What’s 🔥 in Enterprise IT/VC #430

Clay's 7 year overnight success to scaling ARR 📈 and $1.25B valuations - some 🔑 learnings from the journey

This post I shared a few weeks ago struck a nerve. The startup journey is now longer than ever as it takes >8 years to even get a Series D done.

Here’s yet another reminder of this, and hopefully inspiration for some founders and investors who are getting a bit impatient. Also a huge shoutout to my boldstart ventures colleague Eliot Durbin!

Here’s the chart - and yes if that growth continues which is what we see, then 👀

Alex Konrad from Forbes wrote an amazing profile on Kareem and Varun Anand’s journey to overnight succcess - I highly encourage you to read it.

Here’s the initial vision slide from original deck (click through for the Clay story from boldstart’s POV…

Many think startups are always 📈 but as I always like to remind folks 👇🏼

Keep fighting and you’ll know you get to PMF when this happens 👇🏼

Bolt is also a 7 year overnight success story which just raised a new $105.5M round at a reported $700M valuation👇🏼

Remember, startups die when founders run out of energy and Clay and Bolt (Stackblitz) are two more examples of the long journey to an overnight success.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

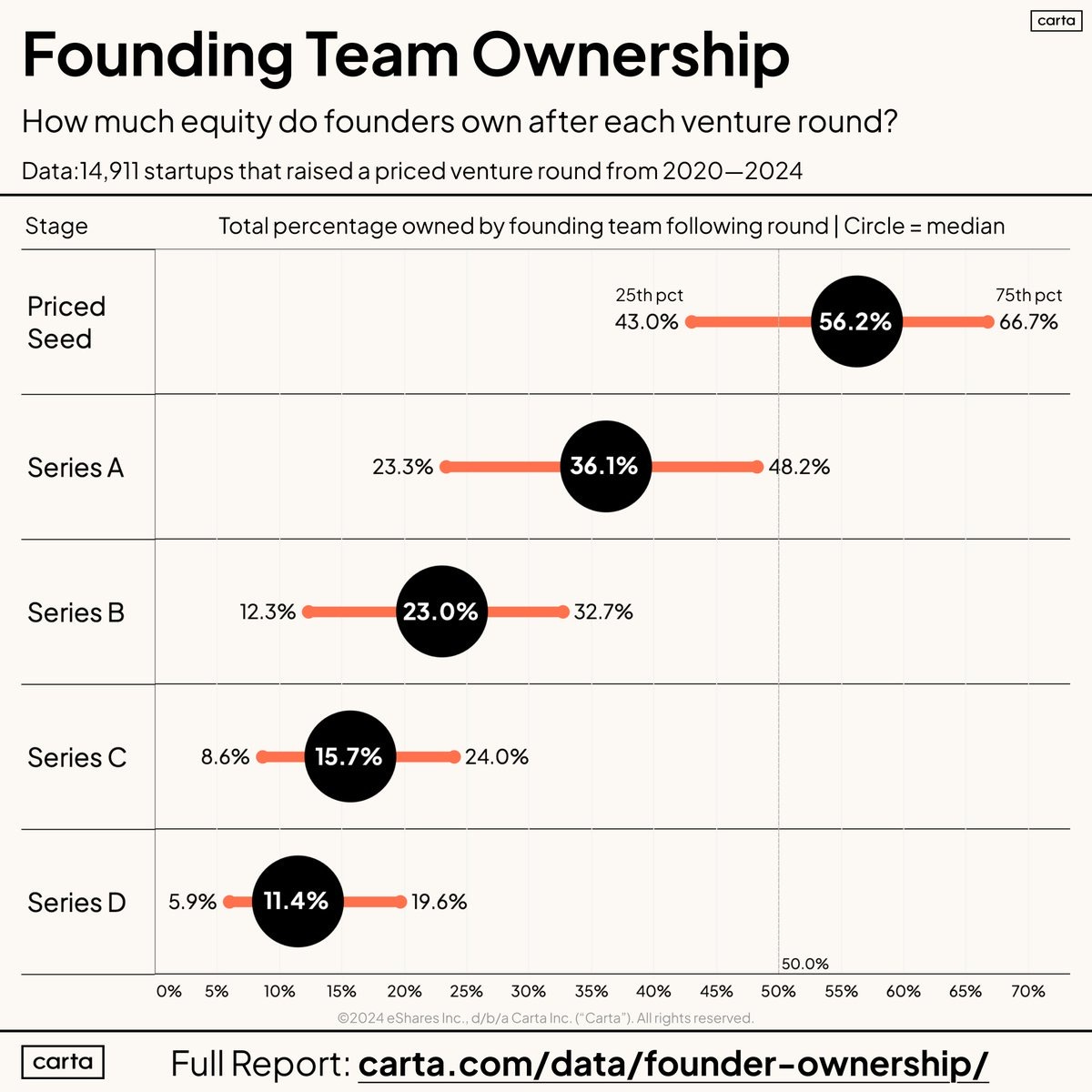

#how much do founders own after what round?

