What’s 🔥 in Enterprise IT/VC #385

Jensen speech on pain + suffering is just what we needed - why we are all destined for greatness, inspiration from Superhuman + Snyk

When I woke up Thursday morning thinking about my opening talk for Enterprise Founders Day- Back to Basics (boldstart co-hosted with our friends at Crew Capital), I had a few different paths I was going to explore. But when I saw this video from Jensen’s speech at Stanford, I knew I had to scrap everything, and start here. So, drop everything now and watch this before reading.

Now read and absorb again.

People with very high expectations have very low resilience. Unfortunately Resilience matters in success. I don’t know how to teach it to you except I hope suffering happens to you.

To this day, I use the word, the phrase “with pain and suffering with great glee”…and I mean that. “Boy this is going to cause lots of pain and suffering and I mean that in a happy way.”

Because you want to train and refine character of company. You want greatness out of them. Greatness is not intelligence. Greatness comes from Character.

And Character is not formed out of smart people but from people who have suffered. So I wish upon you ample doses of pain and suffering

I started with Jensen’s video which set the stage for my preamble about founders helping founders, the most powerful help one can get.

What I’ve learned during 28 years of partnering with founders from Inception, that no matter what I or any investors suggest or say, that a founder saying the same thing will always be 100x more impactful.

By being extremely focused on stage and category (Inception funding and technical enterprise founders), these messages delivered by founders are even more powerful since the relevant experience from founders who have walked the same path previously or doing so now, makes every suggestion that much more impactful.

When you bring together 60+ Type A founders from across the 🇺🇸 🇮🇱 🇬🇧 🇩🇪 one of two things can happen, absolute chaos or magic. Fortunately, we experienced the latter in spades.

My boldstart partner Eliot Durbin summed it up best:

Best thing I heard a founder say to another, if it’s one thing I learned in the past two years - just ship sh** really, really, really fast”

I could have said that until blue in the face - wouldn’t have had the same impact.

Magic indeed!

Back to Jensen - the good news is that all of us reading this, living this, building and investing in companies, have experienced so much pain in the last 24 months. We don’t need more doses of pain wished upon us. Living through the unicorn 🦄 factory creation and fall during ZIRP, multiple compression, layoffs, customer churn - you name it, we’ve lived through it.

That morning, I also saw this post from Rahul Vohra, founder of Superhuman (where we were inception investors and first check), and 10 years into it, this chart further highlights what we all need to do - just keep going!

I remember the day that Google Instant Reply was released a few years ago and the concern it created for Rahul and team. They explored building out a dedicated machine learning team, hiring a few folks, and setting up infrastructure but concluded that spending a couple of million doing this was not worth it, especially when Google had an incredible data moat as well. With the plans shelved, Superhuman focused on launching teams and other enhancements which continued our steady climb.

And then…lightning ⚡️ struck - OpenAI was launched and Superhuman got early access to the API. Little did we know what that would do for new users but as you can see from this chart and the far right, it’s working. In fact, it’s not the AI but how Superhuman seamlessly embeds this in the workflow, making it super simple to use. As I’ve always said, the simplest uses cases are often the most powerful. Here’s a video on the latest instant reply feature which does not cost us much at all, and is 100x more powerful than what we could have created a few years ago.

Just keep going!

Continuing the theme of pain and suffering, I had the pleasure of interviewing my friend and successful founder, Guy Podjarny, who we backed twice before with Blaze, sold to Akamai, and then Snyk. While many know the successes of Snyk and the creation of “developer friendly security” and a new GTM motion around devs as users and security as buyers, I focused our chat on all the bumps in the road that had to be overcome to get there. Disbelief in idea of developers caring about security, lots of users but little monetization, hard to raise early rounds of capital, market not big enough…and the list goes on.

To say the least, the journey that Snyk has gone through to get to significant revenue scale continues to inspire me to this day.

To conclude, as Jensen said earlier:

And Character is not formed out of smart people but from people who have suffered. So I wish upon you ample doses of pain and suffering

When we look at what we’ve all experienced the last couple of years, I can say that we are all ready for greatness, especially when you add one of the most powerful tailwinds in history propelling us forward, AI.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

👇🏼 Interested in top mistakes when scaling a Developer first startup from $0-100M? Must watch talk at SaaStr with Edith Harbaugh, founder/former CEO of LaunchDarkly

What did the first 5 hires at startups receive in equity last year? from Pete Walker at Carta

Median for Hire 1: 1-1.5%

Median for Hire 3: 0.75-0.85%

Median for Hire 5: 0.31-0.34%

Data from 4,922 hires made in 2023 by Carta companies - US employees only.

