What’s 🔥 in Enterprise IT/VC #462

When exit values flat to last growth financing rounds feel like a win? Are rules for growth rounds changing in the AI era? Feeling bubblicious?

Over the past week, we’ve seen something rare: founders selling their companies just months after raising big growth rounds, often at flat valuations or only modest premiums. In the past, if you raised a growth round at a lofty price, it was almost an unspoken rule that you wouldn’t sell so quickly unless it was a significant premium. With plenty of cash in the bank and lots of runway, founders pitched investors on the long haul: building something massive with huge upside no matter the entry price. In the AI era, that rule is evaporating.

The speed of these deals shows bubble-like tendencies. Companies raise at significant forward multiples and valuations on the promise of a massive future, then exit months later before that story is tested. It’s a sign of how fast capital is cycling and how momentum, not milestones, is driving decisions. While not yet a full-blown bubble, the pattern feels eerily familiar and is one to watch.

First we have Statsig which was bought by OpenAI for $1.1B. Iconiq just led a $100M round of financing at a $1.1B valuation which was just announced in May this year. Here’s Iconiq’s post celebrating the acquisition:

And on Thursday, Atlassian announced the acquisition of The Browser Company for $610M just a year after announcing its latest round at a $550M valuation. This is a 10% premium, but this may also include stock options for future employees so could have been a flat exit as well.

Both exits are phenomenal for the founders and early backers!

In Statsig’s case, converting private stock into OpenAI equity delivers immediate liquidity and meaningful upside, a healthy multiple most would celebrate. For The Browser Company, the story is about competitive threats and DPI: later stage investors may be able to recycle capital into better opportunities, and even a 1x return is welcome in a market starved for liquidity. With little to no revenue and intense competition in the browser space, selling now at a high multiple was likely the perfect time.

These examples highlight the tension founders face: balancing near-term liquidity against the vision of building for the long haul. At boldstart, we strongly support founders taking some liquidity along the way. The amounts vary case by case, but it gives them the freedom to think long term.

However, it’s not a perfect solution. Even if founders get earlier liquidity, sometimes the multiples and dollar amounts are so big that it’s hard to say no. When you look at $1.1B and $610M I’m sure these are life changing events for the founders and of course, inception and earlier stage investors. The only other solution, which IMO is a terrible one, is that some growth investors are putting in veto rights where founders can’t sell unless these last round investors receive a minimum return like 2-3X. Don’t go down that path. If you raise at a fair market price, you’ll get market terms; but if you stretch just for valuation, you risk picking up clauses like this that can create real friction.

In today’s world, markets are moving faster than ever as what once looked like a less competitive landscape can change overnight with new, well funded rivals emerging and building similar offerings at speed. When founders raise capital well ahead of milestones, the reality is that many companies would need years to grind it out and grow into the lofty valuations of their last rounds. In this environment, when founders and early investors get the chance to exit, sometimes the smartest move is to hit the bid, even if late stage backers see little near term upside. That is why in today’s AI era, flat can mean survival, and in the right circumstances, even a massive win.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#important 🧵 for VCs and founders - every VC is striving for one of the Top 10 - “Across these 10 funds, just eight companies drove the vast majority of gains: Wiz, OpenAI, RocketLab, Figma, Robinhood, Revolut, Xiaohongshu, Circle” but to be clear with smaller fund sizes you don’t need a $20B outcome to drive significant returns

#Agree or disagree? In the enterprise space, I prefer deep enough vs. pure broad but yeah AI turbocharging a lot of learnings in a compressed time

