What’s 🔥 in Enterprise IT/VC #486

Ten Companies Beat a Decade of Exits: LP AGM Notes

Just wrapped 48 intense hours with LPs and GPs at the StepStone annual meeting. 600+ investors in one room comparing notes on what just happened and what comes next.

Same themes as last year, but dialed to 11.

The power law is accelerating. Capital is concentrating into a tiny set of companies. The mood in the room was equal parts euphoria and quiet panic. AI excitement is real. Liquidity anxiety is real. LPs are rotating toward deep tech and Physical AI. The gap between AI-native winners and legacy software is widening fast. If your product can be reduced to an AI skill, the market assumes you are replaceable.

Feels like 1999 optimism with 2009 liquidity.

So let’s dive in.

The Great Software Reset

As I’ve written before,

the brutal truth: if your startup can be reduced to a skill or plugin, you’re not long for this world. Pure software plays are getting decimated. LPs seemed to be much more interested in “more deep tech, less software” unless you’re building something truly special.

ZIRP era SaaS unicorns 🦄 continue to get crushed:

Companies without AI tailwinds: 14% revenue growth, 3.1x EV/NTM multiple, 1.0x return since IPO

Companies with AI tailwinds: 27% revenue growth, 9.8x multiple, 8.6x return since IPO

That is not a gap. That is a chasm.

The survivors? AI-native, not bolt-on. Companies that infused agents into their 1,000-person culture, not as a side project. This requires founder-led transformation, not a VP of AI initiative. We all should be rooting for founders like Howie from AirTable - it requires this kind of founder led, product led transformation to give your Zirpacorn a real shot.

While at the same time, the market is so panicked over any release from a foundational model provider, that it can take down a whole sector - case in point from yesterday.

The problem is there is no discernment of what should and shouldn’t get crushed - the fear is just so high that every single Claude release is spooking public investors. IMO, some cybersecurity software cos will get wiped out, but the Crowdstrikes and others with deep infra, data, and enterprise hand holding will emerge stronger.

Space, Defense, and Hard Problems

All of the above is why many conversations the last 48 hours circled back to deep tech:

• Space and defense are now core LP discussions

• Physical AI, robotics, and compute are strategic priorities

• Infrastructure for the Autonomous Enterprise is where real value accrues

If you are investing only in thin software layers, you are swimming upstream.

The Returns Picture Is Brutal (and Beautiful) - dispersion between great and OK widening…fast

