What's 🔥 in Enterprise IT/VC #348

Summer of fun 😎 - floodgate 💰 for enterprise infra has opened

While most enterprise 👀 were on the Databricks and Snowflake conferences this past week, something unusual happened in enterprise infrastructure land. A number of Series B and beyond fundings at amazing valuations were announced this past week. Before you beat me up and say that these were all raised over a year ago, I can tell you that I heard about most of these raises while happening in the last 8-12 weeks. These are real, relevant data points. Remember my post from 6 weeks ago on how to raise an outlier Series B round and beyond? These all fit that profile (for the non-AI infra cos).

What's 🔥 in Enterprise IT/VC #341

Fat cats 😺 don't hunt: How Dev + Infra cos can go from massive, preempted Series A rounds to a solid B in this environment. I know of a number of developer first and infrastructure companies raising highly competitive Series B rounds with a profile like this - wandered in desert for first couple years, went back to seed stage co and first principles, after turnaround first year selling booked ARR $500k-1M, Year 2 path to $3M+, and forecasting a 3-4x growth from there at $9-12M with demonstration of a repeatable sales motion. It’s possible, and I’m seeing it. The later stage VCs are writing term sheets to lead $30M+ rounds NOW at attractive valuations.

Based on what I know, there is a lot more to come. Here are a few of the cybersecurity and developer cos that announced healthy rounds this past week.

Cyera - a data security posture management company (DSPM) raised $100M in Series B led by Accel at a $500M valuation 😲 (Calcalist), 15 months after it’s A with an AI spin…”and uses large language models to automatically discover, classify, and secure sensitive data”

Redpanda Data, a streaming data platform for developers, raised a $100M Series C led by Lightspeed, 16 months after it’s B (TechCrunch)

The company says it has enjoyed a healthy fiscal year, which included multiplying its revenue growth 5x over and doubling its workforce. That’s pretty huge — especially at a time when startups are experiencing revenue stress and laying off employees in mass workforce reductions, and very few companies are thriving.

Fly.io, a cloud infrastructure company that runs app servers and databases close to end users, raised a $70m Series C round. BTW, also ❤️ this when it comes to first principles for successful developer platform companies:

🎶 There are two kinds of platform companies 🎶 : the kind where you can sign up online and be playing with them in 5 minutes, and the kind where you can sign up online and get a salesperson to call and quote you a price and arrange a demo.

🎶 There are two kinds of platform companies 🎶 : the kind you can figure out without reading the manual, and the kind where publishers have competing books on how to use them, the kind where you can get professionally certified in actually being able to boot up an app on them.

🎶 There are two kinds of platform companies 🎶 : the kind where you can get your Python or Rust or Julia code running nicely, and the kind where you find a way to recompile it to Javascript.

The kind of platform company we want to be hasn’t changed since 2020. Our features are all generally a command or two in

flyctl, and they work for any app that can packaged in a container.

Some sizable Series A rounds also were announced…

Astrix Security, application integration security, raised $25M Series A led by CRV - AI spin here also “which uses ML to secure app integrations”

Calypso AI, LLM security solutions, raised a $23M Series A extension led by Paladin

Just a reminder, way too many companies who were just features masqueraded as companies were funded the last couple of years, and while the floodgates are opening for the best performers, there will still be lots of roadkill, companies who quietly die. Instead of making excuses about how hard it is to raise money, control your own destiny, cut your burn, figure out a way to grow as there is 💰 out there for you if you can execute. And yes, security and infra is still 🔥, and AI continues to be an outlier.

