What’s 🔥 in Enterprise IT/VC #406

The race to be the last mile AI platform for enterprises - lessons from Palantir's Bootcamp model (BLG is the new PLG), Glean, and others...

What a wild ride 🎢 in the markets! As mentioned previously, it’s so important for us investors and founders to stay the course, play long ball. Let me share with you how that looks like at the moment from public comps, private financings, and GTM (go-to-market) execution.

First, Jamin Ball’s update on multiples is here:

Look at Palantir - well deserved on its 21.1x multiple and even though its NTM growth is much lower than others below, the AI story looms large and its trading at a premium.

Secondly, according to the WSJ Glean, initially a GenAI enterprise search platform (Feb 2024 website) is in talks to raise a new round of funding at a $4.5B valuation.

More importantly, the multiple is quite rich but also will compress if the growth continues:

The $250 million investment would double the company’s valuation from six months ago, a sign of continued enthusiasm for generative AI

The startup sells AI-powered search software that helps employees look up information spread across the organizations they work for. Executives and investors have pointed to such productivity apps as a potentially more lucrative market for generative AI in the near term than consumer-facing applications. To be clear, while Glean’s initial wedge was built around enterprise search, its ambitions are much broader - to be the enterprise platform to build AI-driven apps and workflows in an easy-to-build, privacy-preserving and secure manner. Here’s the website today.

As an aside, I did mention Glean as one of top startups to watch that I have not invested in on this most recent Business Insider list of amazing enterprise software companies (85 of the most promising startups of 2024, according to top VCs).

Well, this is exactly what Palantir is doing - fixing the last mile problem, aiming to be the platform from which every enterprise builds every single application. What does that tell you?

The value is not in the foundational model or LLM, it’s in the workflow and the last mile to make it super easy for enterprises to conceive, build, and deploy GenAI in the enterprise in a rapid, accurate, cost-conscious, privacy preserving, and secure manner. That is the race of the future and every single company that starts with a wedge solving a specific problem will eventually end up in this race.

What’s also interesting is how both of these companies go-to-market. This is real enterprise sales - there is no PLG, freemium play at the moment but…all that being said, both are focused on delivering insane Time-to-value or time to the “Aha” or “Wow” moment for its customers. Look at Palantir’s execution from this past week as it continues to leverage its new model - the AIP Bootcamp - BLG for the win!

