What’s 🔥 in Enterprise IT/VC #466

Inventing the Future While Serving the Present, shipping right at ludicrous speed

Moats in software are ephemeral and in the AI Native world even shorter. Besides your talent, one of only other moats is speed and velocity. Sure it’s way easier to build that into culture at the Inception round, but it’s simply astonishing how OpenAI continues to grow and ship at insane 🤯 speed.

So many great comments in that X post above and reminds me of one of my favorite movies, Spaceballs.

DoorDash CEO Tony Xu who is running a company valued at $116B shares how they invent the future while optimizing the present. It’s easy to say that innovation matters but the more customers you have the more you have to focus on shorter term roadmap items versus longer term. So how does Tony do it and invest and deliver new products like robots?

Here’s the new robot launched:

Going back to OpenAI, besides shipping and moving fast, Signull shares one of its other superpowers.

So many enterprise founders we back now are asking themselves if they need a consumery version of their offering. Perhaps most do not need one, but what’s clear is that a low friction, PLG motion does have a direct correlation to how fast one can grow. It’s super tough for a top-down enterprise sales co to go from $1-$100M in 12-18 months due to the amount of bodies one would need to sell and deliver these solutions.

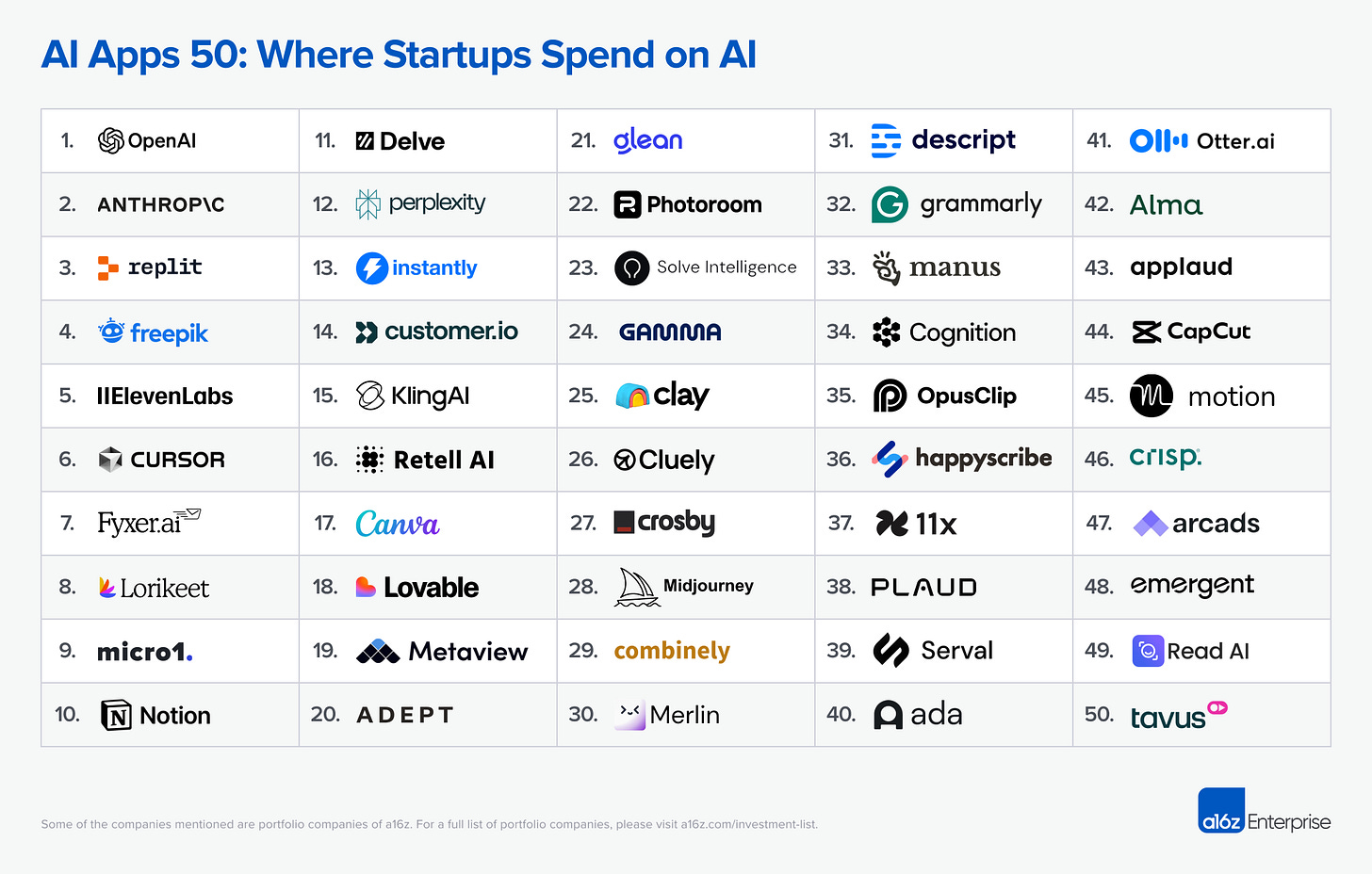

Case in point - most of these Top 50 Apps all have a consumery or easy to use version. Yes it’s startups buying from other startups for the most part but look at these companies. Great to see port cos Clay and Grammarly via Superhuman acquisition on there!