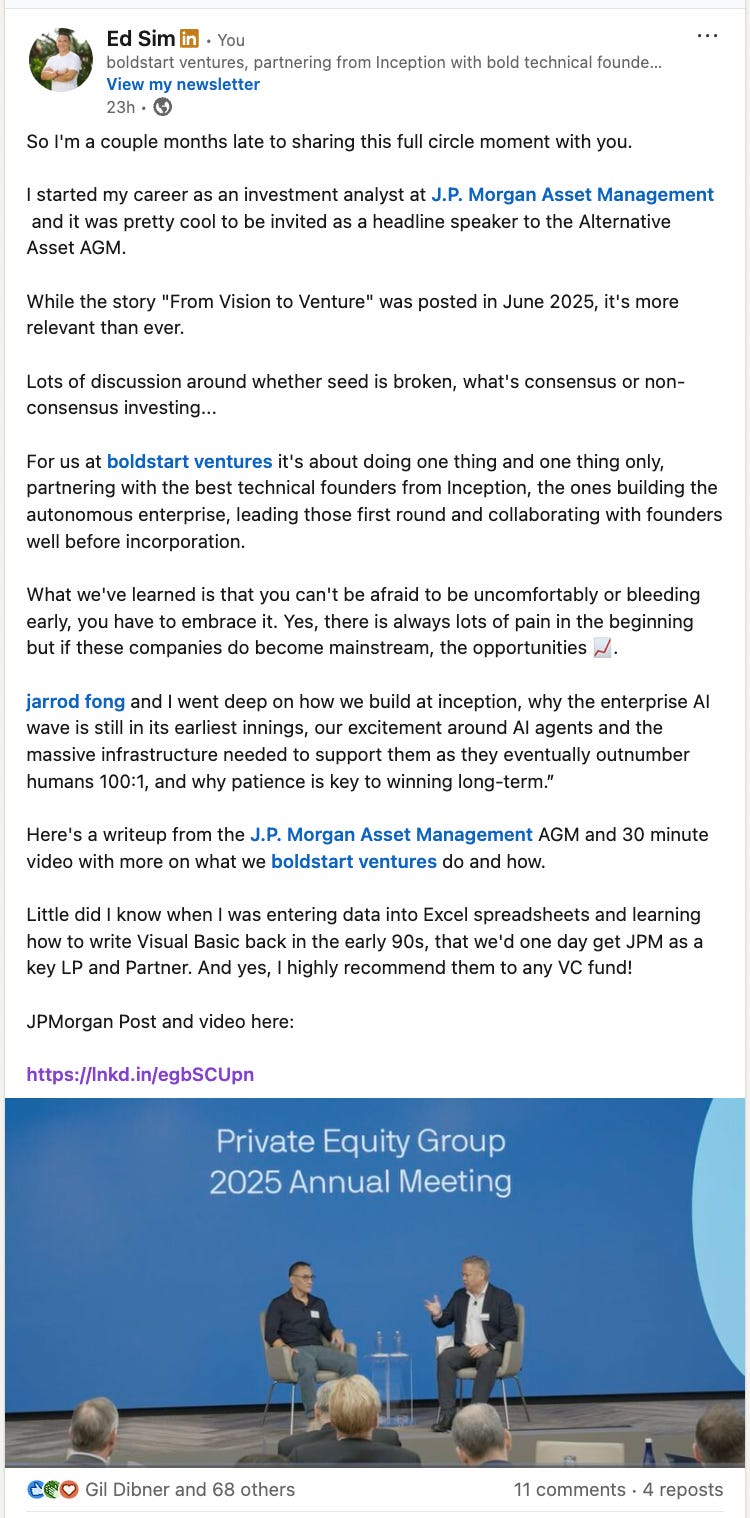

#a full circle moment for me and also deep discussion into why Inception investing matters and what I’m excited about

Enterprise Tech

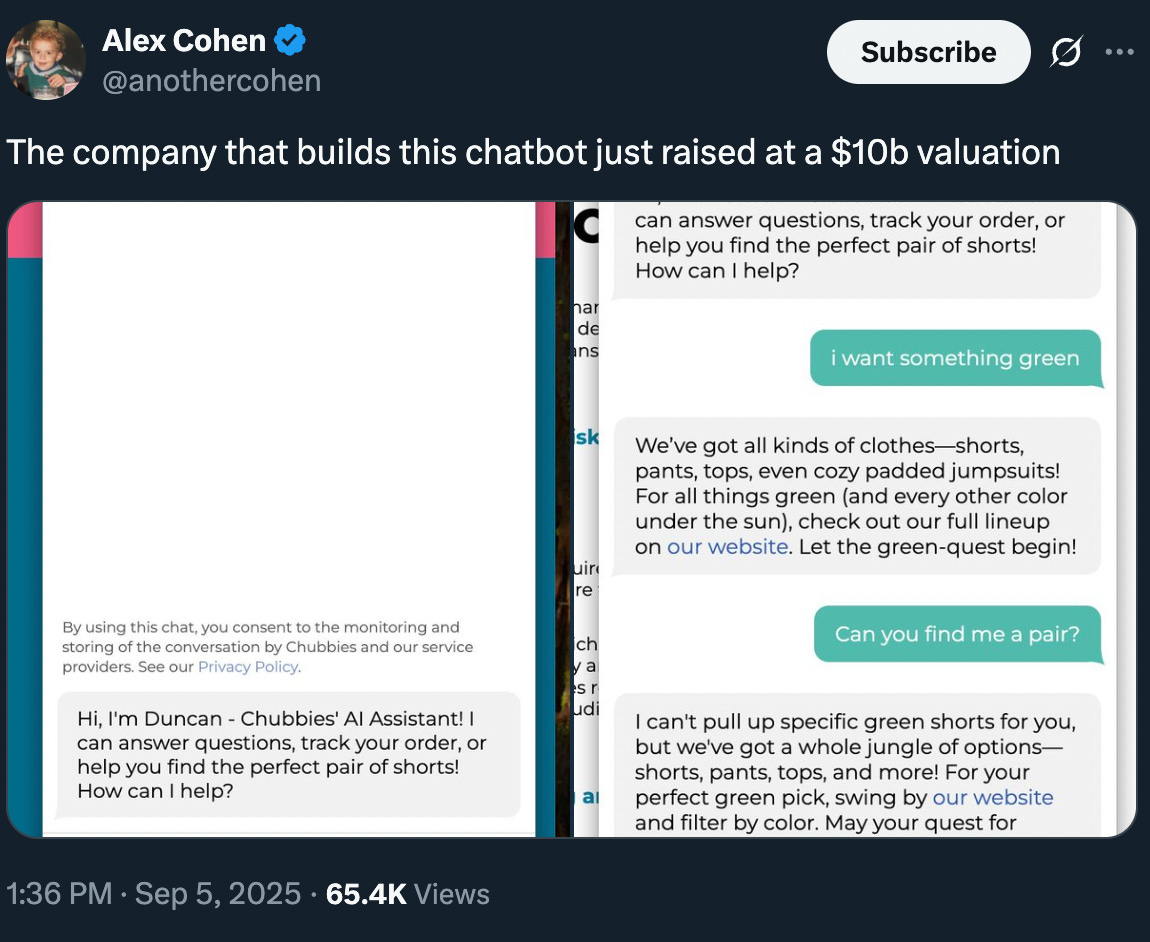

#besides coding, customer support is one of hottest areas for AI adoption - here’s Sierra, founded by Bret Taylor former Salesforce Co-CEO, rumored to be raising at $10B valuation and at $100M run rate a year after raising at $4.5B (Axios)

