What’s 🔥 in Enterprise IT/VC #419

To believe or not to believe, that is the question - AI is eating software but will it also eat labor?

Mic 🎤 drop…

This is simply unprecedented for a company at this size to reaccelerate growth like this - Palantir is now forecasting $2.8B of Revenue for 2024!

While Palantir crushing Q3 is awesome for enterprise AI validation, it also just upleveled the bar for a super attractive IPO - Rule of 68 🤯

Otherwise, public investors can just keep loading up on $PLTR with more scale, profitability, and accelerating growth 📈 versus any new issue.

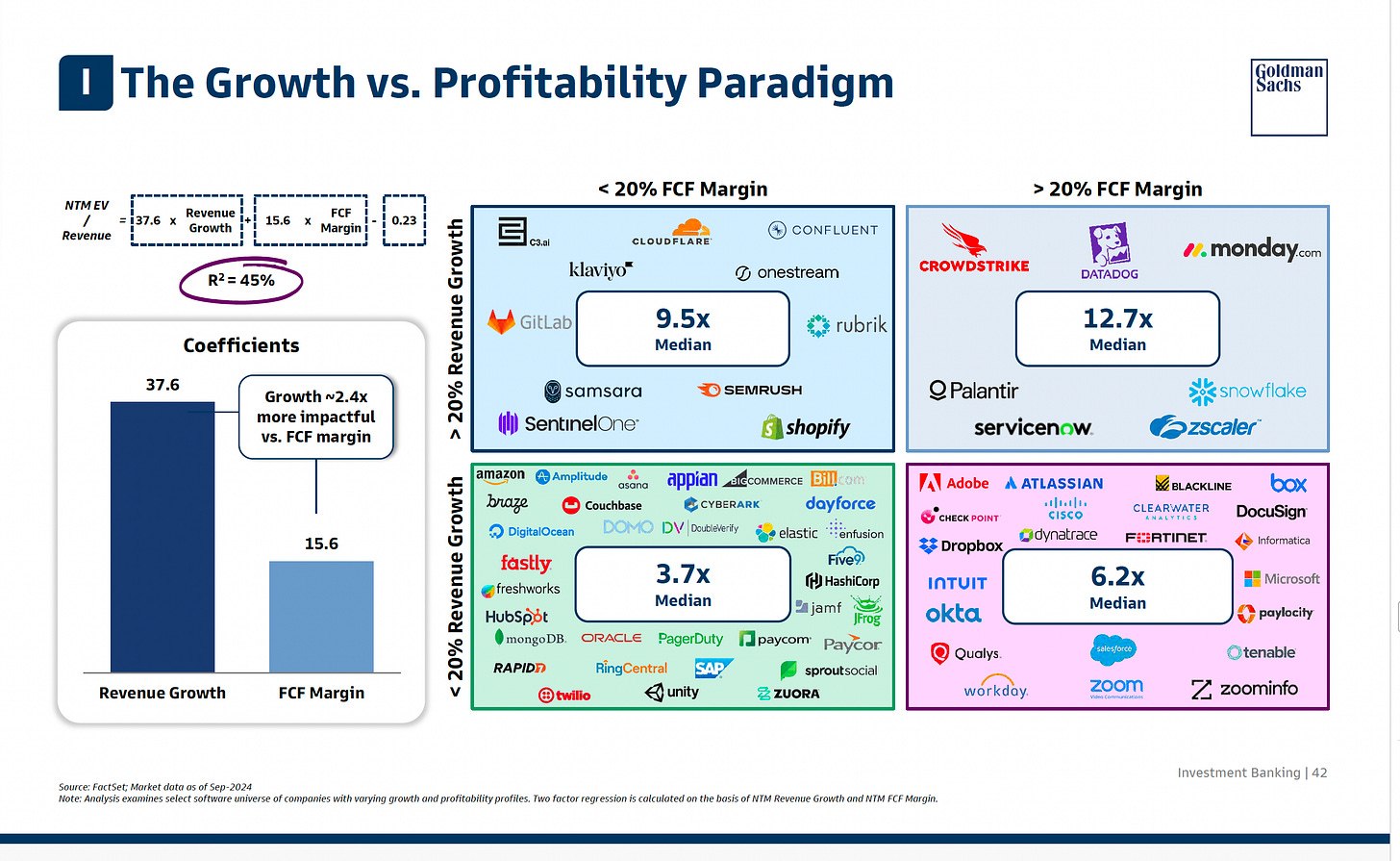

Here’s a great chart from a recent Goldman Sachs Report on IPOs and public software companies - multiples accrue to scale - look at that - only 2 companies <$10B in Market Cap trade at a >10X NTM Revenue multiple 🤯

Another way to look 👇🏼 - why buy companies <$750M in Revenue when you can buy more durable, predictable software companies with >$3B of revenue who are also growing faster with a Rule of 40 that is 2x better!

