What’s 🔥 in Enterprise IT/VC #457

The moment we've all been waiting for, Enterprise AI Gold Rush Week: Azure Soars, Agents Swarm, $25B Secures the Machine Era

👇🏻 this is the moment we’ve all been waiting for…

Here’s Zuck on the race for superintelligence - it’s coming sooner than we think!

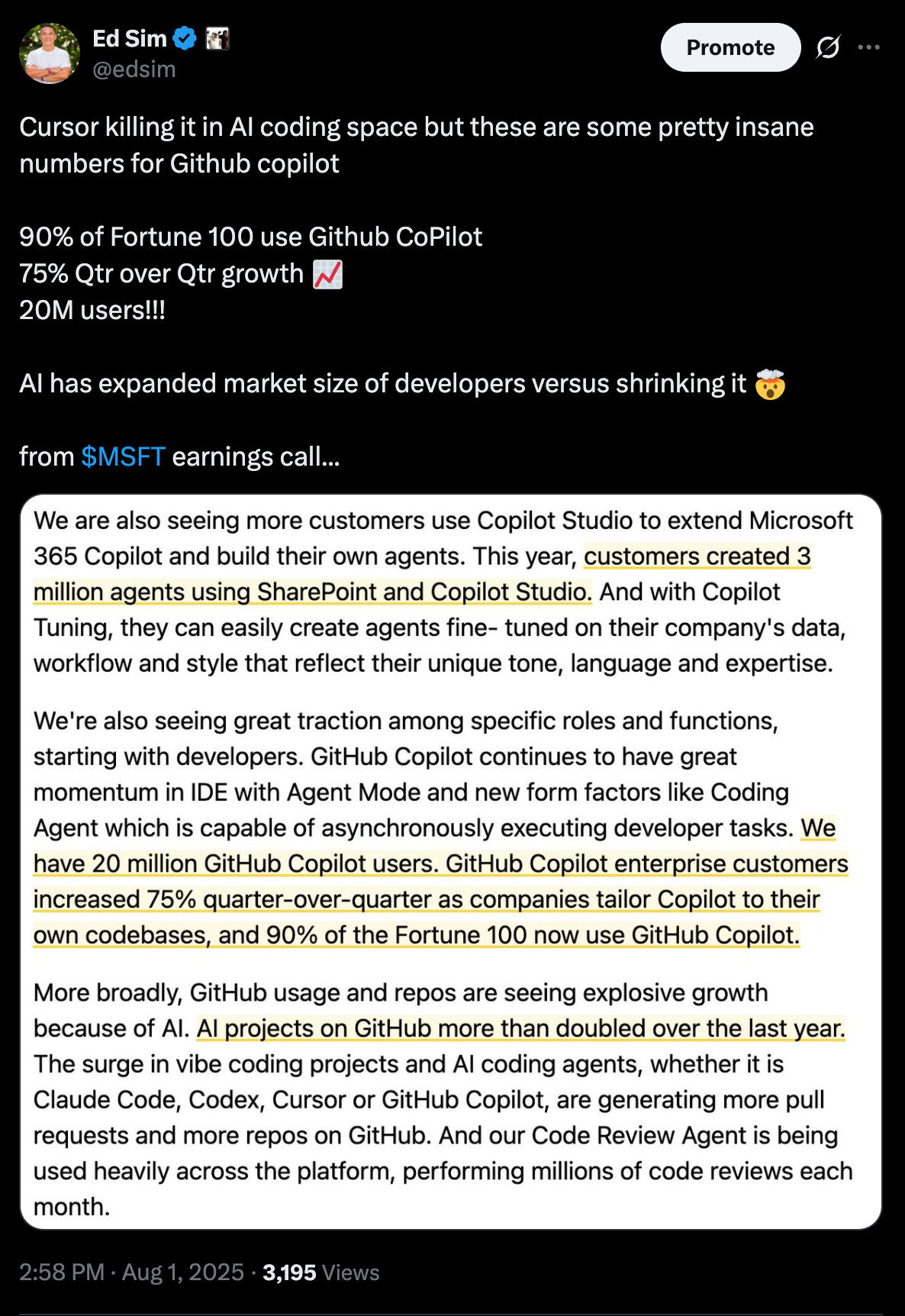

Here’s Microsoft chiming in on Github Copilot growth and agents

These results and comments from both Meta and Microsoft show monetization is just starting, but that we’re also so early in the AI boom. As you know, what gets me even more excited is the agentic opportunity to eat into labor workflows. Notice above - Microsoft customers created 3 million agents using SharePoint and CoPilot Studio. This is just one example of the agentic opportunity ahead.

Here’s yet another from portfolio co CrewAI which just announced it crossed an average of 300 million agent workflows per month, yes per month!

and it just partnered with PWC with a global rollout to move agents from prototype to production!

