What’s 🔥 in Enterprise IT/VC #413

Seeing, catching and riding big waves 🌊 - signs of early success + framework for building in net new markets vs. existing

For the past month, and this week in particular, I feel like there was a major unlock in the venture world. I’m just seeing incredible momentum across the board from enterprise investors looking to aggressively deploy capital into next rounds, Series As, Bs, and Cs. This is not just for what you call AI-only companies but for more categories like Independent Developer Platforms (see Cortex last round) and other more traditional and less sexy areas of enterprise where AI is not the lead but just part of the delivering of value.

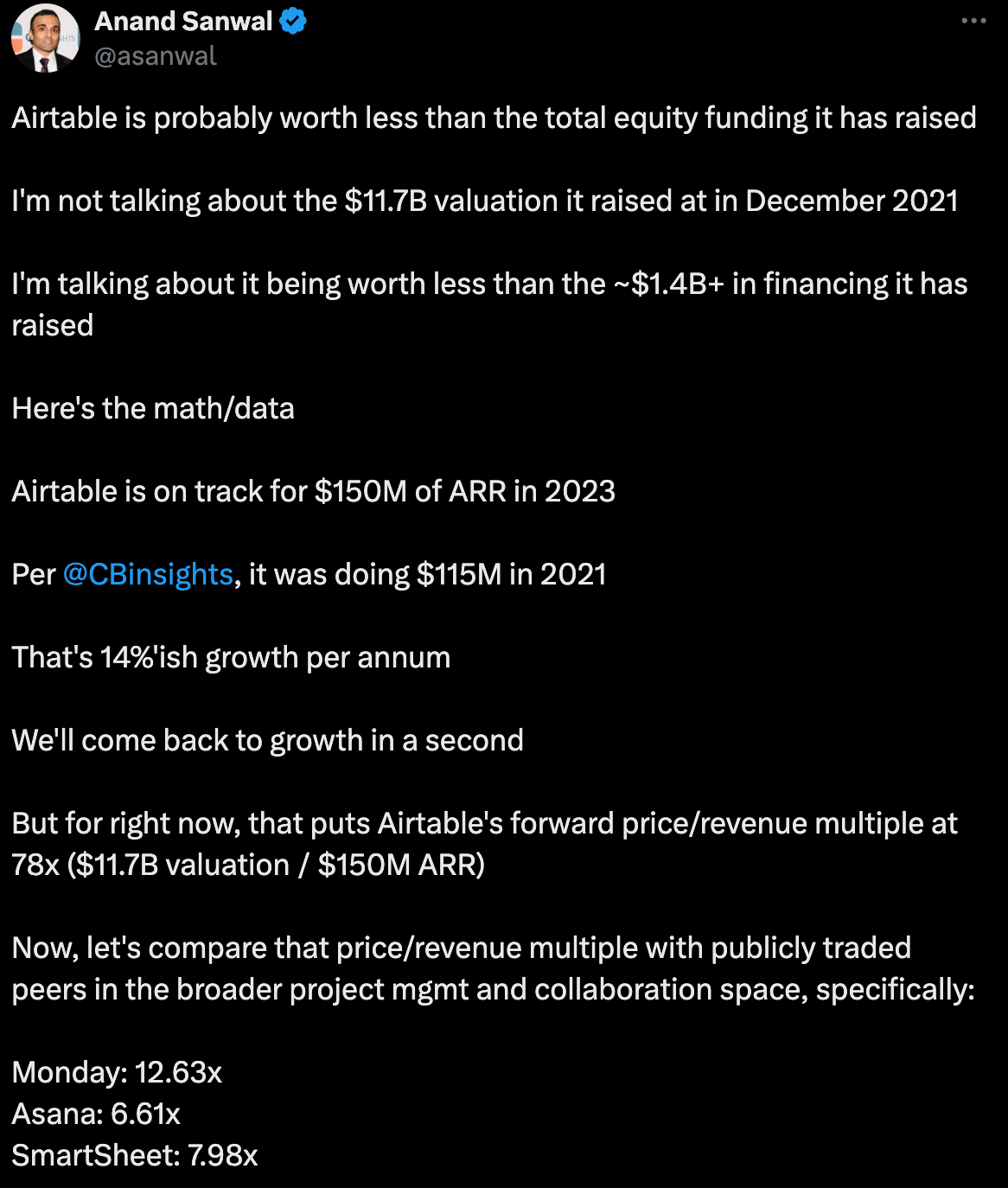

