What’s 🔥 in Enterprise IT/VC #440

Tariff-ied 🤯 - Time to dust off that old Post-ZIRP Recession Playbook 📖

While ZIRP was not too long ago, it seems to have been long forgotten with the euphoria around AI. All that being said, we need to brace for the upcoming storm. Liberation Day does not feel so liberating at the moment as the market threw up 🤮 on Trump’s tariff plans. Now our worst fears are coming closer to reality as the possibility that these tariffs not only push the US into a recession but also the world into a global recession 🤦🏻 has dramatically increased.

Key operative words are “global” and “if sustained” - hopefully the 34% retaliatory tariff from China is not the way that every other country responds 🙏🏼.

Tariffs the Trump administration announced on US trading partners would likely push the US and possibly the global economy into a recession in 2025 if they remain in place, according to JPMorgan’s top economist.

“The risk of recession in the global economy this year is raised to 60%, up from 40%,” JPMorgan Chief Economist Bruce Kasman said Thursday in a note to clients, calling the tariffs the largest tax hike on US households and businesses since 1968.

“The effect of this tax hike is likely to be magnified — through retaliation, a slide in US business sentiment, and supply chain disruptions,” Kasman said in the note titled, “There will be blood.”Even worse, stagflation fears are rising which means inflation and rising prices combined with slowing growth. Sure, potential rate cuts may help ease some of the pain, but irrespective, there are potentially massive impacts ahead for enterprise software and venture. The silver lining is that we’ve been through this before with COVID and the end of the ZIRP era.

Here’s a refresher…

Cash is king 👑 - preserve it and have a runway extension plan

Market uncertainty means IPOs pushed out again, meaning even less liquidity for LPs, M&A also becomes harder in a recessionary environment

Enterprises will spend less which means growth rates for enteprrise software cos will certainly decrease. This also impacts valuations for late stage companies first before it trickles down into the earliest of stages. We are already seeing some multiple impact from this past week as Median NTM is the loweest since 2016 🤯.

How long these last none of us know but it’s priced in already.

Later stage rounds become harder to get done as growth rates slow and growth investors take a pause to get a better understanding of the impact from these tariffs and what future liquidity could look like.

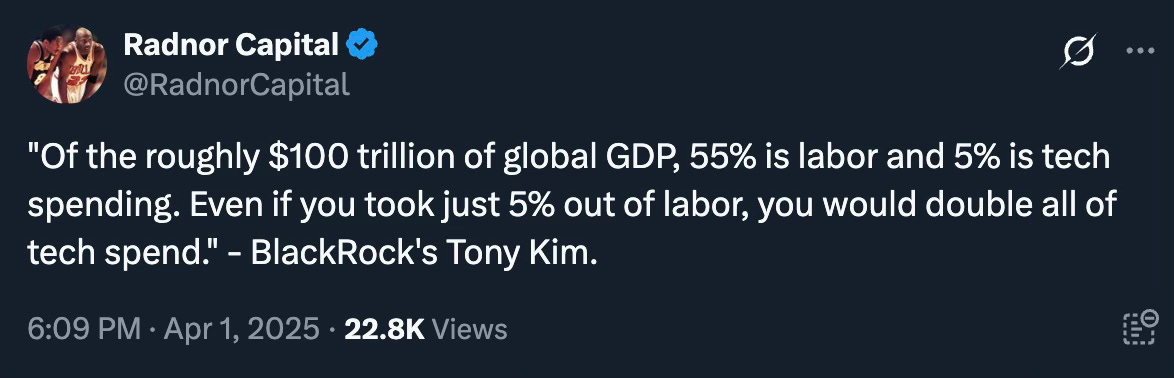

As everyone is looking to do more with less, will this be another catalyst for AI and agents - this could prove to be a tailwind for pushing agents into production faster. Here’s the labor opportunity

Finally, you’ve heard this so many times - starting a company during a recession is probably the best time ever for so many reasons!!! Here’s an excerpt from What’s 🔥 November 5, 2022 when the markets were crashing with the ending of ZIRP.

Only the most passionate and 🤑 founders will start a company in this environment, and with AI we will see the leanest, most efficient companies ever emerge out of these times.

