What’s 🔥 in Enterprise IT/VC #412

The impact of raising Jumbo Inception rounds, where the value accrues + >40% of all 🦄 in last 2 years are AI-related cos...

What a week - that giant sucking sound you heard was basically OpenAI bleeding dry $6.5B of investment dollars. Dan puts this round into historical perspective for us 👀

We better hope that Dan Ives, AI bull from Wedbush Securities, is right when he says this:

In a nutshell we believe the stage is set for tech stocks to move higher into year- end and 2025 in our opinion as the Fed and Powell kicked off its aggressive rate cutting cycle this week, macro soft landing remains the path, and tech spending on AI remains a generational spending cycle just starting to hit the shores of the tech sector. We continue to estimate for every $1 spent on an Nvidia GPU chip there is a $8-$10 multiplier across the tech sector which speaks to our firmly bullish view of tech stocks over the next year.

Taking a step back, Nvidia has changed the tech and global landscape as its GPUs have become the new oil and gold in the IT landscape with its chips powering the AI Revolution and being the only game in town for now. There will be a time that competition from AMD and others ramp up but essentially a $1 trillion of AI Cap Ex over the next few years is coming its way. The cloud numbers and AI data points we are hearing from our field checks around Redmond, Amazon, and Google indicates massive enterprise AI demand is hitting its next gear as use cases explode across the enterprise landscape. While investors may fret about this massive spending wave and frustrated that top- line growth/margins from these investments could take time to materialize this ultimately speaks to our view this is a 1995 (almost 1996) start of the Internet Moment and not a 1999 Tech Bubble-like moment.IDC believes this number is 4.6x

According to the research, in 2030, every new dollar spent on business-related AI solutions and services will generate $4.60 into the global economy, in terms of indirect and induced effects. This is determined by:

Increased spending on AI solutions and services driven by accelerated AI adoption

Economic stimulus among AI adopters, seeing benefits in terms of increased production and new revenue streams

Impact along the whole AI providers supply chain, increasing revenue for the providers of essential supplies to AI solutions and services providersThe real question is where does the value accrue? Some believe models is where it’s at like above (only a game few investors can play), others think the software infra layer which IMO is super crowded and tough, and the final crew believes the value is in the application layer where new applications can be reinvented and get better with every model release. Satya sums it up best here for the app layer powered by data.

VCs are voting with their 💰 as >40% of all new 🦄 created in 2023 and 2024 are AI/ML cos (Pitchbook).

Which leads me to this; the euphoria around the future and GenAI starts at Inception and these rounds are starting to get out of hand. There are huge implications downstream if one raises at the 75th percentile today or in my parlance a Jumbo Inception Round and the milestones that one has to achieve only ratchet up over time.

Absorb the below and click through for the comments 🧵

As Jason Lemkin mentions 95% of founders will take the larger round upfront but for the 5% who listen or maybe if I can convert 1-3%, remember that you limit your optionality by taking too much upfront, constraints breed creativity, and that the investors writing that big check at Inception will either be impatient in your search for PMF and drive you nuts or not care at all as you are just an option for a multi-billion fund.

If you are building for the future, I highly suggest you read this post from Guy Podjarny who we’ve backed 3 times (Snyk 🦄) and now Tessl.io which is leading the charge for AI Native Software Development and rethinking/reimagining what’s possible instead of turbocharging existing workflows. His mental model is spot on.

Here’s Guy explaining the 2x2 matrix:

AI-powered products seem to come in different flavors. Some are big and dramatic, talking about reimagining the world and a bold new future. These solutions are exciting - and potentially frightening - but they also feel quite far away. Others are smaller and pragmatic, typically focusing on productivity. They promise to make you twice as fast and take away boring and repetitive tasks, making them compelling to adopt - but more incremental than revolutionary.

To make sense of this wide range when looking to build, invest in or use an AI tool, I find it helpful to plot AI offerings across two dimensions: Change and Trust.