Sierra, which builds custom AI agents for enterprise customer service, is nearing a deal for a $350 million financing round that values the two-year-old startup at $10 billion, a source tells Axios.

Sierra previously raised $175 million at a $4.5 billion valuation last October.

The new round, like the previous one, will be led by Greenoaks Capital.

By the numbers: Sierra is on track to exceed $100 million in enterprise annual recurring revenue, per the source.#check ou

#still so early for agents in the enterprise - 1 min clip below 👇

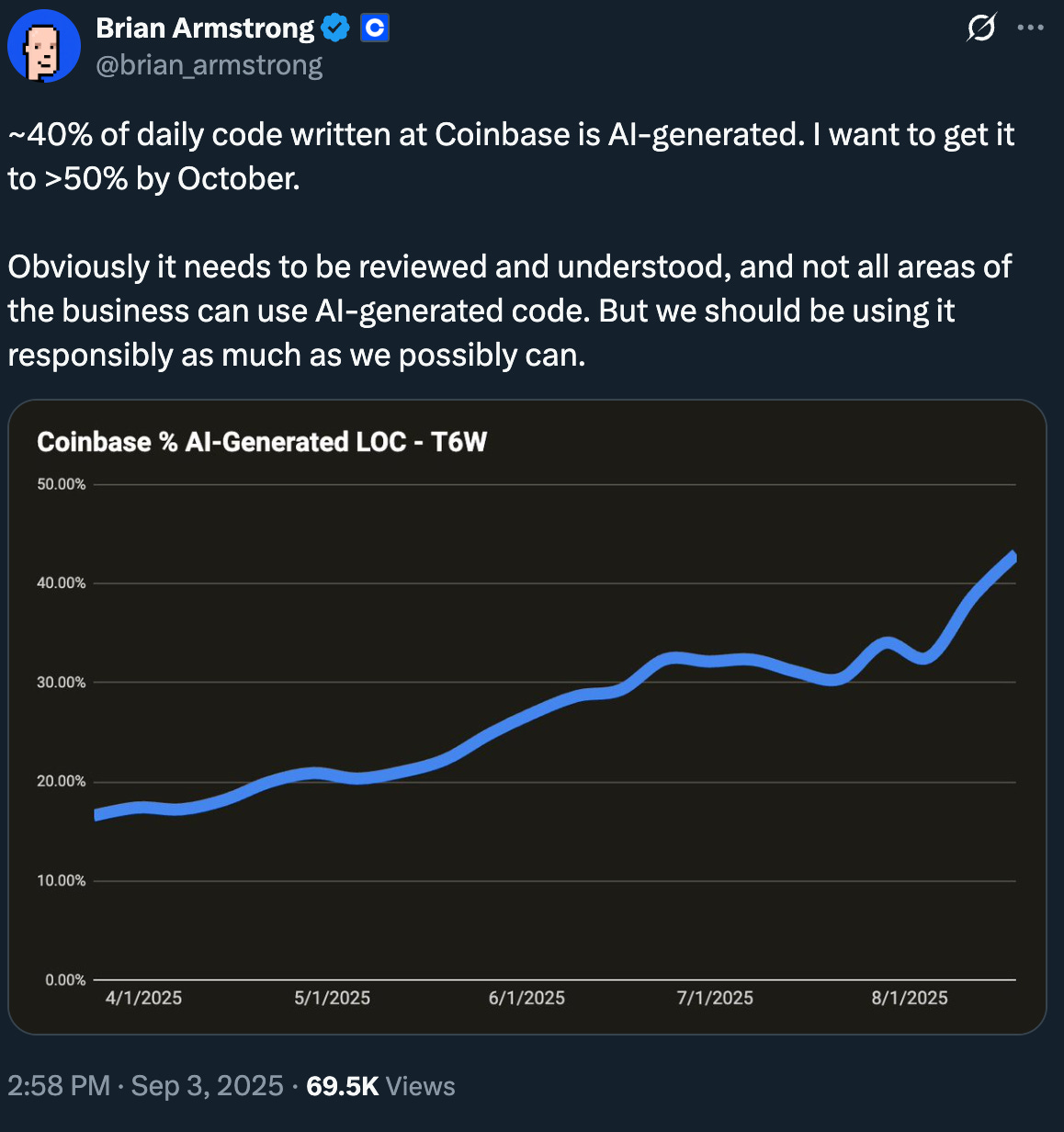

#😲 40% of all code at Coinbase daily written by AI - blog post here with more details + 👇🏻 click for comments

