What’s 🔥 in Enterprise IT/VC #451

The SaaS 🦄 midlife crisis - how to reinvent yourself like Intercom/Fin

What’s 🔥 this week - Karpathy’s take on where software is headed, Coatue’s market outlook slide drop, and a rare note from Andy Jassy to his troops (links all below)

To kick of this week, let’s grab a slide from Coatue and walk down the path of SaaS Unicorn 🦄 land. Using public software companies as a proxy, growth has slowed.

Consequently all of the value to be accrued from the next wave in AI are with the private companies as shown below.

The question is what are subscale SaaS companies with slowing growth to do? The companies with $100M - 300M+ ARR, solid businesses, but too small to go public, especially when AI companies like Anthropic have numbers like this?

Logan Bartlett had a great post earlier in the week about this exact topic.

Jason Lemkin also comments on this - is everything up for grabs after $100M?

But there’s always a chance, especially if you go all-in on AI, can’t be half ass - look at how Intercom did it without killing the core business.

More from Eoghan McCabe, CEO and co-founder as its AI agent is on track to go from $0 to $100M in 2.5 quarters 🤯. Sure lots of that may be existing customers rolling to new agent, but regardless, overall numbers are growing faster than ever and this a master path to re-horning yourself, if you will. More 👇🏻.

The Information mentioned that Intercom could be raising a new round at a valuation between $2-3 billon - significantly higher than it’s last round of funding at $1.25B.

It isn’t clear if Intercom would issue new shares in the deal. The company has also discussed a valuation closer to $3 billion in a deal based on investor-friendly terms, this person said.

The ongoing talks are early and terms could change for both companies.

Either way, the deal would likely boost the share price of San Francisco–based Intercom, which last raised equity funding in 2018 at a $1.275 billion valuation, excluding the new capital.

Intercom in March 2023 began selling Fin, an AI agent for businesses that automatically responds to customers’ inquiries via text. The company was generating around $300 million in annual recurring revenue at the end of last year, though Fin accounted for a small portion of that figure, according to a person familiar with the fundraise.While it’s not valued as highly as the pure plays like Sierra and Decagon, this is an awesome story for those looking for a new growth engine - it’s possible!

Founders, you’re never down and out for the count. If you don’t disrupt yourself, then someone else will. Also, there is always an opportunity to just launch a net new thing, perhaps even branded separately, to perhaps create the next hot AI product. Take a look at 10-year-old Replicated with its SecureBuild launch this week. Got to love it - going right after Chainguard with an edgy launch and even stronger economic incentive for OSS providers.

Reminds me of that great clip from the movie Dumb and Dumber:

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#this is your brain 🧠 on AI - didn’t know where to put this, but stop and read and absorb this - thank goodness I enjoy writing myself!

and this…

#Andy Jassy’s letter to employees is a must read. Act like a startup, lean and scrappy and fast, agent first, and incredible efficiency and job displacement/replacement.

#💯 what can go right vs everything that can go wrong!

#never gets old watching this - “belief in yourself has to be earned”

#💯

Enterprise Tech

#this is how it begins - AI too expensive and then the switch flips - agents will eat into labor and that TAM is just massive

#everyone stop and watch this - ok, GeneralistAI is boldstart portfolio co, but this is the future of robotics built by a team from Google DeepMind, Boston Dynamics, OpenAI and more…

here’s the official launch:

#everyone’s been buzzing about this Andrej video on the future of software - a must watch!

notes from Greg Isenberg here:

#Scale was a pivot - backing people at inception who backed into an opportunity as Meta invests $14.3B into Scale as an acquihire (Bloomberg)

Founded in 2016, Scale has a high-wattage list of investors. Its largest shareholders include Index Ventures, Y Combinator and Tiger Global Management, according to people familiar with the matter.

Though not the biggest, one of the earliest investors in the company stands to make very high returns — earning several hundred times his initial investment. That investor, Paige Craig, a former Marine turned venture capitalist and managing partner at Outlander VC, backed Scale’s founding duo at a $3 million valuation when the company was still building a doctor concierge app operating under the name Ava Labs, he said. Craig declined to comment on the Meta deal, Outlander’s returns after dilution or the firm’s current stake.

The story of Outlander’s investment — about $245,000 in total, excluding special purpose vehicles — is an odd one even by Silicon Valley standards: An Uber driver overheard Scale co-founder Lucy Guo discussing her startup, and recommended she contact Craig, he said in an interview this week. She did, and he agreed to invest.

“I came to the conclusion that I hated their product, but I thought they were brilliant,” Craig said. At the time, “they were young underdogs that no one believed in.”#timing is everything - sounds like a bootstrapped startup called Surge AI was taking serious market share from Scale - reported to have no investors and in 5 years has scaled to a $1B revenue number in 2024 🤯, a number that exceeds the $870M that Scale did last year

#and a vibe coded, solopreneur just sold his co for $80M 👀 - not everyone needs VC

#are you selling software or creating a movement? ❤️ this from Clay, a boldstart portfolio co - GTM Engineering!