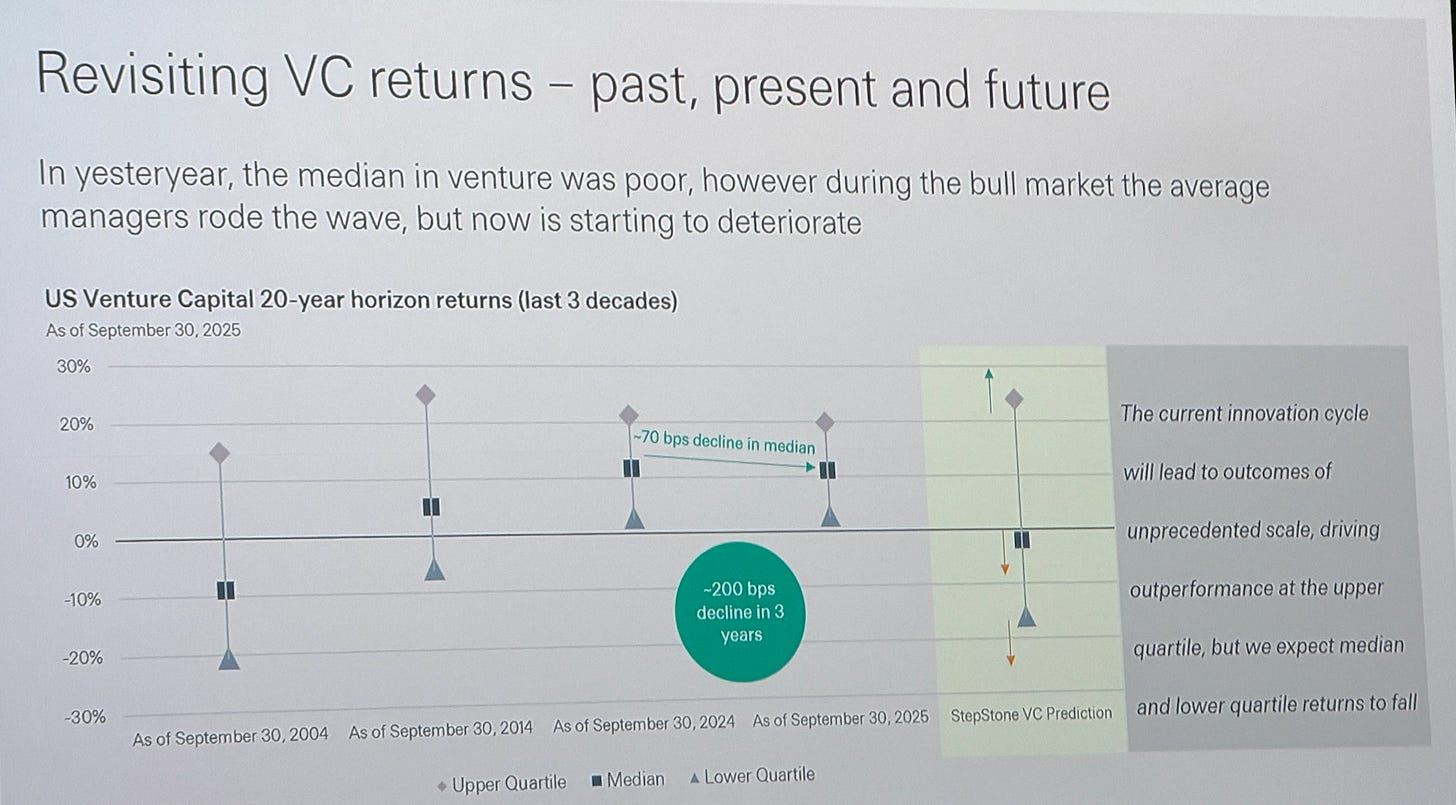

The 20-year return data tells the story. Median VC returns are drifting down, while the upper quartile will be extraordinary. Translation: most managers will struggle to return capital. A small group will generate generational outcomes.

