What’s 🔥 in Enterprise IT/VC #421

Thoughts from Goldman's PICC + optimism for 2025?

I’m finally back from Vegas from a couple of intense and fun days of networking, learning, and hanging out with friends at the Goldman PICC (Private Innovative Company Conference). If you’ve never been, I highly suggest you figure out how to go next year as it’s all about the people. Goldman assembled a world class group of founders, investors from seed to publics, and corporate development leaders from the large publics to share market insights, network, and to get deals done. The highlight for many is who the PICC names are and as you can imagine many are private household names like Anduril and Perplexity, along with a mix of mid-stage 🦄 like Kong and Harness and BigID (a port co) and earlier names like Protect AI, also a port co.

If there is one word to summarize the current state of tech, it would be “optimism” but still scattered with some disbelief at valuations for some of these AI companies.

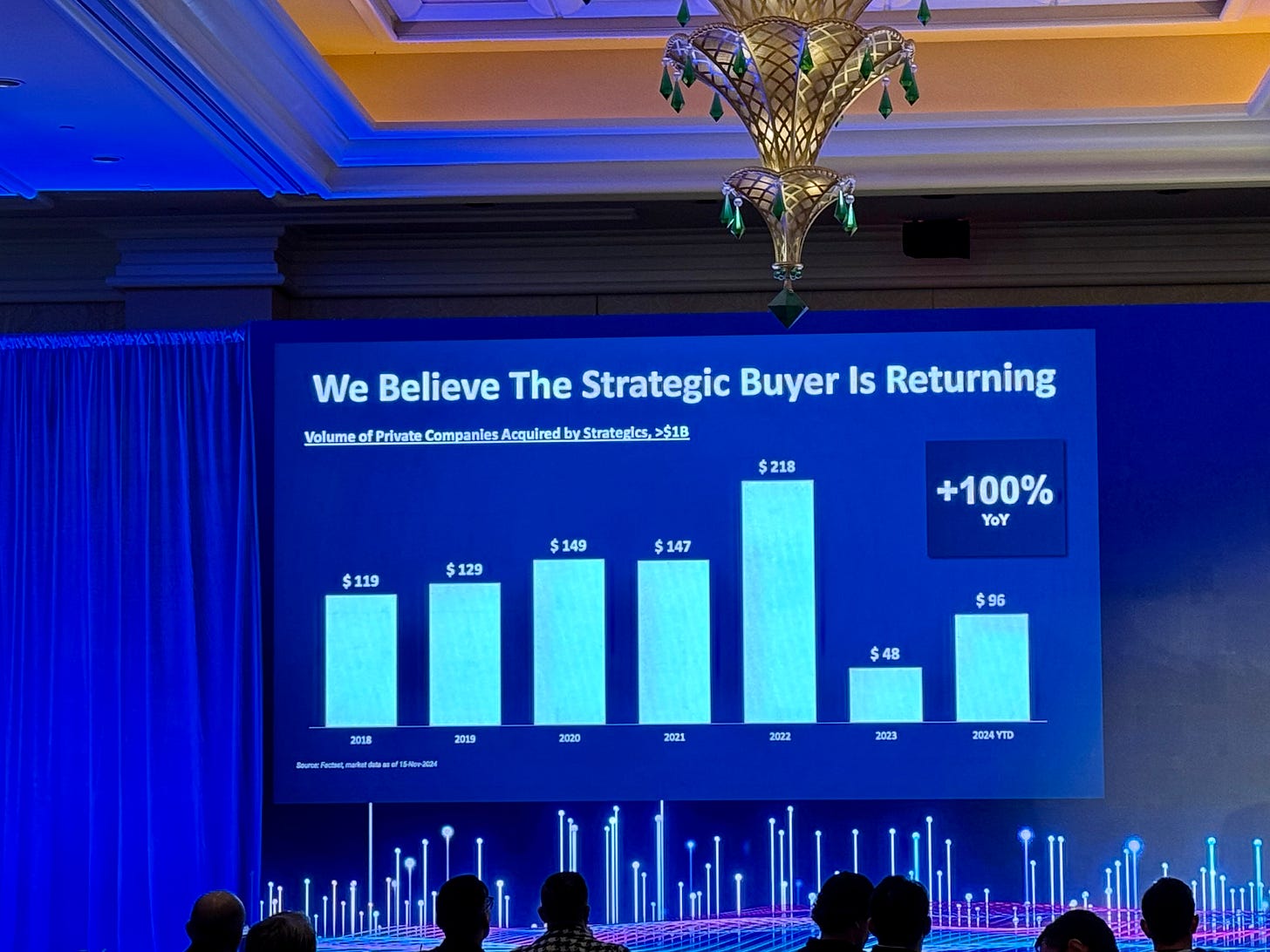

Regarding the exit environment for 2025, these two slides capture what’s potentially ahead.

