What's 🔥 in Enterprise IT/VC #374

Predictions for 2024 and scoring 2023

As a turbulent 2023 comes to an end, it’s time to share my annual predictions or themes for the next year. All I can say is that I’m pumped for 2024 as I truly believe that all of us came out of this past year stronger, more resilient, and with a renewed focus on business fundamentals. For 2024, some of these themes are new, while others are extensions or accelerations of what I observed last year. Overall, I’d characterize them into 3 buckets - still more pain to come driven by the VC sins of the past couple of years, “show me the money 💰” time for AI for both startups and IT buyers, and 🙏🏼 that Mr. Powell and the Fed come through with some rate cuts in 2024.

But before I dive into 2024, let’s review how accurate I was in 2023. Reminder, these predictions were made 1 month after ChatGPT was released so while many seem like table stakes today, I am blown away at how fast some of these predictions became true in 2023.

2023 Scorecard

OpenAI giveth and taketh away - in short, AI is embedded into every app

Score: 9 out of 10 - super correct but not in every app yet

Too many developer tools = need better developer experience

Score: 7 out of 10 - rise of Independent Developer Platforms survey from Port shows 50% already using with another 35% expected to use in 2024Steak 🥩 dinners are back

Score: 10 out of 10 - it became much harder to close deals and there was a huge backlash against PLG as products still need sales people to close deals and as they got harder, IRL became even more importantFocus on efficient growth continues but best companies who got ahead of burn management will have the opportunity to acquire new logos with a land and expand model as others pull back.

Score: 6 out of 10 - looking at the portfolio net new logo lands did work out for those esp. as initial lands of enterprise deals decreased in 2023, but I would not say this was a trend that was overwhelmingly observedYear of Day 2 Cloud Ops and rise of FinOps for cloud cost optimization

Score: 9 out of 10 - ok this was a layup and frankly not that exciting and a trend we all saw but I do believe optimization time is mostly over and enterprises are truly ready for net new workloadsBlockchain/crypto - best time to invest as market is suffering one of biggest downturns

Score: 2 out of 10 - the market got way worse, VC 💰 virtually non-existent🦄 Bloodbath in 2023 of not only orphaned companies but bankrupt 🦄 and down rounds galore!

Score: 5 out of 10 - we did see some huge 🦄 bankruptcies like Convoy and Olive AI and some down rounds but not at pace we expected meaning the 🦄 were able to cut burn enough to last into 2024Lots of startups who raised capital in the height of the market will shut down as there are no more acquihires.

Score: 7 out of 10 - more blood to come sadly…3,200 and counting acc. to PitchbookChat is the new hot UI

Score: 10 out of 10 - yes, this was true and likely already overdoneWASM (first appeared in 2017) is the 🔥 new infra category

Score: 2 out of 10 - still early, still not enough WASM deployed into production

Overall not a bad year of predictions with a 67 out of 100. Without further ado, here’s what I’m thinking for 2024.

2024 Themes

The year of creative destruction - startup failures will increase 50% from 3200 shutdowns in 2023 to almost 5,000 (according to Pitchbook) as we continue to work out the excesses of the past couple of years. On the flip side, new startup creation and inception rounds/seed rounds will experience significant growth in 2024.