Insane Concentration

22% of all deal value is concentrated in foundation models

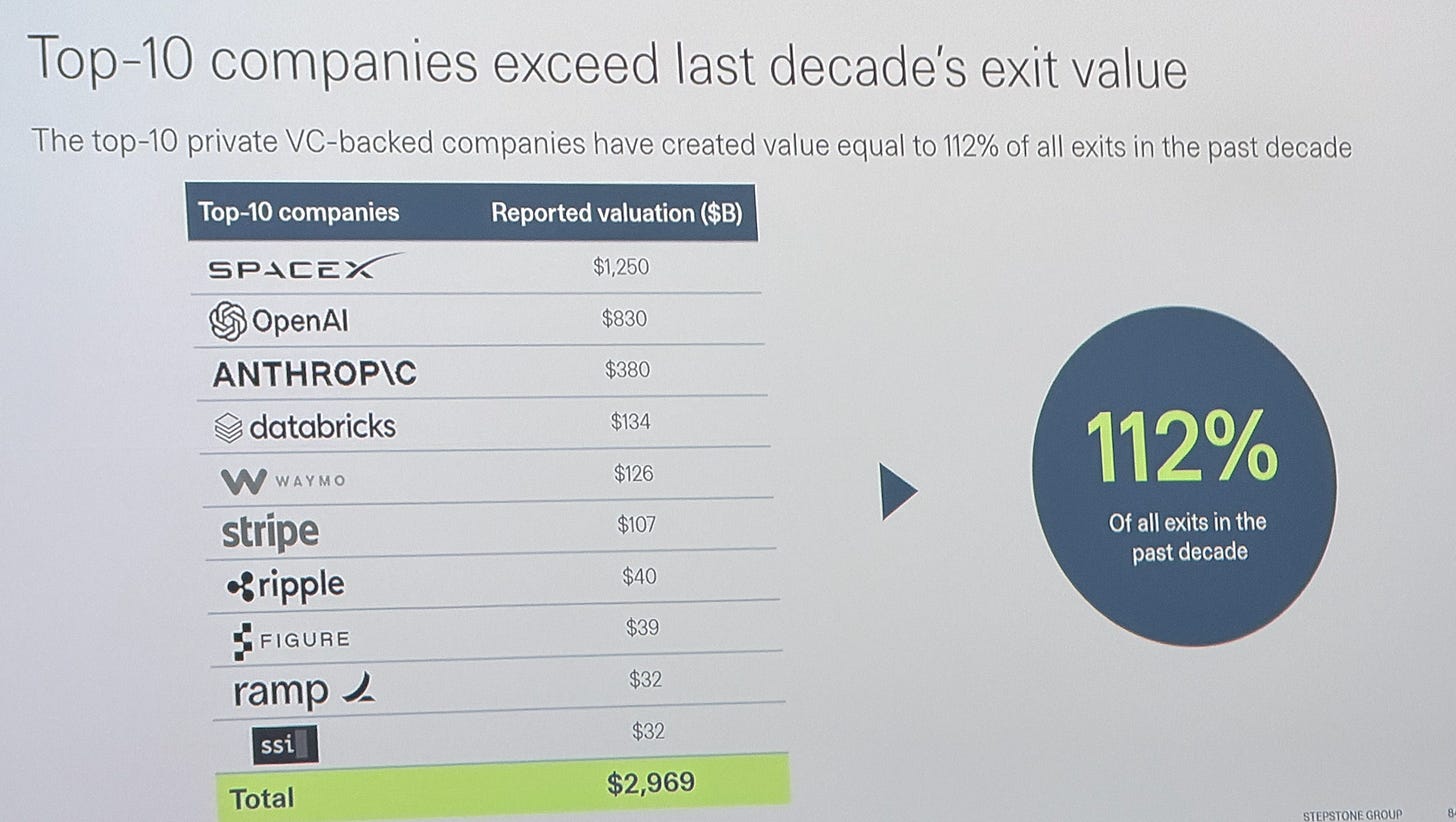

The top 10 private VC-backed companies have created value equal to 112% of all exits in the past decade. More than the entire decade of exits. Let that sink in

