What’s 🔥 in Enterprise IT/VC #448

The Incumbent AI conundrum - all in on AI but ST pressures + zooming out with Jensen - "enterprise AI is ready for take off"

I was talking with a long time friend this week who is a senior executive at a public tech company, and my question was “how is it going.” After a long pause and sigh, he jumped in and shared his thoughts. Here are his comments paraphrased but you’ll get the gist.

We know the future is all about AI and agents, but our largest enterprise customers aren’t there yet in terms of deploying into production as so much is still in pilot phase.

The constant struggle we have is how much to invest in legacy customer requests versus how much money to invest in the future. The larger the enterprise customer base, the more requests we get to satisfy existing customers to drive revenue for the next quarter or two but all of those features take away from our longer term opportunity.

Wall Street rewards growth and performance and want an AI story also.

We know we need to invest for the future, but our short term will also be impacted when it comes to how much to invest now versus the future.

As much as we want to go all-in to sell AI, be the AI company in our space, we know that it can’t be overnight.

Well readers, this exactly is why zero stage startups who are unencumbered have the opportunity of a lifetime even when incumbents have large data moats etc. This is not the same for every single industry or company, but founders, realize that your chance is still here - lots of talk about AI from the large cos but still very few all-in.

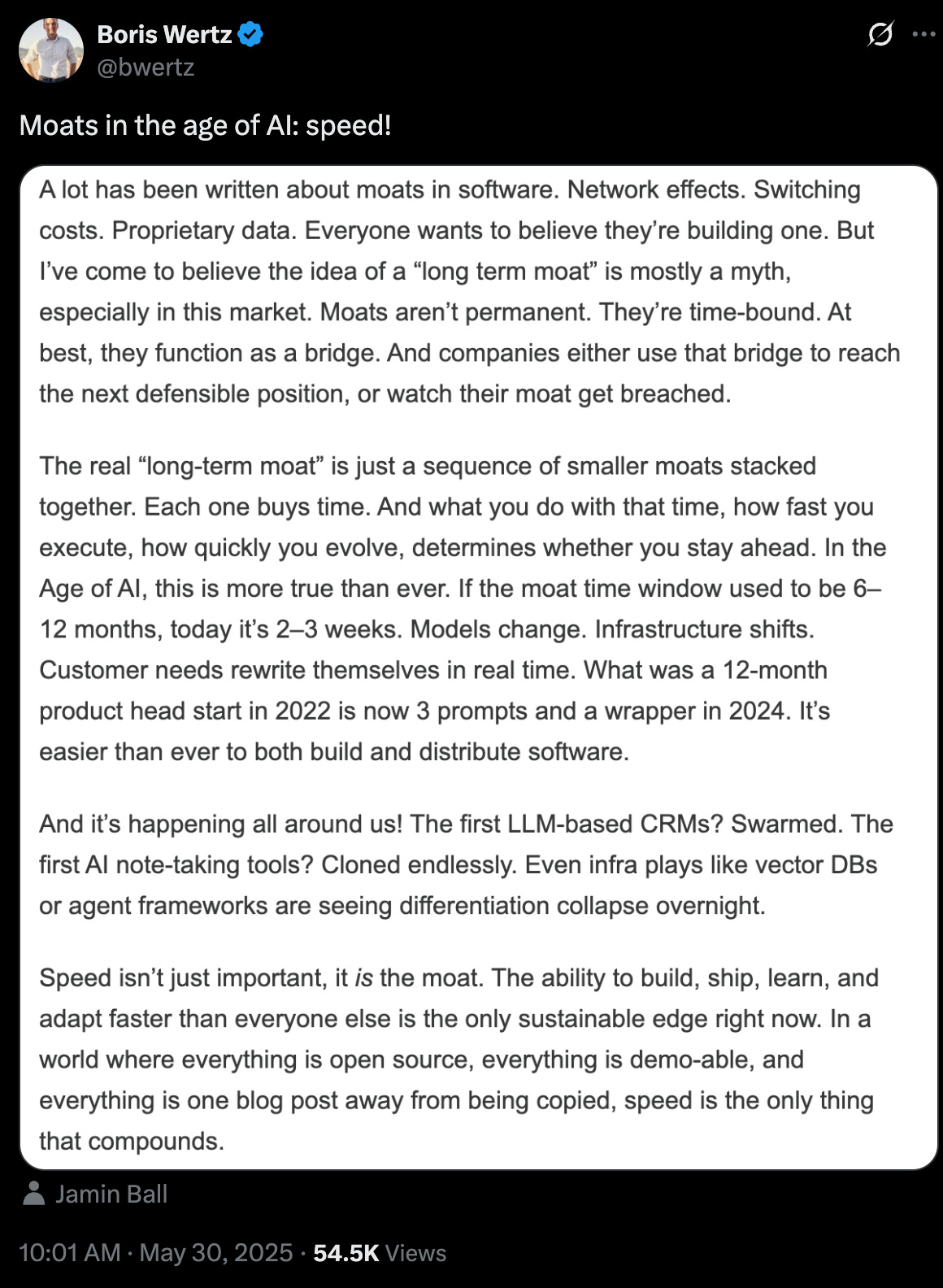

And as Jamin Ball states (reshare from Boris Wertz); speed!!!

A drum 🥁 that I’ve constantly been beating on!

Wrote about this more in depth at What’s 🔥 #432

Dharmesh sums it up where we are in the lifecycle well…but only if it were so easy to just go in on the LT for those large dinosaurs 🦖!

We all know the second you stop investing in the future starts the path to walking dead, but the timing of how much to step on the gas when is what is so hard for public companies.

