What’s 🔥 in Enterprise IT/VC #468

The Many Paths to $100M ARR: Understanding PLG, SLG, and BLG Tradeoffs (Plus: Varun from Clay's 3 lessons for AI founders building for enterprise)

Still processing the conversations from this week’s Bay area trip. Sat down with a group of founders after JP Morgan’s Tech Symposium, and the energy was electric.

One topic kept coming up: time to $100M ARR. The discussion was so good it deserves its own breakdown, especially since it builds on my post from earlier this week.

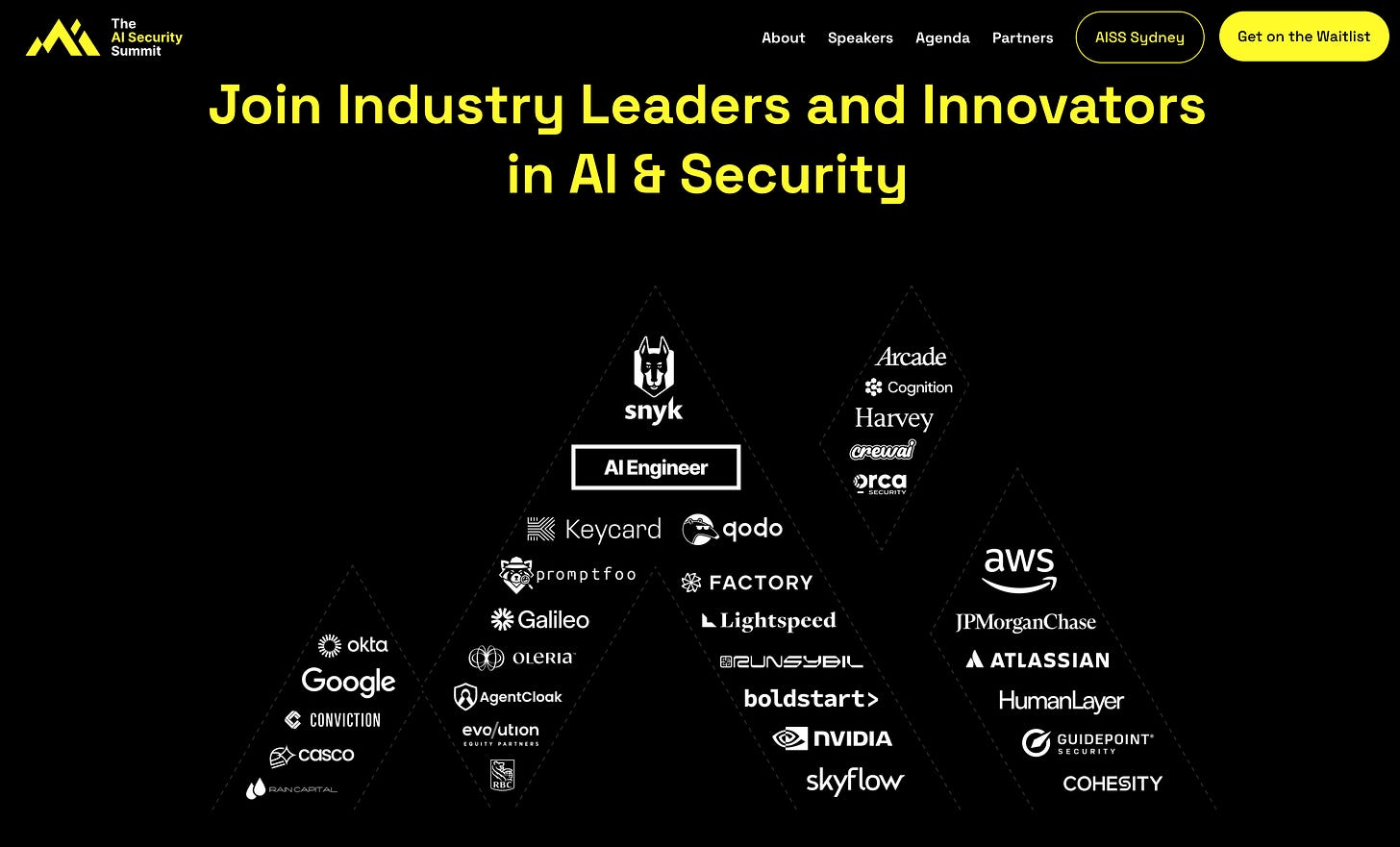

Before I dive in - quick heads up that I’ll be back out there again next week for the AI Security Summit (come join if you’re into agentic security, code security, etc.)

and doing a panel on October 22 with VC friends, hosted by Manoj Nair from Snyk.