#💯 context is everything

#so is the last mile which I’ve always believed (see What’s 🔥 #415)

What’s 🔥 in Enterprise IT/VC #415

AI is the greatest platform shift that we may experience in a long time. That being said, it’s super easy to use an API and create your own AI-related startup. These 3 posts show you how many of these startups actually exist already. Click through each and read the comments. And if you want the Google Notebook LLM summary here it is.

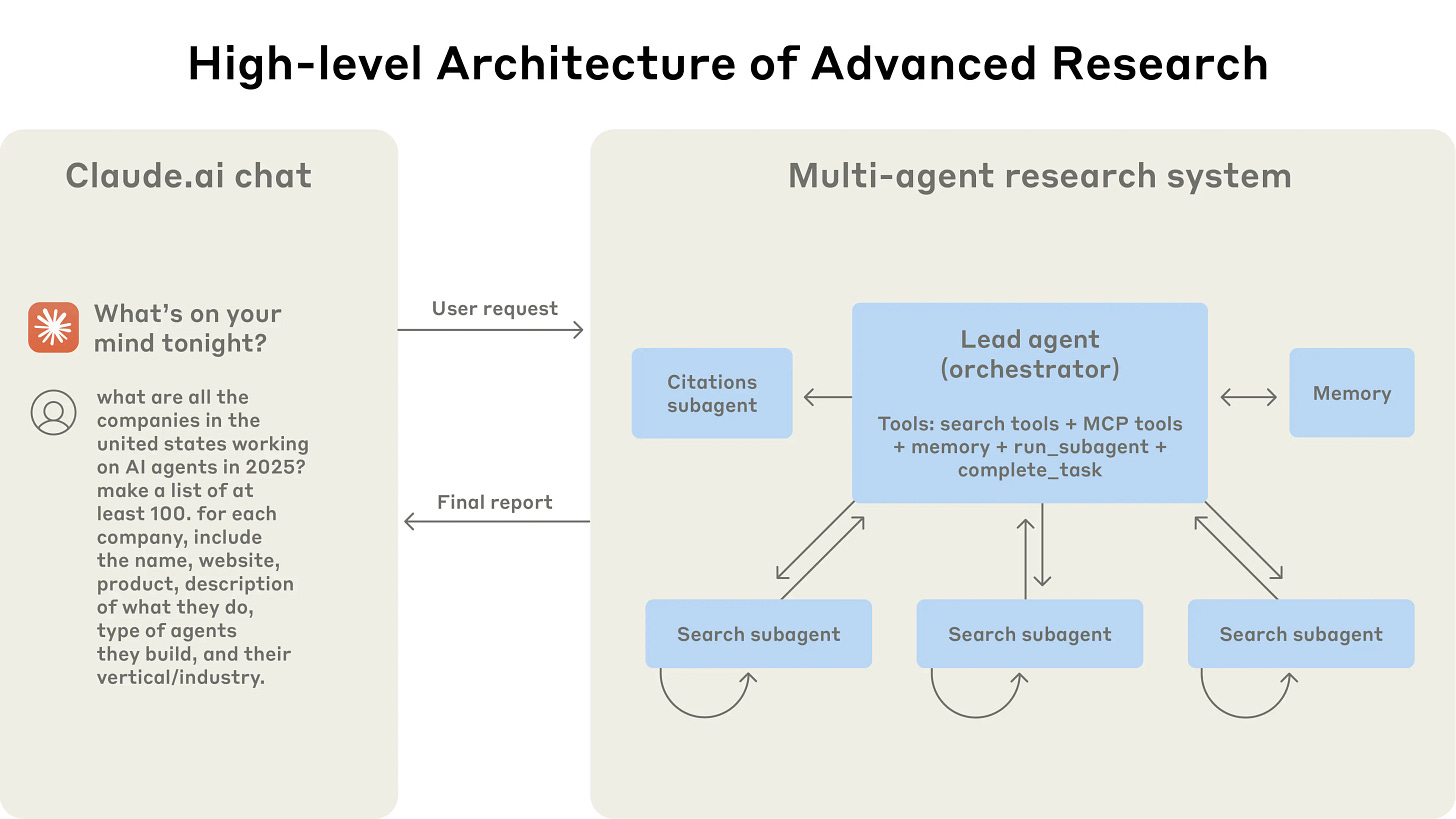

#great paper from Anthropic on how it built its multi agent research system - Our Research feature uses multiple Claude agents to explore complex topics more effectively. We share the engineering challenges and the lessons we learned from building this system (paper here)

#super entertaining - veo based content 📈 - prepare for an onslaught of enterprise related releases soon

#the blockchain movement is just getting started…and this will happen

#what’s the state of security for AI assisted coding in the enterprise? Great deep dive from Guy (Tessl) and Danny (Snyk)

Markets

#Coatue’s fabulous state of the public/private markets deck is out and you can get it here. I clipped a few slides to just show how big the largest private companies have become - growing faster than the large publics, consuming >50% of all private capital, and rounds over last 5 years have grown 📈. Finally, one can see why - growth has significantly slowed in the public software universe which means the rare company which is growing >25% has a premium multiple of 13x NTM Revenue, larger than in previous years. and the AI opportunity ahead is bigger than ever - btw, my point is if software is eating the world, and AI is eating software, can agents eat into labor?

#should SaaS vendors be worried?