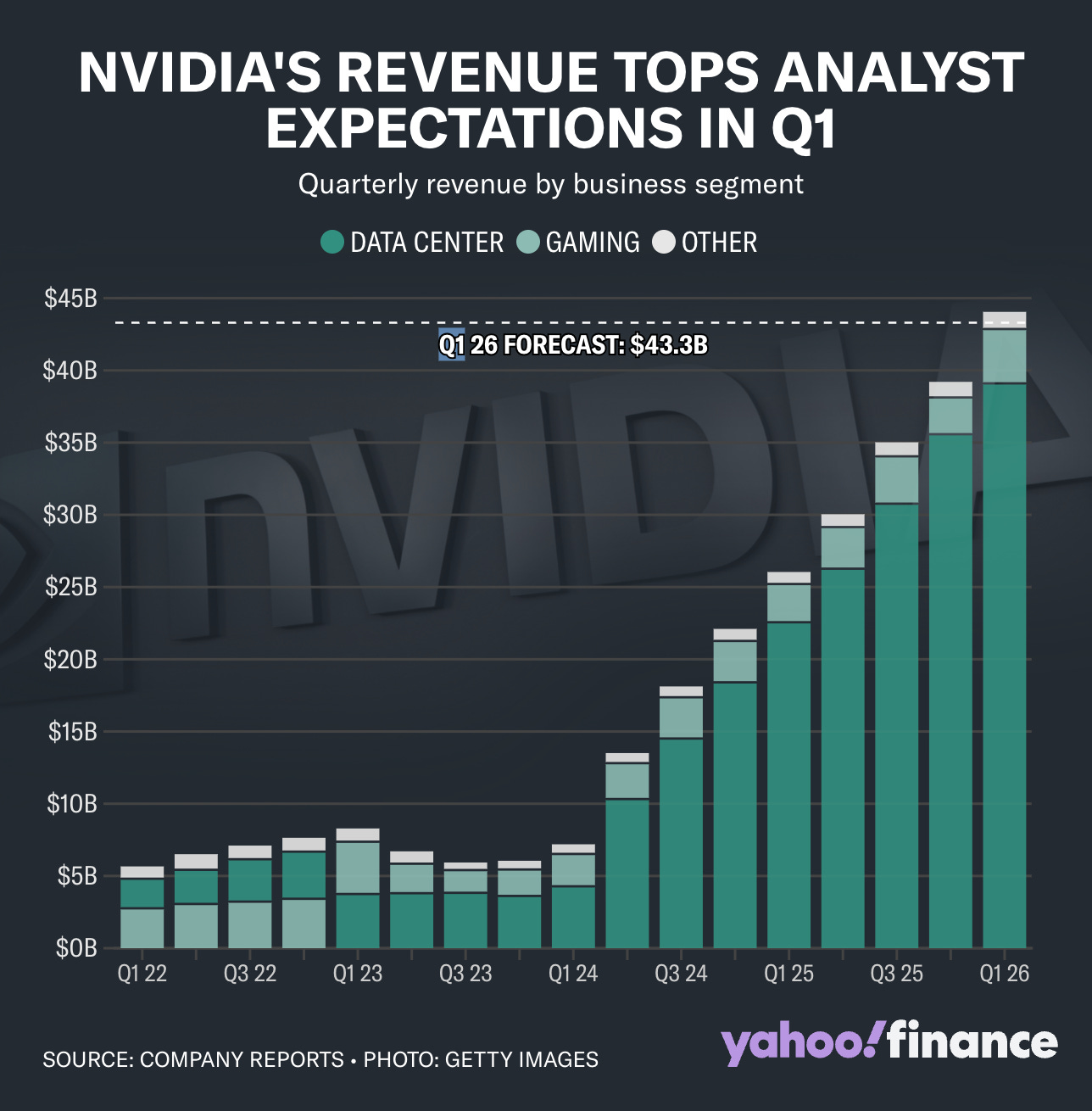

Since I’m in big picture zoom-out mode this week, let’s also reframe where we are on this AI journey referencing the 🐐, Jensen Huang. Nvidia crushed its targets again delivering $44.1B of revenue for the quarter, and yet again, Jensen delivered a number of interesting data points for the future.

Here are a few of his insightful comments from the earnings call that you can find here.

We need more compute + wait till agents kick in

"Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate"

Reasoning is really good - less concern for hallucinations

I would say compared to the beginning of the year, compared to GTC timeframe, there are four positive surprises. The first positive surprise is the step function demand increase of reasoning AI, I think it is fairly clear now that AI is going through an exponential growth, and reasoning AI really busted through. Concerns about hallucination or its ability to really solve problems, and I think a lot of people are crossing that barrier and realizing how incredibly effective agentic AI is and reasoning AI is. So, number one is inference reasoning and the exponential growth there, demand growth.

Enterprise AI ready to take off powered by agents

The third is enterprise AI. Agents work and agents are doing -- these agents are really quite successful. Much more than generative AI, agentic AI is game-changing. Agents can understand ambiguous and rather implicit instructions and able to problem solve and use tools and have memory and so on. And so, I think this is -- enterprise AI is ready to take off. And it's taken us a few years to build a computing system that is able to integrate and run enterprise AI stacks, run enterprise IT stacks but add AI to it. And this is the RTX Pro Enterprise server that we announced at COMPUTEX just last week. And just about every major IT company has joined us, super excited about that.

And so, computing is one stack, one part of it. But remember, enterprise IT is really three pillars; it's compute, storage, and networking. And we've now put all three of them together finally, and we're going to market with that.

On-prem workloads matter!

But beyond that, we're going to have to -- we're going to see AI go into enterprise, which is on-prem, because so much of the data is still on-prem. Access control is really important. It's really hard to move all of -- every company's data into the cloud. And so, we're going to move AI into the enterprise.

Don’t forget industrial AI

And then lastly, industrial AI. Remember, one of the implications of the world reordering, if you will, is a region's onshoring manufacturing and building plants everywhere. In addition to AI factories, of course, there are new electronics manufacturing, chip manufacturing being built around the world. And all of these new plants and these new factories are creating exactly the right time when Omniverse and AI and all the work that we're doing with robotics is emerging.

And so, this fourth pillar is quite important. Every factory will have an AI factory associated with it. And in order to create these physical AI systems, you really have to train a vast amount of data. So, back to more data, more training, more AIs to be created, more computers.

The infrastructure is in place and the drum beat of enterprise take off and optimism abounds, but remember the incumbents have Wall Street to deal with so that is an opportunity!

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

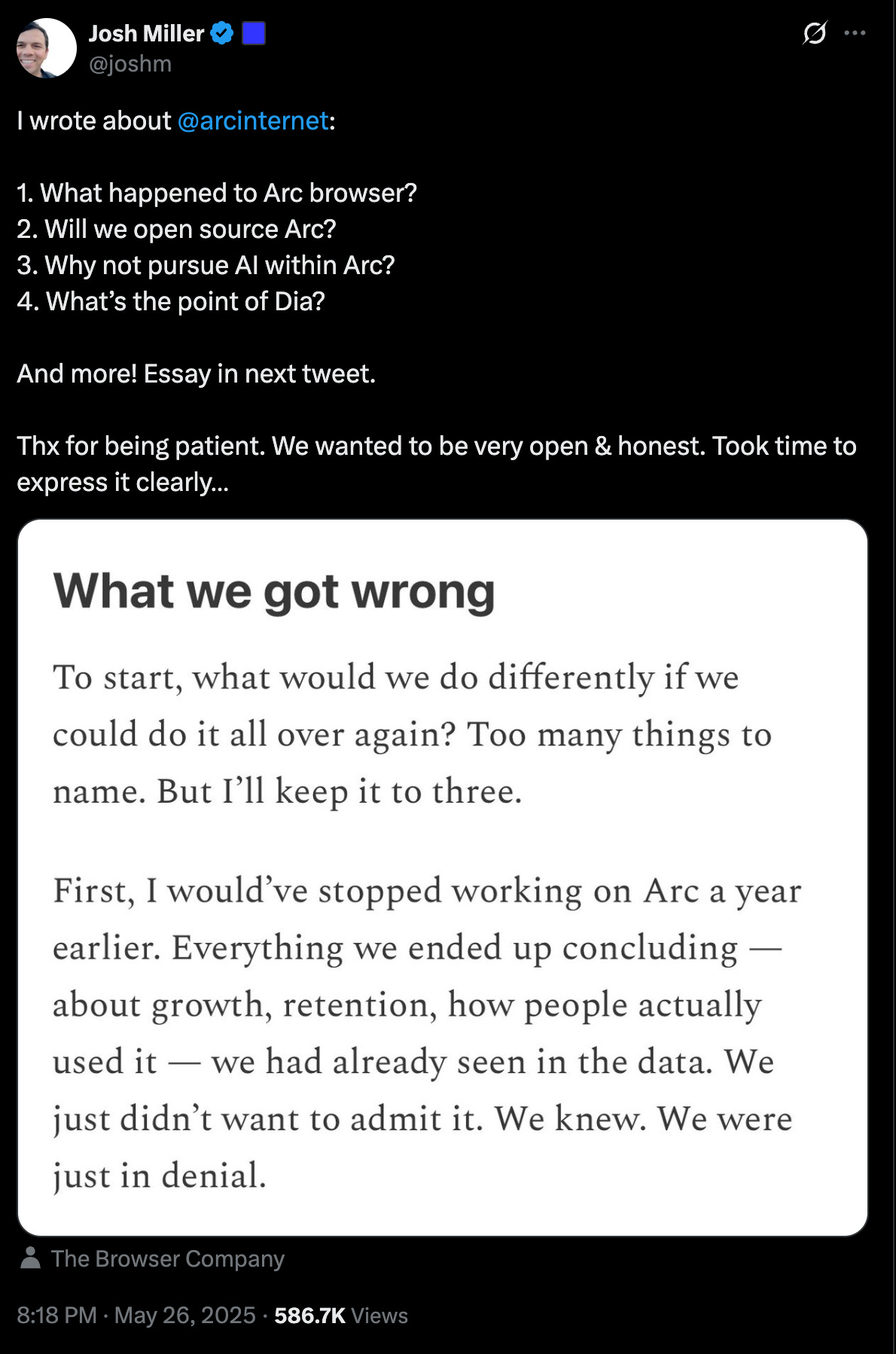

#must read story of pivoting, how Arc browser wasn’t getting the signals, went AI native, and why a completely separate product