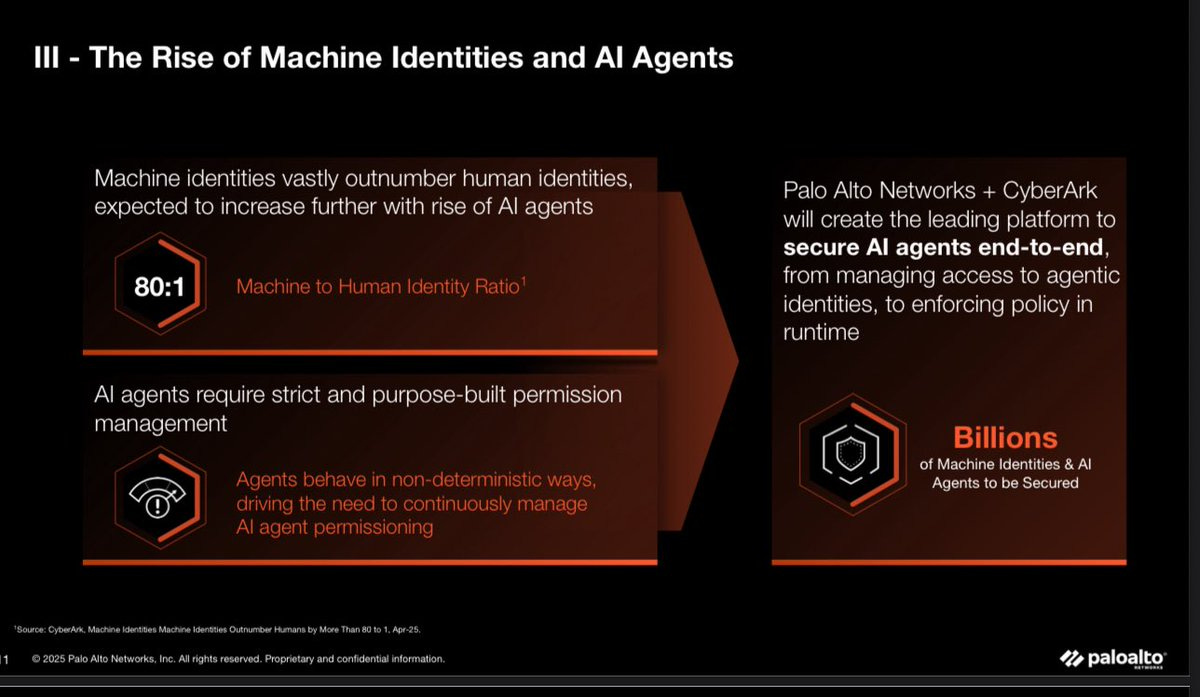

Finally, if there was ever any doubt that agents and machines are taking over the enterprise, I can give you $25 Billion reasons to prove it. Palo Alto Networks just announced its largest acquisition ever purchasing Cyberark for $25 Billion. At 17.8x forward NTM multiple, its astonishing what Palo Alto Networks is paying for kind of a legacy vendor. That being said, Global 2000 customers love Cyberark and it has done a great job positioning itself for the machine era. Here’s one of the money slides:

Here’s more from Palo Alto Networks:

We’re excited to announce the entry into a definitive agreement to acquire @CyberArk, to give AI the right access, not *all* the access. See how we're securing the new workforce of AI agents.

As I’ve aways said, there is no AI in the enterprise at scale without AI Security, and this is the watershed moment for agents. Every CISO I talk to is starting to worry about when agents F*** up at scale. Guardrails (like last week’s post) are needed and Palo Alto Networks is making a huge statement.

Palo Alto Chairman and CEO Nikesh Arora said in an interview with CNBC’s “Squawk on the Street” on Wednesday that the company is entering the identity market as it hits an inflection point, which has always been its strategy.

“They are poised to go and disrupt this market and create the platform we need and also solve the upcoming problem with agentic AI,” he said. “From all those factors, we believe this is the right time to do something like this and be ready for the market in the next 12 to 18 months.”

These are the second order effects I keep talking about - if X happens like AI code is everywhere or agents run amok, then what is needed?

