What's 🔥 in Enterprise IT/VC #358

OK, we get it, you're an AI co but isn't everyone?

It’s that time in the cycle 👇🏼

Case in point 👇🏼

AI-related cos now stand at 134 or 60% of the current YC batch (The Information)

I get it, it’s been a rough couple of years and investors need the next new new thing. The 🔥 investment categories went from consumer mobile to SaaS to dev tools and now AI - more importantly the once dead vertical SaaS sector will be on 🔥 again packaged as AI. For those infrastructure investors who once chased every git star and helped overfund the dev tools market, they can now pivot and point their infrastructure 💰 to all things AI and cover everything from dev tooling to vertical SaaS cos. And founders are smart - they will give VCs what they want to raise the 💰. The bigger question for former infrastructure/dev tools investor/now AI investor is what value will you be adding for a startup selling to veterinarian clinics?

Here’s an example convo at a VC firm:

AI Partner - I found this amazing SaaS co selling to veterinarian clinics, massive data moat, and about to add AI

VC Partner - what do you know about veterinarian clinics? What value will you add?

AI Partner - But it’s an ai co. It has a data moat. I can help them figure out how to use OpenAI, the pricing model…

VC Partner - Ahhh, Ok. But do customers need or want and will pay?

AI Partner - But it’s an ai co

VC Partner - But what do you know about veterinarian clinics?

AI Partner - It’s ai. I also have a cat and a dog and have been to a number of these.

This reminds me of the Blades of Glory scene where Chaz Michael Michaels (Will Ferrell) is talking to Jimmy MacElroy (Jon Heder) about their upcoming routine.

Yes AI gets the VCs going.

I know, it’s a bit extreme, but I can promise you the once dead vertical SaaS market will be revving up again and rightly so given the specialized data sets many of these companies are sitting on. It still begs the question - isn’t this just a SaaS company selling to veterinarian clincs and not an AI business? Yes!!!! So let’s all get back to basic business and refocus on first principles:

What problem are you solving? How big is the pain? How are you uniquely doing so 10x better than existing solutions? And finally, how will AI impact your offering and will customers get 10x better value and be willing to pay for it because AI ain’t cheap!

Don’t get me wrong - this is a transformative technology but it will be so ingrained into every piece of software that we MUST get back to focusing on how your product is going to make the lives of customers infinitely better.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Making the rounds - do what you love - read comments as so many folks like Tobi from Shopify, Max from Paypal and others chime in

Reminds me of the Ford quote - “If I had asked people what they wanted, they would have said faster horses.” Important to balance your product vision and lead customers to where you want vs. just listening…Evernote as prime example

Enterprise Tech

WASM now official - the CNCF WASM landscape is out and can be found here

Originally created as a secure sandbox to run compiled C/C++ code in web browsers, WebAssembly (Wasm) has been gaining traction and momentum on the server-side. In the cloud, Wasm provides a lightweight, fast, secure, language-agnostic, and cross-platform application runtime for diverse user-submit workloads. It is quickly becoming a key part of the cloud-native technology stack.

As Wasm is adopted across cloud-native projects, products, and services, the CNCF worked together with the Wasm community to create a Wasm landscape to help better understand the scope of the Wasm ecosystem. As the original Cloud Native Landscape helped chart the massive ecosystem around cloud native technologies, we believe the same is needed for Wasm as the ecosystem evolves and grows.

The initial Wasm landscape, published in time for the WasmCon conference, includes 11 categories and 120 projects or products, representing $59.4B in total economic value. The Wasm landscape is divided into two large areas: Dev (application development) and Ops (application deployment).

But WASM still not ready yet (Runtime by Tom Krazit)

So it's likely to be at least another year before Wasm actually reaches that "Docker moment," of mass adoption. However, early adopters like industrial giant Bosch showed why so many are excited about its potential.

Emily Ruppel, a research scientist at Bosch, thinks Wasm could help the company develop software across all the different types of hardware that will be required for autonomous cars.

"These software stacks were never meant to handle computers ranging from ECUs (electronic control units) to the cloud in a single application," she said.

Bosch is experimenting with using Wasm to abstract all that hardware away from the developer, who can write their apps to a single platform.

There are still plenty of challenges before it's ready for prime time, she said, but "we see WebAssembly as the most promising solution for bringing lightweight virtualization all the way across cyber physical systems."

