What’s 🔥 in Enterprise IT/VC #415

Old school enterprise sales + delivery needed to solve the last mile problem in the enterprise - yes, services needed!

AI is the greatest platform shift that we may experience in a long time. That being said, it’s super easy to use an API and create your own AI-related startup. These 3 posts show you how many of these startups actually exist already. Click through each and read the comments. And if you want the Google Notebook LLM summary here it is.

Multitude of RAG vendors…

Multitude of AI coding copilots

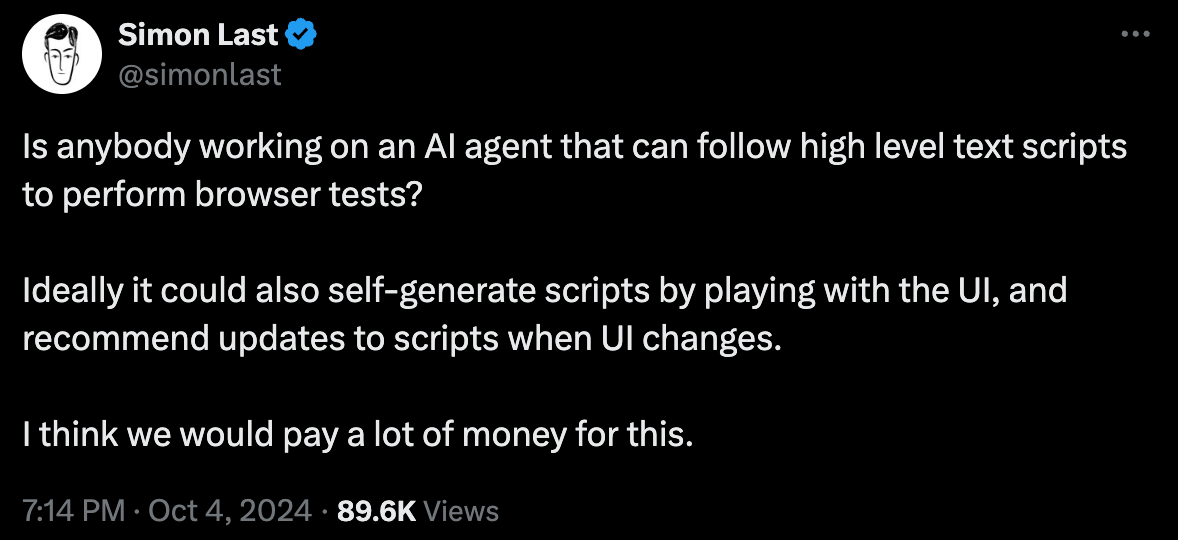

Multitude of testing copilots

So while there are a ton of thin wrapper type features masquerading as companies, what I can tell is that there are plenty of companies that may seem like the former but actually are much more durable in growth and opportunity.

Writer is one such example. On the surface it may seem like another GenAI marketing content generator but underneath the hood there is so much more. This is Writer’s positioning from its $26M Series A annoucement in November of 2021, pre-Chat GPT - it was a writing assistant for enterprises, but it optimized for team and data security back then.

Writer’s platform gives companies a single source of truth for content guidelines, makes brand compliance simple, and uses in-context coaching to teach team members how to write using their company’s voice. Other writing assistants are focused on the technical aspects of writing, are optimized for single-player mode, and ignore data security. By contrast, Writer focuses on the challenges teams face around scaling content production, staying consistent with the brand, and making sure no one ever has to write the same thing twice. It is built to make collaboration on writing easy across teams and enterprises, and is designed to keep data secure, private, and compliant with data regulations.Here is its positioning 3 years later.

That’s a far cry from an enterprise writing assistant! According to CNBC Writer is now rumored to be raising at a $1.9 billion valuation and launching a new model to compete with OpenAI” (CNBC)

* Writer, a San Francisco-based AI startup, debuted a large AI model to compete with enterprise offerings from OpenAI, Anthropic and others.

* The approximate training cost for the new AI model was just $700,000 compared with estimates of $4.6 million for a similarly sized OpenAI model.

* Writer is currently raising up to $200 million from investors at a $1.9 billion valuation, nearly quadruple its valuation in September 2023, according to a person familiar with the situation.

On snythetic data:

Waseem Alshikh, Writer’s co-founder and CTO, told CNBC that Writer has been working on its synthetic data pipeline for years.

“There’s some confusion in the industry about the definition of ‘synthetic’ data,” Alshikh said. “To be clear, we don’t train our models on fake or hallucination data, and we don’t use a model to generate random data. ... We take real, factual data and convert it to synthetic data that is specifically structured in a clearer and cleaner way for model training.”In summary, on the surface most of these companies are likely just thin wrappers calling an API but some have much more beneath the hood! These latter companies understand something that many still do not - in order to deliver these AI solutions at scale in the enterprise, it is a completely different beast. That last mile is so important and is the difference between shelfware and huge ROI.