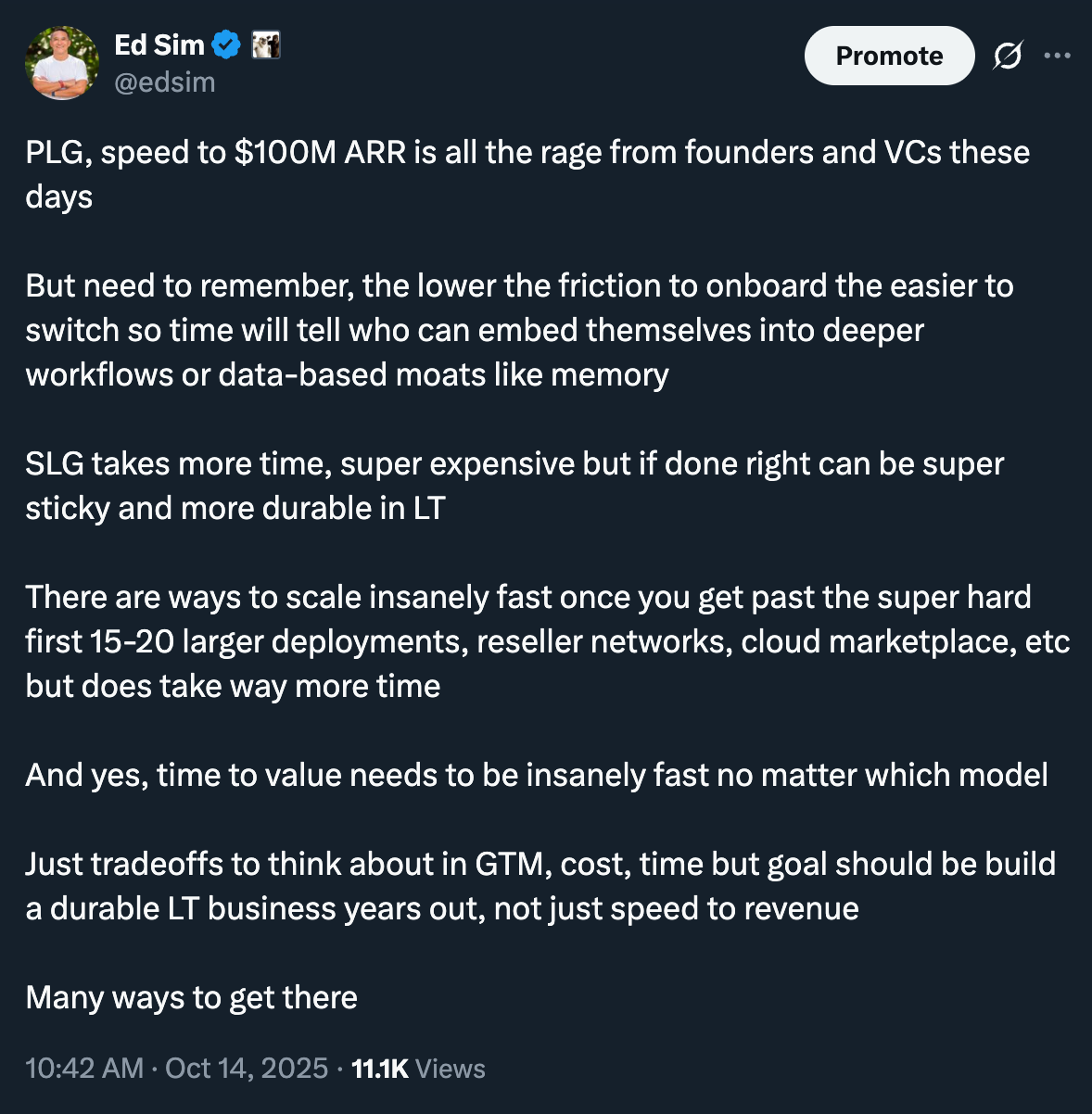

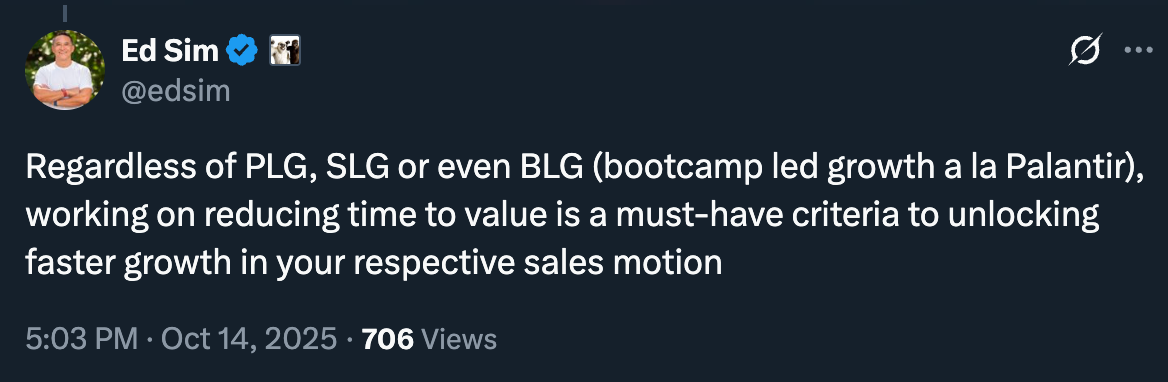

Now, back to that $100M ARR conversation. It ties in nicely with my post from earlier in the week 👇🏻

This connects to what Bryan Kim from a16z said recently. Yes, this is the bar many multistagers want to see for Series A, but I wouldn’t overrotate to speed to ARR as your only proof of future success.

There are many paths to $100M ARR. Plenty of funds find $0-2M in 3 months compelling, while others care more about your ability to build a massive business long-term than hitting arbitrary revenue milestones quickly, especially when those milestones can be misleading (wrote more about that in What’s 🔥 #465).

What’s 🔥 in Enterprise IT/VC #465

Back in ZIRP land, the flex was how much you raised. Bigger round = better company (🙄). Now in the AI era, the flex is all about ARR; specifically, how fast you sprint to $100M. Way better metric, but let’s be honest: not all ARR is the same. Some are padded with pilots, contingent contracts, GMV, or one-offs. ARR ≠ ARR.