#Why startups always have a chance against incumbents - either they don’t see the future and don’t believe, or organizational politics + existing fiefdoms prevent them from moving fast. Vision + speed = opportunity.

#on product strategy and how TikTok became TikTok

Enterprise Tech

#Enjoyed the wide ranging discussion w/friend + serial founder Jesus Rodriguez on TheSequence newsletter for AI builders, researchers and labs

We covered lots of ground investing from Inception, securing AI, agentic worflows, second order effects, + first principles 🤔 building AI-related startups - click through 👇🏼 to read the full interview

#out of stealth - Grepr - Next Generation Reliability Platform for an AI-Powered World 🔥

and why we invested from Inception.

#Deepseek from China dominated the news this week

#must watch video - best 2 minutes on how China innovated and used only $5M of compute to train a model as good as GPT-4 and way, way cheaper - has huge implications…

#now that we have OpenAI, easier and easier to get good enough

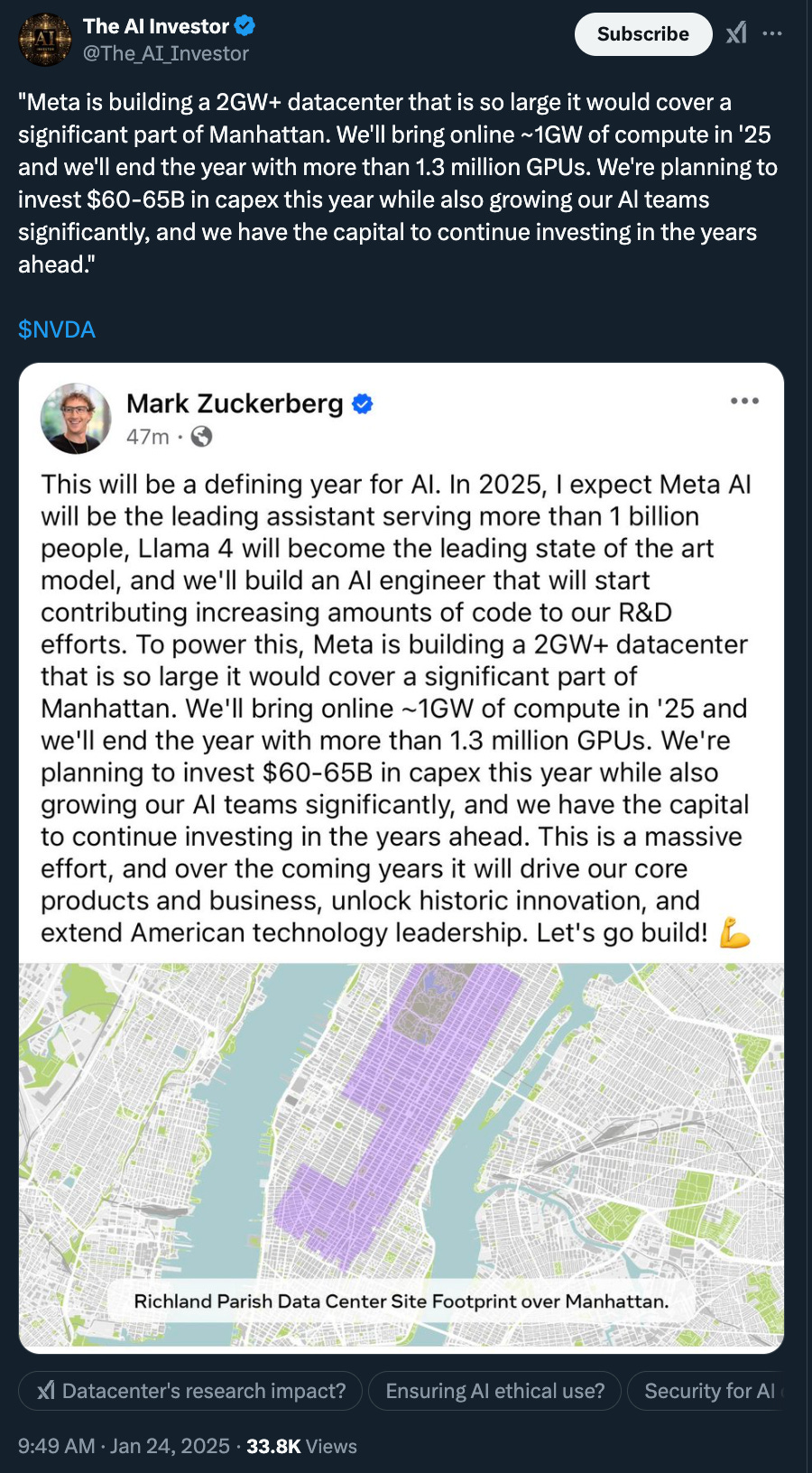

#all of this while Zuck is bragging that Meta is going to spend $60-65B on data centers 🤯

#👀

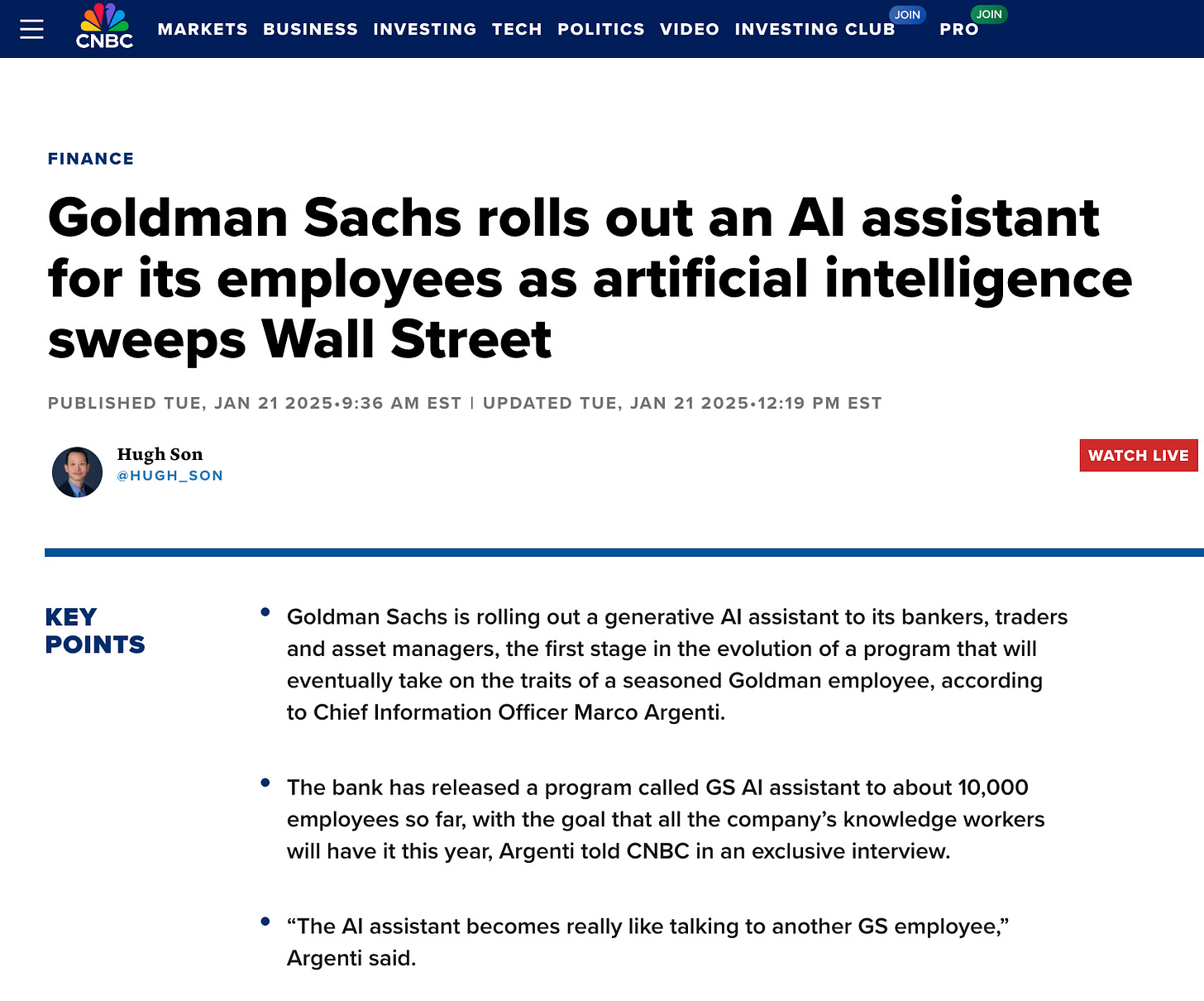

ABSOLUTELY HUGE for a regulated bank to roll out company wide to all 10k employees!

