What's 🔥 in Enterprise IT/VC #373

Thoughts on M&A in light of Adobe Figma, what's the right number of founders to start a company, + Top 5 What's 🔥 Posts in 2023

What a way to end 2023 with the Adobe Figma merger cancelled. There has already been a ton of commentary from investors, but I can’t help myself so will weigh in with a few thoughts.

This sucks - scrutiny from regulators in the US, UK, and EU have made it near impossible to get large deals done. Without strategic multiple expansion, large cos need to rely on public markets to price them meaning that dreamy 30-50X ARR multiple is gone for now.

If a large public company is willing to go through the 12–18 month scrutiny to pull off a large acquisition, the target board will also have to think twice about the real chances of a deal closing and the disruption to the business. Sure the $1B breakup fee is nice which is pretty standard for large scale acquisitions especially when there is regulatory risk, but the limbo period between signing a term sheet and closing is absolutely brutal for founders and startups. In Figma’s case, the time was 15 months before cancellation, and while Figma apparently grew 50% YOY to $600M ARR which is incredible, I do wonder if they could have grown even faster without this limbo. Trust me, I’ve seen what this is like first-hand as it was around a 16-month period between the time Meta announced the purchase of portfolio company Kustomer and the deal actually closing. Employees are partly counting their 💰 so yeah, there is some distraction, especially if it doesn’t close and there is no liquidity. It’s also hard to hire great people as the upside from working at a private company is gone since one must assume you are working for the acquirer. It’s also hard with customers who want to know where your company fits on the acquirer’s strategic priorities, whether or not the product roadmap will change, and how it will impact servce.

For companies at the >$100M ARR mark, your best exit opportunity will be first to go public and second PE.

To go public, companies need to be at least $200-400M ARR, insanely efficient with >30% growth at scale, generating free cash flow, and have the beginnings of a multi-product engine to upsell like Datadog, Crowdstrike, Palo Alto Networks and others.

Those who aren’t great at organically building new products will go shopping for much smaller startups for tech tuck-ins where time to value or time to get product into a channel will be 2 quarters or less - back to efficiency.

There will also be larger private-to-private mergers of two 🦄 combining together to potentially get to IPO scale.

Founders and investors should think long and hard about how much capital should go into a business since it will be SIGNIFICANTLY easier to sell a company <$500M vs. >$500M. The more capital raised, the lower the return.

Every investor will continue to go earlier as being first means it’s the best place to be when it comes to returns albeit one of the riskiest as well. More on the race to be first here in What’s 🔥 in Enterprise IT/VC #365.

Cybersecurity companies where national security is at risk will have a much easier time getting larger deals done.

Switching gears, a wise VC once told me:

VCs on a board are like margaritas, one is not enough, 3 is too many, 2 is just right.

There has been a lot of discussion this year about boards and governance, and as I thought about this analogy, I also believe it extends to the number of founders to start a company:

More from a recent LinkedIn post:

Here’s the data from boldstart Fund IV & V representing 41 portfolio companies.

Solo founder: 9 or 22%

2 co-founders: 28 or 68%

3 co-founders: 4 or 10%

To be clear, this is a tiny sample set in the universe of data. However, anecdotally I can tell that if you are a solo founder and starting a company, challenge yourself to find another partner as you can build faster, and it’s more fun. However, don’t bring on a co-founder because you think you have to or because you think you need one to get funded - ultimate trust and faith and clear division of responsibilities is super important.

In fact, if you choose the wrong co-founder, it can set you back even more than just by building yourself. Within the 2 co-founder bucket, there were 8 co-founder breakups or approximately 20% of all companies we backed at inception. Don’t rush into a relationship; ideal co-founders come from working together on previous companies, make sure you spend a lot of time together.

If you decide to go solo, make sure you find other ways to create that sparring partner environment - some tips below 👇🏼:

Finally, I want to 🙏🏼 all of you for being here on the journey with me and reading this newsletter and sharing your thoughts. To that end, here’s the Top 5 What’s 🔥 IT/VC From 2023!

What’s 🔥 #361: PLG, PLS, Sales led 🤯 - enough acronyms, build a product, sell it efficiently

What’s 🔥 #360: IPOs, Splunk for $28B, mega funding rounds + M&A - are we back or is this just a mirage?

What’s 🔥 #345: Developers + buyers aka "Users and Choosers" - Hashicorp sandwich 🥪 model + practical advice selling dev tools in 2023

What’s 🔥 #370: The End of an era - the extinction of "Hypergrowth" public enterprise software cos, >40% NTM Revenue 📈 - Guggenheim Partners

What’s 🔥 #343: Collaborative doc template for super efficient board meetings

Here was the #1 clicked on link this year: Back to Basics Building Startups from Inception - some random notes

As always, 🙏🏼 for reading and please share with your friends and colleagues! Happy Holidays to all of you.

Scaling Startups

Must watch - more Jeff Bezos on writing a 6 page memo, 30 minute of study hall for all to read, how to structure meetings, + importance of crisp documents to drive meetings - get your What’s 🔥 template here to write your own memo for efficient board meetings

Building like startups used to - cofounder of Udemy on new startup, for tips on building lean and mean from start, remember to read my doc on Back to Basics Building Startups from Inception

Wow - mostly crossover but eye opening nonetheless - “38% of VCs disappeared from dealmaking in 2023” Pitchbook

From Kyle at Openview - SAAS Growth Cheatsheet

Enterprise Tech

Sharing our 2023 boldstart recap along with a look ahead into 2024 - thank you all for your support! Looking forward to another banner year for "Inception Investing" 💪🏼. Checkbooks are open and Happy Holidays!

