What’s 🔥 in Enterprise IT/VC #422

The continued rise of Jumbo Inception Rounds 📈, the importance of ball control 🏀 in winning rounds, and how Inception/seed firms need to decide what game to play and what fund size is right

Happy Thanksgiving 🦃 to everyone celebrating! As in previous years, I trust you've enjoyed valuable moments with family, friends, and loved ones. This occasion is a perfect opportunity to pause, reflect on the year gone by, and contemplate all the things we're thankful for.

As I think about the past year, I can’t stop reflecting on how the “race to be first’ and investing at Inception continues to change. The game has been upleveled to an insane degree, and when we continue to see rounds like below from the past week, we know we’ve entered a new era.

Here’s my commentary which came nowhere near the views above 🤣, but you get the point.

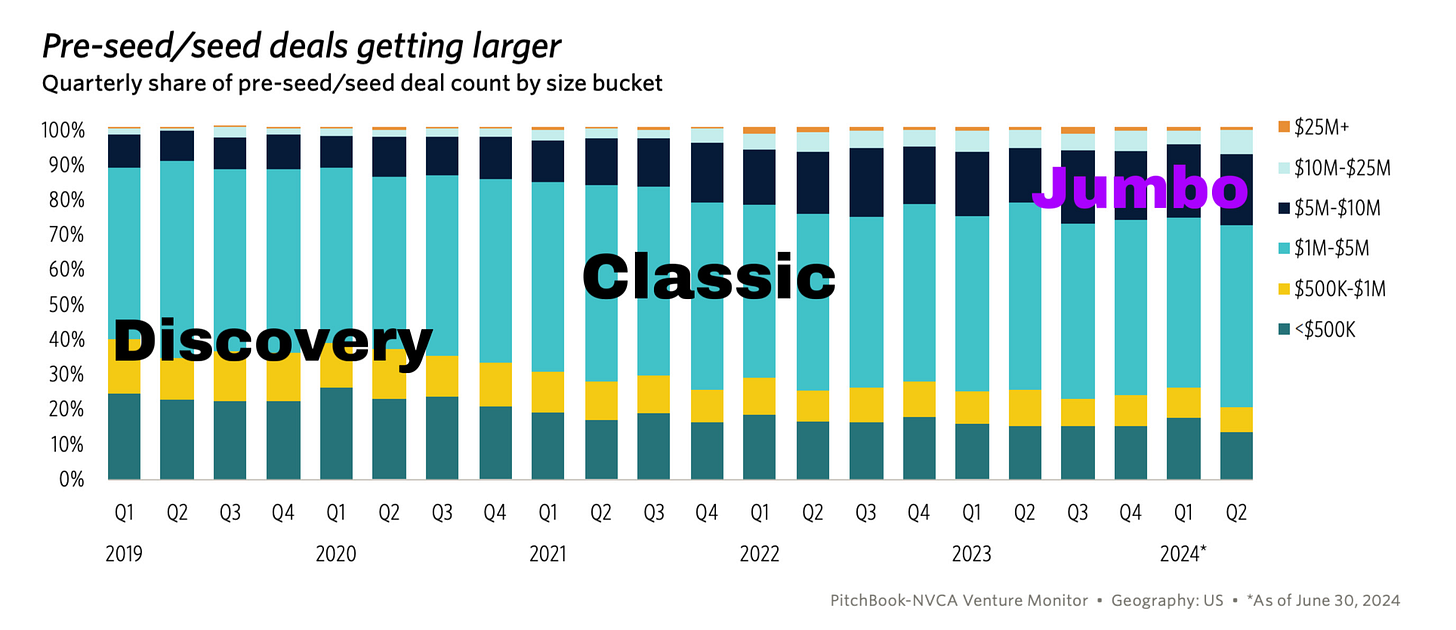

By the way, here’s the data through Q2 this year from Pitchbook showing how the % of rounds >$5M has doubled to 20% from 2019 to 2024 and for rounds >$10M it is up 6-7X.

The real question is who can afford to play this game and how will it end? Clearly for these highly pedigreed founders, it’s a multistage game. But how should smaller seed or Inception funds think about it? Should they do Jumbo rounds, and if so why and how? If you’re looking for a framework, the timing couldn’t be any better as I had a chance to sit down with Erik Torenburg on Turpentine VC to talk about how boldstart ventures thinks about it. And yes, we have been playing in the Jumbo game as well as the smaller check one which we call Discovery rounds.

