What's 🔥 in Enterprise IT/VC #341

Fat cats 😺 don't hunt: How Dev + Infra cos can go from massive, preempted Series A rounds to a solid B in this environment

While the numbers show that VC investment is way 📉 in Q1 from historical highs, I can assure you that the seed market is quite robust, and there is a lot more activity at the Series A rounds, albeit with round sizes normalized to more of an $8-10M versus $15-20M range. It’s a different story in Series B/C land as Zach Weinberg points out.

What’s most interesting IMO is what will happen to all of those companies that raised super early, preemptive Series A rounds at high prices? How will they get their B rounds done? Read 🧵 here.

As much as founders and investors say, we’re different, the pressure eventually gets to founders to live up to lofty expectations. What’s 🔑 here is that there are still many stories to be written, and let me share with you how I see folks getting back to a solid Series B round to continue building their businesses.

To illustrate the opportunity ahead, I created the “Mo Money, Mo Problems” picture overlayed on the Gartner hype cycle to show what happens many times during a preemptive Series A.

For those founders who have learned the hard way that more 💰 does not mean they have more product market fit, they are heading towards the Trough of Disillusionment - which is brutal but also much needed. This is the point that founders must take a whiteboard and reorient themselves and their business to being a lean, mean, efficient seed stage company. All that’s needed is hands on keyboard to build and ship product, and the founders need to close the first 10 deals. Any hire beyond that must be justified. This is also where founders may not cut enough so sometimes they cut in 2 phases which frankly can be even more demoralizing for the team. Assuming that your startup did not burn too much, you will find many preemptive A round startups with 2-3+ years of runway. Getting lean is not about getting infinite runway - it’s about moving faster, creating a sense of urgency, and focusing on the basics.

Here’s where the story can end positively from Series A to B. I know of a number of developer first and infrastructure companies raising highly competitive Series B rounds with a profile like this - wandered in desert for first couple years, went back to seed stage co and first principles, after turnaround first year selling booked ARR $500k-1M, Year 2 path to $3M+, and forecasting a 3-4x growth from there at $9-12M with demonstration of a repeatable sales motion. It’s possible, and I’m seeing it. The later stage VCs are writing term sheets to lead $30M+ rounds NOW at attractive valuations. So instead of getting stressed about expectations, focus on customers, take baby steps, get the first deal closed and then the next and you can write your own story of making it through the Trough of Disillusionment and getting to the Plateau of Productivity.

And if you have the chance to raise a massive preemptive Series A (hint - any AI company), think long and hard about the above. IMO, the best founders operate best when backs against the wall. Fat cats 🐱 don’t hunt.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

On hiring from Gokul Rajaram - 🧵

Hiring an over-senior leader Just met the founder of a series A company who is having challenges with their VP Sales. The Vp Sales is a super senior leader with great experiences. Unfortunately, the company only has 2 AEs and 2 SDRs., so the leader is a fish out of water.

The single biggest mistake I see founders make on the people front is hiring a leader who is 1-2 stages too senior...

Fun - want to watch a movie on underdogs, true believers, taking risk? Watch Air about how Nike signed Michael Jordan to pump its basketball division

Enterprise Tech

Anything AI is defying gravity - “AI Startup Rewind Gets 170 Offers—and $350 Million Valuation in Unusual Fundraising” (The Information) - 500x multiple on $707K ARR - founder was also founder of Optimizely

The company, which charges $30 per month for unlimited access, had $707,000 in annual recurring revenue and, Siroker claimed in his April investor presentation, could one day earn as much as $32 billion in ARR. The NEA partners, for their part, said they were sold by industry-beating metrics on user activation, engagement and retention, “which support the potential of this opportunity.”

Siroker said that his investor presentation was viewed 1.7 million times on Twitter, and that he received 1,010 preliminary offers to invest. In the end, Rewind AI ended up with 170 committed offers. “I decided to forgo the silly tradition of raising a round privately and only talking to a small handful of folks,” Siroker said. “The major benefit of making our pitch public was that I could cast a wide net.”

