What’s 🔥 in Enterprise IT/VC #423

How do CIOs/CTOs/CISOs from Salesforce, Blackstone, Paypal and Juniper think about partnering with startups + AWS re:Invent recap

I must confess that I'm experiencing FOMO for missing AWS re:Invent this year. It was once a yearly weeklong excursion for the boldstart team to Las Vegas, but it became somewhat monotonous and overly crowded after a while. Year after year, we VCs would all sit in on a special roadmap presentation from AWS (2019 slide here) to show us where they were looking to partner or fill in gaps only to understand that all of their new product releases would potentially vaporize existing infrastructure portfolio companies 🤣. OK, I’m being a bit dramatic as not every product that AWS has launched has been a smashing success, but you get the gist. Back to this year - from what my colleague Ron Miller tells me, this year was way different - the energy and excitement is back, especially with all of the announcements around AI for enterprise customers.

The Register did a great job highlighting some of the most interesting AWS product releases, summarized below.

- **Graviton Processor**: AWS's custom general-purpose processor, Graviton, delivers 40% better price performance and uses 60% less energy than x86 processors. This is significant for cost savings and energy efficiency in cloud computing.

- **Trainium2 (Trn2)**: AWS's AI training chip, Trainium2, offers 30-40% better price performance than current GPU systems. This is crucial for cost-effective and efficient AI training and inference.

- **S3 Tables**: A new flavor of Amazon's S3 cloud storage service, S3 Tables promises 3x faster query performance and 10x more transactions per second for Apache Iceberg tables. This enhances data analytics capabilities.

- **Aurora DSQL**: Amazon Aurora's new distributed SQL service provides low-latency reads and writes with strong consistency across multiple regions. This is a technical achievement for distributed data storage.

- **Bedrock Model Distillation**: This new service reduces the size and cost of AI models by training smaller models to be experts in specific tasks. It offers up to 500% faster performance and up to 75% cost reduction.

- **Nova Models**: Amazon's new set of foundation models, including Nova Micro, Nova Lite, Nova Pro, and Nova Premier, are at least 75% less expensive than the best-performing models in their respective intelligence classes. This makes advanced AI more accessible and affordable.

- **Q Developer Enhancements**: Amazon's Q coding assistant now generates unit tests, documentation, and performs code reviews. This reduces time spent on undifferentiated tasks, allowing developers to focus on value-added activities.In short, AWS was all about improving performance, efficiency, and cost-effectiveness in cloud computing and AI, making it easier and cheaper for enterprises to build and deploy on AWS. FWIW, the Bedrock Model Distillation is huge for enterprises to get the benefit of larger models which have more knowledge while also delivering accurate, faster and cheaper results! What’s not included in the list above is automated reasoning which addresses the other problem that enterprises have which is dealing with hallucinations:

Today, we’re adding Automated Reasoning checks (preview) as a new safeguard in Amazon Bedrock Guardrails to help you mathematically validate the accuracy of responses generated by large language models (LLMs) and prevent factual errors from hallucinations.

Amazon Bedrock Guardrails lets you implement safeguards for generative AI applications by filtering undesirable content, redacting personal identifiable information (PII), and enhancing content safety and privacy. You can configure policies for denied topics, content filters, word filters, PII redaction, contextual grounding checks, and now Automated Reasoning checks.

Automated Reasoning checks help prevent factual errors from hallucinations using sound mathematical, logic-based algorithmic verification and reasoning processes to verify the information generated by a model, so outputs align with known facts and aren’t based on fabricated or inconsistent data.

Amazon Bedrock Guardrails is the only responsible AI capability offered by a major cloud provider that helps customers to build and customize safety, privacy, and truthfulness for their generative AI applications within a single solution.Here’s an excerpt from Ron Miller’s new blog FastForward on what he saw:

While the AI hype machine rolls on relentlessly, the fact is that enterprise IT departments move much more slowly and deliberately when it comes to implementing new technologies.

Last year, it felt like AWS was running behind when it came to generative AI, but even then it was clear that it was early, and a company with the resources of AWS surely had time to catch up. It helps when you have your own custom silicon designed to run specifically on AWS hardware, and which also drives down the cost of running AI workloads.

This week, Matt Garman had his coming out party at AWS re:Invent, delivering his first keynote since taking over as CEO from Adam Selipsky, who departed in May. Garman is a company man, and Jon Turow, a partner at Madrona Ventures, and a former AWS employee, said the guy he saw on stage was the Matt he had always known, right down to his checkered shirt tucked into his jeans.

