What’s 🔥 in Enterprise IT/VC #429

The real state of the venture market in one slide + Howard Marks on bubbles "Too much optimism on the new thing leads to pricing errors. In reality only a few newcomers may thrive or even survive"

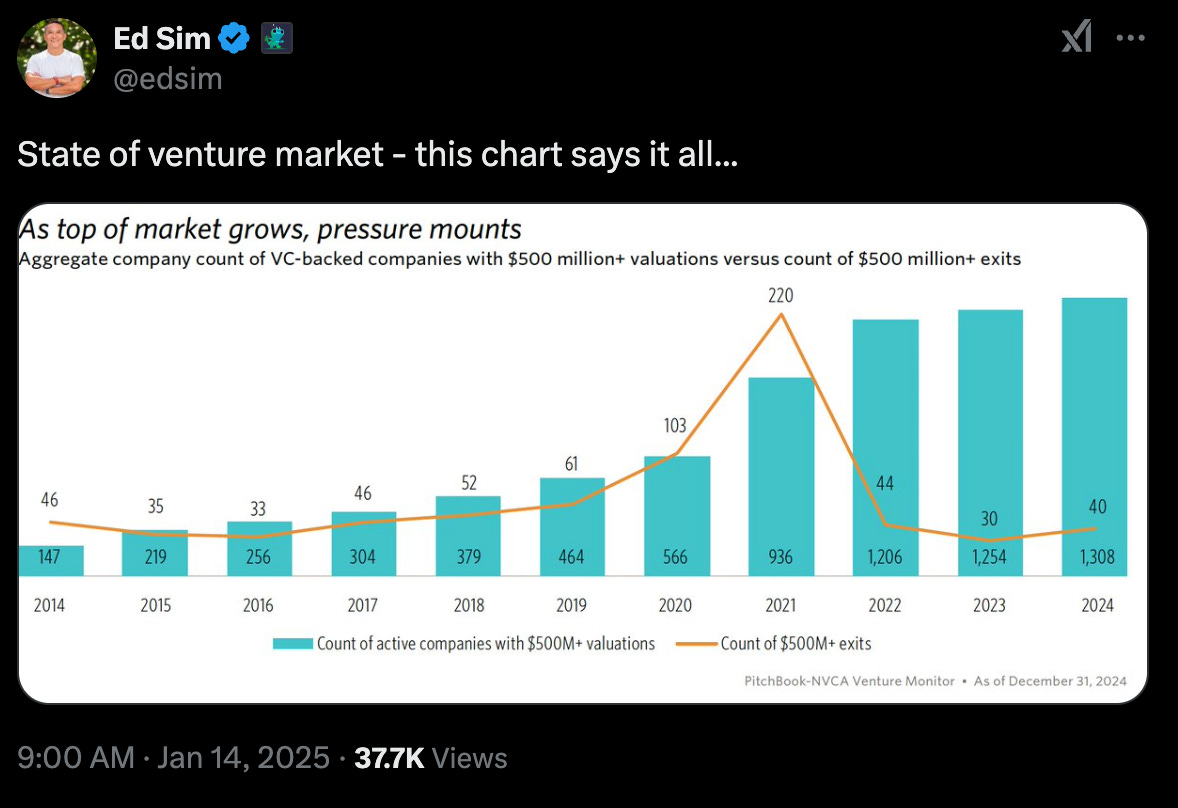

Seems like this slide 👇🏼 got everyone’s attention. It’s pretty shocking when it’s laid out like this in a world predicated on Power Laws.

The inventory keeps building and a shocking 70% of exits happen at the pre-seed and seed rounds.

All of this is driving the big question in venture capital, where the most established multistage firms are raising the lion's share of capital. LPs, particularly endowments, need to make tough decisions about which funds to continue investing in, as the money is not coming back to them fast enough to support operations. This means that many emerging managers will simply disappear in the future. I hope this changes, but I fear it will take a couple of years to start working down this inventory.

The next question one should ask is how do we reduce this inventory, and are we in an AI bubble? In my opinion, there is no better person to turn to than legendary investor Howard Marks who wrote one of the first essays calling out the Internet bubble back on January 2, 2000. Here’s an excerpt from that post which you should read in full here.

Changing the world -- Of course, the entire furor over technology, e-commerce and telecom stocks stems from the companies' potential to change the world. I have absolutely no doubt that these movements are revolutionizing life as we know it, or that they will leave the world almost unrecognizable from what it was only a few years ago. The challenge lies in figuring out who the winners will be, and what a piece of them is really worth today.

Sounds like our current AI wave! As I've said, the winners will be few, but the value they create will outweigh the losses from every other company that gets funded. This is the game on the field that we are all playing and of course, the trick is figuring out and building the right ones!