Trust indicates how much one needs to trust the product to “get it right” for it to be helpful. It ranges from smaller tasks you can easily verify (attended workflows) to tasks that need to get it right on their own to be valuable (autonomous workflows).

Change indicates how much you need to change the way you work to use this product. It moves from products that integrate seamlessly into your current day to day (existing workflows) to those introducing a new way of doing things, requiring your processes to change (new workflows).

Read the rest here...One other enterprise AI trend I’m noticing over the last 6-12 months has been the renewed interest from enterprises for hybrid cloud/on-prem deployments of GenAI related applications and I do believe this will only continue as the Global 1000 think about privacy, security, and privately training LLMs. To that end, two boldstart portfolio cos, CommonPaper and Replicated partnered up to offer the free on-prem software license contract.

If you’re a founder who doesn’t know what it means to move upmarket and be enterprise ready, then go to the definitive guide created by Replicated and others to learn about RBAC, audit logs, SSO and much more.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#the transition to move upmarket in the enterprise is one fraught with peril. Not only do you have to have a willingness to learn to move upmarket but you also need to have the right DNA on team to execute…

Enterprise Tech

#once upon a time getting to $100M ARR felt magical but now the bar is much much higher - so agree (WSJ)

Hot streaks at a few software-as-a-service startups are driving the measure of success out of reach for many others, undermining the also-rans’ prospects for the most lucrative exits.

A few years ago, $100 million in annual recurring revenue was often enough to set cloud companies on the path to larger late-stage rounds at lofty valuations and perhaps even an initial public offering. Institutional investors viewed it as the mark of businesses that could keep growing and deliver a significant return.

Then the goal posts moved.

