What’s 🔥 in Enterprise IT/VC #445

From freak show to Goat 🐐 - How greatness happens - solving problems bleeding 🩸F*^*ing early; Alex Karp + Jensen Huang (lonely where we were)

It’s easier than ever to start a company and scale with as few people as possible with AI, but I’ve written so many times that one of the most enduring moats are the founders and the talent they hire. Those founders are also the ones who create the mission because without a mission, it’s hard to build for exponential change versus incrementals new features. It’s the founders and the team which conceive of the idea, build and ship product repeatedly, and constantly innovate. This week, I wanted to share a few examples for inspiration, for those founders, who may be well ahead of the curve today in terms of creating a new market, but also with a mission to go big. And yeah, Alex shares it’s taken a long time, 20 years for him, and for Jensen 33 years 👴🏻!

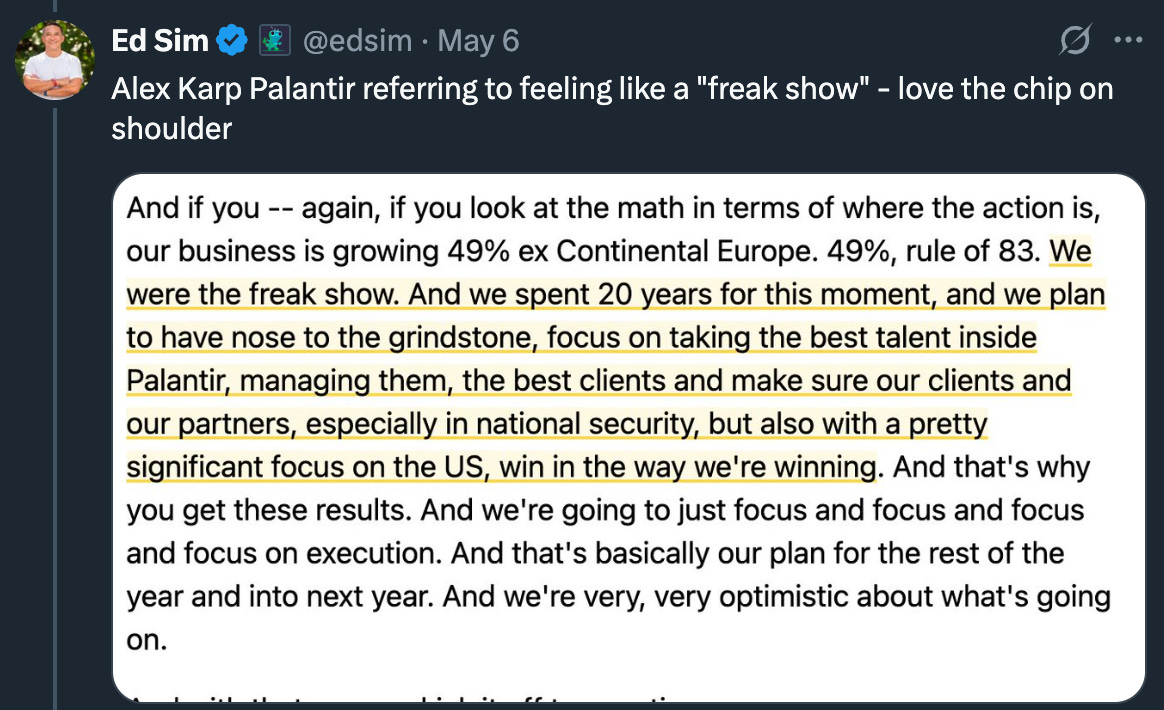

First up, Alex Karp on what it’s been like as founder and CEO of Palantir as he hits it out of the park with Palantirs most recent earnings delivering 39% YoY growth and $884M of Revenue along with the Rule of 83 🤯.

Talk about a founder on a mission - you can feel the pain and also the passion in his words - “We were the freak show” and “We spent 20 years for this moment!”

To pile on, here’s the GOAT Jensen, sharing his initial mission and what it felt like for many years on the bleeding 🩸 edge.

Nvidia mission statement to solve problems that normal compuers can’t

Several problems with that mission statement, turns out it took us 33 years to do and we succeeded at it.

