What’s 🔥 in Enterprise IT/VC #472

Time between VC rounds 📈 + mastering the art of the pause when pitching...

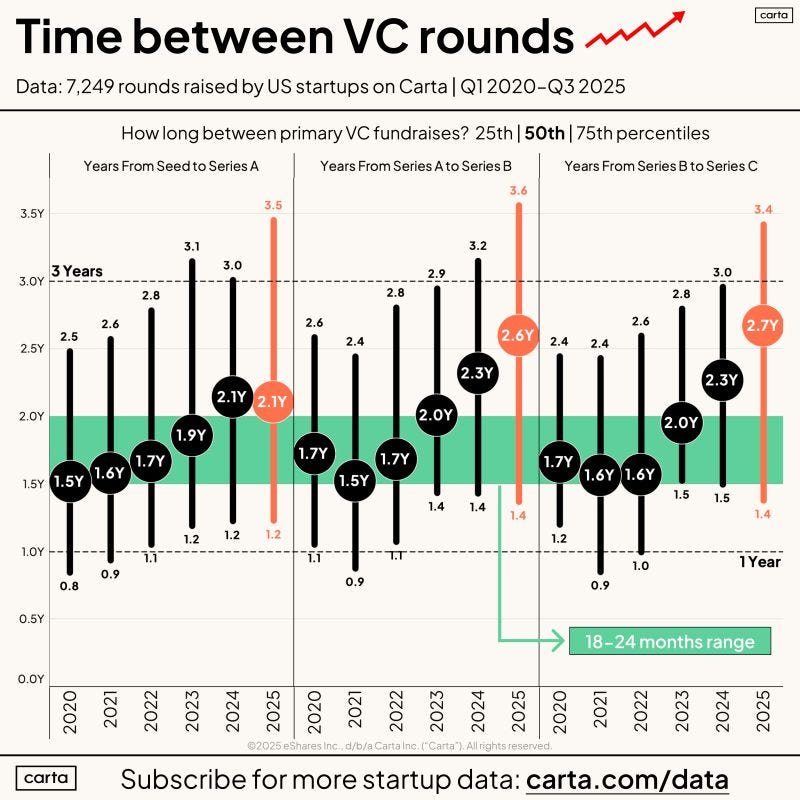

You all read the headlines, preemptive round after preemptive round at insane valuations for the hottest startups...but the reality is that it’s getting tougher to raise that next round. Time between funding rounds has expanded to 2+ years according to Carta’s latest data. Companies are extending runway with bigger raises and leaner operations, but it’s also a function of overfunding - too many startups chasing too few Series A checks.

Which means your pitch better be airtight. Spent this week refining decks with founders going from Inception to Series A. Same pattern every time: too many slides, not enough silence.

Less is more when it comes to decks and pitch meetings.

I had the same problem when I first started pitching our fund. I was so excited to tell our story, it was hard to remove slides. But when you zoom out and ask what’s the most important point you’re trying to get across, you’ll make dramatic improvement. Masterful decks are short, to the point, about 12 slides and always leave the investor asking the next question.

Beyond the deck and story itself, the most underrated skill in pitching is the pause.

The best founders know when to stop talking and let a point breathe. That tiny bit of space is often where an investor actually processes the insight, the shift, the traction, the “why now.”

Most founders don’t give the room that chance. They race, cram, and fill every silence. It comes from excitement and nerves, but it backfires. Nothing lands. You end up presenting at them, not with them.

Founders who get this say what matters, clearly and confidently, then stop. They’re not in a rush or afraid of silence. And when they pause, the investor steps in. The meeting becomes a conversation, not a pitch.

That’s where the magic happens. The best pitches aren’t performances - they’re exchanges. So if you’re getting ready to pitch, practice the pause. Say your point, let it land, read the room. You’ll be surprised how quickly the dynamic shifts.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#Warren Buffet’s best advice as he writes his last investor letter

