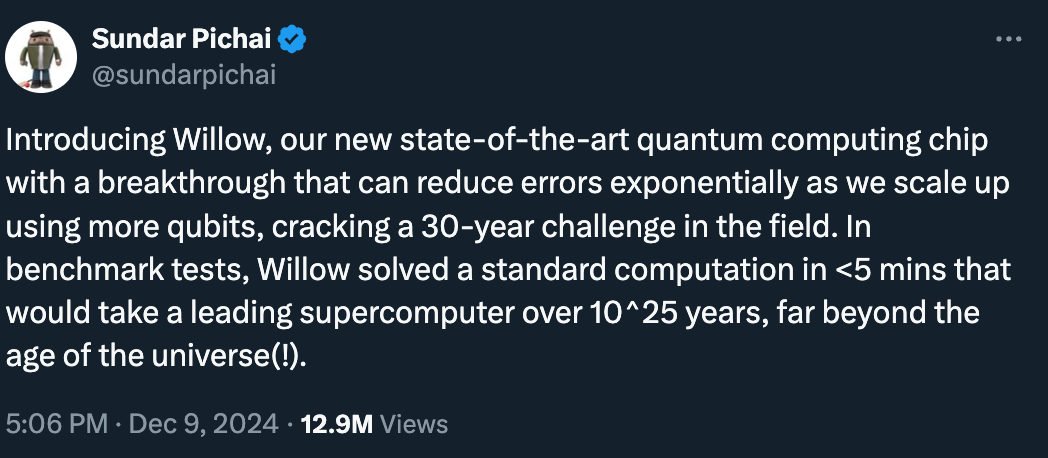

#👀 Google Quantum is here - “solved a standard computation in <5 mins that would take a leading supercomuter over 10^25 years, far beyond the age of the universe 🤯”

however, don’t be so alarmed

#Why Google lab is called Quantum AI - what’s in store for the future?

My colleagues sometimes ask me why I left the burgeoning field of AI to focus on quantum computing. My answer is that both will prove to be the most transformational technologies of our time, but advanced AI will significantly benefit from access to quantum computing. This is why I named our lab Quantum AI. Quantum algorithms have fundamental scaling laws on their side, as we’re seeing with RCS. There are similar scaling advantages for many foundational computational tasks that are essential for AI. So quantum computation will be indispensable for collecting training data that’s inaccessible to classical machines, training and optimizing certain learning architectures, and modeling systems where quantum effects are important. This includes helping us discover new medicines, designing more efficient batteries for electric cars, and accelerating progress in fusion and new energy alternatives. Many of these future game-changing applications won’t be feasible on classical computers; they’re waiting to be unlocked with quantum computing.#cloud security is 🔥 as Upwind raised $100M at a $900M valuation - what’s most interesting to me is the article says it is up 3X from the initial seed round implying a $300M post-money Inception round! Upwind, unlike the Wiz, is all about runtime protection versus just posture management but of course that has all changed as Wiz bought Dazz

In November, TechCrunch broke the news that cybersecurity startup Upwind was getting a lot of inbound interest to raise money on a big valuation. Now, we can confirm that the deal is done: Upwind has closed a Series A round of $100 million. The round values it at $900 million post-money.

The company has now raised $180 million, and this latest valuation triples the price tag it earned with its seed round.

Amiram Shachar, Upwind’s founder and CEO, believes the company’s focus on runtime alerts gives it a unique place among its competitors. Indeed, focusing on alerts alone is quickly becoming commoditized: Just last week, Wiz acquired Dazz to enhance its alert strike rate.

But it appears Upwind will also be extending its focus into more predictive alerts. In an interview, Shachar said some of the investment will be put toward “catching up with some of the fundamentals of cloud security.”

“By the end of this year, and then next year, we’ll be moving towards AI security and advanced prevention, going into code and dependencies in code, to bring even higher fidelity [to the platform],” he said. “This is where we’re going to go.”