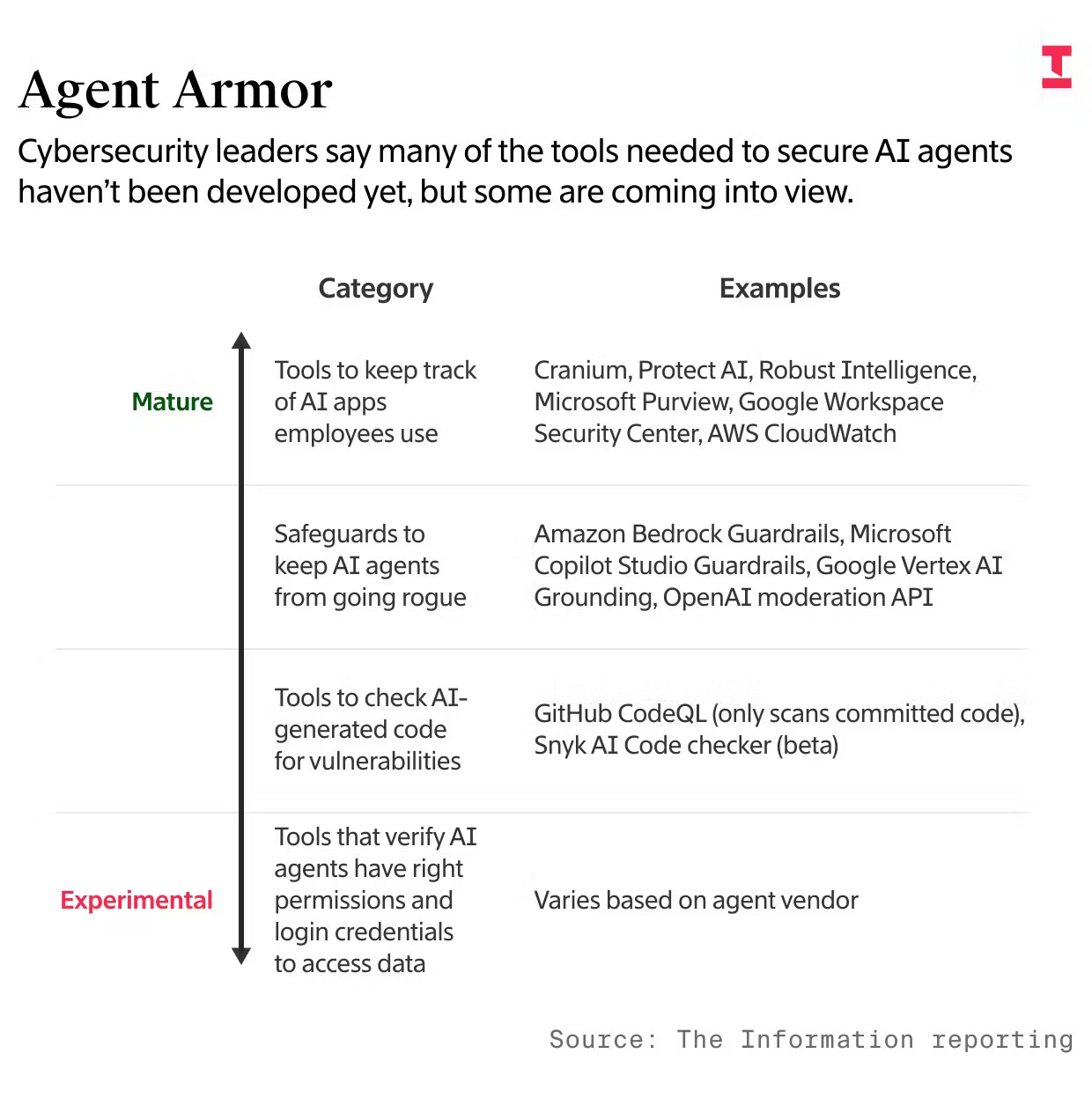

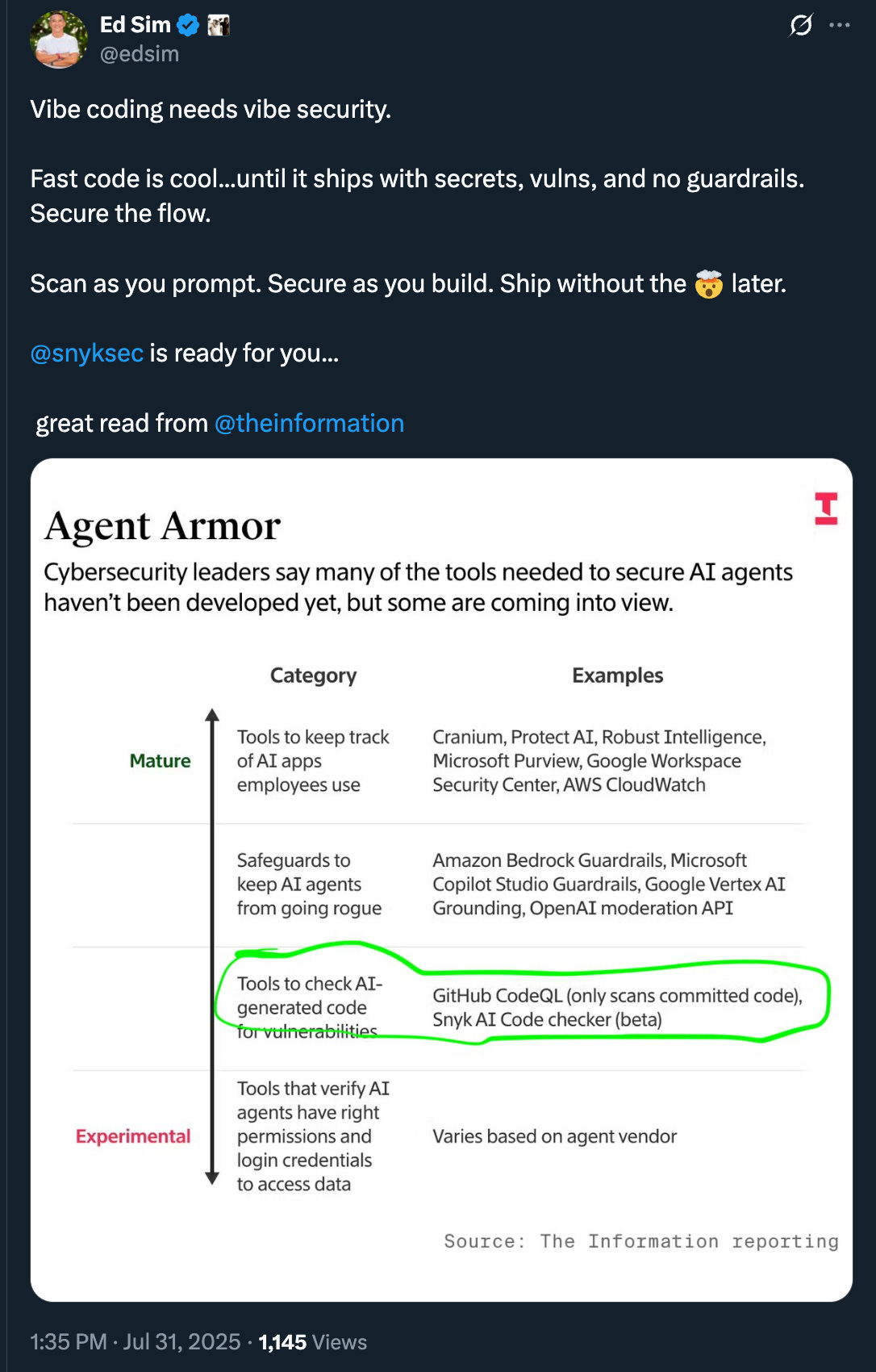

The Information also came out with a timely piece on the same day of this acquisition with an article titled, “AI Threats Raise Demand for Cybersecurity Products That Don’t Exist (Yet)”.

It’s great to see two of my portfolio companies on this list with Protect AI in the more mature bucket at top (bought by Palo Alto Networks for $700M) and Snyk who is a leader in AI code scanning closer to the experimental phase.

And yes, there are still tons of opportunities for founders to build. Grant Miller sums it up well here:

We concur, and as we mentioned in our boldstart ventures fund vii announcement, the autonomous enterprise is coming and this is what’s required.

The Autonomous Enterprise: A Generational Rewrite

We are in the earliest stages of a platform shift that will surpass both cloud and mobile, and it is already beginning to reshape the enterprise. This next wave is not just about automation. It is AI-native, agent-powered, and autonomous by design.

It will not happen overnight. But over the next decade, humans will do less and less, while software, agents, and machines will think, plan, and act on our behalf.

We are backing the core primitives of this shift:

AI-native infrastructure, orchestration layers, secure identity, optimized compute, and semantic interfaces.