Ultimately, Siroker found an established Sand Hill Road venture firm to pay a nearly 500 times multiple.

Dev tools, retention and importance of product email usage reports from Anna Debenham, operating partner boldstart + former early employee Snyk

Email is an area that often gets overlooked, or is considered purely within marketing’s realm. I often hear statements such as “devs don’t read emails” or “email templates are hard to build”. I have some sympathy for both of these statements — as an engineer, I generally ignored my inbox in favour of Slack, and I also disliked building email templates.

However, engineers do read emails that matter to them, and designing nice emails sucks way less than it used to. While tools like Slack and Teams are ideal for “just-in-time” notifications, email tends to have a broader reach (particularly if your Slack/Teams integration is optional) and is better suited to longer-form reports or summaries.

Sending a report to an engineer’s inbox is a great way to show the value your product is delivering and can help build up that value by encouraging certain actions.

CNBC Disruptor 50 List of top 50 private companies is out with OpenAI #1 and a number of cybersecurity startups - Wiz, Vanta, Artic Wolf, Orca, and Snyk (congrats!). Both Wiz and Orca are in cloud security space while Snyk is developer first security (story on Wiz and security)

Speaking of cybersecurity, data security is hot and latest rumor is Laminar is for sale for $200-250M after having raised $70M (Calcalist) - rumored buyers include Datadog, Rubrik and others

On cybersecurity and AI from Guy Podjarny Snyk - can’t see many security profressionals relying 100% on LLMs to do their work - as Guy suggests, guardrails will be needed and perhaps AI needed to monitor the LLMs - also Snyk just released its AI autofix feature this week based on its own data and model

The visual is just fun, but in other areas we need to beware this self fulfilling prophecy. For instance, when scanning code for vulnerabilities, GPT is pretty good at finding and explaining vulnerabilities in public repos used to benchmark security scanners. However, when scanning closed-source code, it's not nearly as accurate, missing vulnerabilities (and hallucinating others) at an alarming rate.

GPT is amazing, and there's no doubt it learns a fair bit of the substance from what it reads. The fact it can scan code at all is mind blowing. However, in many cases, its best skill is giving us the answer we want to hear, making it look even smarter than it is. We should remember that, and be careful when choosing what we depend on it to do.What’s trending in software development from InfoQ