Well, this tweet from earlier in the week still holds true, but instead of dozens of competitors, assume you’ll just have a dozen 🤣.

As always, 🙏🏼 for reading and please share with friends and colleagues.

Bonus material this week - side bar on the agentic stack!

This 👇🏼 - click through for the comments as well.

Will it be an existing SaaS vendor like a Salesforce or ServiceNow - unlikely?

Will it be a net new app vendor?

Will it be an existing glue/infra vendor like a Zapier?

Will be it an AI framework co moving up stack like CrewAI?

Or will it be something completley new?

All I do know is the idea of giving thousands of agents read/write access is really F&*#ing scary so that will need to be solved and locked down in a huge way!

I also know that lots of new tooling needed:

Control plane layer - how do you see thousands of agents in one dashboard, what they are running, how they are operating, how secure they are, governance in terms of what’s allowed

Orchestration layer - to have each agent hand off tasks to another agent which is interoperable with other agents with perhaps a human in the loop here and there.

Observability - tracing for troubleshooting. Also easy to way to do evals on agents and understand handoffs in a workflow and ability to easily make changes to ensure accuracy of result.

Discovery - do we move to a world of open agent directory and MCP directory or will there be registries/internal approved gateway for agents/MCP servers?

Security and Auth - who will do the auth of each agent and also the governance on what agents can do? How does one stop prompt injection attacks on agents or prevent rogue agents or fake agents or fake MCP calls?

Traffic - how do you let the good agents in/keep the bad out, how do you keep the right crawlers in, the bad out…

Dev tooling - how to easily build, connect, add new apps or data sources

Will net new AI native cos be winners or existing incumbents? Interesting times ahead!

