What's 🔥 in Enterprise IT/VC #375

The come to Jesus moment for founders, investors, and boards - either you're early and lean, growing efficiently + lean with cash in bank or access to cash, or you need to find a home or die...

Happy New Year! I may sound like a broken record this year but want to reiterate to founders building in 2024, forget everything you used to know during the ZIRP era, and put your 🪖 on for a fiery 2024.

We are back to basics, building startups the way they were supposed to be built, lean, mean, and capital efficient! Either you are early, growing efficiently with cash in the bank or access to capital, or need to find a home or die - that’s it.

To that end, here’s a cautionary tale for you. There has been lots of discussion (see Hacker News) this week around Airplane being bought by Airtable and the product being officially sunset on March 1. Many are shocked because Airplane was a hot Silicon Valley startup having just announced a $32M Series B round 16 months ago led by Thrive Capital and Benchmark Capital with a product to go after Retool. So what happened?

While no one knows for sure, Daniel Chesley highlighted some comments from Hacker News and if true, 61 employees with <$1M ARR seems out of whack.

On the flip side, others believe the numbers were wrong and Airplane was still flush with cash. Here’s OnlyCFO chiming in:

Also, many saying that Airplane was running out of cash. This is definitely not true. They had between 20-25 employees since their Series B just 1.5 years ago. They likely had lots of cash in the bank still, but growth expectations fell dramatically short so they thought this was a graceful exit.

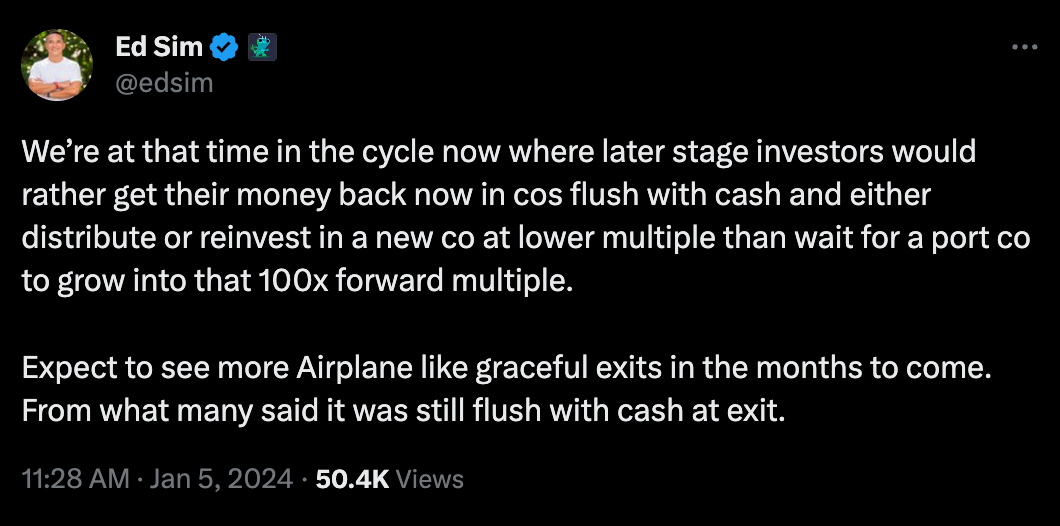

Regardless, this is where we are today:

Jamin Ball eloquently chimed in as well:

My hope is that every board of founders and investors can have that “intellectually honest” conversation sooner rather than later.

Regardless of what story is true, this is not a great ending for a company that raised $40M. Companies die because they run out of cash and IMO can also die because they are suffocated with cash. As we get more of these lessons in the next couple of months, I do believe that founders and investors are finally getting the religion and this class of startups in 2024 will be 🔥. Case in point. Here’s friend Jeff Yoshimura’s recent post on his transition from Operator to Founder. He was formerly CMO Snyk and prior to that Elastic, and IMO nails it when it comes to making that transition from scale operator to founder. I encourage you to read here:

As you know, this aligns 💯 with my Google Doc I’ve been sharing on “Back to First Principles Building Startups from Inception” - see Outline below and you can get the latest version here.

Let’s brace for an interesting 2024 and the year of creative destruction with all of the good and bad is upon us!

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

“Early-stage hard tech firm Countdown Capital shutting down” (TechCrunch) - small venture firms are hard to build 👇🏼 - more of these to come sadly

In the letter, which was viewed by TechCrunch, Malik says he decided to close the fund after coming to two main conclusions on the economics of early-stage hard tech investing: that “funding industrial startups is not inefficient enough to justify our existence” and that “larger, multi-stage venture firms are best positioned to generate strong returns on the most valuable industrial startups.”