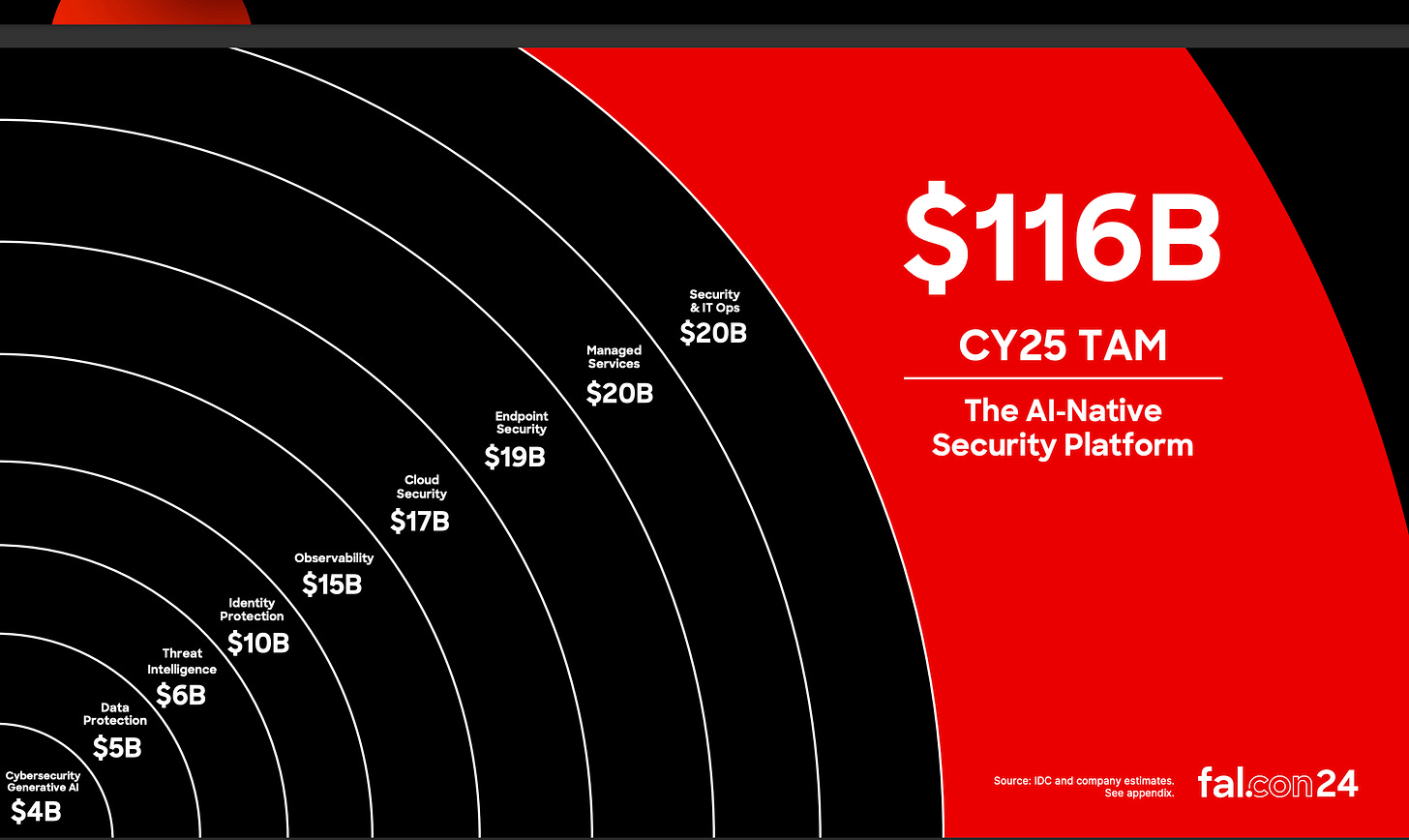

Higher interest rates and slowing growth for software businesses have pushed institutional investors to raise their sights to $300 million in ARR, according to Asheem Chandna, a partner at venture-capital firm Greylock Partners.#always love these TAM charts from Crowdstrike as it evolved from point product to platform - the deck on path to $10B ARR is one to read here - notice the newest and smallest one today as Cybersecurity for Generative AI at $4B!

#Marc Benioff and Salesforce master class on product marketing - how do you take a slower growing 🦖 and reposition it as the future? Read this overview from Constellation Research which has slides and hits the high points from high level Wave 3 to product to customer case studies