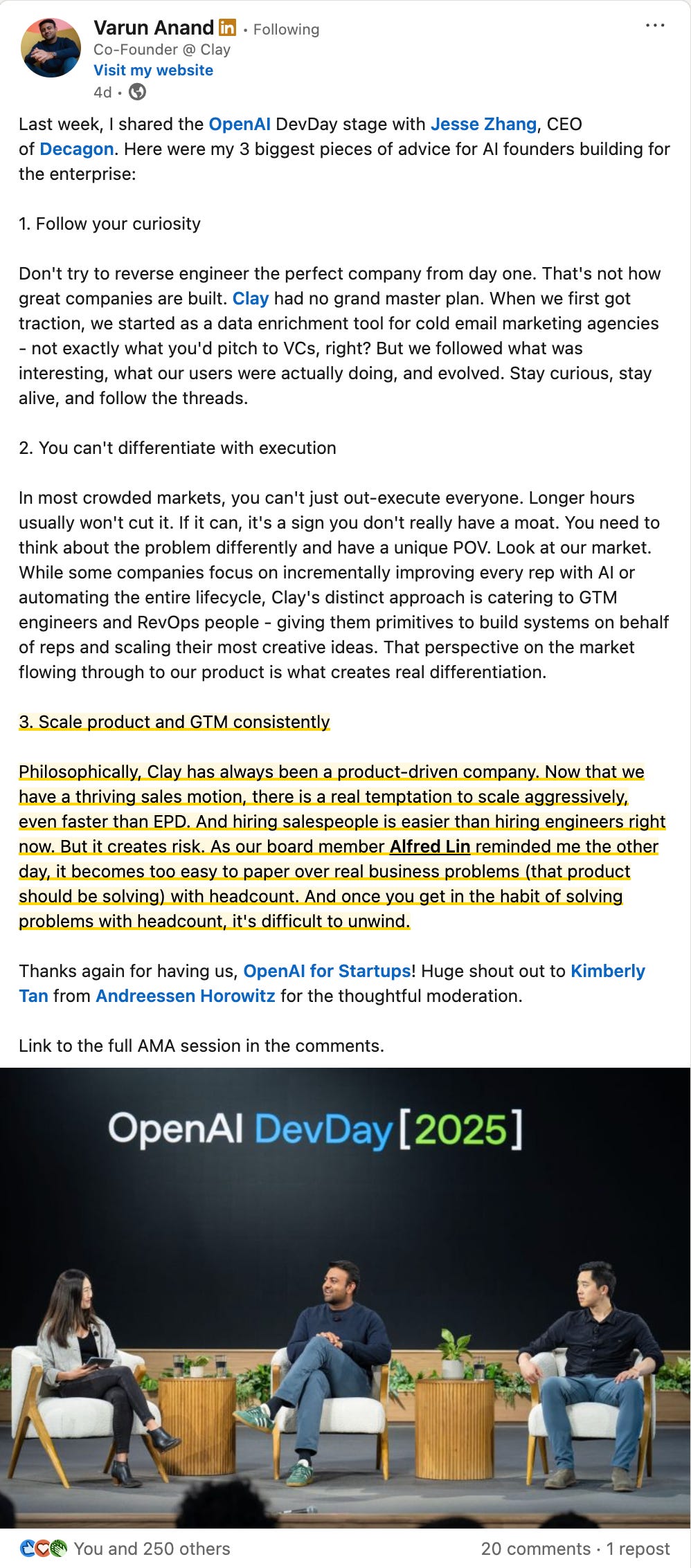

Speaking of GTM and product going hand-in-hand, here’s Varun from Clay at OpenAI Dev Day (also at our boldstart founder dinner above) sharing his thoughts for AI founders building for the enterprise. Notice point 3 perfectly reinforces this theme:

As always, 🙏🏼 for reading and please share with your friends and colleagues!