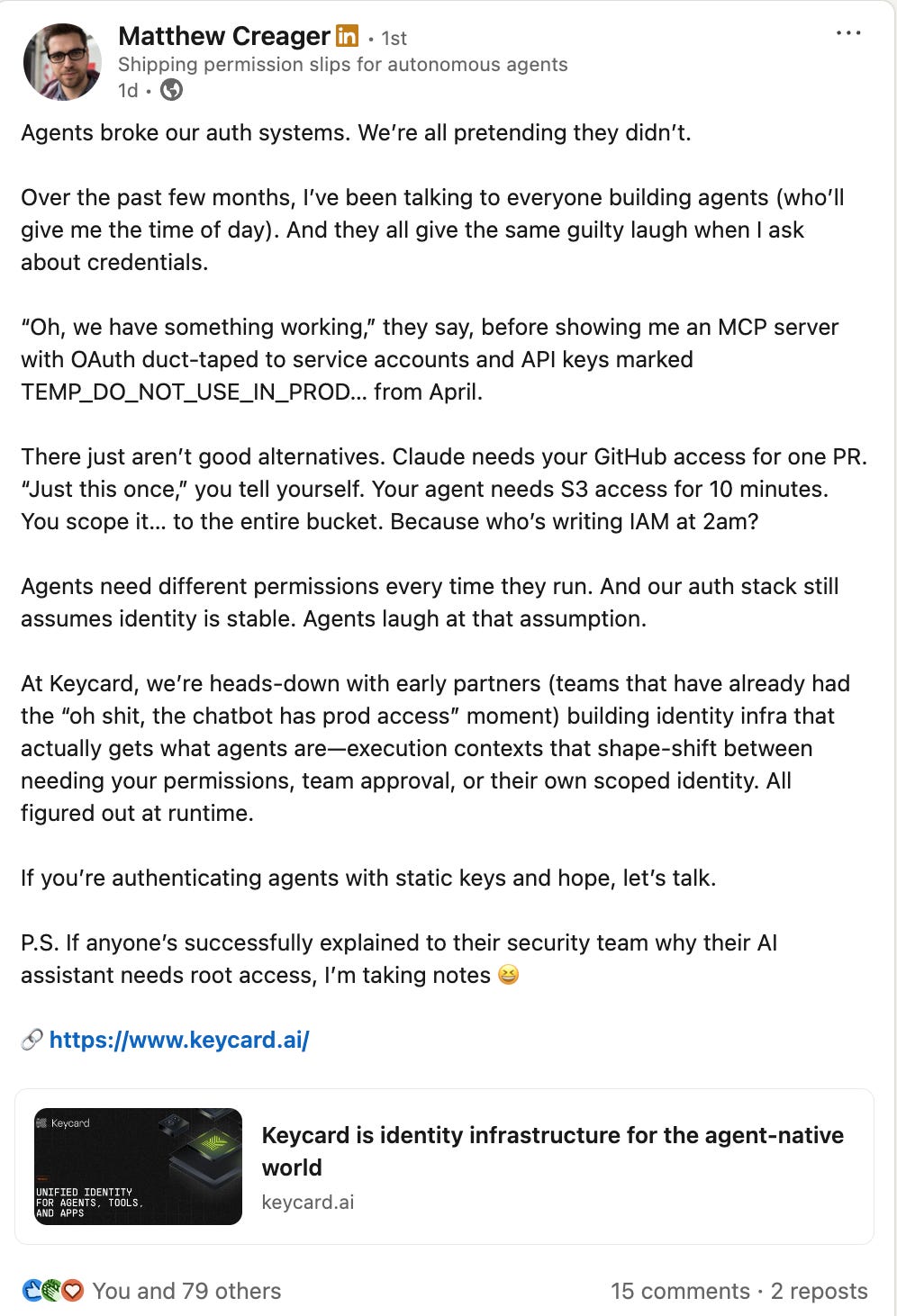

This is also why I’m 🔥 up about companies like Keycard.ai which is presenting at Black Hat next week. The founders are from Snyk and Auth0 and know identity and developers.

Here’s more from Creager on the need for bottom up authenticaion and authorization for agents.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#👇🏻

#💯 just the beginning

#great reminder

#👌🏻

Enterprise Tech

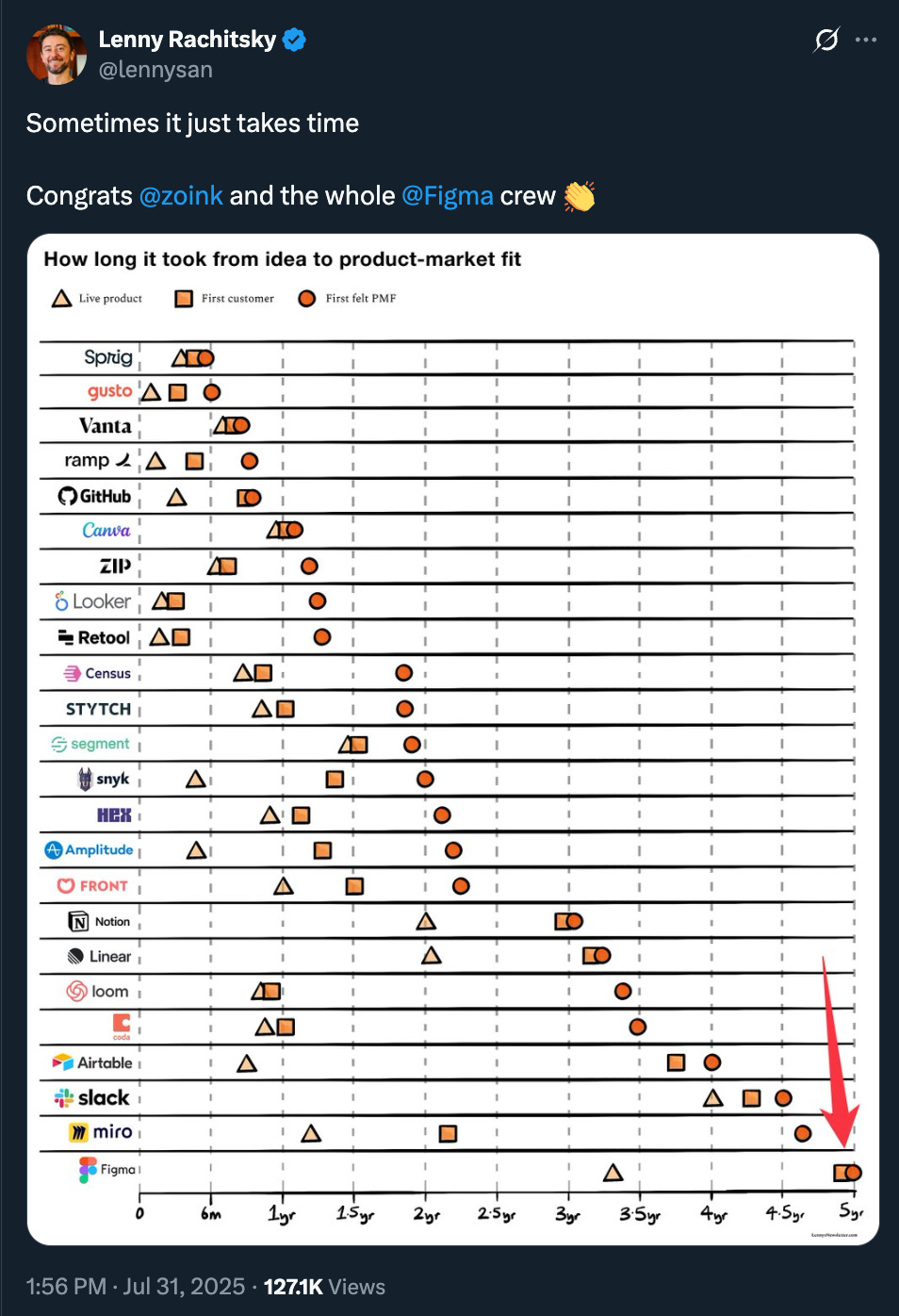

#congratulations to all founders, employees, and investors on Figma! Let’s hope this stock stays strong 6 months in when the lockup expires and then we’ll really know where the IPO market is

#On Figma’s blockbuster IPO and the power of compounding and durable growth - easy to model but hard to actually realize