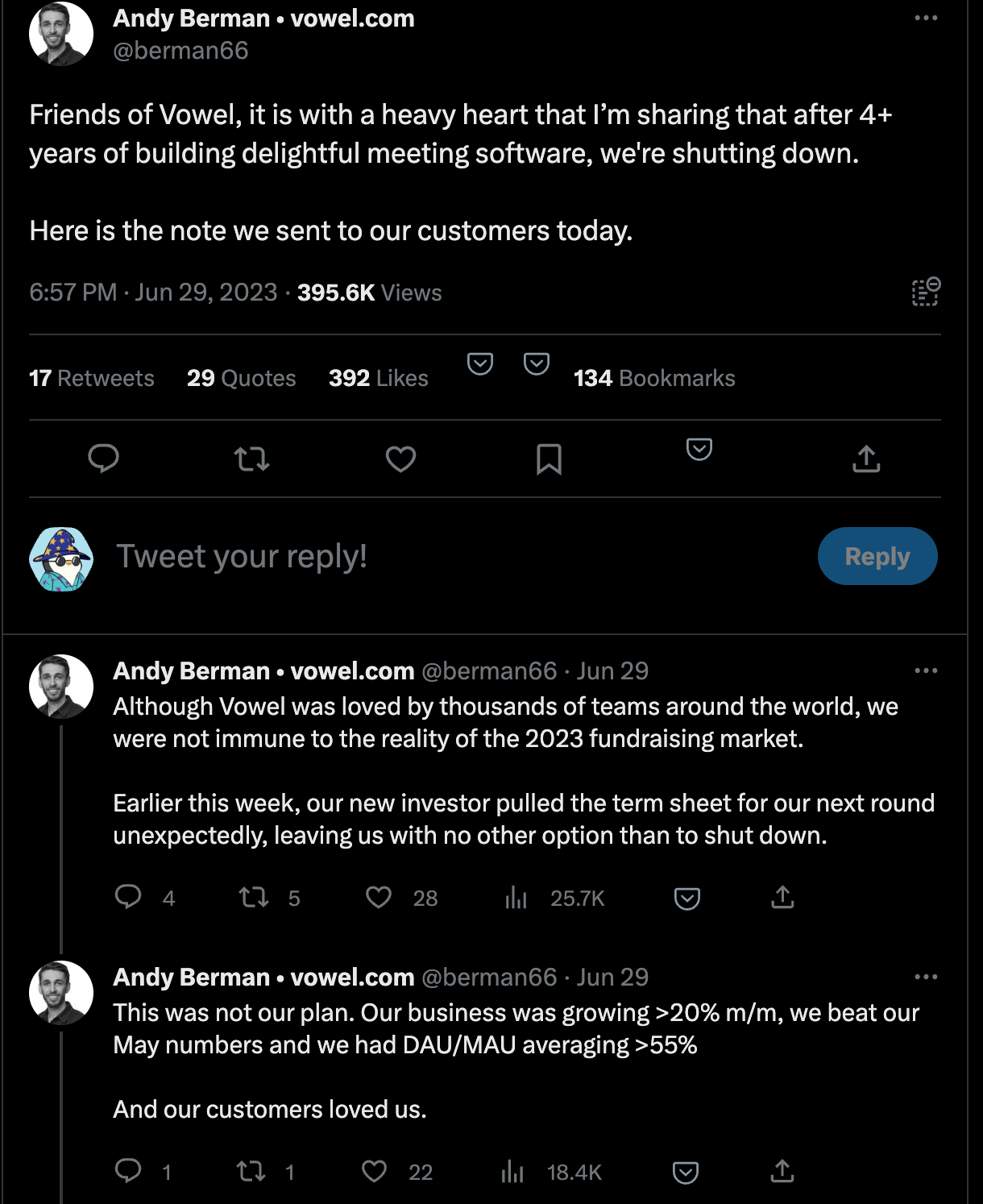

And if you still do all of that, it may not work as Vowel, an AI powered meeting software co, just shut down…