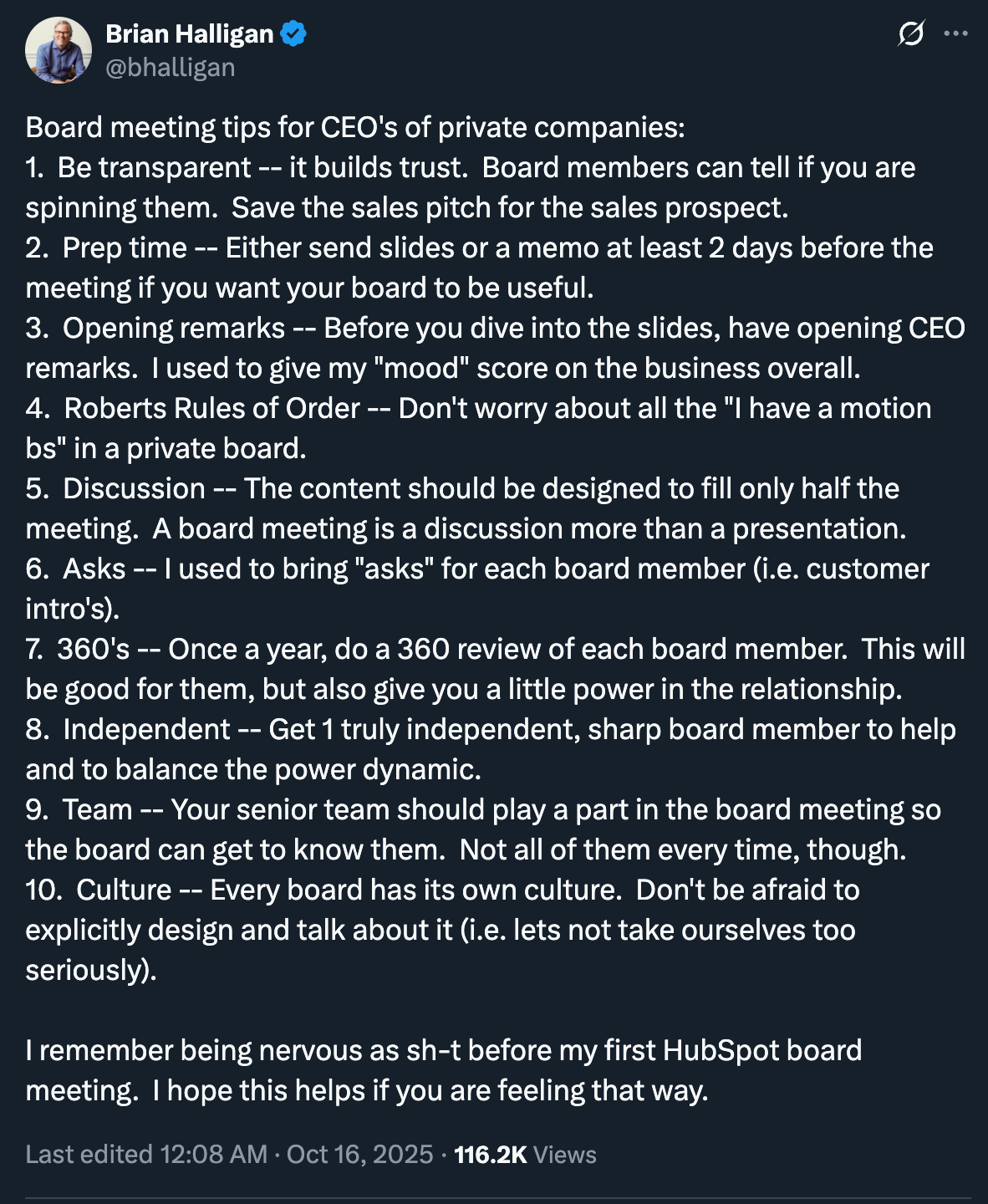

Scaling Startups

#💯 - one 🔑 point is to always try to save as much time as possible for discussion versus just updates

#🤔 great comments in post 👇🏻

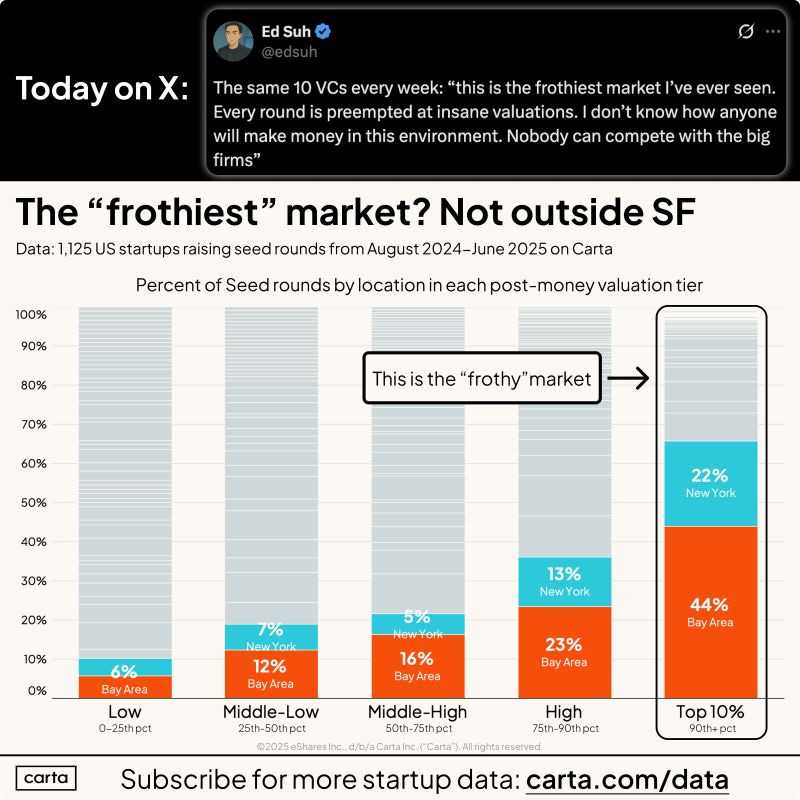

#it’s just a bit different in SF

#🤣

Enterprise Tech

#🤯 inception round of $2B at $10B post and 6 months later on of key cofounders takes payout from Meta rumored to be $2B+, simply insane if your team is just too good, you run the risk of losing them 🤷🏻♂️

#it’s happening

#yes! next wave is starting as models have gotten significantly better and tools easier to use to do training, optimizing, etc