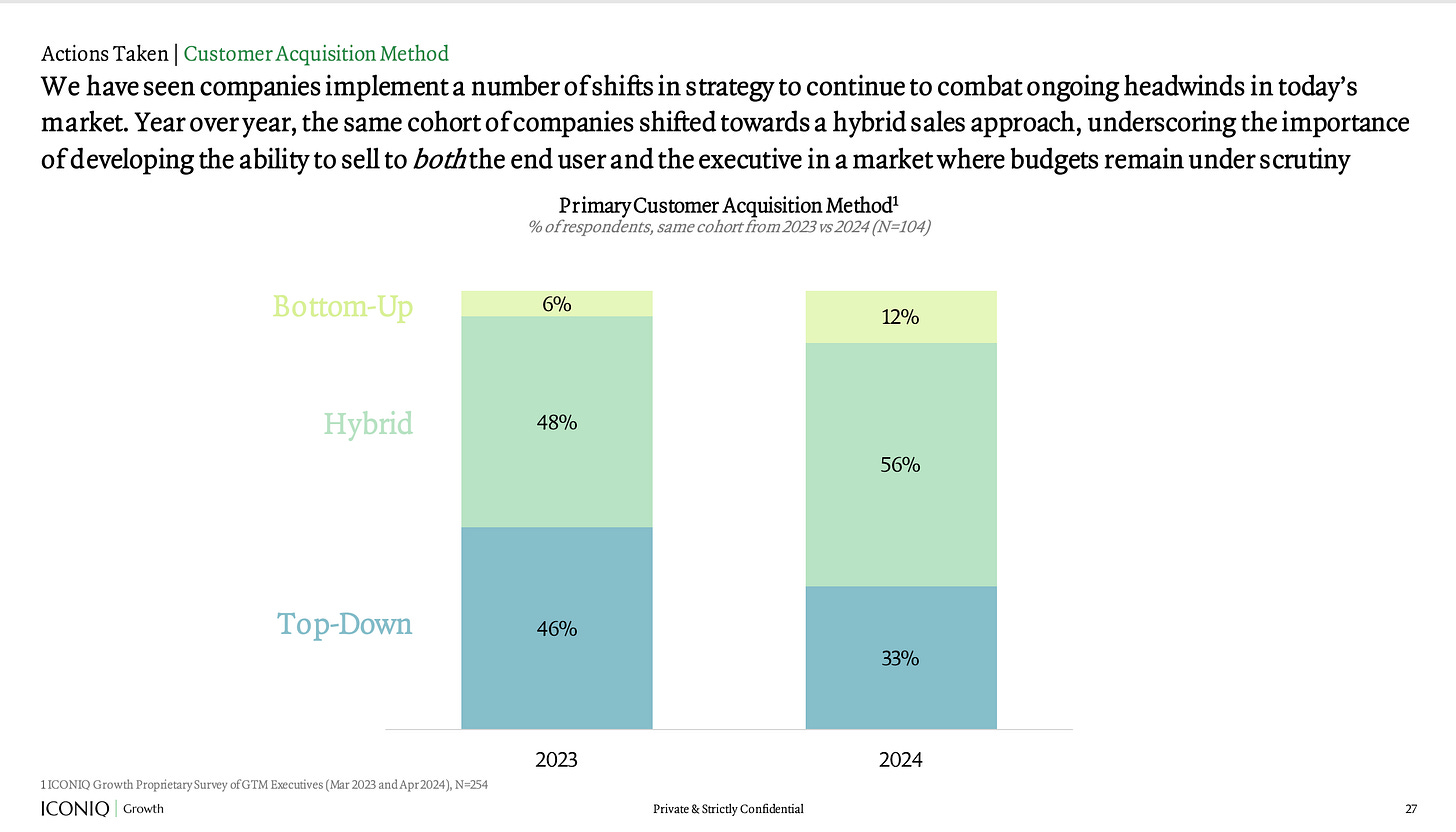

Zooming out, I encourage you to read Iconiq’s The State of Go To Market in 2024. It’s loaded with great survey data on sales motions, cycles, rep productivity and more to benchmark yourself against >150 B2B Saas Companies.

While there are so many slides I could pull out, here are a few that hammer home my points above:

