What's 🔥 in Enterprise IT/VC #352

📣 The hard to find product benchmarks for Dev Tools in 2023 is here - breakdown on conversion, retention, % sales led and more....

Microsoft released its earnings this week and as usual, I’m going to break down some key comments from Satya Nadella as it pertains to the readers of What’s 🔥. Since Anna Debenham from my team at boldstart ventures just released a hard-to-get Dev Tools product benchmark leveraging data from our friends at Openview, let’s start with this 🤯 stat:

Nearly 90% of GitHub Copilot sign-ups are self-service, indicating strong organic interest and pull-through. More than 27,000 organizations, up 2x quarter over quarter, have chosen GitHub Copilot for Business to increase the productivity of their developers, including Airbnb, Dell, and Scandinavian Airlines.

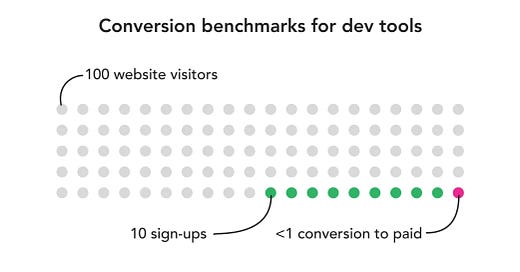

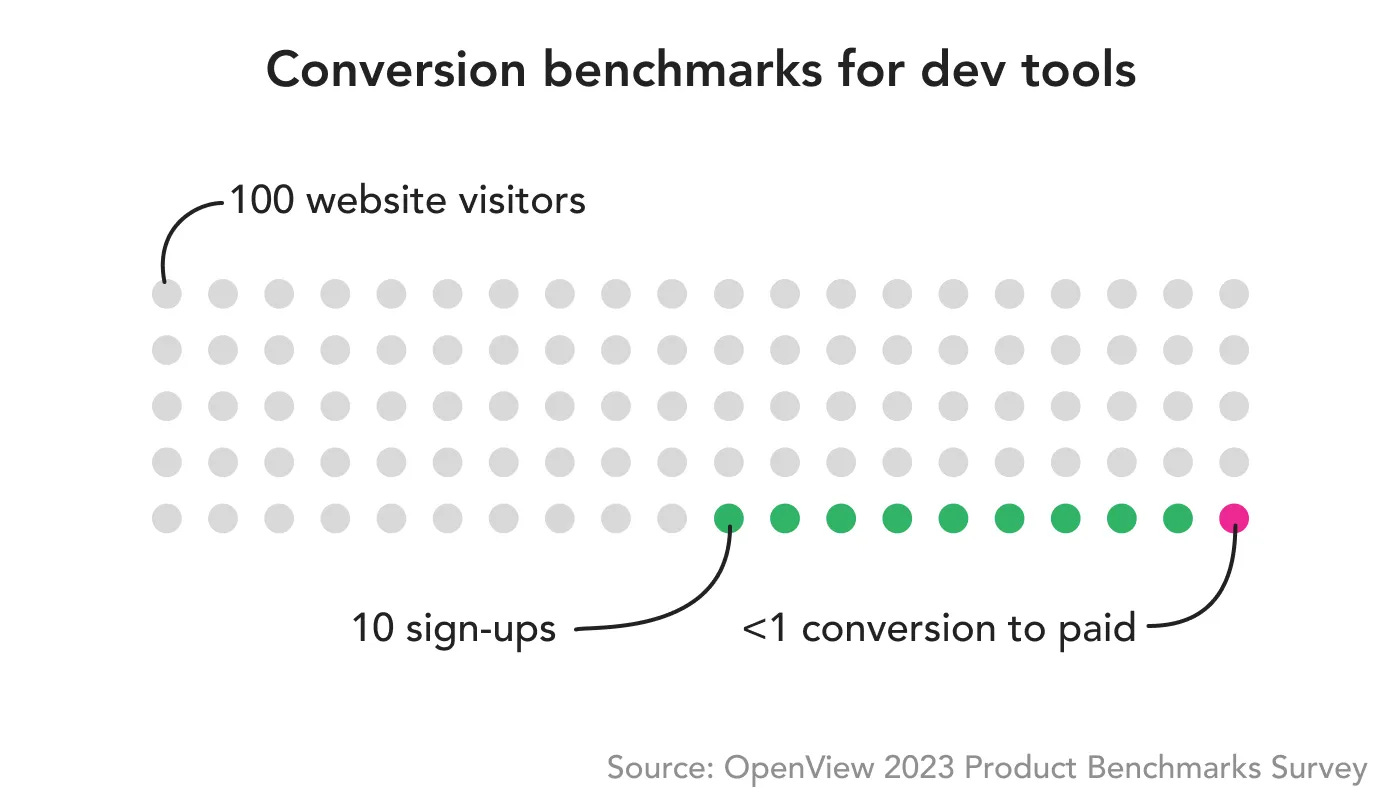

This data will lead you to believe that for any dev tools founder the magic happens when folks visit your site and boom, you are swimming in 💰💰💰. The reality, of course, is much different. If you want to know what good/great looks like when it comes to product metrics like acquisition + retention then read the post here.

This is not an exact science and will get better as more folks submit data. That being said, here is one of the 🔑 learnings from this data - there is no magic PLG bullet and sales does not happen all by itself - in fact, the data shows that more dev tools cos have become sales led with great lead gen from community and trials

The thing that stands out to me most is that the “product-led sales” approach is helping companies grow faster. In this year’s report, OpenView point out the best product-led growth companies seem to be using a bunch of different signals (such as level of product adoption, user role, and customer profile) to determine which users sales should to reach out to. PLG is the most popular method for developer tools, but it’s clear that in most cases, this needs to be paired with some form of sales motion to get a meaningful number of users converting.

So treat your self-serve sign ups as your most valuable lead source, and ensure you’re collecting the right data that Sales can use to help supercharge your product-led motion.

