What’s 🔥 in Enterprise IT/VC #480

Competing and winning when 4 firms account for 40% of all capital raised in 2025 🤯

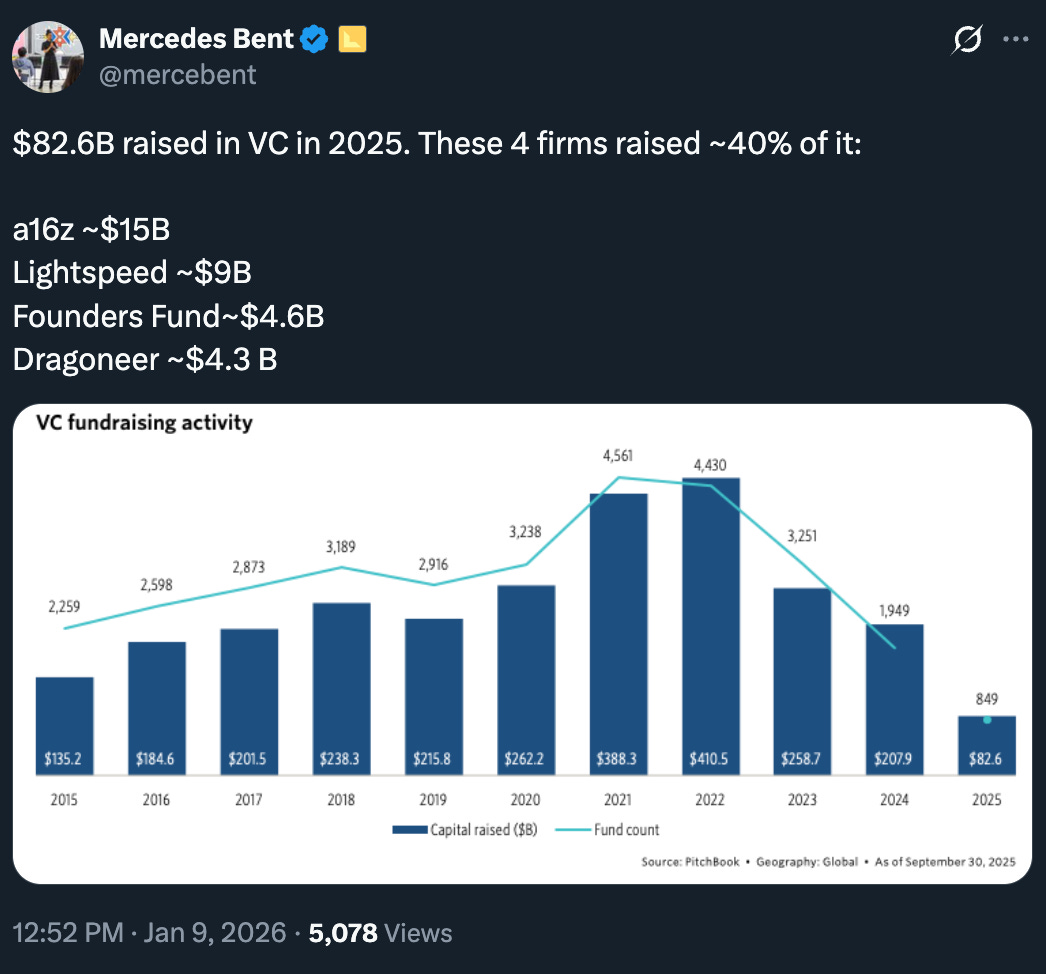

The changing of venture has been happening for a long time, but these numbers are simply astounding. a16z just raised $15B, or 18% of all venture raised last year. Just four firms accounted for 40% of it 🤯.

When capital concentrates like this, winning is no longer optional. It becomes the strategy.

Here’s Jack Altman interviewing Ben Horowitz on what really matters in venture returns: the ability to win. Not as a slogan, but as an operating model.

I definitely agree with this assessment especially as the world moves from too early or not interesting to consensus and hot. To deploy that much capital and to get that much ownership for the right to lead rounds means winning is by far the most important trait. As investors move up the stack and write larger checks at Series A, B, C, and beyond, competition intensifies. The pool of obvious winners narrows, capital crowds in faster, and the right to lead is fought over. Winning compounds.

Which is why, more than ever, investors need to be honest about what game they are playing.