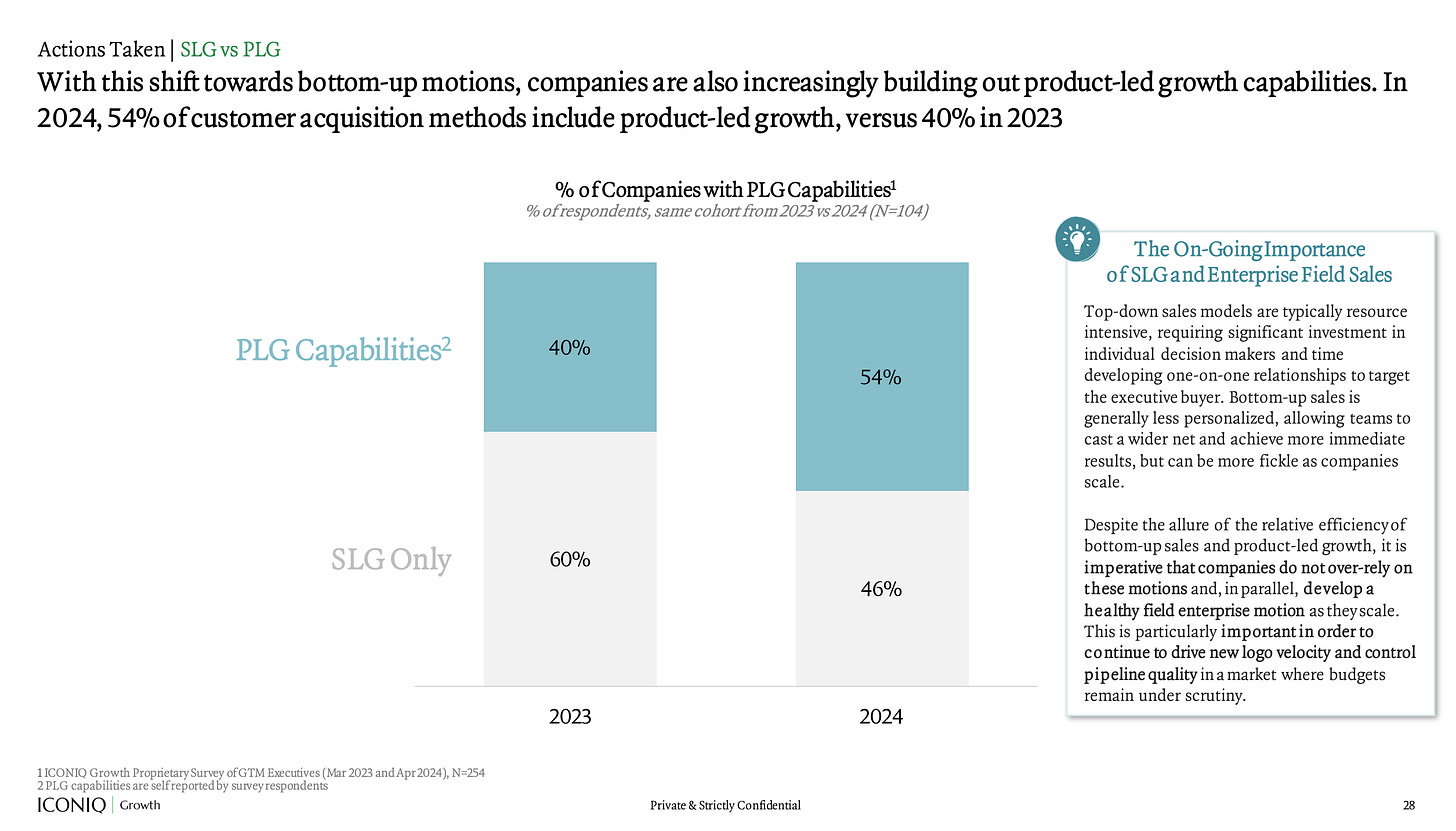

#Slide 1 - SLG vs PLG - this first one is super important as companies need to stop getting enamored with sales acronyms like PLG, SLG, now BLG, and just focus on getting customers to the “WOW” moment as soon as possible. TIME TO VALUE MATTERS! The easier your product is to try, test, etc, the quicker to the Aha moment. As you can see here, more SLG companies are going more PLG and thus making it easier and easier to get their products into the hands of customers with miminal friction - that’s a big shift from 40% to 54%.

This has resulted into a large shift away from Top-down sales to Hybrid and bottom- up. Frankly, I am all about hybrid as at the end of the day all roads eventually lead to enterprise sales and steak 🥩 dinnahs!

In light of this survey data from ICONIQ and the shift from SLG to hybrid, let’s take a deeper look into Palantir’s GTM.

I originally wrote this post 6 months ago but never released it but based on this past week’s numbers, we can say that the Bootcamp/BLG model is working pretty well!

More on the BLG model:

PLG or product led growth was all the rage during the ZIRP era as products seemed to sell themselves. However, as times got tough, folks learned that easy onboarding also equaled easy offboarding, and that PLG is just lead generation that generates highly qualified customers. Eventually everyone needs to sell, and all roads eventually lead to top-down enterprise sales.