Open source IMO is marketing and eventually every OSS co finds the big 💰 in large enterprises and steak 🥩 dinnahs!

One of 🔥 dev tool launches in awhile - big idea, selling speed, speed, speed and ease of use - npm. at 30ms vs 100ms…features collapsed into bun, removing lots of dependencies

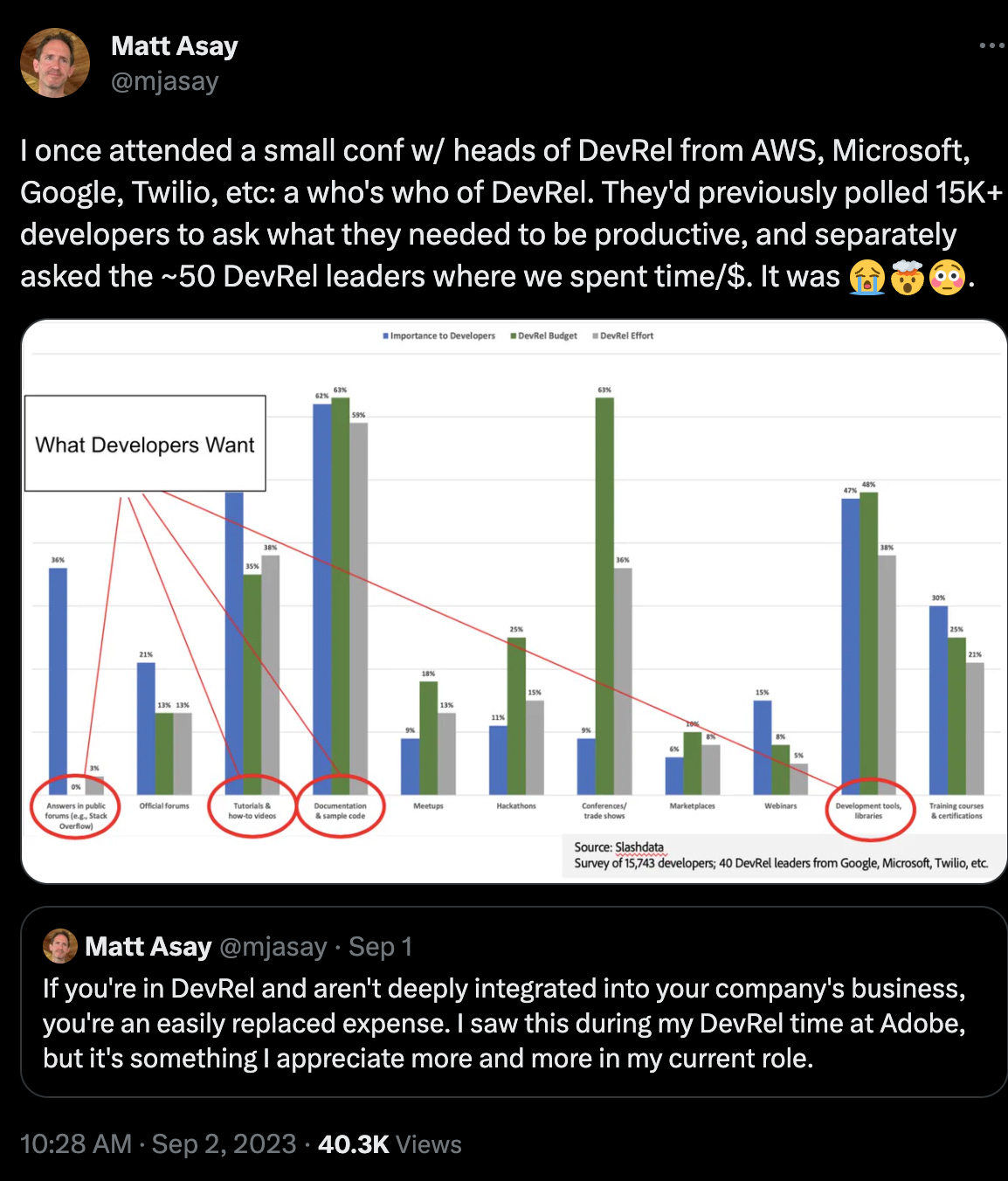

How Developer Relations can make itself indispensable from Matt Asay, VP DevRel at MongoDB - needs to map to business goals, not just cool demos and talks - in fact more done not at events unlike what most DevRel folks will tell you

Incumbents - data, AI, willingness to move fast, betting big and early starting in 2019 - Intuit adds AI to all products

The lightbulb moment spurred Goodarzi, who became CEO in 2019, to lead the company into a massive strategy reset putting A.I. at the center of the business. The revamp has included two major acquisitions costing $20 billion in total, firing hundreds of employees, and investing heavily into A.I., years before the technology made a blockbuster debut into the public consciousness.

