What’s 🔥 in Enterprise IT/VC #471

Notes From an AGM - What’s top of mind for LPs in the AI era.

This week we hosted our Annual General Meeting (AGM), a room full of the LPs who’ve backed us throughout the years, and a few who just joined the journey. These are some of the smartest, most long-view allocators in the world, and the conversations were candid. Everyone is trying to reconcile two truths at once: AI feels both overheated and unavoidable. Capital is abundant at inception, yet competitive pressure has never been higher. Markets are shifting fast, and the definition of edge is shifting with them. Below are some of the themes, signals, and questions that came up behind closed doors, and how we’re thinking about them moving forward.

First, for your opener, bring the energy and set the tone 🤣!

AI-generated videos are great for distilling thoughts. Top of mind for many investors was whether we’re in a bubble or not, the answer in IMO is that both are simultaneously true especially in certain pockets of AI/agent related investing.

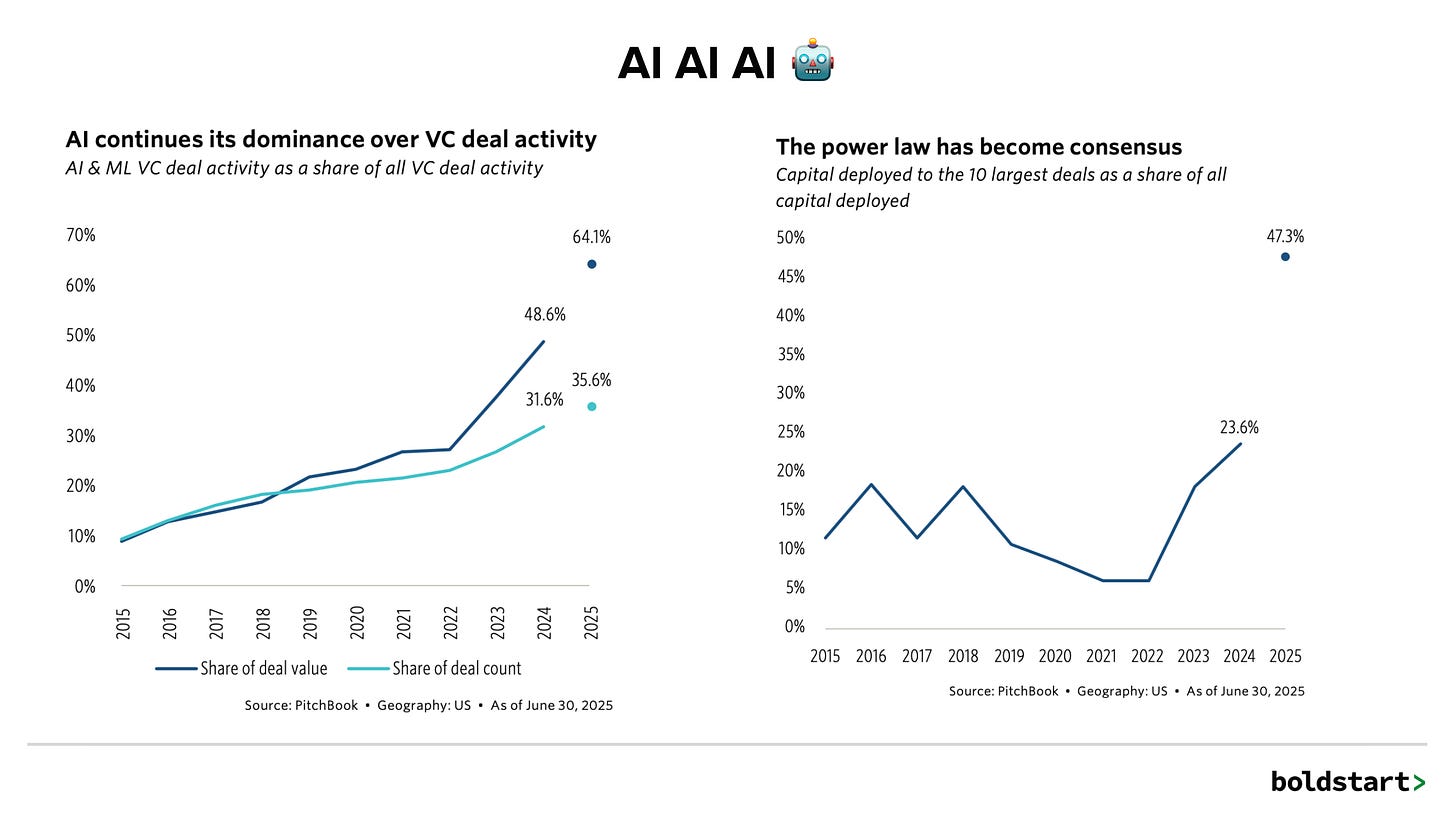

Frame your story with data. Here are a few charts that show how the market has dramatically changed for venture capital. AI, AI, AI…

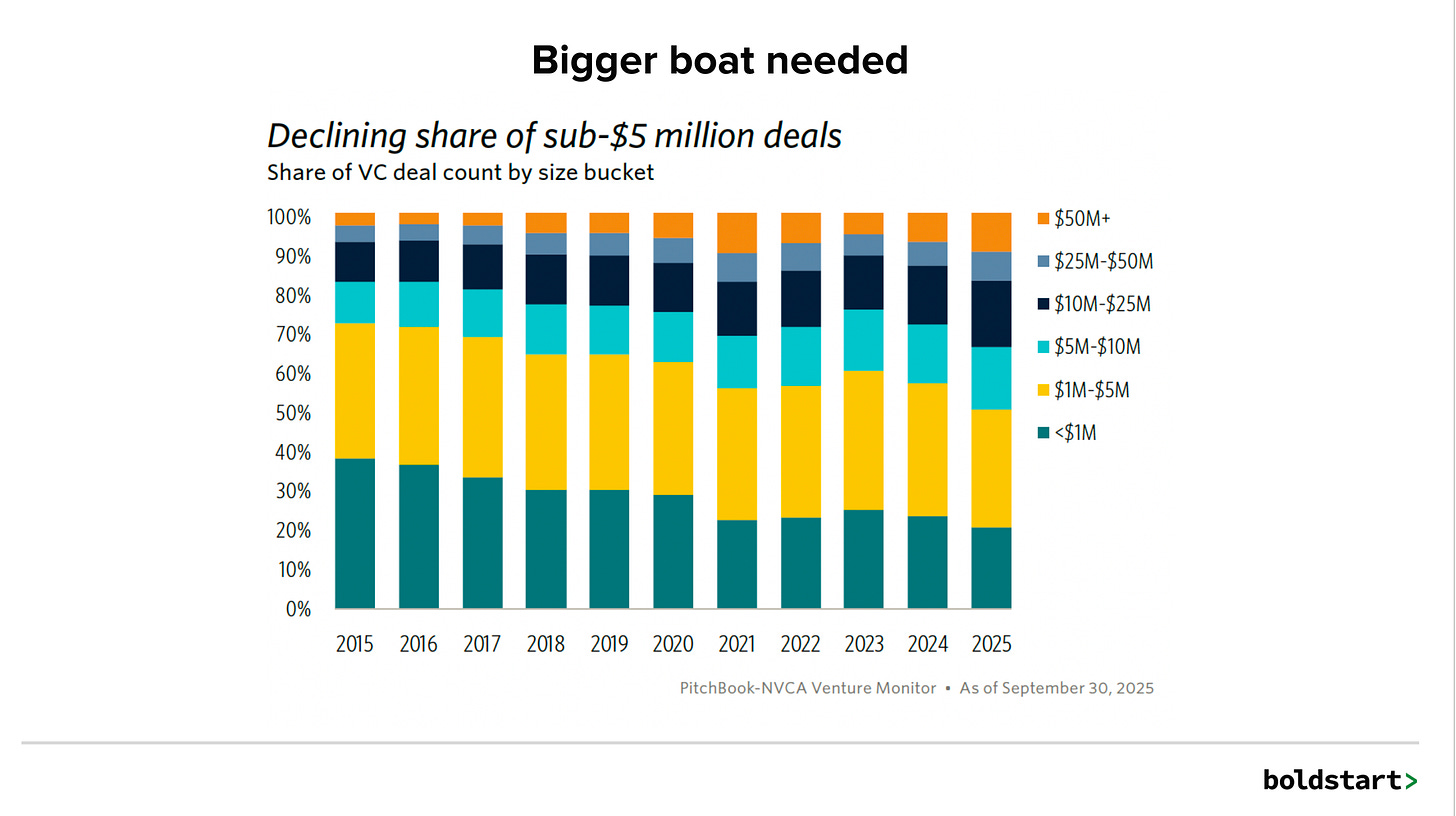

Next, let’s look at the share of rounds >$5M - in the last 10 years which has decreased from over 70% to around 50% - deals are just getting bigger and bigger.