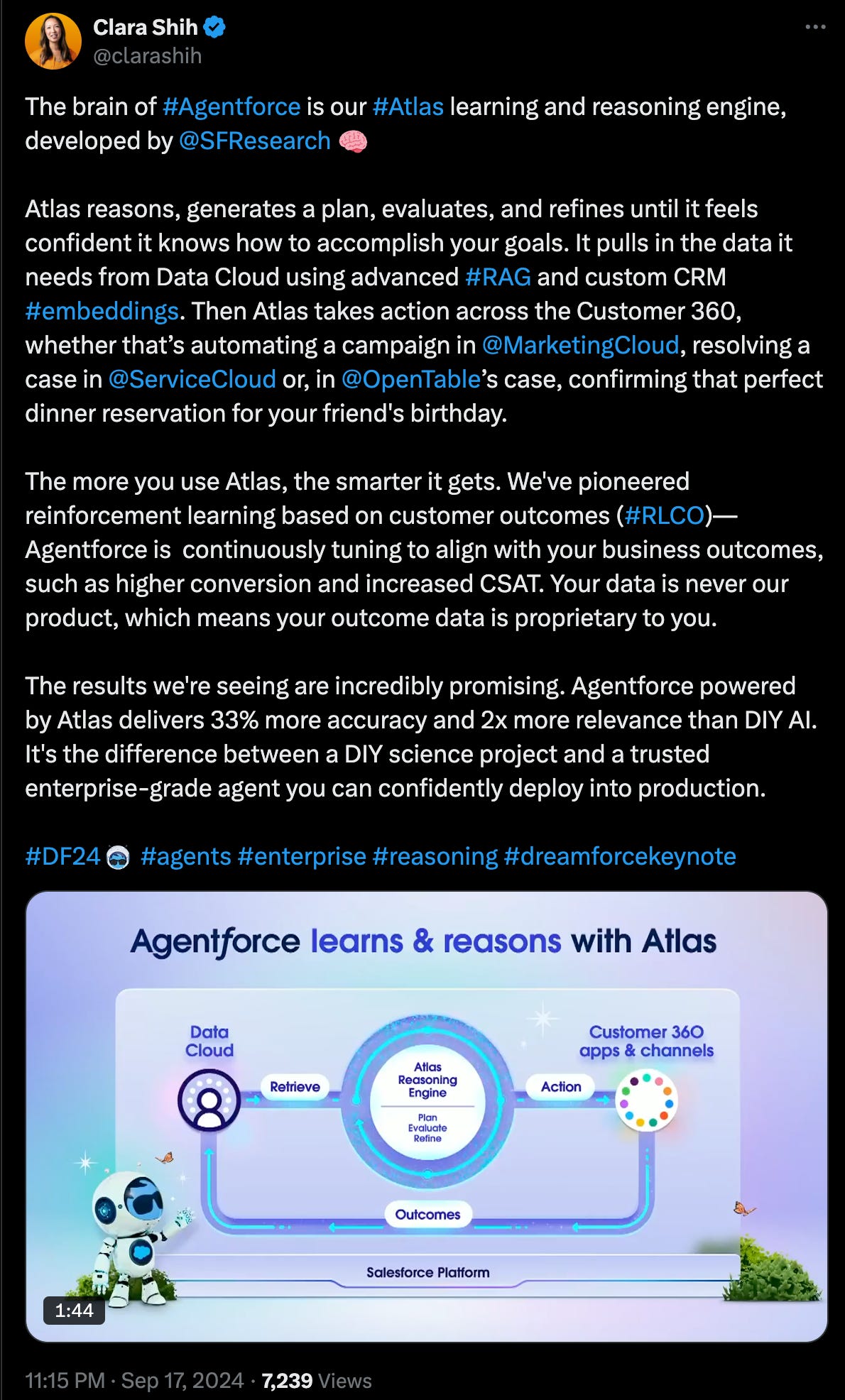

#Clara Shih lays out the reasoning engine - once again so smooth, all powered by the data and holistic platform that Salesforce has and super simple - private data, tuning from customer outcomes…

#and masterful Marc was - even though some of this is attributed to the 50bps rate cut, just as much is from AgentForce - the AI hype on Wall Street is not dead yet as we move to the “show me the money” application era from the hyperscaler infra era of AI investments

#also bold move from Salesforce to start going from seat-based pricing to outcome based pricing at $2 per conversation…(Bloomberg)

Salesforce Inc. is unveiling a pivot in its artificial intelligence strategy this week at its annual Dreamforce conference, now saying that its AI tools can handle tasks without human supervision and changing the way it charges for software.

The company is famous for ushering in the era of software as a service, which involves renting access to computer applications via a subscription. But as generative AI shakes up the industry, Salesforce is rethinking its business model for the emerging technology. The software giant will charge $2 per conversation held by its new “agents” — generative AI built to handle tasks like customer service or scheduling sales meetings without the need for human supervision.#Sam on agentic experiences coming…