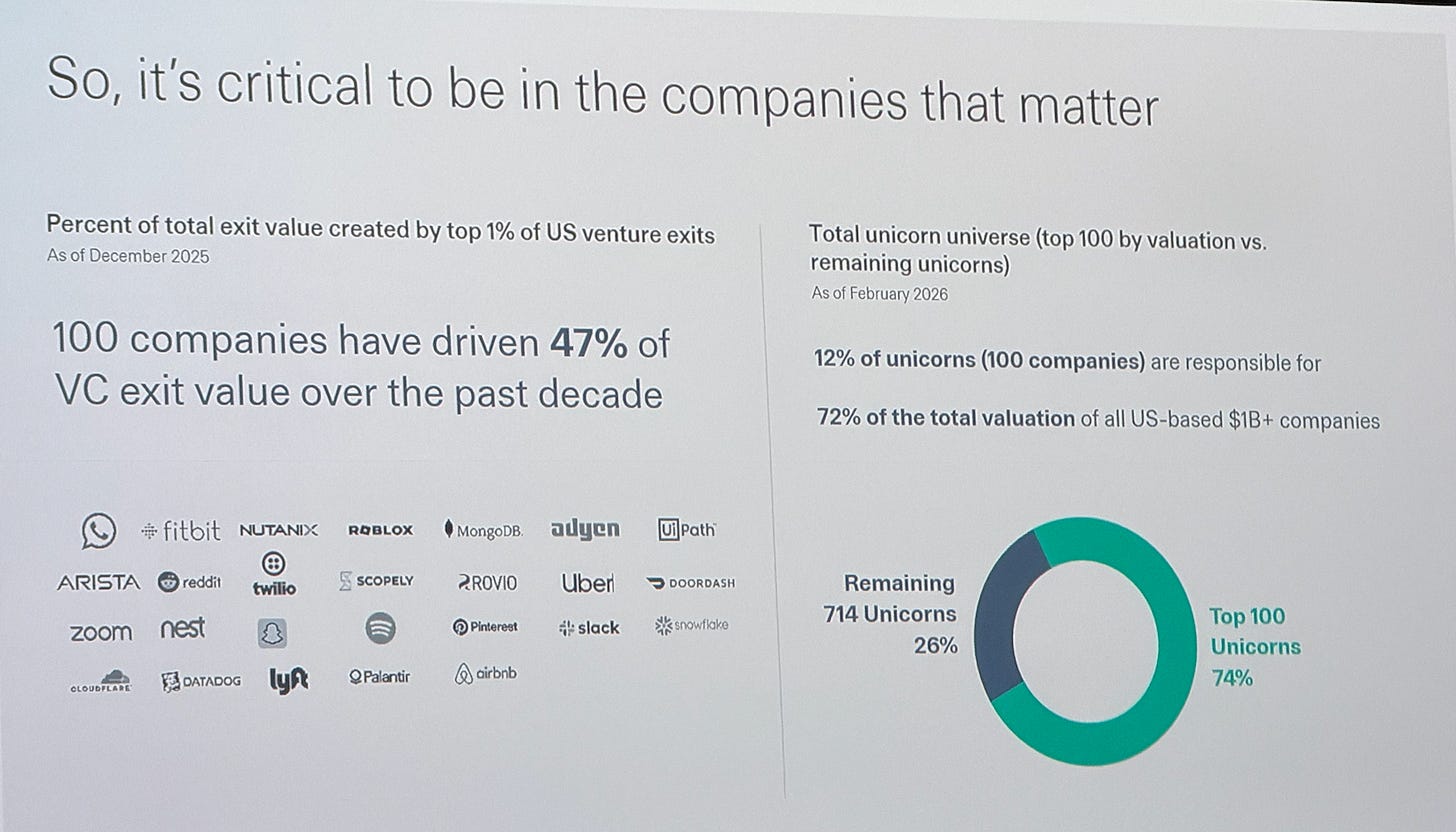

100 companies have driven 47% of all VC exit value over the past decade. 12% of unicorns (just 100 companies) represent 72% of total valuation of all US-based $1B+ companies

