What's 🔥 in Enterprise IT/VC #325

Startups as art: lessons from legendary music product Rick Rubin on creating music that feels like magic

If you see this buddhist master, zen-like figure online, I highly encourage you to click through and watch. It’s Rick Rubin and for those of you who don’t know, he’s a legendary music producer having been a “day one partner” to acts like the Beastie Boys, Run-DMC, Public Enemy and LL Cool J. He’s also produced for “later stage” acts like Metallica, Johnny Cash, and the Red Hot Chili Peppers.

In fact, you should watch the entire 60 minutes segment as I promise you it will be well worth your time. There are so many 💎 for creators of not just music, but any art form. Rick describes creating art as a spiritual experience and while you may think it’s a bit out there, I love learning from legends in other disciplines, and ultimately, I believe the creation of new products, companies, and day one investing is more art than science, especially in the early days.

What’s even more amazing is that this is also Rick Rubin in the early days of his own startup, Def Jam Recordings.

If any of this resonates with you, I also highly recommend reading his book (The Creative Act: A Way of Being) which was released this past week. I set the release date as a reminder in my calendar months ago and ended up reading 1/2 the book in the middle of the night. It’s that good! All of my Kindle highlights are shared here on my Goodreads profile.

Here are some of the more impactful quotes from Rick along with my commentary on how it relates to products, startups, and even investing.

The Wise Advisor

RR: “I’m giving cues to look for in yourself because it all has to do with the artist.”

AC: But it all does sound very spiritual.

RR: It is. The whole thing is spiritual - it’s magic 🪄.

Chuck D from Public Enemy sums it up well by saying Rick says he can’t teach you but he can help you explore yourself, something wise VCs on boards know how to do. They don’t tell founders what to do but ask the right questions to help founders accelerate the learning process of what to do which is an art form.

On Creating New Categories and Products

RR: The audience comes last.

AC: How can that be?

RR: Well the audience doesn’t know what they want. The audience only knows what’s come before.

AC: isn’t the whole music business built around what someone likes?

RR: Maybe for someone else it is but it’s not for me.

Sound a lot like Steve Jobs?

“Some people say give the customers what they want, but that's not my approach. Our job is to figure out what they're going to want before they do. I think Henry Ford once said, 'if I'd ask customers what they wanted, they would've told me a faster horse.' People don't know what they want until you show it to them. That's why I never rely on market research. Our task is to read things that are not yet on the page.”

Steve Jobs

And yes, these are the founders I like to back and write about, mission oriented, passionate, building for themselves and for the right reasons to see their creation in the hands of many people as possible vs. what I call “whiteboard founders” who draw a 4x4 matrix and brainstorm to create a new company in a white space. We ❤️ problem solvers creating new categories where the majority say “No” for the first couple of years before they start emphatically saying “YES.”

Not all projects take time, but they do take a lifetime. In calligraphy, the work is created in one movement of the brush. All the intention is in that single concentrated movement. The line is a reflection of the energy transfer from the artist’s being, including the entire history of their experiences, thoughts, and apprehensions, into the hand. The creative energy exists in the journey to the making, not in the act of constructing.

On Product - Simplicity is Elegance

"I like the idea of getting the point across with the least amount of information possible," Rubin said. (video clip here)

"And that's what you're doing in a recording studio?" Cooper asked. "You're listening to music, to sound, and trying to strip it?"

"Just to see what's- what is actually necessary," Rubin said. "Getting it down to that essence to start with is really helpful in understanding what it is."

"I'm listening to the feeling," Rubin said. "My body's moving. I feel that melody awaken something in me. There's something familiar about it, but I don't think I've heard it before. The feeling of familiarity is a good feeling."

And from the book…

Distilling a work to get it as close to its essence as possible is a useful and informative practice. Notice how many pieces you can remove before the work you’re making ceases to be the work you’re making. Refine it to the point where it is stripped bare, in its least decorative form yet still intact. With nothing extra. Sometimes the ornamentation can be of use, often not. Less is generally more.

The Aha Moment

This epiphany is the heart of creativity. It’s something we feel in our whole body. It causes us to snap to attention and quicken our heartbeat, or to laugh in surprise. It gives us a glimpse of a higher ideal, opening new possibilities in us that we didn’t know were there. It is so invigorating that it makes all of the laborious, less interesting parts of the work worth doing. We are mining for these events: the moments when the dots connect. We revel in the satisfaction of seeing the whole shape come into clear focus.