"The AI assitant becomes really like talking to another GS employee"full rollout to 10k employees and built internally - 2025 is the year of AI rolling to production in the largest enterprises

#we have AI Engineering but what is the future of PM, what are skills for the AI PM? 🧵 and comments super interesting

Given a clear specification for what to build, AI is making the building itself much faster and cheaper. This will significantly increase demand for people who can come up with clear specs for valuable things to build.#most popular tools from Lenny’s “what’s in your stack” survey

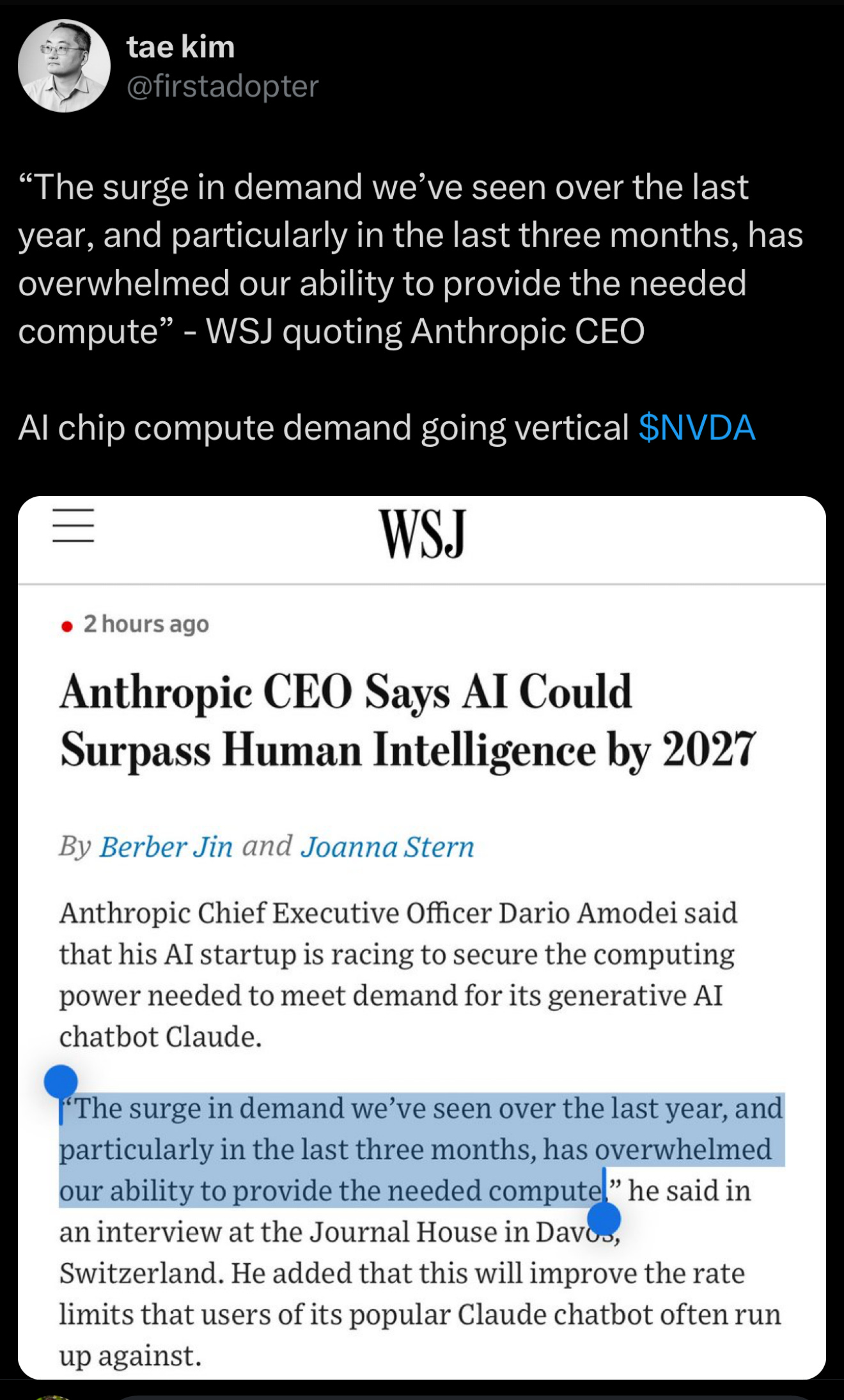

# 🤯 demand for GPUs 📈

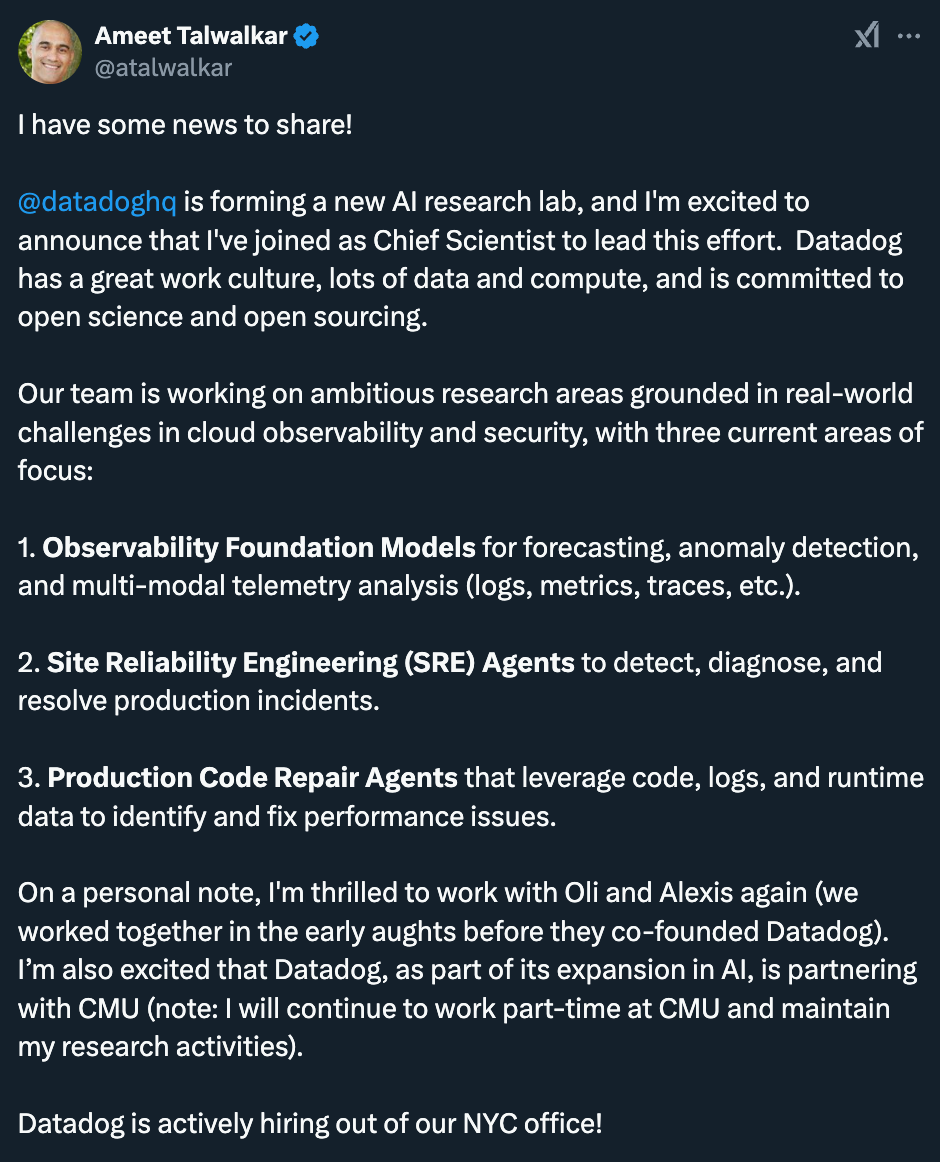

#where Datadog is going next in AI

#second order effects as we live in a world full of agents…

#super cool story as rookie Jayden Daniels has the Commanders in the NFC Championship game - VR simulation!

Markets

#another fantastic S-1 breakdown from Alex Clayton at Meritech 🧵

#multiples creeping back📈 from Clouded Judgement

On the scarcity idea. Bloomberg this morning

DeepSeek and Masa Son Have Lessons for Stargate https://www.bloomberg.com/opinion/articles/2025-01-27/deepseek-and-masa-son-have-lessons-for-stargate

The Deepseek innovation on the cheap is just another example of how abundance can hold us back. The Scarcity mindset drives efficient innovation out of necessity and the need to survive.