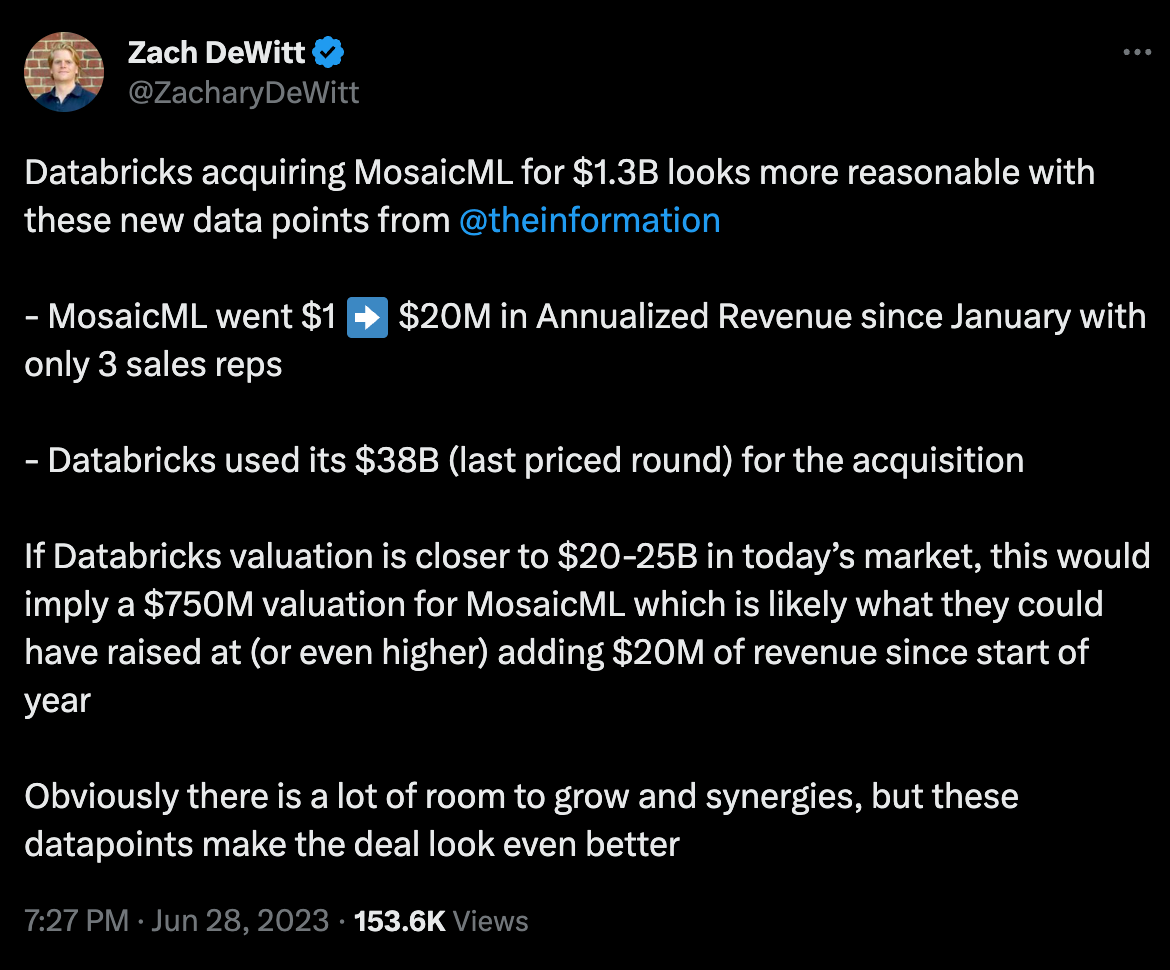

In this summer of fun 😎, the AI acquisitions have also kicked off this week starting with Databricks $1.3B acquisition of Mosaic ML which Zach breaks down here.

Regardless of what Databrick’s valuation is, that’s a healthy return in 2 years and for a company with 62 employees.

generated by Midjourney

Add to that the purchase of Casetext by Thompson Reuters for $650M, a vertical AI legal solution. Casetext has been around for 10 years, raised $64M of funding, and only had 103 employees.

Casetext was granted early access to OpenAI's GPT-4 large language model, allowing it to develop solutions with the new technology and refine use cases for legal professionals. Its key products include CoCounsel, an AI legal assistant launched in 2023 and powered by GPT-4 that delivers document review, legal research memos, deposition preparation, and contract analysis in minutes.

“For the last ten years, we have harnessed the power of AI to build products that elevate the practice of law and enable attorneys to serve more people’s legal needs, with the ultimate goal of increasing access to justice,” Casetext CEO Jake Heller said in a statement. “Joining Thomson Reuters is an incredible opportunity to advance our mission and the field of generative AI solutions exponentially, not only for lawyers but across professions, ensuring this revolutionary technology can benefit as many people as possible.”

There are several paths to exit value. First, the super fast 2 year ramp with a repeat founder or the 10 year slog with a 10x outcome on dollars invested. Regardless, both companies seem to have been super efficient from an employee perspective with 60-100 employees. Back in the days of hyper growth mode, these headcount numbers were likely double with 1/3 the revenue. Efficiency still matters and if you have growth + efficiency, then you’re in the best place.

Finally, LFG Memphis, a new boldstart portfolio co, which just announced its seed round co-led by us and Angular Ventures. More from TechCrunch and my partner Shomik Ghosh on Stream Processing that Doesn’t Suck.