I can feel it and see it - the dam is starting to break open, and all of those dollars on the sidelines are starting to get deployed. Sure, it’s tough for cos growing 20% YoY as the value is more closer to a Smartsheets at 8x trailing on $1B revenue than an OpenAI, but hey, one can dream a bit as we’re seeing upticks and uprounds happening.

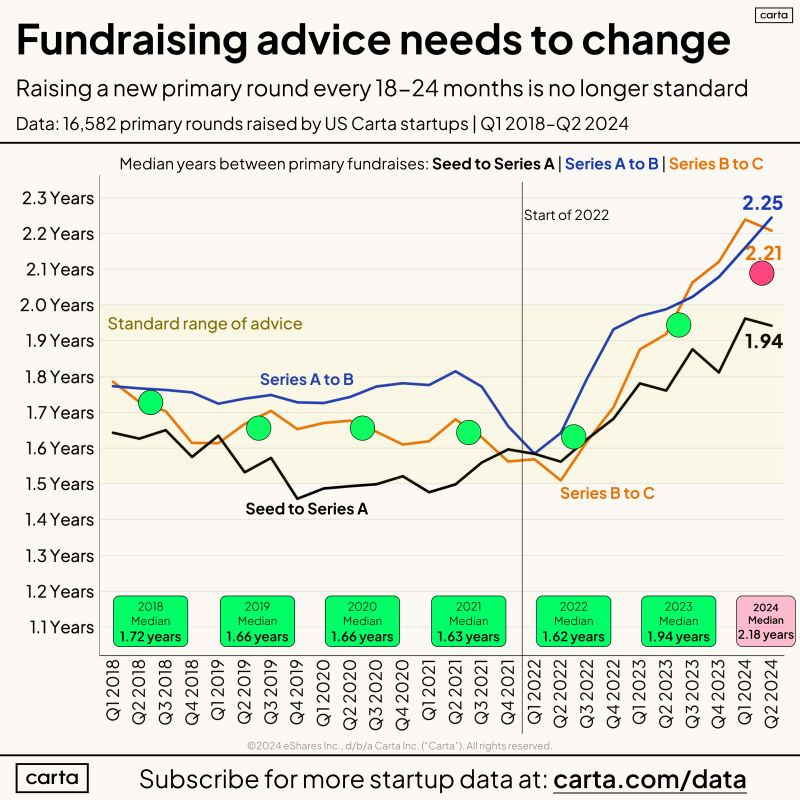

That is, if you survive long enough to get to the next round. This chart from Peter Walker, Carta from this past week spells out the time to next round over the last 6 years. It has lengthened by about 6 months for most startups. This data can be interpreted in so many ways since rounds got much larger, startups cut burn, but however you look at it, founders on average should make their cash last at least 2+ years and work backwards from those milestones.

