What's 🔥 in Enterprise IT/VC #307

🙏🏼 Hope springs eternal in SaaS land...but only a rare, few like Figma

🙏🏼 Adobe for its $20 BILLION acquisition of Figma and for bringing hope to the beaten down masses of enterprise founders whose valuations have been on a downward 📉 spiral.

While this gives hope to the few who can build a killer product, execute like mad, and scare the living daylights out of an incumbent, the reality is that these prices are reserved for a select few. Let’s recap, $200M ARR, forecasted to end year with $400M ARR and with 150% Net $ Retention and cash flow positive! How many companies at that scale have growth and retention like that? Yes, very very few.

Here’s the slide deck from the Adobe call with Wall Street.

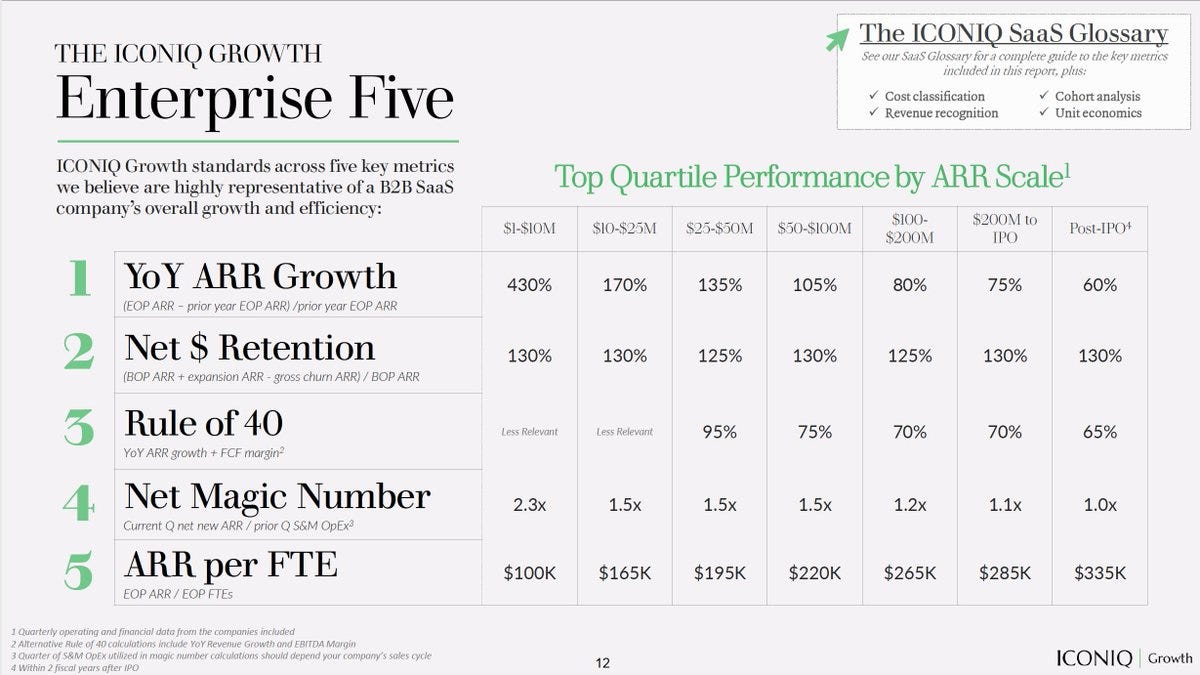

Using Iconiq Growth’s most recent SaaS benchmark report which you can find here, Figma is off the charts with Net $ Retention of 150% and ARR growth of a smaller company at 100% (h/t @modic123).

Here’s more from from the founder…

and from the buyer.

BTW, Scott was founder and CEO of Behance prior to this and now CPO so it takes a startup founder to understand how disruptive startups can be to an incumbent. While he did not do this himself, I can surely bet that Scott led the charge.