#Year 4 on the Forbes Midas Seed List of top seed investors in the world! 🙏🏻 for the amazing founders I’ve had a chance to partner with and the team at boldstart (👇🏻 click for full list)

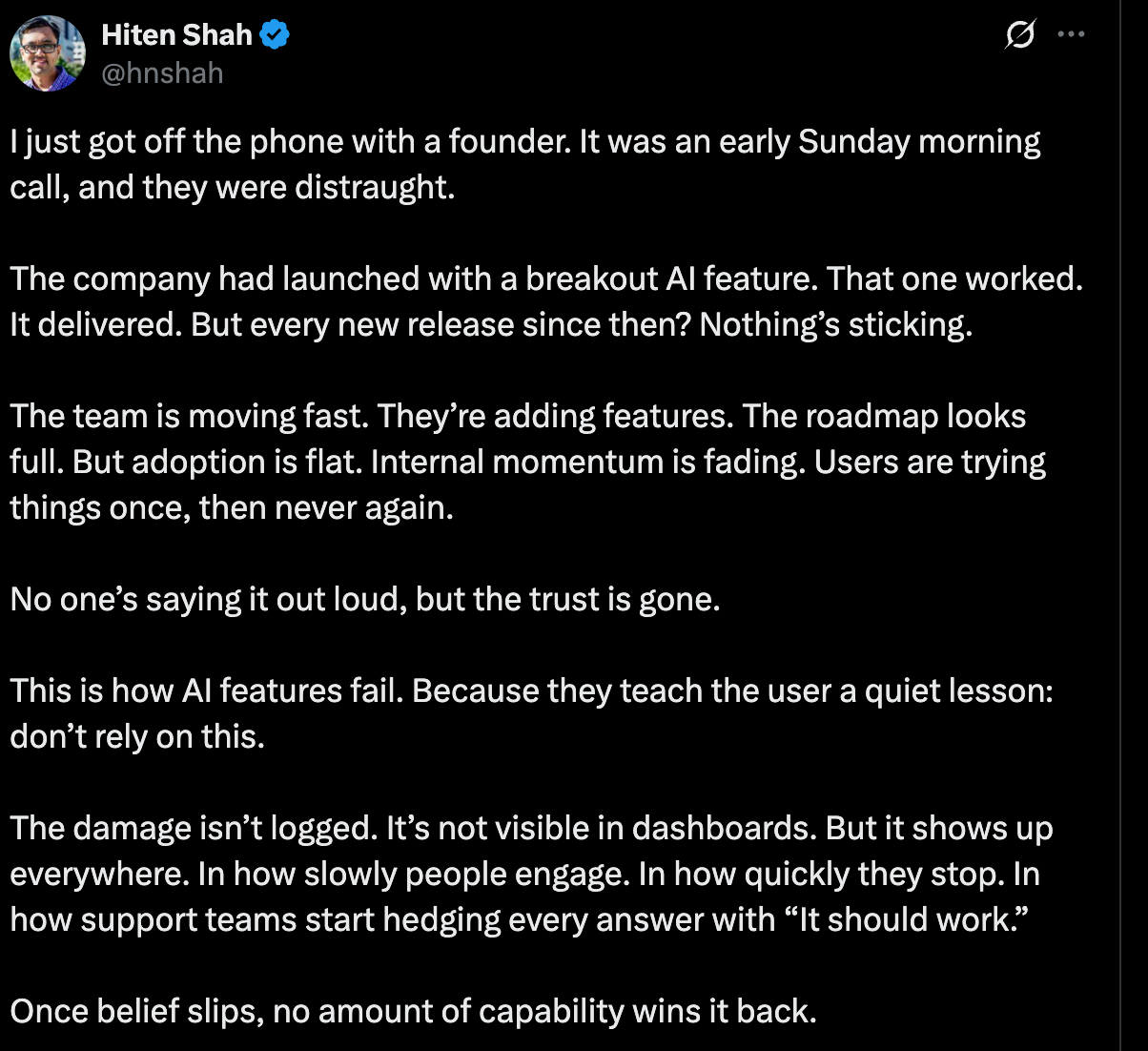

#💯 on shipping product - build trust! 👇🏼 clickthrough to read more…

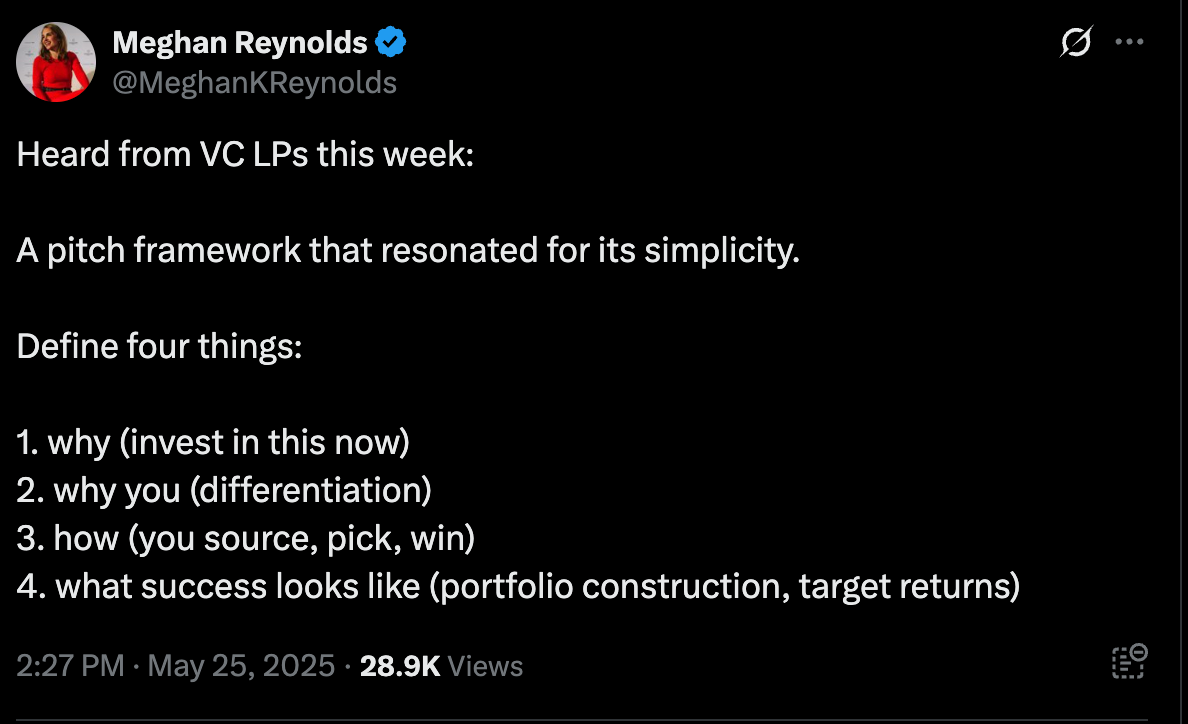