But what if you have a complex enterprise sale that always requires an extensive POC? How can you increase time to value? How can you get prospects through the funnel faster?

Enter the bootcamp which Palantir has been using to stunning success. Here’s CRO Ryan Taylor commenting in its Q4 2023 Palantir earnings call:

We're already seeing evidence of bootcamps helping to significantly compress sales cycles and accelerate the rate of new customer acquisition, which rose to 22% sequentially for U.S. commercial in Q4 versus 12% and 4% in Q3 and Q2, respectively. And we more than doubled the number of U.S. commercial deals with TCV of $1 million or more from the fourth quarter in 2022 to 2023.

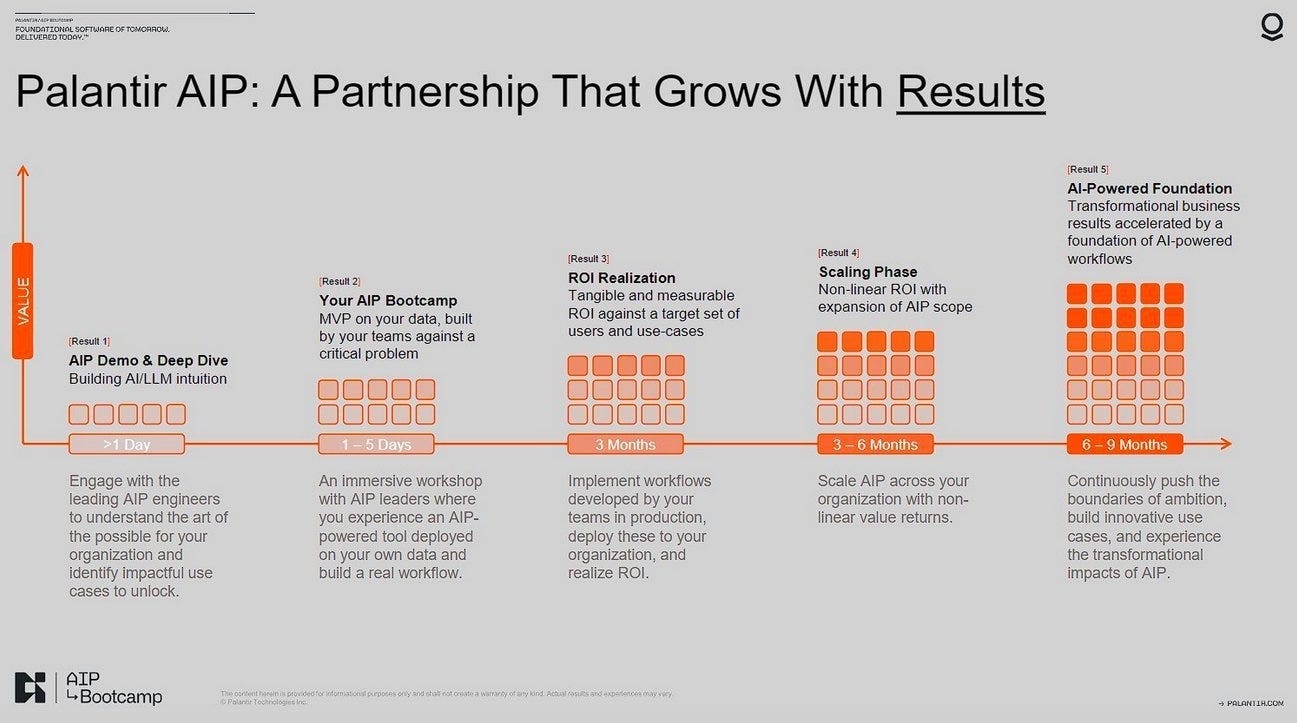

So what’s an AIP Bootcamp - here’s Palantir’s description:

Palantir Artificial Intelligence Platform (AIP) enables new and existing customers to dramatically accelerate high-value AI use cases. To meet the intense requirements of the moment, we have introduced AIP Bootcamps. In these immersive, hands-on-keyboard sessions, participants can expect to go from zero to use case in just one to five days.