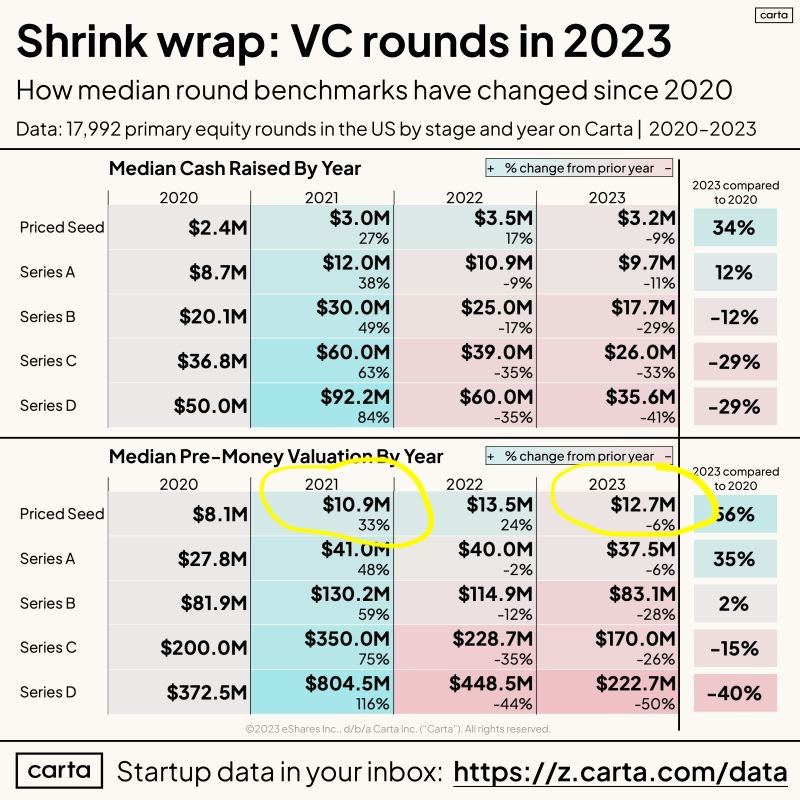

We have a bubble in Inception Rounds as every investor no matter how big or small continues the chase to fund two founders and an idea with unlimited check sizes - this will not end well as you can surmise. I predict by YE multistage firms (>$1B funds) who are responsible for driving up round sizes and pricing finally pull back as they recognize that it’s F&^%$8ing hard to invest at inception. Expect the pullback to start second half of 2024 and expect to see median cash raised and valuation for these rounds to finally stabilize in 2024 vs. increasing from 2023. For other rounds, expect a slight recovery in pricing from 2023 lows and an even larger one if Jerome Powell reduces interest rates.

The startup class of 2023 and 2024 will be epic as founders have gone back to basics to build lean and mean from day one (more in my “Back to Basics Building Startups from Inception” doc), solving real problems for real customers, not building incremental features, and building with one of the biggest platform shifts in history as AI is infused into almost every application yielding some amazing results that one could not previously imagine.

Enterprise Tech

AI hits the mainstream in the enterprise second half of 2024 as a number of pilot projects graduate to full production and customer facing applications. While many expect this to be a fait accompli, I also believe that many underestimate the massive drag along effect in IT spending for cloud, new tools, infra and security that will be driven by tens-of-thousands of workloads being moved into production.

AI evolves from narrow tasks like writing text to enterprise workflow and automation - we are in the beginning phases with agent technology showing what’s possible, but it’s clear to me that these enterprise workflows, say in a ten-step process, may include using several different models from OpenAI to open source, multiple modalities from text to image processing, and will include human-in-the-loop for 👍🏼 or 👎🏼 to further refine these models.

AI security becomes mainstream as an epic hack happens in 2024 which will involve some form of data leakage, prompt injection attack, or some other hole not plugged driving significant growth in AI security spending. Palo Alto Networks, Crowdstrike and others will launch their own AI security offerings or buy a startup in 2024.

Time for reinvention - many existing market leaders in dev tooling and infrastructure categories have not been reimagined or reinvented for 10-15 years. These categories, while dominated by a few, also have a number of folks complaining about lack of innovation and/or pricing - keep an eye out for new startups in Source Code Management (SCM) to go after Github/Gitlab, secrets to reimagine Hashicorp Vault, observability/monitoring to chip away at Datadog and the continued complaints on pricing. There are many more categories to be rebuilt and ambitious founders will be ready in 2024 as the VC spigot continues flowing for inception rounds.

AI evolves from proactive chat to seamless suggestions - if last year was the year of chat as the logical interface for using GenAI models, this year will be the year of seamless AI assistance as applications evolve and provide new ways to interact with AI like Superhuman’s embedded 1 line summary format in emails.

AI moves beyond Github copilot and coding to testing, ops, + 🫢 AIOps again (a dirty word for DevOps professionals) as generative AI models get trained on reams of data and DevOps professionals start trusting AI to surface valuable insights and make routine decisions based on event correlation, anomaly detection, and resource allocation.

PLG as a term is dead, long live steak 🥩 dinners - I’m doubling down on this theme in 2024. The rise of GenAI will only mean more spam and noise for targeted buyers. The days of PLG everything are over as founders finally understand that in order to close real enterprise sales you need talented reps to close those deals (read What’s 🔥 #361 - PLG, PLS, Sales led 🤯 - enough acronyms). As enterprise budgets start opening up in 2024, I’m doubling down on the need for steak 🥩 dinnahs to close those massive deals as IRL is the only way to get it done.

Crypto is back but not in the way you imagine with worthless tokens being launched. 2024 will be the year of real-world use cases mostly driven by large financial institutions using the blockchain for what it is best suited for which is instantaneous, low-cost, cross border settlements with the use of stable coins. There will be some massive financings this year for the leaders in infrastructure helping these banks, payment processors, and others build, custody, and secure these transactions.

Markets

IPOs reemerge in Q3-Q4 2024 as the Fed eases interest rates and companies like Rubrik and others finally hit the public markets.

Big tech M&A will slow to a crawl due to regulatory pressures leading to a huge year for smaller, tuck-in acquisitions in the <$500M range as many larger cos understand that in order to be a durable public enterprise software company one must be a true platform with multiple product offerings. Startups who don’t raise a lot of capital and building tech that is 1-2 years ahead will have the opportunity to either take a strategic tech multiple for a product in the >10x multiple range or decide to slug it out to build something bigger. I do believe that way too many infrastructure software cos with niche offerings were funded during the ZIRP era and expect many to take the exit option now. That being said, the companies who say no will have the opportunity to build really big, efficient, durable businesses ready to capture value in any market scenario.