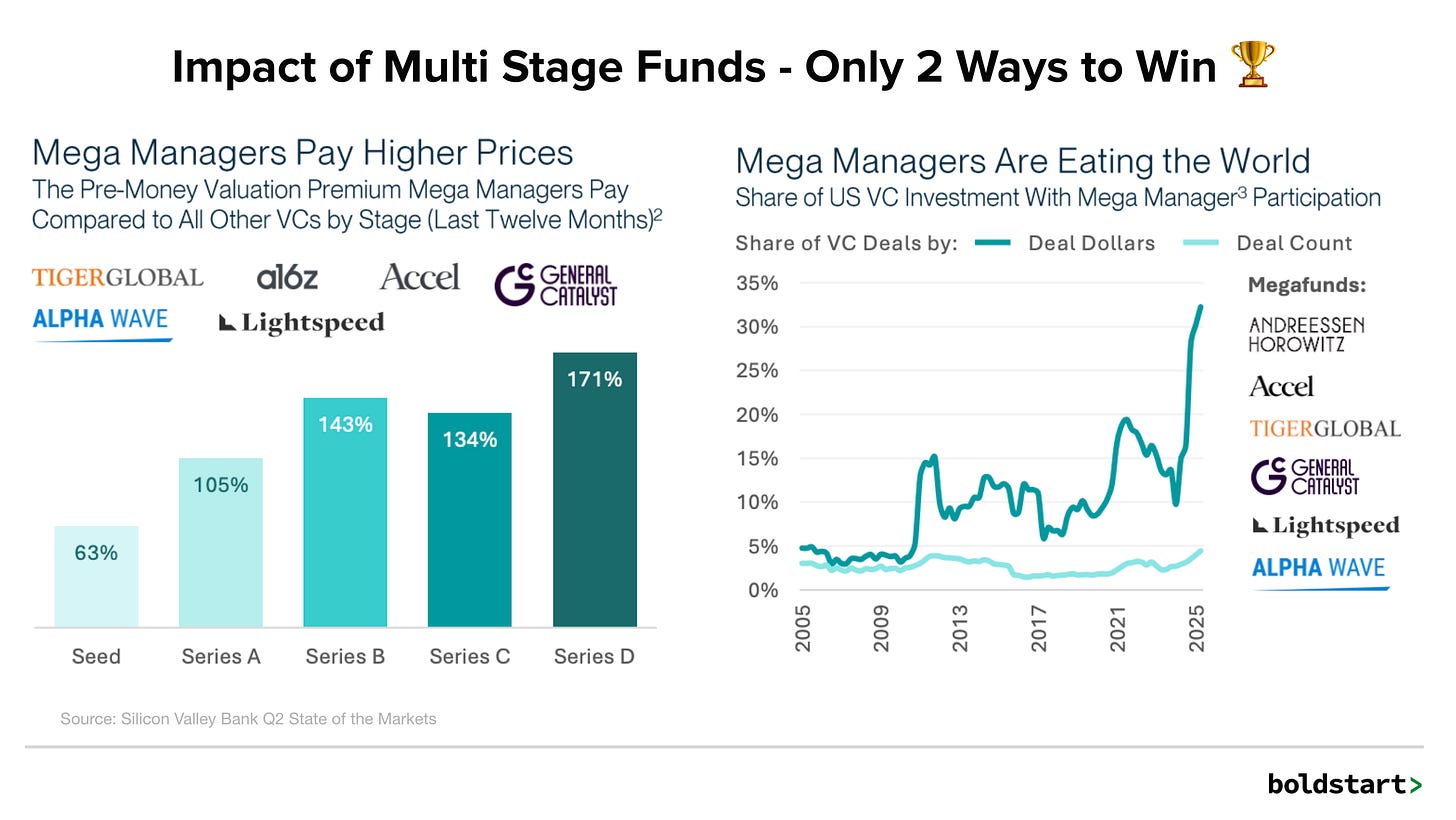

This is clearly the impact of Multistagers indexing the market - buying in early for optionality and tripling down on winners. They are also less price sensitive and can often just throw more money for the same dilution to founders which means they pay higher prices. Here’s some data from Silicon Valley Bank’s Q2 State of the Markets showing this.

You all know our story, Inception. If you want to compete in this market at Inception/seed, you need to be thoughtful about who you are and portfolio construction. The bigger the fund you raise for being early, the more you need to own, the more you need to lead to get ball control, and the more competition you will face from the multistage funds/mega mangers who are all writing seed checks as well.

This is the clear choice we made at boldstart throughout the years, going head to head with multstagers and either winning or splitting with our friends at these firms. However, it’s not for the faint of heart, and it’s a battle 🪖 out there!

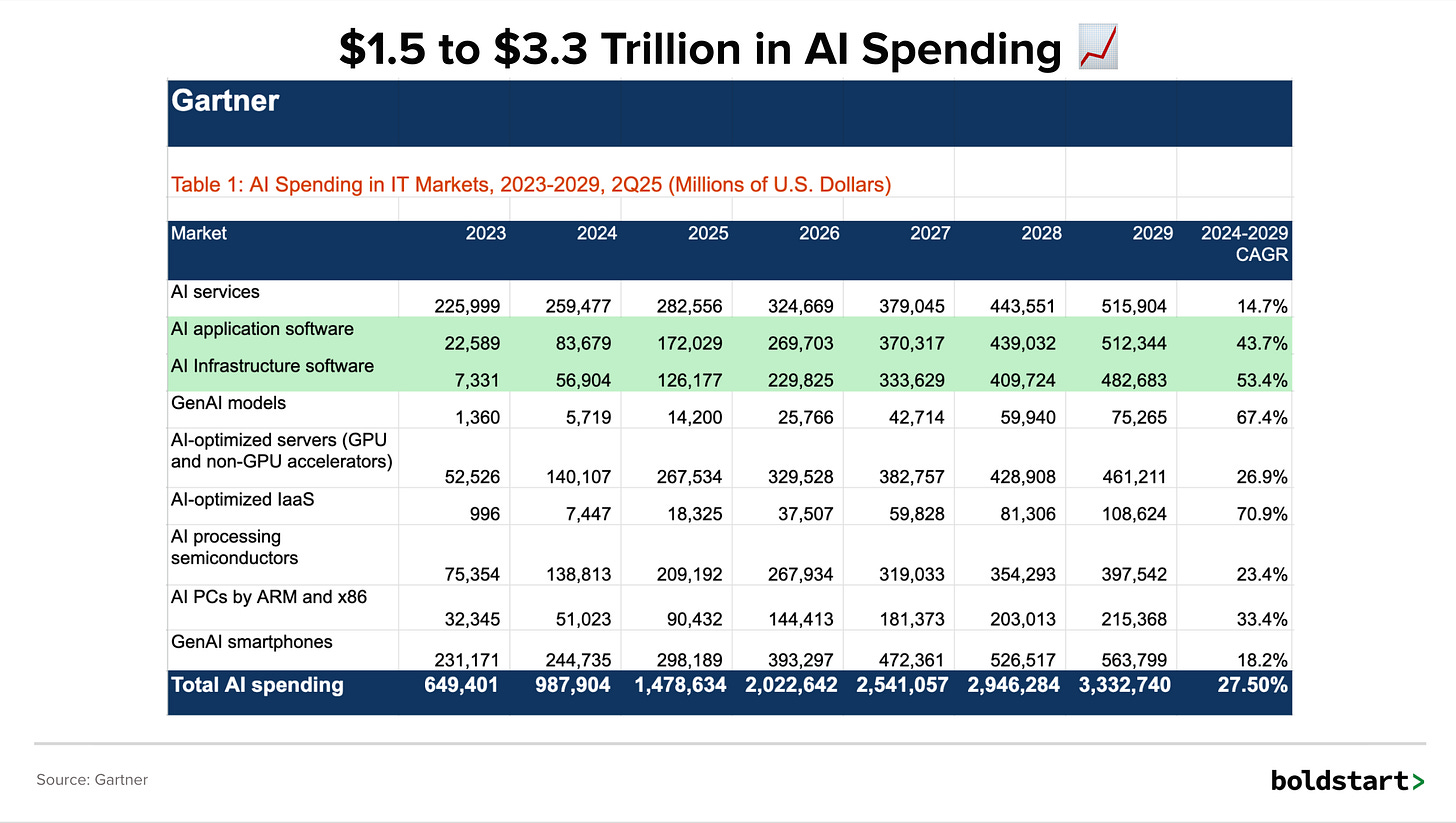

Here are a couple of other impactful slides on why so much money 💰 continues to pour into AI related startups. This is insane projected growth for numbers of this magnitude and notice that AI application and infrastructure software are poised to grow even faster at 300-400% during this same time period.

