What’s 🔥 in Enterprise IT/VC #425

Will business applications collapse in the agent era? Where does logic go + what are the "second order" effects when hundreds or thousands of agents are running amok at enterprises?

So this tweet got some solid traction last Sunday morning - filled with a few typos, etc but the point was made quite succinctly by Satya Nadella - stop, watch, and listen 👇🏼

I also wrote more about it here in What’s 🔥 #410 (scroll to Enterprise Tech section):

Adding to this thought, as Marc Benioff transforms Salesforce to be all about agents, it strikes me that the very idea he is pushing is one that could put Salesforce at existential risk. Yes, it’s all about the data and Salesforce is the system of record for sales and many other applications but one will no longer need to go to Salesforce as the front-end and UI gets reimagined with AI. We now have AI pinging a database, training and getting smarter and then an agentic workflow can stitch together other various apps and systems of record over time. Once the front-end where the user changes, one can easily see an end around in which the application becomes just a database/system of record and customers migrate to the cheaper, faster, more agile system with best-of-breed components. Just 🤔 out loud! This is also where many a startup like Clay in our portfolio and Attio and others are going around and eating at these large businesses at Salesforce with little innovation.Reminder - this is future thinking as the “how long will this take” is the big question. We are already seeing some evidence of this happening for super simple applications. For the more complex applications like an ERP like Workday, it may take “forever and a day” but bits and pieces of those apps are already getting chiseled away and agentized.

Here are some use case examples from the CrewAI (a boldstart portfolio co) State of Agents in Enterprise survey released this past week:

As readers know, I keep thinking about “second order” effects as it relates to this future where each of us has dozens or hundreds of agents doing work for us. Who’s going to provide the security infra to provide access control? Who’s going to manage these? Is there a platform to manage disparate agents and secure them? What about a runtime system for Claude’s MCP which feels like a dockerized, secure sandbox for agents to do work (check out Dylib.so - a boldstart port co) on this future. More to come…

So how does this euphoria around the agentic future relate to the startup market? Check out Peter Walker from Carta’s data on the “AI” premium for startups.

FWIW, I asked Peter what constitutes an “AI” company as it’s pretty much embedded in most software, so I’ll share and update when I hear back (UPDATED)

Of course, higher valuations usually equate to larger rounds and this data also confirms that. Check out those Inception rounds on the 95th % at >$12M!

What a year! That’s a wrap - Happy Holidays 🎄 🕎 to all of you!

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#how are LPs (investors in venture funds) thinking about 2025? Beezer Clarkson from Sapphire Ventures (a boldstart LP) nails it here on themes to watch 👇🏼

#AI 🦄 - faster to $1B valuation with 1/2 the headcount - of course, real question remains - which of these cos deliver the returns at end of day?

#Before you have your company take that hill, make sure it’s the right one!

Enterprise Tech

#the enterprise AI search wars accelerate - will top down Glean win or bottom up PLG startup Perplexity which has officially entered the arena with the acquisition of Carbon, a 4-person startup (TechCrunch). Oh yeah, it also announced a $500M round led by existing investor IVP at a $9B valuation 🤯 tripling its valuation from June (Bloomberg)

#best product of 2024 from founder/CEO of Vercel - comments 🔥 - lots of Cursor and Claude

#tech to geek out on over the holidays - comments are 🔥

#The state of the AI Agents ecosystem: The tech, use cases, and economics (Insight Partners) - must read covers everything from Agents to the infrastructure and tooling for them!

#👀 hiring 2000 salespeople to sell agents to replace people - Salesforce (CNBC)

Salesforce will hire 2,000 people to sell artificial intelligence software to clients, CEO Marc Benioff said on Tuesday, double the number the company indicated it was planning to add a month ago.

The cloud software company, which targets sales reps, marketers and customer service agents, is among the many technology companies hoping to boost revenue with generative AI features.

“We’re adding another couple of thousand salespeople to help sell these products,” Benioff said at a company event in San Francisco. “We already had 9,000 referrals for the 2,000 positions that we’ve opened up. It’s amazing.”#enterprise sales in high gear from Gil Dibner (Angular Ventures)

Beyond TTDD. Over the past year, the scale of the AI-powered vertical application software opportunity has become increasingly clear. We continue to meet companies with impressive early growth tracks, and we continue to hear stories of software companies - particularly in the US but in Europe and Israel as well - that are posting very impressive early revenue numbers. As Ed Sim pointed out recently, the “triple-triple-double-double” (TTDD) revenue trajectory that defined successful enterprise startup revenue trajectories for the past decade is being re-evaluated in the face of AI application companies that seem to be growing much faster. The new upper bound seems to be two years of 10x revenue growth (10x10x), but even somewhat more modest pathways such as Ed’s proposed “quintuple-quadruple-triple-double” (QQTD) are more frequently observed than previously. TTDD get you from $1M to $36M in four years. QQTD gets you from $1M to $120M in four years. 10x10x gets you to $100M in just two years. The list of companies that are apparently achieving results on the upper end of this scale is longer than ever before: Bolt, Cursor, Together.ai, 11x, Eleven Labs, Character.ai, Sublime, Wiz, and several more.

Observations and questions. These types of growth rates are absolutely happening and they have impacted the startup ecosystem already. They also raise some questions for which we do not yet have good answers...