It’s no wonder that OpenAI is now worth $500B and the most valuable private company now.

One last thought - while OpenAI and Anthropic continue to 📈, be mindful of this clip from Jeff Bezos - a must watch! In fact, I watched it 3x!

So keep shipping fast and shipping right no matter how big you are - scale should not be an excuse for complacency.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#yep 👇🏼

#more on startup and investor obssession on revenue or ARR - not all the same!

And Fortune: Founders are using creative accounting to boost lofty ‘ARR’—the hottest startup metric in Silicon Valley

Read my breakdown on this from last week’s issue!

What’s 🔥 in Enterprise IT/VC #465

Back in ZIRP land, the flex was how much you raised. Bigger round = better company (🙄). Now in the AI era, the flex is all about ARR; specifically, how fast you sprint to $100M. Way better metric, but let’s be honest: not all ARR is the same. Some are padded with pilots, contingent contracts, GMV, or one-offs. ARR ≠ ARR.

#Great post for enterprise founders of 10 things learned from founder Aleksandr Yampolskiy, SecurityScorecard, as he scaled from an idea out of our offices on way to 600+ employees, 70% of Fortune 100 customers, and triple digit ARR...

Embedded in all of this is incredible grit as the journey can be rocky at times and passion to win!

#founder ownership after rounds

Enterprise Tech

#repeat after me, for GenAI deployments in the enterprise, the last mile is the longest - notice workflows, deep understanding of them and more…which is why Accenture and consultants continue to rake it in - those are staggering growth numbers helping F500s build and deploy AI into production

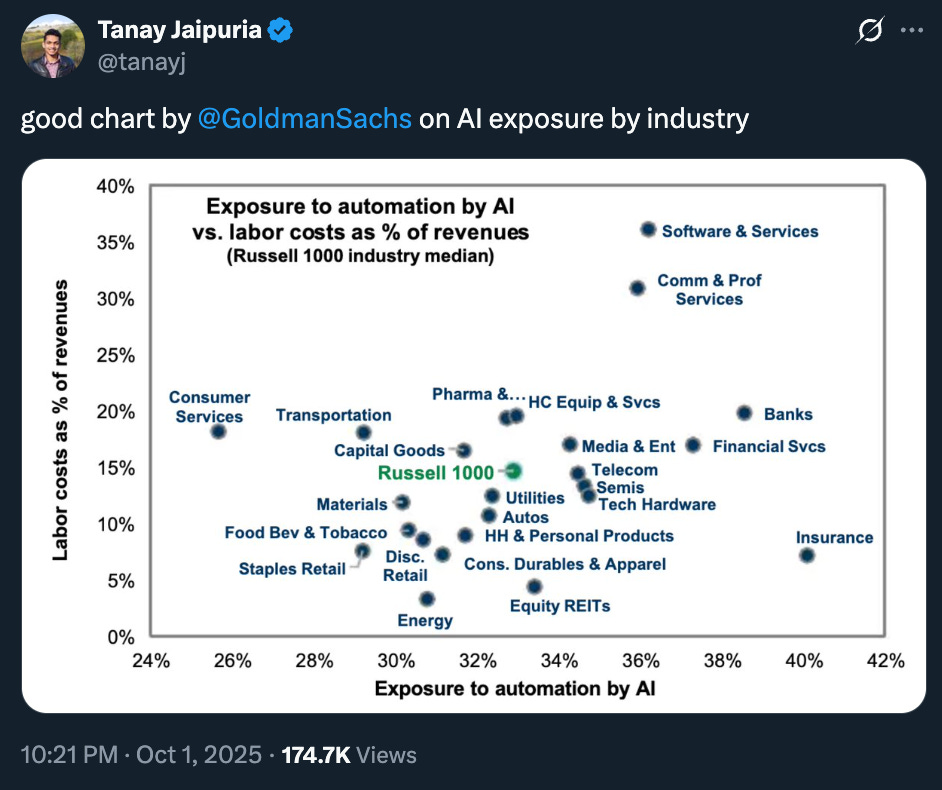

#which industries are most exposed?