#for those emerging managers - solid advice

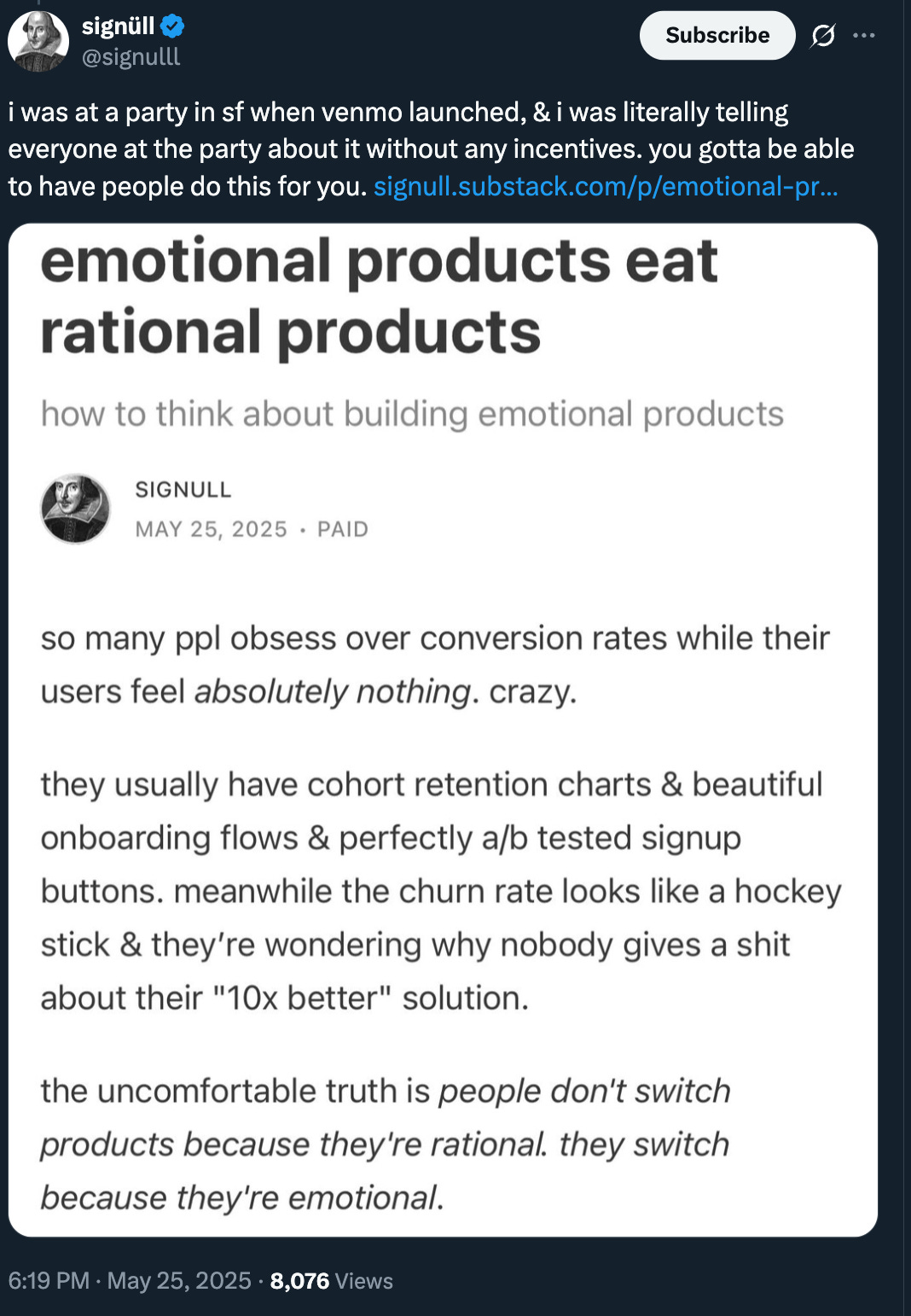

#emotional over rational product hooks…

Enterprise Tech

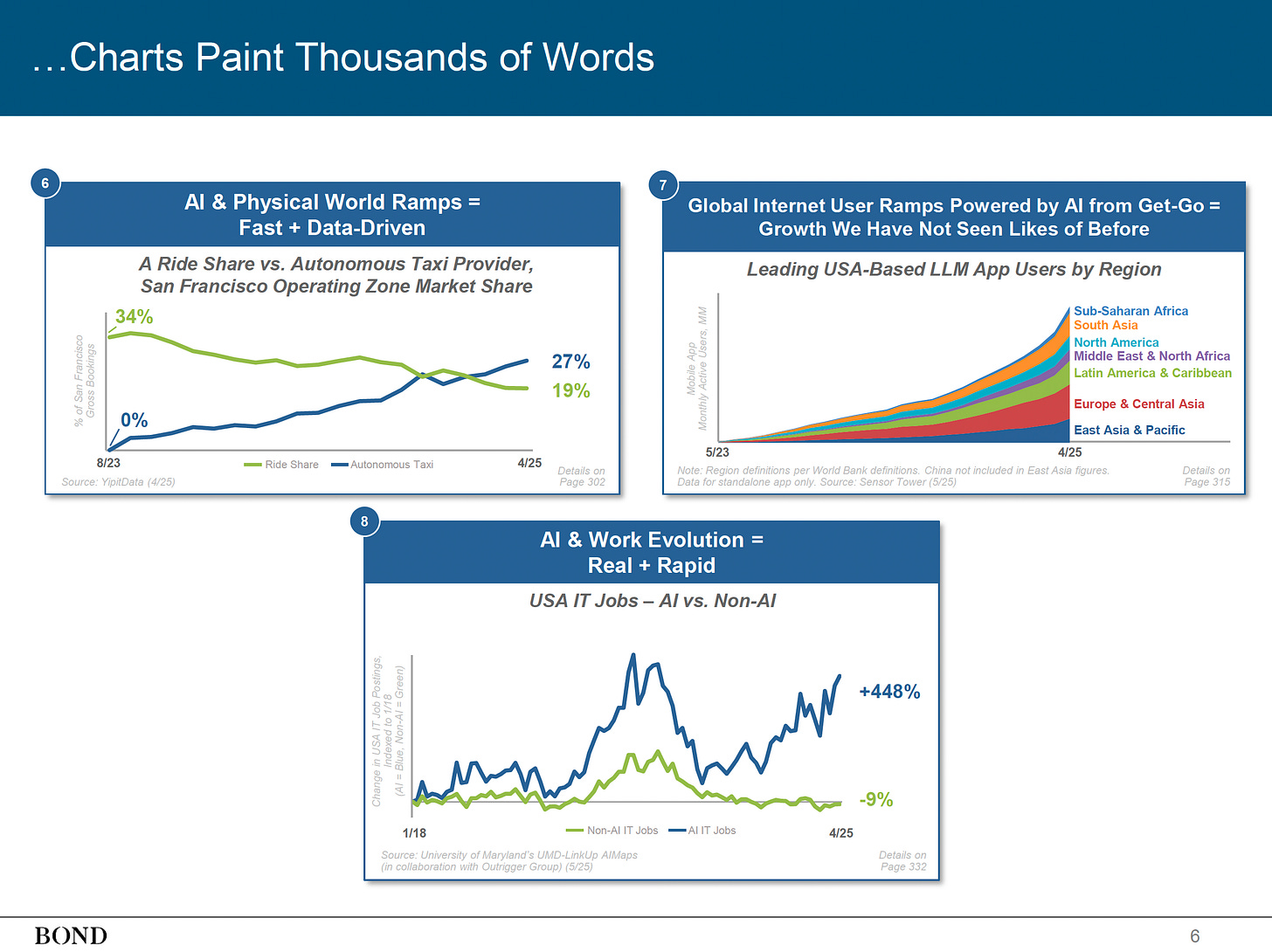

#the definitive report on AI from Mary Meeker (Bond Capital) is here - a must read chock full of data and insights - here’s the preamble backed by lots and lots of charts!