#so true - find some balance

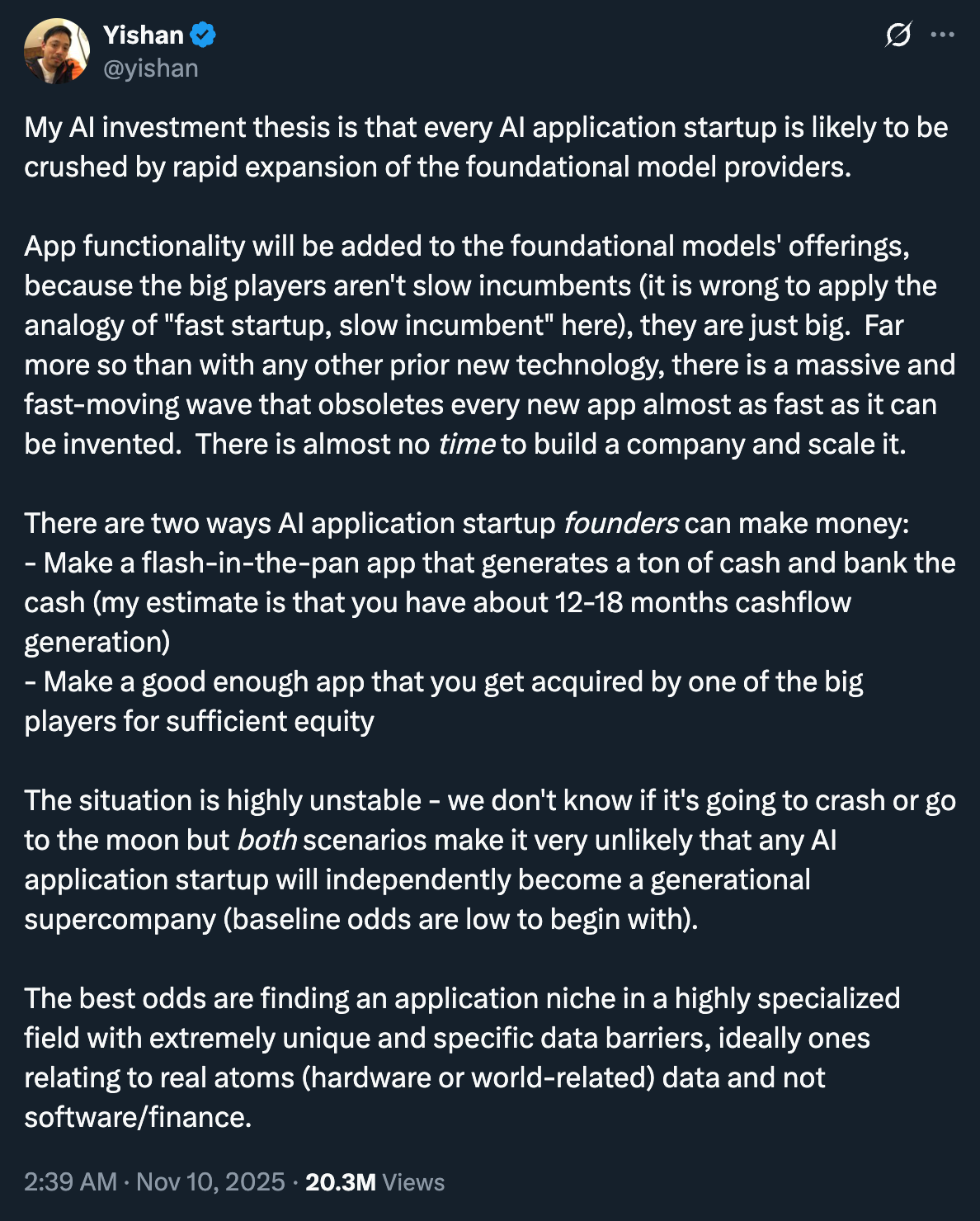

#viral debate of week - do we even care? Need to back founders who can build fast, adapt, create a data flywheel like Cursor! If successful that fuels massive fundraisings in which capital becomes a moat - if not, you die, as the capital that the largest foundational models already have allows them to do lots of things to outlast you.

#the guys from TBPN not just reporting and FWIW, not my cup of tea this rage bait stuff but for others, they love the attention - worth a read and comments are great

#good reminder for founders all in on AI and agents - your customers don’ care, what’s the value proposition, how you are making their lives 10x + better with your product than without - great comments in 🧵 including from founder of Notion

#not surprising and if you raise institutional capital, always be out there Jan 1 as most of all allocation going into next year is reserved for existing funds heading into the new year, so the earlier you raise in calendar year, the better off you are and yes, time diversifcation matters