#which is why kubernetes is still not going away 😅

#can’t wait to dig into this 👇🏻

#the culture you need and how to keep building and shipping product in the AI era when growth from $1-$100M in 29 months

#the power of Answer Engine Optimization (AEO)

#💯 the future is agents understanding intent proactively

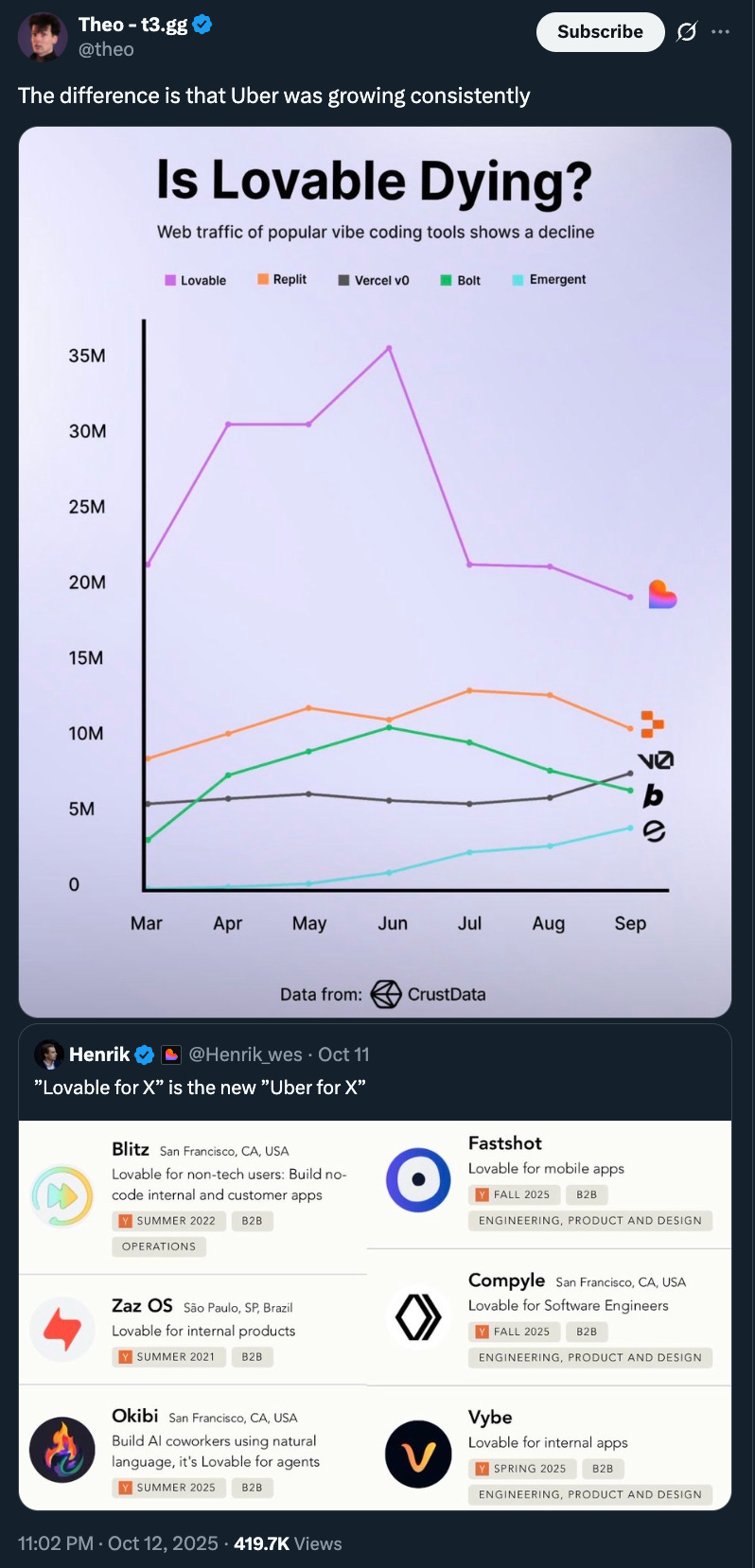