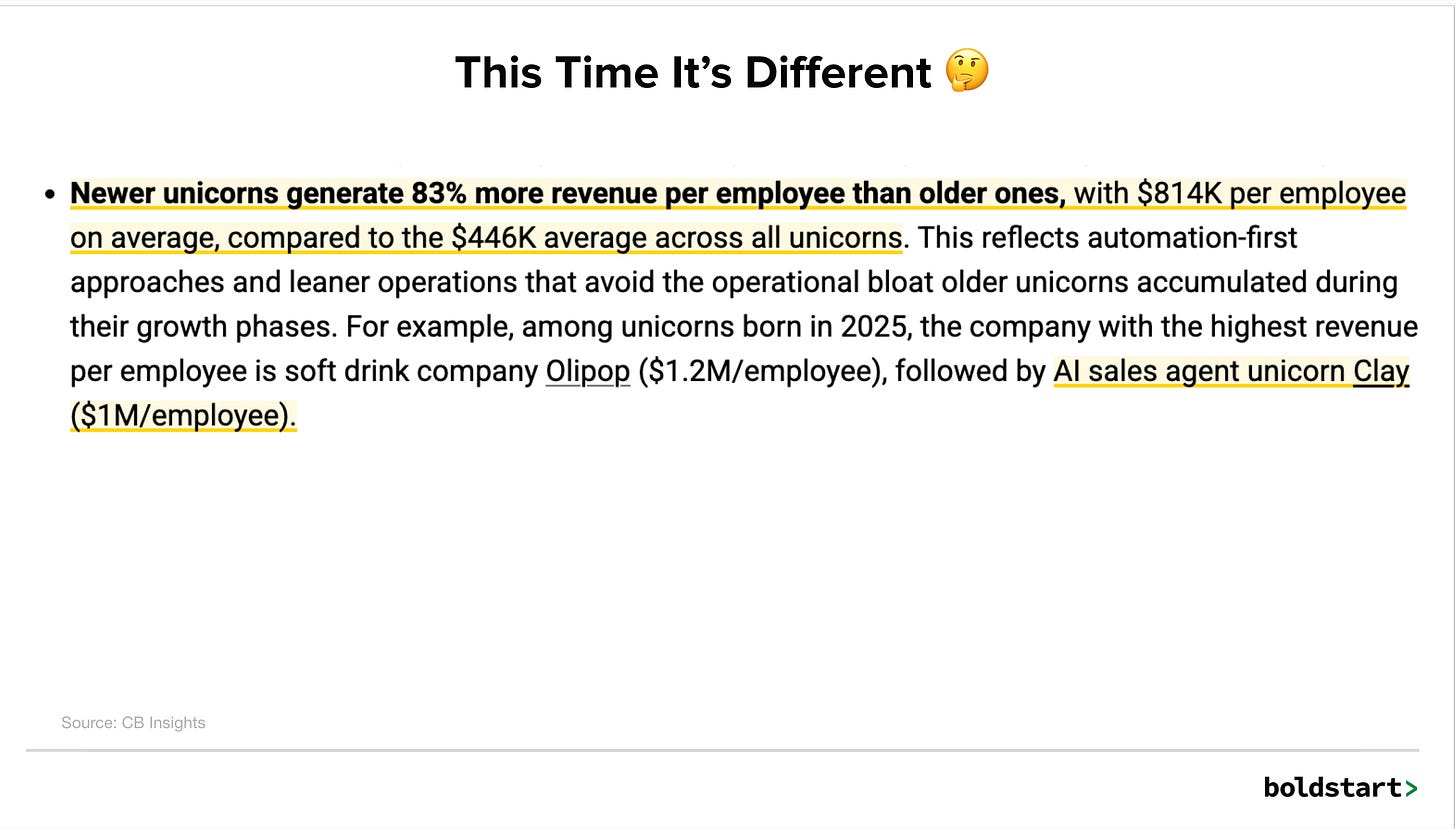

Leaner, meaner and more efficient startups.

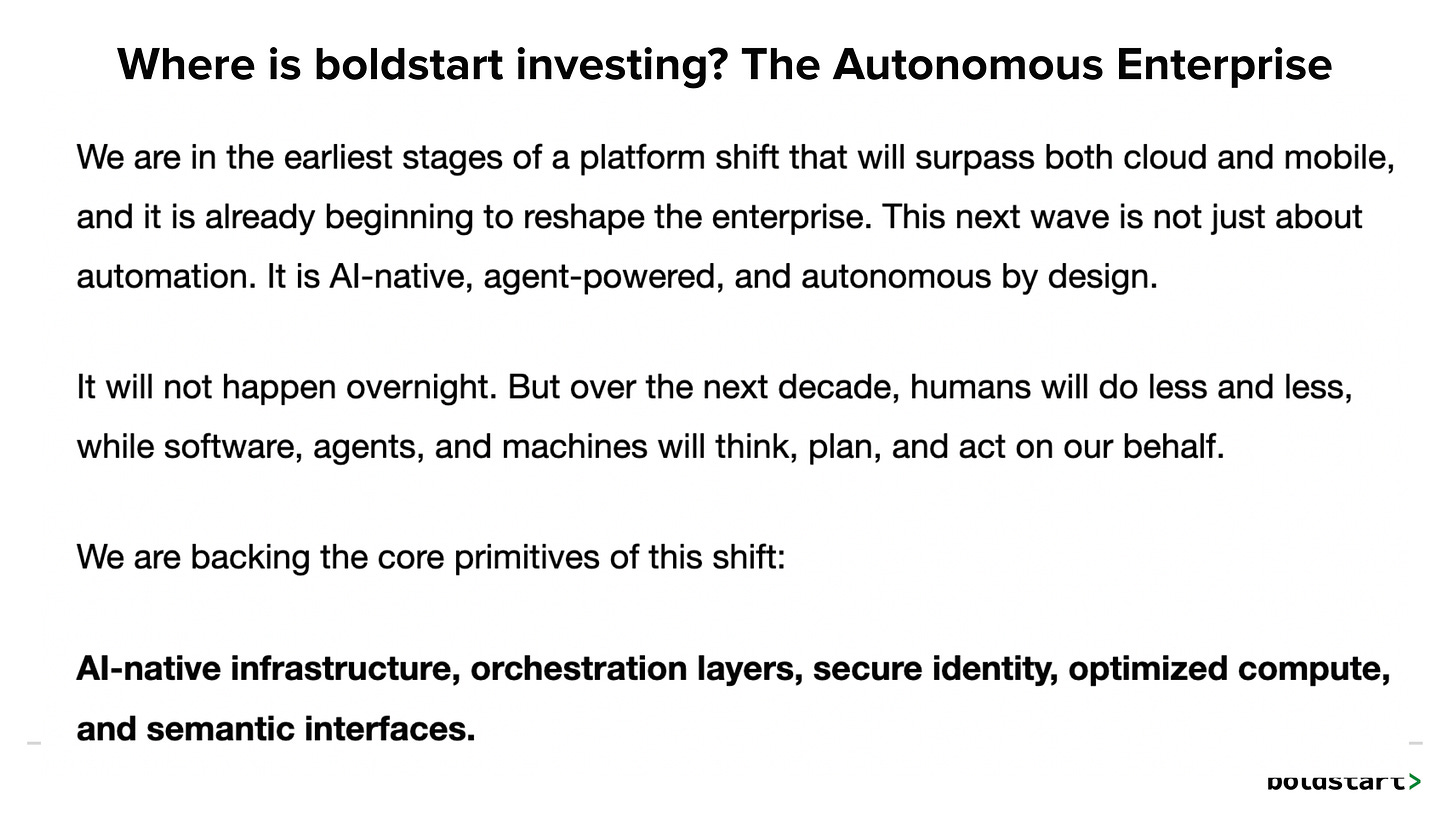

Where we’re investing.

This autonomous enterprise is aspirational for sure, but it’s a world we’re all driving towards and is going to take 5-10+ years to become realized. This also includes the physical world like robotics, bio, and other areas. Here’s a fun AI-generated video we created for our Fund VII launch earlier this summer.

Finally, share your data on performance and investing and of course EXITs and DPI make LPs super happy! Tell stories about those as well - thank you to Ian Swanson, co-founder and CEO of Protect AI for the massive win selling to Palo Alto Networks for >$700M.

Close it out with some fun - yes, that’s me wearing an helmet - it’s a war out there! I’m joined by my partners Eliot Durbin, Ellen Chisa and co-founders of Keycard, Netpreme and Topos Bio.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