Here’s Howard’s latest memo - while the points below relate to public markets, this can equally be applied to venture:

"Too much optimism on the new thing leads to pricing errors. Since bubble participants can’t imagine there being any downside, they often award valuations that assume success. In reality only a few newcomers may thrive or even survive."

The good news is his conclusion is that the markets are perhaps frothy but not nutty.

Link to FT here and his original memo, “On Bubble Watch” here.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#startup life and 🔑 to success

#advice for founders - just informing you to go in with your 👀 wide open - healthy comments 🧵 so click through - to be clear there is a nuance “when your inbox suddenly fills up in days" - yes, you should pick a few relationships with investors to get to know them well before a raise as relationships over transactions but just be skeptical if 10-15 of these requests come in a few days when you’re heads down building!

#I can’t emphasize the importance of “time to value” enough!

#state of European tech from Luciana at Sequoia

#great comments on selling to a technical audience on hacker news - h/t Ian Jennings TestDriver.ai - hacker news link here

I'm a CTO who makes purchasing decisions. There are numerous products I likely would have purchased, but I either find a substitute or just go without because I won't play the stupid "let's get on a call" game.

If your website doesn't give me enough information to:

1. Know enough about your product to know that it will (generally speaking) meet my needs/requirements.

2. Know that the pricing is within the ballpark of reasonable given what your product does.

Then I will move on (unless I'm really desparate, which I assure you is rarely the case). I've rolled-my-own solution more than once as well when there were no other good competitors.

That's not to say that calls never work or don't have a place, because they definitely do. The key to using the call successfully (with me at least) is to use the call to get into true details about my needs, after I know that you're at least in the ballpark. Additionally, the call should be done efficiently. We don't need a 15 minute introduction and overview about you. We don't need a bunch of small talk about weather or sports. 2 minutes of that is ok, or when waiting for additional people to join the call, but beyond that I have things to do.

I know what my needs are. I understand you need some context on my company and needs in order to push useful information forward, and I also understand that many potential customers will not take the lead in asking questions and providing that context, but the sooner you take the temperature and adjust, the better. Also, you can get pretty far as a salesperson if you just spend 5 minutes looking at our website before the call! Then you don't have to ask basic questions about what we do. If you're willing to invest in the time to get on a call, then it's worth a few minutes of time before-hand to look at our website.#how PE folks think - makes senses and easier said than done but if you end up thinking about PE as an exit, remember this 👇🏼

Enterprise Tech

#it’s show me the money time - the new bar…

#more 💰 - Harvey preempted by Sequoia at $3B valuation! 5x growth YoY from $10M to $50M ARR - company is only 3 years old 🤯

Harvey expects to raise about $300 million at around a $3 billion valuation in a round led by Sequoia Capital, according to people with direct knowledge of the fundraising. This would come about a month after the company surpassed $50 million in annual recurring revenue, a third person tells me. That was up from about $10 million in ARR a year prior and would make Harvey one of the biggest generative AI startups in terms of revenue, nearly as big as search startup Perplexity, according to our Generative AI database. #Speaking of European tech, Synthesia just raised a new round at $2.1B for AI-generated video avatars for enterprises, making it the most valuable AI co in the UK - NEA, GV, Nvidia - first round was 2017 according to Crunchbase and now raised over $500M

#the context - 30 years of change compressed into 3 years and oh yeah, Microsoft is now taking a page out of Palantir playbook and also building and running apps!