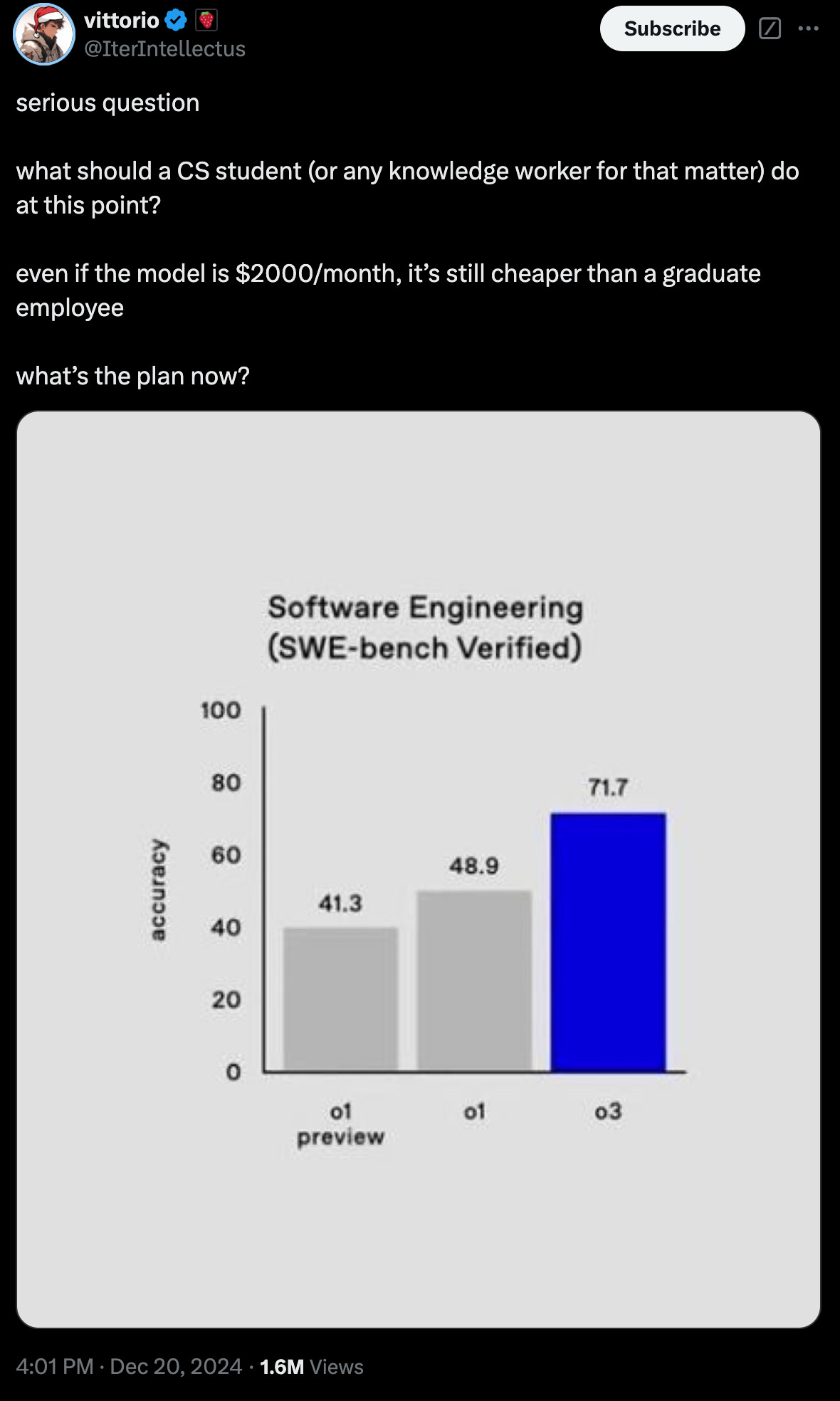

Read more...#the future of coding and CS?

#ZIRP valuation get together - Grammarly, which last raised in Nov 2021 at a $13B valuation, buys Coda, who also raised during ZIRP era in July 2021 at $1.4B post (Axios)

Grammarly, a writing assistant valued by VCs at $13 billion, agreed to buy productivity startup Coda, with Coda's CEO Shishir Mehrotra to take that position at Grammarly.

Why it's the BFD: Grammarly is kinda/sorta one of the earliest AI agents, founded in 2009, but faces extinction-level competition from the GenAI class. Merging with Coda helps it expand from a one-trick pony into a productivity stable.

By the numbers: Axios has learned that this was an all-stock deal at each company's most recent post-money valuation. That means that Grammarly shareholders will hold around 90% of the combined company, as Coda was last valued at $1.3 billion.

Grammarly had raised around $400 million from backers like General Catalyst, IVP, and SignalFire. Coda had raised around $320 million from backers like General Catalyst, Greylock, and Kleiner Perkins.

The bottom line: This deal moved at the speed of the AI revolution. Mehrotra tells me that the first conversation was just three weeks ago, with the agreement signed on Monday.

As for the CEO swap, it seems to be about both sides' desire for a founder to lead the combined company. Outgoing Grammarly CEO Rahul Roy-Chowdhury had joined in 2021 from Google.#speaking of agents, is this the future?

#you don’t always want to or have to go to the CISO…

Markets

#💪🏼 🤣 Congrats to Databricks and also George Mathew from Insight as one of leads of this new $10B round at a$62B valuation - what was the bad advice George gave Ali that he thankfully ignored? (TechCrunch)

Databricks co-founder and CEO Ali Ghodsi (pictured) sought out advice from Mathew, who had run big data company Alteryx as COO before becoming a VC. The two had been friends since Databricks’ early days.

“Ali called me a few years ago and said, ‘Hey, I’m thinking about going into the data warehousing market.’ And I just said, ‘That’s the stupidest idea I’ve ever heard.’ And I could not have been more wrong,” Mathew laughs, adding he’s glad Ghodsi didn’t listen to him, nor hold his bad advice against him.#👀 The Venture Capitalists Set to Win Big in 2025 - The Information

#anon corp dev employee shares thoughts on M&A

#🤔