But the first thing, is that, the whole economy, the whole industry, the whole ecosystem wants to go where problems can be solved, no one wants to go where problems can’t be solved. And so where we are was rather lonely. There aren’t other people solving this problem because it’s hard to solve. There aren’t many customers because they tend not to choose problems like that. They want to have their problems be solvable not unsolvable…(from Milken Institute interview, clip from The Transcript)

Here’s Robert Greene talking about mastering a field = bordering on the religious! Mission transcends short term goals and helps you endure through the pain.

It’s pretty clear that both Alex and Jensen convey this sentiment.

Finally, how do the founders and team maintain the lead as they pursue their mission? You keep innovating and shipping product like your life depended on it. To that end, it is absolutely mind blowing 🤯 what Stripe has built and shipped in the past year even as it’s valued at $91.5B!

They even built their own foundational model for payment fraud. What other company at this scale or even 1/10 the size is shipping product like this?

As always, 🙏🏻 for reading and please share with your friends and colleagues!

Scaling Startups

#the bar if you are raising capital from the top multistage funds - they see most deals and will think of your company as compared to these…

for the Series A, this below is still the view - revenues can kill the dream unless you have exponential growth - many founders who have pedigree and can tell a big story with some product thinking behind can raise a sizable A - after that, one must show me the money 💰

#🤔 experience can also be a hindrance to seeing the future…from Koyfin sharing legendary investor Stanley Druckenmiller emphasizing investing in the future - for Inception I’d say 18-24 mos out and definitely not now as it’s already too late

Enterprise Tech

# who wins in the agentic future?

Along with the video clip - the storytelling is 🎯

#that was fast - Microsoft adopts A2A from Google!

#our agentic future is coming faster than we all think and the hackers will be there to exploit the gaps - read more about how Palo Alto Networks used several different techniques to hack agents 👇🏻

#If Software is eating the world and AI is eating software and Agents eat into Labor which is an exponentially much larger market, well, here’s YC request for Summer 25 - full stack AI cos - labor + automation along with Voice AI and Internal Agent Builders

#RSA Takeaways from Goldman Sachs 👇🏻 - great to see port cos Protect AI and Snyk mentioned…PANW now leader in AI security with acquisition of Protect AI, Snyk says more code than ever = more vulnerable code than ever, and Cyera mentioned more inquiries into Gen-AI than ever before - market is here moving faster than we thought

also expect consolidation to kick off in AI security soon but in LT there is always room for best of breed vendors when it comes to new attack vectors which where I spend most of my time!

#watch out for those North Korean hackers trying to get a job - 👇🏻 to watch

#AI coding 🔥 - the much rumored financing of Cursor and acquisition of Windsurf are now official - before AI, the dev tools market was growing but not exponentially - now any one can be a developer, more code than ever is being written - what are the second order effects of this?

💰 $900M raise at a $9B valuation for the makers of Cursor! (FT)