Enterprise Tech

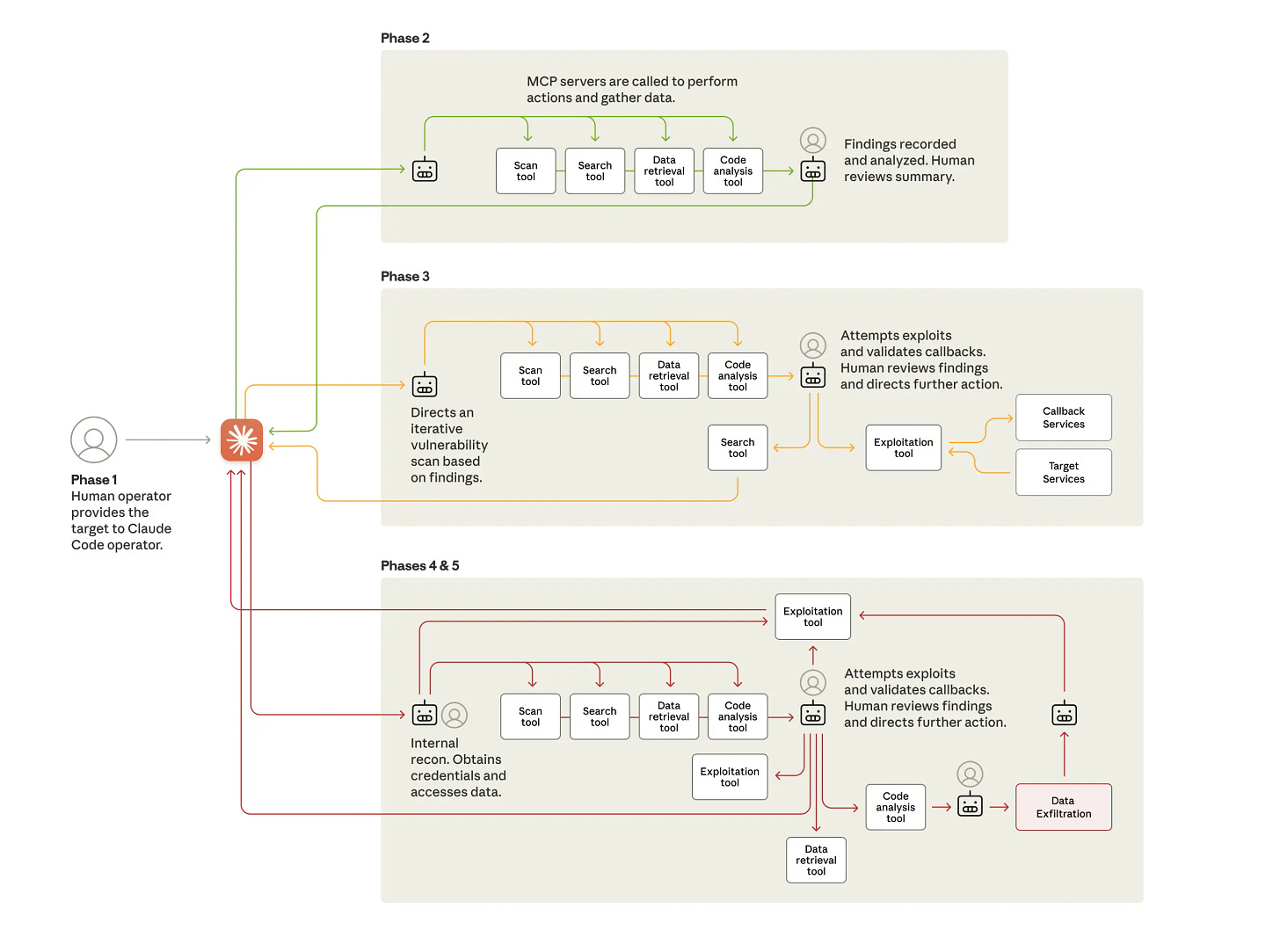

#the autonomous cyberhacker is here and THIS IS A HUGE DEAL - we all know hackers have been jailbreaking LLMs to create malicious code and do other attacks but this is the first documented attack used by Chinese hacker which is almost fully autonomous using agents! Read the report, it’s fascinating and has upped the ante for cybersecurity. Interesting part was that the hackers did a little of their own social engieering by pretending it was a legitimate cybersecurity professional and was smart enough to break up the tasks into lots of little ones to not raise alarm bells. In the long run, the only way to keep up with the volume and sophistication of these attacks is with AI-powered defense. Let the games begin.

If you want the TL:DR I used Google Notebook LLM to create a quick video overview, start around minute 2