In other words, that the firm would be unlikely to realize excess returns consistently based on capital limitations and swelling competition from large incumbents.Advice for founders from the Bruce Springsteen

Latest fundraising data from Peter Walker at Carta

On startup life 👇🏼

“Always remain open to turns and surprises along the way. Welcome the unexpected.” Rick Rubin

Enterprise Tech

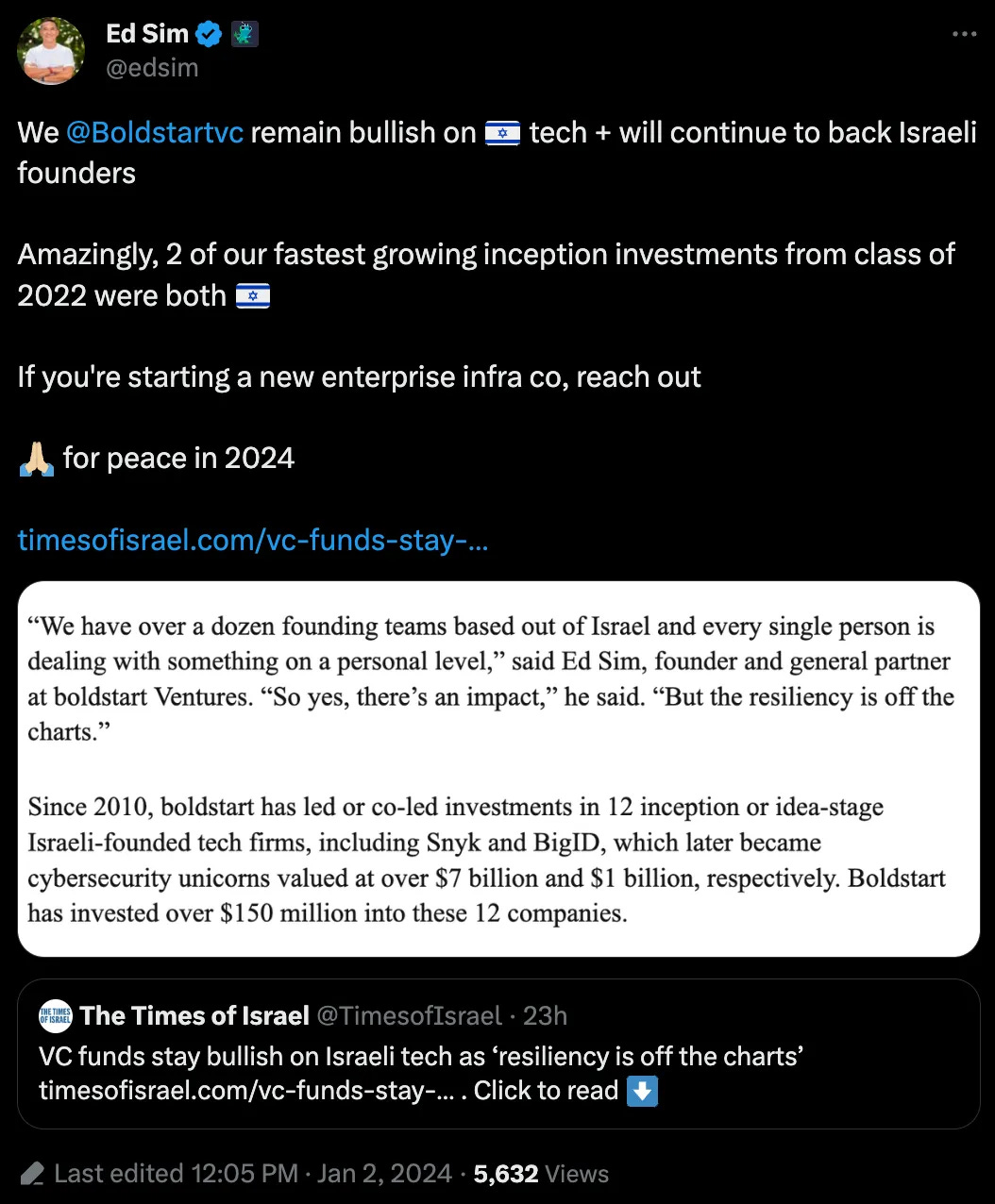

Still 🔥 for Startup Nation - 🙏🏼 to be quoted with peers from General Catalyst, Bessemer and Vintage - read on 👇🏼 in Times of Israel for what’s ahead

Get your Devtools predictions from my boldstart partner Ellen Chisa👇🏼 - great to see we had some overlapping themes as well!