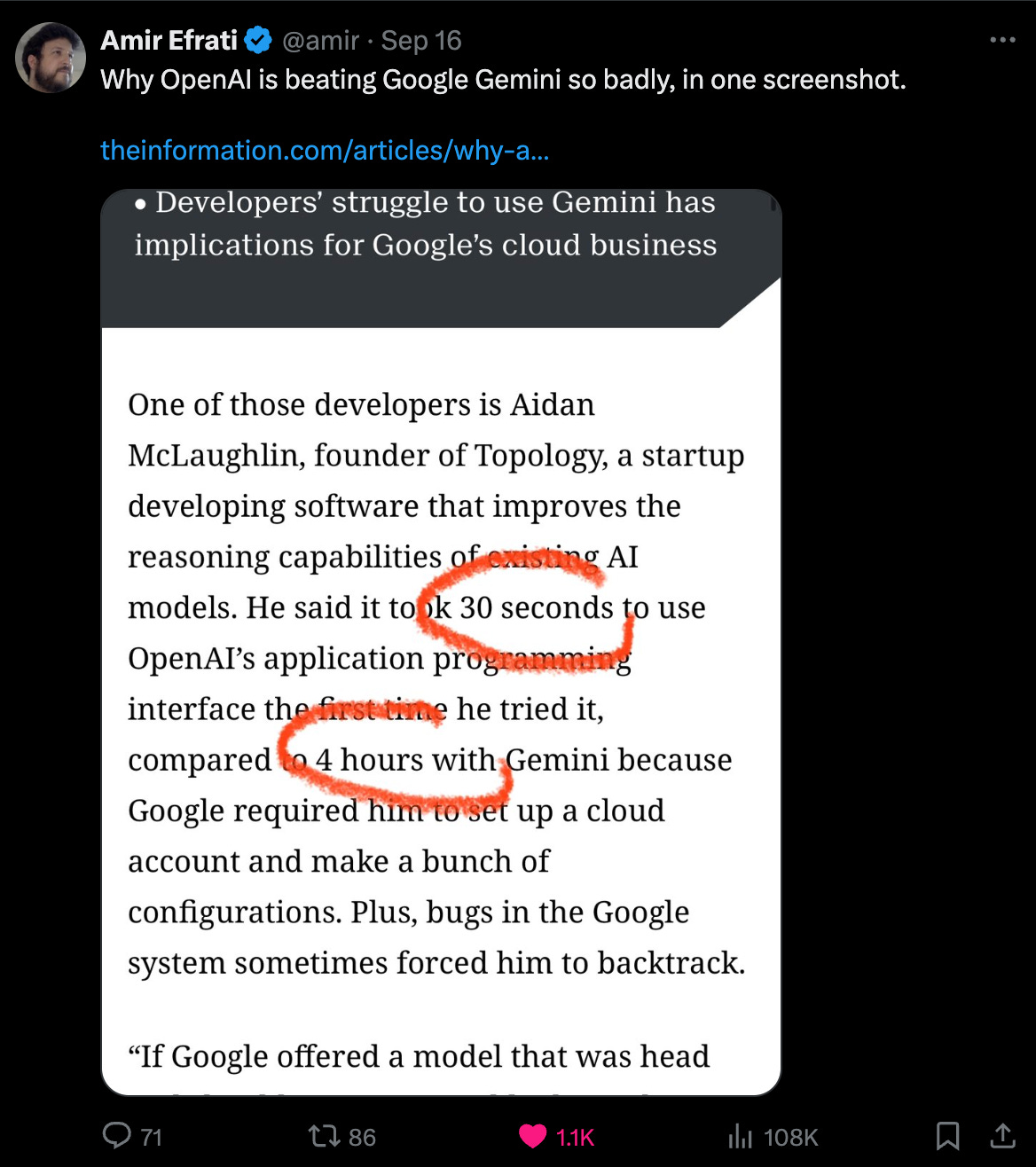

#👇🏼 says it all

#Like Intel inside and Microsoft windows, more on the hardware/software cycle - Blackwell inference can go from minutes to seconds to support OpenAI reasoning 🍓