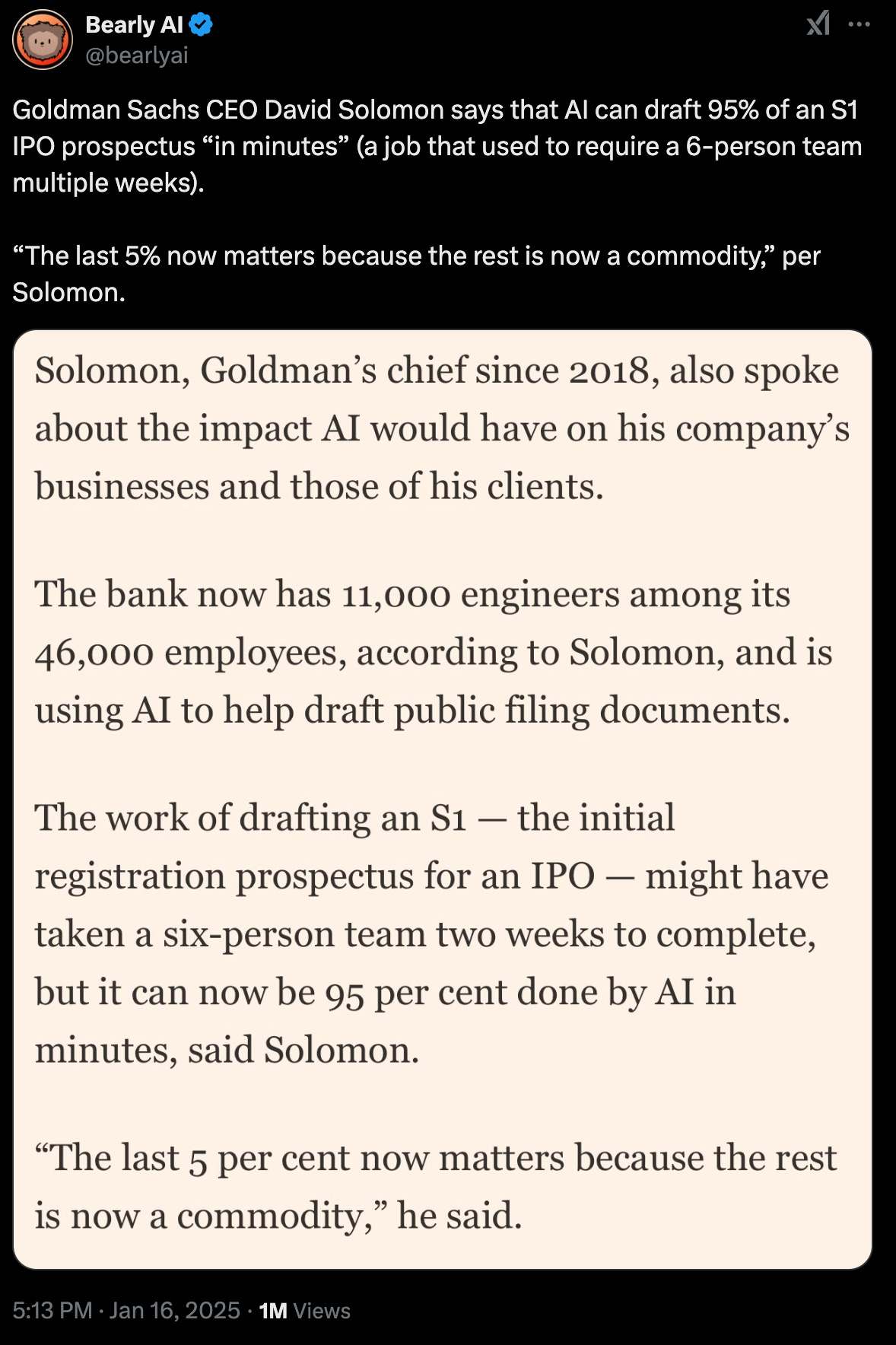

#David Solomon CEO of Goldman Sachs on AI - all about the last mile!

#sad but true

#it’s happening faster than we realize, starts at edges and then 🤯

#thoughts from a month with Devin the AI coding assistant released by Cognition Labs and sitting on a $2B valuation - promising but still lots of failures…

Working with Devin showed what autonomous AI development aspires to be. The UX is polished - chatting through Slack, watching it work asynchronously, seeing it set up environments and handle dependencies. When it worked, it was impressive.

But that’s the problem - it rarely worked. Out of 20 tasks we attempted, we saw 14 failures, 3 inconclusive results, and just 3 successes. More concerning was our inability to predict which tasks would succeed. Even tasks similar to our early wins would fail in complex, time-consuming ways. The autonomous nature that seemed promising became a liability - Devin would spend days pursuing impossible solutions rather than recognizing fundamental blockers.

This reflects a pattern we’ve observed repeatedly in AI tooling. Social media excitement and company valuations have minimal relationship to real-world utility. We’ve found the most reliable signal comes from detailed stories of users shipping products and services. For now, we’re sticking with tools that let us drive the development process while providing AI assistance along the way.#agents also have much to improve - it’s ok, we are still in the early days!

#the AI agent opportunity and current state from Aaron Levie’s own experiences at Box - as written so many times before, first internal and then it goes external and we’re still so early! also great comments in 🧵

#meet your future robotic overlords - it’s real 👀

#the magic 🪄 moment

#OpenAI releases tasks - preview of much bigger ideas…worth a scroll through

#Google’s newest architecture called Titans - what happens if you bring idea of LT memory to models?

From a memory perspective, we argue that attention due to its

limited context but accurate dependency modeling performs as a short-term memory, while neural memory due to its ability to memorize the data, acts as a long-term, more persistent, memory. Based on these two modules, we introduce a new family of architectures, called Titans, and present three variants to address how one can effectively incorporate

memory into this architecture. Our experimental results on language modeling, common-sense reasoning, genomics, and time series tasks show that Titans are more effective than Transformers and recent modern linear recurrent models. They further can effectively scale to larger than 2M context window size with higher accuracy in needle-in-haystack tasks compared to baselines.#the long promised idea of digital twins for industrial use cases is coming (TechCrunch)

Nvidia has been doubling down on the opportunity to build robotics and other industrial AI applications, with the launch of its Omniverse platform, and most recently Mega, an Omniverse Blueprint framework to create digital twins to operate these applications. It’s also investing in digital twin startups to get the effort off the ground.