#great reminder in era of vibe coding and growth from $0-100M that not all companies look like that and sometimes it just takes time to get there but when it does, it ramps fast! Great to have port cos Snyk and Front on there and should add Clay…

#fantastic discussion on valuation for SaaS cos - 👇🏻 click to read

#PLG works - Lovable locks down largest deal to date - and prototyping means encroaching on Figma’s turf

#AWS losing its mojo as Azure and GCP continue to grow faster…

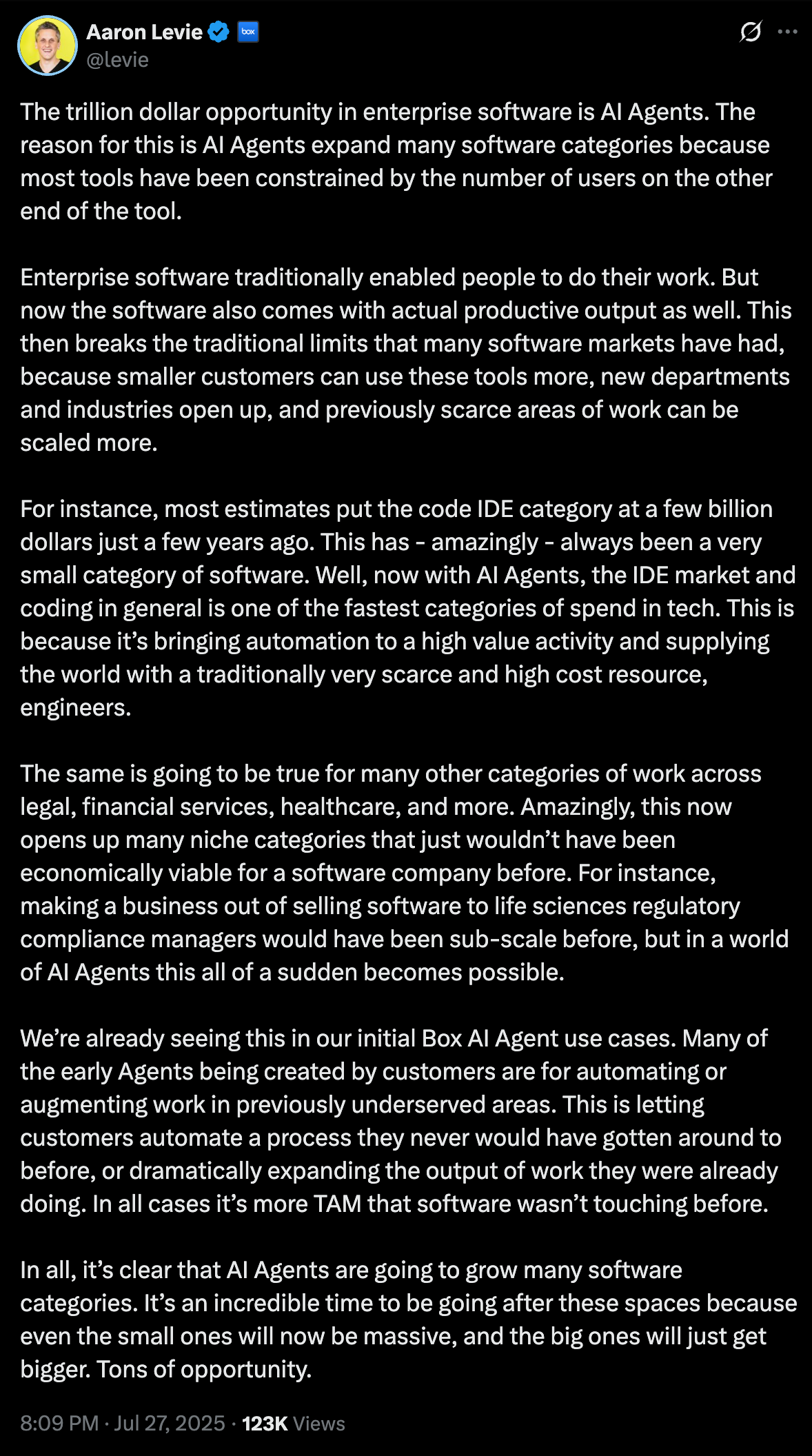

#Aaron from Box continues to nail the agentic opportunity 🎯

#Jamie Dimon continuing to emphasize cybersecurity as a huge systemic risk to system - listen in 👇🏻