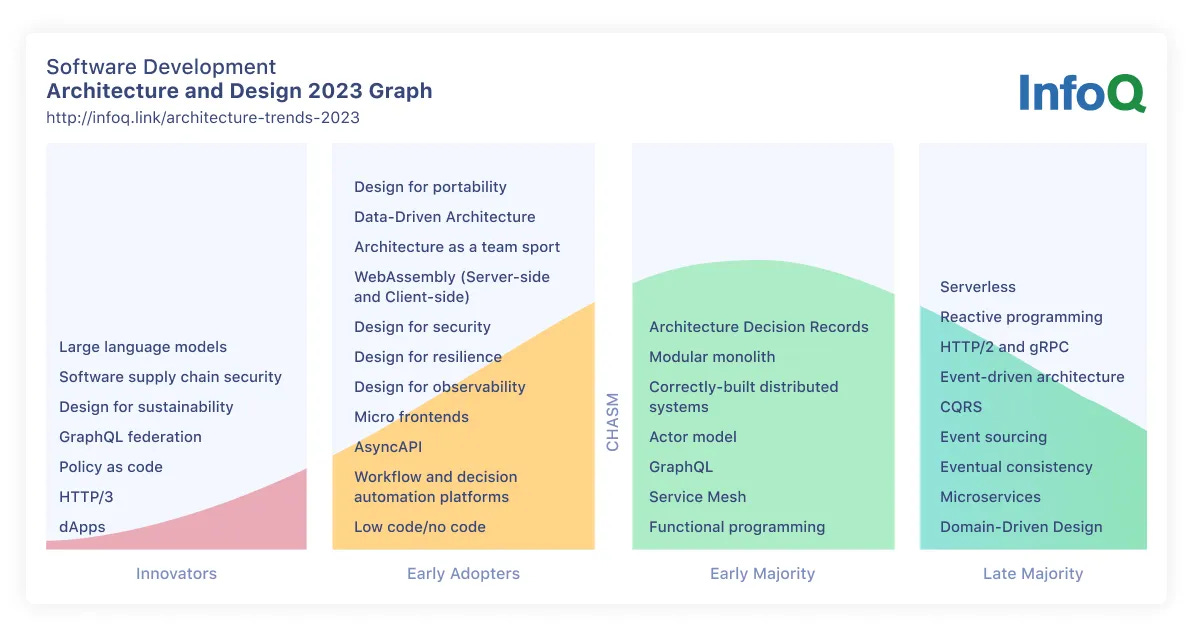

Three new items were added to the graph this year. Large language models and software supply chain security are new innovator trends, and "architecture as a team sport" was added under early adopters.

IBM launches enterprise AI tools with familiar Watson name (TechCrunch), partners with Hugging Face

Watsonx solves this, IBM asserts, by giving customers access to the toolset, infrastructure and consulting resources they need to create their own AI models or fine-tune and adapt available AI models on their own data. Using Watsonx.ai, which IBM describes in fluffy marketing language as an “enterprise studio for AI builders,” users can also validate and deploy models as well as monitor models post-deployment, ostensibly consolidating their various workflows.

But wait, you might say, don’t rivals like Google, Amazon and Microsoft already provide this or something fairly close to it? The short answer is yes. Amazon’s comparable product is SageMaker Studio, while Google’s is Vertex AI. On the Azure side, there’s Azure AI Platform.

IBM makes the case, however, that Watsonx is the only AI tooling platform in the market that provides a range of pretrained, developed-for-the-enterprise models and “cost-effective infrastructure.”

Great post from Francesca Krihely of DevFirst (former MongoDB/Snyk) lays out a framework for DevRel and content marketing called the Content Galaxy

The Sun: The large content that sets the stage for all the subsequent recycled content. For DevRel organizations, this is often a sample app you create to demonstrate a problem or showcase a new solution.

Planets: These are content pieces created out of your original Sun. A tutorial based on the sample app is an example of a planet! You can and should have multiple planets as part of a Content Galaxy

Moons and Stars: These are short-form content pieces that you can simply and easily create once you have a Sun in place! For example, Twitter threads, TikToks, and Emails.

Who’s going to win when it comes to enterprise AI deployment - secure, safely, accurately at scale - Palantir makes a case - here’s what Alex Karp had to say in Q1 Earnings call:

The issue of how do you have security, a data model or knowledge and wisdom that's proprietary, interact with an external large language model or with generative AI is not new to Palantir, and that's why we're able to launch our platform AIP so quickly, the demand for of which is nothing I've ever seen in 20 years of being involved in Palantir.

And the reason the demand is high is people suspect that this will -- if you wheel these technologies correctly, safely and securely, meaning extract the value in the context of your own enterprise, whether that's sensitive or nonsensitive or regulated or moderately regulated, you have a weapon that will allow you to win, that will scare your competitors and your adversaries. And we are in a unique position to supply that platform, and we have the resources, both because of our profitability, our $2.9 billion in the bank, our lack of debt, and quite frankly, our entrepreneurial founder-led spirit at this company.

Markets

Putting AI and public markets in historical context with metaverse, blockchain, etc. (Bloomberg)

Great stuff as always, Ed! Just a heads up the InfoQ "whats trending in software development" link appeared to be bad.

I think you were going for this one -> https://www.infoq.com/articles/architecture-trends-2023/.