Enterprise Tech

More on the state of cybersecurity and exits - I encourage you to click through and read comments, 🧵

AI Tailwinds 🌬️ (from Stripe annual report)

In 2023, the influx of AI companies onto Stripe grew even larger. Twice as many AI companies went live on Stripe compared to 2022, including new trailblazers like Perplexity and Mistral. They join leaders like OpenAI, Anthropic, and Midjourney, which continue to expand their offerings and launch new products with Stripe. Aggregate revenue from AI companies grew by 249% in 2023, and, of course, AI was a major tailwind for countless companies across Stripe that do not self-identify as “AI companies” per se

Devin, positioned as your first AI software engineer blew up on Tuesday…I encourage you to watch the demo and the hot takes from folks like Andrej Karpathy (founding team OpenAI) and Andrew Kean Go (Langchain)

Here’s DevinWhen something looks too good to be true, the experts test and chime in:

Here’s Andrej Karpathy (founding team OpenAI)

Here’s Andrew from LangChain 🧵:

i never believe recorded demos so I reached out to the

cognition_labs team for early access to try for myself and got it!

will be sharing my unfiltered opinions on #devin here. 🧵1/n….

probably starting new thread bc this is getting long but thoughts so far:

Pros: Devin feels UI/UX first, not Gen AI first. IDK if this makes sense. The AI is a core component but it's the surrounding infra they built that is the star of the show

The product feels quite finished, This is not a demo. They have things built out such as auto deploy to netlify, api key protection, intelligent way to interrupt without interrupting, a good UI that is *tailored to humans* and bridges LLM and human dev, the slider to move backwards in time

It's fun to watch things unfold

A lot of features around the AI. You can share the conversations, follow the AI around, etc. The AI is the magic behind the scenes but they have created a very good infrastructure around it, like runwaymNegative:

biggest negative is the slowness. even the site feels a bit slow (but i am also using like a 1 MBPS Starlink connection so that part is probably me)

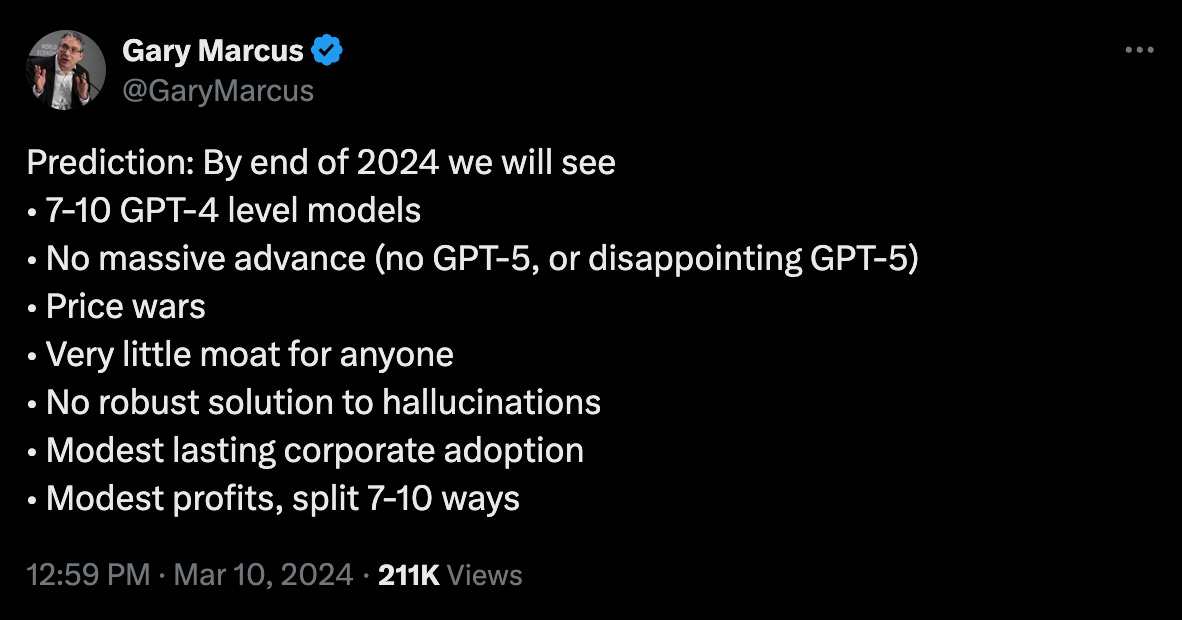

Not collaborative yet, you can't edit the code (although it makes sense why)🤔 don’t agree with them all, esp. the modest lasting corporate adoption as I believe it’s still early innings but the basic use cases will prove a ton of value for support and other mindless tasks - question is what will be the next level understanding and analysis and here we don’t need AGI to keep improving. As mentioned in last week’s What’s 🔥 #384, who cares about the AI, it’s a commodity, focus on the problem you are solving etc…

