What's 🔥 in Enterprise IT/VC #347

A new wave of dev tools startups built on first principle thinking

I have to admit, that things were slow on my end for a couple of quarters in terms of making new investments. It’s not for lack of trying as our deal flow remained the same or higher the last 6 months versus the same period the last couple of years. That being said, as we primarily focus on enterprise infrastructure, developer tools, cybersecurity…there has simply been way too much 💰 chasing incremental ideas or features. I do worry about this in AI infra as well as the amount of 💰 pouring into companies in a fast evolving stack means many founders will get vaporized.

That being said, the last month has been 🔥 for us. Not sure what’s in the water, but we are seeing so many experienced founders coming back with big and bold ideas to reinvent how things work from code to cloud. I’m not talking another plugin to an IDE but fundamental changes around how developers code, deploy, monitor and secure their applications. More on 🧵 below…

If you believe in creative destruction, then it’s time. I remember when we led the initial round of Snyk at company formation in October of 2015, that the only relevant public developer infra co at the time was New Relic and as you see in our memo “Snyk is creating the New Relic for Security (market cap $1.9B)”.

Now we have Hashicorp, Gitlab, Datadog and many other companies which are >10 years old with market caps 5-15x New Relic in 2015 and up for reinvention.

We’re seeing a number of founders come back with a first principles approach similar to how Guy questioned current wisdom on how things are done today vs. how things can be more efficient tomorrow.

As of the last few months, you have companies like Poolside (from Jason Warner, ex-CTO Github), System Initiative (reinventing DevOps from one of pioneers, Adam Jacob), Render which just raised $50M to go after AWS in a more focused manner (see below for pitch deck), and Warp which is reinventing the CLI 🤯!

If a founder is 🤪 enough to do this, one 🔑 challenge of going after incumbents is the bar to product MVP is much higher than new category creation. First, as a founder, you need to have a unique insight with a technical underpinning that is the reason for disrupting the existing solutions. But, in order to get any one to swap out an existing tried and true tool they use but don’t love, you still have to get at least 80% feature parity to existing solutions in order for developers to take the leap of faith to try your 10x product. That takes time, effort, and money.

From a go-to-market perspective, you also have to hone your Ideal Customer Profile (ICP) and organization to determine your key entry or insertion point. Do you start with one specific feature to 10x a developer’s time or do you start with something bigger off the bat? My strong suggestion is that whatever you do, make sure the user and buyer does not have to do a forklift upgrade of an existing product in order to try yours.