As always, 🙏🏼 for reading and please share with your friends and colleagues. Happy New Year to you, and cheers 🥂 to 2024!

Scaling Startups

👇🏼 must read for founders as they look to bring on their next investors and yes, as an inception investor I’ve seen this countless times…I would make one

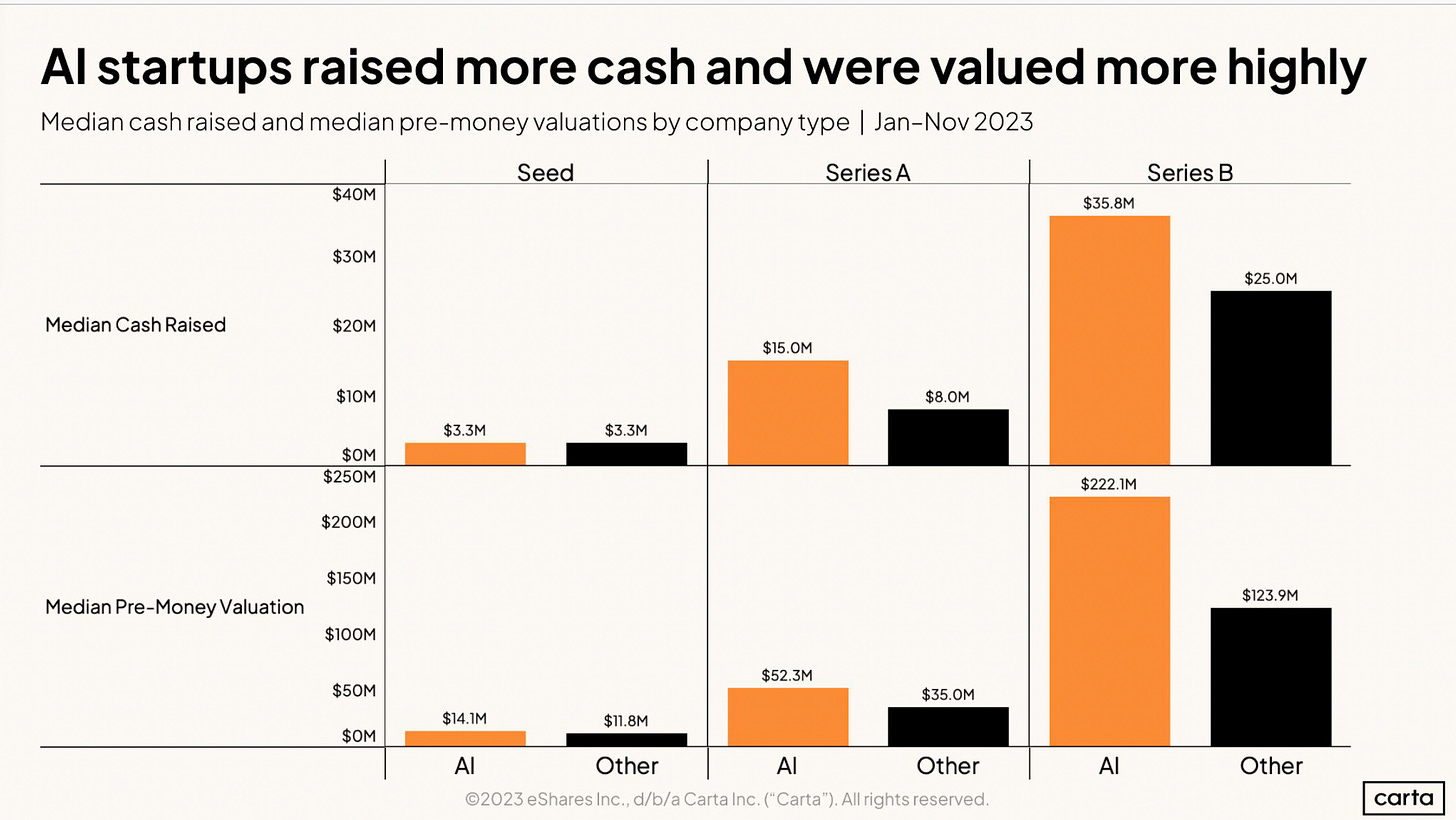

State of US Startups in 45 charts from Carta - must read 👇🏼 - look at that “AI” premium 👀

Love this interview clip with Novak Djokovic - everyone goes through emotions but how quickly can you bounce back and reset mentally

Want to move faster as you scale your org? Try Delete Week from Brian Armstrong of Coinbase

Companies, just like any organization, trend toward complexity over time because it's easier to add something than delete it. In psychology this is known as the endowment effect, or loss aversion. Our board member, Tobi Lütke (co-founder and CEO of Shopify), has observed that "The best thing founders can do is subtraction. It’s much, much, much easier to add things than it is to remove things." At Coinbase, let us aspire to spread this superpower throughout the company.