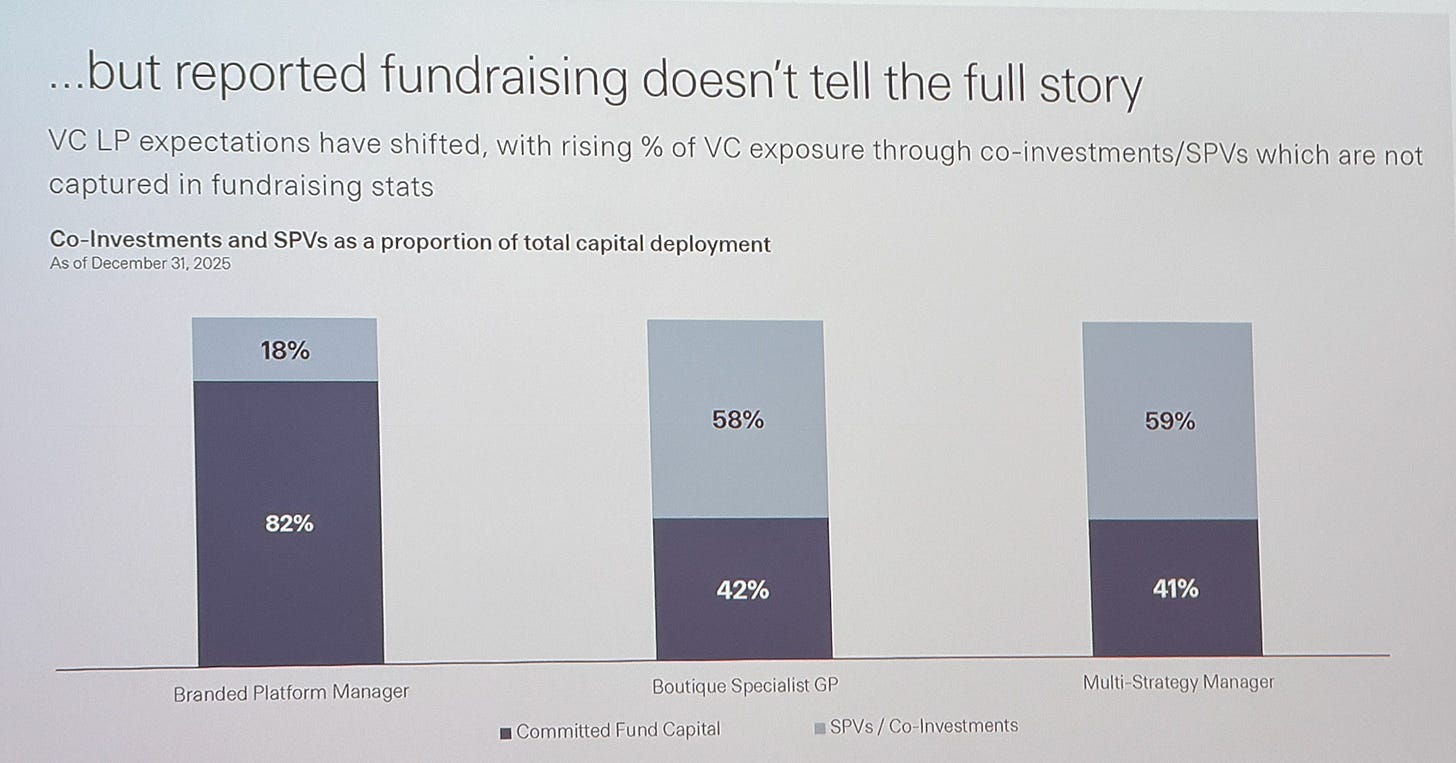

Concentration in the Top 10 is higher than any one really knows as 59% of all dollars invested by the large platform VCs are through SPVs and co-invests

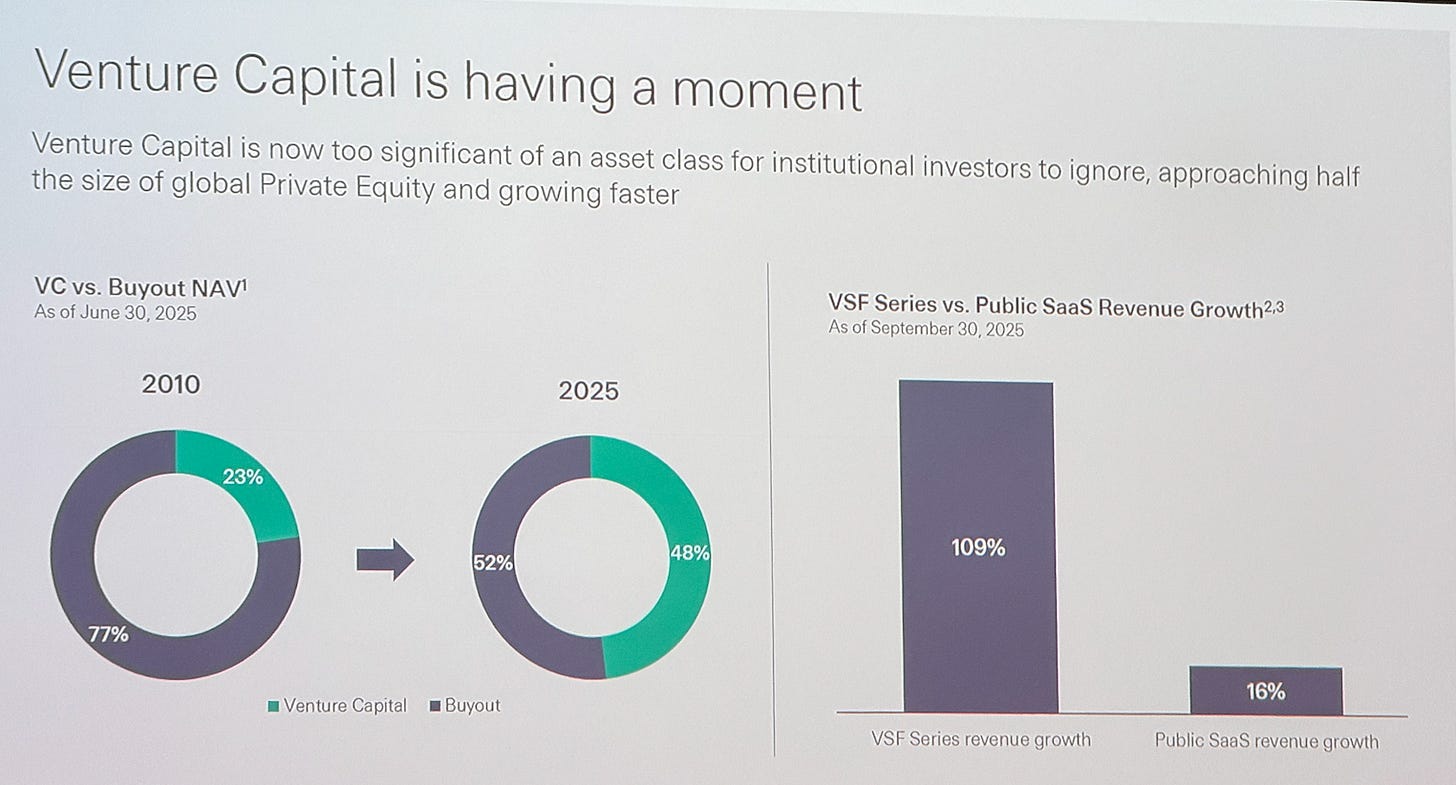

The VC NAV Explosion

VC NAV has gone from 23% of combined VC + Buyout NAV in 2010 to roughly 48% in 2025. Nearly equal. Even with more exits, NAV keeps growing because late-stage exposure is one of the only ways to access massive growth. Growth at this scale simply is not available in public markets.