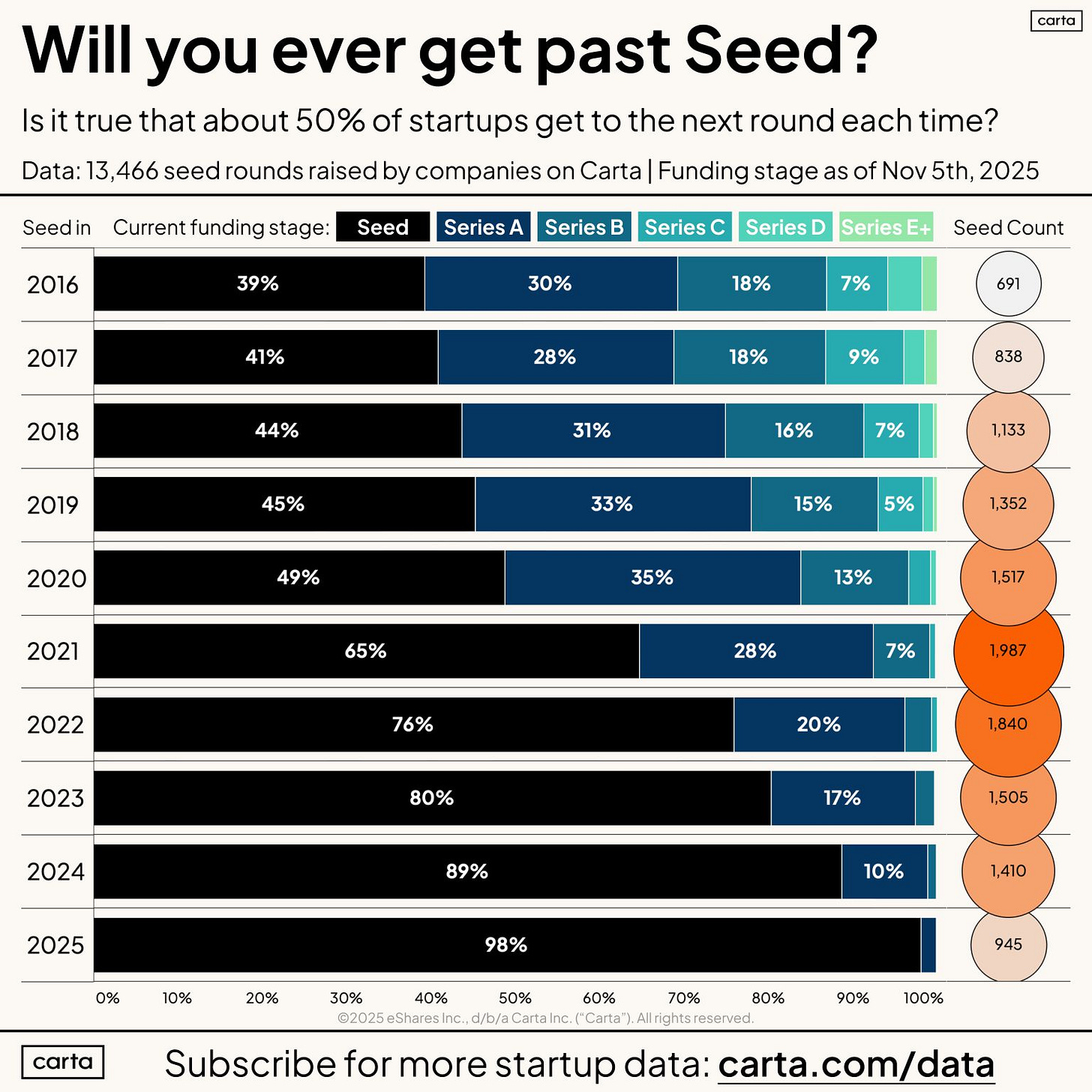

#going from seed to A - Peter Walker (👇🏻 click for post)

Enterprise Tech

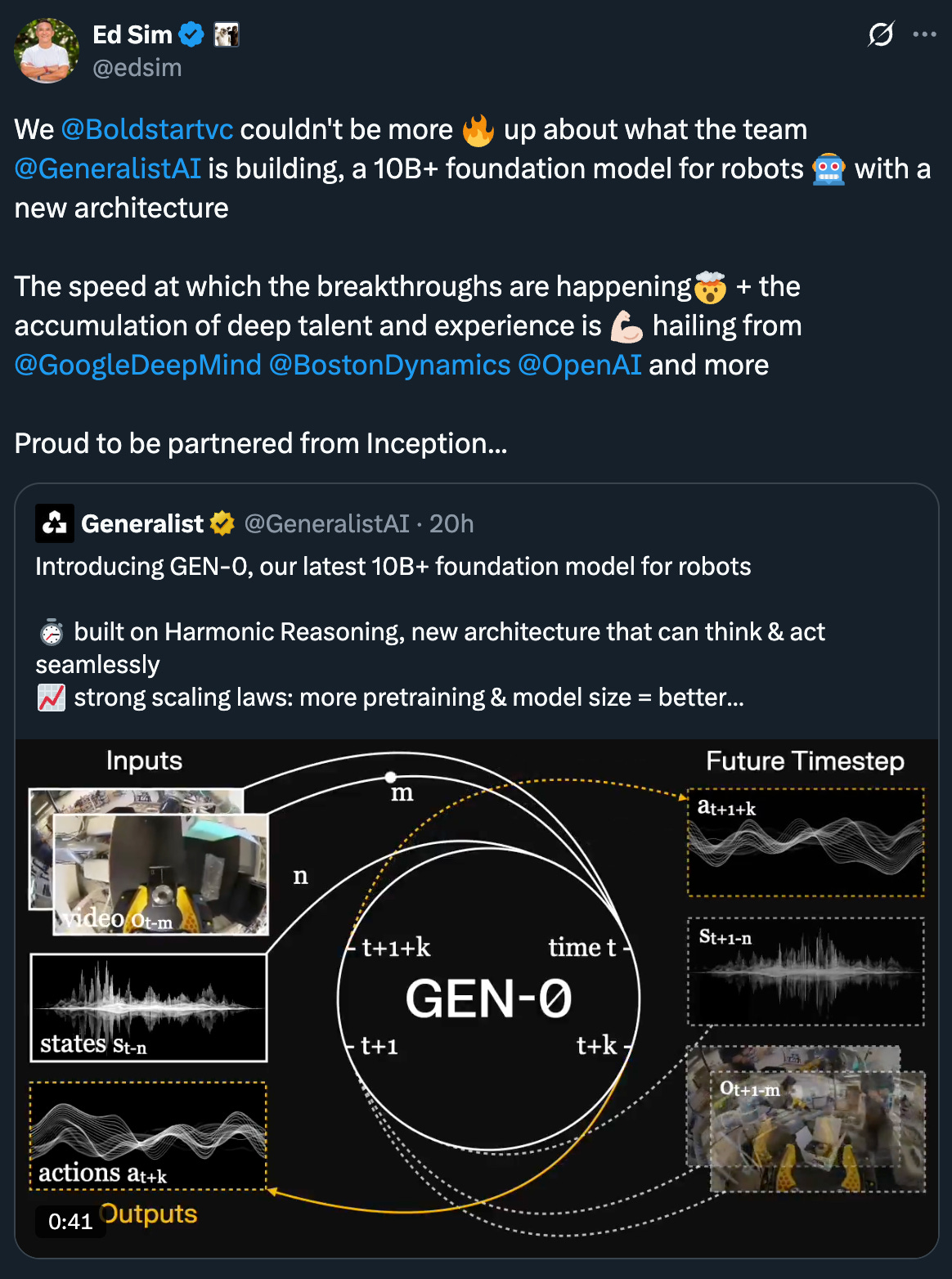

#major breakthrough in robotics space from Generalist AI, a boldstart port co - read 🧵 below and check out some of the videos! Insane what is coming in this space.