+100% YoY for strategic acquisitions and how buyers are initiating more of the M&A discussions with a better win rate versus 2018.

In other words, this chart says the more forward thinking and aggressive buyers have a better chance of buying that prized asset and the bankers tell me they are busier than ever so we should expect to see a significant uptick in M&A in 2025. FWIW, many still think that swapping out Lina Khan will be advantageous to getting deals done but are still skeptical of how that evolves for the mega cap names as the Trump admin still does not like cos like Google.

One other topic of conversation I had with friends from several venture funds was the bubble-like environment for many momentum AI companies. When businesses are priced in the billions of dollars with 200% YoY growth with multiples of 100X forward, eventually gravity does set in as these companies can’t continue to grow at that pace, especially as everyone eventually competes with one another. Which means, the only opportunity to return 2-3X from those prices is to hope for a strategic buyer as public offerings require much more scale than what these companies have today and those multiples are 10-20x NTM. This is all the more reason why everyone is racing to be first, the first investor of record for startups and why valuations at the Inception/seed stage continue to rise as round sizes get bigger and bigger. This phenomenon is not going away - the multistage firms with their multi-billion 💰 bazookas are here to stay clearly aimed in my direction.

Finally, every venture investor told me it felt like ZIRP again as pacing of new founders building new companies and the speed at which rounds are getting done is unlike what they have seen in the last couple of years. FWIW, our pacing at boldstart in Q4 from net new founders we backed to existing port cos raising new capital has been the busiest quarter in 2 years. This pacing is sure to continue or even accelerate into Q4 especially as a number of venture firms gear up to raise significantly more capital. It’s going to be an interesting December for sure.

As always, 🙏🏼 for reading and please share with your friends and colleagues. I also hope you find time to be with friends and family as we enter the Thanksgiving 🦃 holidays.

Scaling Startups

#founders make sure to hire your engineers carefully!

#don’t just sell software, start a movement and make your product so loved it becomes part of the job spec - 👇🏼 one of reasons why Clay, a portfolio co, is growing so fast 📈

Enterprise Tech

#congrats Spectro Cloud (a boldstart portfolio co) on its $75M Series C led by Goldman Sachs. Spectro Cloud is a a leader in modern multi-cluster Kubernetes management at scale across a variety of deployment environments, including on-premises hardware, single and multi-cloud, and the edge

To fully understand how far Spectro Cloud has come since we announced our investment in March 2020 (investment in 2019) at Inception, read our Why We Invested post on the team and vision and idea