We dove deep into going from $1 to $850M+ under management, fund construction, fund sizing, the importance of ball control, should we do supersized Jumbo Inception rounds or not, competing/partnering with multistage firms, knowing what game you are playing and how you win, making conscious choices, and my biggest fears…

Here’s a video clip from that interview:

Here’s a highlights 🧵 from Turpentine 👇🏼 you should check out.

Finally, if so inclined, here’s the full video.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#Inertia is the strongest force, need to constantly fight it to create greatness in your org (Frank Slootman)

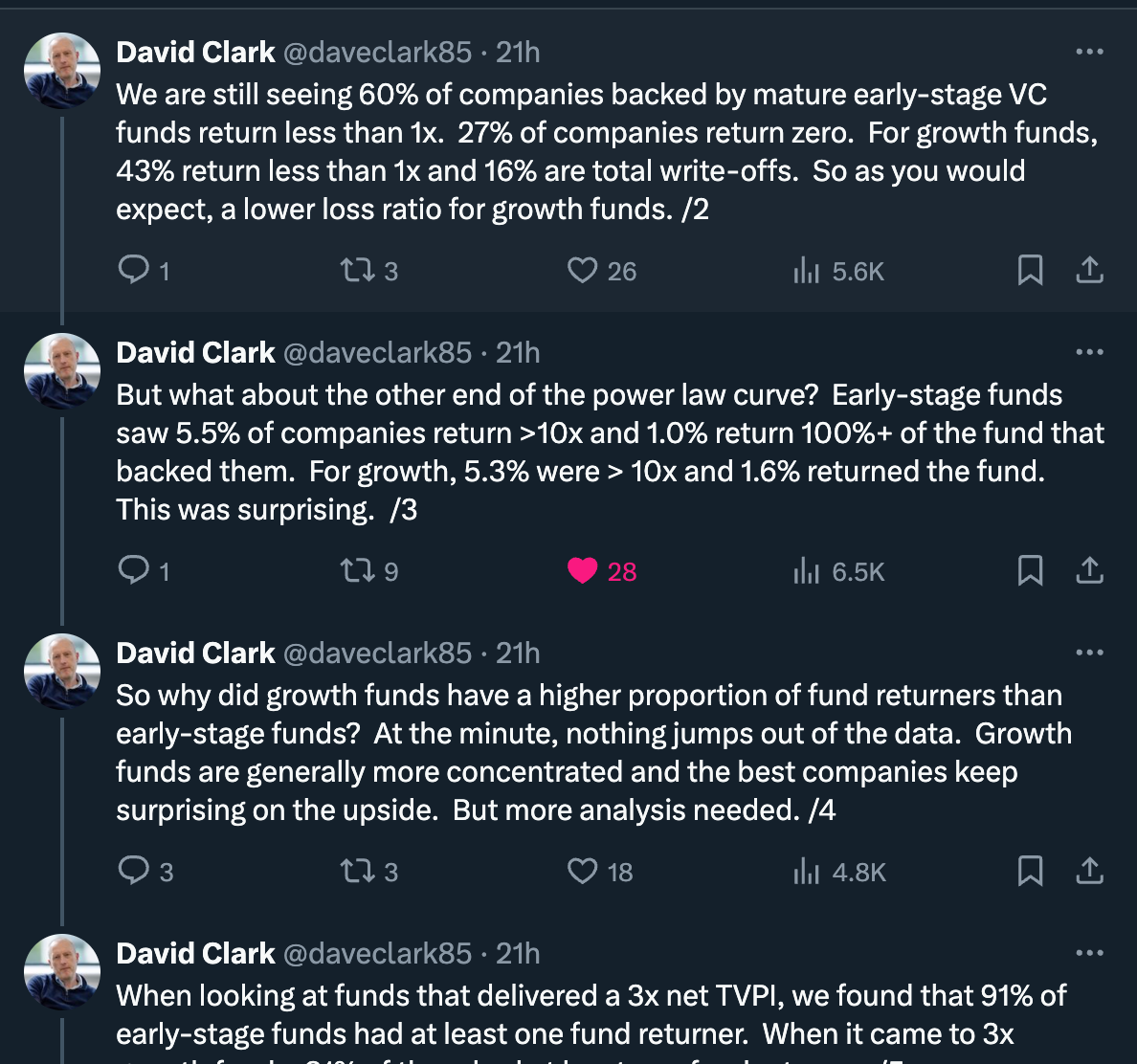

#we know there is a Power Law for early stage funds (1 company returns majority of fund) but how about for growth? 👇🏼

#Conviction matters, the earlier you go the more important it is not to overthink the opportunity and team and later you go means the difference between winning a competitive deal not on price alone vs. losing - speed of decision making based on conviction matters

more on that for Inception investing…

and why founders still say pre-seed is not cutting it for them

#all about founder led sales on Lenny’s podcast with Jen Abel - love her thinking as we share many of same thoughts on closing those first few deals…