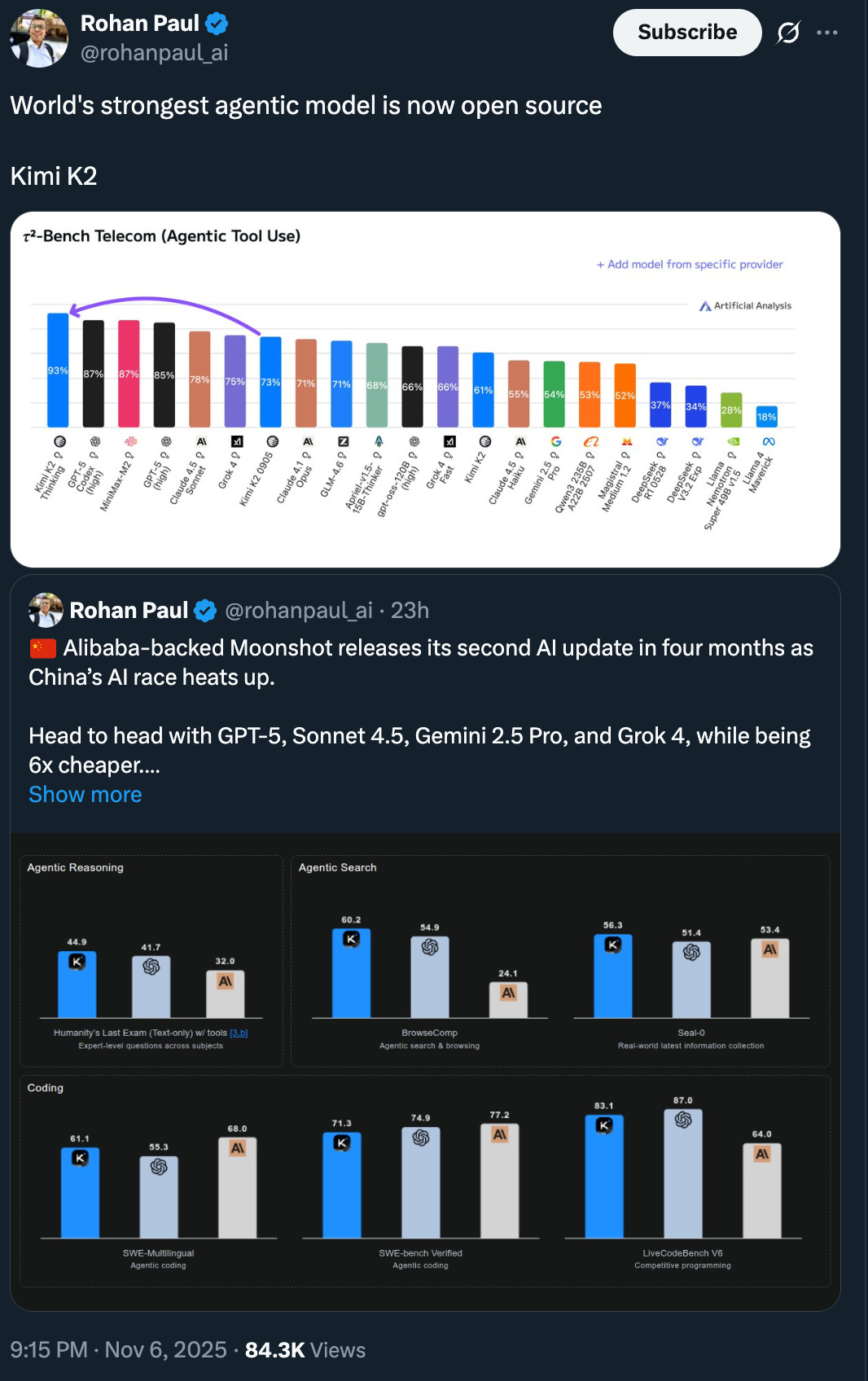

#open source Chinese model takes #1 spot for agentic reasoning and 10x cheaper than GPT-5 and 20x cheaper than Sonnet 4.5 😲