When it comes to the Rule of 40, Wall Stret wants it all; >20% growth and >20% FCF which yields a 12.7X Median NTM Revenue multiple.

Jason Lemkin nails it here 👇🏼

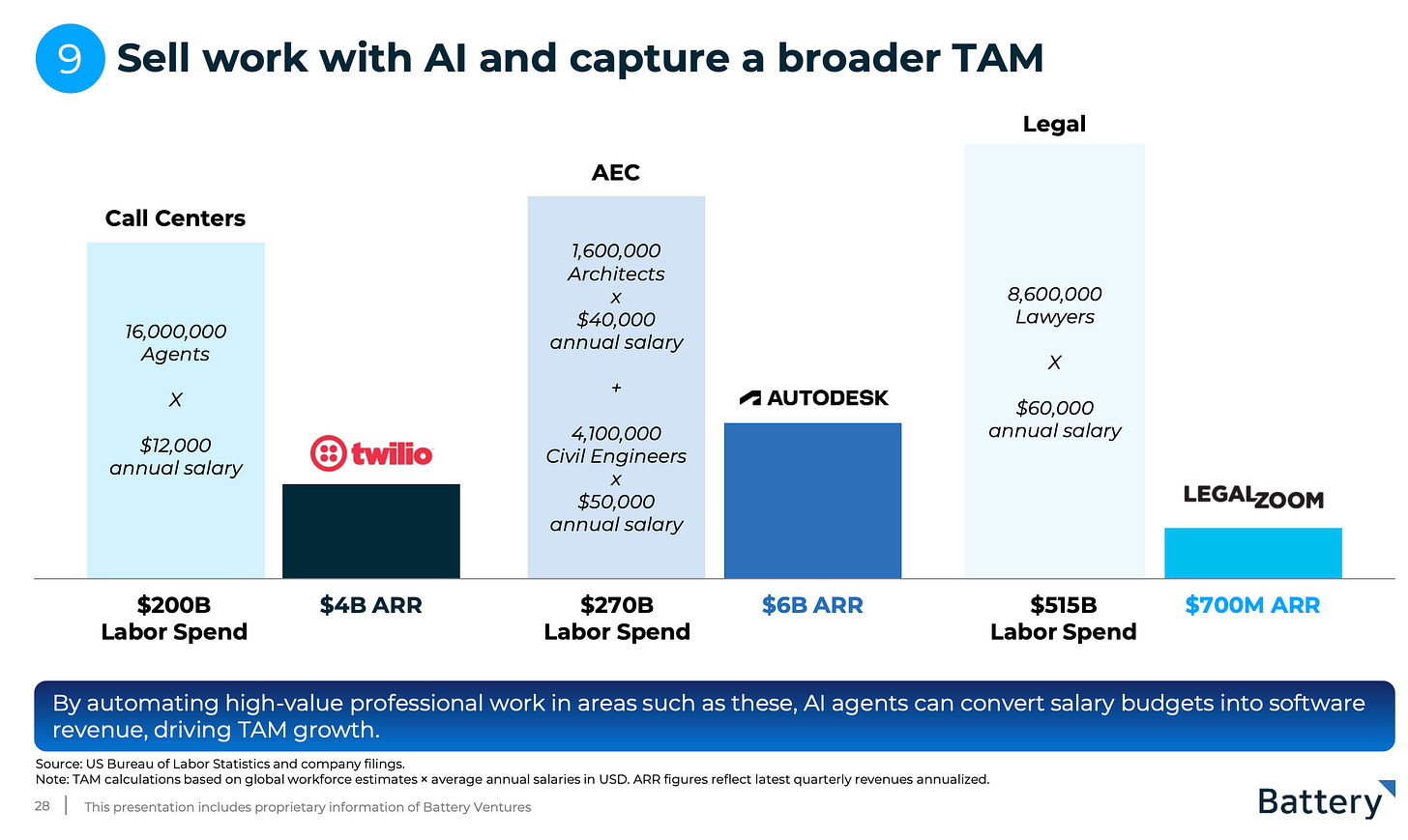

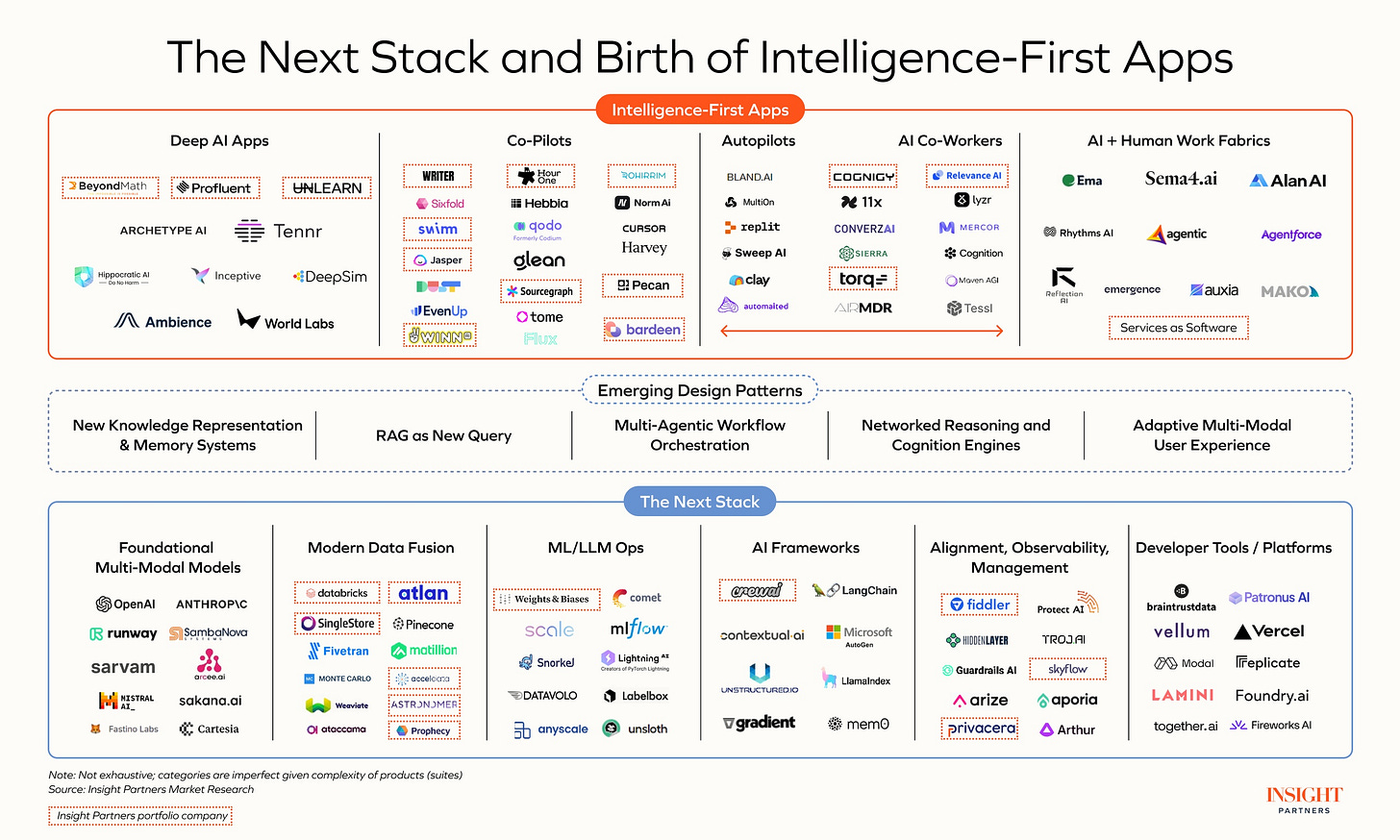

To believe or not to believe, that is the question! AI is eating software, but will AI also eat labor? Will every worker have an agent or dozens or hundreds of agents augmenting or even replacing some of their work or not? How much of work will become personified? If you believe, then you play the game on the field and invest. Hopefully you’ve chosen wisely and if so, you’ll ultimately be rewarded with TAM and multiple expansion. If you’re a non-believer, then you just wait it out.