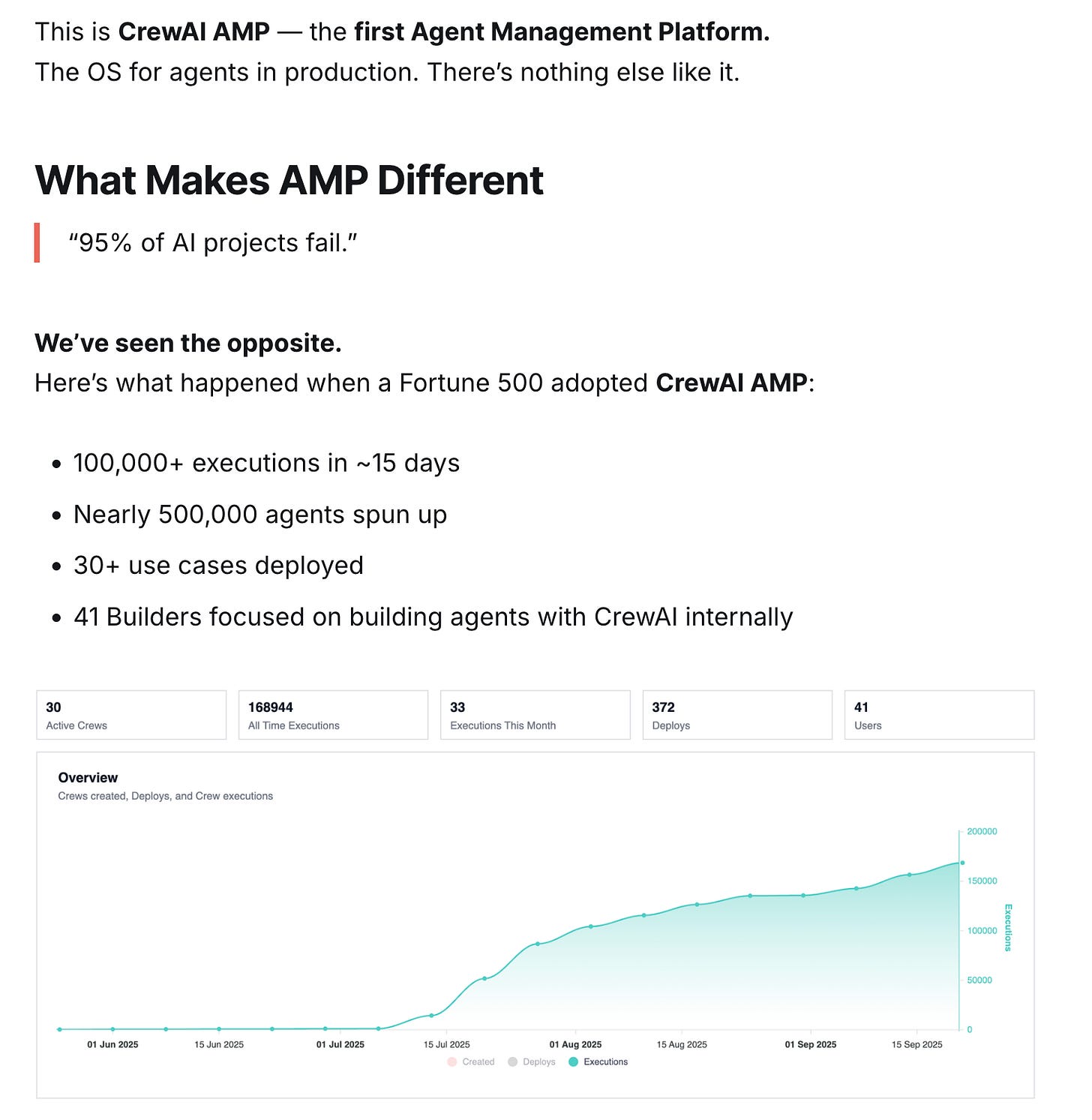

#yes lots of agentic workflows stalling in enterprise, huge launch from CrewAI, a bolstart port co, with CrewAI AMP - the first Agent Management Platform - more here