In looking across the company, we find that teams that adopt LLMs at a faster rate are building frontend UI features, working with less-sensitive data backends, and quickly expanding their unit testing suites. Additionally, rapidly-developed greenfield products benefit greatly from the increased speed of LLM-based workflows.#Forbes Cloud 100 is out and lots of familiar names with OpenAI, Anthropic, Stripe and Databricks as Top 4. AI Native cos made the list mostly at bottom but Cursor debuted at Top 10. 🔥 up for boldstart port cos Snyk and Clay to make the list along with Grammarly (acquired our port co Superhuman) and Automation Anywhere (acquired port co FortressIQ) also listed

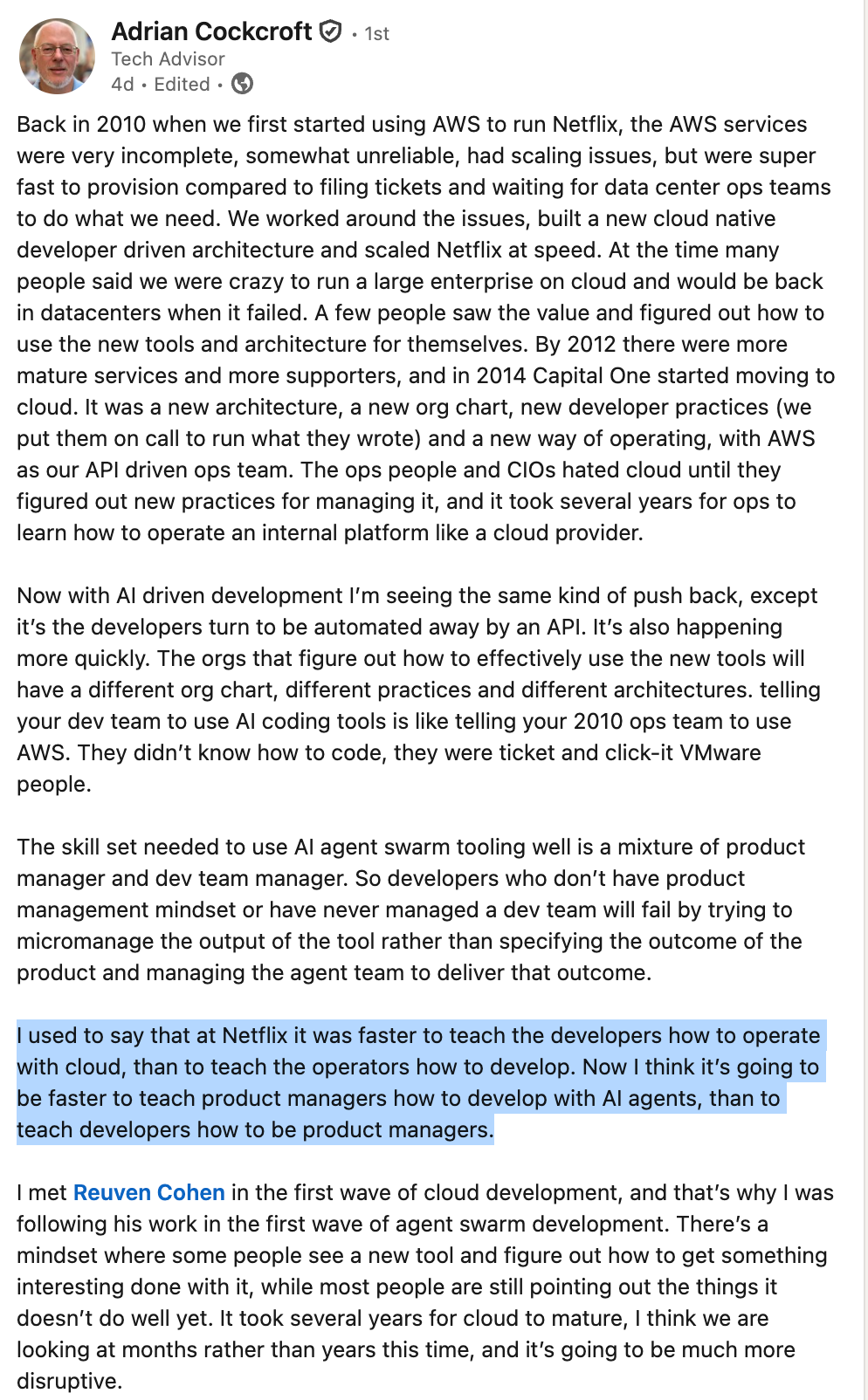

#🤔 For those of you who don’t know Adrian, he’s a technologist best known as the cloud architect who led Netflix’s pioneering migration to AWS and later serving as VP of Cloud Architecture Strategy at Amazon Web Services2.