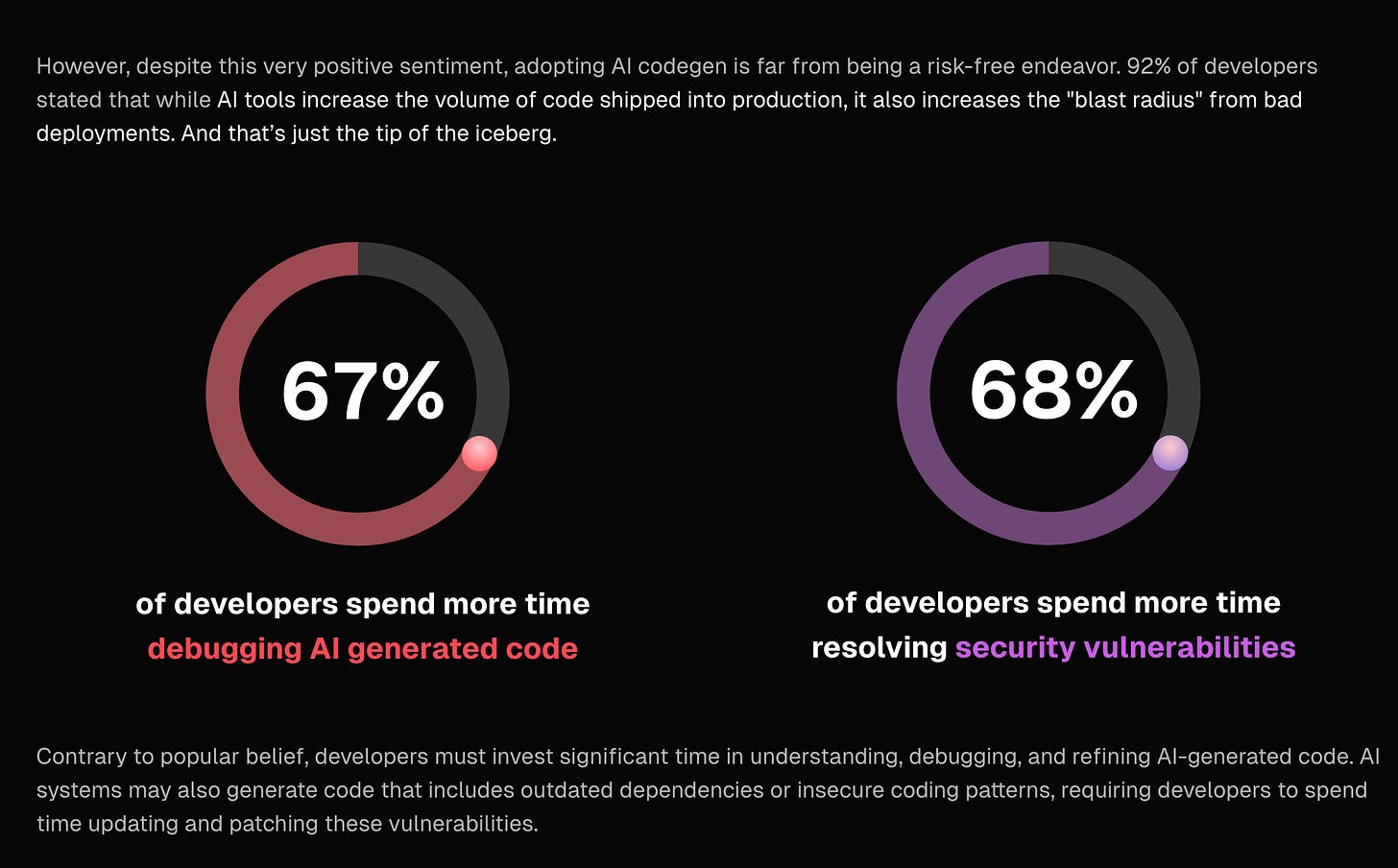

Taiwan’s MetAI has developed a model that can quickly generate “SimReady” (simulation-ready) digital twins using AI and 3D technology, by converting CAD files into functional 3D environments within minutes.#impactful report from Harness, Beyond CodeGen: The Role of AI in the SDLC - second order effects of more AI-generated code highlighted here

#this is beyond an AI coding assistant - pay attention and watch 👇🏼

#what will really happen when it comes to software engineering jobs and AI - devs will work on higher order and more complex problems

#cool list of engineering projects on Guillermo’s (Vercel) post

#your AI open source stack

#🤣 from head of AI at OpenAI

Markets

#🤯