What’s 🔥 in Enterprise IT/VC #477

Tranched Rounds, Intuitive TAM & The Best of 2025

When a company is deemed truly hot 🔥, investors stop debating price and start competing for allocation. Great discussion if you clickthrough the tweet.

Here’s a prime example of a hot company with a killer team and big market opportunity as “Ex-Splunk execs’ startup Resolve AI hits $1 billion valuation with Series A” in a tranched round.

Once upon a time, tranched rounds were milestone-based. Hit X in revenue, unlock Y dollars at a higher price. Today’s AI special is different. A new investor wins a competitive deal by paying a headline price ($1B), while quietly investing significant dollars at a lower price. This reduces the blended entry price.

No milestones required. Two prices at closing. One declares market leadership. The other improves the investor’s economics.

The headline valuation for the fresh round is $1 billion, sources said. However, the company’s actual blended valuation was lower because of a multi-tranched structure. In this setup, investors purchased some equity at a $1 billion valuation but acquired the remainder — likely a larger percentage of the round — at a lower price. This novel investment approach has recently become popular for the most sought-after AI startups, investors say.

The startup’s annual recurring revenue (ARR) is approximately $4 million, two of the people said. The size of the funding round couldn’t be learned.

Founded less than two years ago, the startup is led by former Splunk executive Spiros Xanthos and Mayank Agarwal, Splunk’s former chief architect for observability. The duo’s partnership dates back 20 years to their graduate studies at the University of Illinois Urbana-Champaign. This isn’t their first collaboration; they previously co-founded Omnition, a startup that was acquired by Splunk in 2019.

Translation: a $1B headline on ~$4M ARR from a two-year-old company. Amazing founders, huge market, and a reminder of what “hot” really means right now.

While this can certainly feel amazing on the upside, founders just be forewarned. The downsides are obvious which include setting a bar that is perhaps way too high for you to realize before a next round stepup, and also increasing the 409a valuation in which employees are granted stock options. On the way up it doesn’t hurt as much, but if things ever get tricky, you may end up with lots of employees with options that are underwater.

I still prefer clean rounds. One price. One story. And, of course, being there first at Inception.

This trend is only accelerating for hot deals, but here’s my thinking 🤣 - it’s not about consensus vs. non-consensus, or obvious vs. non-obvious.

It’s about finding amazing technical teams first, at Inception, with a unique insight into a super early market. Before it is deemed hot 🔥 and especially at Inception, most folks yawn or don’t believe what could be.

So here’s how to look at it: it’s not the TAM you start with; it’s the TAM you exit with. For new markets, timing is impossible to predict. But if you use common sense and think long-term, you can sense how big something can be.

Let’s call it Intuitive TAM. Use this framework and perhaps you too will one day become hot 🔥 and have plenty of options.

BEFORE WE WRAP 2025

We’re nearing the end of the year and I may not write next week, so here are the top 5 posts from 2025. Thank you for being on this journey with me - here’s to an amazing holiday season with family and friends!

The Enterprise Agent Hunger Games - the agent wave 🌊 is just starting—but without the last mile of IT infra/security it’s all vibes and no production. 🧠⚙️

What’s 🔥 in Enterprise IT/VC #442

While the whiplash we are experiencing from our current administration can feel nauseating at times 🎢, it is quite clear that the net effect will be a massive accceleration for AI and agentic adoption in the enterprise, for pilots moving into production, for agents to eat into labor.

Tariff-ied 🤯 - Time to dust off that old Post-ZIRP Recession Playbook 📖

[What’s 🔥 in Enterprise IT/VC #440 - Apr 5]What’s 🔥 in Enterprise IT/VC #440

While ZIRP was not too long ago, it seems to have been long forgotten with the euphoria around AI. All that being said, we need to brace for the upcoming storm. Liberation Day does not feel so liberating at the moment as the market threw up 🤮 on Trump’s tariff plans. Now our worst fears are coming closer to reality as the possibility that these tariffs…

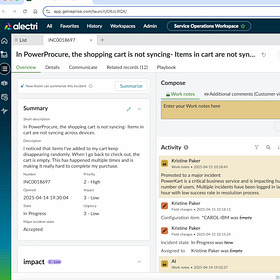

Can This Really Be the UI of One of the Hottest AI Enterprise Companies?

[What’s 🔥 in Enterprise IT/VC #470 - Nov 1]What’s 🔥 in Enterprise IT/VC #470

Move over Mag7, ServiceNow is claiming we now have the Super Eight.