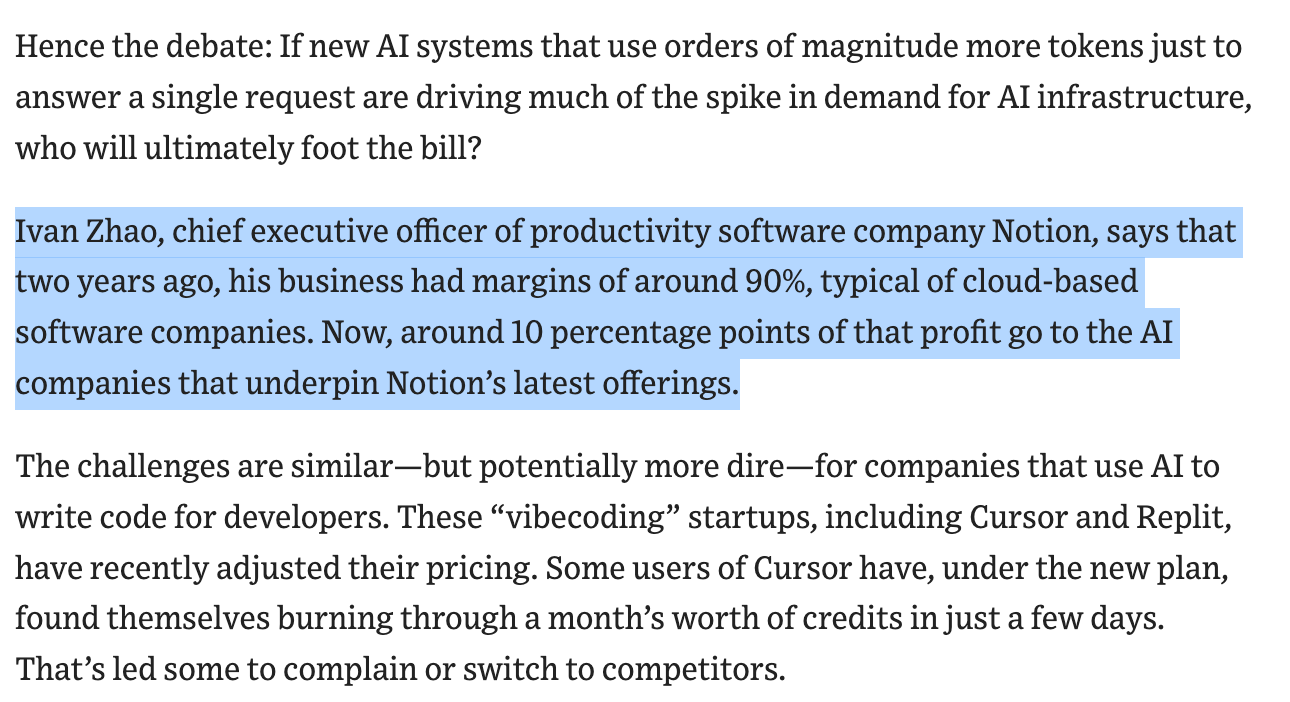

#Here’s another story from Chris Mims at the WSJ about the value accruing to the model providers - Cutting-Edge AI Was Supposed to Get Cheaper. It’s More Expensive Than Ever (WSJ).

#OpenAI continuing to go after every massive potential use case - can’t wait to see as they come after the finance bros! and Linkedin - spreading itself too thin?

#Important service announcement on agents, identity, and understanding good vs bad traffic

#VC 💰 straight from LPs to pay for lawsuit to pay authors to tune of $1.5B!