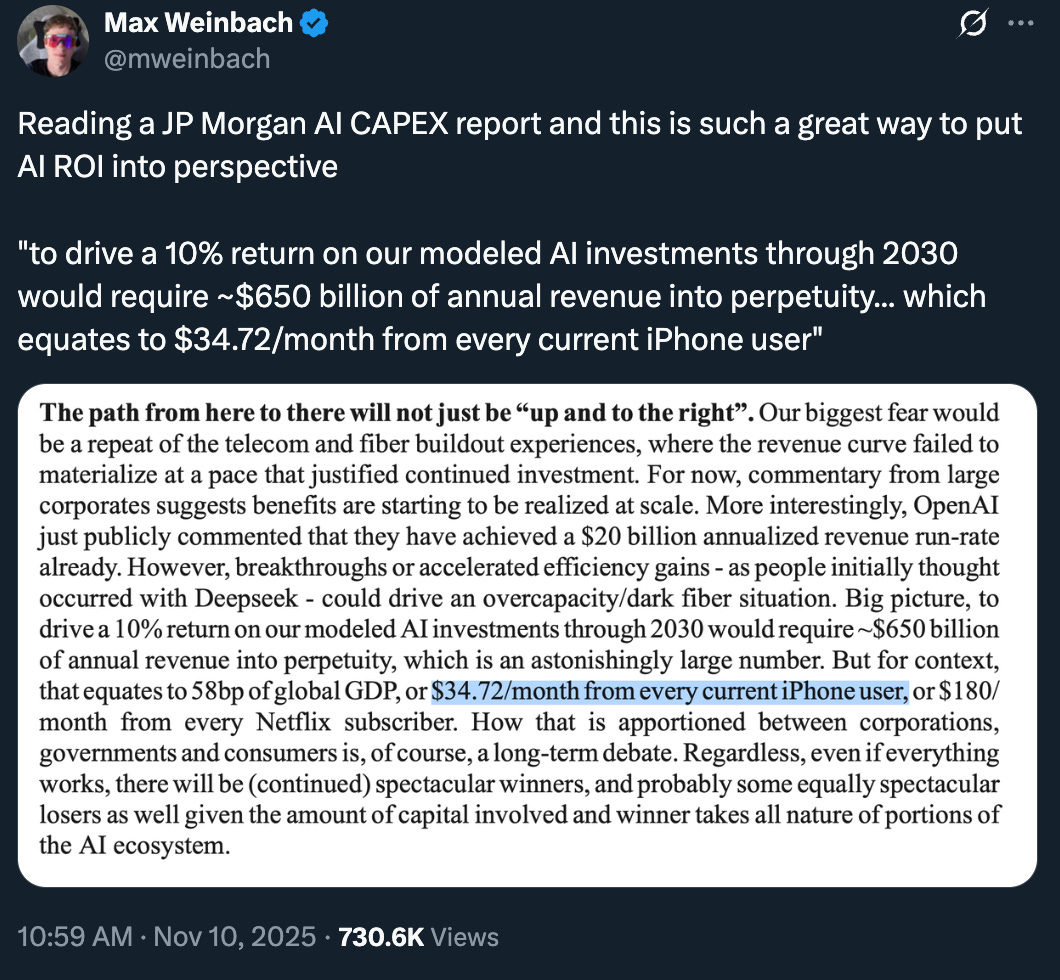

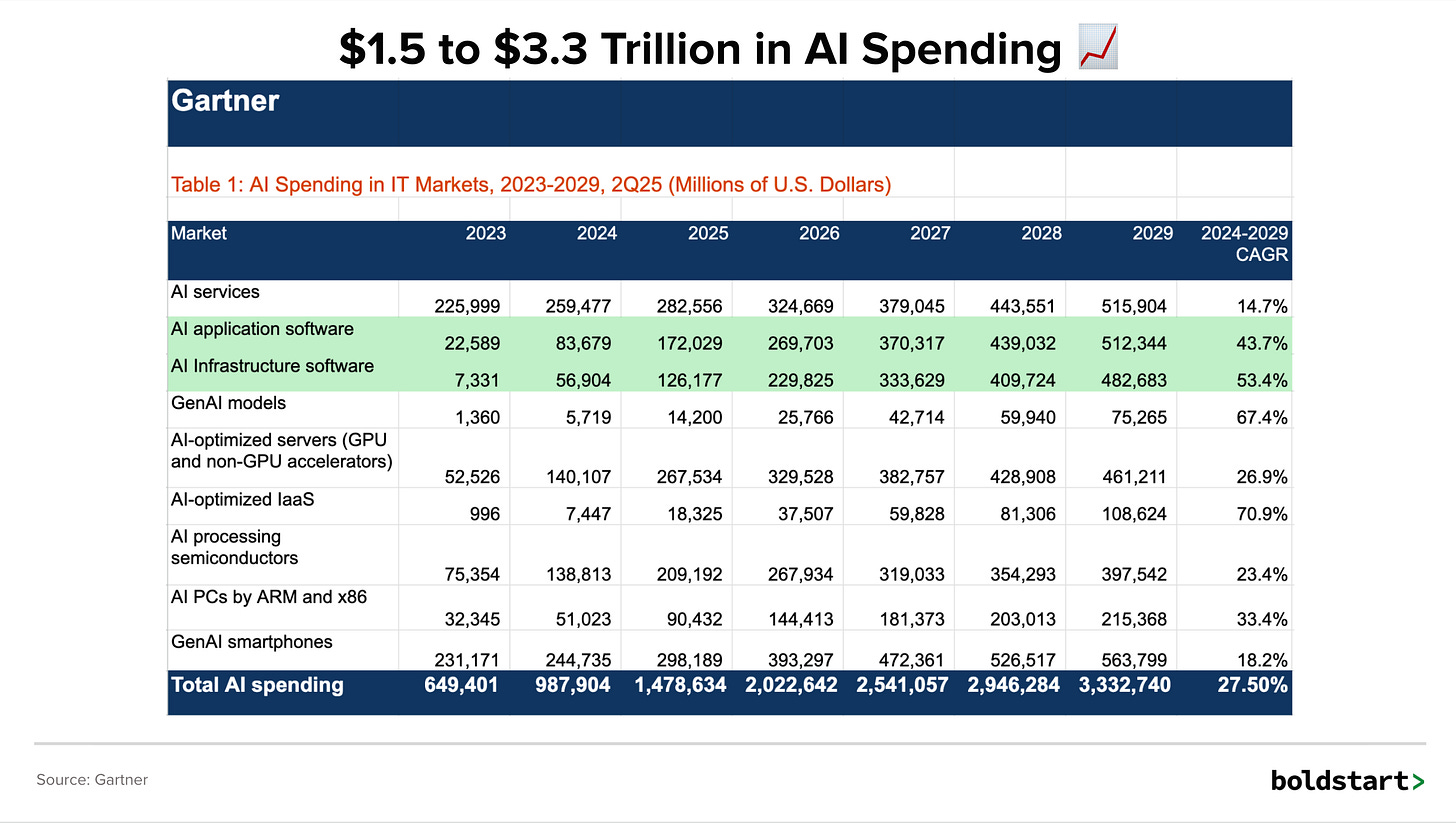

#bullish or bearish on the odds? for me, only works if agents really work and eat into labor which is trillions of dollars of opportunity - if not, we are in for a world of hurt down the line

and yes enterprises will have to pay for it - here’s the Gartner forecast I used in my AGM slides I posted last week