Garman also went a little old school when it came to talking about his company’s capabilities, highlighting the pure infrastructure building blocks that make AWS what it is. In fact, Ray Wang, founder and principal analyst at Constellation Research says Garman really demonstrated his deep understanding of the broad AWS product line on stage this week...Speaking of Ron Miller, I forgot to mention that my firm boldstart ventures just joined the media game 🤣 as we hired Ron from TechCrunch where he was an enterprise reporter for over 10 years. Ever since we started boldstart in 2010, I’ve been thinking about how we can continue to expand and strengthen our Global 2000 CIO and CISO network and here’s our approach - please visit and sign up to 👇🏼

Ron Miller is joining boldstart ventures as an Operating Partner and our first Editorial Director. Much of his focus will be on launching a new blog and newsletter called FastForward to dive deep into enterprise insights and trends at the intersection of Global 2000 CIOs, CISOs, and IT executives and enterprise founders. FastForward is more than just a publication as we'll amp up in-person events and dinners on trends like AI and security allowing IT Execs to learn from one another and to also meet founders in emerging spaces.

We’re 🔥 up as our inaugural profiles include some of the best and most forward-thinking CIOs, CISOs and IT executives. Here are some specific excerpts from their interviews on how they work with startups:

fastforward profile: CIO Salesforce, Juan Perez

Perez says that startups can help push things along, and he is open to working with them when it fits with his strategic goals. “I do think that there's a space for startups. I've had the opportunity to work on that before, and we have found some really interesting solutions that have actually worked and created value for the company.

He likes to look at the risk-reward equation when it comes to working with startups, while making sure that it’s an approach that aligns with his company's strategy. He also wants to see startups with something to show that’s concrete, or he’s not going to be interested. "The company has to be building something that is grounded in reality, not grounded in imaginary things that will come in time. It's really important to me that [the product] exists," he said.

Beyond that, he wants to be sure that this isn’t a flash in the pan, and that there is clear financial backing before he partners with a startup. “I think it's important, of course, that there is some level of financial support for those startups, not only by my company, but by others that perhaps are not competitors of ours, but who believe that there's value in the technology these guys are be working on,” he said.fastforward profile: CIO Juniper Networks, Sharon Mandell

In Mandell’s view, there are always going to be places where innovative startups can help her company. “So we are always looking at startups because you have to, because the big guys aren't solving every problem,” she said.

When it comes to startups, Mandell says she assesses that risk/reward equation and what the startup can offer her company that maybe she can’t find somewhere else with a more established vendor, even if it sometimes comes with a higher level of uncertainty.

“You know, where you put these technologies matters, and sometimes you might take a bet because the upside is so big, and you'll take the upside as long as you can get it. And if it goes away, you'll deal with it later, right?"

But she tries to shield the core business operations from the vagaries of dealing with startups by hedging her bets across multiple vendors whenever possible. That way, if the startup gets absorbed by a larger company or runs into problems, she can recover by moving those functions to a similar product that’s already in place. “I try to have mitigations around that risk, which means I have to have other vendors in place to be sure that if a particular startup is not available to me anymore, it doesn't stop the core of my business."

She says mostly it comes down to building relationships with startups and their investors before they get too involved. “We try to do our best to know who we're buying from and who's backing them, and whose reputations are on the line if it goes bad, besides ours,” she says with a laugh. “But you simply can’t ignore the startup community right now because that's who's going to solve many of these problems.”fastforward profile: CISO Blackstone, Adam Fletcher

Speaking of innovation, Fletcher says he often works with startups providing innovative solutions to tough problems because they tend to move faster than the incumbents, but again, he tries to mitigate the risk of working with a young, sometimes unproven company. “You have to look at the whole picture, and that comes down to looking at who their investors are, who the founders are, what the hypothesis is and where they can potentially go,” he said.

Even when he likes the answers to those questions, he doesn’t just kick out the incumbent. Instead, he works to build a relationship with the startup and makes sure whatever product they are developing is rigorous enough for a company like Blackstone. That could involve a PoC that lasts months or even years, depending on how important and sophisticated the product is. Only after it’s proven itself will he incorporate it into his toolkit, and perhaps drop the incumbent if it makes sense.

