What’s 🔥 in Enterprise IT/VC #427

The 15 year startup journey and implications for founders and investors

Welcome to 2025 and the death of venture capital as we know it 🤣. Death is an extreme, but we can all agree that it must adapt. There was lots of discussion online this week about the future of VC and exits, so here’s my take.

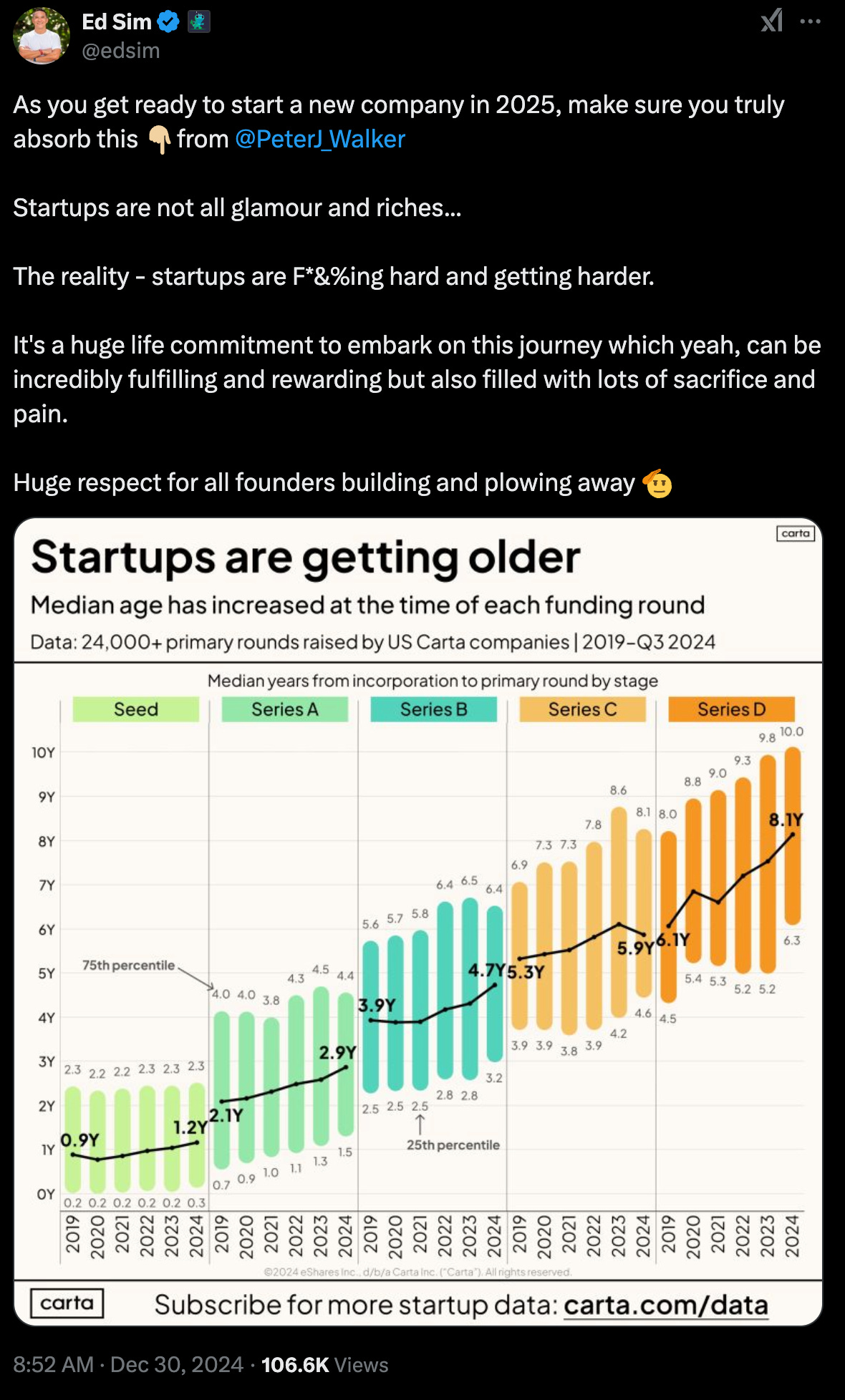

First, this data 👇🏼 has huge implications for founders and VCs as the median age from incorporation to primary round stage continues to lengthen.

When I began my venture capital career in 1996, it was a bespoke, cottage industry and I remember the rule of thumb for time from founding a company to IPO was around 7 years. Look at the data now - it’s 8.1 years to just get to a Series D round! There is, of course, so much more private capital out there, the bar to going public is super high, and it’s not easy to build on a quarterly basis. But wow, now it takes 8.1 years just to get a Series D round done!

Garry summarizes it well!

Jason also chimes in on the 15+ year plan to IPO which is double the length of time from when I started in VC in 1996.