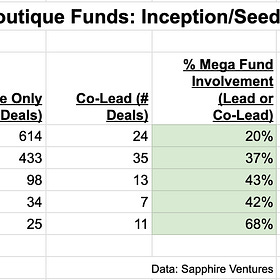

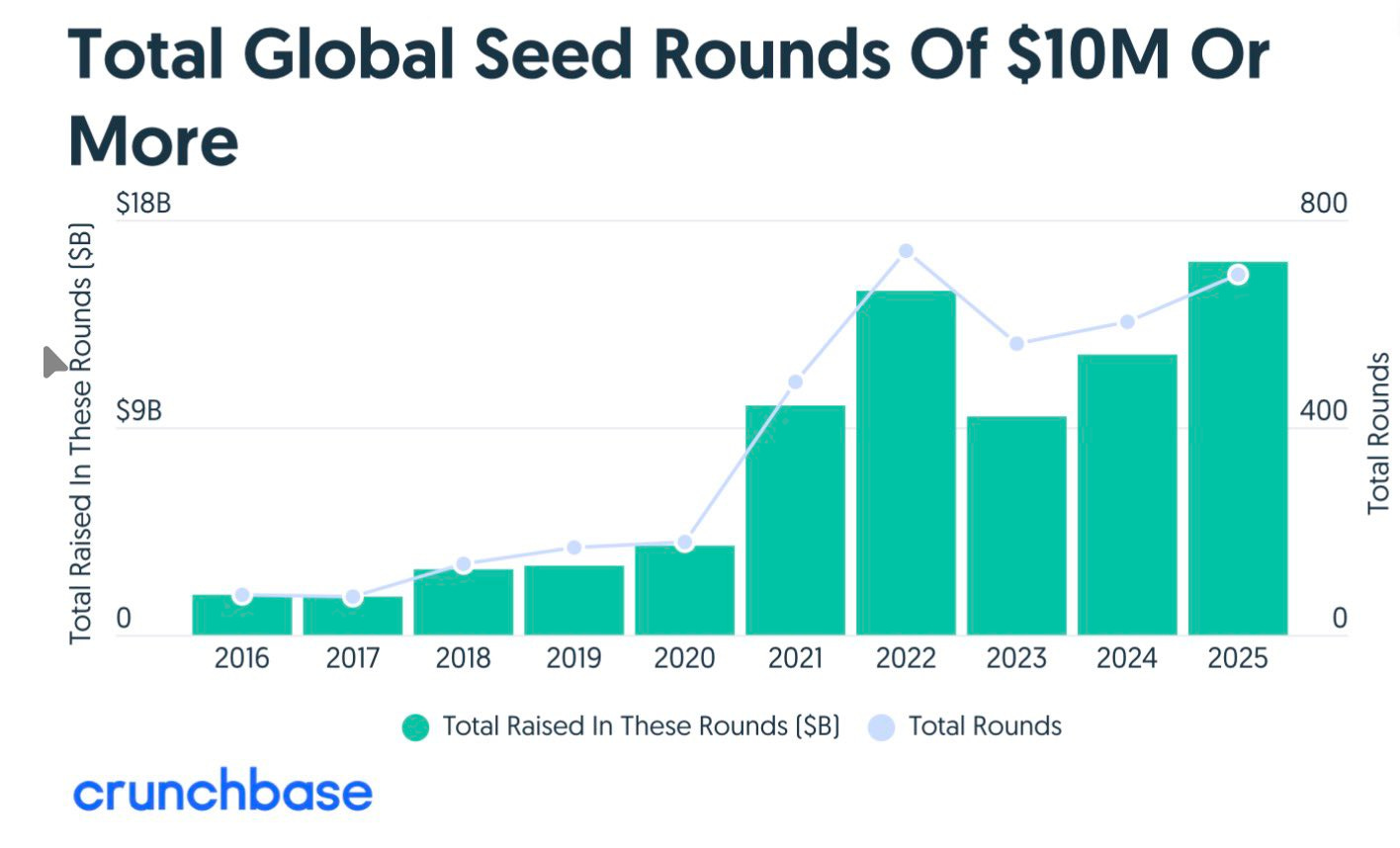

The $5M Line That Is Redrawing Inception/Seed Investing

Your round size picks your investors. Your fund size picks your battles.

[What’s 🔥 in Enterprise IT/VC #474 - Nov 29]What’s 🔥 in Enterprise IT/VC #474

Your round size picks your investors. Your fund size picks your battles.

AI Native vs. Incumbent - speed to distribution vs. speed to innovation and when ZIRP-era 🦄 should just go all in on AI

[What’s 🔥 in Enterprise IT/VC #452 - Jun 28]