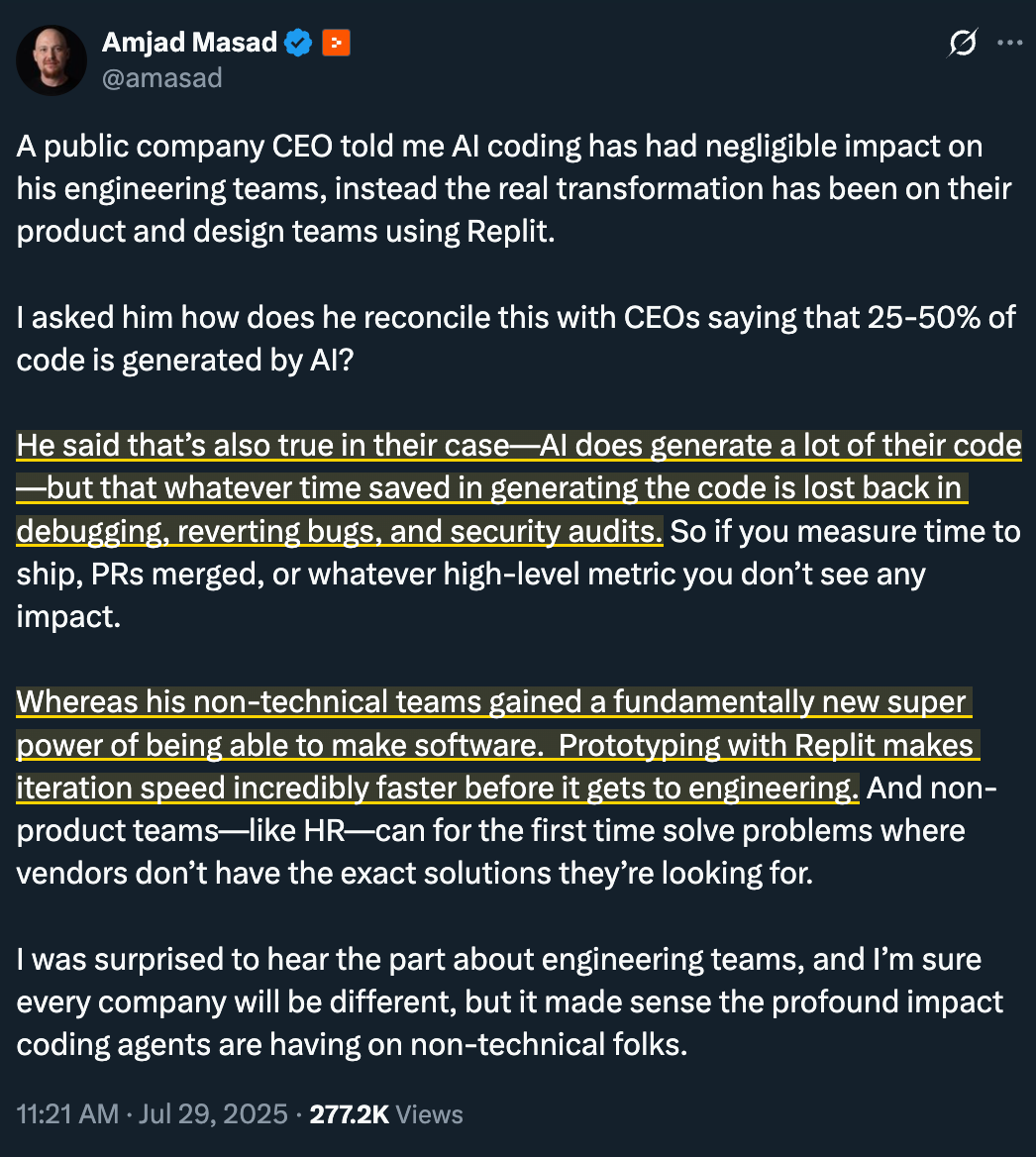

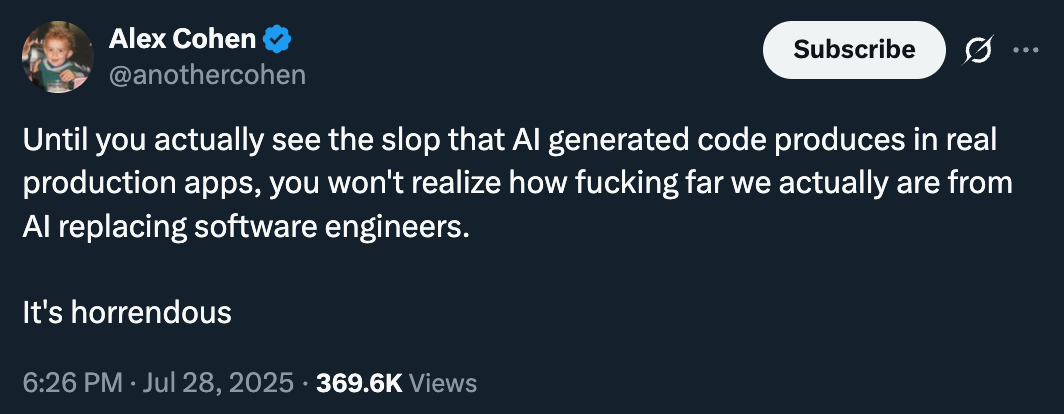

#more code generated, more to review and secure - people feeling the second order effects

#the comments are quite interesting…

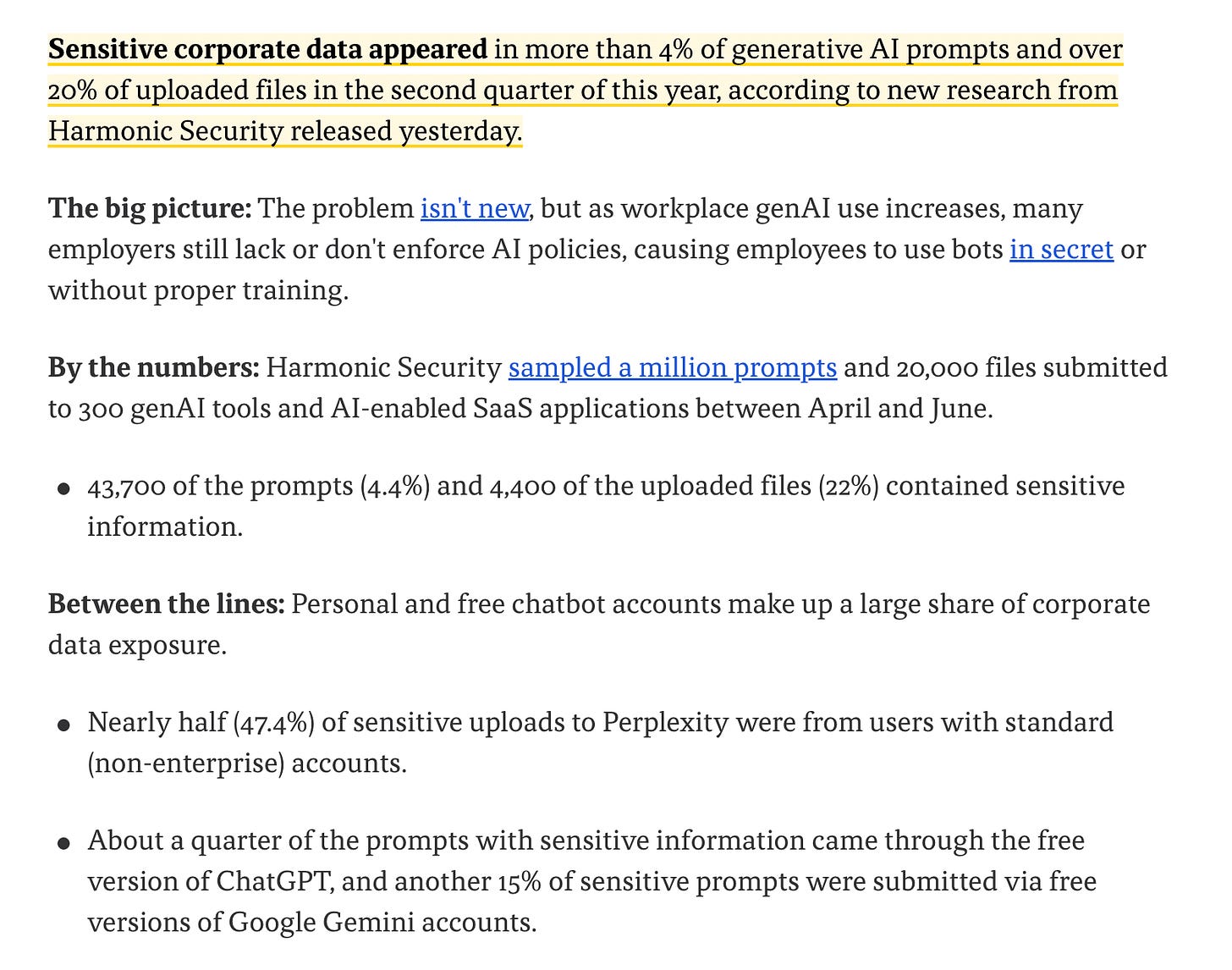

#second order effects also include vibe security for vibe coding

#personalized secure AI is needed where your data is 100% safe along with SaaS detection and prevention from cos like Reco AI - a boldstart port co (Axios AI)