Ed Sim refers to a successful pairing of product and sales as the “sandwich model”, where a bottoms up motion is complemented with a top-down one. This ensures there’s not an over-reliance on one or the other, and I’ve found this also leads to a more well-rounded product that can stretch to the needs of both small and large teams.

What I’ve observed over the years is that no matter how you build and start your GTM motion, developer first, product led growth (PLG), or top down, every company eventually becomes an enterprise software company selling to large institutions…

This is the the 🥪 model in action where you build for a bottoms up user, grow the funnel and sprinkle in a few top down design partners in the early days.

Now back to Microsoft and reading the tea leaves for AI in the enterprise which is still in the super early stages of growth and deployment (transcript here)

Early Innings

Satya Nadella -- Chief Executive Officer

Sure, Kash. Thanks for the question. So, maybe I'll start and then, Amy, you can add because I think -- we do think about what's the long-term TAM here, right? I mean, this is -- you've heard me talk about this as a percentage of GDP, what's going to be tech spend? If you believe that, let's say, the 5% of GDP is going to go to 10% of GDP, maybe that gets accelerated because of the AI wave. Then the question is how much of that goes to the various parts of our Commercial Cloud and then how competitive are we in each layer, right? So, if you sort of break it down, talked about how Microsoft 365, we think of this Copilot as a third pillar, right? We had the creation tools.

We then had all the communication and collaboration services, and we think of this AI Copilot as the third pillar. So, we are excited about it. Amy talked about how we want to get it out first and part of this preview. And then in the second half of the next fiscal year, we'll start getting some of the real revenue signal from it.

So, we're looking forward to it. But we think of it long term as a third pillar, like we thought about something like, say, Teams or SharePoint back in the day or what have you. Then Azure, the way I think about it is we still are, whatever, you're inning 2 or inning 3 of even the cloud migration, especially if you view it, right, whether by industry moves to the cloud, segment move to the cloud, as well as country adoption of the cloud, right? So, there's still early innings of the cloud migration itself. So, there's a lot there still.