🤯 everything in outbound will be automated with AI starting with port co Clay to this…which will only get better - must listen 👇🏼

The Definitive NIST Report on AI Security is out - covers evasion, poisoning, privacy, abuse…

“We are providing an overview of attack techniques and methodologies that consider all types of AI systems,” said NIST computer scientist Apostol Vassilev, one of the publication’s authors. “We also describe current mitigation strategies reported in the literature, but these available defenses currently lack robust assurances that they fully mitigate the risks. We are encouraging the community to come up with better defenses.”

Invision the OG 🦄 of design software officially shutting down end of 2024 - so much written in past how it discounted Figma in early days and how it missed a product cycle - here’s a post I wrote about in July 2021 in What’s 🔥 #246:

Speaking of a company losing its way, I also highly encourage folks to read the “The rise and fall of InVision.”

The cumulative result is a hodgepodge of apps built on top of apps and stitched together with yet more apps (many with both new and legacy versions existing at the same time). All of these with competing branding that makes it hard to keep track of what’s going on, and a lacking layer of experiential polish to boot.

Product North 🌠 - don’t lose sight of it

Here’s Steven Fabre founder of port co Liveblocks commenting on his time at Invision - comments are worth reading

💯 aligns with my 2024 predictions: Hybrid AI and apps will be in focus in 2024, says Goldman Sachs CIO (ZDNet)

Only the richest companies such as OpenAI can build 'foundation models,' like GPT-4. The rest of the corporate world will need to build smaller, more-focused programs that tie into the foundation models.

from What’s 🔥 #374

AI evolves from narrow tasks like writing text to enterprise workflow and automation - we are in the beginning phases with agent technology showing what’s possible, but it’s clear to me that these enterprise workflows, say in a ten-step process, may include using several different models from OpenAI to open source, multiple modalities from text to image processing, and will include human-in-the-loop for 👍🏼 or 👎🏼 to further refine these models.

🤯 Canva $1B secondary sale to generate liquidity for employees, early investors and of course - of note, last private round was done in 2021 at $40B valuation and this secondary was done at a $26B valuation according to The Information which would be 13x trailing ARR numbers are correct

Canva, which finished the year with $2 billion in annualized revenue, initially sought a roughly $28 billion valuation, but some investors the company wanted in the deal negotiated the price down, people familiar with the matter said. The names of the investment firms buying Canva stock in this deal couldn’t be learned.

SentinelOne to Expand Cloud Security Capabilities with Acquisition of PingSafe: As mentioned in my 2024 Predictions, the M&A tuck-ins are starting, especially in cybersecurity as the big get bigger or catch up to PANW and others - Pingsafe only raised $3.3M - expect many more of these smaller deals to happen in 2024 as vendor consolidation continues

With the acquisition of PingSafe, SentinelOne will offer differentiated capabilities such as advanced secrets scanning of runtime and build-time environments and an attack surface management rules engine that runs breach and attack simulation scenarios against Internet-exposed cloud assets to identify how an adversary could compromise those assets. These capabilities will be in addition to core CNAPP capabilities like cloud security posture management, Kubernetes security posture management, agentless vulnerability scanning, and shift-left Infrastructure as code scanning.

“Combined with our Singularity Data Lake, Purple AI, endpoint security, and identity security capabilities, PingSafe will enable us to provide a compelling and cost-effective alternative to standalone CNAPP offerings unlike anything else in the market and a superior, more integrated user experience, ” Smith said.

Perplexity AI raised $70M at $520M post led by IVP to go after Google with AI search (WSJ)

Started less than two years ago, Perplexity has fewer than 40 employees and is based out of a San Francisco co-working space. The company’s product, which it calls an answer engine, is used by about 10 million people monthly.

And from TechCrunch

Underpinning the Perplexity platform is an array of gen AI models developed in-house and by third parties. Subscribers to Perplexity’s Pro plan ($20 per month) can switch models — Google’s Gemini, Mistra 7Bl, Anthropic’s Claude 2.1 and OpenAI’s GPT-4 are in the rotation presently — and unlock features like image generation; unlimited use of Perplexity’s Copilot, which considers personal preferences during searches; and file uploads, which allows users to upload documents including images and have models analyze the docs to formulate answers about them (e.g. “Summarize pages 2 and 4”).

Markets

From Andy Kessler WSJ: “The Lesson of 1975 for Today’s Pessimists -

Things always seem dark and desperate before a new age of innovation kicks off.”

Every industry is about to change, which will defy skeptics. Figure out how, and then, as Mr. Wozniak suggests, get your hands dirty. As always, the pain point is cost. Look for things that get cheaper—that’s the only way to clear the smoke and get new marvels into global consumer hands. The democratization of every sector will proceed in mysterious ways. Happy hunting for opportunities. And stay warm this New Year’s.