For us at boldstart, that game is Inception. Being first. Partnering with technical founders at the ideation stage, before markets are obvious and competition explodes. While many inception rounds are competitive, being there early dramatically reduces the universe of competitors and changes the risk profile.

Winning still matters, but so does intuition. Not overthinking opportunities. Not anchoring too tightly to early market maps. Remembering that it’s not the TAM you start with that matters most, but the TAM you exit with.

I call this Intuitive TAM. It’s a different style of investing. It underwrites conviction about what the world can become, not just what it is today.

But it’s clear the world is bifurcating even more where IMO the only way to win in venture is to go big, go niche and specialize by stage and expertise, or go home as it’s tough to compete in the middle.

In our case at boldstart, it’s all about Inception, being first, and funding the autonomous enterprise. We focus exclusively on company formation. That discipline carries through to fund size. Fund VII at $250M gives us the flexibility to lead small rounds while also writing $15M inception checks for truly exceptional, experienced founders.

For founders raising their first round, remember this simple rule of thumb: your round size picks your investors. Around the $5M mark, the investor universe changes materially.

The world is completely different as we head into 2026 with numbers like this.

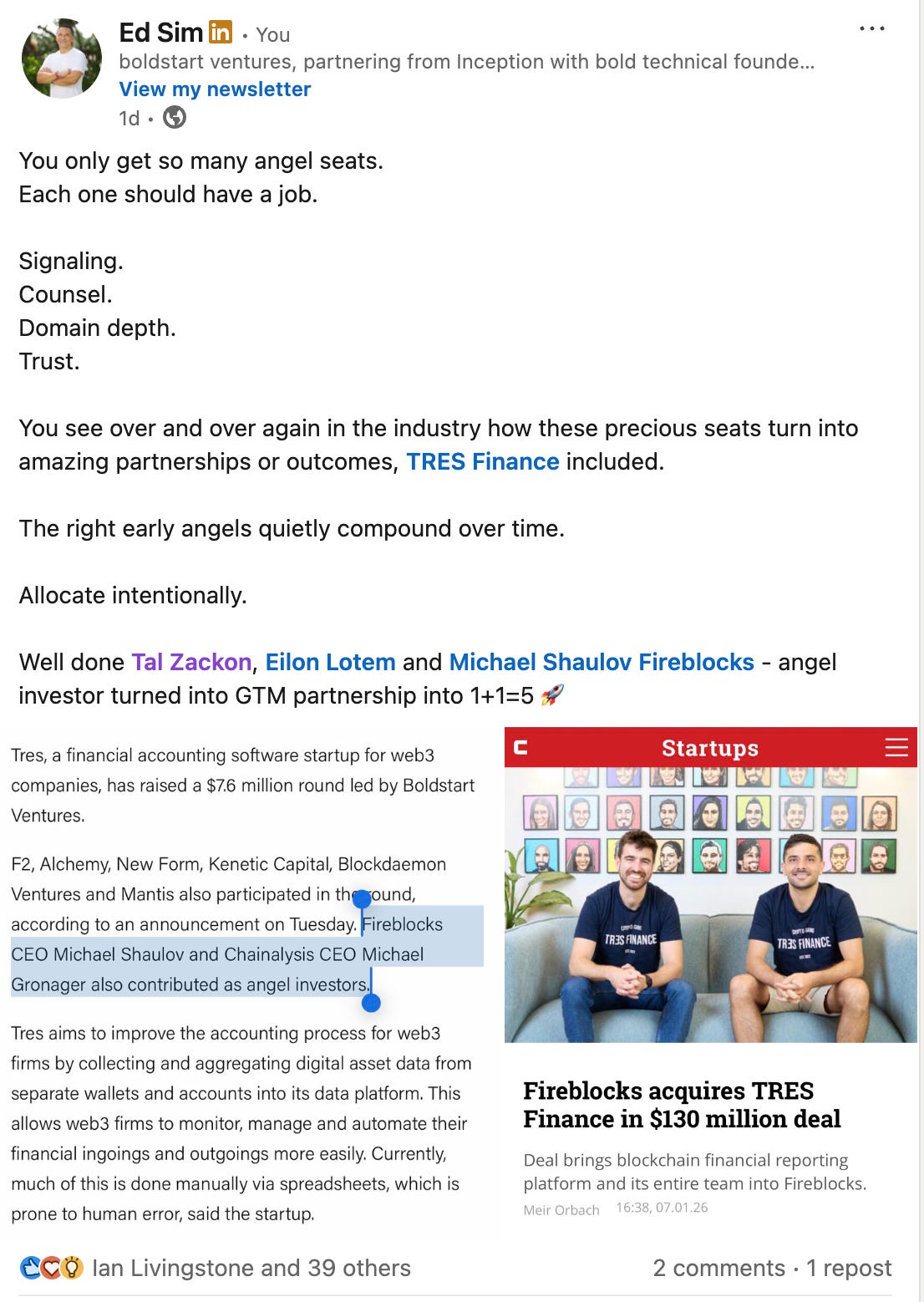

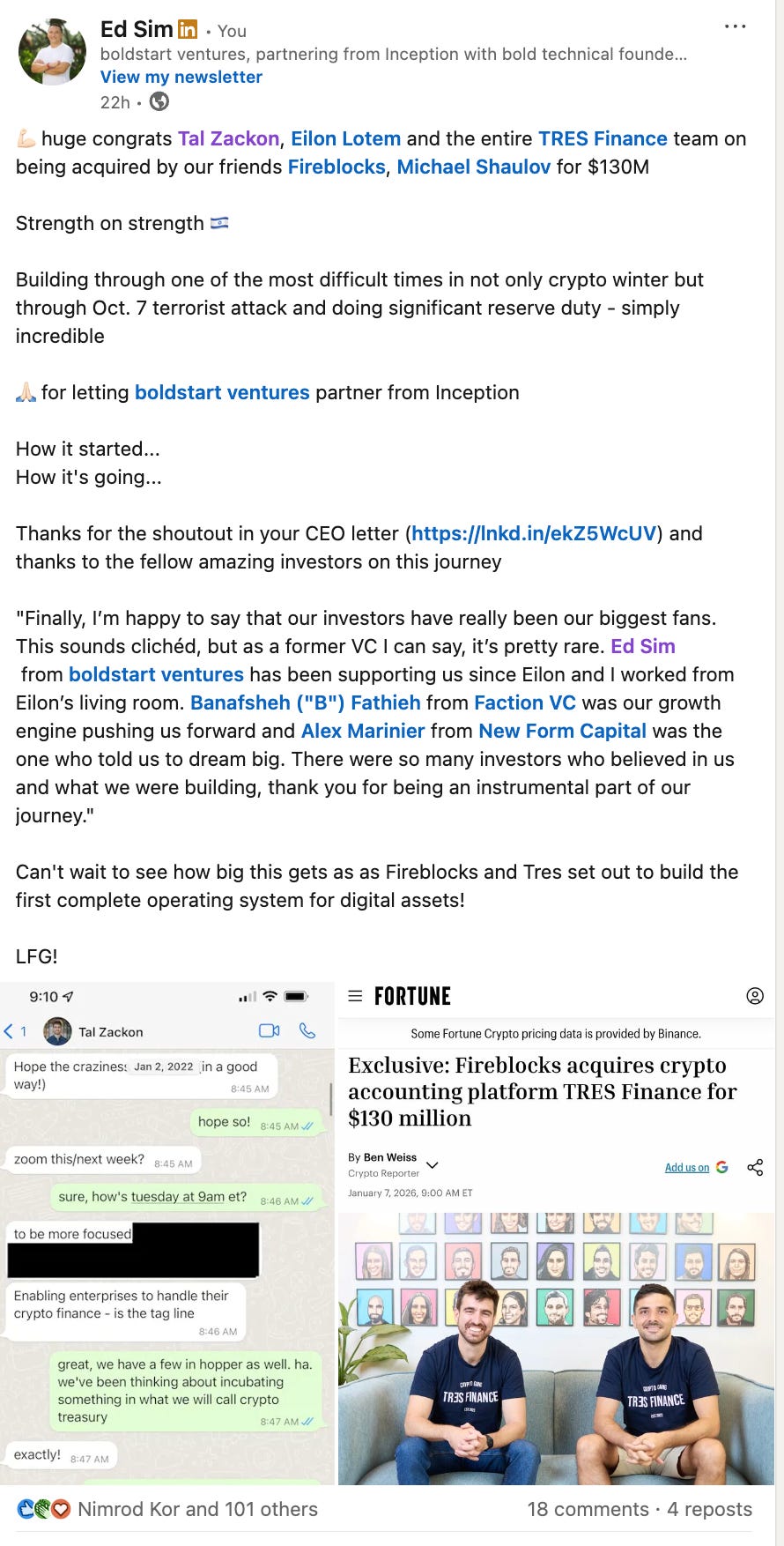