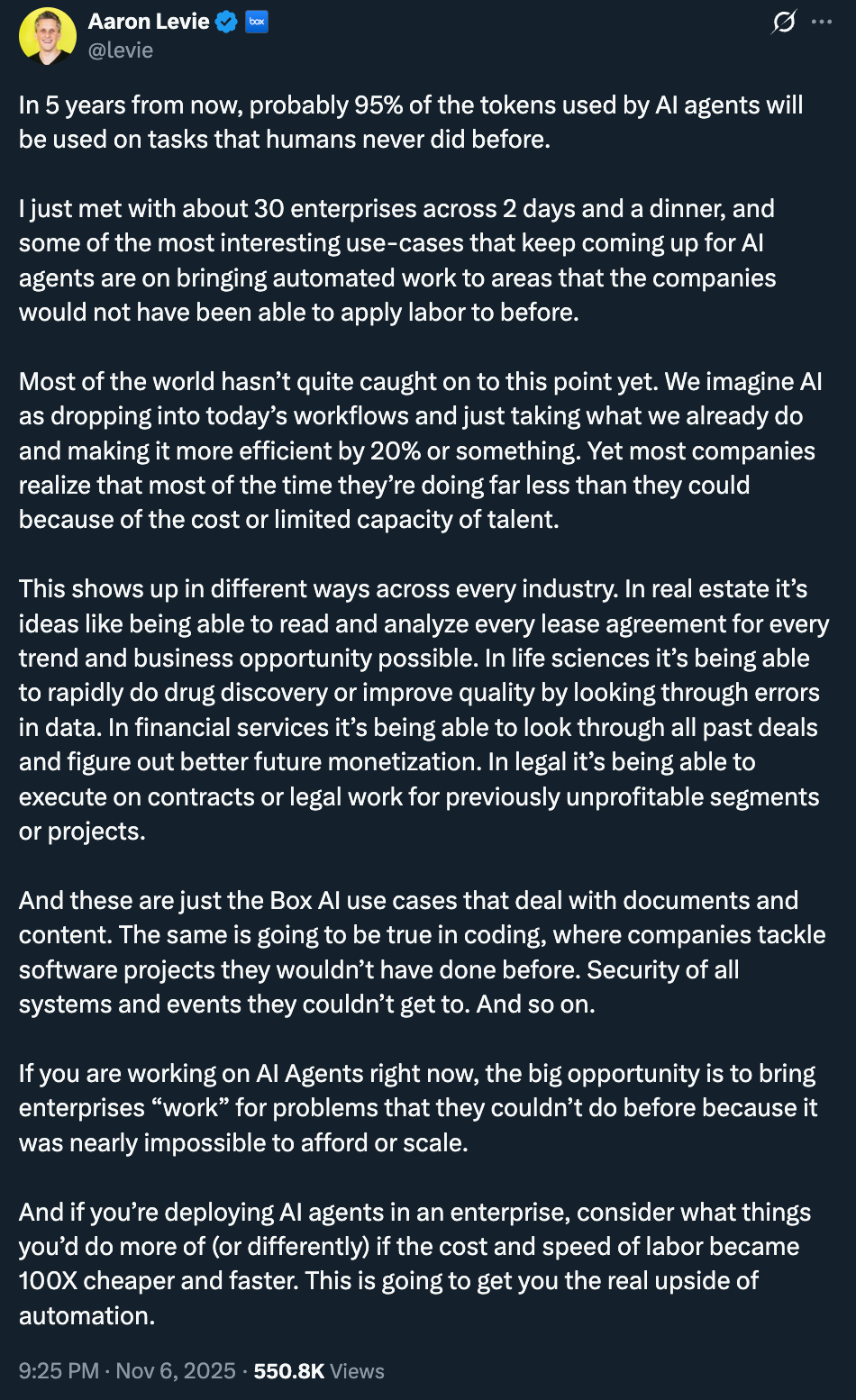

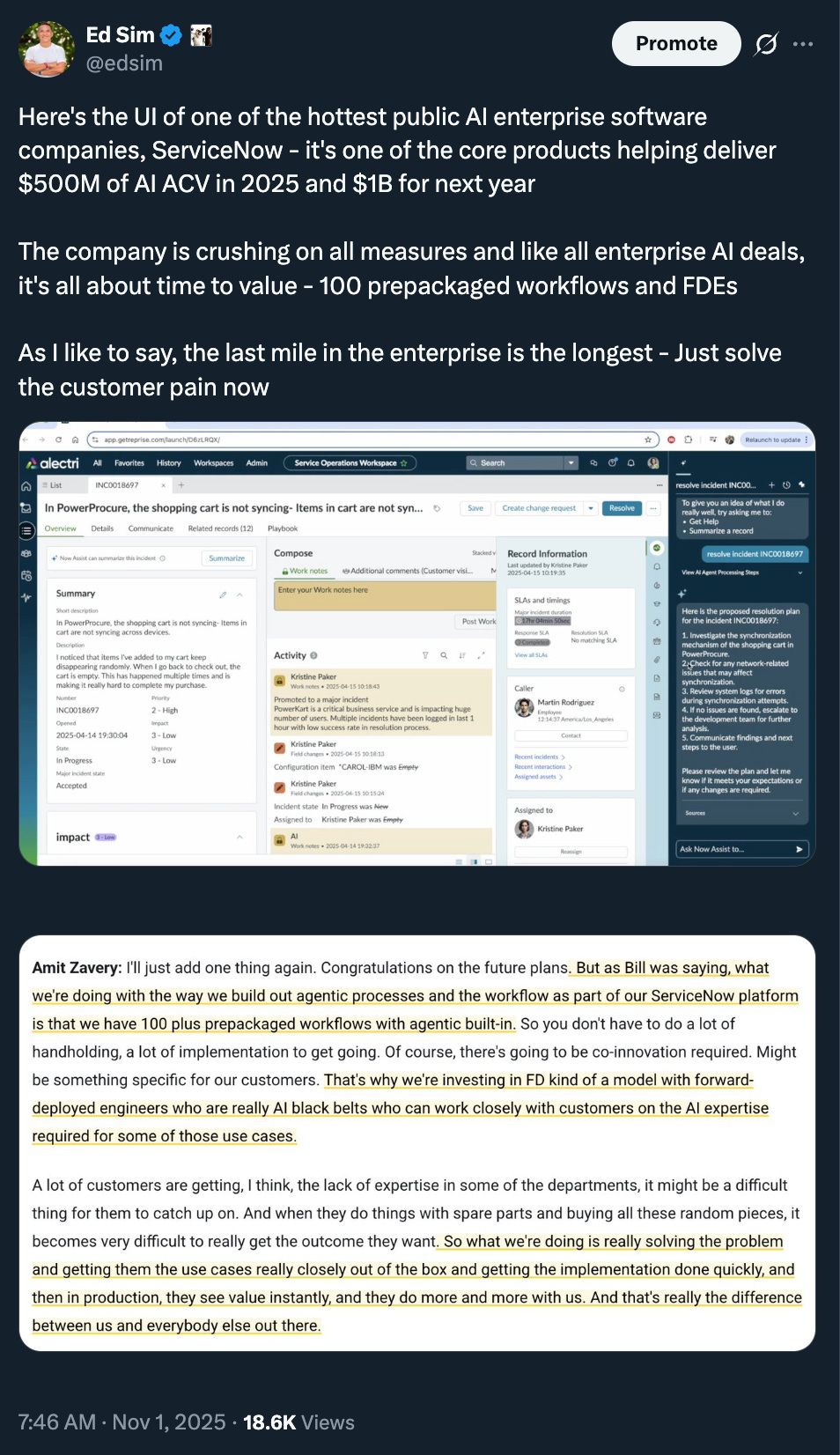

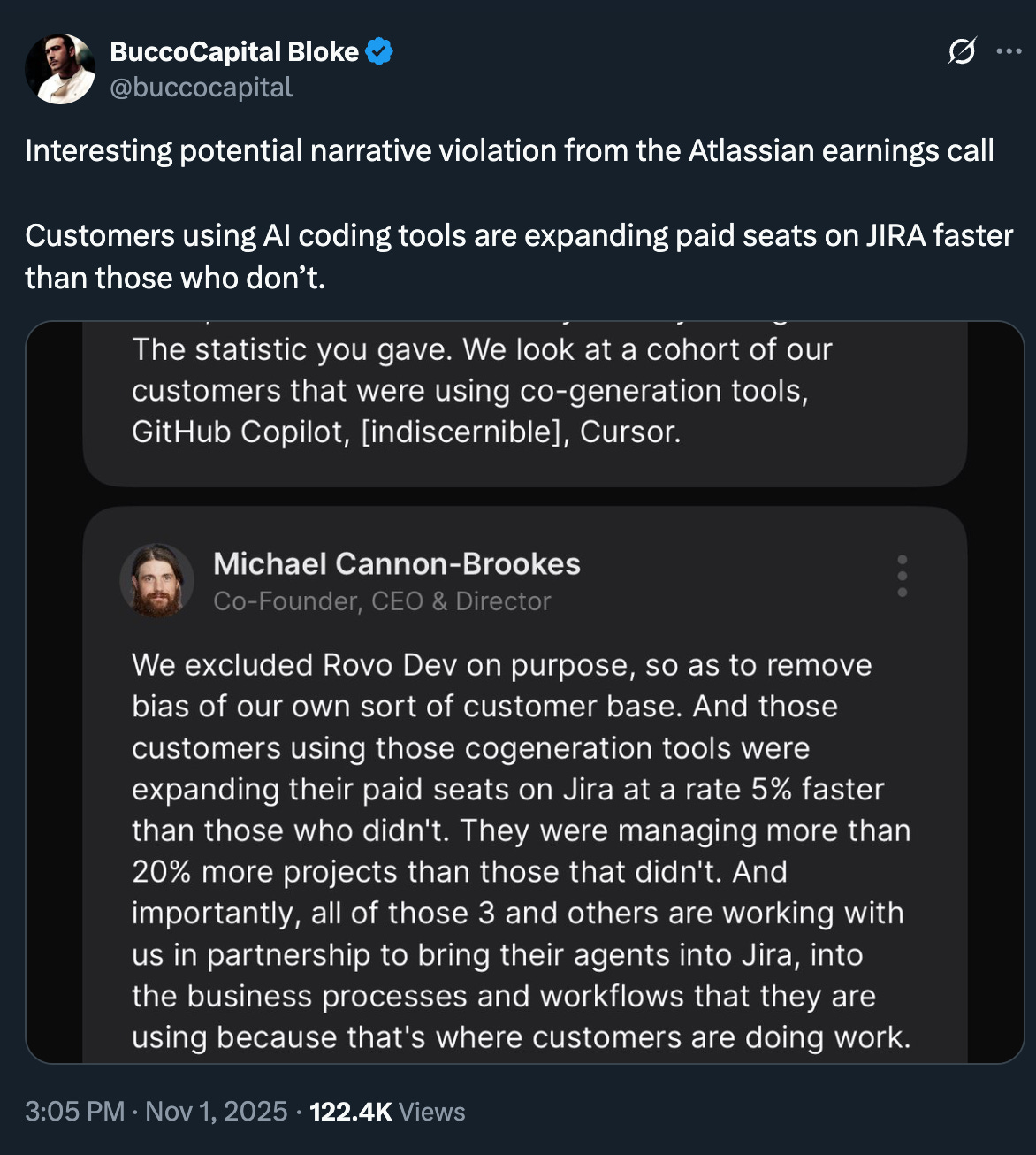

#as I’ve always said, not about just automating existing processes but also reimagining from first principles or creating whole new automations and tasks