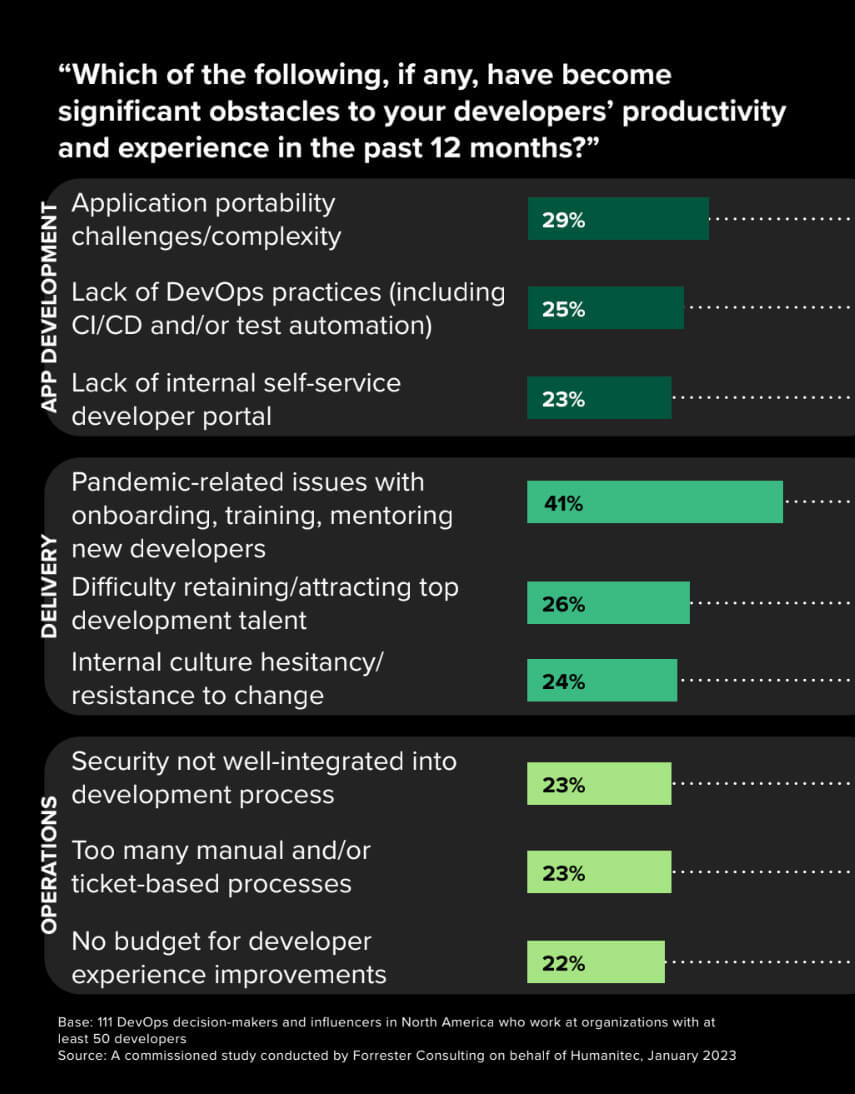

In terms of opportunity, despite all of the dev tools that exist, a recent survey from Forrester (via The New Stack) shows there is still a gap around developer productivity and experience.

To that end, we are stoked to have invested in 2 big swings as of late and have a few more insane founders ready to go.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