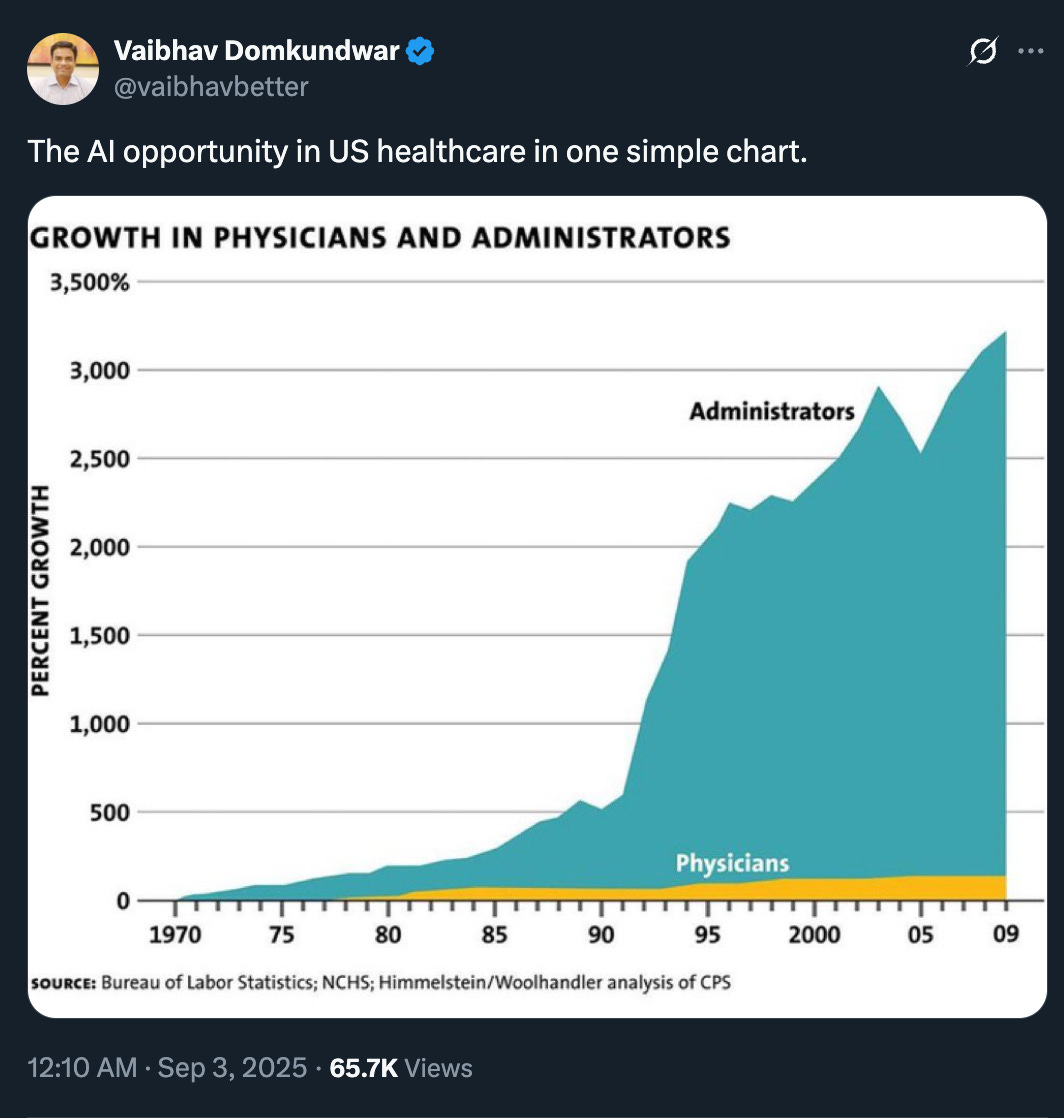

#💯 lots of paper based workflows to be automated

#having a Vector database investment was all the rage just a few years ago but of course, was not obvious how this would play out as model providers added their own capabilities as well as cloud providers - it’s so hard to invest in infrastructure in AI as the world is moving so fast - curious to see how this plays out…”Top-Funded AI Database Startup Pinecone Considers a Sale” (The Information)

In recent months, leadership at Pinecone, which was founded six years ago, has talked to investment bankers about potentially finding a buyer, according to a person familiar with the talks. The company’s leadership has also received interest from some companies about a potential takeover, according to a second person who has spoken to them. It’s not clear how far any of the talks have progressed.

Database providers Oracle, IBM, MongoDB and Snowflake, all of which offer vector database technology, could be among the potential acquirers, according to people who work at some of these companies. In theory, an acquirer could use Pinecone’s software to augment or upgrade its existing vector database features.

A sale could resolve pressure on Pinecone’s business. At the end of last year, it lost one of its biggest customers, productivity app Notion, according to a person with knowledge of the situation. Before leaving, Notion had been spending between $4 million and $5 million annually on Pinecone’s vector database services, the person said. Notion is now using services of a startup called Turbopuffer, the person said.#to top it off, 💪🏻 and huge congrats Mehdi - the definition of perseverance and yeah, we did OK 😄