#good reminder

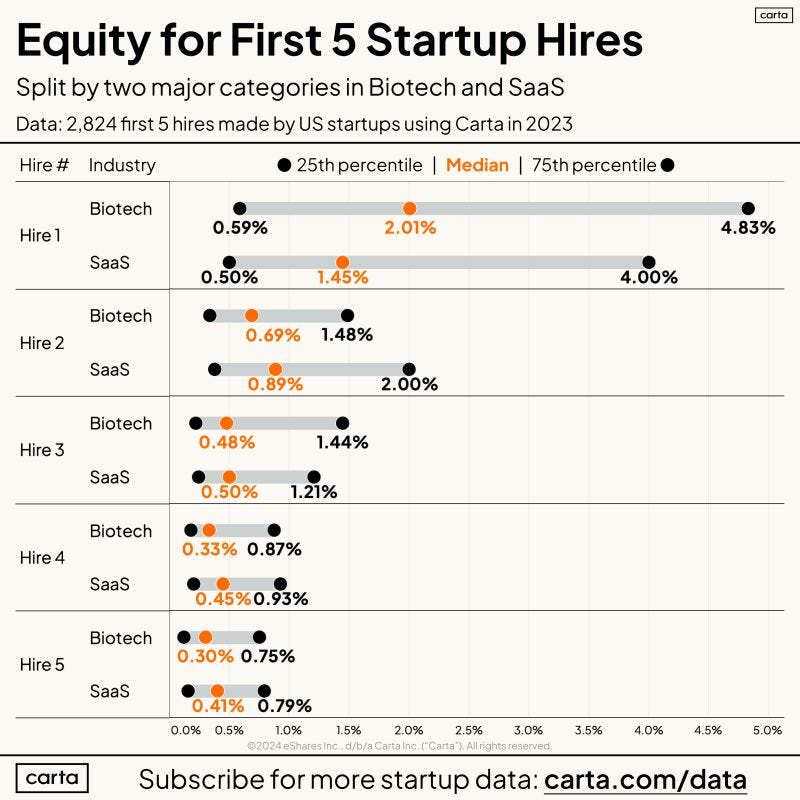

#Equity for first 5 hires (Pete Walker)

Enterprise Tech

#reminder - AI is not magic

#MCP from Claude is insane…

#reminder, internal use of AI can drive costs down significantly

#UI for AI - first Paul B who created Gmail and then Des from Intercom amalgamating thoughts on what UIs should look like - click through as comments are what’s 🔥

#big news in cybersecurity - RSA top 10 finalists now must accept $5M SAFE uncapped - wonder how this changes who decides to enter and not - FWIW, see BigID, a port co, who won in 2018 - it definitely did provide a nice lift for the company

#Some 💎 from co-founder of Notion when it comes to building with AI - worth a listen

#pretty cool list of use cases using computer vision from Claude

#🤣

#great reference to maximize results from LLMs

#it’s happening

Markets

#Databricks secondary of $8B at $55B valuation 🤯 (Reuters)

Nov 26 (Reuters) - Databricks is in talks to raise up to $8 billion from investors that would value the data analytics company at $55 billion, in one of the largest fundraises in Silicon Valley, according to a source familiar with the matter.

Most of the new funding would be in the form of a secondary share sale, where early investors and employees are allowed to cash out some of their stock holdings, the source said. It would also be used to cover the tax cost associated with the share sales, which could cost billions.#have cloud cos seen the worst of it yet? Growth coming back? (The Information)

After a brutal downturn, software startups are doing better. Airtable, an app firms use to help employees collaborate on projects, is growing at a 30% annual rate, according to Chief Financial Officer Ambereen Toubassy, and has turned cash flow positive. Toubassy said Airtable hopes to be prepared for a possible initial public offering next year.The Takeaway•

Gong, which sells software tools for salespeople, returned to growth in the second half of last year, after stalling between mid-2022 and mid-2023, said cofounder and CEO Amit Bendov. And in the past couple of quarters, growth has accelerated, said a person with direct knowledge of Gong’s business. Gong’s annualized run rate is now close to $300 million, said the person. A Gong spokesperson declined to comment on the numbers.#Ivana nails it on how investors think about Palo Alto Networks

#🤦🏼♂️

#🤯 - full government control of AI? Worth a listen…

Startup enterprise is not for the faint of heart! Great information, thank you for sharing! ♥️☀️☮️🌈🏁