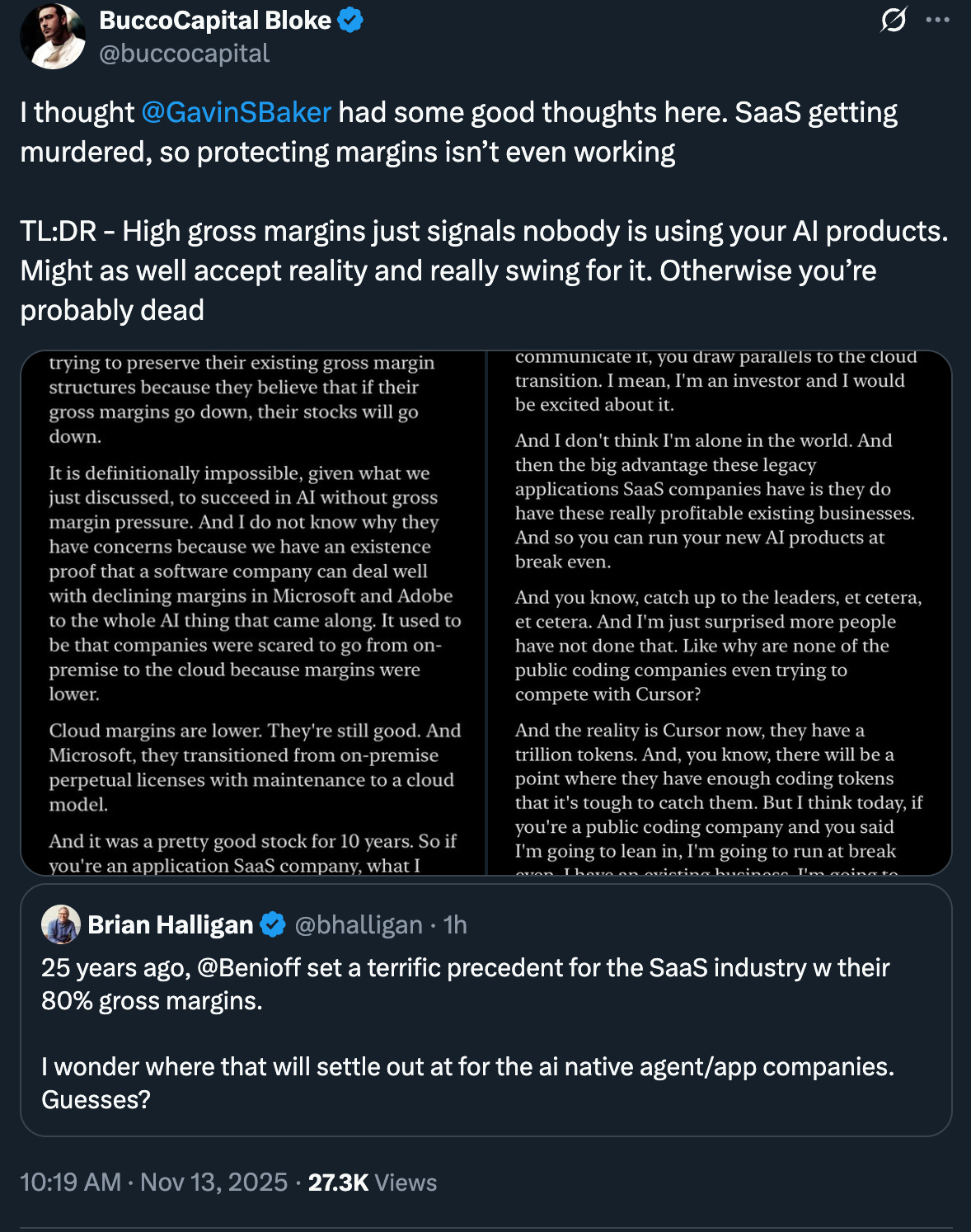

#show the usage first…

#👀 working for Cursor to point above and WOW

Cursor’s tool allows users to toggle between different AI models, from OpenAI to Anthropic to Google and more. Developers love its usability and flexibility, but the startup pays the big AI-model companies substantial fees for access to their models. The competitive pressure ratcheted up this year when OpenAI and Anthropic launched their own AI-coding tools.

In late October, the company launched its new AI model, called Composer. The model could eventually become an opportunity for the company to reduce its dependency on third-party models and keep more of its revenue, but for now the main goal is simply to continue adding more users to its product, investors said.

As the biggest AI-model builders continue to grow—in size and in product development—investors and founders are looking to Cursor to see if a startup can successfully build an independent company on top of the models from OpenAI, Anthropic and others.

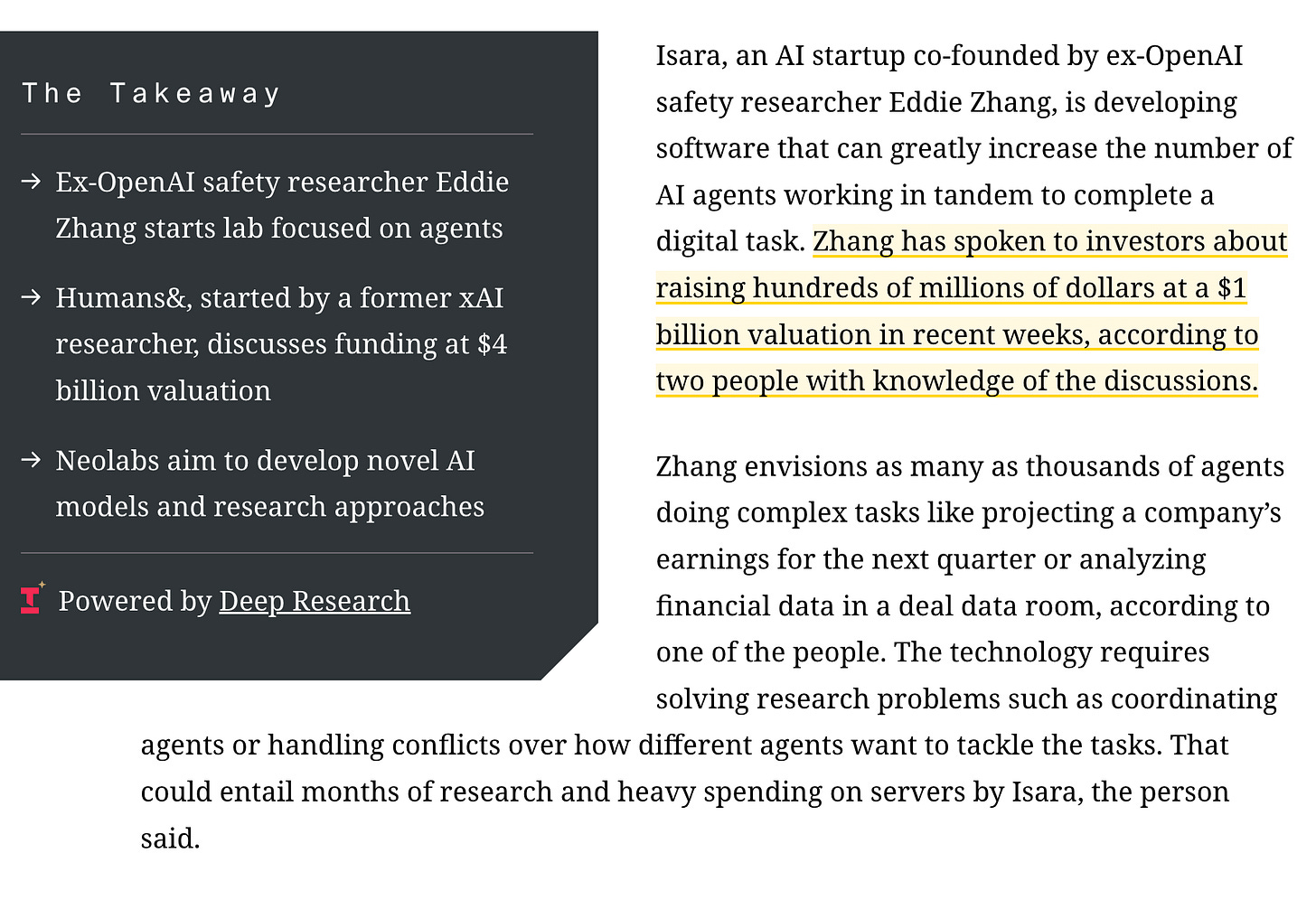

#the inception rounds just get bigger and bigger (The Information)