And then on top of that, there's this complete new world of AI driving a set of new workloads. And so, we think of that, again, being pretty expansive from a TAM opportunity and we'll play it out. But at the same time, you know, as we are a $111 billion Commercial Cloud that has grown in 20s, and so therefore, we do hit law of large numbers. But that said, we do think that this is business that can have sustained high growth, which is something that we are excited about.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

Many believe that very successful founders have all the answers when starting their second company but Jared nails some of the common mistakes

👇🏼 great 🧵 and reminder when growing to think about how lean, mean + optimized trumps large teams

State of affairs in startup land - expect this to continue to 📉

How COO of Vercel experienced and managed hyper growth - great 🧵 from COO Vercel - - there it is again, velocity matters - I’ve written extensively on that topic on the early signs of success as well below

AngelList state of pre-money valuations end of Q2

Enterprise Tech

Let’s go Protect AI 💪🏼! Simple thesis from early 2022 - amazing team we’ve known for awhile coming out AWS most recently leading GTM for AI/ML and some founders started one of first MLOps companies called Datascience.com which was sold to Oracle. It was clear that securing AI models, data and getting visibility on what models were in production + secure but what was quite unclear was what would the catalyzing event be to force enterprises to get one of these? Well the team built and built, iterated with some early enterprise design partners, and we got the catalyst, ChatGPT, a couple years earlier than expected. Now it’s 🏃🏼♂️ time and super excited for this group of investors joining the team to help ProtectAI deliver AI at scale in the enterprise with security!

Still super early for Generative AI in enterprise - more from ServiceNow earnings transcript

Satya believes we will return to normal cloud growth cycle in next couple of quarters

Satya Nadella -- Chief Executive Officer

Sure, Brent. Thank you for the question. Yeah, a couple of observations. One is I think overall in the cloud, you do see new project starts and then those projects starts get optimized and then you sort of time series all of that, and that's sort of what you see in the normal course.

What happened here was during the pandemic, obviously, there were lots of new project starts, and optimization in some sense was postponed, and that's where you're seeing, I'll call it, catch-up optimization. And that's something that, to your point, we will lap going into the next couple of quarters, I think, will come down. And we are seeing new project starts, both traditional type of project starts, even cloud migrations, data applications, and of course, obviously, the AI applications. But we'll get back to I'll call the normal pace of new project starts and optimizations going forward, that we will cycle through, I think, in the next couple of quarters, what is the last catch-up optimization.

Data security wars 🔥 up as Thales buys Imperva for $3.6B enterprise value or 6.1x 2024 Revenue. Not growing fast but accretive deal of scale for Thales:

2024-2027 organic sales growth: +6 to +7%,

2027 EBIT3 margin to reach 16.5%.

OneTrust in data privacy space just raised $150M at $4.5B down round valuation from last raise in Dec 2020 at $5.1B valuation. Interesting note is valuation today vs 2.5 years ago as company doubled ARR to $400M with growth rate of around 40% per year and now cash flow positive but still down round with multiple of around 11x vs. 25x trailing ARR.

another security Posture Management co, this time ASPM (application security posture management) co Bionic.ai rumored to be bought by Crowdstrike for $200-300M after $82M raised (TechCrunch)

AI Coding Tools landscape from Insight Partners (h/t Michael Yamnitsky)

Want to know what the future of AI and coding? Take a look at Github Next projects - it’s also hiring aggressively - Copliot for PRs, for docs, for CI and more

I know nothing about the Barbie movie other than the social marketing was off the charts - if interested in knowing what the marketers did, here’s a 🧵 from Aakash Gupta laying out how Barbie generated $337M of ticket sales in the first weekend

Markets

With comments above on cloud returning to normal spending and consumption patterns within the next 2 quarters, is there a silver lining of growth ahead in early 2024?