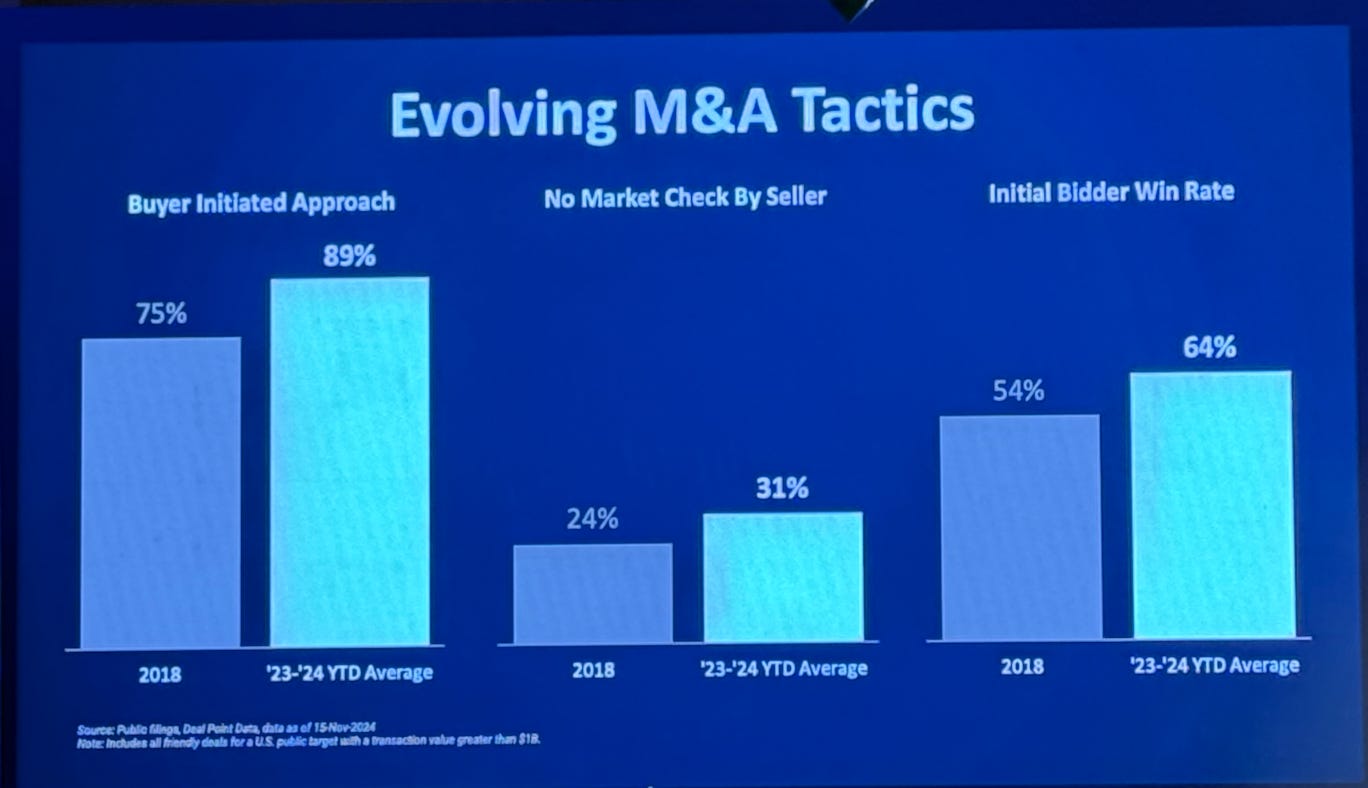

#Menlo Ventures State of AI 2024 - MUST READ report - here are a couple charts that summarized what’s happening in enterprises (top use cases and spend by department (❤️ seeing portfolio co Clay on that last pie chart)