The company wanted to build a solution that helped solved these kinds of problems for developers building real-time streaming applications, and they built and open sourced this new message broker they called Memphis. He said they wanted to attack two key problems that they saw with streaming large amounts of data and building applications making use of that data.

“So the first part would be the management over the scalability, the maintenance that it requires, the amount of time that it takes and complexity to really implement such a technology or a solution within the organization.” The second part involved how to build applications that really take advantage of the data the engine was processing.

The founders started by building the open source project, and eventually building Memphis Cloud,

As always, 🙏🏼 for reading and please share with your friend and colleagues! For those of you celebrating, enjoy your 4th of July weekend! Also, RIP Alan Arkin, who played George Aaranow in one of my favorite plays/books/movies, Glengarry Glenn Ross…

“Glengarry Glen Ross” concerns the hustlers and grinders of Premiere Properties, who specialize in “investment opportunities” of Florida swampland, sold primarily to unsuspecting suburbanites under the guise of many-strings-attached prizes and ticking-clock options. Only the hotshot Ricky Roma (Pacino) is selling — or, in their preferred parlance, “closing” — any of this stuff; his fellow salesmen Dave Moss (Harris), Shelley Levene (Lemmon) and George Aaronow (Arkin) are on the verge of getting the ax.

Scaling Startups

IPOs back in the day - Dell Technologies - $30M raised with a market cap of $85M!!! Less than the size of some AI seed rounds. It’s not the price you start at but the one you exit at…

Enterprise Tech

Must read Coatue deck driven by data on macro and micro trends - glimpse of what’s to come in 2023 and what does all this macro stuff mean for founders…

The Rise of the AI Engineer (Swyx)

We are observing a once in a generation “shift right” of applied AI, fueled by the emergent capabilities and open source/API availability of Foundation Models.

A wide range of AI tasks that used to take 5 years and a research team to accomplish in 2013, now just require API docs and a spare afternoon in 2023.

Enterprise reps hitting quota - always been tough for VC backed startups but look at trend line for public tech cos 📉

How SaaS go-to-market leaders are redesigning sales incentives from Iconiq - logo acquisition with smaller lands in preparation for 2024, new sales compensation incentives? (Full report from May here with benchmarks for comp and incentives)

As part of a new research series, we collaborated with sales executives across the ICONIQ Growth portfolio and network to understand how they are changing their go-to-market strategies this year. Rather than focusing on big-ticket deals with custom features and integrations, many tech leaders are shifting their focus to closing smaller-scale deals that can be expanded over time. Instead of spending on getting more top-of-funnel leads, leaders are investing in strong conversion, strong retention, and selling more to existing customers. As priorities and strategies shift, sales leaders are transforming their team’s compensation structure to realign incentives…

Many enterprise software cos I know are also experimenting with what accounts for quota attainment and other incentive schemes to drive growth in an era where it is harder to drive net new ARR

However, given team-wide quota attainment averages between 60-70%, these types of incentives will only apply to the small percent of sales reps that are hitting and exceeding their quotas. Some sales leaders are trying to implement incentives that will “lift the tide for all boats”.

2023 SRE (Site Reliability Engineering) Report from Catchpoint - some interesting points - AIOps still early on journey, 53.5% if those surveyed use 3 or more tools, and 30% of SRE teams build their own homegrown solution

Lots of Mega AI Fundings

RunwayML raises $141M extension to our Series C with participation from Google, NVIDIA, Salesforce Ventures, and existing investors, among others.

🤯 Inflection AI today announced that the company has raised $1.3 billion in a fresh round of funding led by Microsoft, Reid Hoffman, Bill Gates, Eric Schmidt, and new investor NVIDIA. The new funding brings the total raised by the company to $1.525 billion.

Typeface announced $100M in new funding to accelerate personalized GenAI for enterprises everywhere. Excited to have closed our Series B round with top-tier investors like Salesforce Ventures, Lightspeed, Madrona, GV, Menlo Ventures, M12

Reka raised $58M to build custom AI models for the enterprise led by DST Global Partners and Radical Ventures with participation from strategic partner Snowflake Ventures, alongside a cohort of angel investors that included former GitHub CEO Nat Friedman.

Detailed review from Dan Shipper (Chain of Thought) on Superhuman AI for email

Crypto not dead as the institutions continue to build

This ICONIQ sales performance report brings the heat! Thanks for sharing