The results speak for themselves. Our partners have been able to solve problems that they have been struggling with for years in a matter of days. They are able to build their own intuition and skillset to be able to independently identify and execute on AIP use cases in subsequent weeks. AIP Bootcamps are also fun for all involved, as winning tends to be.

What’s important to note that Palantir is famous for coining their own customer delivery process with “forward deployed engineers” which really meant that they would sell a huge platform and have engineers custom build solutions while living at the enterprise.

A Forward Deployed Software Engineer (FDSE), or “Delta,” is a software engineer who embeds directly with our customers to configure Palantir’s existing software platforms to solve their toughest problems. While a traditional software engineer, or “Dev,” focuses on creating a single capability that can be used for many customers, FDSEs focus on enabling many capabilities for a single customer. We are deployed across many industries and problem domains, so the breadth of projects we tackle is large and always evolving. Since joining Palantir, I’ve had the chance to work across cyber, healthcare, and defense.

Bootcamps are an exponential leap in time to value as the new AIP platform enables Palantir to show time to value in days versus months.

AIP is the AI-powered operating system for the enterprise, not a Q&A bot, not an agent framework, not a way to dabble, but a way to deliver. At a recent two-day bootcamp with the construction, engineering, and architecture company, our customer developed a production-ready use case that provided $10 million of savings. They used AIP to build an AI-powered disruption manager application that processes production disruption notifications through AIP Logic to determine what the best new production plan would be. AIP, wielding a linear optimizer as a tool, and using LLMs to parameterize and contextualize the disruption, translates the notification to a clear understanding of impact on the optimized schedule.

Given how early we are in the AI cycle, it’s an amazing way to move prospects to close much faster. Here’s a chart showing the Bootcamp sales process and from reading comments from management it sounds like deals are closing post-bootcamp and pre-full ROI realization of 3 months.

Here’s what Ryan Taylor (Chief Business Affairs Officer) of Palantir said about the bootcamp motion 3 quarters ago in its Q3 2023 earnings call:

In the last quarter, we reoriented our go-to-market approach around AIP boot camps, which has allowed us to deliver real workflows on actual customer data in five days or less versus our traditional pilots, which generally take one to three months. We're seeing different stakeholders at the table, including tangible engagement from IT, a quicker time to value for customers, a wider range of organizations partnering with us and the ability to have multi-organization boot camps.

Early indications point to vast improvements on our unit economics from initial contact to customer conversion, all while accelerating new customer negotiations. Boot camps are also driving contract expansions. We're on track to conduct boot camps for more than 140 organizations by the end of November, nearly half of those are taking place this month alone, which is more than the number of U.S. commercial pilots we conducted all of last year.

In these boot camps, our customers attack problems that have immediate impact and learn how to deploy AI into their unique operating environment in a matter of days. Our customers' results speak for themselves. One attendee said that we achieved more in one day for them with AIP than one of the top three hyperscalers had accomplished over the last four months, and then presented their work with Palantir instead of the hyperscaler to the CEO the very next day. Another attendee said, we basically built 10x faster with 3x less resources, and yet another claimed, we have built in a day what they wouldn't be able to get internally in months, and then it probably still wouldn't meet the requirements.

Palantir’s COO Shyam Sankar chimes in later:

Maybe to start with the second one here with AIP. I think you should really think that the boot camp is more than just what's happening in the boot camp. Because you're exiting the boot camp with a series of use cases that are production ready or near production ready that you can go forward with. You're exiting the boot camp with as the customer and usually IT with enough hands-on experience with the product that you can actually keep going and compounding it going forward.