#it’s getting nutty out there

#💯 on my list to watch this weekend

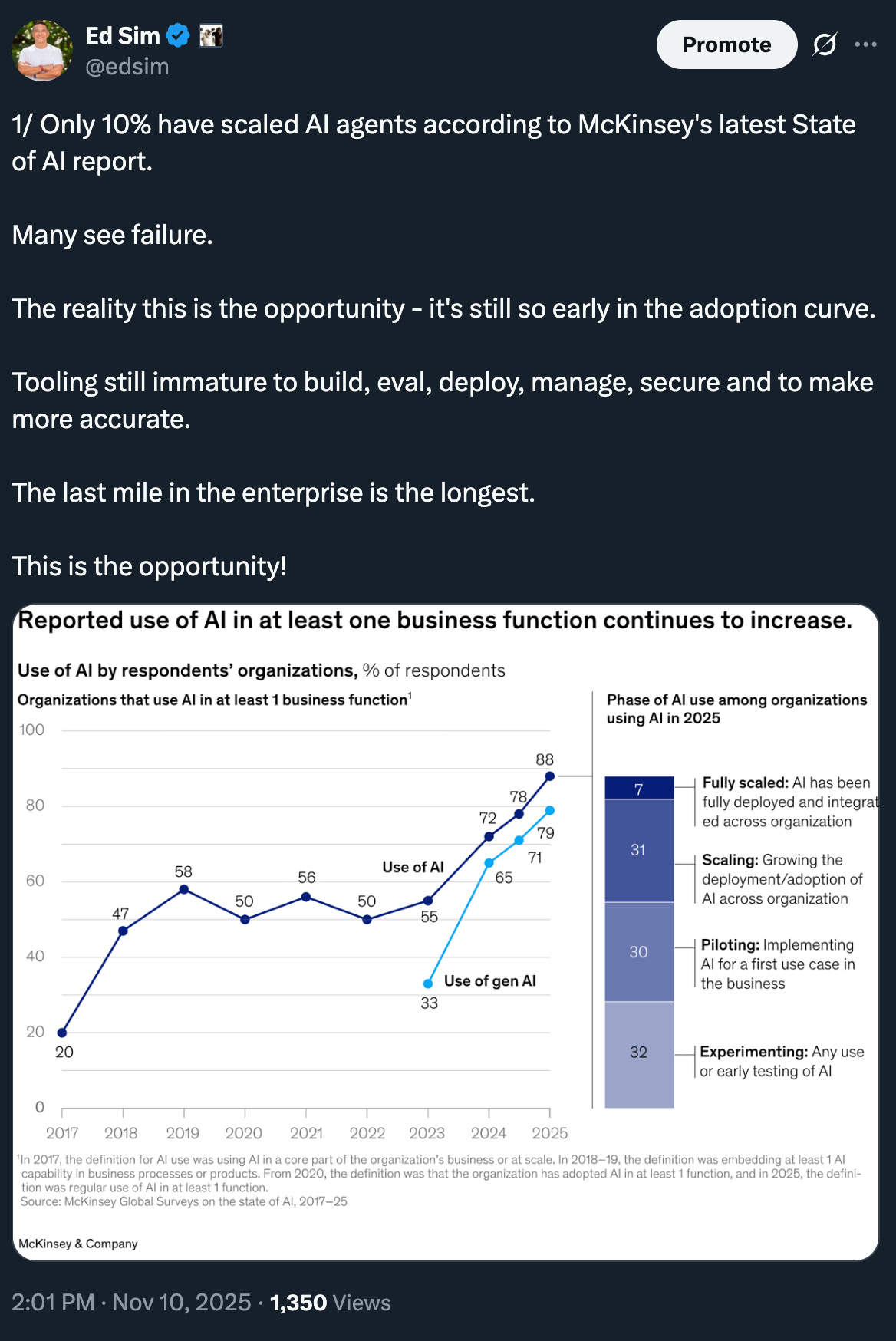

#the opportunity for agents in the enterprise, not the failure

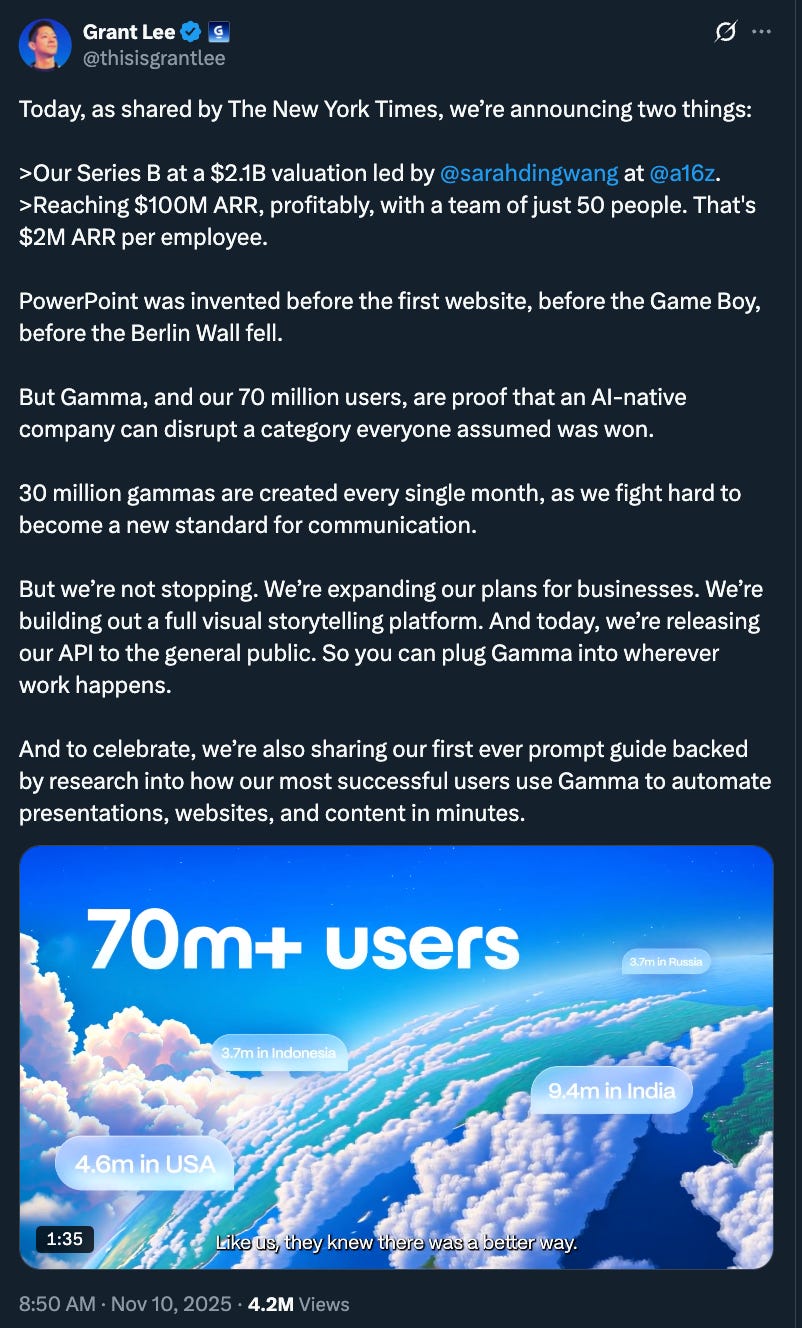

#you can’t reinvent powerpoint and build a big business 🤦🏻♂️ - wow, incredible $2M ARR per employee and $100M ARR in two years

#🙏🏻 to be partnered with long time friend and founder Rob Locascio for a second time as he launched Uare.ai, your own, personalized AI, trained on your stories, thinking and data, securely and privately for you - your own digital twin - already with dozens of initial customers!

#this is called Fred Flintstoning to PMF or doing things that don’t scale to prove the market exists 👇🏻 - also a bit creepy they listed to every call

for those too young to remember who Fred Flintstone is, here’s why the reference!

#every large AI vendor has one - Microsoft, OpenAI, Google…which is a pretty robust offering IMO