In spite of all that, he says he wants to avoid being the guy who says no all the time when it comes to implementing new innovative technologies, so he takes a team approach to getting stakeholders involved to make sure new systems, whether cloud, AI or any new technology, are being implemented with the level of security required by a company like Blackstone.fastforward profile: SVP Consumer Engineering, Marty Brodbeck

When it comes to evaluating startups, he looks at four key questions that he’s honed over 20 years of making technology buying decisions. “Number one, do you have a unique set of capabilities that can help us solve a problem? Two, how would this solution integrate into our existing tech stack? Three, how would you operate and support this thing at scale? And four, what's your feature roadmap for future capabilities we're going to need as part of this platform?”

While the company needs to integrate smoothly with PayPal’s tech stack, it’s up to Brodbeck to make sure that the tech stack can deal with new approaches. “Part of my job is to constantly be modernizing my own tech stack to enable it to be easily integrated into other platforms that sit within your company, or platforms that sit outside of it,” he said.

Throughout his career, regardless of where he was working, Brodbeck says he has always analyzed how flexible and nimble the current tech stack is, while constantly looking at ways to improve it or make it more nimble.

All of Brodbeck’s decisions on technology, and that includes whether to work with startups or not, comes down to a delicate balance.“I think you have to balance innovation that's going to drive the business with the reality of the here and now, and what are the things that we're working on that are paramount to moving the business forward,” he said. “So you try to balance both, and you try to sprinkle in the innovation where you think it is going to move the needle on some of these initiatives.”For those VCs interested in how and why we decided to launch a new blog and newsletter, you can read more on my Medium post. If you're a CIO or CISO or IT Exec at a Global 2000 and want to share your story, please reach out!

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

#being a founder is not easy, let alone a solo one - interesting data from Pete Walker Carta

#💯 always find leaders who lead from the front no matter how big you get

# 🚀 this is the way

Enterprise Tech

#massive milestone hit - Snyk crossed $300M in ARR! What a journey since inception in 2015!

#Marc is a master marketeer and salesman - here he is riffing on the greatest opportunity that many readers know about - the opportunity for software and agents to eat into labor vs. just software eating the world

Here’s Marc’s worldview from the earnings call - everyone has been waiting for proof of success for agents and Salesforce is off to a good start delivering >200 deals - of course, selling is one thing so we need to see how these actually get deployed and how much ROI they truly provide

Here’s another excerpt 👇🏼

#the best build their own GTM motions - this is the future for sales teams - GTM Engineering! And 🔥 up for my firm boldstart to be an investor since Inception