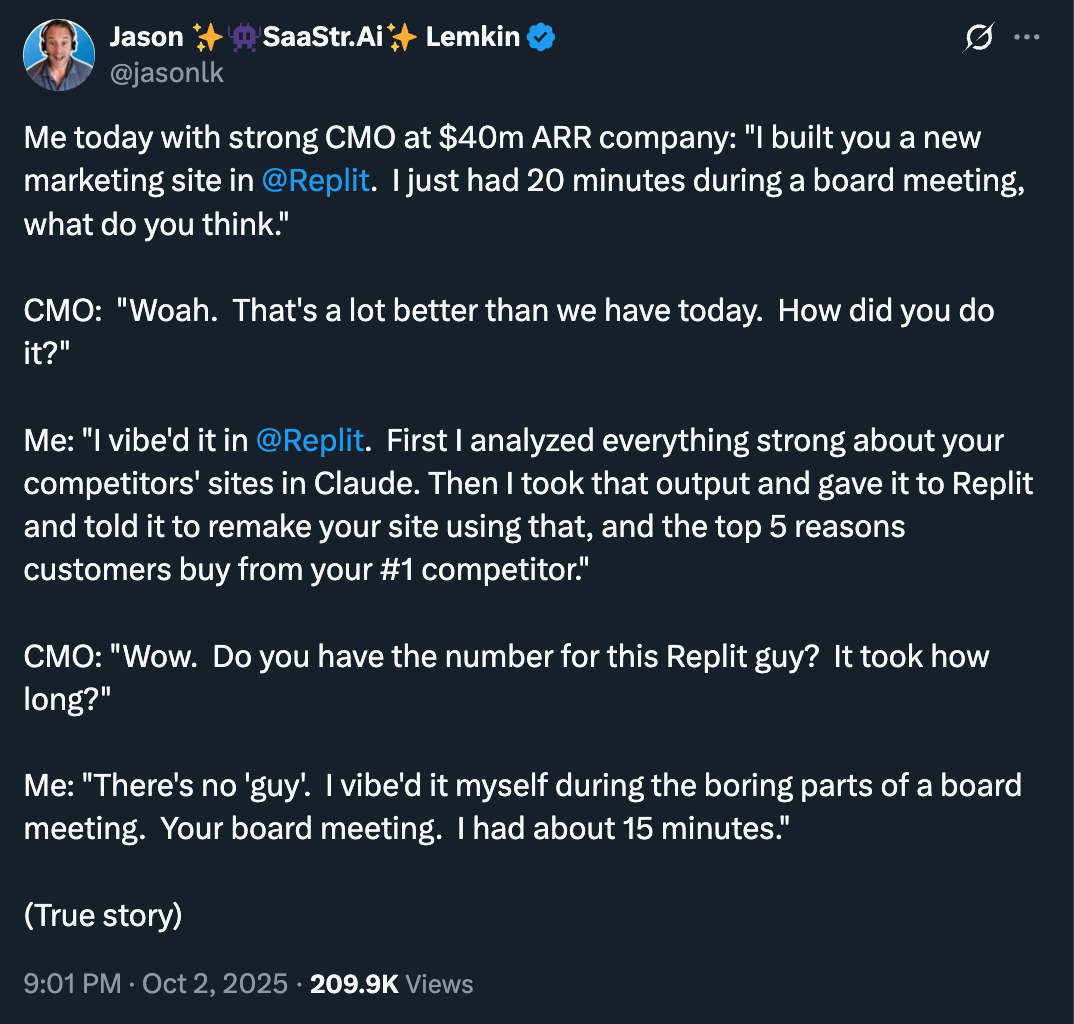

#you can just do things - old school versus new school CMO/exec

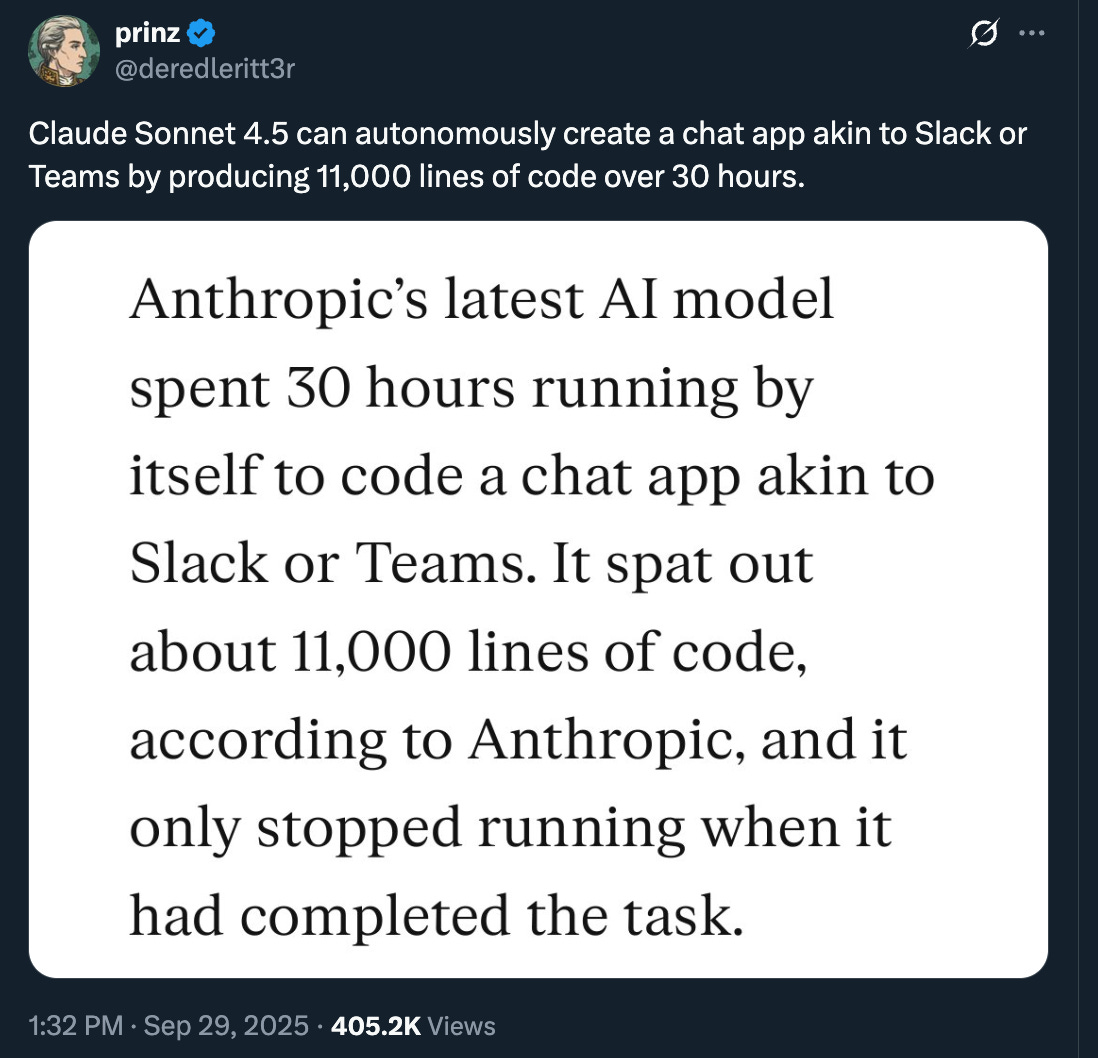

#30 hours continuously running 🤯

#not to be outdone, OpenAI brings checkout to ChatGPT

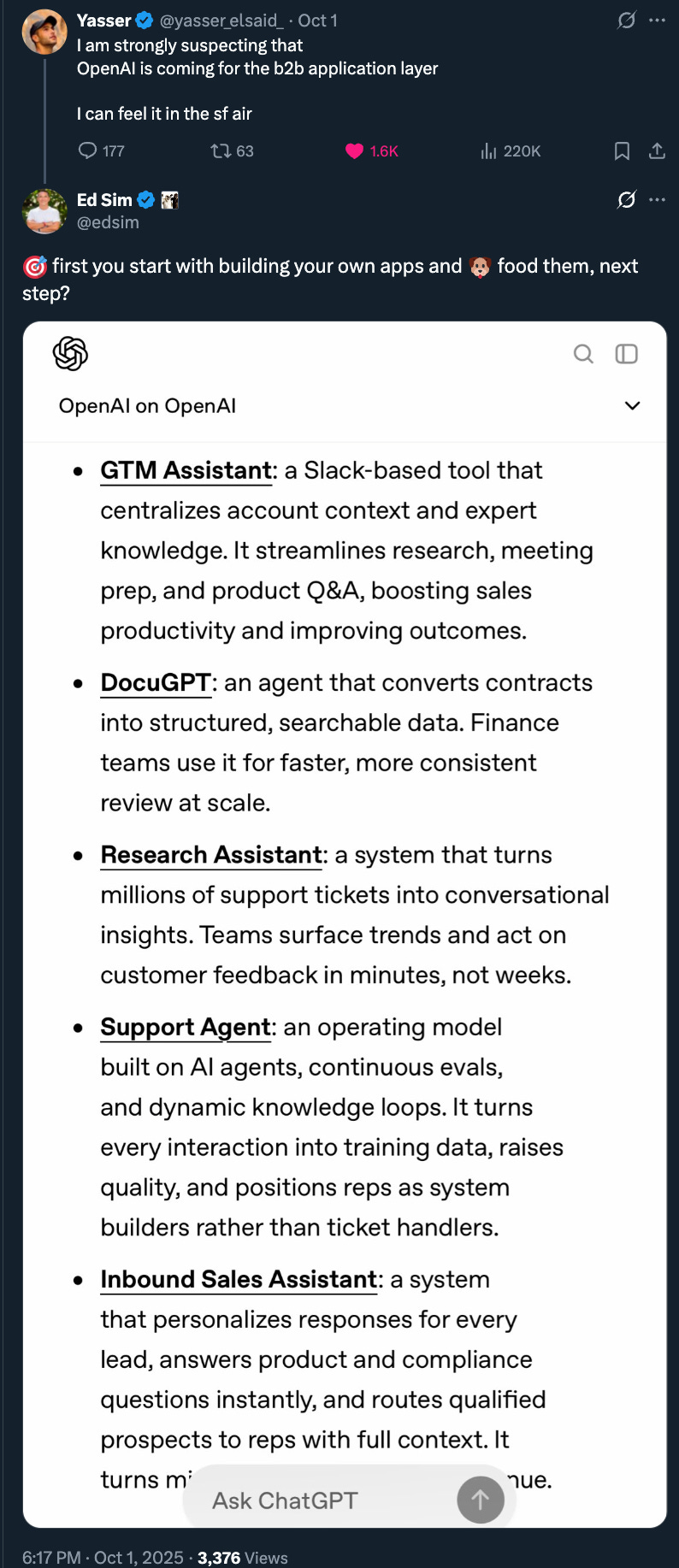

#OpenAI launching apps in future? Me thinks so as well…

#here’s what Mira’s been cooking since assembling a top team and closing a $2B Inception round at $10B valuation

#it’s still early for agents in the F500 - here’s a research note from Deutsche Bank covering the Leaders in AI Summit with speakers from New York Life, JPM, Alaska Airlines, J&J…data prep, data cataloging all still matter!