Finally, while not a $1B headline, I’m super pumped for Tal Zackon and Eilon Lotem, co-founders of Tres Finance, on their $130M exit to Fireblocks. For us at boldstart, it’s also a meaningful win as we led from Inception. A key lesson for founders: who’s on your cap table matters. Managed thoughtfully, angel allocation can pay significant dividends over time. Here’s how we help founders get this right from day one.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#not surprising but EIQ and people skills always mattered but even more in age of AI

#i’ll keep reminding all of us, authenticity will matter more…great read from Lulu

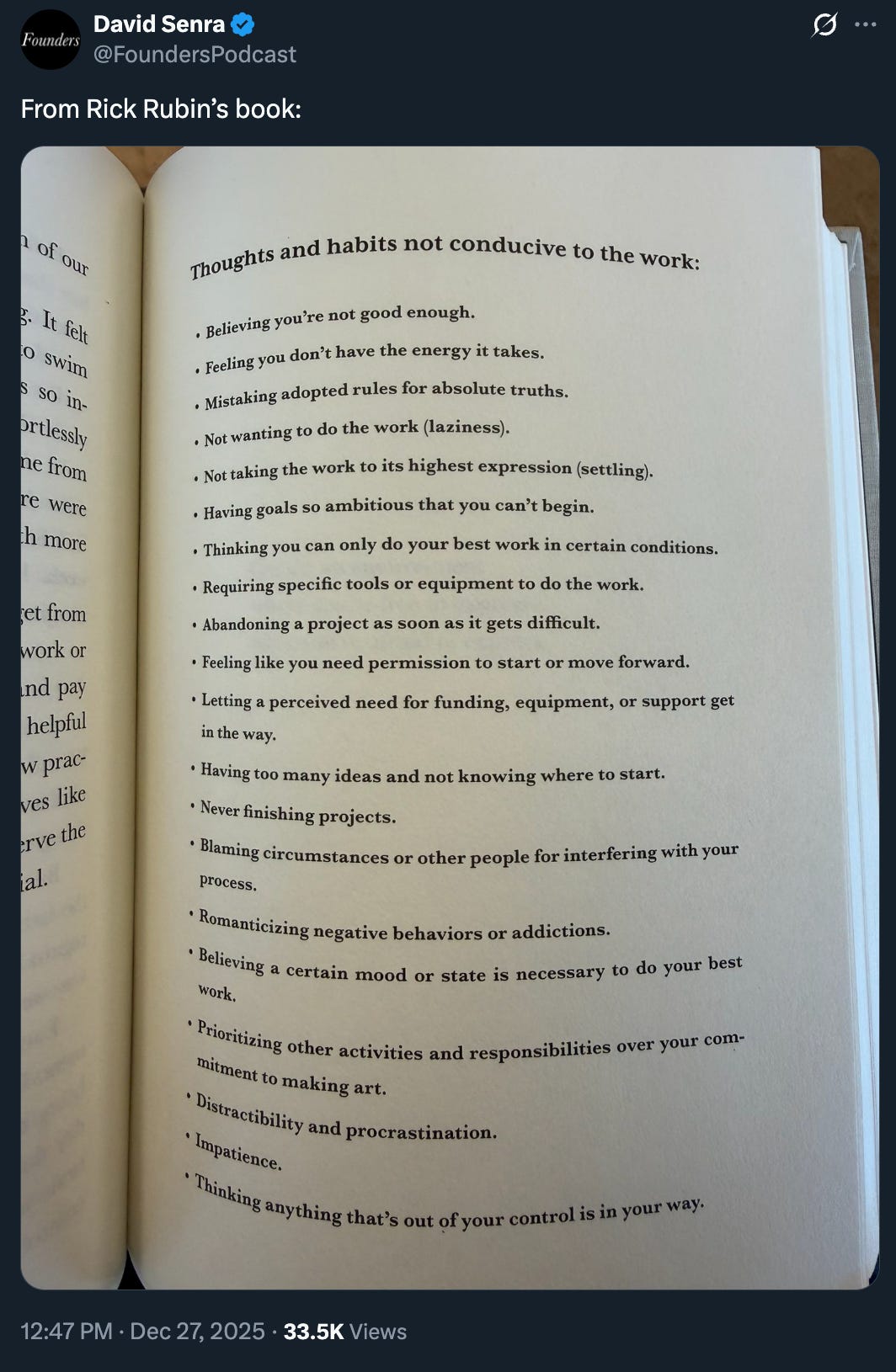

#from the legendary music producer Rick Rubin’s book, The Creative Act which I wrote more in depth about below