Scaling Startups

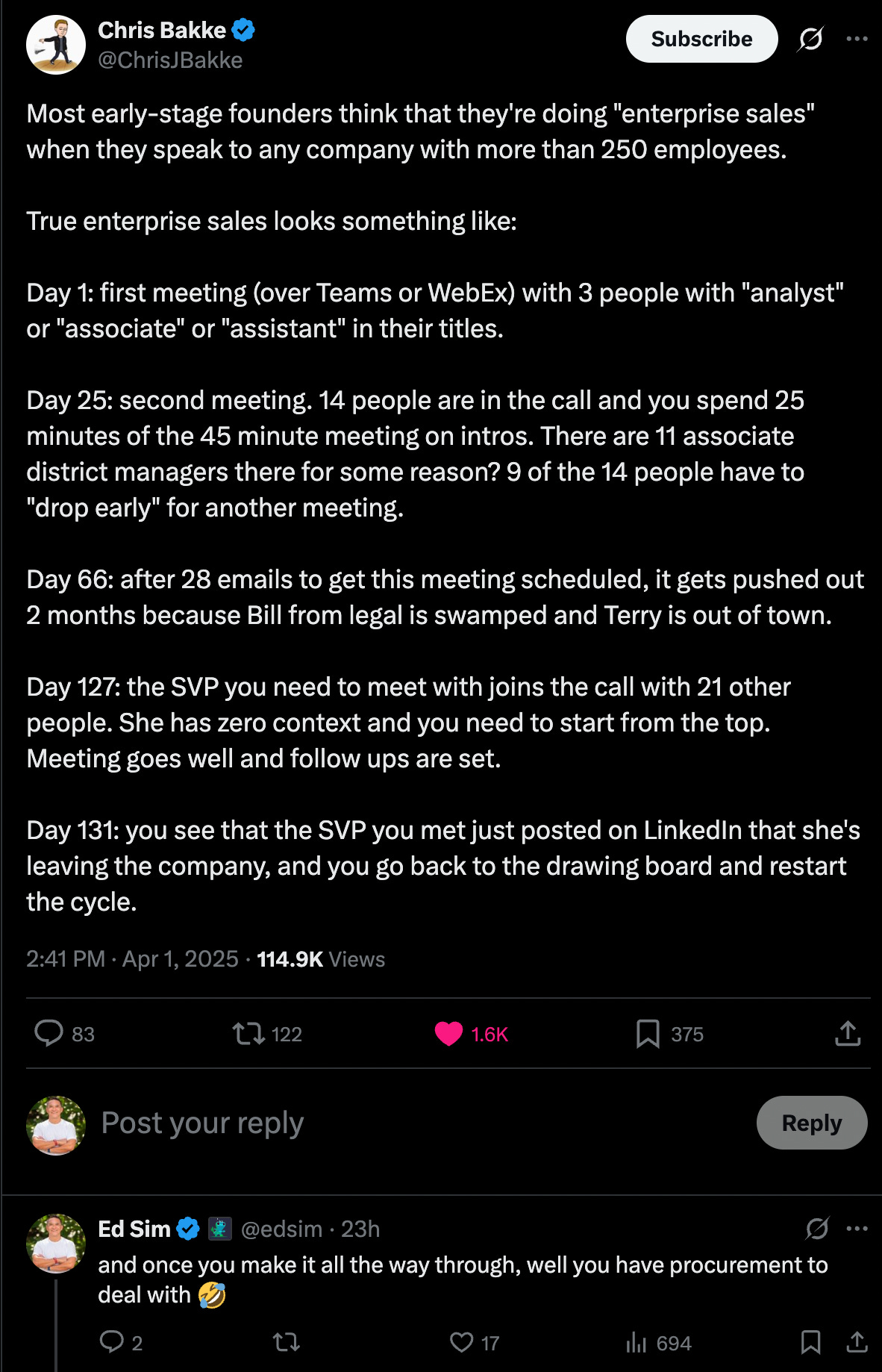

#🤣 so true - be careful what you wish for!

Enterprise Tech

#simple incredible - ChatGPT is the moat for OpenAI - each query and result and each thumbs up/regeneration is just more training data for OpenAI

#this is so good - also Microsoft is now 50 years old!

#how the Fortune 500 selling AI and agents to Wall Street and what are live production use cases - notice Palantir and AWS as key part of platform - 20% growth story vs a cost cutting one only

#with any new tech, first comes experimentation, then comes optimizing costs - in some use cases we are entering that second phase (The Information)

Cybersecurity firm Palo Alto Networks last year started adding artificial intelligence chatbots to its products to help customers get answers about their network security. The tools originally relied on state-of-the-art models from OpenAI and other firms.

But Palo Alto Networks recently found that open-source models from DeepSeek, a Chinese developer, could handle the same tasks for just 5% of the cost of the OpenAI models, CEO Nikesh Arora said.

As a result, Arora’s firm is expecting to spend less on AI to power its existing products in the near term, he said.“For the tasks where we’re getting efficiencies and driving lower costs, I don’t think the model’s IQ needs to be much higher than it already is…and I don’t want to pay a dollar for that. I’d rather pay five cents,” he said.#how LLMs 🤔 - must watch