I also highlighted a 🔑 point:

"but the exciting part is the consideration of what can go right. Time and Time again the case for optimism is one of the best bets one can make"

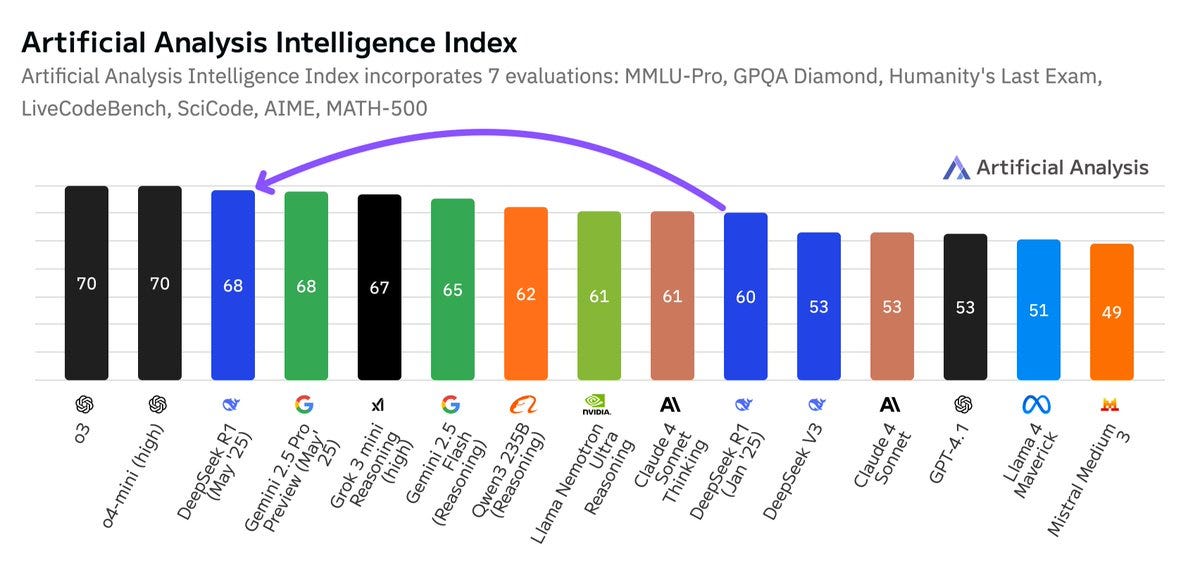

#DeepSeek takes the top spot in open weighted models

more analysis from Artificial Analysis

Takeaways for AI:

👐 The gap between open and closed models is smaller than ever: open weights models have continued to maintain intelligence gains in-line with proprietary models. DeepSeek’s R1 release in January was the first time an open-weights model achieved the #2 position and DeepSeek’s R1 update today brings it back to the same position

🇨🇳 China remains neck and neck with the US: models from China-based AI Labs have all but completely caught up to their US counterparts, this release continues the emerging trend. As of today, DeepSeek leads US based AI labs including Anthropic and Meta in Artificial Analysis Intelligence Index

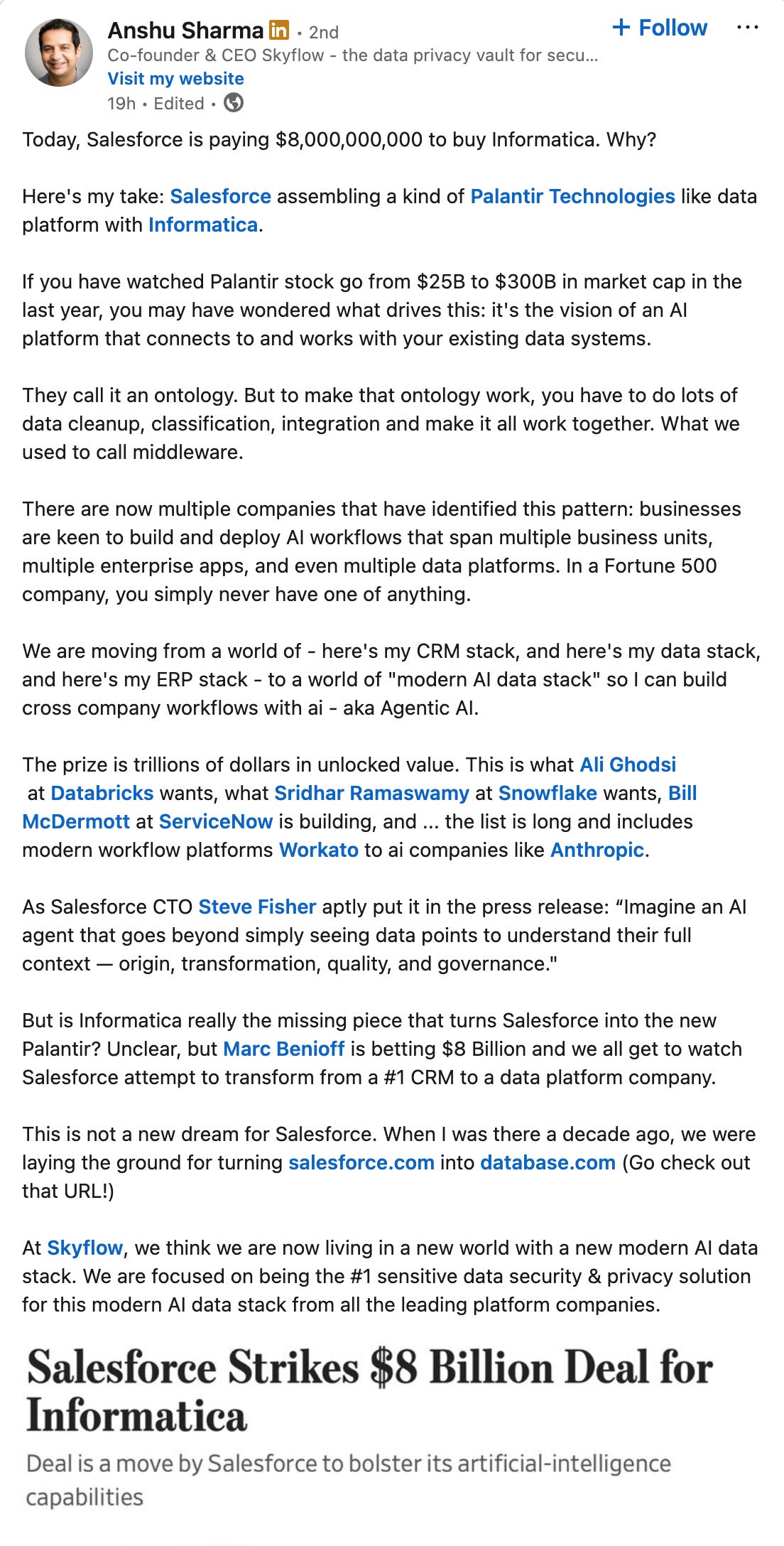

🔄 Improvements driven by reinforcement learning: DeepSeek has shown substantial intelligence improvements with the same architecture and pre-train as their original DeepSeek R1 release. This highlights the continually increasing importance of post-training, particularly for reasoning models trained with reinforcement learning (RL) techniques. OpenAI disclosed a 10x scaling of RL compute between o1 and o3 - DeepSeek have just demonstrated that so far, they can keep up with OpenAI’s RL compute scaling. Scaling RL demands less compute than scaling pre-training and offers an efficient way of achieving intelligence gains, supporting AI Labs with fewer GPUs#Huge news - Salesforce finally buying Informatica - for $8B, down from $11B a year ago - with revenue of $1.66B the multiple is around 4.8x trailing as its only growing 2.8% per year - Anshu has best post on the why now