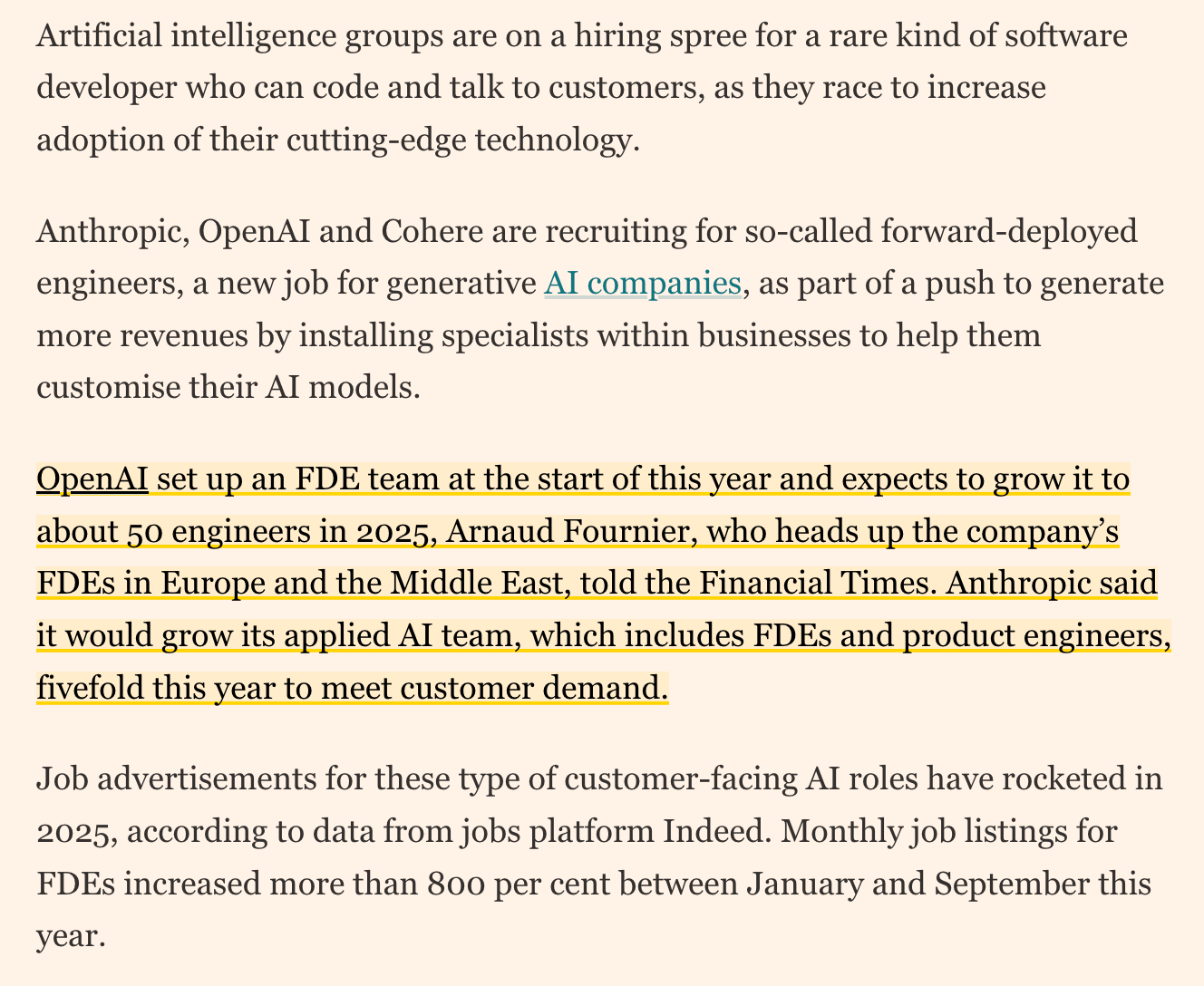

#from FT this week

echoes this post from last weekend

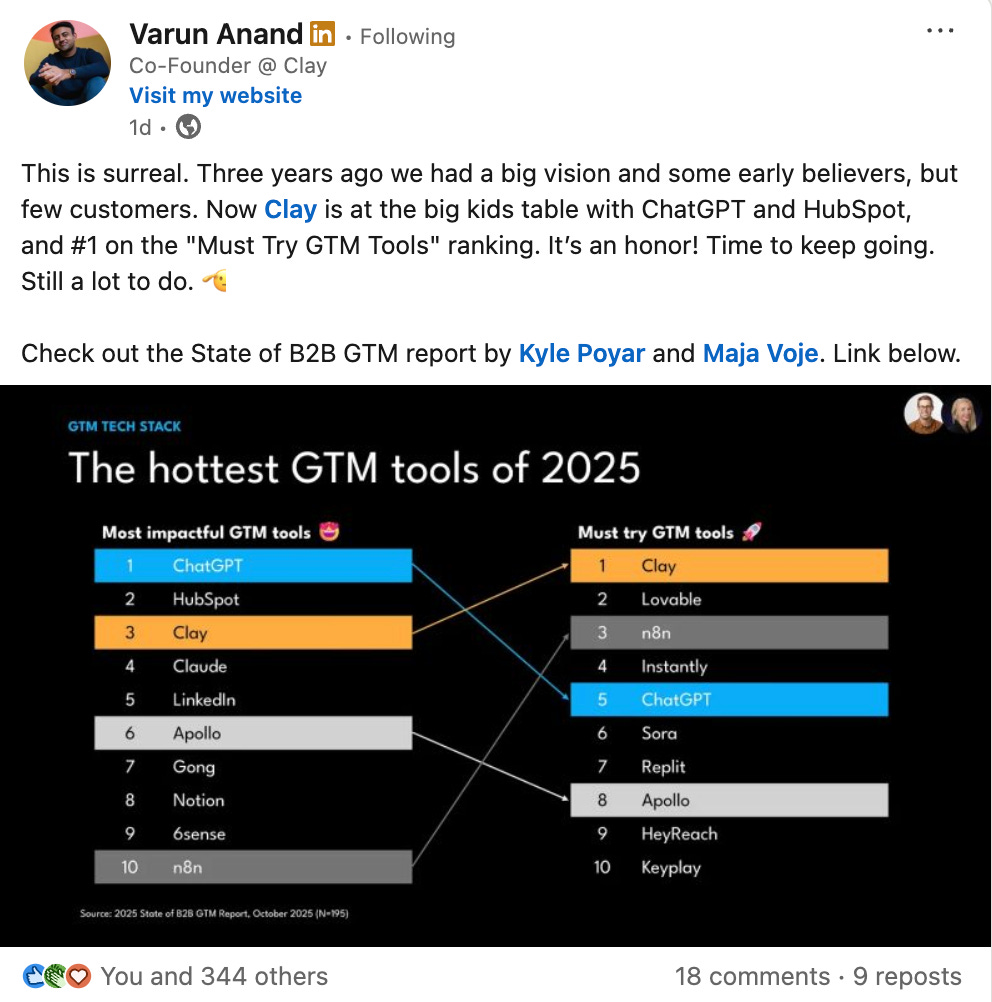

#hottest GTM tools of 2025 from Kyle Poyar and Majo Voje (go Clay, a 0 port co)

full report here

#👀

#super excited about this new investment into Pipelines!

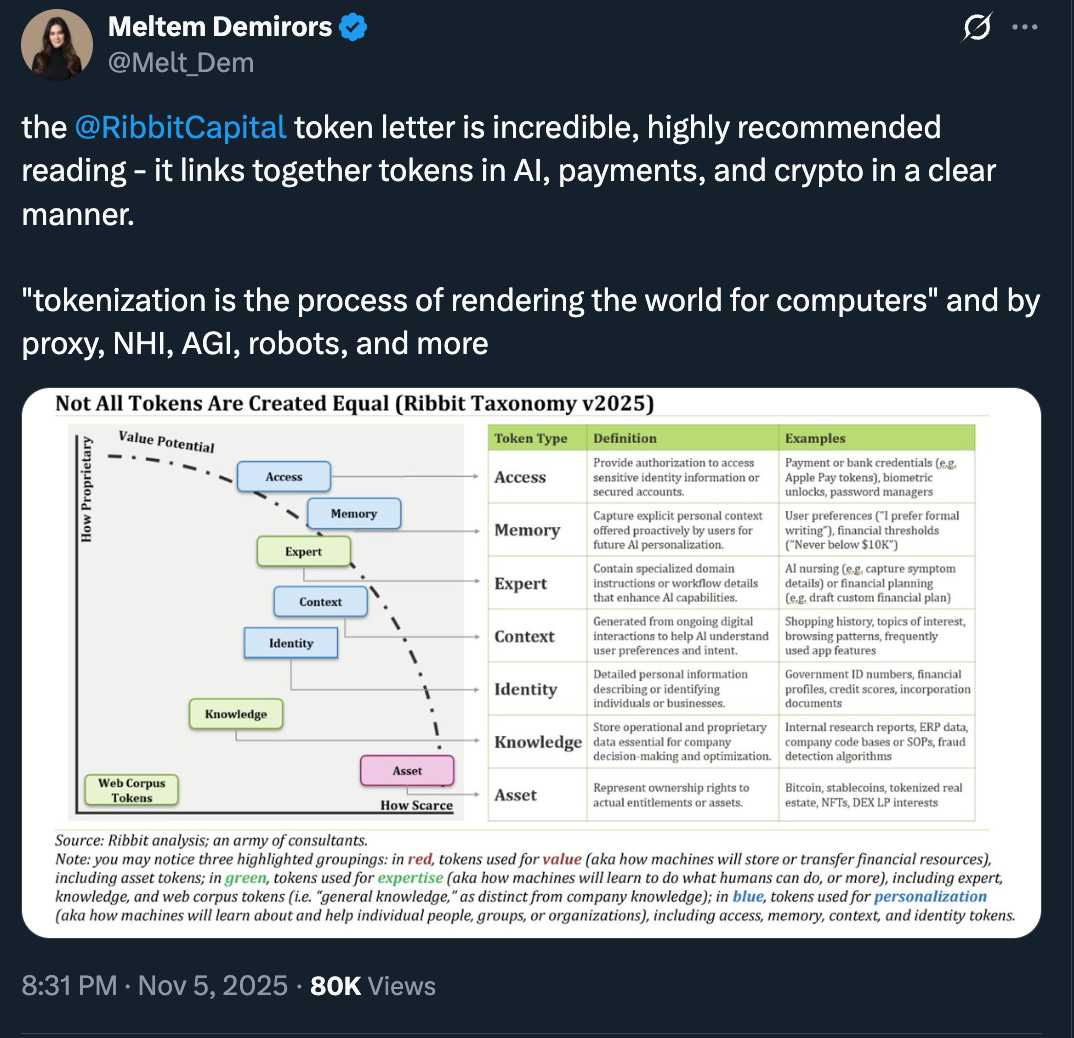

#this is worth a read…

#Energy is the bottleneck - worth a watch 👇🏻

#💯

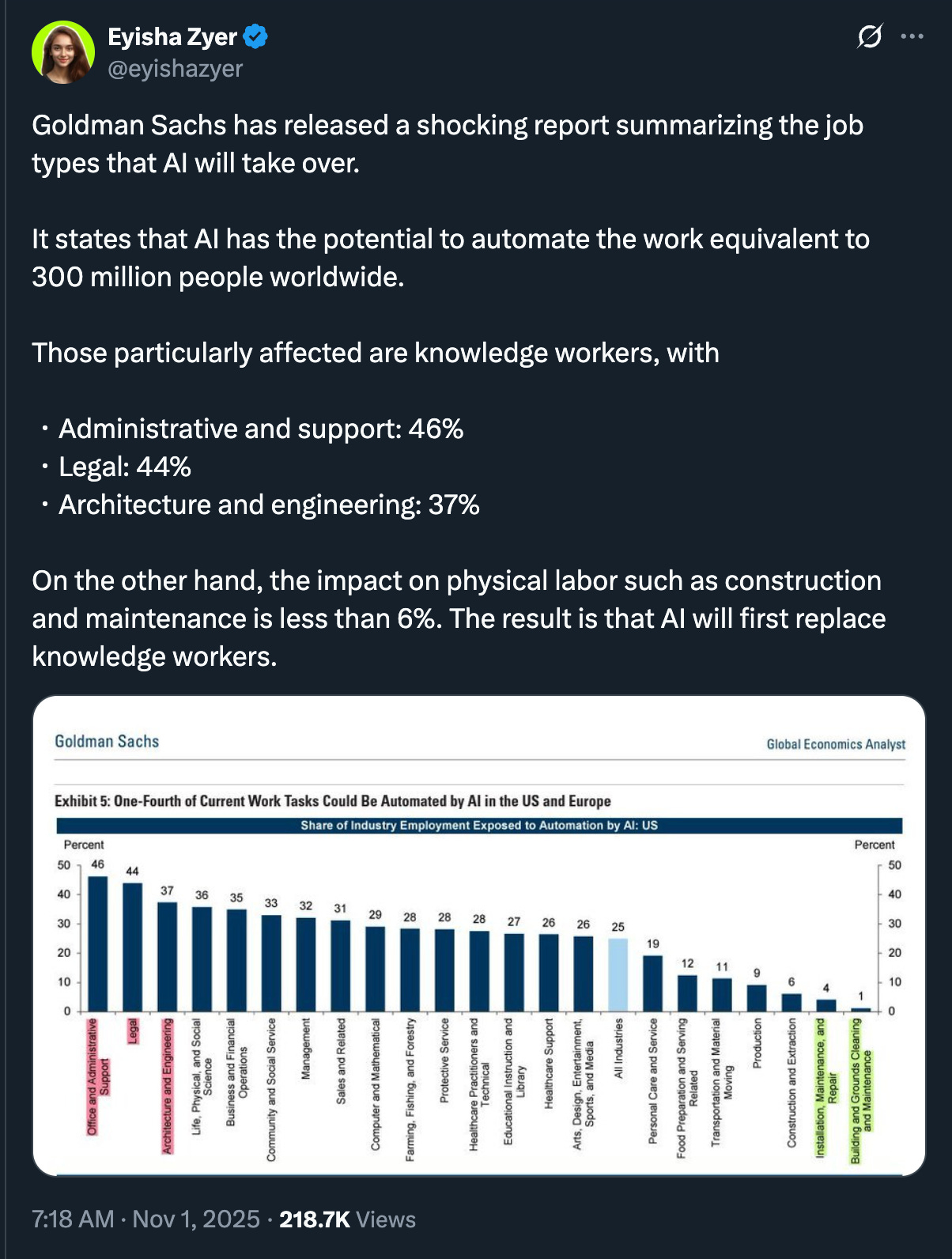

#so much to automate…i do think robots will hit physical labor in a much bigger way however