The company has been incorporating elements of A.I. into its business for years, but its first major standalone A.I. product for consumers, called Intuit Assist, debuts today. It's embedded into products including TurboTax, Credit Karma, QuickBooks, and Mailchimp, and the company says it can do everything from foreseeing a looming cash crunch at a small business to creating and executing an email marketing campaign.

Goodarzi believes that an early gamble on A.I., along with a massive trove of data, is a winning strategy to extend the company’s domination of tax and accounting software for individuals and small businesses. And he has quite literally bet his entire company on the idea that millions of people will trust an A.I. service to recommend specific, personalized business decisions.

"At the end of the day there are certain decisions you have to make,” Goodarzi says. “And the decision I made was, as a team, we're going to bet the company on data and AI."

Data matters 👇🏼

Despite Intuit's history of constant transformation, when Goodarzi decided to put A.I. at the center of its business model in 2019, not all of his top lieutenants agreed. “It was a big debate,” he recalls. “Five years ago, putting A.I. at the core was hard to see. You had to have a belief.”

Intuit CEO: Our innovation has been fueled by investments in data and AI

The deciding factor in that decision was the company’s incredible trove of data—something that A.I. needs to train, and what enables the company to give detailed financial recommendations tailored to each customer. “A.I. is really useless if you don’t have vast data and clean data,” Goodarzi told Fortune three years ago. Speaking more recently, he said that when it came to a new strategy, “the decision I made was, we’re going to bet the company on data and A.I.”

Intuit already had data from its 57 million customers, which gave it a significant advantage when it came to financially-focused A.I. Then in 2020, Goodarzi bought Credit Karma, a personal money management platform, for $8.1 billion. That brought in 110 million consumers and their financial data. And in 2021 he bought Mailchimp, a marketing platform, for $12 billion. That brought in 10 million more customers and their data.

“Everybody wants to talk about how great their data is,” says Jackson Ader, a MoffettNathanson analyst who covers the company. “But Intuit’s dataset, on the consumer side or small business side—it’s second to none.”

Existential threat avoided from Chat-GPT - data, data, data

The fears are unwarranted—for now. GPT-4 can read the tax code, but it can’t give personalized recommendations because it doesn’t have Intuit’s massive proprietary dataset. GPT-4 is “more friend than potential threat” to Intuit, says Ader, because Intuit “has the data—that is what they have in spades.”

Serverless adoption continues to grow (h/t Gareth Rushgrove) - 8 new facts to consider in the Serverless v Containers debate

Yes, real crypto use cases being put into production - Visa

Gitlab - will single tenant SaaS be how enterprise cos monetize their AI offerings?

Sid Sijbrandij: Thanks for that question. Rob, I understood it as like what's going to drive self-managed revenue to SaaS revenue. And I see two big things. I see Dedicated, our new offering, which is single-tenant SaaS. We have gitlab.com, which is multiple-tenant SaaS but to address the most complex compliance requirements. We're super excited about this new offering, and it's a great way to get our biggest customers with the most complex requirements up to the SaaS platform, where we maintain it for them. Another driver of the move to SaaS can be additional functionality for self-managed. We call this GitLab Plus and for example, some of the AI features will require a connection to GitLab SaaS in order to consume them. So there's more features that we've thought about, but not yet launched, but additional features to kind of get kind of a hybrid installation.

Some of it is on-prem. Some of the new features are SaaS provided in the cloud and kind of gradually move those customers over.

Markets

Alteryx, a publicly traded data infrastructure company, is rumored to be for sale - we will see a number of these once high flying companies looking to be taken private (Reuters)

Great read! I appreciate the perspective that startups no longer need to pitch their AI functionality as a unique selling point. While AI has indeed become more ubiquitous, I believe it's still crucial to emphasize how a startup's specific AI capabilities solve real-world problems. It's not about having AI; it's about how you use it to deliver value to customers. Thanks for sparking this important conversation!

- Andy's ChatGPT.