#just one data point so hard to extrapolate but…

#models not bigger but smarter

#so many of these started in 2022 and 2023 🤯

#👀

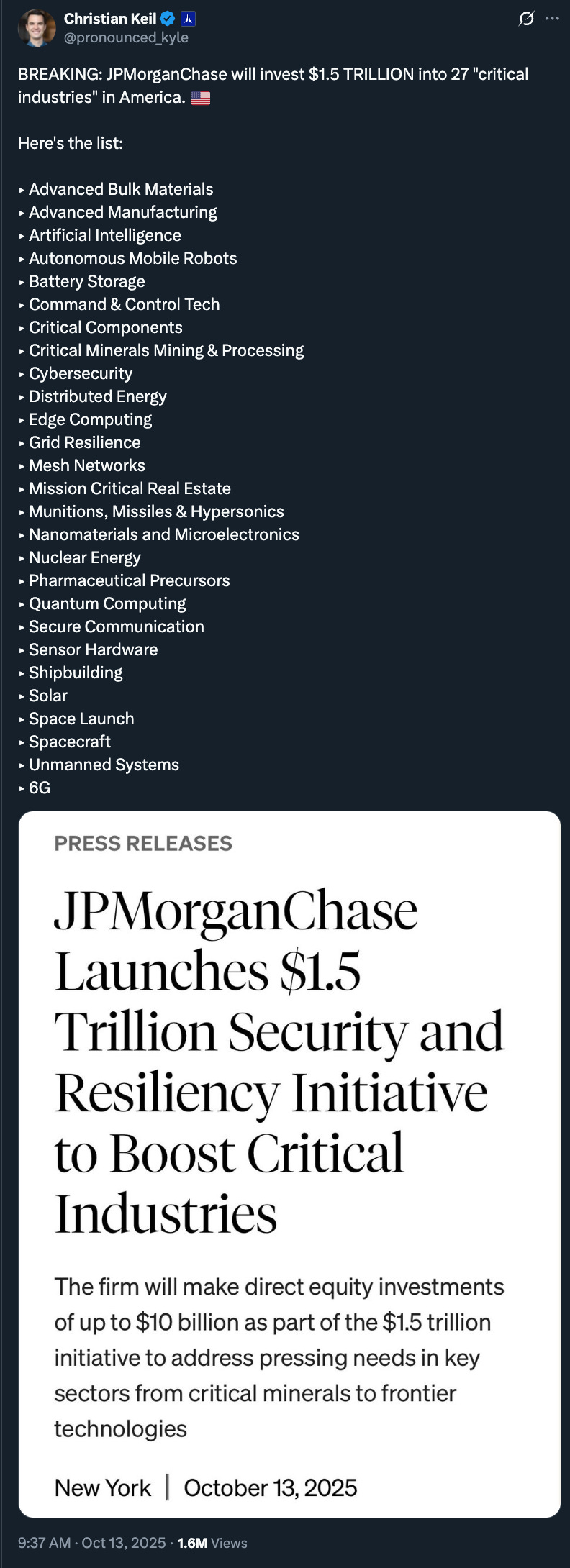

#more TradFi getting into crypto

Markets

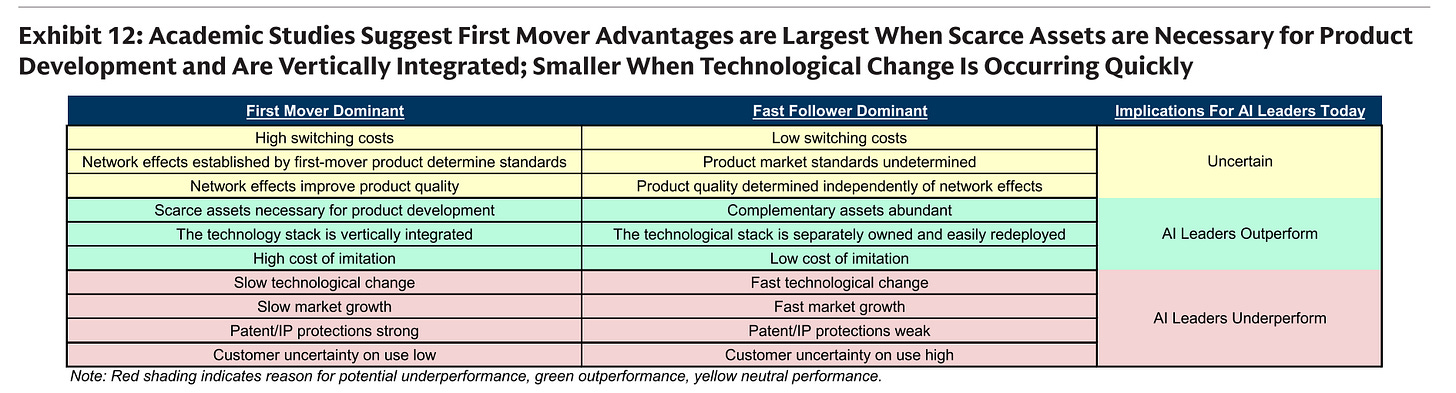

#interesting chart from Goldman Sachs research report “The AI Spending Boom Is Not Too Big (Briggs)” - left shows number of companies and right