All of this has huge implications for founders and investors!

Always start a company for the right reasons - it’s taking longer to create a massive outcome - 15 years to an IPO. If you build something new for the world, do it because you are obsessed with solving this problem and not because of the money. There are easier ways to make money if that is what you care about it.

Enjoy the journey.

Prepare for pain! Must listen podcast released this week on lessons from best founders 👇🏼

Choose your partners and co-investors wisely!

40-50% of first marriages end in divorce w/median length 8 years... Time to IPO is 15 years!

Founder vesting needs to be rethought? Typical vesting schedule is 4 years, 1 year cliff with monthly over next 3 years. What happens after year 4 on a 15 year journey? What if one of your co-founders who has 20% of the company leaves at year 5 and there are 10 more years to build and deliver value? How do founders stay motivated, compensated, etc? Should vesting be longer, different? Here’s a founder, Huber, chiming in.

VC fund timelines should be lengthened from standard 10 years to 12 years or longer. The typical length of fund commitment is usually 10 years for venture capital funds after which venture investors have to ask their LPAC for a series of 1-year extensions. The real question is are we kidding ourselves to think we can return the capital when it takes 15 years to IPO for your winners. This, of course, has huge implications for LPs or investors in VC funds as they are locked up longer in illiquid investments.

Early liquidity matters for Founders…and investors? Given how long founders are signing up on this journey and given the sacrifices that they make, helping them get some early liquidity in the Series B rounds and after allows founders and investors to truly go long. Of course, these decisions should be made on a case-by-case basis. Most of my big winners have founders who have sold some on way up over time to give them some breathing room and ability to think bigger. Once again, this is not for everyone and the amount matters, but something that should not be a “never ever” type of thing, and this should become more prevalent over time.