Markets

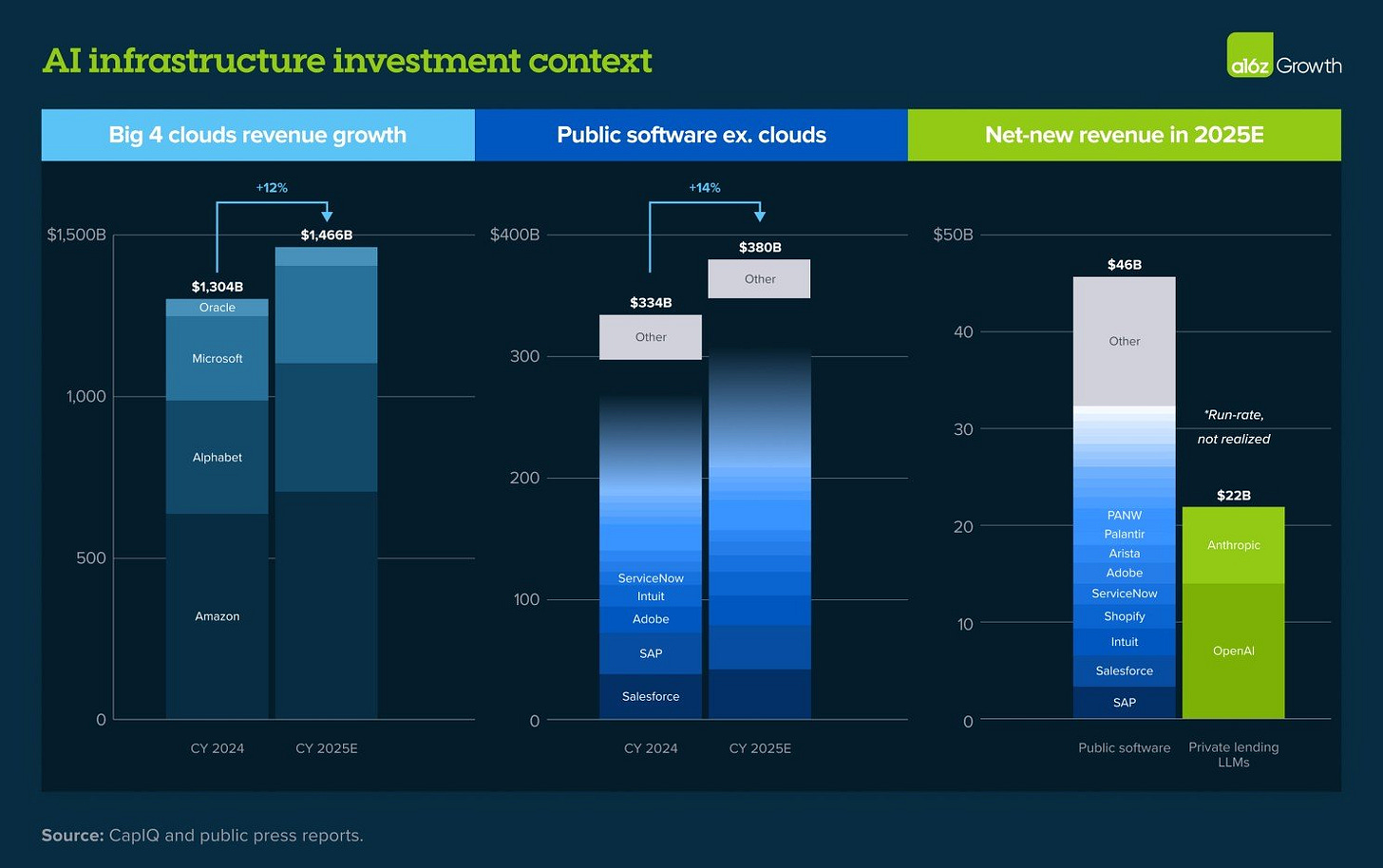

#pretty insane chart below shows why many fear SaaS is hurting - OpenAI & Anthropic adding ~1/2 the new revenue of all public SaaS ex Mag 7 this year 🤯 (source: Alex Immerman at a16z Growth):

Tech has eaten everything, tech is the fastest growing sector, the fastest growth is in private mkts.

<5 public tech co's expected to grow 30%+ in '26. Nearly every private co we see tops that