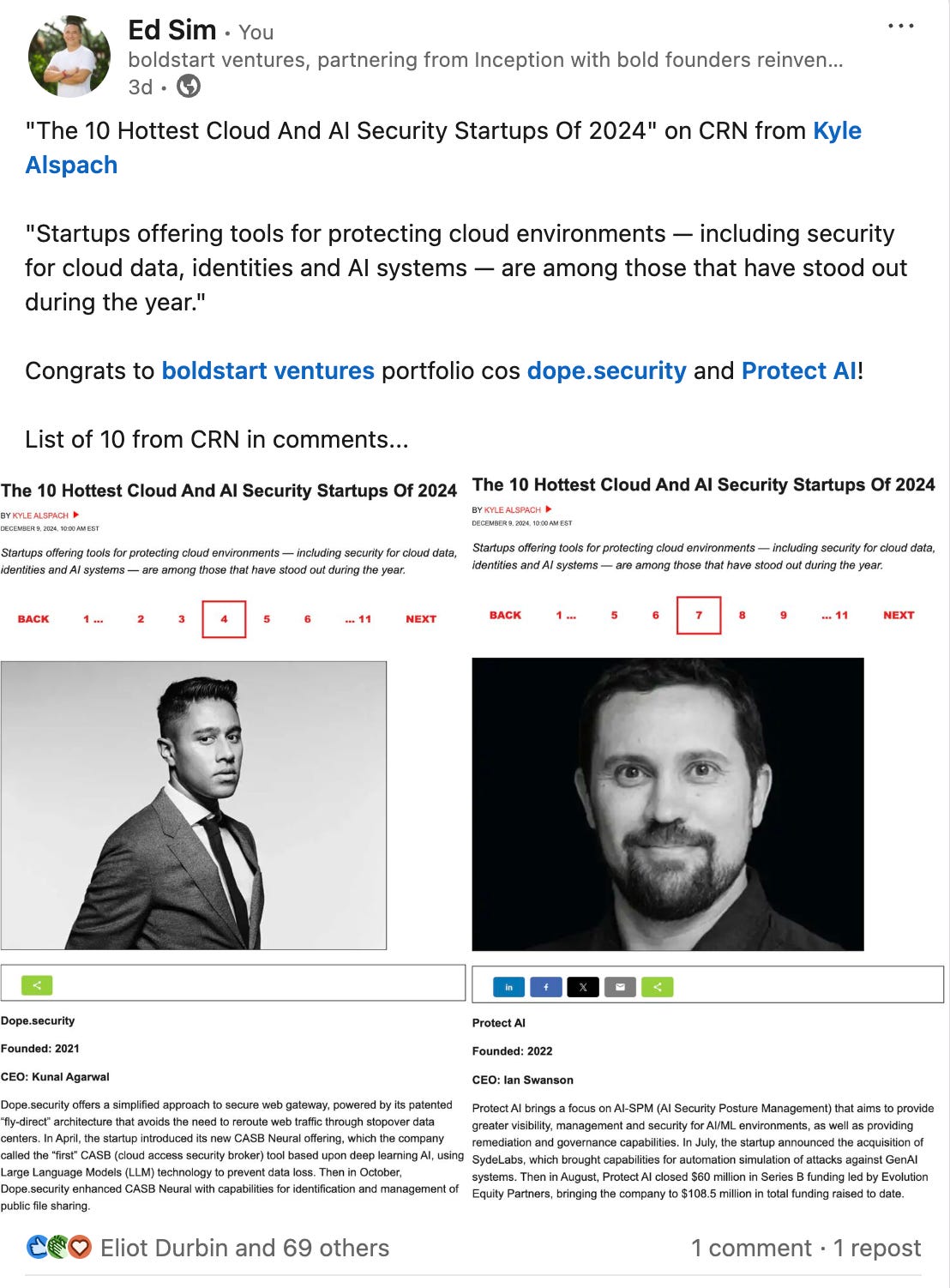

#Great list from CRN on 10 🔥 Cloud and AI Security Startup of 2024 - congrats to port cos Protect AI and dope.security

#how do AI coding assistant startups make 💰? Enterprises of course…here’s Codeium on some price changes and why enterprise means individual devs can get super cheap usage

For those new to the Codeium journey, there might be questions on how we plan on making money if we pass all the savings back to the developer. Unlike other AI IDE products, we have an entire B2B Enterprise arm to our company that is highly profitable. We hit eight figures in annual recurring revenue (ARR) for that business in less than a year. So unlike other AI IDEs who are trying to make money off the individual developer, that is just not our profit-making target. Just because we have seen success with Cascade doesn’t mean we are changing the pricing to now make quick money, we are just trying to make sure this B2C side of the business doesn’t financially sink us.how about poolside - designed for enterprise from day 1 (see blog post on AWS partnership)

poolside was built for enterprise from day 1 given our ability to deploy on our customers’ side, and our focus on prioritizing governance requirements and data privacy needs. At poolside we don’t use customer data to train our foundational models – and we can do so thanks to our approach to improve models via Reinforcement Learning From Code Execution Feedback, or RLCEF. It allows us to push past the limit of available code and reasoning data 1, generating synthetic training data at scale. This gives our customers the best of both worlds: sophisticated models in their developers’ hands, with the assurance that their most important asset – their data – stays private.

#open source foundational models 🔥

#TradFi strikes back - I’m witnessing this first hand - who is going to provide all of the infra for them - wallets, staking, tracking, security? (Bloomberg)

Revenge of the TradFi?

Crypto-native firms are expected to flourish as a result of a more favorable regulatory regime under President-elect Donald Trump. This lighter regulation, however, may end up being a dual-edged sword.

Most investors expect the looser regulatory environment to speed up growth of companies like the biggest US crypto exchange, Coinbase Global Inc., whose shares have surged since the election. Privately-held crypto-native firms got a boost as well, with shares of Ripple Labs gaining 72%, per secondary-market platform Forge Global.

But all the optimism comes with a catch: The potential for growing competition from traditional financial companies.

Worried about regulatory uncertainty, many traditional financial institutions offered none, or only limited, crypto-related services. That will change under Trump, with institutions like State Street, JPMorgan Chase, BNY and Bank of America expected to delve deeper into crypto, offering services like digital-asset custody or trading services, according to Owen Lau, an analyst with Oppenheimer & Co. Markets

#Multiples for Top 10 📈 but big difference during ZIRP era is profitability of these cos - that being said, growth is still valued more highly than profitability, but point is Wall Street is rewarding these best-in-class cos with premium multiples

#🤦🏼♂️ 💩sign of the times