And no, this doesn’t mean VCs will return to paying 100x TTM ARR or 50x NTM ARR. This also does not mean that the M&A floodgates will open either as how many public companies will pay 12% of its market cap to admit defeat in one of its core businesses and pay multiples that are way higher than the highest public comps trading in the 20X range. In fact, this was not well received by Wall Street as the stock traded down 16.8% after the news erasing $29B of market cap from Adobe or more that the price it is paying for Figma. That being said, technology can be brutal and if a company misses a product cycle, it can lead to a death spiral and frankly this is an insanely smart bet that will pay off in the future.

Finally, here’s a great 🧵 on building in real-time collaboration from day one versus trying to retrofit it into a product.

Which is also why I’m so 🔥 up about LiveBlocks, a boldstart portfolio co, an API for adding multi-player collaboration.

Thanks again to Adobe and Figma as it seemed to put a smile on everyone’s faces this week. Hope does spring eternal, and as always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

My quick take on what I look for in founders, startups, and what the early signs of success are from day one…thanks to Tanya Dua for hosting me on VC Wednesdays on LinkedIn News

🚨 Welcome back to VC Wednesdays. This week, we're joined by boldstart ventures' Ed Sim. Read on for more. 🚨

✒️The biggest thing you look for when investing in a startup?

This is for highly technical enterprise and infrastructure founders, but why you start a company is just as important as what you're building. What's your unique insight that allows you to build this thing 10 times better than what exists?

✒️What separates successful entrepreneurs from the rest?

We partner with founders on day one, which means there's no product. So the earliest indication of success for us is a velocity. Product velocity: How quickly can you get something out of the door, iterate on it, and test it. Hiring velocity: I love it when founders have a core team from day one. And learning velocity: How quickly can you test a hypothesis, design experiments around it, and adapt based on what you learn.

✒️The emerging tech you're betting your money on?

The rise of developer-first startups, which are impacting every industry. In security, we're investors in Snyk and Jit. Cybersecurity and crypto infrastructure is also interesting. The folks selling the picks and shovels during the gold rush is who we love funding. The more technical…👇🏼

Enterprise Tech

Speaking of PLG, super excited about dope.security (a boldstart portfolio co) - reimagining a secure web gateway w/a fly direct approach, delightful end user experience, + new architecture built for ↑ speed + reliability - here’s more on why we invested and also the TechCrunch article

Collaboration on 🔥 as both Canva and Zoom going after Google Docs and Microsoft Office

Reminder that no matter where you start your GTM initially, all cos end up becoming an enterprise software co and need to then manage multiple sales motions for multiple customer types - Dev, CEO of MongoDB, from the Goldman Sachs tech conference this week

Dev Ittycheria

Yes, so because we're going out to such a big market, we quickly realized early on that you can't just have one mode of going to market the typical ways, hire a bunch of field salespeople, try and cover as much territory as possible, scale them as fast as possible. But we knew that didn't make sense because of how large this market is. So we have not only just an enterprise sales organization, we have a mid-market team that's predominately inside sales. And then, we have a self-service business and we also have a partner organization. And the partner organization works with both like large partners like our hyperscale partners, as well as SIs and ISVs because this market is so big, and it's a very large ecosystem. So I think we've been very innovative in terms of thinking through how to go-to-market, not everything started day one. We've listened to customers, we've also changed the way we engage with customers with our cloud business. The classic enterprise software motion is to get someone to sign up for big commitment up front. But in the cloud business, when the customers don't even know how large or how much their app is going to grow. It's very hard to get them to commit out early and realize, given the high retention rates that we have, and that databases and data platforms are so sticky, let's just get them on the platform. And that's paid huge dividends for us, as evidenced by Allison's growth the last few years.

eBPF rising - great article from Redmonk on why you should care - also here’s a tweet from a couple weeks ago related to eBPF use cases

Congrats to Bruno from Magna on his seed round and launch of Magna which is building token distribution software that makes it easier for protocols, decentralized autonomous organizations (DAO) and crypto funds to send and receive tokens, a process that has so far lacked automation and has been prone to error.

As a metrics fan boy, I appreciate you including the ICONIQ Enterprise 5 grid. Super helpful to have benchmarks by ARR cohort. 🧮🙌