How enterprises are thinking 🤔 about AI Security from UBS

💯 will open up a whole new world - edge devices, sensors, etc…

Wow - still barely dented Fortune 1000 - I’d bet on Azure in 2024 gaining more market share since they already have the enterprise customers and way ahead in AI

Wedbush equity Analyst Dan Ives shares his Top 10 Tech List for 2024

👇🏼 must read FAQ on cost savings moving off the cloud to on-prem and how to do it yourself - from Basecamp/Hey - “The Big Cloud Exit FAQ”

Because we bought the marketing pitch. That it was going to be cheaper, easier, and faster. Only the last promise ever really came through for us. The cloud makes it really fast to provision a whole fleet of servers. But that’s just not something we do very often, so it’s not worth a huge premium.

But we spent years trying to unlock the savings from “economies of scale” and “ease of use”, but it just never really happened. The managed services still needed management. The advances from Moore’s Law rarely got passed on as savings.Where your training data for AI Models comes from matters - “Child abuse images found in AI training data” Axios

Markets

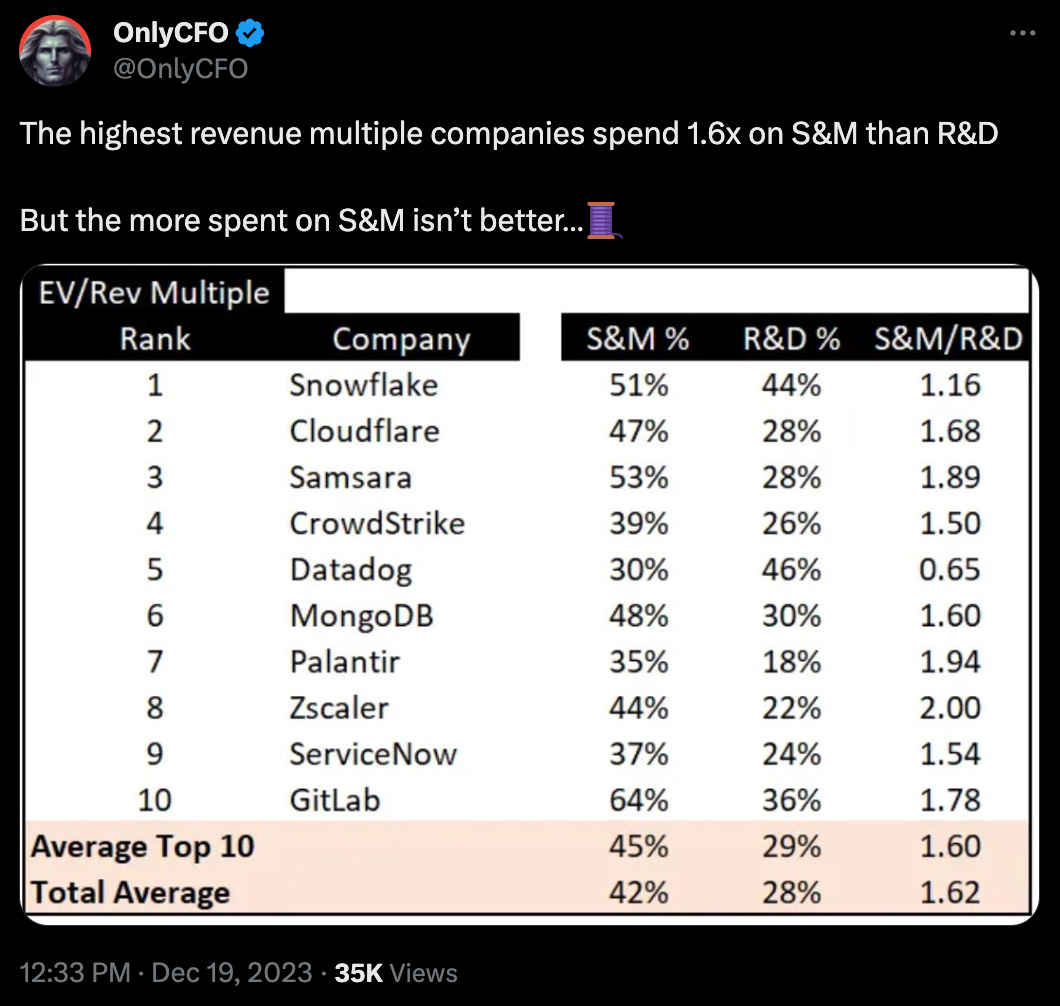

At scale, what GTM efficiency looks like 🧵

From the standpoint of being an investor and a capitalist, why does the negation of the Adobe acquisition of Figma suck? As an investor, I get that a $20B liquidity event would be very nice both for investors and Figma employees. But given than Figma is still growing, and given that anecdotal evidence strongly suggests that Figma's user base is glad the acquisition was scuttled, isn't this a good thing? In other words, wouldn't you rather own Figma when it surpasses Adobe than owning a smaller portion of Adobe when it acquires Figma? If, as an investor you believe in Figma as a company, than why not continue to believe in it as a independent entity rather than a part of Adobe?

As a capitalist, wouldn't you rather have true competition in the market than a handful of large players who hoover up any and all competition? Isn't the whole point of "creative destruction" to create an environment where companies that nobody knows about today become the Amazons, Googles, and Apples, and Microsofts of tomorrow?

I get why regulatory scrutiny like this is anathema to investors who want to make a return on their money. But I've got to be honest: I've got a very hard time squaring this sentiment with any of the investing philosophies I've subscribed to. You invest in a company because you believe in its business. One's belief in Figma shouldn't change simply because it won't end up being owned by Adobe. And the whole point of capitalism is to create a free market, where upstarts can compete with the incumbents. That breaks down completely if the success is mostly defined by upstarts being acquired by incumbents.