#the new browser wars, Microsoft Edge building in agents along with OpenAI and Perplexity and more - he who controls the browser, controls the universe 😄 - JK, but wow, the data and learnings that flow through and the controls one can build from that data is a strong moat

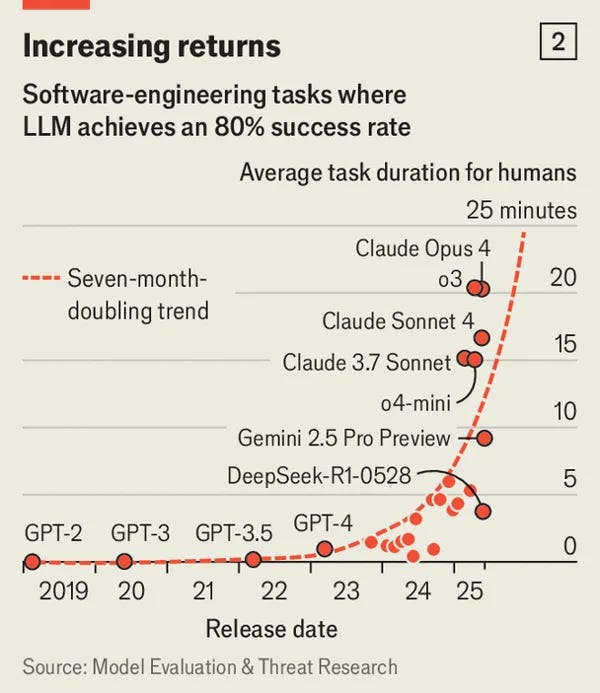

#🤯 from Economist

#the floodgates are opening for crypto…

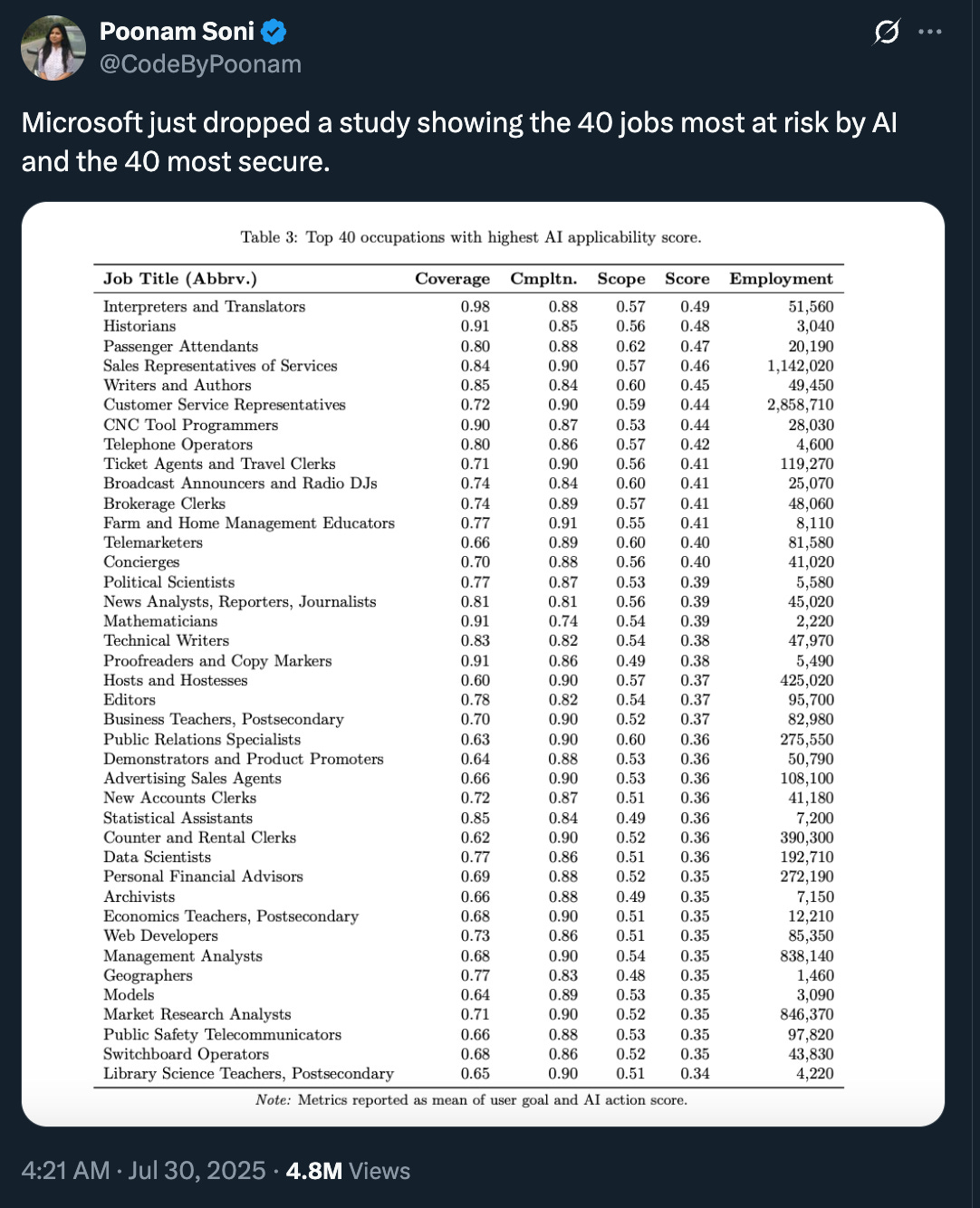

#some of the roles most likely to be killed by AI

Markets

#IPOs are back - holy Figma!