And because of this, I also see a back to basics, old school sales is back

Here’s Palantir’s CTO hammering this point - must watch 👇🏼 (start at minute 6:41 if you want the last point).

The value being delivered is going back to the way it used to be so architect your solution from Inception to be able to deliver in any environment, cloud, hybrid, or on-prem with the underlying premise that Time to Value matters. And don’t be afraid to throw some bodies at the solution as that is that is what will be needed to make customer happy!

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#❤️ this - well said…

#kind of wild, less deals done but prices higher? What gives?

#Build 🏗️

#Going OG again with Bill Gates - ❤️ this video, provides context for what I also believe is going to be huge in the next 10 years

#LT relationships matter - the world of investing got too transactional, great story from Guy Podjarny founder of Snyk on a “failed” preemptive Series A round and sharing how everything is not always 📈 - important for founders and investors to listen

Enterprise Tech

#🤔 will PE just buy lots of 🦄 for cheap and then use AI to squeeze efficiency? what happens to all employees?

#AI is experiential - get busy and implement to learn vs. being theoretical and from CTO, so easy to build a charismatic prototype, it is so hard to get from a brutal prototype to something that is valuable, rock steady, in production

“One of our customers, a very large US insurance company… we’ve automated all of insurance underwriting. A process that used to take 2 weeks, can now be done in 3 hours”‼️

“If all of your competitors take 2 weeks to price risk, and you take 3 hours, it’s going to be a fundamental dislocation of the market.”powered by 78 agents in a workflow 🤯 - watch here

#the future is about agents and agentic workflows but don’t forget about the data (Runtime)

However, as the enterprise software industry tries to cram agents into anything and everything, it's not clear how many companies are ready to take advantage of the technology. Like any generative AI technology, unlocking whatever special outcome is promised by the tool requires sharing a ton of data with that tool in tool-friendly ways.

When Intuit started building an internal AI platform that allows its developers to create agents for internal and customer-facing use, "we made a huge investment in modernizing our data platform," Srivastava said. That required breaking down the barriers between different types of data and creating a map of all that data that drew links between similar data types.

"Data hygiene is even more important today than it was in the past. Everything can be knowledge for those AI agents, and so they're really able to leverage unofficial knowledge that exists in organizations and uncover existing patterns without a lot of investments from people."

Ashok Srivastava, chief data officer at Intuit #👇🏼 must watch if you’re interested in the future of coding and AI

#👀 Shades of the ZIRP era are back as massive preemptive rounds are back for the growth stage…

Sierra - AI agent for customer service (The Information) raising at $4B

Sierra, an artificial intelligence startup co-founded by former Salesforce co-CEO Bret Taylor, is raising hundreds of millions of dollars in new funding led by growth-stage investor Greenoaks Capital, according to two people who have examined the deal.

The new financing will at least triple the company’s valuation, which was $1 billion in a funding round in January, one of the people said, adding they expected the valuation to surpass $4 billion. It’s the latest sign of the high prices investment firms have been willing to pay for shares in young AI firms with little revenue, particularly those led by Silicon Valley veterans.

Sierra, which is selling an AI “agent” that can automate certain tasks such as customer service, including voice calls, was founded just over a year ago. The additional capital will add to the $110 million in funding it raised in less than a year.and the agent now talks, read and click through to listen, it is pretty darn good

Investors are scrambling to get into ElevenLabs, which may soon be valued at $3 billion (TechCrunch)

This person said a deal is likely in coming weeks.

Investors from two other firms confirmed that ElevenLabs is raising, but are passing on the deal. One of these sources heard secondhand that the company’s annualized recurring revenue (ARR) has grown from $25 million at the end of last year to roughly $80 million in recent months, making it one of the fastest-growing startups developing actual applications for AI. (These investors asked for anonymity for competitive reasons.)

If accurate, that revenue figure means that investors could value ElevenLabs at around 38 times the most recent ARR figure. That multiple is slightly lower than some enterprise-focused companies such as Hebbia and Glean.#💯 huge believer in Jevon’s Paradox - i mean just look at cost of internet bandwidth from early days to now…

#low hanging fruit use cases for AI, support, marketing and code but what’s next?

#crypto adoption according to Blackrock 📈

Markets

#what will the future look like? If you have time, must watch - stock is down 8.5% but the video of the future is pretty darn cool - makes you wonder and love how Elon thinks big

#this is pretty good - read🧵