#👍🏼 or 👎🏼

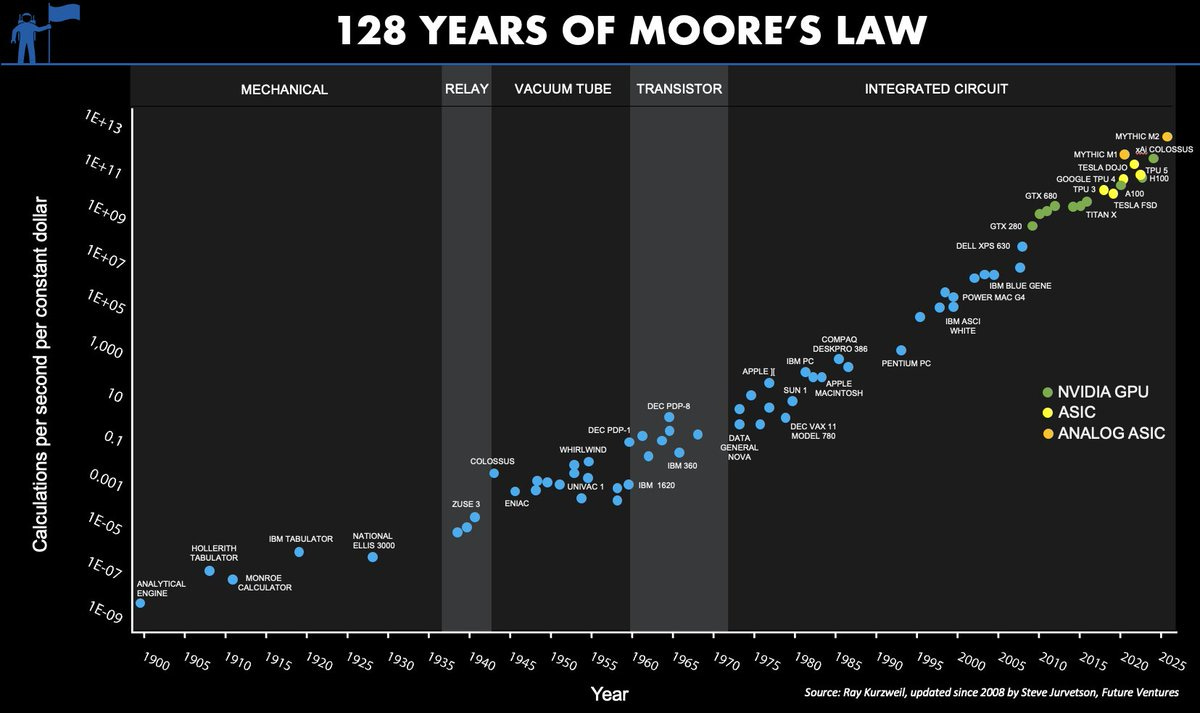

#Moore’s Law - post from Steve Jurvetson - love the experimentation becomes a simulation science as opposed to a physical R&D science - we are seeing this in lots of new cos…

In the modern era of accelerating change in the tech industry, it is hard to find even five-year trends with any predictive value, let alone trends that span the centuries.

I would go further and assert that this is the most important graph ever conceived. A large and growing set of industries depends on continued exponential cost declines in computational power and storage density. Moore’s Law drives electronics, communications and computers and has become a primary driver in drug discovery, biotech and bioinformatics, medical imaging and diagnostics. As Moore’s Law crosses critical thresholds, a formerly lab science of trial and error experimentation becomes a simulation science, and the pace of progress accelerates dramatically, creating opportunities for new entrants in new industries. Consider the autonomous software stack for Tesla and SpaceX and the impact that is having on the automotive and aerospace sectors.

Every industry on our planet is going to become an information business. Consider agriculture. If you ask a farmer in 20 years’ time about how they compete, it will depend on how they use information — from satellite imagery driving robotic field optimization to the code in their seeds. It will have nothing to do with workmanship or labor. That will eventually percolate through every industry as IT innervates the economy.#AWS launched automated reasoning and here’s why this can help reduce hallucinations 🧵

How it works -->

Upload a policy doc (like leave of absence rules), and AI converts it to logical rules that can be mathematically proven.

The system extracts variables, creates testable rules, and proves whether statements are true/false. No more guesswork!

Best part? No more hiring teams of logicians. Write in natural language, and AWS handles the complex stuff behind the scenes.#AI is coming for Wall Street (Bloomberg)

“AI’s coming for me now,” he said. “It turns out it’s annoyingly better than me.”

The Greenwich, Connecticut-based firm, which runs about $116 billion, is also using AI to generate trading signals from text and boost productivity by speeding up coding, for instance, he said in the interview. It’s a big statement of confidence from a quant who once doubted if buzzy new trends like big data would ever affect the basics of the business.#what’s ASML and why so important to AI 🧵?

Markets

#for those interested in why Bitcoin, here is Michael Saylor’s presentation for Microsoft to try to convince them to buy Bitcoin for its treasury

Full slide deck here

#ServiceTitan pricing

#Beware of vanity valuations loaded with lots of other terms…lessons from ServiceTitan (TechCrunch)

In its latest S-1A SEC form, the company disclosed that it plans to use a big chunk of the money — about $311 million — to buy back all the shares of its nonconvertible preferred stock, at $1,000 a share, which is the price these investors paid.

Plus, it will pay those stockholders any unpaid dividends per share. The investors are, according to these documents, Saturn FD Holdings, LP, and Coatue Tactical Solutions PS. The company was on the hook for annual 10% dividends for five years and 15% for the sixth for these shares. For context, the average dividend yield for public companies in tech is 3.2%, says Dividend.com. Those are not, by the way, the largest VCs invested in ServiceTitan. ICONIQ Growth, Bessemer Venture Partners, and Battery Ventures are, in that order. An entity of TPG is also a major investor, the documents say.

Unwinding expensive private capital investments is not what most companies say they will do with their IPO funds. They tend to dedicate the money to running their businesses, or for possible acquisitions. In this case, ServiceTitan says it will use whatever is left over as working capital for the company or other corporate uses.

This latest disclosure follows news that ServiceTitan sold its soul, so to speak, in 2022 when it raised a Series H round by agreeing to grant the investors in that round a “compounding IPO ratchet structure.”

great job as always, Ed!