Marc Benioff shares his why:

#congrats Snyk (a portfolio co) on launch of the first AI Trust Security Platform - secure coding has to start by default and Snyk is here for developers from the IDE all the way to deployment (👇🏻 click for video)

#super important to watch - what does it mean to predict the next token - can it go deeper into emotions and truly understanding humans 🤔?

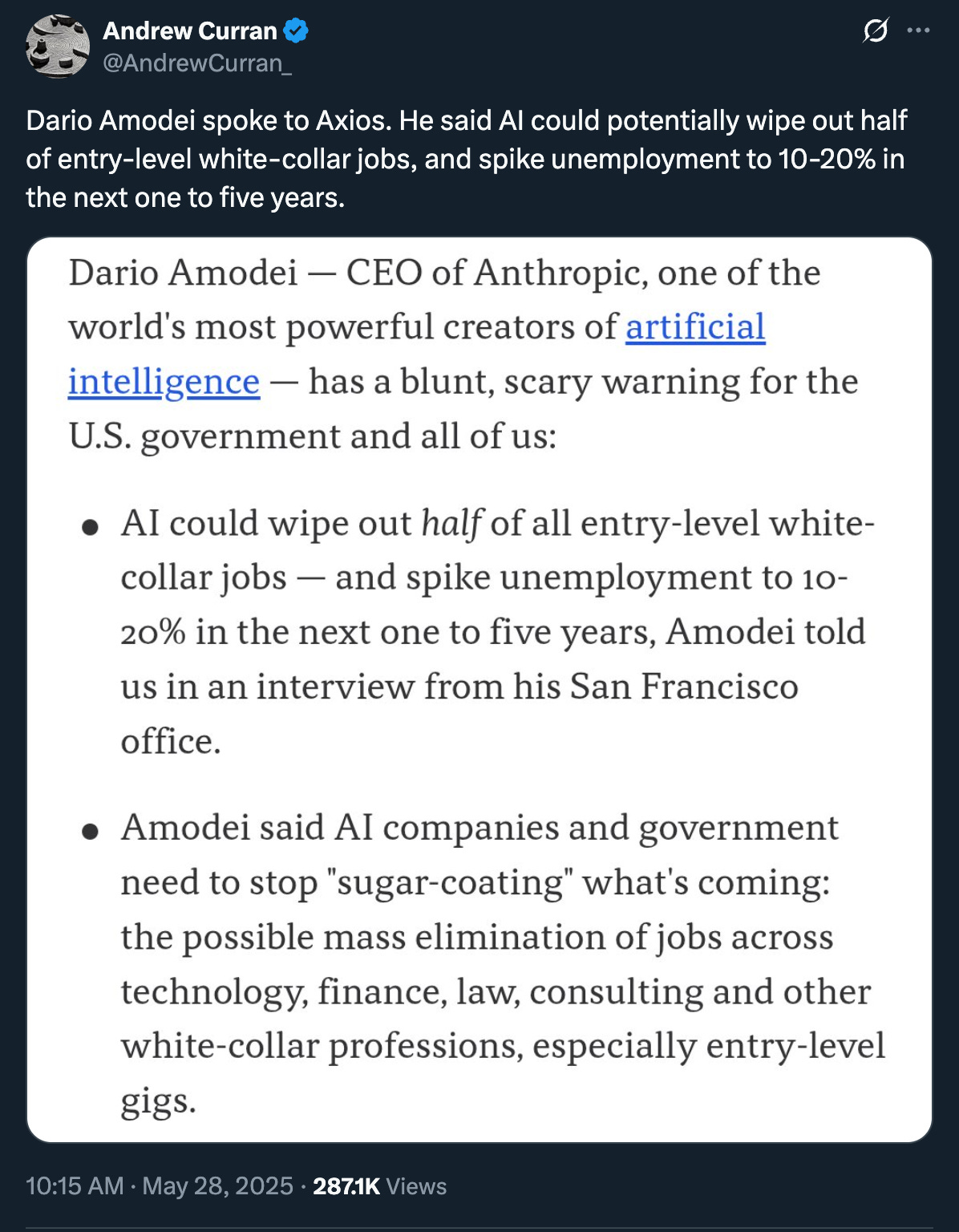

#When Jensen’s enterprise AI and agentic future becomes a reality, what are your thoughts on this below? Too doom and gloom or true or somewhere in the middle?

I also suggest reading the whole Axios piece here.