So there is this exit velocity that's fundamental to it, where it's not just the go-to-market motion, it actually now becomes the implementation motion. It becomes the way in which you engage with partners because now partners can run their boot camps. Partners can drive use case growth for themselves around what came out of the boot camp and the exit velocity around that. So I think it's quite profound and why you're seeing both our emphasis of it and the impact that it's having on both the financials and the operating reality of the business.

What Shyam is saying is that the bootcamp is also a leveraged model since consulting partners can run these for customers and it also speeds time to implementation or time from booking to happy customer as it becomes the implementation motion.

Here’s how the AIP bootcamp worked 1 quarter later! The stock was up 📈 30% (Feb earnings call) that week.

AIP and bootcamps are accelerating our business, particularly in U.S. commercial, where fourth quarter revenue grew 70% year over year, evidencing a significantly expanding addressable market. In October, we set a goal of executing 500 AIP bootcamps within one year.

We have already blown that goal out of the water, having completed more than 560 bootcamps across 465 organizations to-date. We are deploying AIP to implement hundreds of real tangible use cases in production for our customers. One bootcamp attendee remarked, "What your team did in just two days was incredible. We can already think of 100 use cases for this." While another said, "It seems there are endless solutions.

It seems there's nothing Palantir cannot do." When combining LLMs with Foundry through AIP, the ability to deploy use cases becomes much more widely accessible, so the addressable market expands considerably. We're seeing initial momentum as a result of that expansion, while also still being at the starting line in the journey to capture that market. In our U.S. commercial business, the expanding addressable market driven by AIP, is propelling growth both through new customer acquisitions and expansions with existing customers.

I've never before seen the level of customer enthusiasm and demand that we are currently seeing from AIP in U.S. commercial. With regard to new customer acquisition, the expanding addressable market is reflected in the greater scale of the top of our sales funnel. And now, we're doubling down on how we're converting bootcamps to enterprise deals.

We're already seeing evidence of bootcamps helping to significantly compress sales cycles and accelerate the rate of new customer acquisition, which rose to 22% sequentially for U.S. commercial in Q4 versus 12% and 4% in Q3 and Q2, respectively. And we more than doubled the number of U.S. commercial deals with TCV of $1 million or more from the fourth quarter in 2022 to 2023.

Reminder, bootcamps as a motion is not cheap and best used when deals are huge

Out of these deals, we're seeing several archetypes emerge as a result of AIP. First is the new customer who attends a bootcamp and signs an enterprise contract shortly after. For instance, an American cable television provider signed a nearly $3 million deal following cold outreach on LinkedIn that led to a five-day bootcamp, then an enterprise agreement, all in the span of last quarter. Then, there's AIP-driven conversions of ongoing pilots.

Following a two-year prospecting effort, a large American consumer packaged goods holding company agreed to a pilot, during which AIP was also introduced, then converted in December to a five-year $19 million contract. Then, also, there's AIP-driven expansions in key existing accounts, including one of the world's largest telecommunication companies where we demonstrated speed to value at bootcamps by delivering new use cases on top of the existing ontology in as little as 24 hours, with the results contributing to an agreement for a multimillion-dollar expansion of our existing contract.

Shyam reiterates “getting hands dirty” with AI important!

So much of what data defines a process is not actually in the system that runs that process, but instead in conversations, conference calls, videos of the factory floor, or images of a site. What's in the enterprise process system is a lossy latent representation of this reality. Our software always exploited that phenomenon that the truth is out there, not in your ERP system or that blessed application. With AIP, we are investing in multi-modal approaches to compound on this proven value driver and expand the addressable market of use cases within the enterprise.

As I've said before, with AI and LLMs, you can't think your way through it. You have to get your hands dirty and work in anger to get use cases into production. In AIP, we have built a platform to deliver proof, not just proofs of concept, to our customers, and bootcamps are the way to flex that strength. At AIPCon 3, we will have many customers on stage showing you their great work.

More from Alex Karp, Palantir CEO, in his annual letter to shareholders. The key here is the delivery of the AIP platform “which has gone from a prototype to a product in months.”