shows market share of the market share of the leader (TSMC, Nvidia, OpenAI…)

but real question based on past infrastructure movements is if the value continues to accrue to the first mover of fast follower in the LT

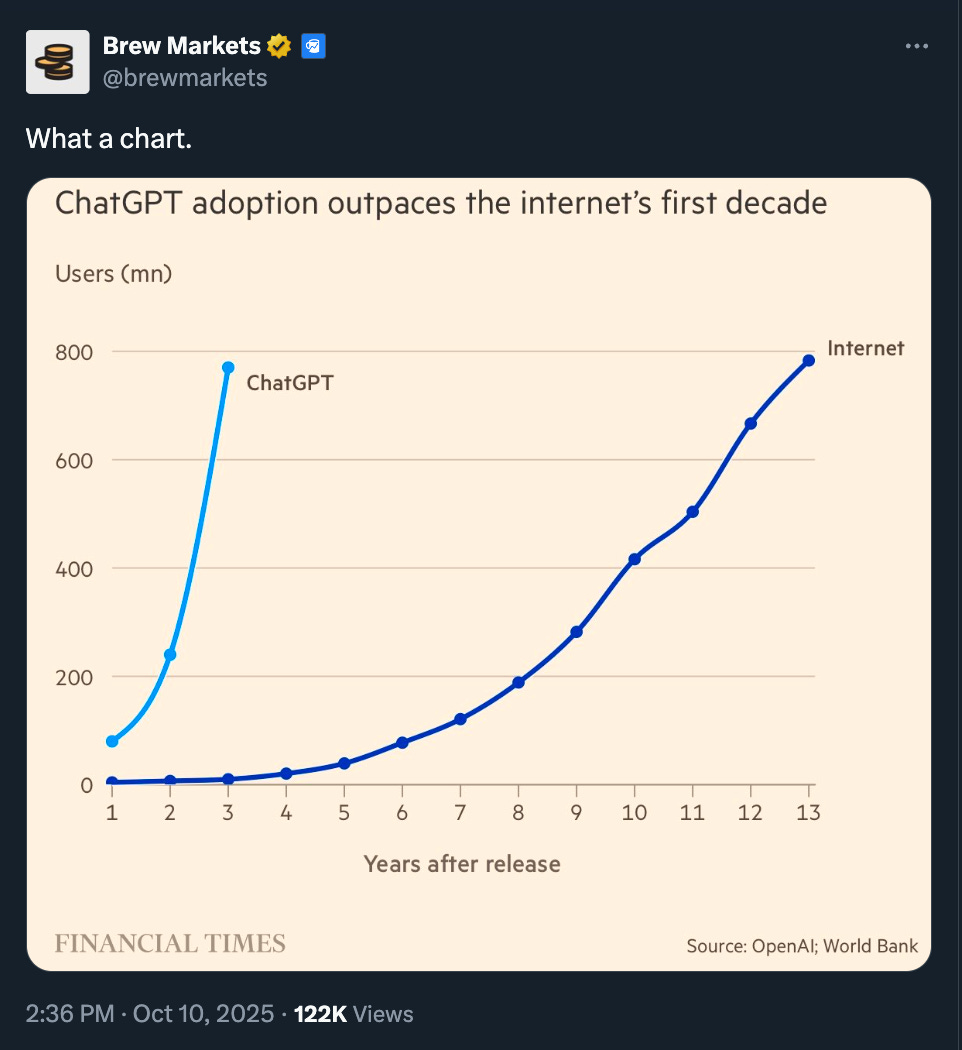

#the world is just moving faster and faster - AI making Internet time feel like dog years

#investing in the future