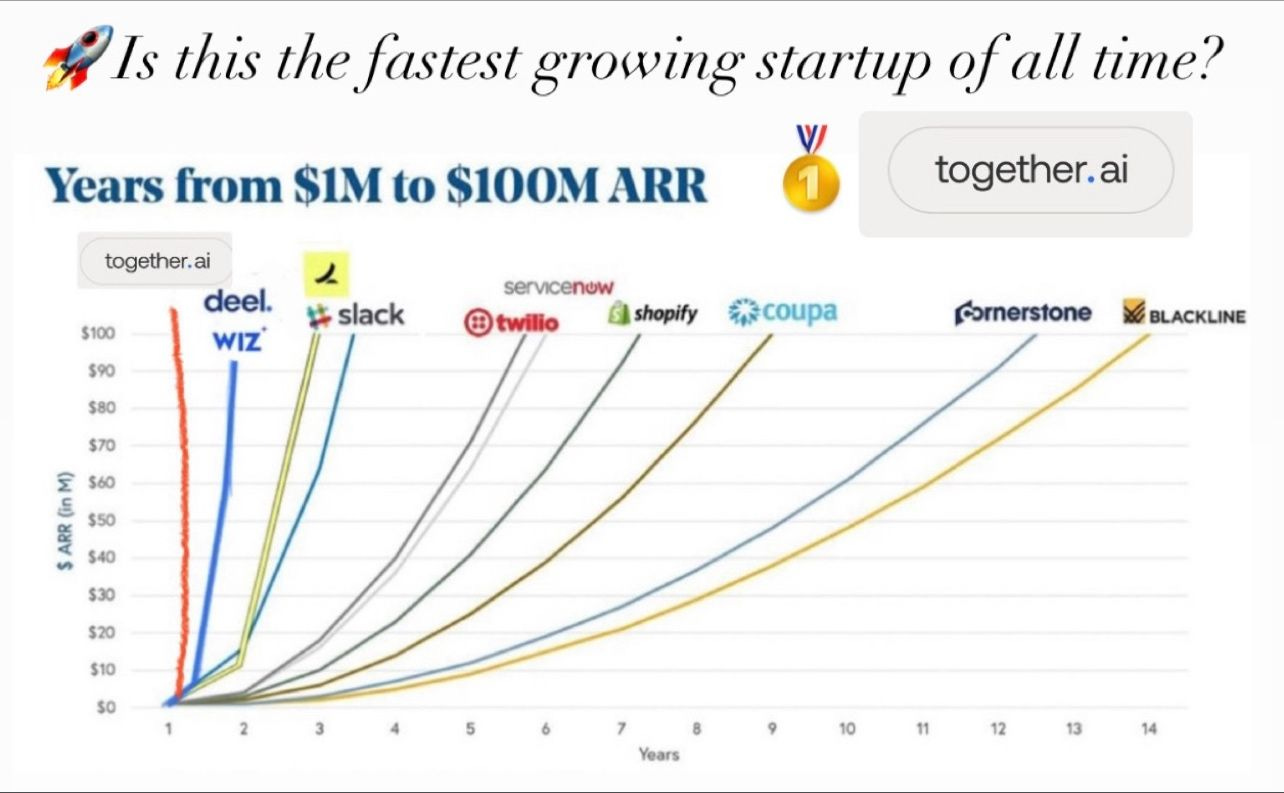

It also helps if your startup revenue curve looks like this - data from Stripe as reported by the FT.

To be clear, this is time from turning on billing on Stripe so some companies may have been building for months and others for years.

The AI start-ups in the cohort took a median 11 months to hit $1mn in annualised revenue after their first sales on Stripe, compared with 15 months for the previous generation of SaaS companies, the data showed.

AI start-ups that have scaled to more than $30mn in annualised revenue achieved the milestone in 20 months — five times faster than past SaaS companies.

However, a report by Goldman Sachs this month has raised concerns about the profitability of AI businesses given “the AI winners of today are no longer capital-light businesses”, referencing the significant costs required for computing infrastructure to run and train AI models.Founders don’t worry - it’s not how long it takes to get to $1m but how fast you get from $1 to $5M and beyond. That search for Product Market Fit can take a while and you are ready to scale when customers love ❤️ your product so much that you can’t pry it out of their cold dead hands, and you can’t handle all of the inbound leads coming in.

Tying this all back together to Inception Investing and how to go big and be one of the success stories above, there are two kinds of founders we meet. Those who want to create a new category in a new emerging market and those who are going after incumbents, reinventing and reimagining the future.

