What’s 🔥 in Enterprise IT/VC #434

2025 - notes from a LP AGM - the short version of what LPs and VCs are thinking...

The pace of innovation every week is simply astonishing. This past week Satya announced a new chip telling us that quantum is years, not decades away, we had yet another SoTA model release with X.ai’s Grok 3, and insane financings like the rumored $1B at a $30B valuation with no revenue for Safe Superintelligence. Against this backdrop, I spent two days at a LP AGM with my venture peers and fund investors representing every category from family office to sovereign wealth fund to endowments…to discuss what’s next.

So what were most people talking about? Here are some top of mind notes and comments.

More managers care about the 2 versus the 20!

Pricing for AI companies now worse than ZIRP!

VC is all about the haves and have nots

Lots of managers will disappear.

Average managers looked good in a bull market. Moving forward, folks believe that the dispersion between the top performers and the bottom will increase significantly.

Megafunds are like index funds - you have to have them and you know what you get with them.

To point above - 100 companies have driven 45% of VC exit value over the past decade!

Smaller funds generate alpha but the beta is way too high. However the demand is there, especially for GP spinouts from brand name firms as perceived “safe” choices.

Go BIG, go NICHE, or Go HOME

Inception/seed pricing gone wild 🐯. There is no limit to price paid for that Inception round depending on who it is.

It’s the best of times for any investor with an AI-heavy portfolio and worst of times for those stuck with legacy 🦄 who have not exited.

More consistent supply of IPOs on the horizon but not a boom.

Optimism around more M&A in the $500M to $1B range but still jury out on mega deals

Surprising - unlike last year, no one said I need less venture. Appetite is still there!

Overall concerns about venture capital as an asset class - will returns decrease over time because of all of the points above?

It’s one of the most exciting times ever in venture. There will be a few massive, industry defining winners and well lots more losers. The value created, however, will far outweigh the 💰 lost. It’s the game on the field - put your cleats and 🪖 on. LFG

Here are last year’s notes to show you what was top of mind in 2024 - notes from an AGM March 2024 from What’s 🔥 in Enterprise IT/VC #383

My overall takeaway is that the mood was quite positive unlike last year. There is a feeling that the winners created during this next phase will be way bigger than previous technology shifts in the internet and cloud. Dealmaking was prevalent - folks were smiling. This felt 1000% better than last year. However, underneath it all, if you peer much deeper, there are some old, grizzled veterans who are asking what the end game looks like. Too much venture money, sky high valuations, the big getting bigger which all means that returns will just get dragged down over time…which would suck.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#reminder, all about speed and velocity (just like in last week’s What’s 🔥 on 🔑 to success for founders building from Inception)

#especially in the world of AI

#regarding moats in the world of AI (read What’s 🔥 #432), here’s one and an interesting take to further engender loyalty with your users 👇🏼 (from port co Clay)

#a technical founder’s takeaways from our boldstart founder summit last week…

#🤯

Enterprise Tech

#quantum in years, not decades 🤯 - what time to be building!

#crypto is so back - ummm, wait a minute, oh crap 🤯 - $1.5B stolen in largest hack ever…

#here’s how it could have been prevented using Hypernative (a portfolio co)

#Safe Superintelligence (Ilya from OpenAI) to raise $1B at $30B valuation 🤯 led by Greenoaks - yes, no revenue, bet on the future (Bloomberg)

#what the college students can build in a weekend powered by AI

#Mira, also from OpenAI, launches Thinking Machines - land grab for talent!

