What’s 🔥 in Enterprise IT/VC #446

The goalposts have moved - what makes a great Series A + also a 99th % outcome?

As I’ve written many times before, the Race to Be First at Inception is one of the biggest things happening in venture. Read more from What’s 🔥 #365 from October 2023 for a deeper breakdown on why:

What's 🔥 in Enterprise IT/VC #365

Wow, that was lots of fun! I’ve been investing at the earliest stages of enterprise venture for 27 years and have been witnessing a sea change in early stage venture and in particular, what it truly means to be a founder’s first partner.

So what happens when all of these companies raise initial rounds from everyone from pre-seed to seed firms and large multi-stage platforms? Well, you have way too many companies looking for A rounds and frankly, not all of them will or should get funded. Peter Walker from Carta now has the data.

😲 Looking back 2 years from the last seed round, only 15.5% of startups have raised their Series A. This is significantly down from the 2017 vintage where after 8 quarters the graduation rate was 36% and peeked at 40.5% with 2020’s cohort.

What once looked like solid growth at 3x can look ho-hum in the world of AI where companies can grow 4-10x quickly. IMO, once you get on the revenue treadmill, you better be damn sure that you can keep running fast. Sometimes and for certain founders, you may be better off building product and not turning on the revenue spigot too early with a focus on raising a vision round. Being stuck in the middle is the worst place to be.

What this also tells me is that founders should also choose their initial inception investors wisely. Graduation rates to Series A, particularly in more recent quarters, should help founders understand better how various firms can help them get next rounds of financing completed.

On another note, I found this post from Keith Rabois also enlightening. The goalposts have moved not only for what can get a Series A funding done but also what the top 1% of all outcomes are. The 99th% outcome in startup land was once $1B in the early 2000s then $5B in 2010 and now $20B 🤯!

Finally, as I always like to say, raising VC money is not for everyone. There is a social contract between founder and investor to build something big. You can just as easily bootstrap your way to success especially with AI. Raise VC if you want to go big, accelerate your path to that goal but remember, it’s really F*#*ing hard out there.

As for me, I continue to see amazing founders building out of this world new startups that keep my own dream alive as well. After all, this is the greatest platform shift I have ever seen or will ever see and we are just in the first inning! LFG 🚀.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#best way to learn is by doing…even CEO of one of largest asset managers is building using AI

#if you’re not using AI in sales and marketing, you will fall behind - how Owner which is valued at $1b does it…

#this what portfolio co Clay calls GTM Engineering and I concur 💯 - this is how the best cos are going to market from OpenAI to Anthropic and others - read more from Clay also here

#Honored to be on this list with a fantastic group of investors - 👇🏻 clickthrough for The Seed 100 List

Enterprise Tech

#OpenAI’s new coding agent is out and here’s a link to Sam Altman’s X post and a great in-depth review from Dan Shipper on Every - notice what I highlighted, turning every engineer into a manager, something that all of us will need to get used to - becoming a manager of agents 🤔

#voice is one of hottest next-gen UIs at YC and reminder that EVALS matter! 👇🏻 click for more:

”If you have a voice AI startup, ask yourself, would somebody even consider you if they put 1000x of your usual volume. If not, think why. In my experience, it always came down to observability and control, hence evals. This is how you position yourself as "enterprise-grade".”

#the last mile is the longest when it comes to AI in the enterprise!

#how Cursor thinks about which model to use

#Klarna overdid it on the marketing - customer support agents are still not ready for total replacement of humans - oops!

with excerpt from Bloomberg article:

The fintech stopped hiring for over a year as it focused on building AI capabilities, and an announcement in 2024 about how AI was doing the work of 700 customer service agents sent shares in call center provider Teleperformance SE spiraling. The Paris-based group’s stock advanced as much as 4.4% on Wednesday.