Remember to enjoy the journey and have fun - startups ain’t easy.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

SEC proposing to make it easier to sue VCs and investors - cost of business could go up and would mean no boards or active involvement (ok, hold the jokes back on VCs + active 🤣) from Bloomberg

Following up from my post last week on the official reset of venture round sizes - let’s see what Q1 looks like (🧵 from SVB/AngelList data)

Enterprise Tech

Operative word - blockchain is back - no crypto so to speak - builders keep building

Developers still building on crypto 🧵, down from peak in Jun but still up slightly YoY - all the data here

Monthly active developers grew +5% year-over-year, despite 70%+ decline in prices.

23,343 monthly developers as of December 2022.

471,000+ monthly code commits are made monthly toward open-source crypto.

+8% YoY growth in Full-Time developers. Full-Time developer growth is the most important growth signal to track because they contribute 76% of code commits.

All-time high of 61,000+ developers contributed code for the first time in 2022.

Microsoft’s plans for world domination on AI front continue as API for ChatGPT on Azure

Why should Microsoft have all the fun? Google will embed into every application as well

Railway, an infrastructure company that provides instant application deployments to developers, started with databases only. ❤️ the insane focus - I can’t say this enough times - the best developer companies go extremely narrow and deep first and then wider later versus covering too much surface territory at the start but only going an inch deep. Read the Railway post to see the evolution.

Railway Started as a One-dimensional Product

The Railway Roadmap in 2020 was very simple: let users spin-up a database in a few seconds. That was basically it. It didn’t need to be complicated, but it had to feel like magic.

Since we founded Railway to make it trivial for engineers to deploy code without thinking about servers, we started with databases. Where else was there a stronger desire to avoid thinking about servers? It was a perfect fit.

Once we created the v0 of Railway, we started getting hammered with questions from users looking to expand their use cases.

“Can you make this deploy my Django app?”

“How do I deploy a node server onto this?”

“When can I host [insert static web framework here] on Railway?”

Good point, getting a database was just the first step. Next we needed to add a way to wire-up a service to your database.

The Duo Security Impact 5 years later - lots of talent and interesting to see all the companies execs went to….(from Patrick Garrity)

50 CISOs to watch according to Lacework - “the criteria we used to select these 50 leaders was based on a few core ideas – these leaders are forward thinking in how they solve tomorrow’s security challenges today. This future-leaning mindset includes a clear focus on emerging technologies — like the cloud, Kubernetes, and serverless — and ensures that shifting left has its intended effect: making data even more secure.”

Markets

Great 🧵 on how the process really works

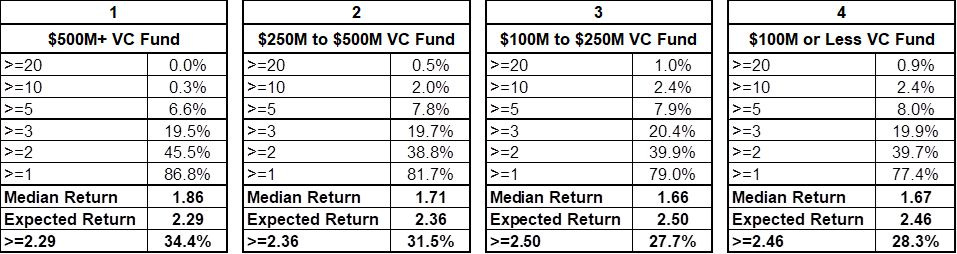

What size VC funds perform better? (from Jamie Rhode Verdis Investment)

Does fund size matter when it comes to returns in venture capital?

Below are returns broken down by fund size for VC from 1978 to 2019. The distribution of returns is highly similar for funds in bracket 3 and 4. Even the $250M to $500M bracket is similar, except for the percent above 20x. This is likely because it is easier to deploy smaller amounts of capital into the earliest stages of VC, where there is more upside, while the largest bracket has the lowest loss ratio but also a cap on your upside.

In the full dataset, only 0.1% of funds have a TVPI greater than 40x and they are found in bracket number 4.