#how JPM is transforming itself with AI infused into every department - worth a read and yes it does talk about potentially even offshoring investment banking jobs to analysts in cheaper locations who are AI-powered and reducing ratio of senior to junior bankers from 6:1 to 4:1

#💯

#real world AI benchmarks - 👇🏻 watch video and clickthrough

#🤔

#hiring software engineering interns?

#if you’re interested in a history of robotics and what the future looks like, look no further than Rodney Brook’s (the father of robotics) essay titled “Why Today’s Humanoids Won’t Learn Dexterity”

🤖 Dexterity remains elusive: Despite billions in VC funding, humanoid robots still lack the tactile sensing and nuanced motor control needed for human-like manipulation. Watching videos isn’t enough—touch matters.

🧠 End-to-end learning isn’t a silver bullet: Successes in speech and vision relied on engineered front-ends mimicking human physiology. Dexterity demands similar breakthroughs in sensing and data capture, which don’t yet exist.

🦿 Walking robots aren’t safe at scale: Full-sized bipedal robots pose serious safety risks due to energy scaling laws. Today’s locomotion systems are brittle and dangerous in human environments.

🔮 Future humanoids won’t look human: In 15 years, “humanoid” will mean wheeled, multi-armed, sensor-laden machines optimized for task—not form. Today’s designs will be forgotten relics of hype.