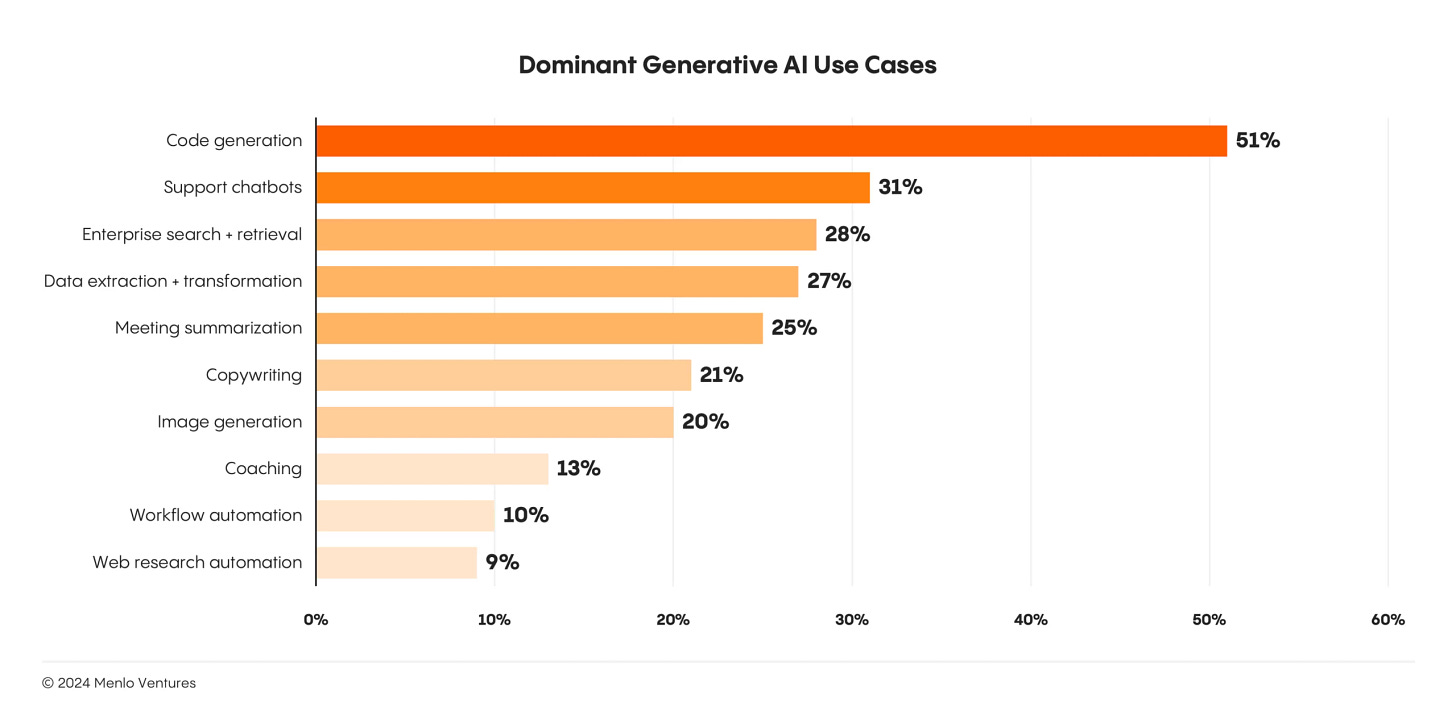

#AI-native application market map from Cathy Gao at Sapphire Ventures - ok, it’s small, read the full post here at Sapphire

By our count, there are now at least 47 AI-native applications in the market generating $25M+ in ARR vs. 34 at the beginning of the year, and we believe we will likely see an equivalent number north of $50M ARR by this time next year. Early successes in fields like code assistance, customer support, and marketing are expanding into new functions and vertical use cases. Startups and incumbents alike continue to announce ambitious AI-native offerings. Simply put, today’s ecosystem of AI-native applications is much more robust than it was a year, or even a quarter ago, in our opinion.#so much infra will need to be built for agents - also who’s building the equivalent for internal only? (comments interesting - click through below)

#use cases for agents with desktop vision - scroll through list

And Anthropic now with $4B more cash from AWS to spend back on AWS

#2024 SaaS Benchmarks Report from High Alpha along with breakdown and highlights from Kyle Poyar