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#🤔

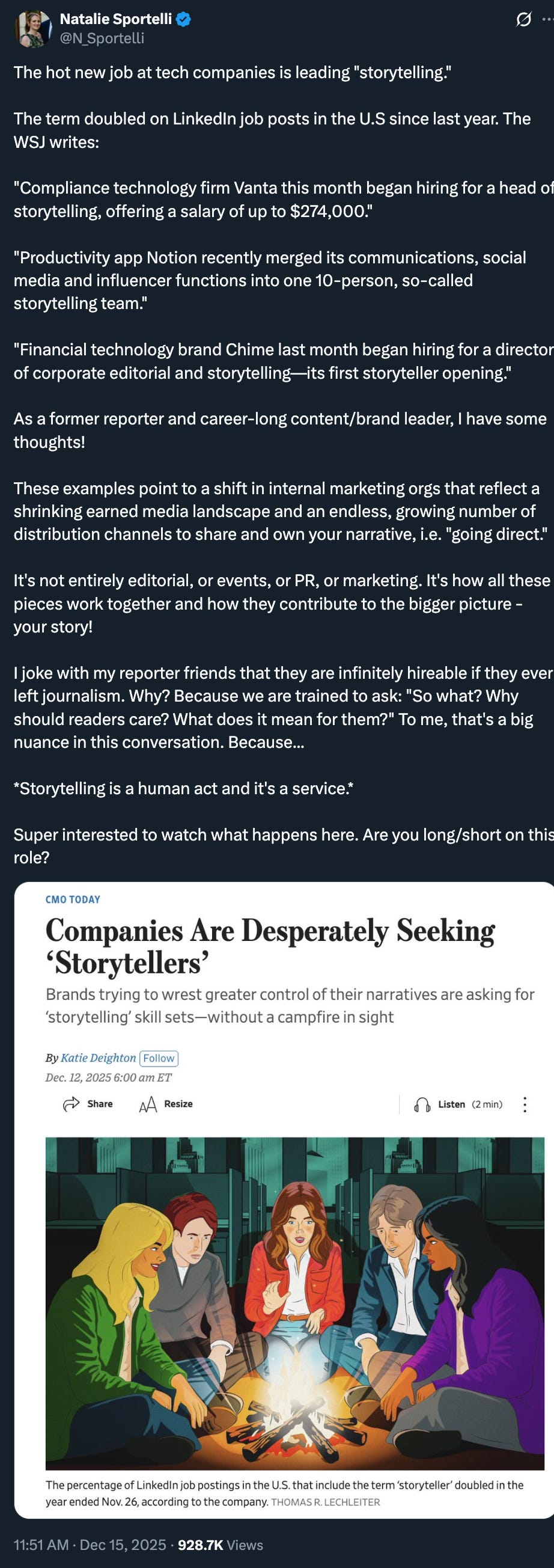

#still needs to driven by the founder with a team to help

#the jumbofication of inception/seed rounds 📈 as multistagers/mega managers continue moving earlier