Matt Harney also has a great breakdown here which also addresses why venture investors continue to “race to be first” and inception invest.

Ok back to Palantir - this is why I’m super excited about the enterprise AI future. It’s still super early! Here’s an excerpt from Alex Karp’s Q3 Letter:

This is still only the beginning.

The growth of our business is accelerating, and our financial performance is exceeding expectations as we meet an unwavering demand for the most advanced artificial intelligence technologies from our U.S. government and commercial customers.

The world is in the midst of a U.S.-driven AI revolution that is reshaping industries and economies, and we are at the center of it.

Our revenue last quarter reached a record $726 million, representing a 30% increase from the same period last year as we continue rapidly scaling our business.

The year-over-year growth rate of our revenue has increased over the past six quarters, rising from 13% in Q2 2023 to 30% in Q3 2024. This is an ascent that we always believed was possible and have worked tremendously hard to achieve.Enterprise AI is real folks and don’t forget where the value is as Alex Karp says:

“They have a huge opinion about how to handle LLMs. It’s completely theoretical and idiotic. If you want to manage LLMs or AI, the infrastructure that allows you to manage them is where the actual value is. Video here 👇🏼

And the investment to be ready for right place right time has been in the making for years!

A juggernaut is emerging. This is the software century, and we intend to take the entire market.

The unrelenting march of our business has been driven by an early and decades-long investment in the technical infrastructure that is now making the large language models that have reshaped our world useful and valuable to large enterprises.And a reminder from Alex - “This is still only the beginning.”

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#so good from Alex Lindahl at rapidly scaling Clay (a boldstart portfolio co) - always adapt your sales GTM and even be open to the profile of your hire - it’s a new world with AI and new playbooks are needed. It’s working btw in a big way for Clay BTW this is very Palantir like - give me a use case and let’s build something together!

#VC funds may have to be longer than 10 years by default…(h/t Beezer Clarkson) - exit timeframe only getting longer…esp. for those exits >$500M

>$500M exits 📈 from 6 years in 2010 to 9+ years in 2023!

Enterprise Tech

#fantastic report from Battery Ventures - Inside the Coming AI Market “Supercycle” and How Cloud Startups Can Benefit: The Battery Ventures 2024 State of OpenCloud Report”

#2 more VC AI Market Maps, both hitting on the “AI is eating Labor” trend

Insight Partners - Intelligence First Apps

Foundation Capital - system of agents delivers the labor productivity

And my firm boldstart ventures port co is just 📈

#💯

Why Kustomer’s work-based pricing is the future - see last week’s What’s 🔥

What’s 🔥 in Enterprise IT/VC #418

🤯 so much happened this past week! We had new product announcements from GitHub Universe, cloud earnings from the Big 3 (demand outstripping supply, reacceleration and AI demand is strong), and something near and dear to my ❤️, the relaunch of Kustomer