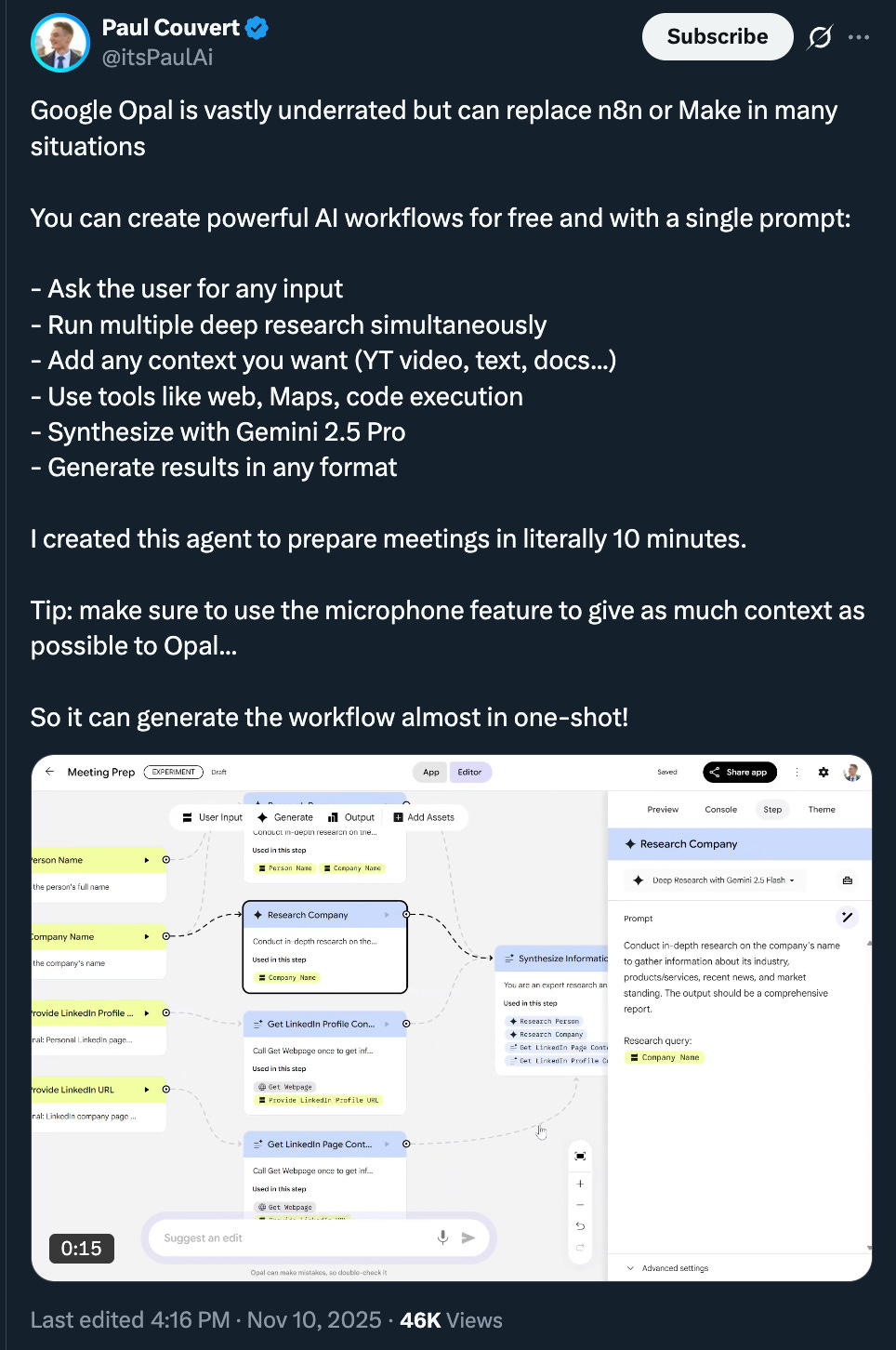

#McKinsey agent report

#there has to be a better way to stop Social Engineering Attacks - 🔥 up for this announcement from Humanix.ai, a boldstart portfolio co!

#tokenization of every asset coming…imagine all the infra needed - digital wallets, security, tools…

Markets

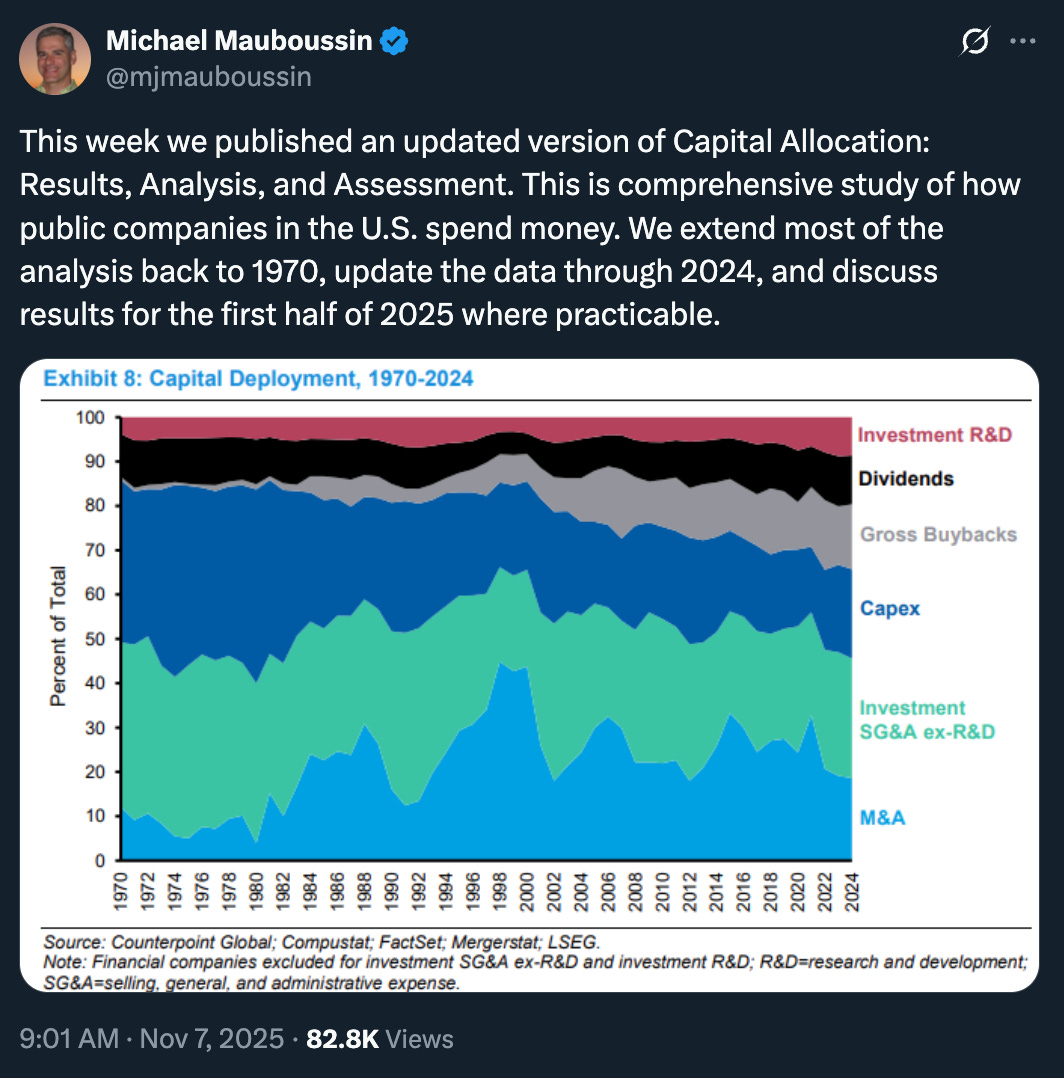

#time and money is all you have a founder, both are finite resources, how you allocate those resources on day 1 to day 10,000 determines success - Maboussin dropped a great paper on the capital allocation piece and how great companies just know what to do with its money and a guide for assessing the value created from these decisions.

Capital allocation matters because it is the CEO’s most important job: deciding where every dollar goes to create long-term value. In a world where AI is accelerating competition, the companies that can rapidly redirect resources toward their highest-return opportunities will win, while those that cling to past spending patterns or chase growth without returns will destroy value. Capital has an opportunity cost, and deploying it wisely requires discipline, valuation rigor, and the willingness to shift strategy as conditions change. This is even more critical now because AI allows companies to scale faster, iterate faster, and compound advantages faster, meaning capital allocation decisions amplify more sharply into either outsized success or rapid failure.

#AI as sustaining innovation or not? 👇🏻