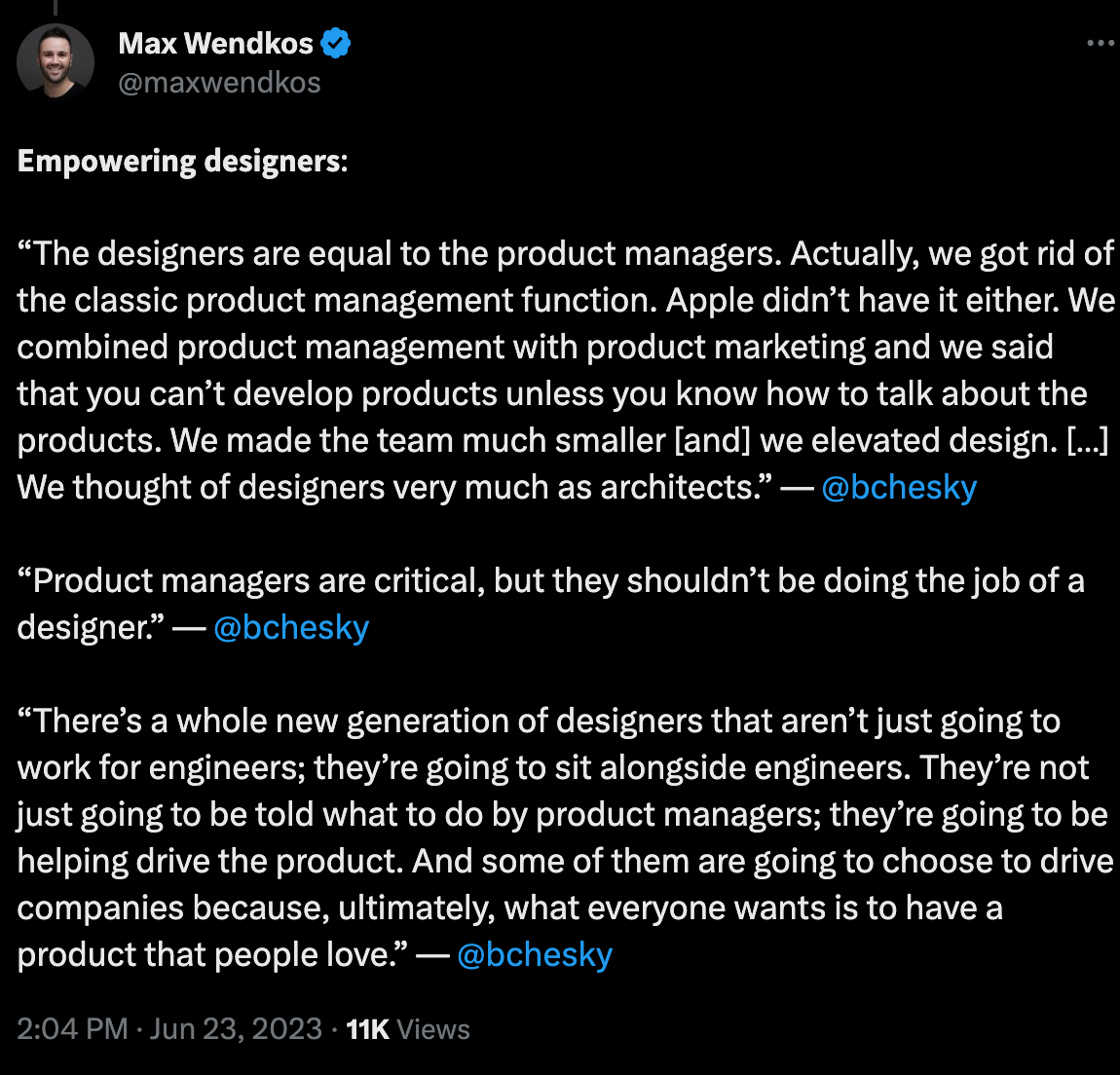

One of 🔥 discussions in tech this week was around Brian Chesky’s comments on AirBnB getting rid of product managers - there is, of course, more nuance than that - read the 🧵 to get full context

Repair tips for leaky conversion funnels from Anna Debenham, boldstart operating partner + Employee #4 at Snyk - Anna shares her experience from Snyk and working with several fast growing boldstart dev tools cos

Love this…so many reasons why it can’t work but need to think about why it can - sometimes need to just keep building…

Enterprise Tech

CB Insights AI 100 - the breadth of companies in industries is a great reminder that AI is an enabling technology. Congrats to Protect AI (a portfolio co) in the AI Security section.