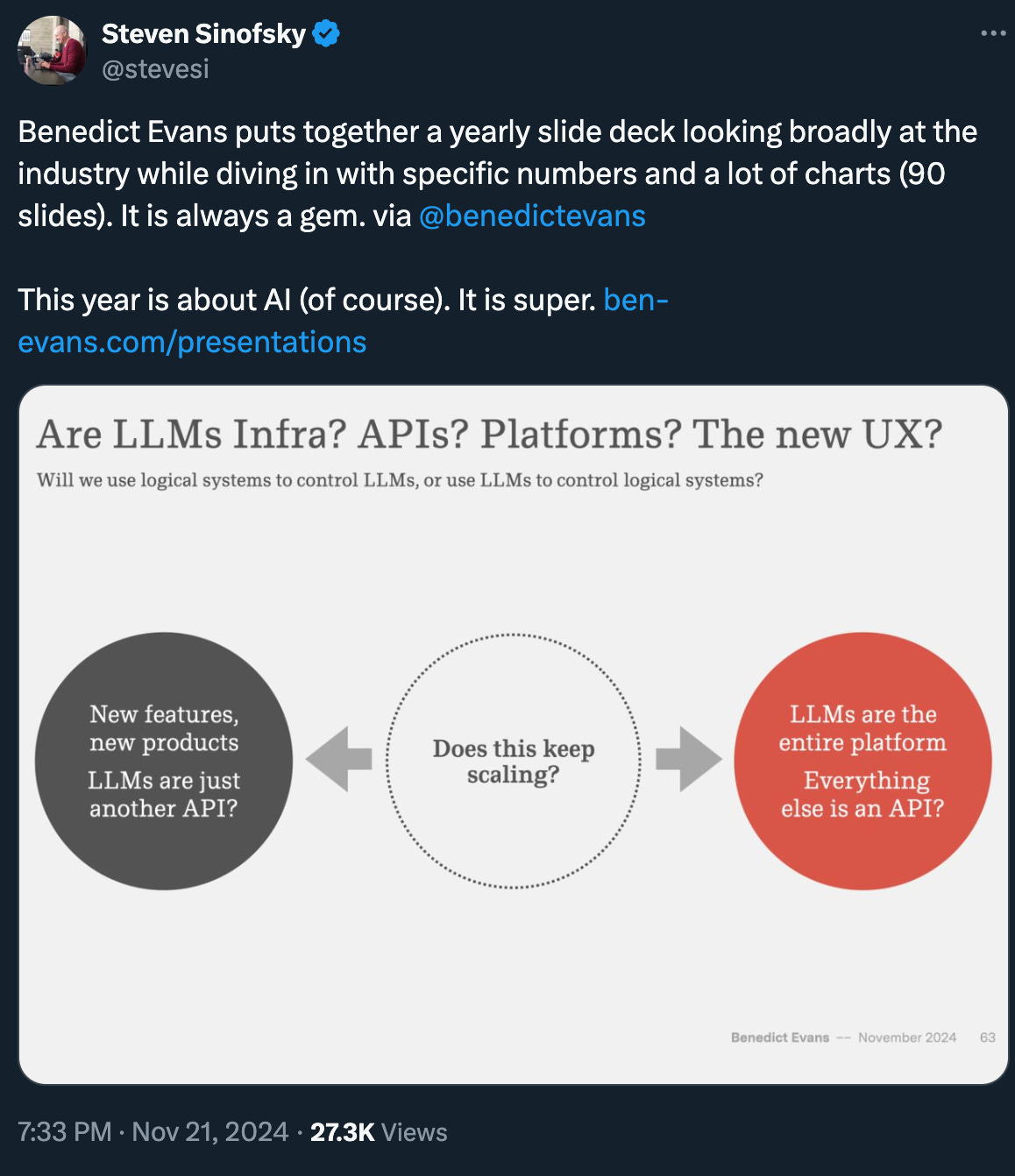

#💯 game on as models move from API to app layer even more aggressively - value continues to move up stack to app layer as bottom of stack continues to get commoditized

#to the above, check out these slides from Ben

#great interview on Runtime with ServiceNow President, CPO and COO - on AI - with the potential “Great Unbundling of SaaS” potentially ahead powered by agentic workflows, I still find it problematic that cos like ServiceNow and Salesforce think platform because these very same agents can relegate them as just a database and heterogeneity is going to win

But the goal now, and if you see some of the announcements they've done, and what I've been now looking into, is agentic AI. How do you create the system of agents?

The good thing is the differentiation ServiceNow has is a little more end-to-end, and it's action oriented. It's not like the siloed agents who do pieces of it and they're not connected together. The idea of having an orchestration across all these agents is something which we can keep on enhancing and keep on delivering value to customers.

Customers don't really care what happens underneath the covers, right? If I want to go on maternity leave as an employee, can I have the agent do all the tasks underneath? Which means changing things in one particular application, giving you all of the benefits associated with your leave, making sure you have an existing employee who will take over your role? All the parts of the workflow connect so many different pieces together, so the agentic AI can do all this task for you by just providing one prompt.

It's much more powerful than saying "I will go to the benefits agent, then I will go to the agent for my employee management. I will go to agents for my out-of-office email system." That is not really what agentic AI will be.

My goal, as we think about the future of all these things, is that agents are definitely the future of how people are going to work. Can we now do a very good predictive as well as integrated end-to-end system for that?More on this from #410 - Speed mode + also, is the great unbundling of SaaS powered by agentic workflows?

#coding moving from AI assistants to the first agentic IDE with 5 agents: brainstorm, spec, plan, implement, build/repair

#The 5 next big technologies in security and privacy for 2024 (Fast Company) - great list and congrats to port co dope.security

dope.security

For protecting organizations’ internal systems

The name’s an obvious attention grab, but it also hints at the Bay Area startup’s unorthodox approach to network security. For decades, secure web gateways have protected organizations’ internal systems by rerouting the traffic of in-office and remote users through stopover data centers for security checks. But this brings with it privacy and performance and reliability issues, especially if any piece of the network is down. Dope.security’s software, dope.swg, secures systems at the endpoints, the computers connected to the company network, by calling on the cloud or relying on cached models to enforce rules about individual domains. By removing a stop between enterprise resources and end users, dope’s “fly direct” technique (think airline travel) offers what it says is a fourfold performance improvement. After securing a $16 million funding round led by Google Ventures, the company has expanded to over 150 clients globally, and developed a LLM-based tool to help organizations identify sensitive documents inadvertently exposed to the public internet.#Israeli cybersecurity on 🔥 as Cyera raises at $3B valuation and Wiz acquired Dazz for $450M

Markets

#how hedge fund analysts 🤔

#future IPO candidates?

#Prescient as ServiceTitan, a venture-backed vertical software company for the trade industry, just filed - here’s a S-1 breakdown from Alex Clayton at Meritech. However are they really going public because of last round deal structure - a compounding ratchet from last round?

Customers range from mom-and-pop contractors with a few employees to large franchises with national footprints of over 500 locations, and on average, an active customer (defined as a customer with >$10K annualized billings) pays ServiceTitan ~$78K per year. Given the mission-critical nature of the product, ServiceTitan has strong retention with >95% gross dollar retention and >110% net dollar retention for each of the past 10 quarters.

The comment on Stytch is worth money. It's great material you are sharing.