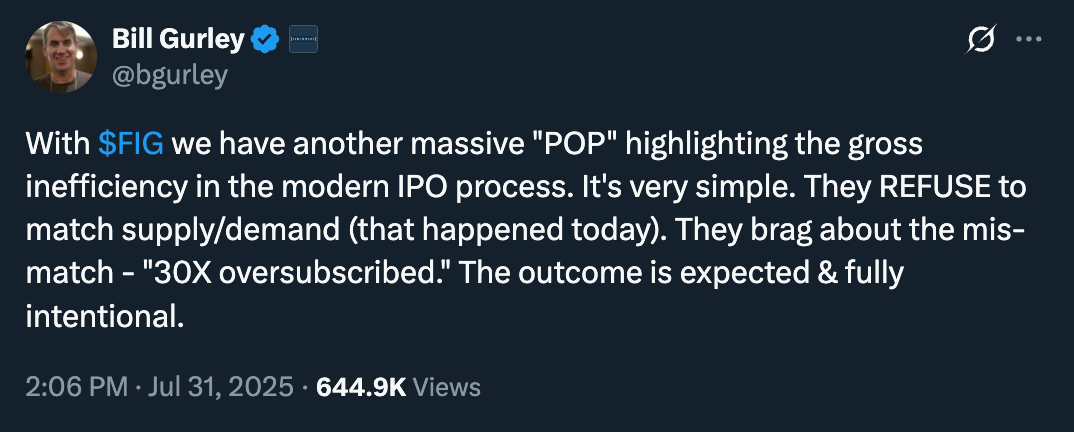

#Bill G continues to do his thing and he’s right

from Copilot:

Figma's IPO was nothing short of explosive. Here's a breakdown of the numbers and impact:📈 Figma's IPO Performance

IPO Price: $33 per share

Closing Price on Day 1: $115.50 per share

First-Day Pop: +250%, the largest for a U.S.-listed company raising over $1 billion in at least 30 years

Amount Raised: $1.2 billion, though only about a third went directly to Figma; the rest went to selling shareholders

Market Cap at Close: Nearly $68 billion fully diluted

💥 Context and Implications

The IPO was more than 40x oversubscribed, with many investors receiving no allocation

Figma’s valuation now far exceeds the $20 billion Adobe had offered in its failed acquisition attempt in 2022

The massive pop has reignited debate over IPO pricing inefficiencies, with critics like Bill Gurley calling it a “gross mismatch of supply and demand”

🧠 Strategic Takeaways

Figma’s IPO success positions it as a formidable player in creative and collaborative software, especially as it expands into AI-driven tools.

The pop may open doors for acquisitions or further capital raises, but it also raises questions about sustainability and long-term valuation.

Would you like to dive into how this IPO compares to others in recent years, or explore what it means for the broader tech and VC landscape?

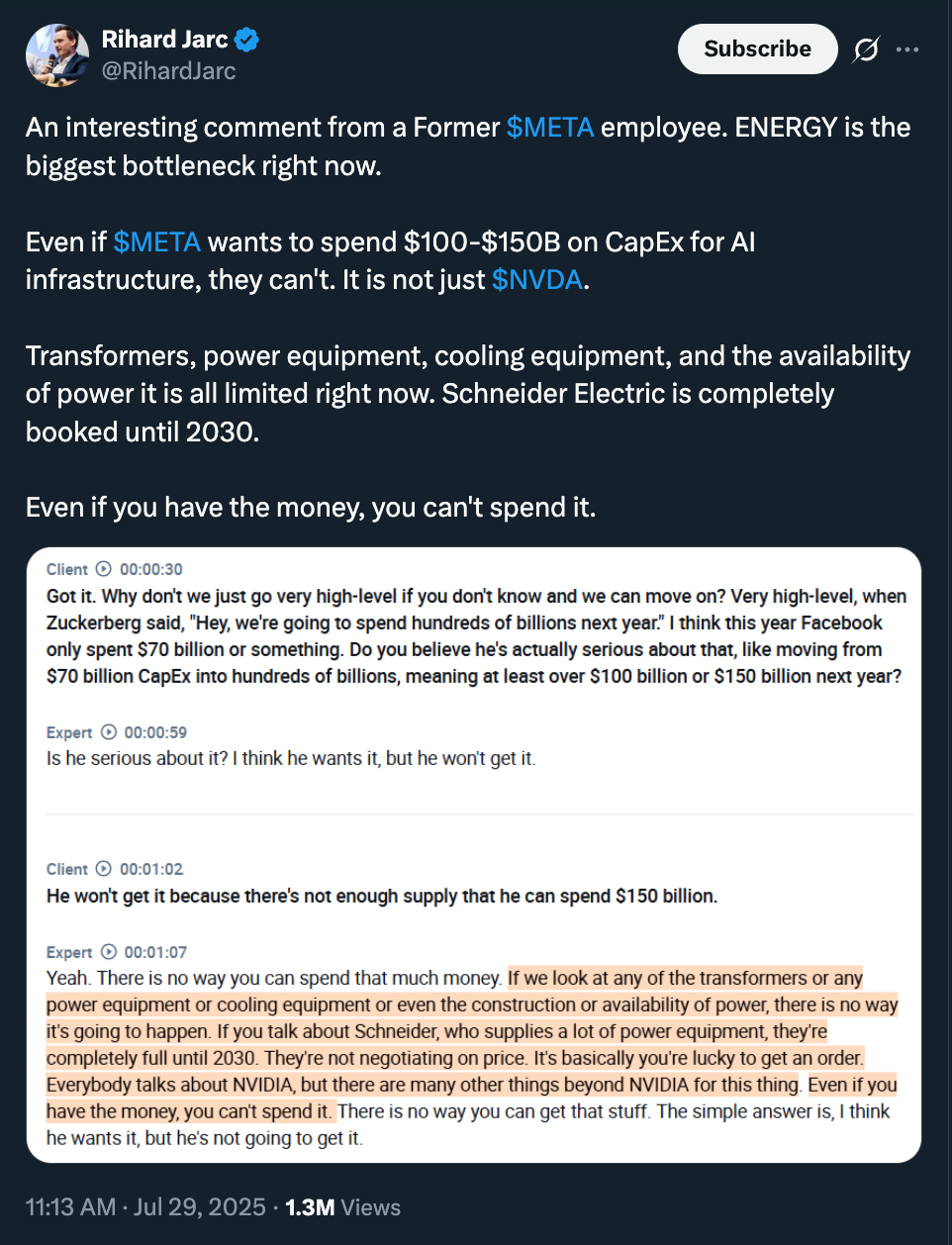

#buy energy stocks!

#but beware the bubble…