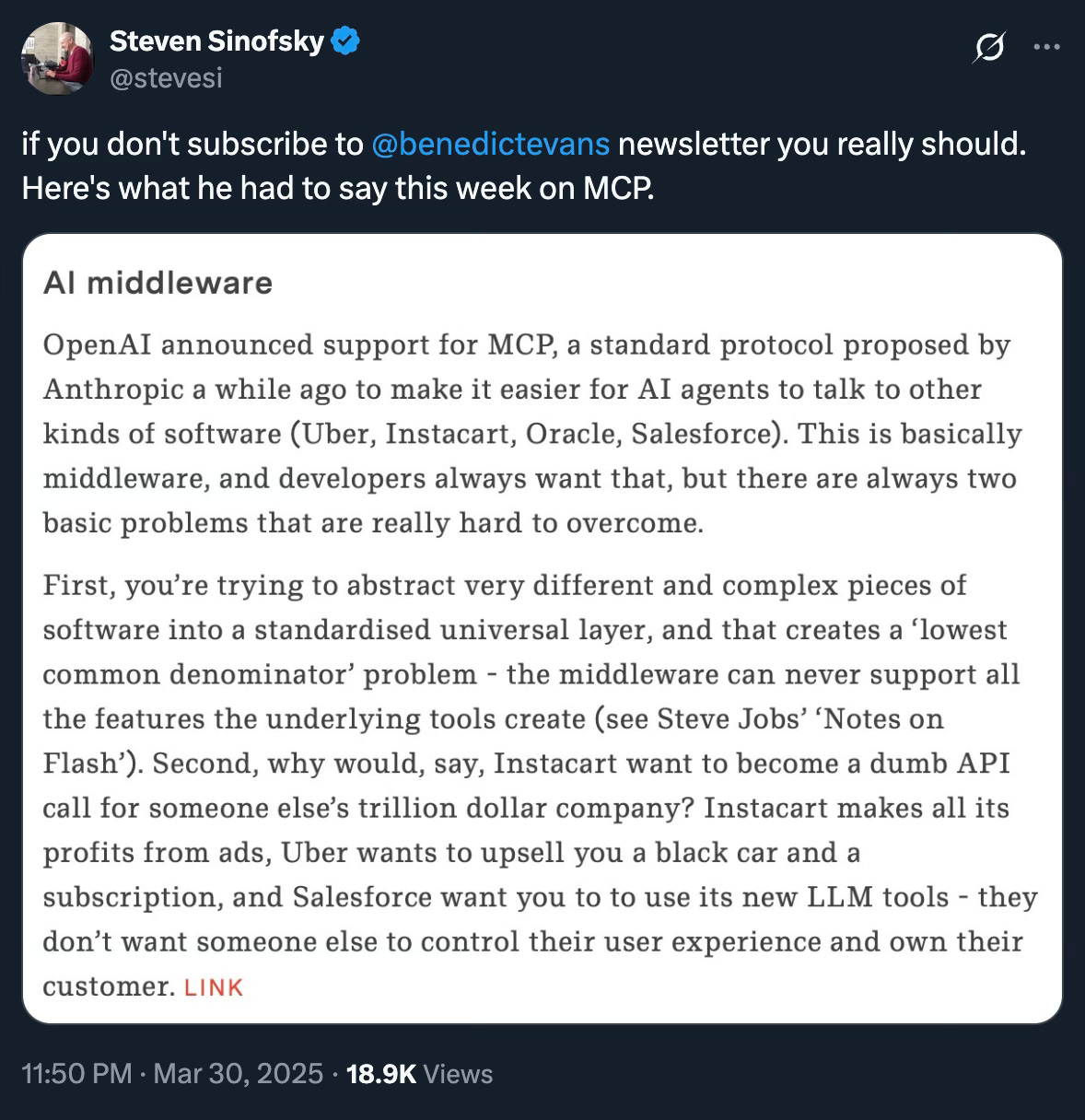

#MCP baby you know me - more follow up from last week’s post here

#MCP debate - if agents far outnumber human users by a factor of 1000 x 1, then everyone will want to be able to be discovered and features called using MCP - question is will there be MCP gateways to meter traffic, good vs. bad, etc…

#to my point…

#and when there is a hot new technology or standard, well, the hackers will be there - MCP not all fun and games and why we also agree with Steve Manuel why MCP.run (a port co) and WebAssembly is the only secure option…

#when the ChatGPT moment for MCP and what it will look like…

#full list of Israeli cybersecurity 🦄 from The Security Industry - great to have Snyk, BigID and Fireblocks on there from our portfolio - the question is who’s next?

#Coming after internal data and Glean and others…

#and Microsoft making it easier and easier to go from copiliot to intelligent teammate trained on your data - take a look 👇🏼