Another week, another $20M Inception Round - the game is changing fast for “seed” managers who now need to regularly compete and think about where to play and how to win in the Inception Round market from Discovery only <$2M, Classic $3M-$5M, or even Jumbo >$6 but usually $8-10M+++

🧵 here on Inception Rounds (what, data, why) along with interview from 20VC with Harry Stebbings where I went in depth on what’s happening

Fully automated vulnerability research is changing the cybersecurity landscape from Jason Clinton, CISO of Anthropic, creators of Claude

Fully automated vulnerability research is changing the cybersecurity landscape

Claude 3 Opus is capable of reading source code and identifying complex security vulnerabilities used by APTs. But scaling is still a challenge.

Demo: https://claude.ai/share/ddc7ff37-f97c-494c-b0a4-a9b3273fa23c…

This is beginner-level prompt engineering: I just simply asked the model to role-play a cyberdefense assistant and to look for a class of vulnerability. And yet, even with this trivial prompting, Claude was able to identify the vulnerability which was unveiled in https://googleprojectzero.blogspot.com/2023/09/analyzing-modern-in-wild-android-exploit.html… a month after our training data cutoff:

Code defect scanning is not new, but this technique points the way to a more nuanced, complete analysis—especially with very large, 1M token context windows.

This is part of a larger story: there are now two different ways that vulnerability discovery is being automated by defenders.

1) Defenders can wire-up LLMs to cluster fuzzers Starting with last generation’s models, Google pioneered this work here: https://security.googleblog.com/2023/08/ai-powered-fuzzing-breaking-bug-hunting.html… . This has now been implemented by a number of players on the defenders’ side since last year. The technique is to have LLMs write the test harnesses and triage the results. This has, reportedly, increased the fuzzer signal-to-noise ratio by 20x, depending on the technique and software. Google has new research in this area posted recently.

2) Defenders can ask models to analyze code using large context windows…

Fully automated vulnerability discovery is here and it will only become more available. I believe that—in the future—the availability of patches to fix vulnerabilities from these methods will be coming out daily. Defenders should prepare to patch their environments on a rolling basis.Apple buys Canadian AI startup earlier this year but just discovered - making AI smaller and faster would make sense esp. if Apple wanted to leverage its strengths for on-device AI models

DarwinAI has developed AI technology for visually inspecting components during the manufacturing process and serves customers in a range of industries. But one of its core technologies is making artificial intelligence systems smaller and faster. That work that could be helpful to Apple, which is focused on running AI on devices rather than entirely in the cloud.

Markets

The public markets can be brutal - once a darling in DevOps land, HashiCorp is now mulling a potential sale as its stock price has languished since its IPO (CNBC)

As of Friday’s close, HashiCorp was trading at $26.50, or 67% below its initial public offering price. Its market cap sits at around $5 billion. In the latest quarter, revenue growth slowed to 15% from 41% a year earlier.

CEO David McJannet said on a conference call with analysts last week that HashiCorp is “behind where we wanted the company to be at this point in our growth cycle, and we have work to do.”Is down the new up for IPOs? (FT)

Down round IPOs “are not only going to become common, they will become the standard for the class of 2021”, says Venky Ganesan, a partner at Menlo Ventures. He is referring to a group of late-stage companies whose valuations soared that year as investors, punch drunk on low interest rates, poured in astronomical sums. US venture investment in 2021 was a record $345bn, more than double the previous year.

Successful new investments in AI could offset a multitude of misjudgments in the recent past. And there is a growing consensus that it is finally time for founders to swallow their pride, accept a massive haircut to valuation and help establish a new floor for their stock to start growing again, helping to encourage all the companies coming up behind them to do the same.

Not everyone will fall into line. Stripe co-founder John Collinson told the Financial Times this week that he was “not in a rush” for an IPO of the $65bn payments group. But a few more solid companies coming to market at reset prices may help destigmatise the long-held psychological opposition to down-round financing that has become baked into Silicon Valley’s culture. Reddit’s investors have maybe had to recognise the reality that it is not a $10bn company at IPO but if the company does well, the lower valuation might become a floor for its stock price.