#🤔 - worth a deeper read…

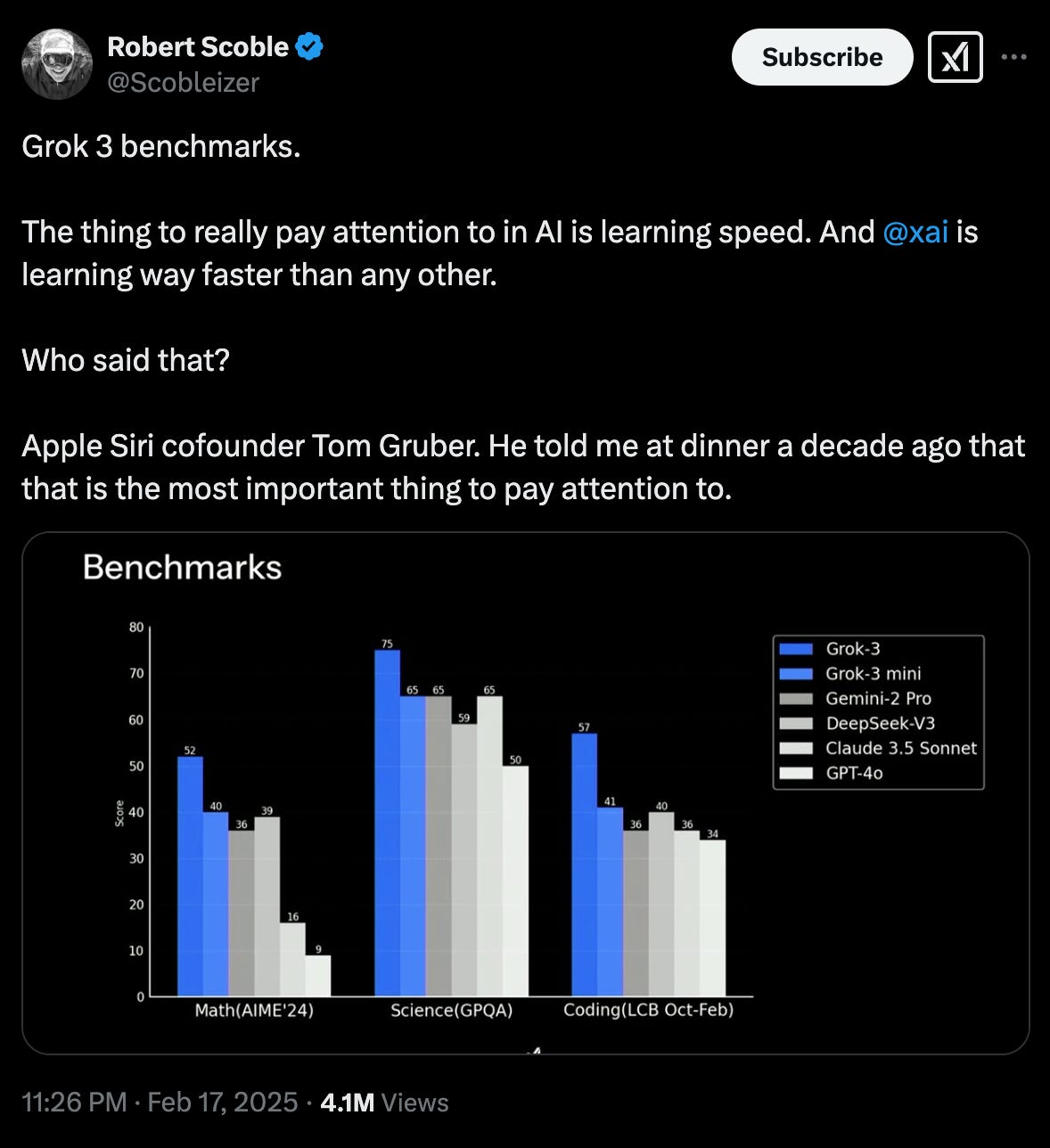

#i talk about velocity as the key to success for startups, especially learning velocity - well Scobelizer sums it up well with X’s release from Grok - just 19 months!

#19 months 😲

#that was fast!