Massive step change in AI functionality in just last two months = insane economic dislocation coming

The Industrial Revolution played out over 100 years

This AI shift is at 10x the speed, 10x the size, 10x the labor impact

We will experience economic dislocation at a pace nobody’s prepared for

We are only getting more consensus-driven

Capital is concentrating in the same companies and the same firms:

Everyone is chasing the same founder archetype, the same logos, the same pedigree

If everyone’s in the same names, what actually separates winners from losers isn’t getting in. It’s how and when you get out?

By Series F, rounds are so massive that growth funds are becoming indistinguishable from each other

The Existential Question

Do you have exposure to the top 10 companies of tomorrow?

Do you have exposure to the top 100 companies of tomorrow of which some will become the top 10?

Can your fund managers find them and own meaningful stakes?

If you can’t find the next big one, but you still find some amazing founders early, your returns depend entirely on fund size and ownership at exit

And you’d better show you can still crush it through concentrated ownership even if your companies aren’t in that top 100

For us at boldstart, this reinforces partnering at Inception. If ten companies drive venture returns, you need to be there before the deck exists and own enough in technical founders building infrastructure-level moats, not products that can be replaced by the next plugin. Agent-native infrastructure, security, and Physical AI powering the Autonomous Enterprise. That is where durable value will compound.

Bottom line: The size of the prize has never been bigger. Speed has never been faster. Concentration has never been more extreme. And it’s an amazing time to be a venture investor and founder because if you can reach escape velocity, the opportunity and timeframe to build massive businesses are better than ever.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#agree or disagree? lots of opinions…

#we all need one of these - read author Ryan Holiday’s essay “This Simple Skill Will Put You Ahead In The Era Of AI” 👇🏻

#keep writing

#wow, Palantir coming - can’t wait to fund all those future founders!

#not so fast…

Enterprise Tech

#super enjoyed my chat with McKinsey Partner and CTO James Kaplan - here’s a clip on the “autonomous enterprise” as aspiration but the importance of rewiring all of the infra to get there and why the world is just one markdown or .md file aka skills as an atomic unit of work for the future…much of the narrative above from the LP meeting is summed up here

full 40 minute interview here…

#as I discussed above, delivering robust secure agentic technologies in the enterprise requires a lot of last mile work! (from the Chief Architect Palantir)

#OpenClaw is now part of OpenAI - fits hand in glove, esp. as OpenAI has some catching up to do

#if agents are writing 100% of the code for Anthropic, then why do they need engineers? from the guy who created claude code

#If agentic development is the future, then skills are the atomic unit.

But how do you move from experimental to production-grade agents?

You need Tessl, the dev-grade package manager for skills. It’s your registry for evaluated skills + platform to manage their full lifecycle. 🔥 up for this launch (a boldstart port co)

#how Stripe built one-shot, end-to-end coding agents - the gap between those people and orgs who are going all in on agents and those who aren’t is getting wider and wider every day and the shipping velocity is accelerating

#yes this is true 👀

and further confirmed from my trip to SF the week before 👀

#more Claude Code and Codex on laptops and machines which is why Palo Alto Networks paid $400M for it right after its $38M A round (CTech)

#just the beginning of agents and AI eating labor?

#partly the problem…

#open source still creating amazing AI software

#and agents just updating and improving themselves…do we need infra and monitoring software in the future??? this is in reference to an article titled “Your OpenClaw is useless without a Mission Control. Here’s how to set it up”

Markets

#Ray Dalio long article revisiting his frameworks and economic cycles in context of today’s world - declaring the post-1945 world order’s collapse, placing global powers in Stage 6 of the Big Cycle which is characterized by rule-free disorder, escalating conflicts from trade wars to potential military clashes. One conclusion - sell debt and buy gold to counter war-driven money printing

#👀 job dislocation sadly will happen faster than any of us imagine