#clip from my interview on The Cube at AI Security Summit

#🤔

Markets

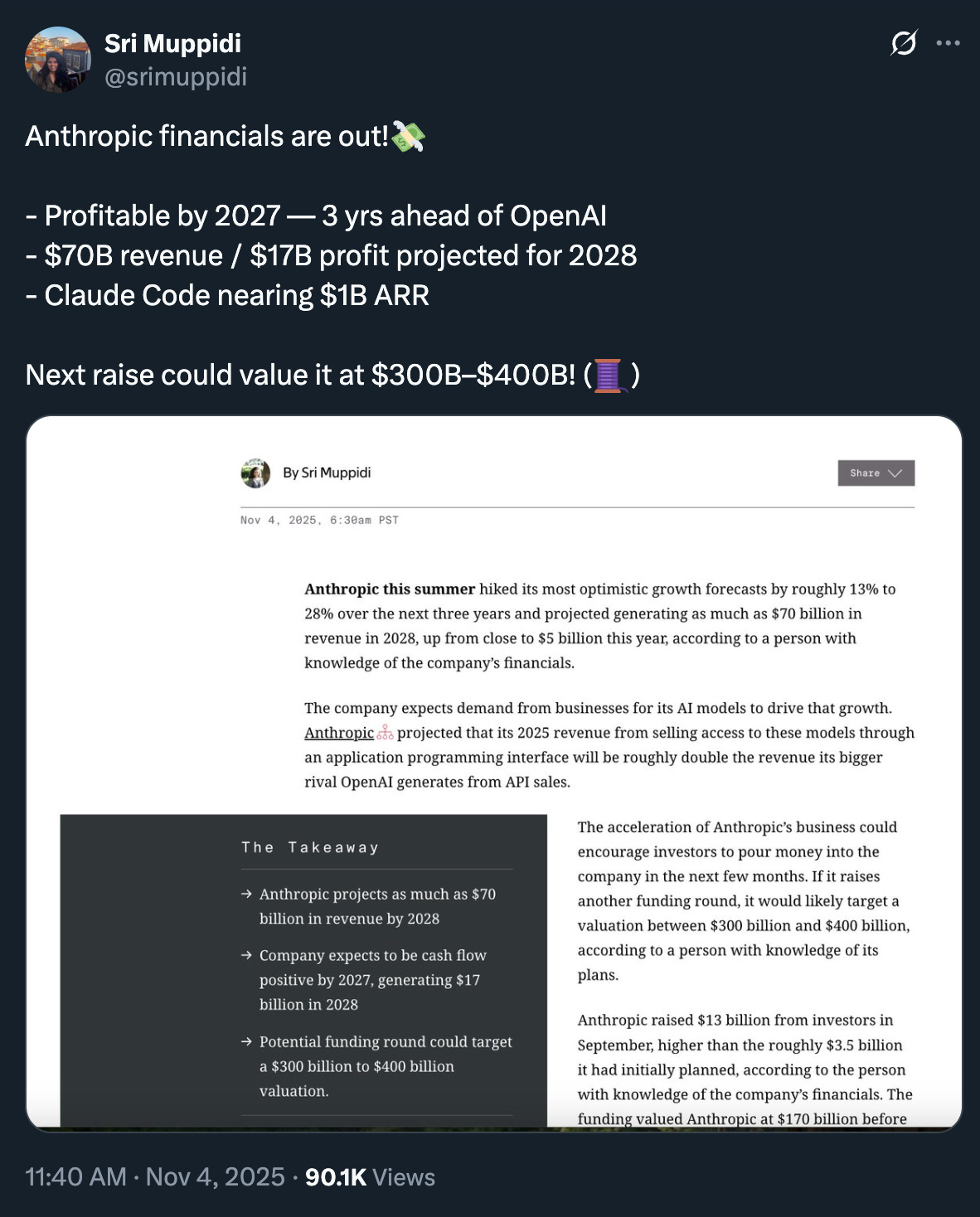

#getting frothy out there…The Information

Decagon, which develops AI for automating customer service, is discussing raising equity funding from new investors at a valuation of $4 billion to $5 billion, according to two people with direct knowledge of the deal. The discussions come just five months after the company announced financing at a $1.5 billion valuation.

The two-year-old startup is currently generating “significantly more” than $30 million in annualized revenue, compared to $10 million in annualized revenue as of last year, according to one of the people with knowledge of the discussions. Annualized revenue is last month’s revenue multiplied by 12.

Decagon faces a lot of competition. Older private firms such as Intercom and Kore.ai and numerous enterprise software incumbents such as Salesforce have similarly launched customer service age

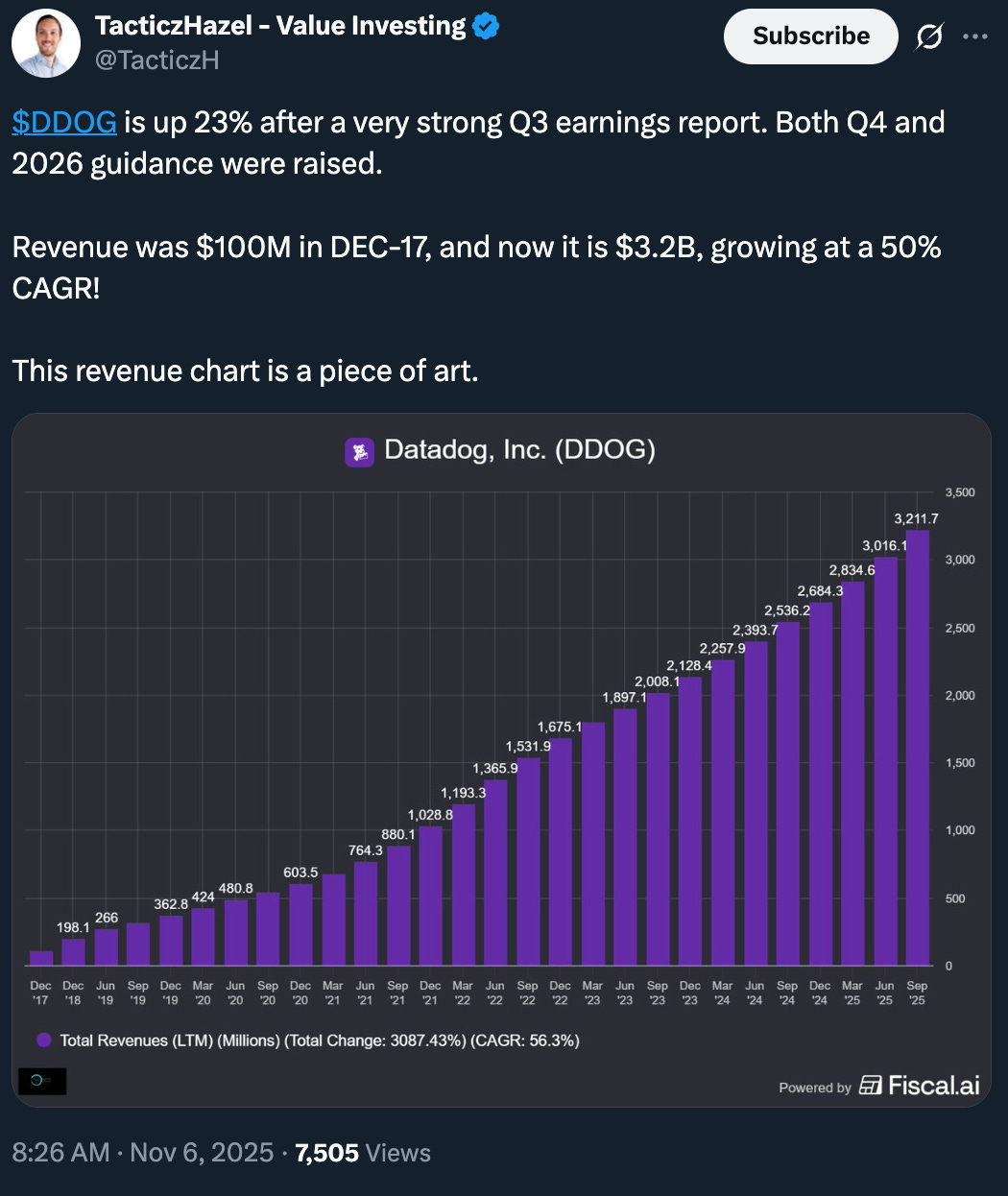

#wow, Datadog keeps delivering, stock was up 21% after earnings this week