The demand for large language models from commercial institutions in the United States continues to be unrelenting. Every part of our organization is focused on the rollout of our Artificial Intelligence Platform (AIP), which has gone from a prototype to a product in months. And our momentum with AIP is now significantly contributing to new revenue and new customers.

It once took weeks and months, if not longer, for data integration and analytical software platforms to be set up and integrated with a customer’s existing systems.

AIP can now be up and running in as little as a few hours.

Enterprises across commercial sectors that have invested hundreds of millions of dollars in lackluster or failed data integration projects are now seeing results in days.

The proliferation of and interest in large language models obscures the simple fact that the sophistication and power of such natural language processing systems mean little without an effective way of allowing those systems to interact with an organization’s underlying and proprietary data, which is often scattered across hundreds if not thousands of disparate repositories. AIP is that connective tissue, and the organic and unconstrained demand for its capabilities is unlike anything we have seen in two decades.

We conducted fewer than 100 commercial pilots in 2022. Since introducing AIP last year, we have already conducted over 500 bootcamps on top of the more than 130 pilots we undertook in our commercial business in 2023.

And while we have just introduced AIP in the marketplace as our fourth platform, our product pipeline is more robust than it has ever been in our history.

AIP is the future of our company, and we believe that it will become the dominant platform for the entire industry.

So how’s the BLG motion working 6 months later? 🤯 💰 (Q2 24 Earnings call Transcript)

The world is struggling with this huge problem. There's a great bottleneck between prototype and production. The world has also come to understand what we've been saying all along: The standard playbook does not and will not work. It cannot solve this problem.

While many companies can build prototypes, the leap from prototype to production is substantial. Palantir has made that leap. Our focus is on deploying enterprise AI and production, solving meaningful problems for our customers. We have the right products at the right time, and our history means that we understand the $600 billion opportunity unlike anyone else in the space.

We are uniquely situated, and you see that in our results now. Last quarter, we signed 27 deals worth $10 million or more and closed nearly $1 billion of TCV. One of the most notable indicators of our delivery is the volume of existing customers who are signing expansion deals, many of which are a direct result of AIP. We continue to see the greatest transformation in our U.S. commercial business, evident in the mini AIP-driven deals closed last quarter. Our U.S. commercial revenue, excluding strategic commercial contracts, climbed 70% year over year. Our U.S. commercial ACV closed was up 44% year over year and up 19% sequentially, while our deal count in U.S. commercial was nearly twice what it was just one year ago.Time to value matters! Bootcamps work, and I’m sure we’ll see many more enterprise software companies who sell big ticket items top down create their own version of the AIP Bootcamp. BLG baby!

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#stop and listen to friend Rob Bailey, co-founder of CrewAI, initial COO for Kustomer - I’ve had the pleasure of working with him on over 6+ companies and starts here with lesson 1 - you can’t brute force PMF

#fun chat with Grace on inception investing, the 5 Ps for investing at Inception, what we look for, portfolio construction…

#💯 startups, you are lean, focused - leverage your advantage

#here’s the full video from last week’s live stream with Michael Krigsman of CXOTalk covering many of my points above about what we’re seeing in F500s (full transcript here)

“Confidence comes from preparation.”

~ Kobe BryantEnterprise Tech

#Forbes Cloud 100 is back - congrats to boldstart portfolio co Snyk for placing again and coming in at #27 while OpenAI takes the top spot over Databricks and Stripe

#Microsoft’s AI Can Be Turned Into an Automated Phishing Machine (Wired) along with video from Barqury’s presentation at Black Hat

Today at the Black Hat security conference in Las Vegas, researcher Michael Bargury is demonstrating five proof-of-concept ways that Copilot, which runs on its Microsoft 365 apps, such as Word, can be manipulated by malicious attackers, including using it to provide false references to files, exfiltrate some private data, and dodge Microsoft’s security protections.