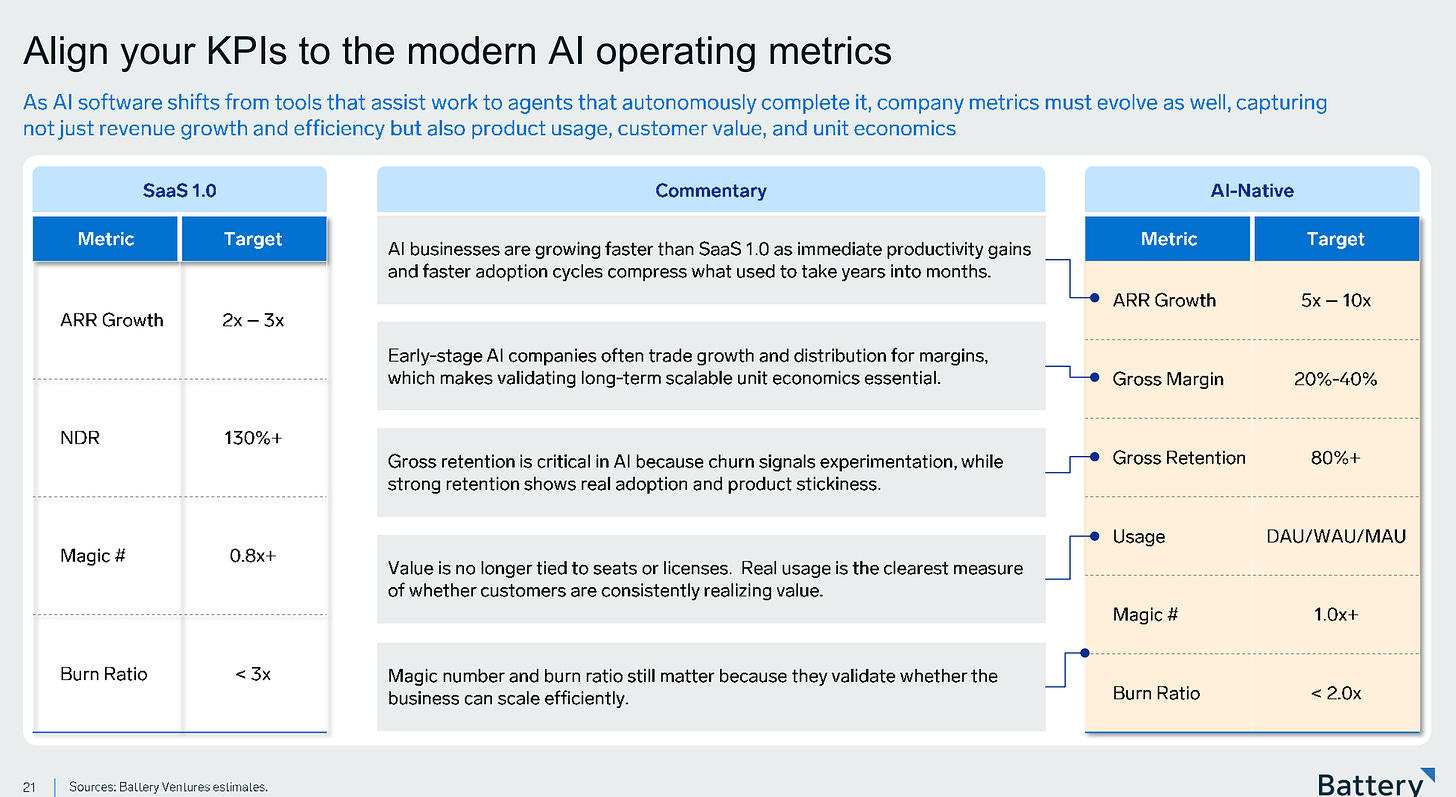

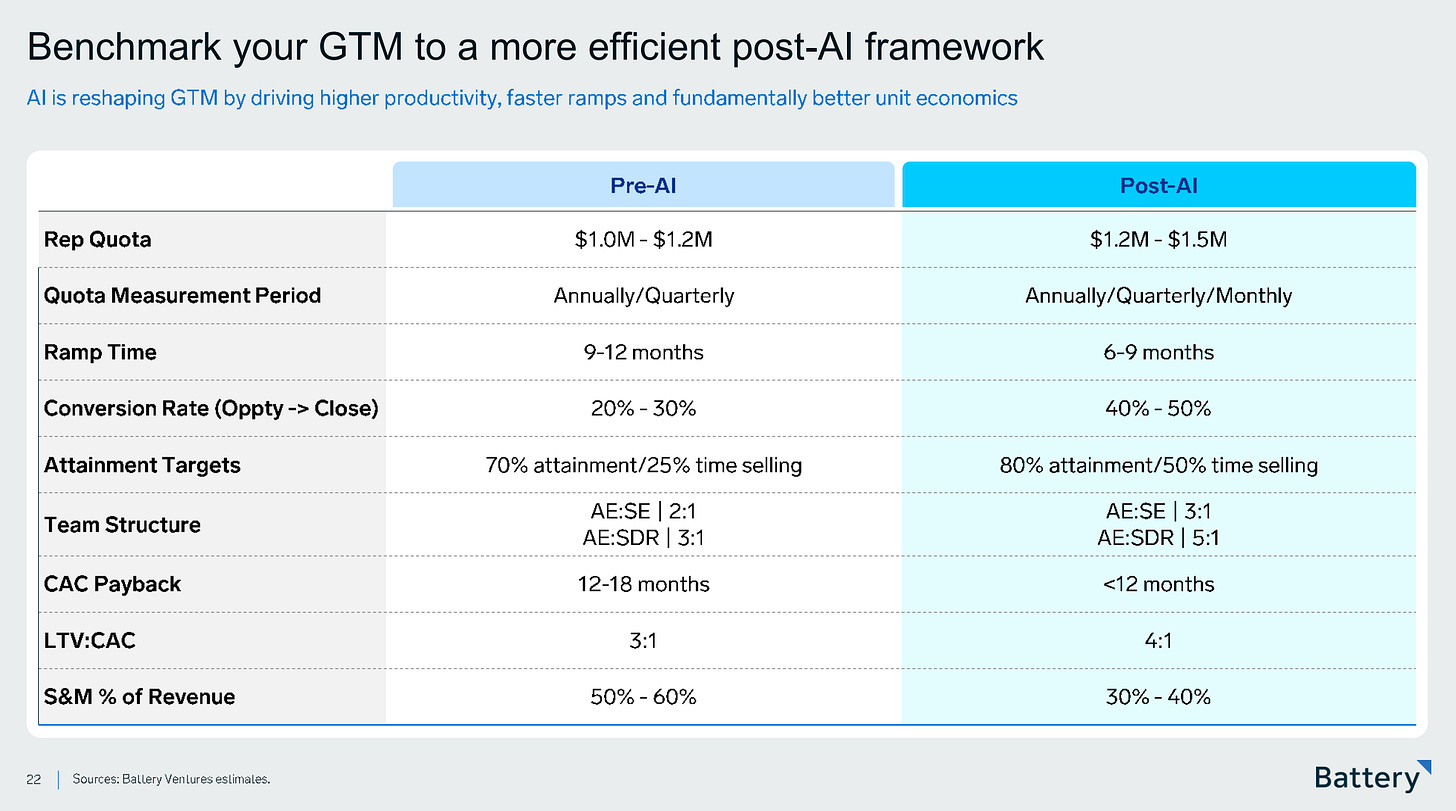

#great benchmarking data and must read from Battery State of AI

Enterprise Tech