I’d say about 3/4 of the founders we back are more on the new category/market side than the existing market side but I suspect that will change over time as each new sector gets more crowded. Each type of market that a founder goes after has its own nuances on product and timing and you can read more about my framework herein What’s 🔥 #277:

It’s always super fun to see a new wave 🌊, catch it and ride it, but the only issue is that you never know when it’s coming. I like to say that many of these startups we back at Inception are un-Gartnered and un-market mapped meaning its fricking early! This past week let me show you two signs of how you know the market is moving in your direction.

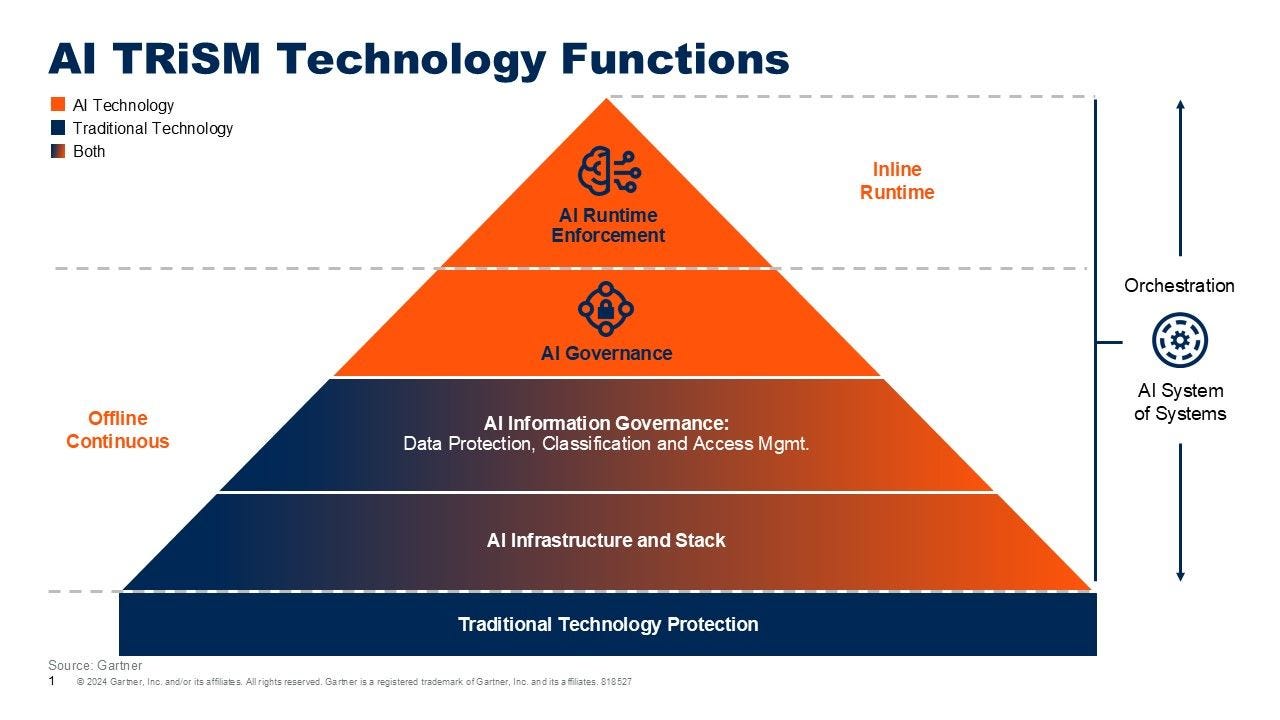

First, here’s Gartner releasing a comprehensive framework on what AI Security is and should look like (more below). We started collaborating with the founders of Protect AI in October 2021 and closed the initial round in Jan 2022 well before ChatGPT released. It’s taken 2.5 years but here we are - a Gartner market!

It’s still early but super exciting to see the wave 🌊 come earlier than even we expected - sometimes you get lucky and sometimes you run out of money and die.