One of the most alarming displays, arguably, is Bargury’s ability to turn the AI into an automatic spear-phishing machine. Dubbed LOLCopilot, the red-teaming code Bargury created can—crucially, once a hacker has access to someone’s work email—use Copilot to see who you email regularly, draft a message mimicking your writing style (including emoji use), and send a personalized blast that can include a malicious link or attached malware.#all 38 🦄 created this year (TechCrunch)

#what is the future of software engineering as per President of Devin 🧵 - this post is 🔥

also love how Russell discusses 2nd order effects (read What’s 🔥 #379) 👇🏼

What's 🔥 in Enterprise IT/VC #379

Microsoft delivering on AI + thinking about second order effects for startups in a world where 50% or more code is written by AI?

#the LLM model race encapsulated - quickly getting commoditized, low switching costs

#💯 👇🏼 as I like to say, all real enterprise sales eventually lead to steak 🥩 dinnahs esp. in a world where AI-spam only increasing.

#software engineering vs AI engineering: “we are acknowledging it will never be “right” because its fundamentally nondeterministic, but building new capability and turning it into product is all the engineering”

#how to think about AI application development from Anton, founder of Chroma 🧵 - I took out slide 9 but encourage you to read

#great writeup on boldstart portfolio co Clay from Zachary DeWitt - also read this post from my partner Eliot Durbin about Clay’s origin story as it took them 6-7 years before Clay really inflected

#looking to the publics when understanding how to monetize AI - here’s ZoomInfo

#AI at end of day is about jobs to be done, productivity - no better way to look at impact than understanding Indian outsourcing industry (WSJ)

The most vulnerable operations employed more than 1.4 million people in 2021, according to the latest data from Nasscom. A third of these jobs are in call centers. “The prize is to move up the value chain and go after new processes,” said Murugesh.

AI might accelerate trends that have already made the industry less labor-intensive. About a decade ago, companies needed about 27 employees to earn $1 million in annual revenue. That number has now fallen to 21 employees, Nasscom data show.

Companies typically charged clients based on the number of employees working on their projects. Now, fees in some cases are linked to the outcome delivered.

“Global demand for people is going to decrease. India’s share of this decline is less clear, but I am a little pessimistic,” said Danielle Li, a professor at the Massachusetts Institute of Technology’s Sloan School of Management who co-wrote a paper titled “Generative AI at Work.”#cybersecurity still on 🔥, growth rounds back as Abnormal Security in email space announced a new $250M round at a $5.1B valuation, up from a $4B valuation in May 2022 - 100% YoY growth and over $200M ARR

To prevent this threat, Abnormal Security takes a unique approach to understanding human behavior. In order to protect humans with AI, the platform connects via API to analyze thousands of signals from multiple data sets and precisely baseline known behavior. Autonomous AI models then enable Abnormal to precisely detect anomalous activity and stop never-before-seen attacks with superhuman speed and accuracy—understanding human behavior better than humans to protect humans better than humans. In addition to providing email security for Microsoft 365 and Google Workspace, Abnormal also delivers uniform multi-platform defense for more than a dozen cloud infrastructure and SaaS applications including Workday, Salesforce, ServiceNow, Slack and Amazon Web Services.

The new investment follows years of exponential growth as Abnormal Security continues to see 100%+ year-over-year increases in annual recurring revenue, recently crossing $200 million in ARR. More than 2,400 organizations already trust Abnormal to protect their employees, including 17% of the Fortune 500. Since last August, Abnormal has expanded further into Europe, Asia and Australia and is continuing the process of becoming FedRAMP compliant.Markets

#Zooming out over time - 🔑 lessons

#🤔 - this can’t end well, can it?

Hi Ed — huge fan of your weekly recap. Thank you for putting out quality content. On the last featured tweet about consumer Debt, this narrative is somewhat misguided without the context of income levels. FRED puts out great charts showing the historical trends of household debt to income ratios. We seem to be at, or even below, trend.