in What’s 🔥 #325

What's 🔥 in Enterprise IT/VC #325

If you see this buddhist master, zen-like figure online, I highly encourage you to click through and watch. It’s Rick Rubin and for those of you who don’t know, he’s a legendary music producer having been a “day one partner” to acts like the Beastie Boys, Run-DMC, Public Enemy and LL Cool J. He’s also produced for “later stage” acts like Metallica, John…

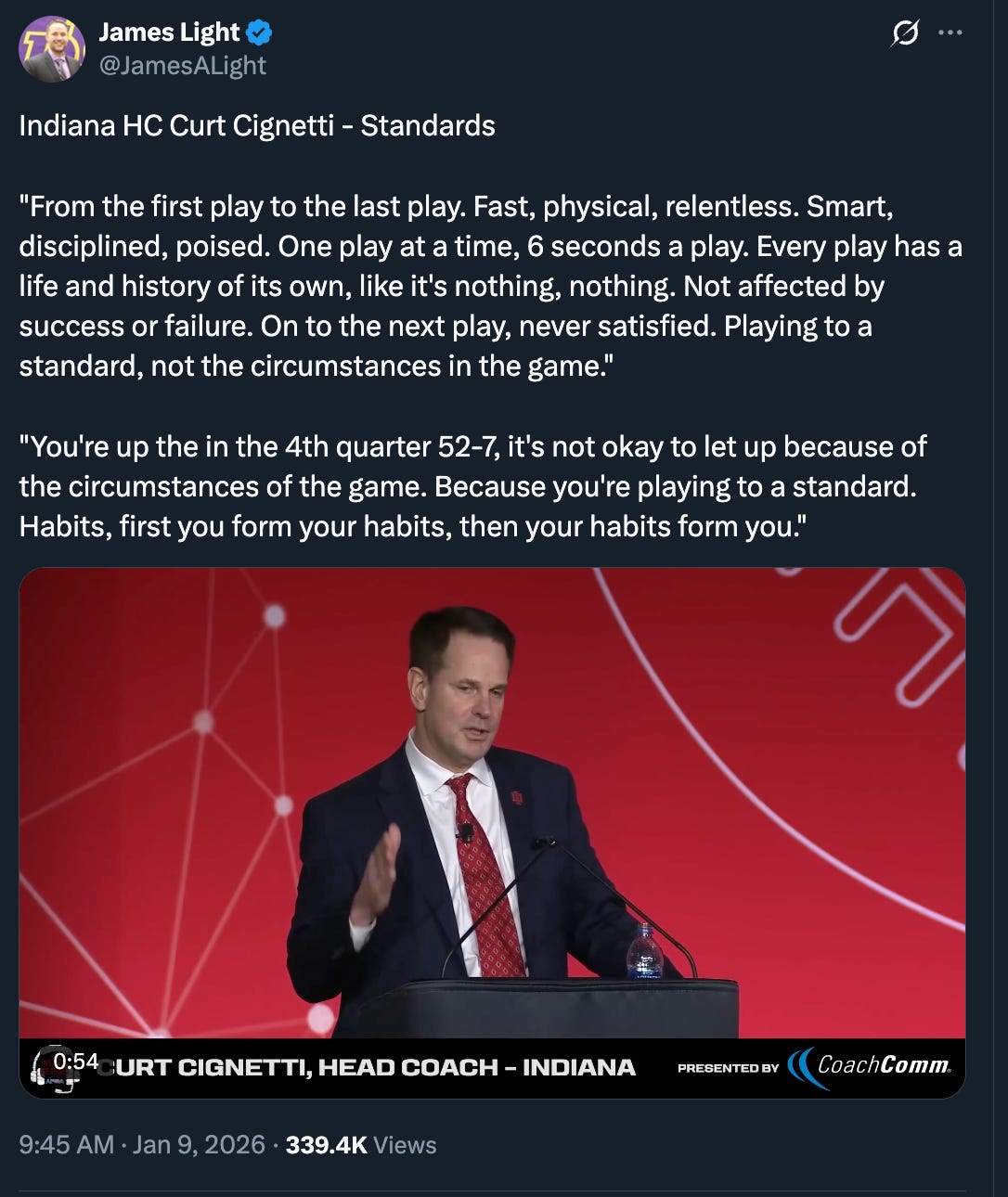

#🎯 creating a culture of winning - super impressive from Indiana football coach who turned the program around in a couple of years to play for the national championship