the comments below are enlightening - click through

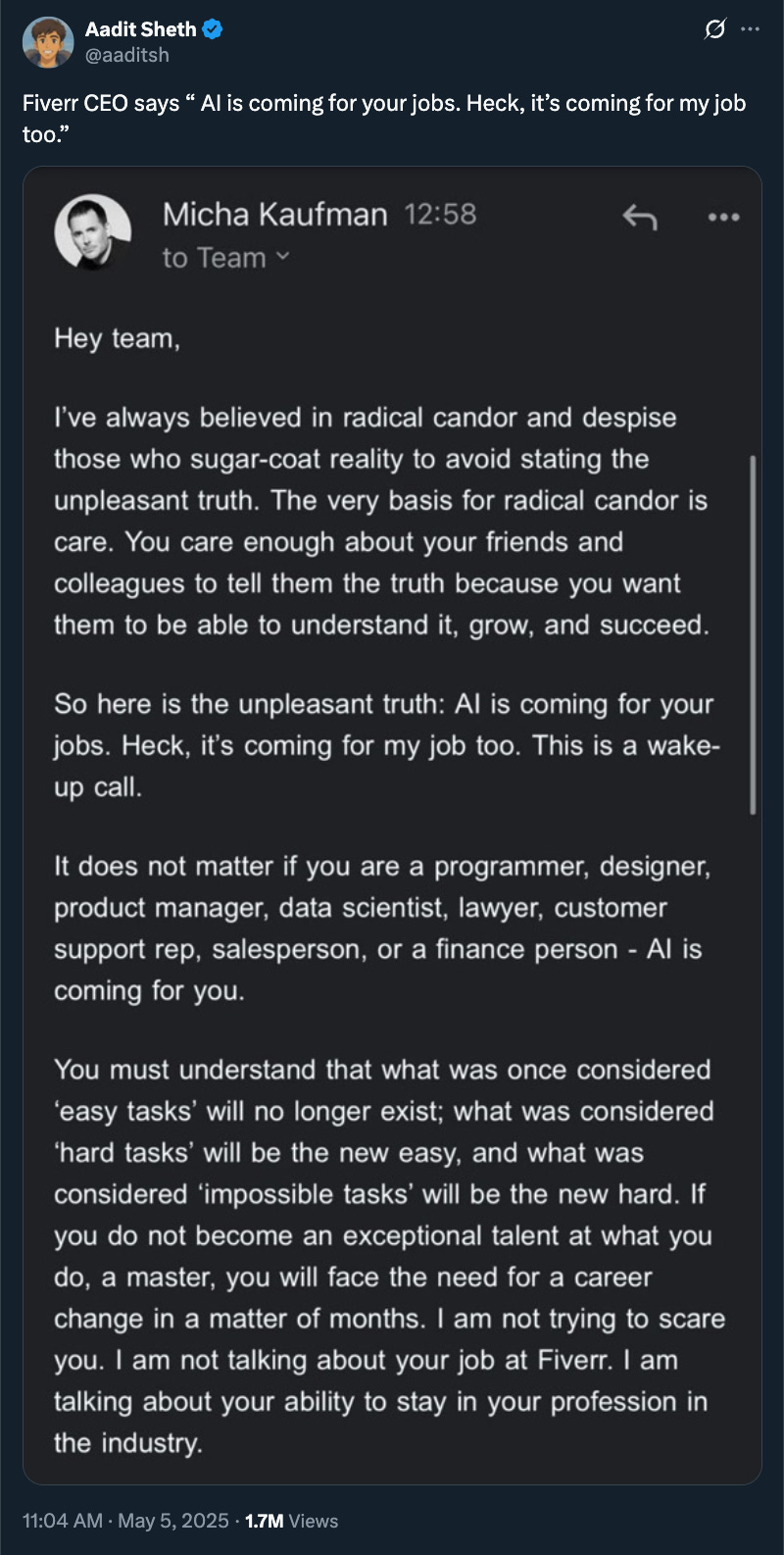

#AI is coming for you…click through 👇🏻 for rest of letter

#crypto and stable coins could be the secure unlock for agentic payments?

#$7 Trillion forecasted spend for AI Data centers 💰💰💰- McKinsey

#Ironman Jarvis like capabilities coming - what can you do with these? How will this change your interaction with AI and the world? What are the enterprise capabilities? Zuck claims we’ll have this in <4 years 😲

#Perspective

Markets

#Clay, a boldstart portfolio co, doing things their own way as usual and takes care of its employees with a tender offer (TechCrunch)

It took seven years of hard work for Kareem Amin, co-founder and CEO of sales automation startup Clay, to see the company’s product finally take off in 2022. Since then, the startup has experienced explosive growth, reached a valuation exceeding a billion dollars, and expanded its employee count from low double digits to over 150.

Despite the team’s average short tenure at the company, Amin made a rare decision: Clay is allowing employees who have at least a year of tenure to sell some of their shares at a relatively high share price to one of its existing investors, Sequoia. It’s a win for everyone. The employee tender offer values the company at $1.5 billion, up from the $1.25 billion it secured in its Series B funding in January. Sequoia, an investor in Clay since its 2019 Series A, has agreed to purchase up to $20 million in employee stock.

Startup employees often trade lower pay for a bet on the company’s future, Amin told TechCrunch. “Most of the startups don’t work out, but Clay is working out, and so we wanted to make sure that they have the option of liquidity.”#this is huge news - democratizing access to venture capital - also quarterly redemption after 1 year with lower fees of 1.25%, 5% hurdle then 12.5% return

#from one of the greatest as he passes the baton

#along those lines - this is old, but why Miami 🌴 for me now - love being able to zip into RSA for a week and then come back and have some time to think clearly and differently