Second, here’s an example from CrewAI, another boldstart portfolio co, from this past week.

This is how you start a movement - make your product ubiquitous and so loved to the point that having expertise for said system is part of the job description - I have seen this many times and the correlation to success down the line is 🔥

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#Reminder, your first 5-10 hires set the culture for the company for years to come and each individual matters…

#Patrick Collison on leadership and founder mode (I hate that term)

Was chatting with a well-known founder yesterday about the "founder mode" discussion.

We were both wondering if people would misinterpret it, and undervalue the importance of hiring great leaders. Steve Jobs, the canonical example of "founder mode", was also gifted at identifying stellar leaders, without whom no great organization gets built. (And we're lucky to have many at Stripe.)

To the extent that there's an ostensible tension here (founder-mode micromanagement vs the classic view that one should focus on enablement), this founder pointed out that the lens of domain-specific judgment helps reconcile the dichotomy.

• You need to have excellent judgment in your problem area.

• You need to recognize the importance of good judgment as a phenomenon.

• You need to demand it in others...

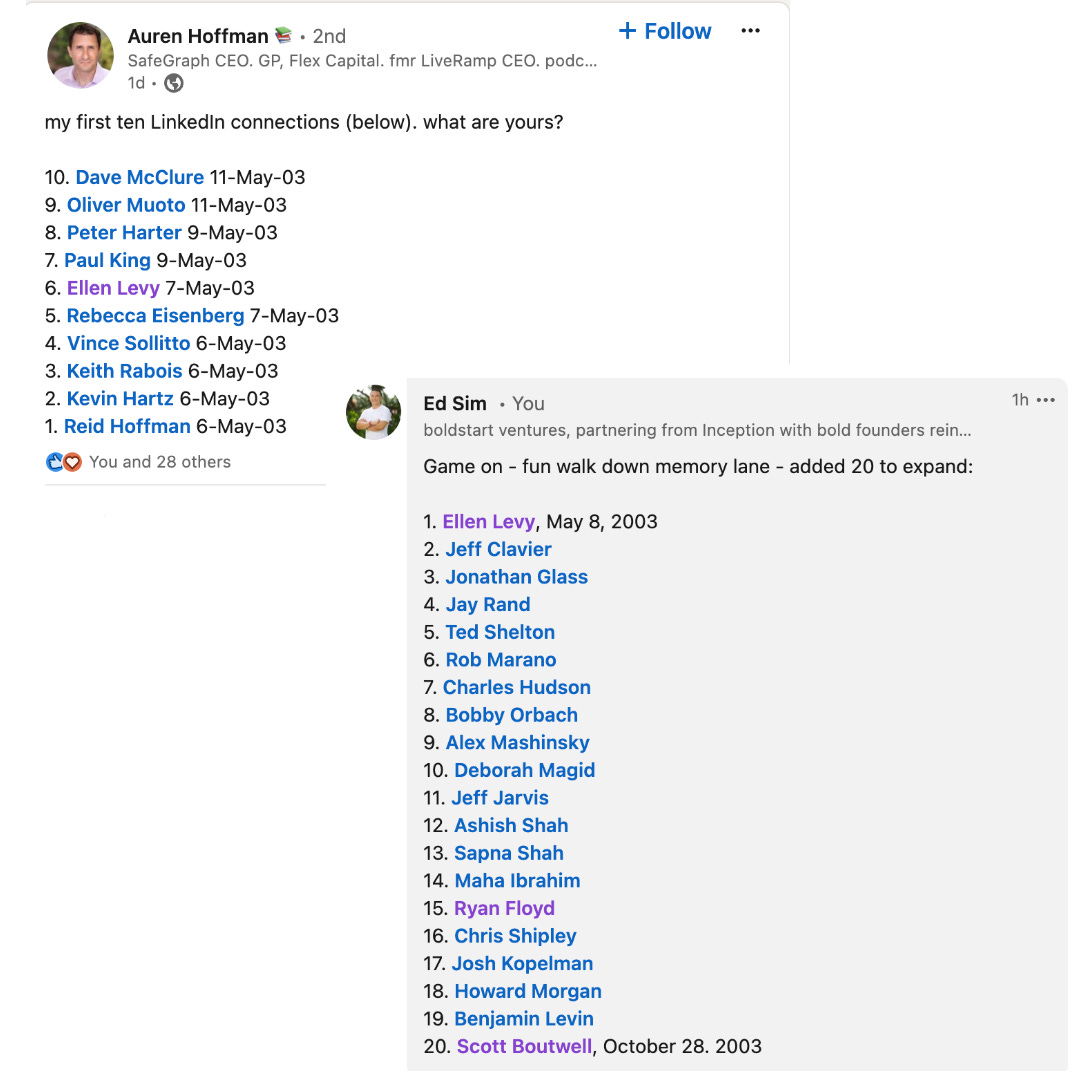

Read rest here...#how networks start - the early days of LinkedIn, fun walk down memory lane kickstarted by Auren Hoffman - some real OGs back in May 2003

#💯 - however your team operates, just be intentional

Enterprise Tech

#if VCs write about agents, well then there’s a market or at least lots of funding for your startup 💰 🤣!

First, Menlo Ventures market map on agents - “Beyond Bots: How AI Agents Are Driving the Next Wave of Enterprise Automation”

and this from a16z this week - “Every White-Collar Role Will Have An AI Copilot. Then An AI Agent”

and even YC pushing vertical SaaS - please no - read 🧵 for lively debate

Wrote about this a year ago - every SaaS investor going vertical for data moats on AI

What's 🔥 in Enterprise IT/VC #358