Enterprise Tech

#important read as everyone plays around with Claude Code building apps and writing to your file system on your laptops…a world of apps running on your own machines equals incredibly intelligent and private

#celebrate your wins - big stuff coming in crypto infra in 2026 as most TradFi institutions get onboard

#to my point above

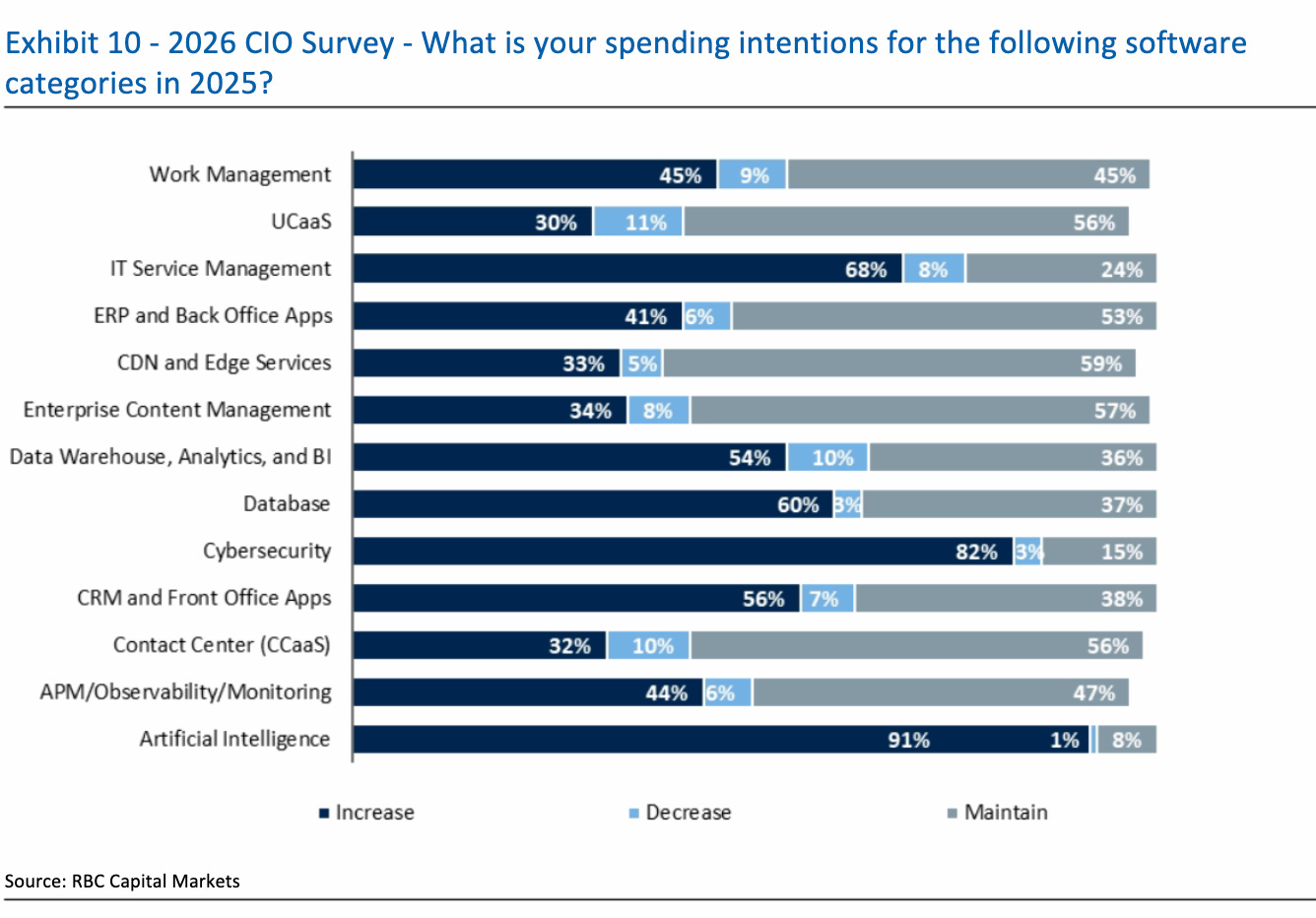

#RBC CIO Survey - no surprise here, mostly everyone increasing spend on AI and cybsersecurity