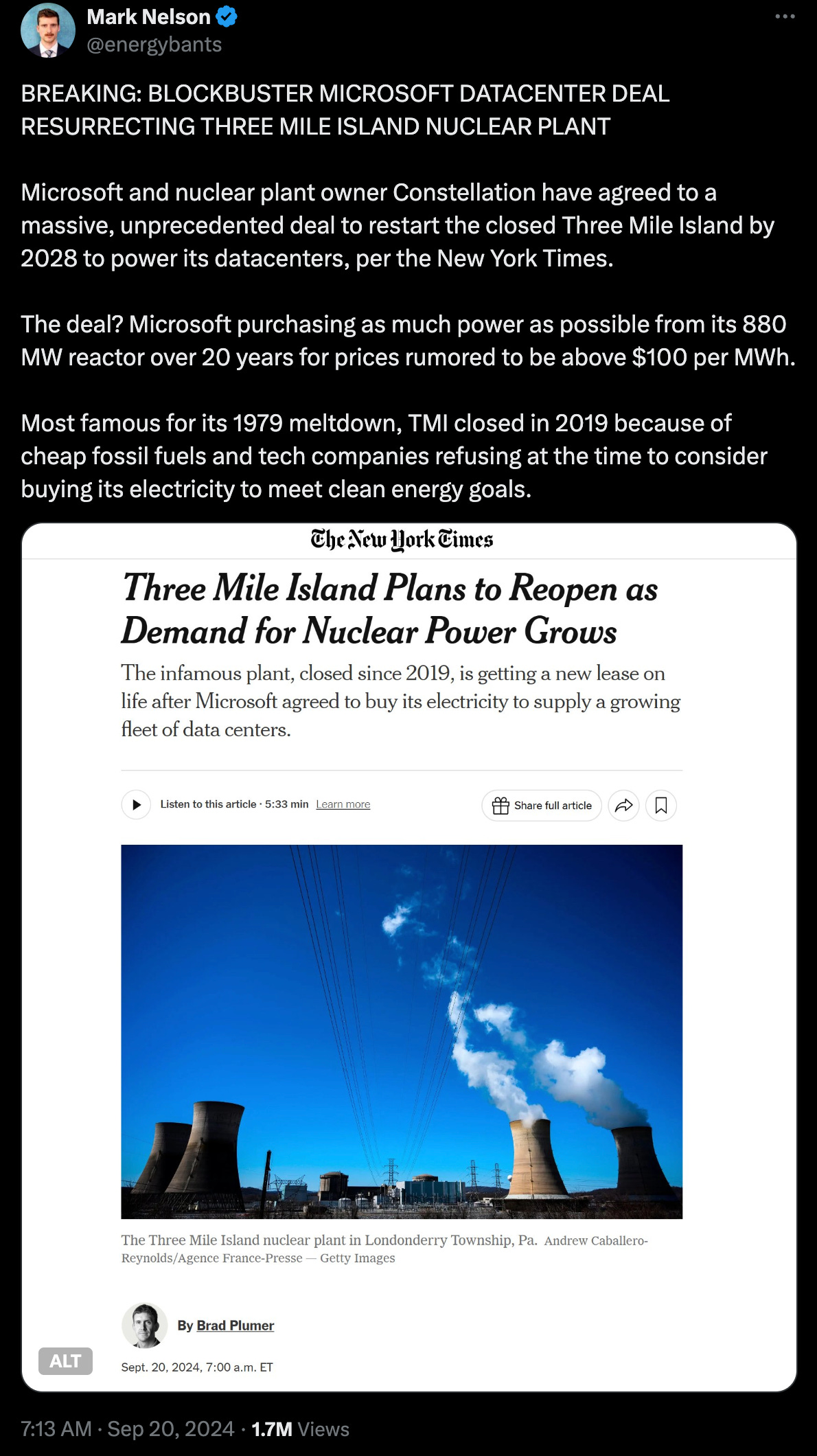

#when you need power…this insane as I remember this meltdown as a kid but nuclear is the way to go 🧵

#huge news in crypto space if banks can actually custody assets for customers - becoming a real asset class - there will be some tremendous opportunity for the startups who provide the infrastructure plumbing and security for these insitutions

Markets

#the median exit value for a 🦄 in 2024 is at .56X last round price vs. 1.24x in 2021 👀 (Pitchbook)

#Orlando Bravo commenting that he’s buying lots of distressed VC-backed assets at prices not seen since the dot com bubble especially for unprofitable cos where growth is slowing, 5x revenue and sometimes even at 1x to 2x revenue for $100M to $200M of ARR 👀 (watch video)