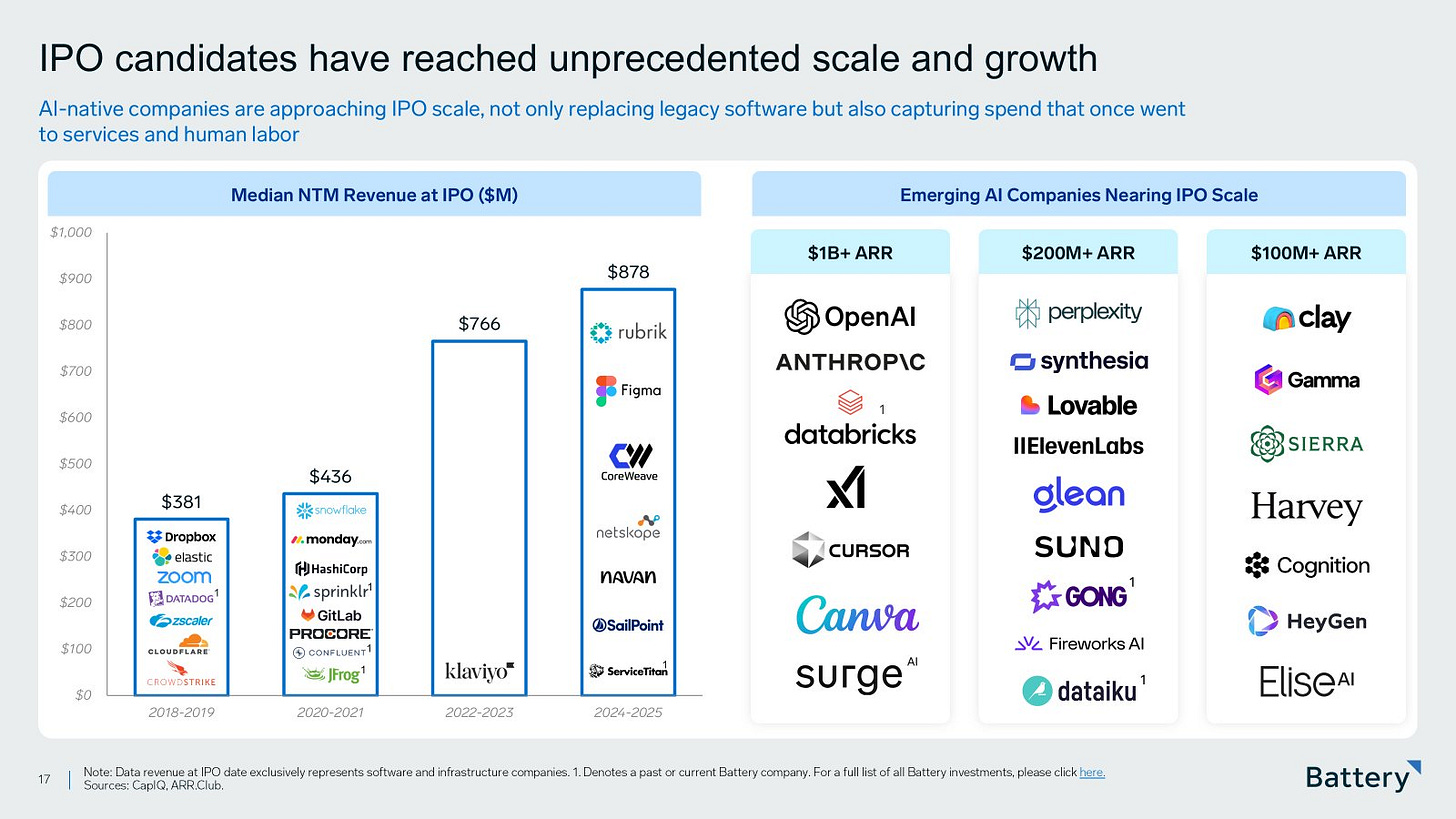

#what a historical time to be a founder but problem is bulk of revenue at moment is concentrated in top 20 startups…let’s see how this plays out in next 12 months