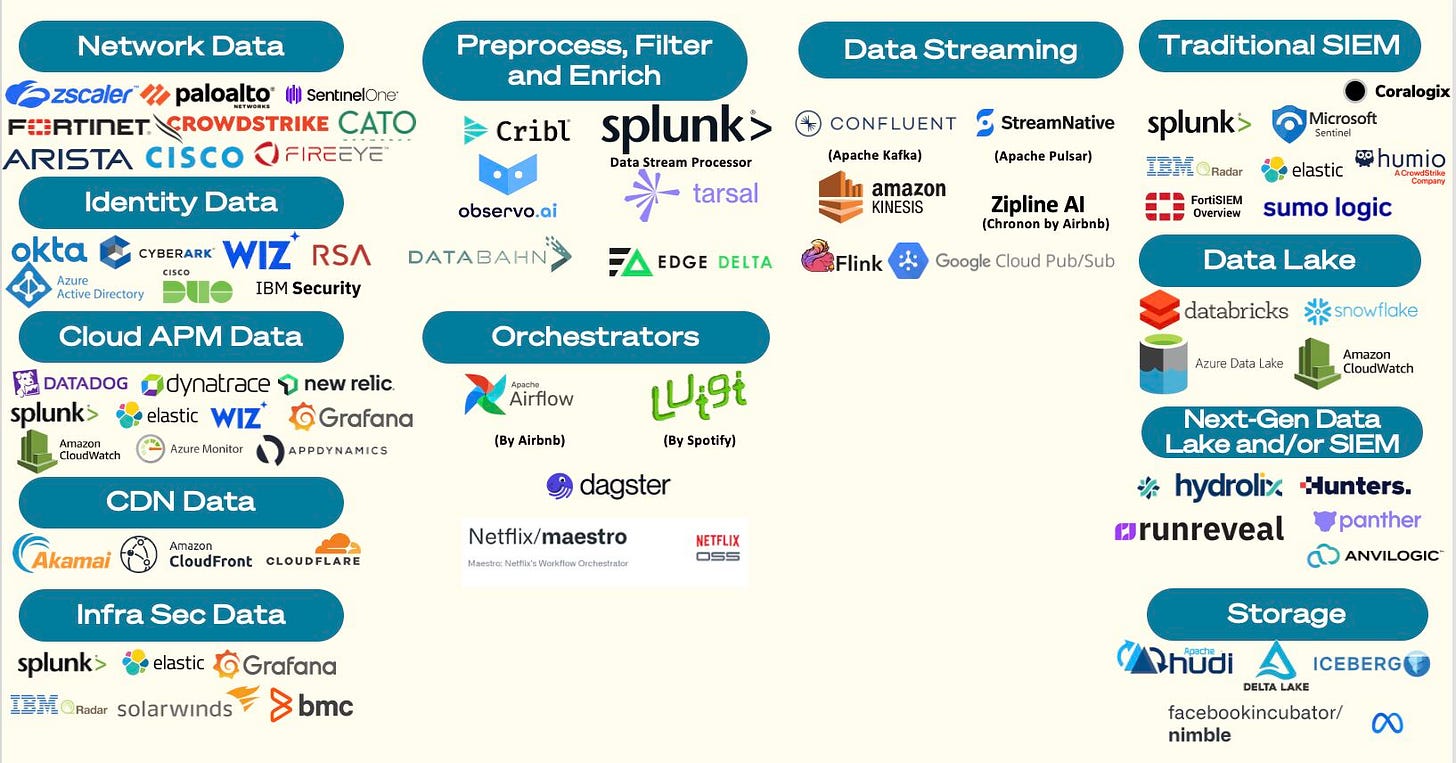

#great post from Chris Zeoli from Wing VC - move from logs, metrics and traces from IT ownership to data engineering problem with AI - how to rethink the observability stack with LLMs in the loop. We have Grepr.ai, a portfolio co, in the hunt here as well

#it’s all about the data

#Agree or disagree?

#yes, Dylan is joking - Jevon’s Paradox in full swing

#Black Mirror is coming…from my friend Rob Locascio who I backed first when he started one of first live chat platforms for customer support, LivePerson - pretty amazing article in Business Insider - click image for story/paywall

Markets

#state of the markets

#best take yet on tariffs from Gavin Baker

#vibe coding Replit in talks to raised at $3B valuation triple its last round price 3 years ago (Bloomberg)

and Cursor closed - that’s almost $13B of market cap for 2 vibe coding cos 😲

#why go public when you can just do a tender offer - amazing scale from Scale AI (Bloomberg)

Scale AI, a startup that helps companies develop artificial intelligence applications, expects to more than double revenue this year and is in talks for a tender offer that would value the company at $25 billion, according to people familiar with the matter.

The company generated about $870 million in revenue in 2024, with its annualized run rate reaching $1.5 billion by the end of the year, according to one of the people. Scale AI expects $2 billion in revenue this year, said the person, who asked not to be identified because the information is private.

A tender offer allows new or returning investors to purchase existing shares from employees or early investors. The stock sale’s expected valuation would mean the company is worth over 80% more than its valuation in a fundraising round last year. Business Insider earlier reported on Scale AI’s tender offer.

Thanks for the call out Ed!