I get it, it’s been a rough couple of years and investors need the next new new thing. The 🔥 investment categories went from consumer mobile to SaaS to dev tools and now AI - more importantly the once dead vertical SaaS sector will be on 🔥 again packaged as AI. For those infrastructure investors who once chased every git star and helped overfund the dev tools market, they can now pivot and point their infrastructure 💰 to all things AI and cover everything from dev tooling to vertical SaaS cos. And founders are smart - they will give VCs what they want to raise the 💰. The bigger question for former infrastructure/dev tools investor/now AI investor is what value will you be adding for a startup selling to veterinarian clinics?

#13 companies from YC Demo Day 1 that are worth paying attention to (TechCrunch)

#this AI thing might be big 👀 (Akhil Paul LI post)

🚨𝘽𝙍𝙀𝘼𝙆𝙄𝙉𝙂: Did Together AI just break a record? It’s eclipsed $100Mn ARR in 10 Months with only 80 employees….🔥#i just love it when new markets emerge out of nowhere - here’s the updated Gartner view of what AI security means - there is no market map yet but expect that in another 12 months or so - Avivah Litan - Gartner

#AI Trust Risk and Security Market (AI TRiSM) architecture UPGRADED

✨✨✨Gartner's AI Trust Risk and Security Management technology framework has just been updated! See https://lnkd.in/eyuVvKen ✨✨✨

The #AITRISM market includes technology functionality and solutions for all three domains - trust risk and security - and for all AI entities - models, applications and agents.

✔The market has evolved and matured quickly in response to growing end user demands, since the time we wrote our first AI TRiSM Market Guide over three years ago.

✔ It still has a long way to go but end user clients are already asking us for vendor shortlists in different AI TRiSM categories. This is a clear sign that money is being spent on managing AI risks and threats, and that organizations are realigning to support these important capabilities.

✔Our research delves into each layer of the pyramid shown below, and is based on numerous invaluable conversations with Gartner clients that actively helped shape it.