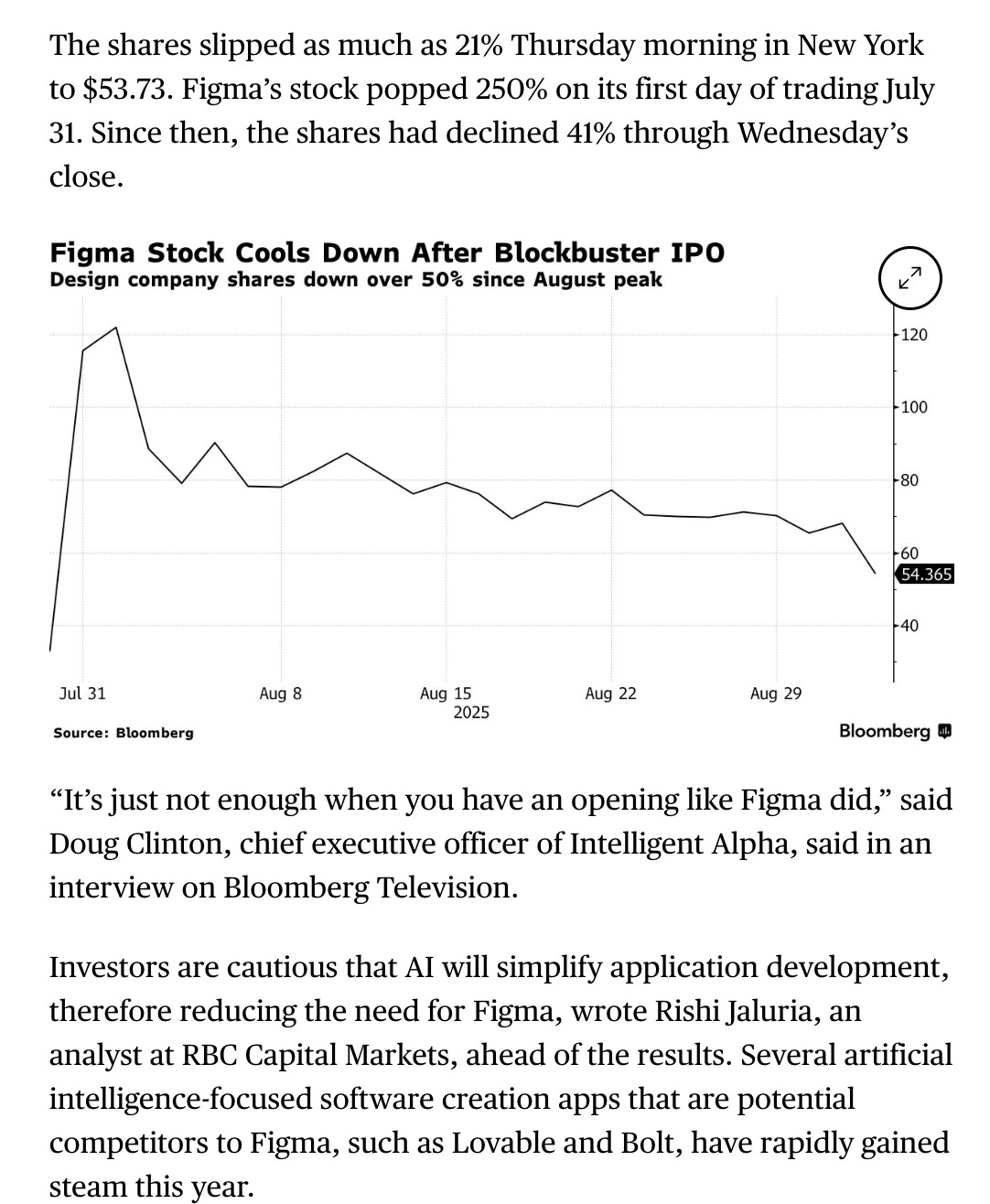

OpenAI & Anthropic adding ~1/2 the new revenue of all public SaaS ex Mag 7 this year#it’s always so important to overdeliver in the first 2 quarters post IPO especially as lockups expire and investors and employees can sell. If you’re priced to perfection like Figma and feel the looming threat of AI, even 41% YoY growth won’t cut it if you forecast decelerating growth 👇🏼 in future quarters - down 21% down but still well above IPO price of $33

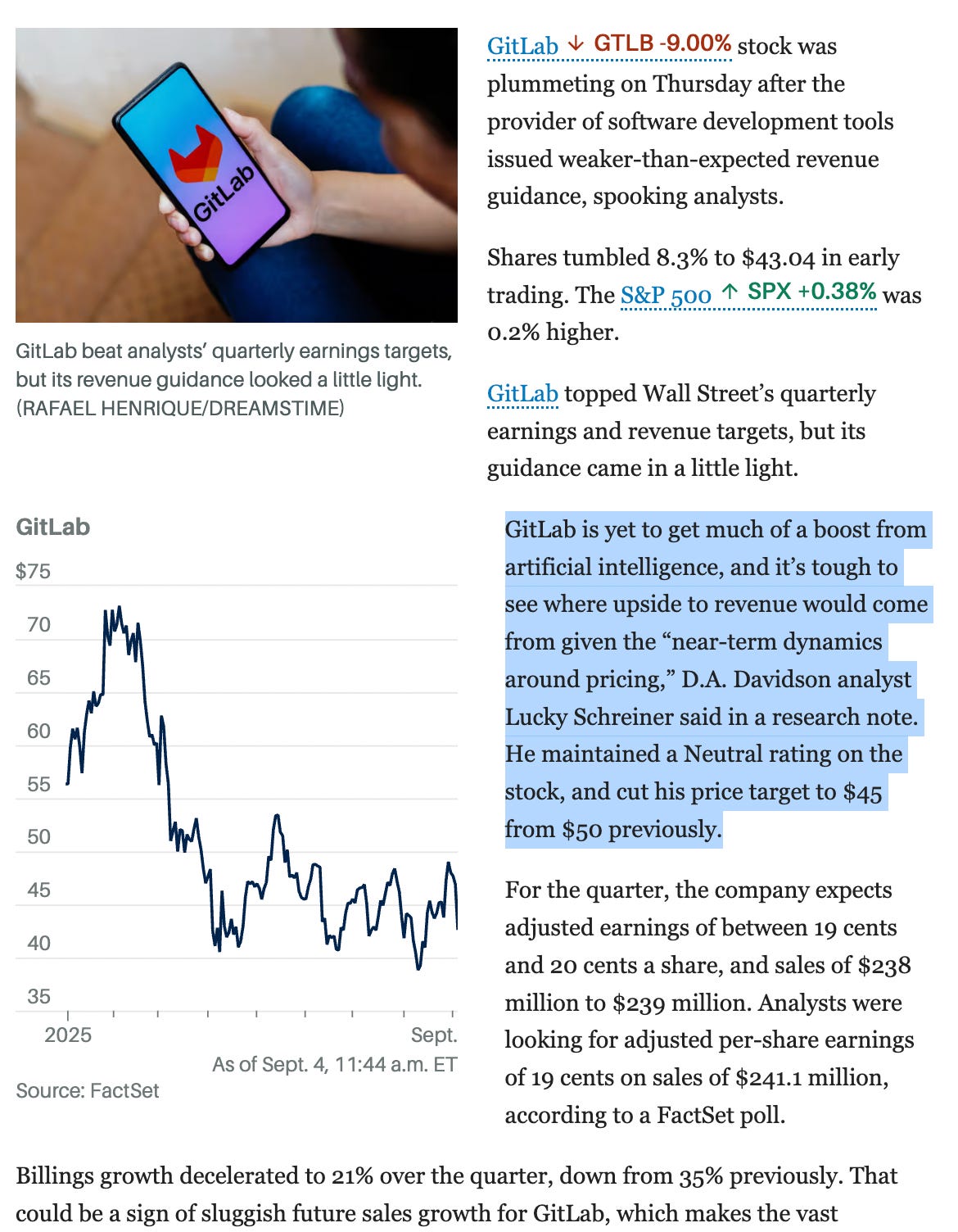

#despite an earnings beat, Gitlab without an AI story and lighter revenue guidance = 📉