#umm, yeah, this AI stuff works - real ROI post bootcamp

#💯

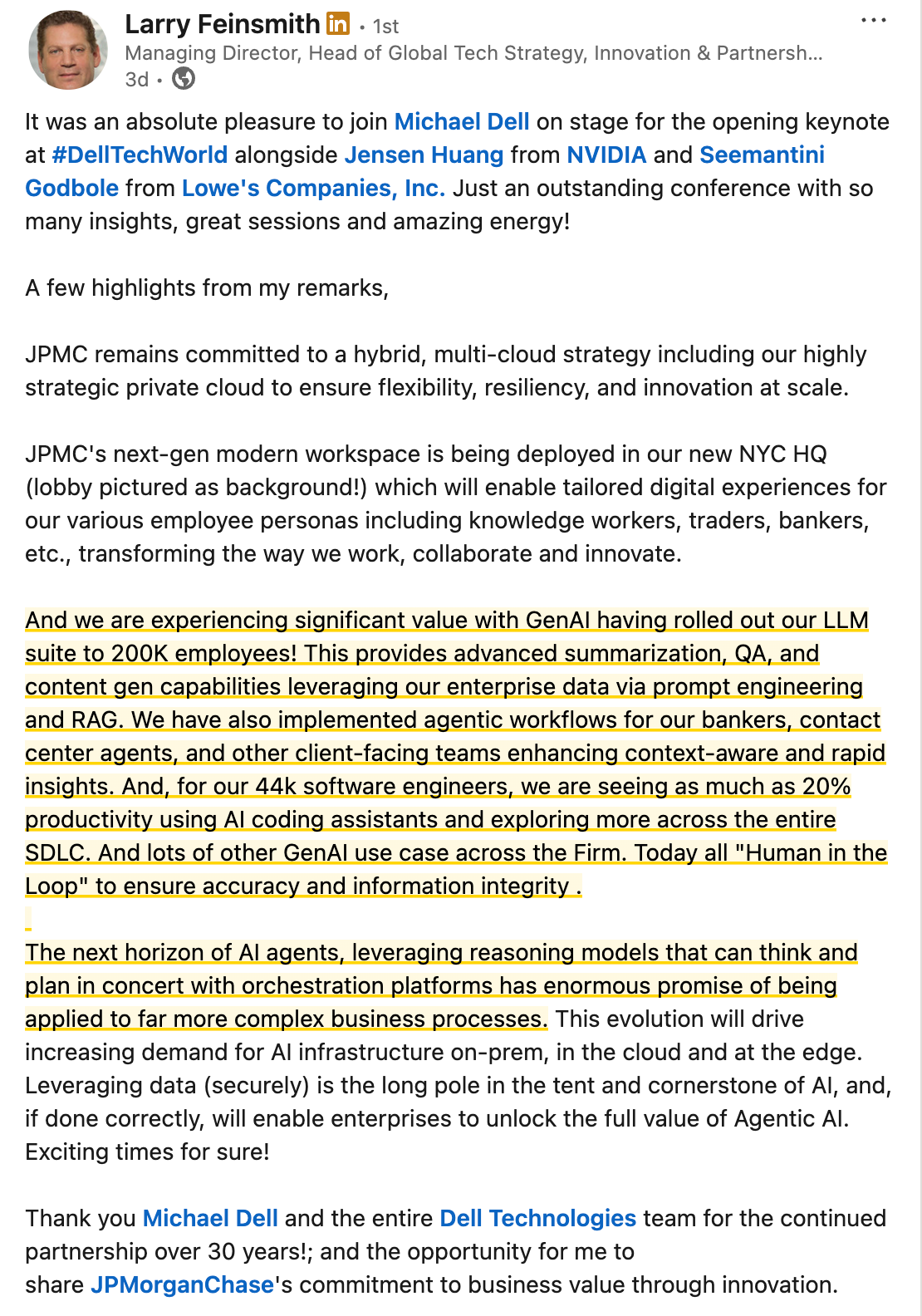

#more on how far along JPM is on AI and what’s the future for agents (Larry Feinsmith)

#thoughts on agentic security from Ian Livingstone - Keycard

#massive $350M Series C for Clickhouse as it has become the database for monitoring agents

The momentum behind ClickHouse is accelerating: the company grew over 300% during the past year and now serves over 2,000 customers across a range of industries from fintech and transportation to consumer and healthcare. New customers include Anthropic, Tesla, and Argentina’s Mercado Libre, among others. They join companies such as Sony, Meta, Memorial Sloan Kettering, Lyft, and Instacart, as well as AI innovators Sierra, Poolside, Weights & Bases, Langchain, and more.

Today’s announcement was made at ClickHouse’s inaugural user conference, showcasing how enterprises are building data products to meet the demands of the agentic era.

“As AI agents proliferate across data-driven applications, observability, data infrastructure, and beyond, the demand for agent-facing databases like ClickHouse has reached an inflection point. The future of analytics isn’t just dashboards. It’s intelligent agents that interpret data, trigger workflows, and power real-time decisions,” said Aaron Katz, CEO of ClickHouse. “But AI is just one driver. We designed and built ClickHouse from day one to support a broad spectrum of real-time data applications across industries, and our momentum reflects that enterprises are hungry for a platform that can keep up with their scaling ambitions.”Markets