Starting the second week of January, our Delete Week experiment will kick off. It is optional for any employee or team who would like to participate.

As you find areas to reduce complexity and delete items, share them in the #delete-week channel. Here are a few categories to spark ideas:

Features or products: What features or products are rarely used and accumulating debt? Can we gracefully wind them down?

Lines of code: What large sections of code can be removed or simplified?

Backend services: What services are no longer used or can be consolidated, that are taking up resources and are no longer maintained?

Security: What attack surfaces or duplicate systems can we eliminate across the company that are no longer worth keeping?

Meetings: What recurring meetings can be eliminated, or added ad-hoc only when needed?

As you enter the New Year from Robert Greene author of The 48 Laws of Power and other bestsellers

You must always be prepared to place a bet on yourself, on your future, by heading in a direction that others seem to fear.

Enterprise Tech

Reminder to bring the energy for next year - Developers, developers, developers

Anthropic projecting $850M ending ARR run rate next year as it is in talks to raise at a $15B valuation? (The Information)

Anthropic, an OpenAI rival backed by Amazon and Google, has projected it will generate more than $850 million in annualized revenue by the end of 2024, according to two people with knowledge of its financial picture. Just three months ago, Anthropic told some investors it was generating revenue at a $100 million annualized rate and expected that figure would reach $500 million by the end of 2024. It isn’t clear why the latest projections are materially higher.

The projection underscores the three-year-old startup’s remarkable growth expectations and may offer more evidence that generative artificial intelligence is gaining steam among enterprises.

Key concept when it comes to AI and why Microsoft calls it copilot…

SATYA NADELLA, CEO, Microsoft

The one big design decision we made was to think about this as a copilot, not as an autopilot. Designing it in such a way that the human is in control. Thinking of anything that gets generated as a first draft, whether it's a piece of code or a piece of text or an image, that's probably a good way for us to think. Humans have to do their job too.

Many saw this NYTimes lawsuit against OpenAI and Microsoft coming but here’s a great breakdown of the complaint including allegations that OpenAI weighted NYTimes sources more heavily than others (@MatthewBerman)

The New York Times just sued OpenAI and Microsoft for copyright infringement for using its content to train ChatGPT.

Some of the allegations are STUNNING!

I read all 69 pages of the lawsuit, here are the most 🔥 parts:🤯 is data a real moat? Only if it’s proprietary 👇🏼 from Rohan Paul

BloombergGPT was great when it came out.

But just to put the rapid evolution of LLMs into perspective

📌 Bloomberg invested over a million dollars in developing a finance-domain focused Large Language Model (LLM) named BloombergGPT.

And within just six months of the release of BloombergGPT, a model (AdaptLLM-7B) costing merely $100 came out surpassing BloombergGPT in performance.

📌 And now fine-tuning a 7-bn parameter model can be done for less than $100 on AWS and can be completed in 5-7 Hours.

📌 Some may contend that the BloombergGPT was designed using proprietary data.📌 However, this proprietary data made up a negligible 0.70% of the dataset. And the rest 99.30% of the data originated from public sources accessible to everybody.

More pain to come in enterprise infra - Armory, once valued at $200M and having raised >$80M, was sold to competitor Harness for $7m 🤯. Armory was a unique OSS company in that it did not create the Spinnaker project but did take it over and create the enterprise version. Wrote more about Armory as a unique OSS co in #207 and how it went after enterprise scale deployments first

Software deployment platform Harness is buying competitor Armory, according to two people with direct knowledge of the sale. Harness will pay $7 million for the company in an all-cash deal, one of the people said. Details of the deal, which is still in progress, could change.

It's a dramatic fall from grace for Armory, which as recently as 2020 was valued at more than $200 million according to data from PitchBook.

In all, Armory has raised more than $80 million from Bain Capital Ventures, Insight Partners, and Salesforce CEO Marc Benioff among others. Armory was also selected as part of Y Combinator's 2017 winter class under then president and now OpenAI CEO and founder Sam Altman.

Markets

One of best public tech market roundups from Octahedron Capital - look forward to this every quarter from Octahedron - covers consumer demand and then goes into categories from ad tech to enterprise software to semis - must read

If you’re wondering what happened to growth rounds look no further than the investment pace of the Top 10 players

These nine invested in a total of 44 unicorn companies in 2023 — or 13% of all unicorn companies that raised funding in the private markets this year.

In 2022, they invested in 213 companies, or around 28% of unicorns funded that year. In 2021, that number was 471 companies, or 30% of this asset class.