#the same goes for robotics - all about the data…

#why you need AEO (Answer Engine Optimization) 👇🏻

#practical tip - create an amazing headshot with Gemini

Markets

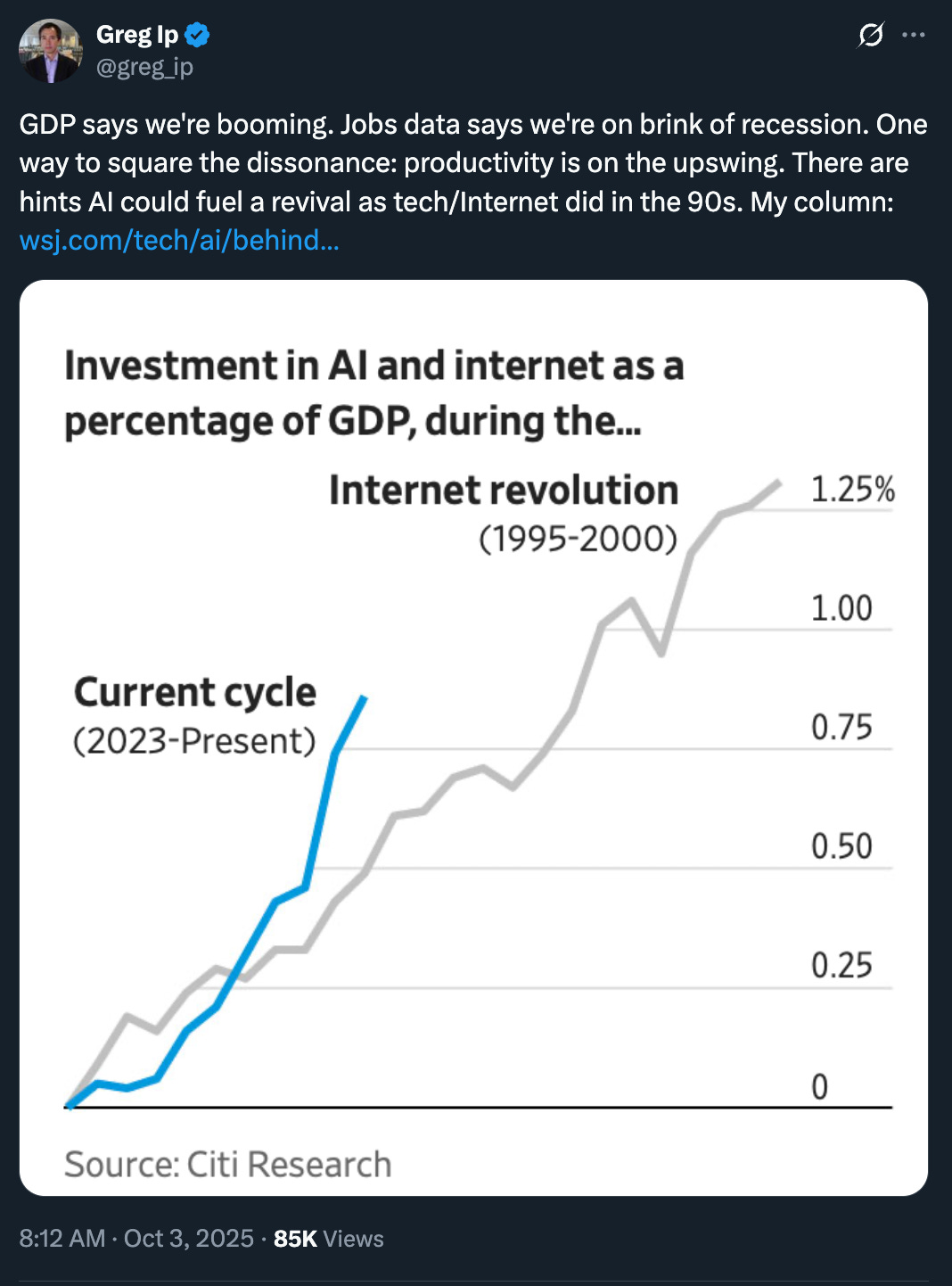

#”Citi estimates annual spending on AI equipment has risen by 0.9% of GDP a year since 2023, a bigger surge than at the equivalent point of the 1995-2004 boom.”

#Wow (Bloomberg)

#👀 Grafana crosses $400M ARR and at $6B valuation (Forbes)