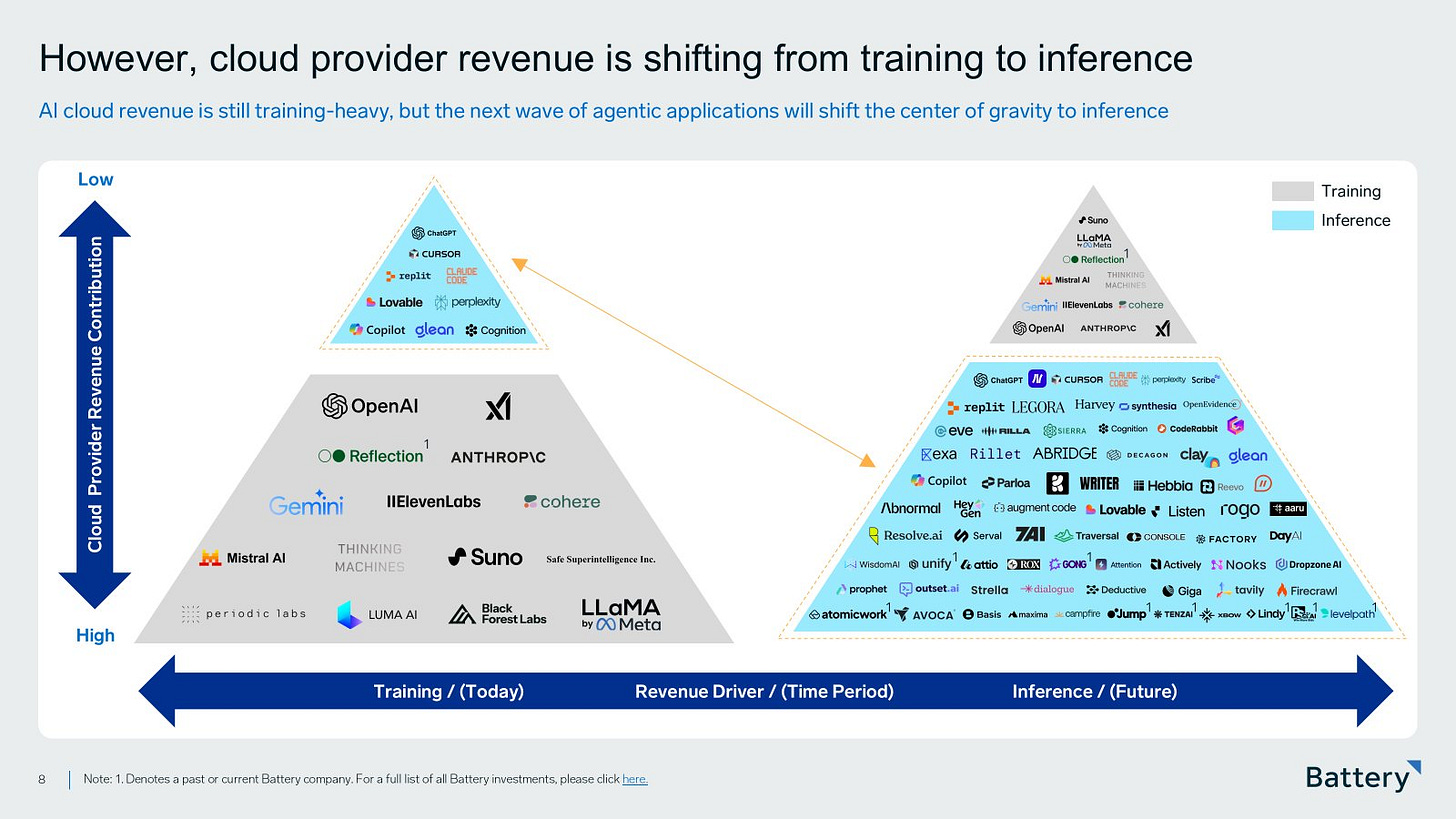

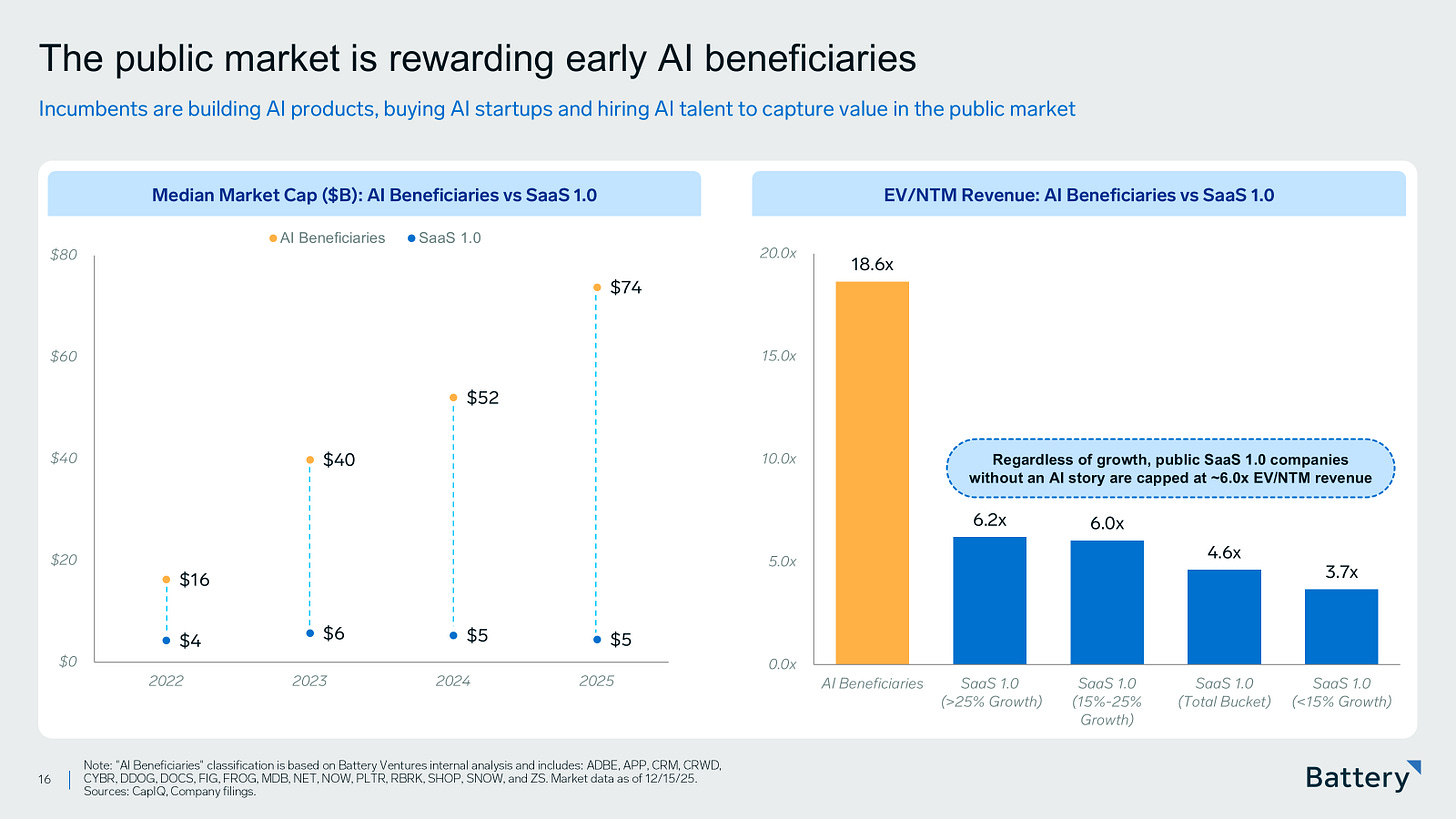

#speaking of - look at where value is starting to accrue, question is how durable for these next gen cos on right - from Daniel Dayan Battery

#the market prices of crypto show 📉 but what’s happening behind the scenes is fulfilling some of the original use core use cases of crypto - most of the largest banks called TradFi are pushing to tokenize assets - just the beginning!

#Cyera…almost the next cybersecurity decacorn - raises $400 million at $9 billion valuation in Blackstone-led round

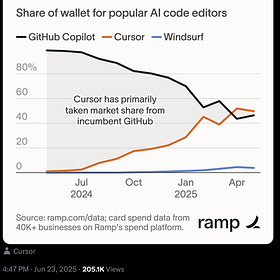

#Cursor bought Graphite for code review - second order effects of AI generated code acccelerating is finally getting attention - code review, security reviews…according to Axios the purchase was mixture of cash and stock and way higher than the last round of $290M for Graphite - here’s a blog post from Cursor on this problem

The way developers write code looks different than it did a few years ago. But reviewing those changes, merging them safely, and collaborating on them has increasingly become the bottleneck for building production-grade software.

The team at Graphite has spent the past few years thinking deeply about these workflows and have built a code review platform used by hundreds of thousands of engineers at top engineering organizations. The boundary between where you write code and where you collaborate on it feels increasingly arbitrary, and there’s a lot we think we can build by collapsing that distance.

which I’ve written extensively about

What's 🔥 in Enterprise IT/VC #379

Let’s zoom out and think about the second order effects if we assume that 50% of all code or more will be written by AI in the next 3+ years? Here are a few IMO and where I’m meeting some founders building insane stuff:

First thought - every code copilot will eventually sell security but do you want the fox guarding the henhouse meaning that do you trust the AI that may write insecure code to secure the code? In addition if every developer can easily use a copilot plugin from Github, AWS, Google, Replit, etc, will a user want to pay separately to secure each of those? In addition, one needs AI to help review all of the AI generated code as it will be impossible to keep up - hence, why I’m so excited about Snyk, a portfolio co, and it’s Deepcode AI offering. Peter McKay of Snyk recently summarized this view in a Forbes article:

#Andrej year in review a must read for all that happened in AI

#from Intercom’s co-founder - product vs. consulting…

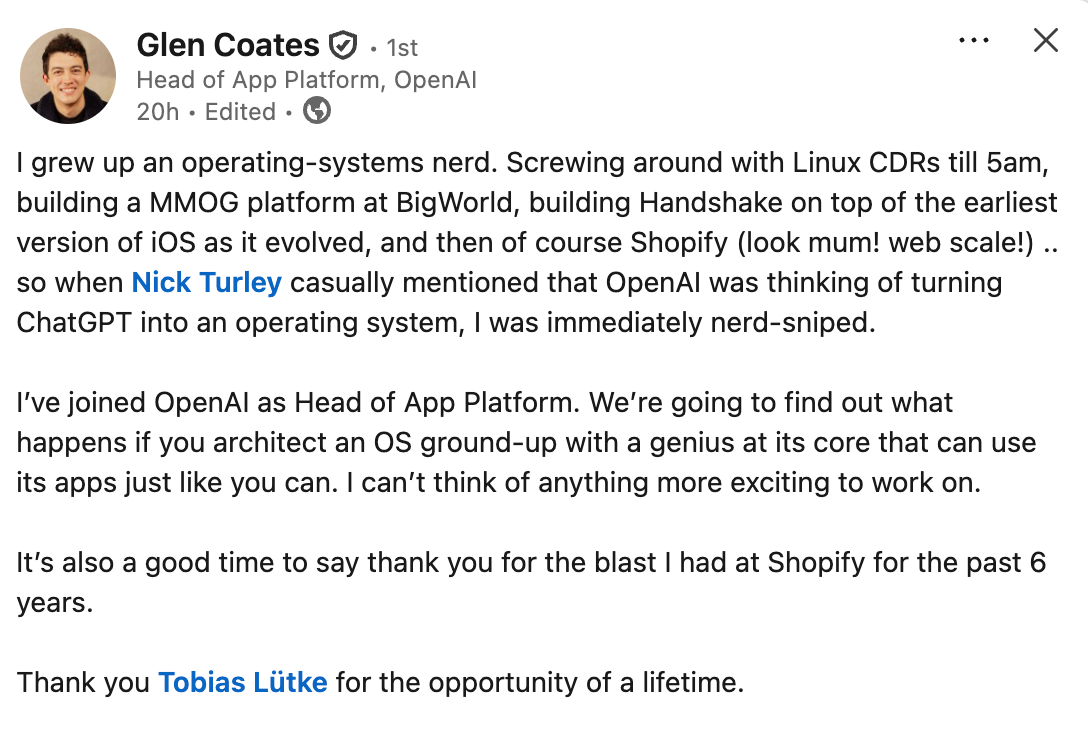

#head of app platform? who will OpenAI go after next? Great to see founder of former boldstart portfolio co Handshake (sold to Shopify where he led product) continue to make noise

Markets

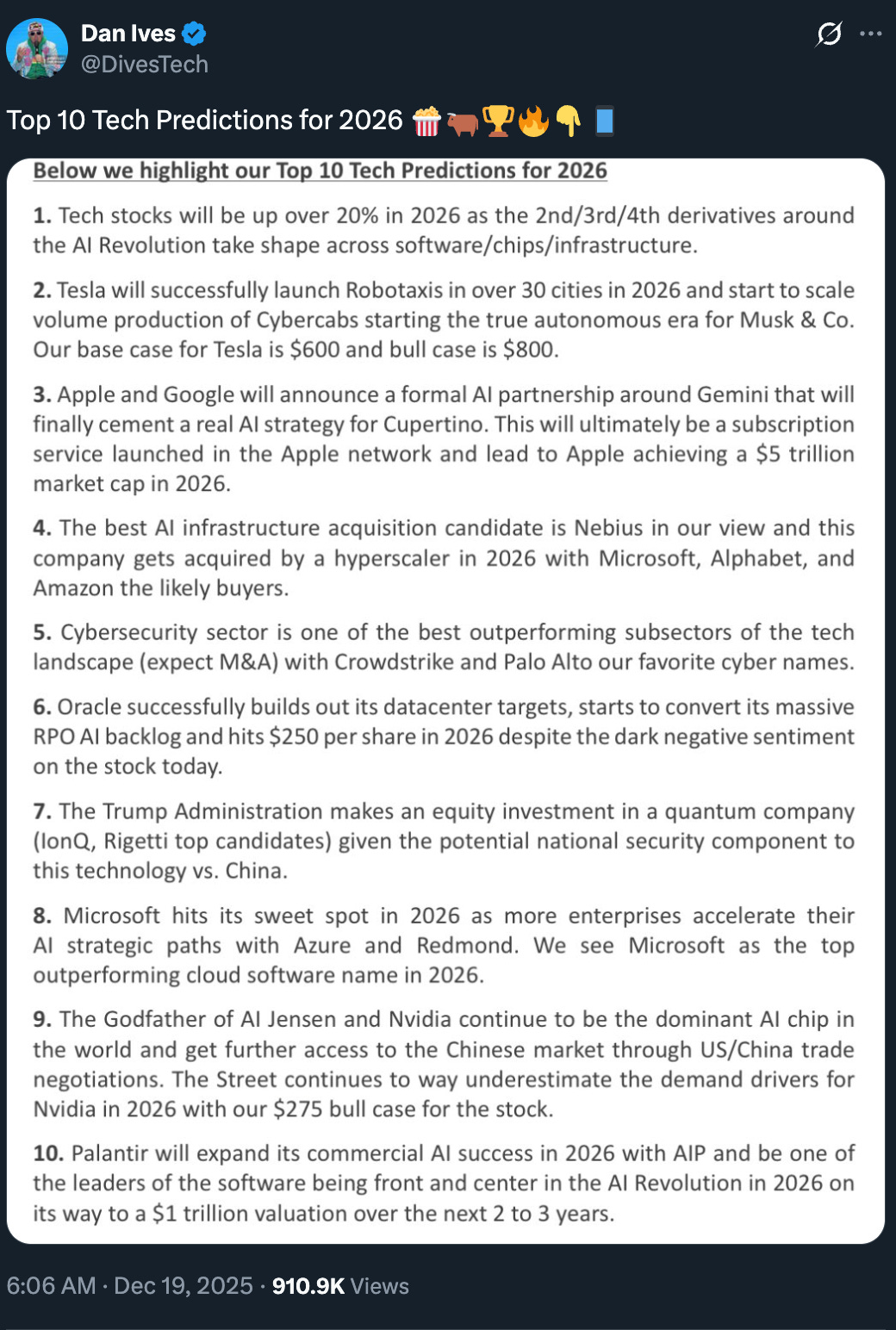

#Dan Ives from Wedbush Top 10 Predictions for 2026

#from Battery State of AI - great chart on what we all know, No AI story, no multiple expansion!

Future IPO candidates? Hello Clay!

Hey, great read as always. This tranched round for Resolve AI is wild. It really builds on those clever investment structures youve highlighted before. Super insightful.