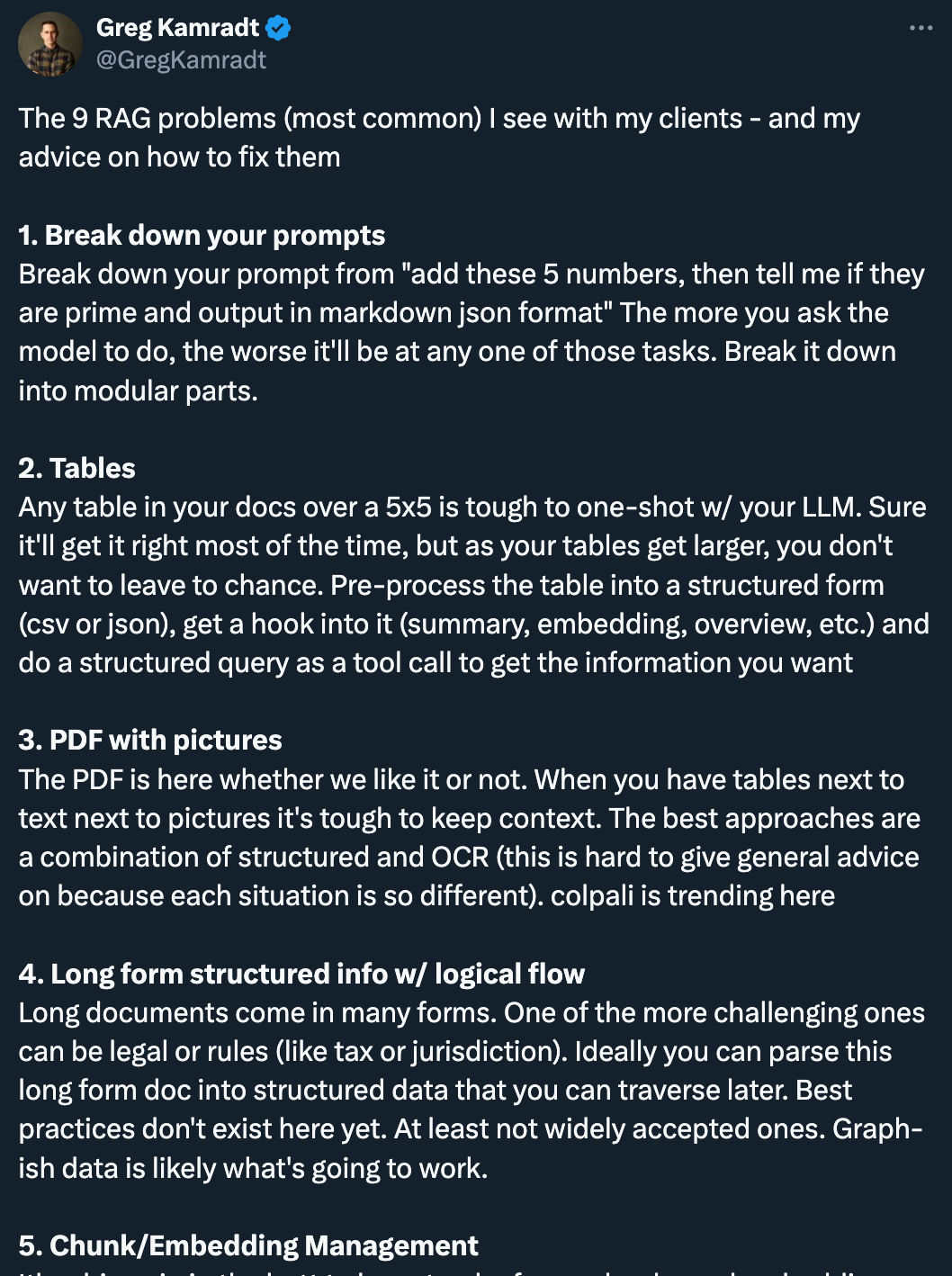

#9 most common RAG problems…

#SSPM (SaaS Security Posture Management) becomes real as Crowdstrke buys Adaptive Shield for a rumored $300M with $44M of overall VC funding

#Speaking of, how does Pat Opet, CISO JPM, think the world of cybersecurity has changed and why Adaptive Shield and SSPM makes sense? (Fortune)

“The most significant change to the ecosystem is the sophistication of the ransomware actors,” says Opet, adding that there’s even been some coordination between nation-state adversaries and cybercriminals that can make it difficult to decipher between the two.

Secondly, there’s the increased reliance on cloud-based, software as a service (SaaS) applications, which have proliferated in popularity in recent years and saw an especially strong surge of adoption as companies embraced remote work during the pandemic. “All these changes in technology creates the opportunity for weakness or failure if companies aren’t diligent in how they mature these capabilities to make them available to employees,” says Opet.

And lastly, JPMorganChase has itself become a much more technology-centric organization, embracing machine learning, public and private clouds, and newer technologies like generative artificial intelligence. The firm has said every new hire will be trained on AI and new tools. An AI assistant that rolled out this summer has been made available to 140,000 employees at the financial giant.

As new tools are rolled out and employees get access to more forms of technology, Opet deploys a “federated” approach to cybersecurity. The CISO has a team of security architects and engineers who are embedded into the development teams to build the necessary safety controls of the latest generative AI tools or cloud platforms.#JPMorganChase has a $17B IT budget…yet they are also amazing at partnering with early stage technology companies. And attending its annual Technology Innovation Symposium (2024 was #16) is a must-have for any founder or investor fortunate enough to join. Huge congrats to Snyk, a boldstart portfolio co, on its selection to the esteemed Hall of Innovation - previous winners include companies like Databricks. More here and also from Peter McKay at Snyk who shares some of the journey…

Markets

#Datadog with another earnings beat and the multi-product platform is one of keys (presentation here)