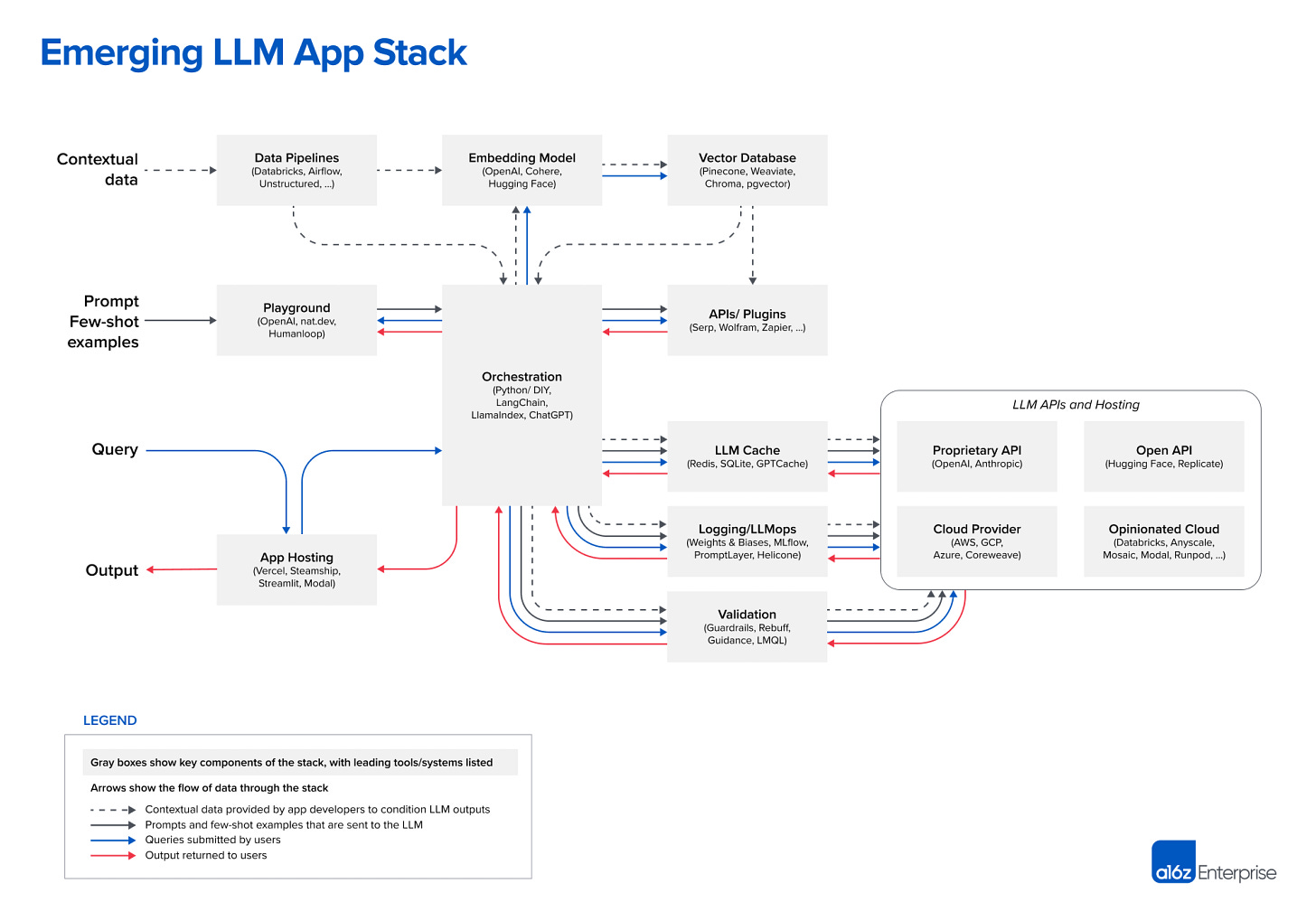

Emerging LLM Stacks by a16z, reference architecture for emerging LLM stack + market map

Decoding PLG from Michael Yamnitksy (Insight) + Evan Peters - lessons learned from helping scale Datadog. Well laid out and agree. You also know my position, PLG is a continuum and very few cos have swipe a credit card and eventually all roads lead to steak 🥩 dinners and enterprise sales.

While we aren’t particularly fond of the term “PLG,” we see it as a new operating model for modern software companies – one that intentionally aligns product development and revenue growth in ways that previous generations of software businesses did not. Today, product features don’t just satisfy customer requests; they create new usage patterns that revenue teams can leverage. Sales teams don’t prospect in a silo, they are tactically fed usage signals directly from the product. If DevOps is the cross-functional fusion of development and operations, PLG is the cross-functional fusion of product and revenue…

More on our perspectives from our bold.camp earlier this year: Demystifying PLG

Pitch memo for Mistral’s $105M Euro seed round with no product (PDF here)

Pitch deck for cloud provider Render to build a better cloud infrastructure as it raised a $50M Series B from Bessemer (Insider)

Interesting paper from Google on how it trains large machine learning models for software development, not just code…

Zscaler going all in on AI for future of zero trust security (VentureBeat) - on heels of Microsoft Security Copilot, Palo Alto Networks, Crowdstrike and now Zscaler highlighting AI in product portfolio for Wall Street

Security AutoPilot with breach prediction: Using AI engines to learn from cloud-based policies and logs to secure data continuously, Security Autopilot is designed to simplify security operations. It prevents breaches by recommending policies and performing impact analyses. Zscaler’s ThreatLabz is testing it. Another design goal is to train LLMs with billions of Zscaler logs to predict breaches before they happen.

“Consumption Pricing Models Are Here to Stay” and how early stage startups can leverage them by Dharmesh Thakker Battery Ventures

AI and finance - finally read this one from a couple of weeks ago but broad coverage of how banks are experimenting with a variety of use cases (Bloomberg)

“Every business, trading desk and investment group tries to understand it deeply,” Yuriy Nevmyvaka, head of Morgan Stanley’s machine learning research group, said in an interview. “It’s in a safe and contained environment and it’s all within our walls.”

Markets

Median Net $ Retention declining and so is best in class

also see my post from February covering this topic on Net $ Retention

“Europe has fallen behind America and the gap is growing - From technology to energy to capital markets and universities, the EU cannot compete with the US” (FT)

In 2008, the EU and the US economies were roughly the same size. But since the global financial crisis, their economic fortunes have dramatically diverged. As Jeremy Shapiro and Jana Puglierin of the European Council on Foreign Relations point out: “In 2008 the EU’s economy was somewhat larger than America’s: $16.2tn versus $14.7tn. By 2022, the US economy had grown to $25tn, whereas the EU and the UK together had only reached $19.8tn. America’s economy is now nearly one-third bigger. It is more than 50 per cent larger than the EU without the UK.” The aggregate figures are shocking. Underpinning them is a picture of a Europe that has fallen behind — sector by sector.

The European technology landscape is dominated by US firms such as Amazon, Microsoft and Apple

so glad headcount and $ raised as a sign of success is a thing of the past