#💯 must build for agent first world

#which kind of crushed this open source company Tailwind

And more specifically in the audio note from Adam summarized here:

They made Tailwind CSS so accessible and well-documented, it became a favorite for AI tools (like LLMs and code agents) to reference and integrate, which exploded its adoption and popularity. However, this backfired on the business side because those AIs pull info directly without driving users to the official docs site—Tailwind’s primary funnel for upselling paid products like UI components and themes. Traffic dropped 40% from its peak, starving revenue despite the framework thriving in the wild. He even mentioned frustration with OSS contributors pushing for more AI-friendly features (e.g., “copy code” buttons in docs) that could exacerbate the issue. It’s a classic open-source monetization trap: great for the ecosystem, deadly for sustainability without pivots.

#that feeling everyone got over the holidays using Claude Code as it wrote software, created files, opened them and changed them, and kept building and building while you watched a movie

#🤔 wait till Claude Code really goes enterprise and learns on those massive code bases, right now super amazing for new new creation, huge opportunity to understand and update existing legacy codebases

#2026 is where agents force a new control plane: guardrails, context, and accountable intent. Execution shifts upstream. You can read more on my earlier post on the Execution Intelligence Layer 👇🏻

#robotics will be huge in 2026 - the end shows how it learns from teleoperations with sensors to understand grip, etc - much different from the pure data based approach from port co Generalist AI

#Woohoo – finally out of stealth! Our excitement for the autonomous enterprise at Boldstart Ventures also extends to Physical AI, with investments in several domain-specific models powered by proprietary data from GeneralistAI in robotics, and backed by Boldstart, Nvidia, Spark, and Jeff Bezos, to ToposBio, an AI-powered drug discovery platform.

#merging of observability/sec ops/data infra continues as Observe is bought by Snowflake for a rumored $1B+, last round done at $750M post in July 2025, so slight uptick but once again, super solid retuns for the early investors (The Information)

Observe was on track to generate $70 million in annualized revenue by the end of its fiscal year ending this month, up from $30 million in annualized revenue a year earlier…

But the company, which already shared close ties with Snowflake, was recently burning cash at a pace of about $60 million annually.

#another Palo Alto Networks/Israeli startup acquisition in works - Koi for $400M just 2 years after founding and raising $48M 🤯 (Ctech)

Koi has since built a platform designed to fill a crucial gap in enterprise security. Its main product, Supply Chain Gateway, serves as a central checkpoint for all incoming software. It provides software inventory management, real-time risk analysis, automatic policy enforcement, and proactive blocking of dangerous code. At the heart of the system is Wings, an AI engine that classifies software components, tests them in isolated environments, and identifies threats that traditional scanners often miss. This allows security teams to control software installation proactively, rather than reacting after breaches occur.

#what’s holding agents back - lots of talk about truly securing agents but still so much to build to offer decision-time understanding and truly dynamic, runtime authentication and authorization along with cryptographically proving the agent continues to be the agent as it moves from app to app

Markets

#which is why Crowdstrike paid $740M for SGNL

#👀

#Models raising massive rounds - Anthropic raising $10B at a $350B valuation (WSJ) up from $183B valuation just 4 months ago 🤯 and X.ai raises $20B at a $230B valuation (CNBC)

#Cyera in security DSPM space just raised at $9B valuation (CTech)

AI and data security company Cyera announced on Thursday a $400 million Series F funding round, bringing its total capital raised to over $1.7 billion. The round, led by funds managed by Blackstone and supported by existing investors including Accel, Coatue, Cyberstarts, Georgian, Greenoaks, Lightspeed Venture Partners, Redpoint, Sapphire, Sequoia Capital, and Spark, comes just over six months after the company’s previous funding event and lifts its valuation to $9 billion, a threefold increase from a year ago.

The rapid escalation reflects the growing urgency for enterprises to secure data in an era of accelerating AI adoption. Agentic AI, which operates with autonomous decision-making capabilities, is gaining traction across industries.