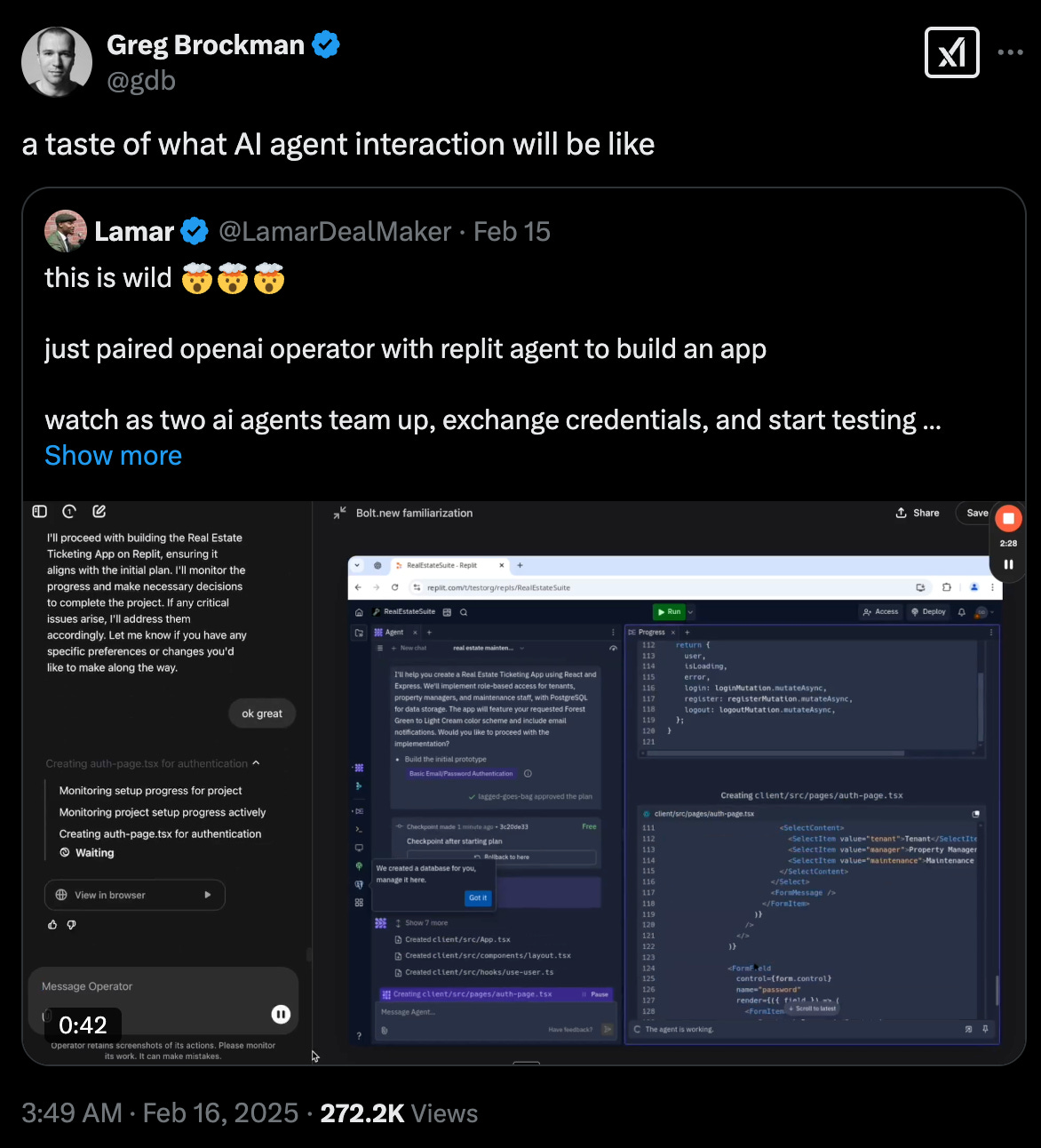

#as mentioned in last week’s newsletter, we are now in world of B2A but heading to A2A in future?

#Gergely nails it…paywalls are coming, gateways to block agentic traffic coming, best data will be private or paid for

#along those lines, this is how you get every VC and founder doing the same thing…more important than ever to be an original

#Good news, any one can be a developer so the market has expanded significantly Bad news, only more tools will come out and share of wallet will get brutal...OpenAI dev agent? Others? Going to be an interesting next few years...

#case in point…

#Cursor rolling out to large public cos now

#while more developers, are we doing the jr. engineers a disservice?

#the future, agents embedded in glasses 🤓

#MCP starting to become a thing - model context protocol or “"Think of MCP like a USB-C port for AI applications" that's excellent framing.” from Tobi Lutke Shopify

#

Markets

#Sailpoint at 17X current ARR multiple…