🎆Two primary AI risk-related issues continually pop to the surface in client conversations:

🧨 third party AI risk management

🧨effective data classification and permissions management at AI runtime#now that’s an Inception round 👀 - “Cider Security founder nets $28M in Seed funding for stealth cyber startup” - successful 2nd/3rd time founders are not raising $2M pre-seed rounds or not even $3-4M rounds - they are raising $10M+

Less than two years after selling Cider to Palo Alto Networks in a $300 million deal, Guy Flechter has raised a significant sum for his new cybersecurity project named Sola Security. Investors include S Capital, S32, and Michael Moritz

The company is the second startup of entrepreneur Guy Flechter, who previously sold Cider Security, which he founded with Daniel Krivelevich, to Palo Alto Networks in an impressive exit valued at $300 million. Cider was only two years old at the time of the sale and had raised just $38 million. However, shortly after the deal, Cider had to lay off a third of its approximately 90 employees as part of the integration process with Palo Alto, the American cyber giant founded by Nir Zuk, which today employs about a thousand workers in its Israeli development center.

CTech#Meta Orion glasses - the future is here and will make AR seamless, physical world with holograms overlaid on it and no wires all powered by a wrist-based neural interface - yes, one day, there will be enterprise applications - must watch 🍿 🧵

and watch this to understand all the tech that went into this - what are you all thinking now?

#data matters when it comes to AI - congrats to long time friend Jason Droege who just joined Scale AI as Chief Strategy Officer as it crosses the $1B ARR mark with even more impressive 4X YoY growth 👀

#🤔

#wow, that was fast - it’s working at least for customer support and code - lots more opportunity ahead to unlock value in the enterprise with more bespoke data - this where the fun is

#Palantir laying out reason why Ontology matters for AI/LLMs - part of their secret sauce…from 2022

Palantir $PLTR CEO Alex Karp and Chief Architect Akshay Krishnaswamy discussing what it takes to create an ontology and why an ontology layer is so important to derive meaningful value for a business:

2 observations —

1.) I now understand the terminology in this clip literally 100x better than when I first saw this in 2022 and it only furthers my conviction on the ontology being the secret Palantir knows about that eventually the market will figure out

2.) Karp says that “the term ontology is a little bit older than we think” implying how that word has roots in philosophy from hundreds of centuries ago, bringing out his PhD in philosophy background which I love because the main reason I looked into Palantir is because that word, ontology, triggered me to dive deeper into why a philosophical term was so special to a data analytics company 😂😂

Watch video here...#crypto infrastructure needed as Blackrock looks at future…interview summary from Bankless with Robbie Mitchnick, Head of Digital Assets at Blackrock 🧵

ARE LARRY FINK AND BLACKROCK MOVING BEYOND THE ETFS ALREADY?

The aspirations of Blackrock and Larry Fink go well beyond just Bitcoin and Ethereum ETFs. Here are Robbie’s own words.

"Blockchain has the potential to be massively transformative for financial infrastructure. Particularly when paired with some of the defi applications you can build around tokenized assets. We have to remember we are super early on this journey towards tokenization. There’s three big things that need to happen to have the inflection moment towards accelerated adoption."

Read more here...Markets

#What does Smartsheet acquisition by PE at 8x trailing ($1B revenue) mean for the other collaboration players? Must read - if you ain’t growing >25-30% then your multiples get crushed fast 🧵 and comments lively 👇🏼

#Zoom cutting back on stock-based compensation joining Salesforce, Workday and others - all about dilution of earnings…

Equity in Zoom has been issued to workers at a rate that is “not sustainable,” Chief Executive Officer Eric Yuan wrote this week in a note to employees. “We grant a significant amount of shares each year that has led to very high dilution. Put simply, we are granting too much equity and must proactively reduce it.”

The technology industry has long paid workers a large chunk of their compensation in company stock. The idea is to align employees’ interests with the company’s success in an industry where frequent job-swaps are common.

But continually issuing new stock for compensation reduces the value of existing shares, which is called dilution. Investors and executive teams have in recent years raised concerns about the practice. In addition to adjusting compensation plans, dilution can be countered by company share buybacks.