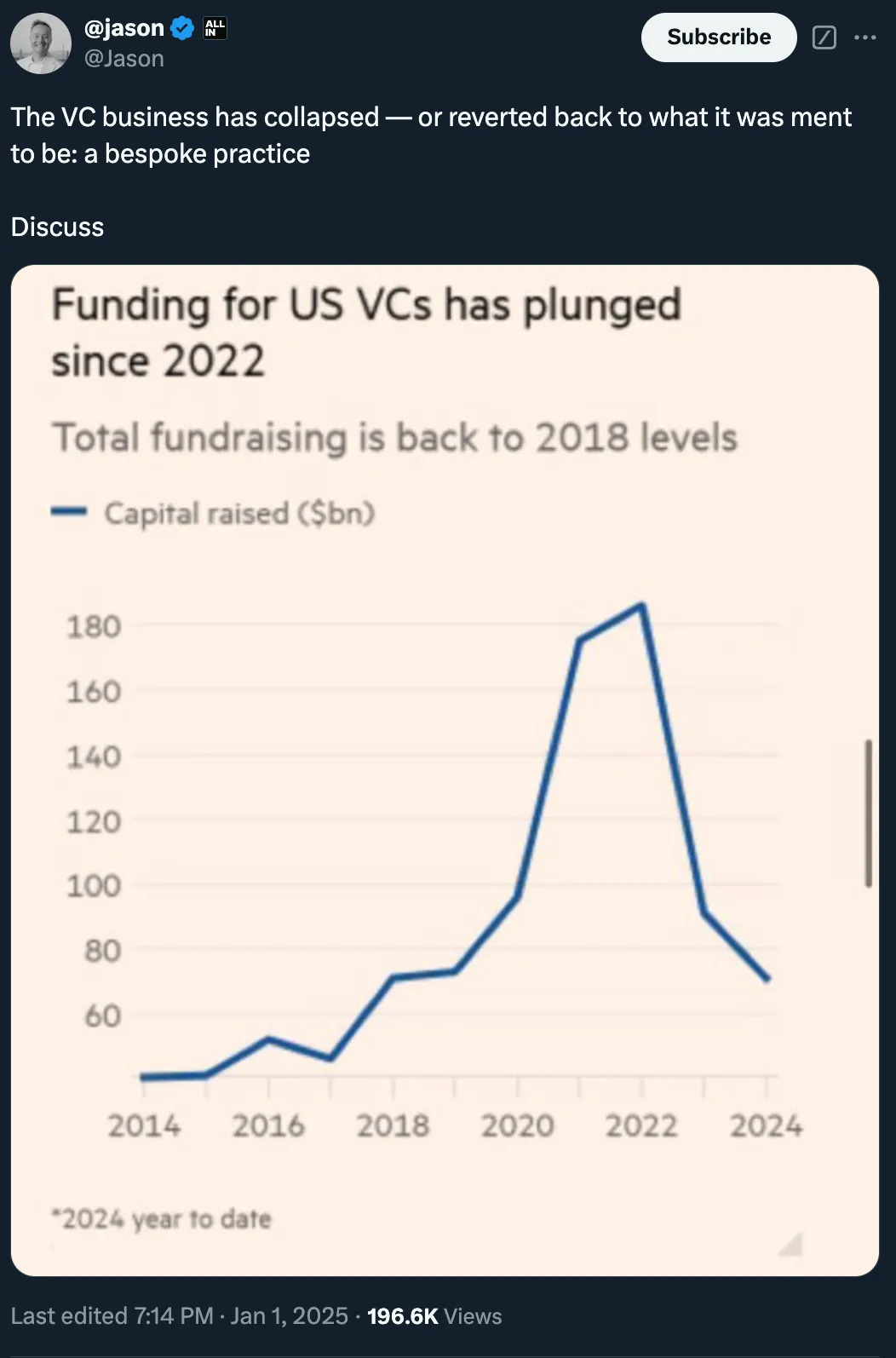

Finally, investors are also signing up for the long haul, both VCs and their LPs. The rule of thumb is always to make sure you own as much as you can in your best companies, but if you’re an early stage fund, should you take some off table over time as well. While nuanced, my answer to that question is yes, this is something that all early stage investors should think about as their best companies keep raising at higher and higher prices. How you do that and at what price and how much is a much longer conversation.Finally, all of this has massive implications for venture funds raising capital. The more money that is committed to venture capital and the longer it is locked up with little liquidity means the less that these LPs can commit to new funds. There has been a ton of debate this week on how the most established funds are the raising the bulk of the capital, and how that will impact founders down the line. FWIW, while painful, I do believe this culling out of funds is healthy for the industry ( read more at FT).

And comments on posts like this from Jason.

More to come in 2025 and Happy New Year!

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#15 lessons from best founders in history

#lots of debate out there on who is Tier 1 VC vs Tier 3 and only raise from Tier 1s but reminder for founders…

#Founders ABS Always Be Selling

#so good…

#venture debt lessons from abrupt shutdown of Bench

Enterprise Tech

#so many opportunities for founders to think about second order effects for more AI-generated code, something I’ve been focused on for awhile

#spot on with my predictions 🤣 - more VC predictions on what’s 🔥 in the enterprise in 2025

#do agents need a holiday break?

#Hubspot co-founder and CTO Dharmesh Shah 3 Predictions for 2025 (nice shoutout for CrewAI, a boldstart portfolio co)

My first prediction: The future will not be just about singular agents but more about networks/systems of agents where agents can discover and collaborate with other agents.

We've made some amazing progress this past year in creating single-purpose agents. You know, the ones that can handle customer service, do company research, analyze data — that kind of thing.

This has been made possible by some incredible advancements:

Better LLMs with improved reasoning capabilities

More sophisticated structured output

Advanced function/tool calling

And even early multi-modality support (hello, audio and video!)

That's all awesome. I'm here for all of it.

But next year, I think we’re going to go much further.

2025 is going to be the year of multi-agent networks.

What I think is coming:

Agents will be able to "declare" their capabilities

They'll be able to specify their inputs and outputs

They will highlight their "experience" (think agent resumes!)

Think about it this way: In the same way that current LLMs support tool calling (whereby a set of tools is made available to the LLM, which it can then use to formulate a more useful response), in the future, agents will be provided access to a network/system of other agents. The agent can then invoke these other agents in order to handle tasks that it can't do itself.

The agent can then invoke these other agents in order to handle some number of tasks that the agent can't do itself.

We're already seeing early signs of this. There are powerful dev frameworks for building these kinds of multi-agent systems (CrewAI comes to mind), and low-code platforms (like agent.ai).

These are early days, and a lot has to happen to fulfill this network of agents vision. But it feels like we're moving this way very, very quickly.#great roundup of AI in 2024 from Jim Fan Nvidia Sr. Research Mgr 🧵

#solid list of AI products to check out…

#Augment or replace? I’m about incredible efficiency and for now devs will do way more work with AI superpowers - the future TBD

#and around and around we go - more $ invested from strategics into startups and the more $ they get back - Nvidia invested $1B last year into startups, up from 872M prior year (FT)

Nvidia invested $1bn in artificial intelligence companies in 2024, as it emerged as a crucial backer of start-ups trying to gain from the AI revolution the big tech group’s chips are powering.

The semiconductor giant, which surpassed a $3tn market capitalisation in June on the back of huge demand for its high-performing graphics processing units (GPUs), has pumped ever greater sums into some of its own customers in the burgeoning sector.

According to corporate filings and Dealroom research, Nvidia spent a total of $1bn across 50 start-up funding rounds and several corporate deals in 2024, compared with 2023, which saw 39 start-up rounds and $872mn in spending.

Markets

#Dan Ives from Wedbush shares his prediction for tech stocks in 2025

#must read on how $7.8B became $70b 👀

some of 🧵 here