Siemiatkowski said that strategy isn’t the right fit any more. “As cost unfortunately seems to have been a too predominant evaluation factor when organizing this, what you end up having is lower quality,” he said. “Really investing in the quality of the human support is the way of the future for us.”

To be sure, Klarna remains enthusiastic about AI. Siemiatkowski points to the rebuilding of the company’s tech stack that will incorporate AI to improve efficiency.#there are no absolutes - one would have imagined game over for AI-assisted code with how far ahead Github Copilot was but even with first mover advantage, data moat, and distribution, it’s still fading…

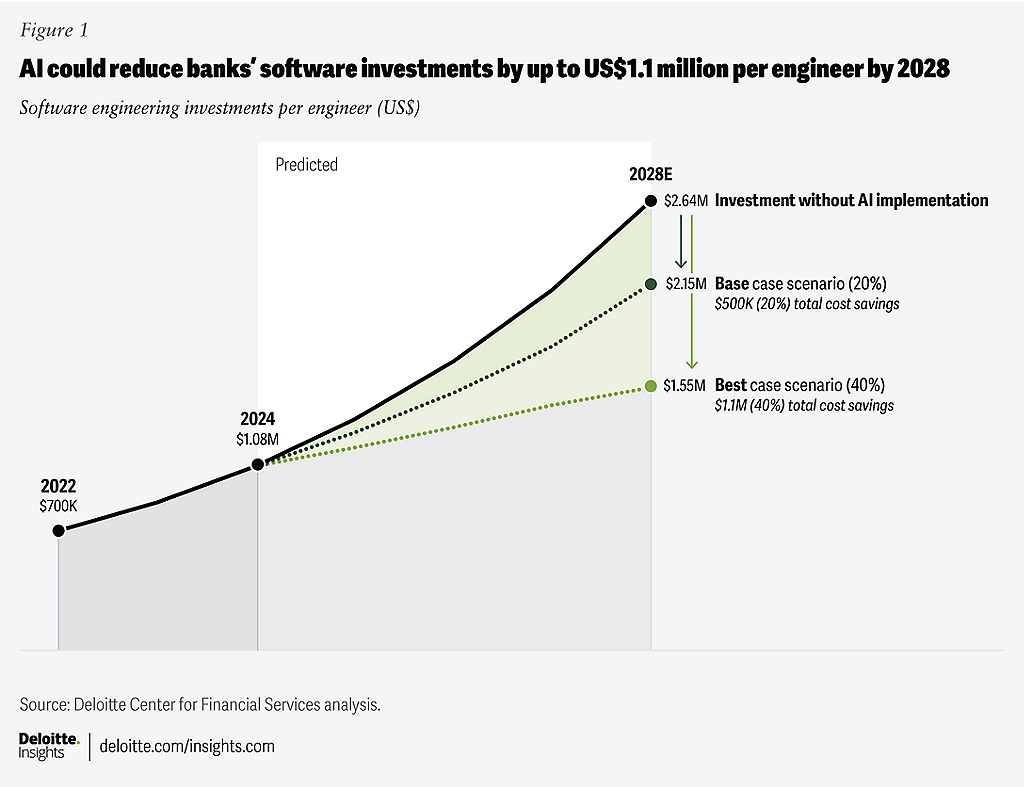

#those are some massive numbers! from Deloitte - AI can help banks unleash a new era of software engineering productivity

#Speaking of Microsoft, it did a RIF of 7,000 employees or 3% of workforce - from Bloomberg - tell me AI efficiency wasn’t a huge part of this

and is this the beginning of the end of mid-layer management? while individuals all have to learn to manage more, agents that is? from Bloomberg

#why security matters!

#if agents are going to disrupt labor then merging the CTO and HR role makes sense

#Francis the Analyst shares his conversation with Nikesh Arora, CEO of Palo Alto Networks, on the better together story with Protect AI, a portfolio co! Thanks for the shoutout!

#

Markets

#humanoid robots to be $5 Trillion market 👀

#