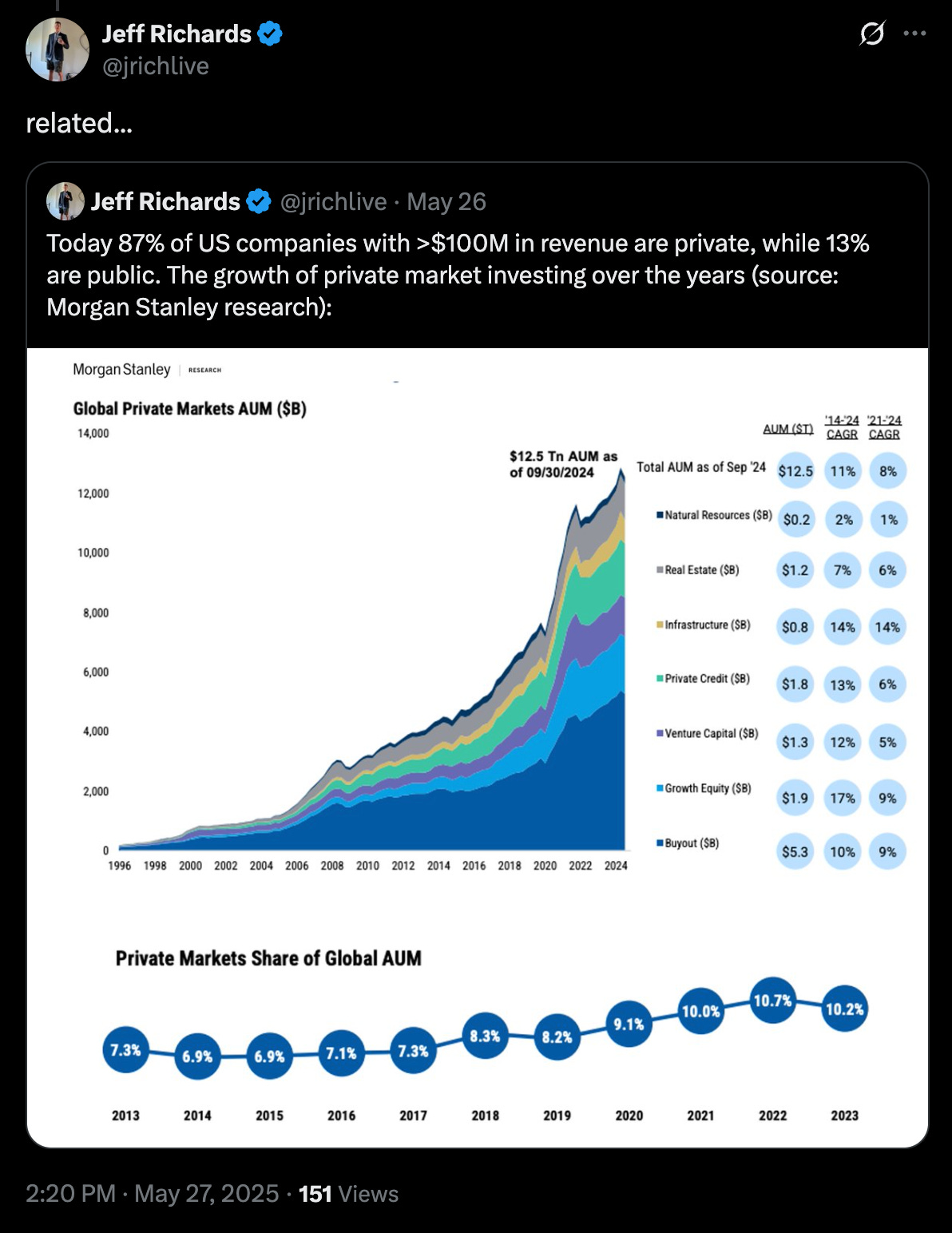

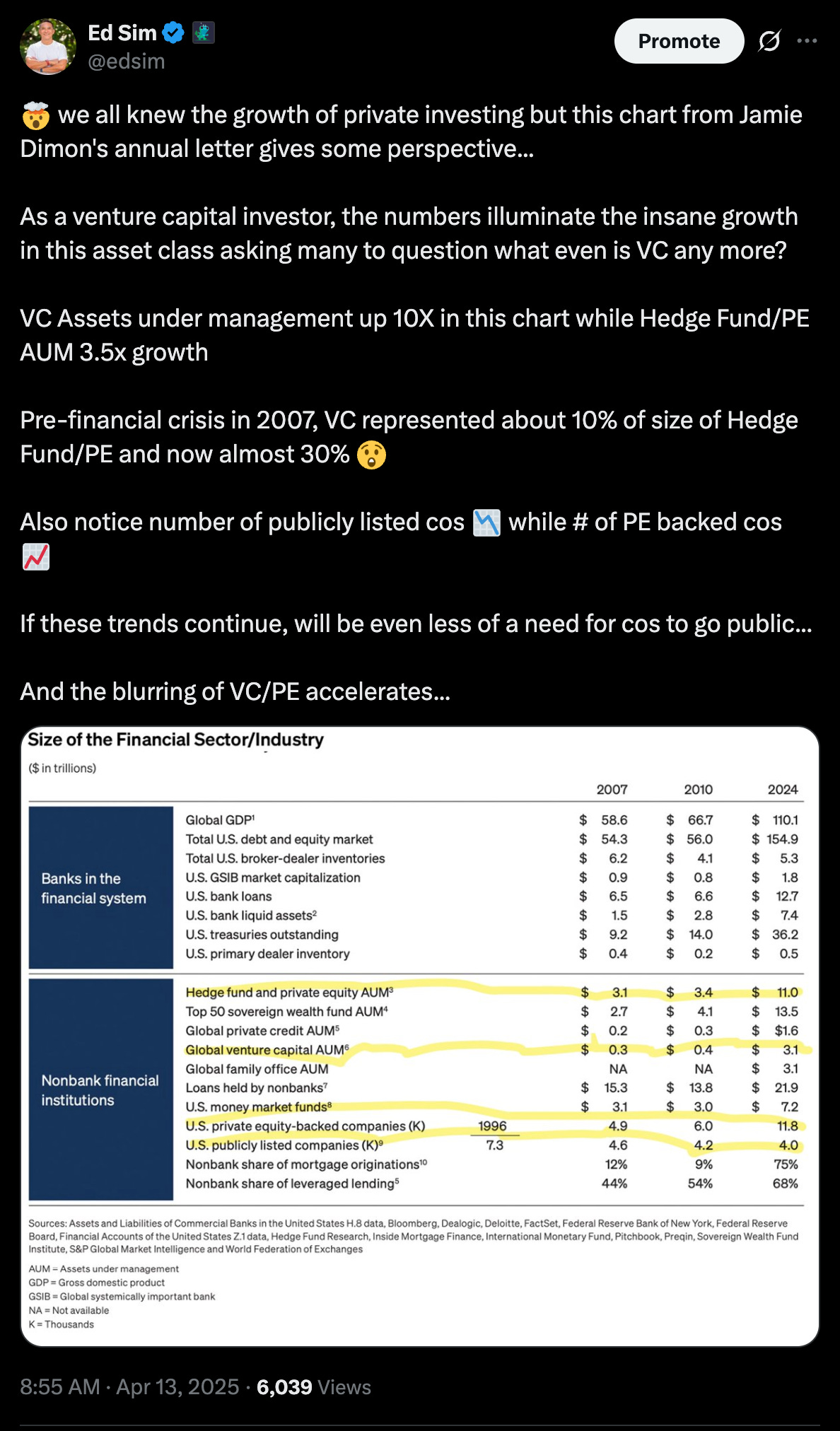

#🤯 the 💰 flowing into private markets continue 📈

ties into a post from last month…

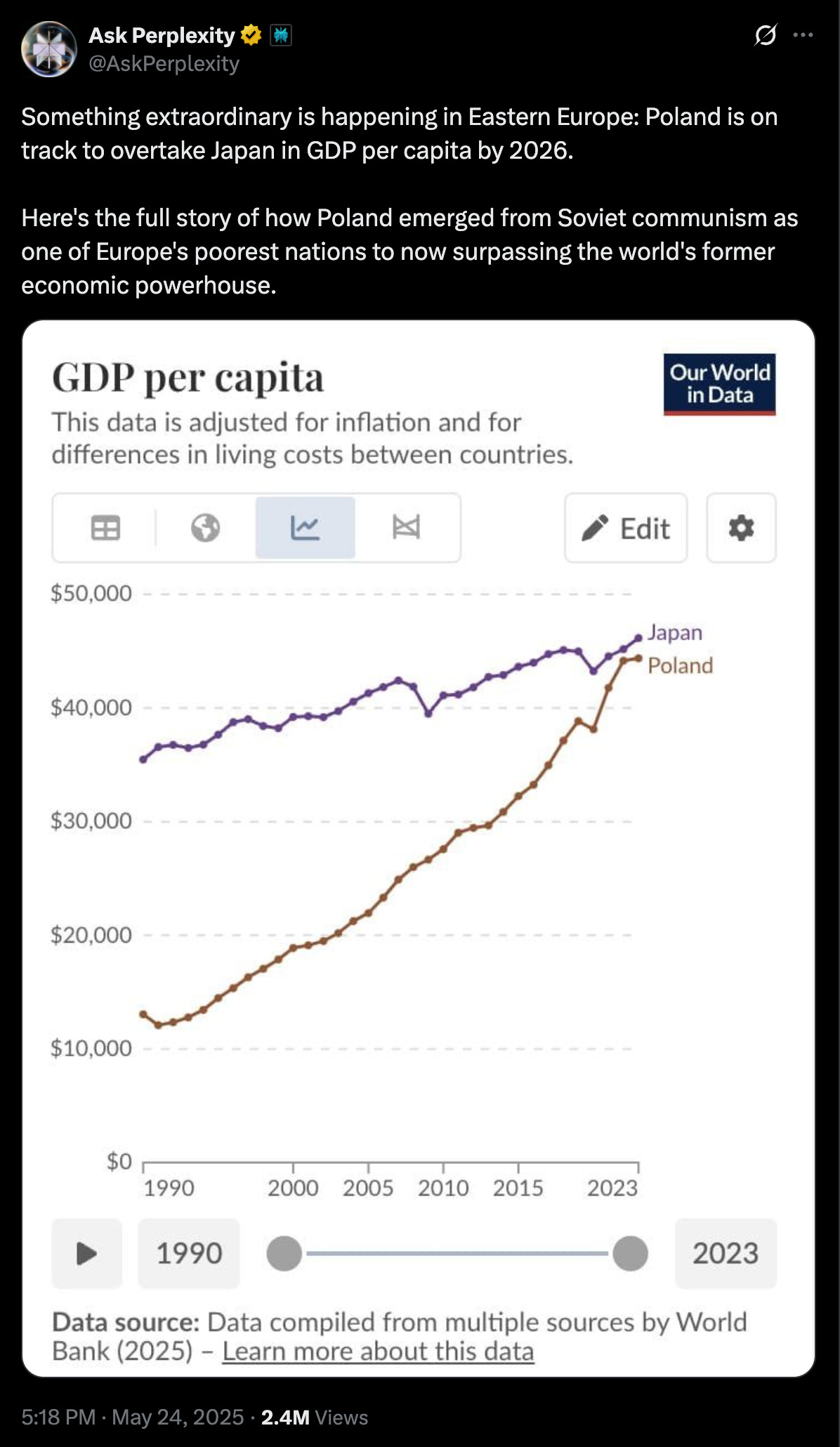

#zooming out - pretty amazing! Also becoming a startup hub…

Great post as always. I look forward to it every week.

Every day I read that you have to "just ship;" "keep grinding;" "no more moats;" "speed is the only moat; "competitors will copy your features and vaporize what you just shipped..."

Let me see if I have this right: the only path to success left now is to build a high-speed software engineering machine that ships features almost daily. Forever. Anything short of that will fail (and take investor money with it). Is that it?

Is this what customers want?

Not being snarky. Sincere question.