What’s 🔥 in Enterprise IT/VC #405

$2.9 Trillion wiped out in stocks, $1 Trillion in CapX spend for AI - stay the course, just a mini-bubble in a long 10+ year game - time to keep building 🏗️ but choose wisely as always!

What a week! Let me summarize as best I can:

from the Kobeissi Letter:

Current market mentality:

1. Jobs report stronger than expected = sell stocks, higher rates are here to stay

2. Jobs report weaker than expected = sell stocks, we are going into a recession

3. Jobs report as expected = sell stocks, inflation is still a problem

For the last 2 years, bad news was "good news" for the stock market.

Bad news is bad news again, and that's how you know recession fears are rising.

It's going to be a bumpy road ahead.Technically speaking, here’s what happening behind the scenes in finance - the good old fashioned Yen carry trade which is unwinding (John Doss):

$SPY $QQQ US hedge funds borrow money in Japan at 1.5% and buy U.S. tech stocks levered 3x with Treasuries. Japanese raise rates plus QT and hedge funds must deleverage. SoftBank may be in trouble as well. Fintwit looks back ($AAPL EPS). You need to look forward.And concurrent with this, the megacap tech cos like Microsoft, Google, Amazon, and Meta are asking Wall Street to be patient as over $1 Trillion gets spent on CapX to build data centers and buy GPUs to support the “coming” AI boom. Wall Street is getting impatient behind the backdrop above. Now add escalating tensions in the Middle East and a small chance for WW III (please no), and you have a 10% Nasdaq correction and fear infiltrating the market.

But hey, we are venture investors and founders - nothing that I have heard tells me to change direction. If anything, at least for investors, perhaps the froth is out of the AI bubble, and we’ll have more realistic valuations as we partner with founders who are solving real problems leveraging AI vs. being the “AI for X”.

As Warren Buffet said:

Be Fearful When Others Are Greedy And Greedy When Others Are Fearful

It’s time to stay the course. We’ve seen this movie 🎥 before. History rhymes, choose wisely and in the long run I have no doubt we will all be 📈. Here’s just a reminder from the last AI bubble in 2017.

Today’s “AI is a bubble” is timely as markets are having worst day since March 19, 2020 sparked by COVID fears. (FT)

Hedge fund Elliott Management has told investors that Nvidia is in a “bubble”, and the artificial intelligence technology driving the chipmaking giant’s share price is “overhyped”.

The Florida-based firm, which manages about $70bn in assets, said in a recent letter to clients that the megacap technology stocks, particularly Nvidia, were in “bubble land” and it was “sceptical” that Big Tech companies would keep buying the chipmaker’s graphics processing units in such high volumes.

AI is “overhyped with many applications not ready for prime time”, Elliott wrote in the letter sent this week and seen by the Financial Times.

Many of AI’s supposed uses are “never going to be cost efficient, are never going to actually work right, will take up too much energy, or will prove to be untrustworthy”, it added.

“There are few real uses,” it said, other than “summarising notes of meetings, generating reports and helping with computer coding”.

AI, it added, was in effect software that had so far not delivered “value commensurate with the hype”.As I’ve said before, we will have a series of mini bubbles on our way to 📈 in 10 years. I had a chance to discuss all of this as I went on CXOTalk live yesterday (watch here) as a “VC Update: AI Investing” which is a catch up from the last time I went on the show over 7 years ago March 2017! Take a look at this excerpt 👇🏼 from that 2017 talk.

You can also watch here if interested- feels like a time warp!

Here are a few clips from that talk and all equally apply today as they did 7 years ago:

When you get down to it, AI is going to be huge in the enterprise, but you need to make sure to focus on solving real business problems.

- @edsim

Companies are removing #data silos. This will enhance usage of applied #AI

— @keithbrisson @edsim on #CxOTalk

There’s lots of hard work to make #AI easy for the user

— @sychou @wearecatalytic on #CxOTalk

Great #AI is invisible to user.

— @sychou @keithbrisson @edsim #CXOTALK

AI is like water. Every company will have it eventually. i like to talk about “applied AI.” What problem does it solve?

~ @edsim #cxotalkIf you stayed the course back then through the crash, you’d be sitting pretty. And had we all not invested in data infrastructure, the cloud, labeling, classification, and more we would not have set up the rails and framework for where we are today in the GenAI revolution. BTW, my other guests who were founders of portfolio companies Init.ai and Catalytic both ended up selling their companies to Apple and PagerDuty respectively. We all learned a ton in that wave.

Yes, this GenAI wave 🌊 is going to take time, and the big public cos are asking Wall Street to be patient, but I do know that all of this CapX will only make the models 10x better over time, compute for inference and training much cheaper, and many of the projects we are dreaming of will come to fruition.

Microsoft’s Amy Hood talks about a 15 year outlook!

Within that, roughly half is for infrastructure needs where we continue to build and lease data centers that will support monetization over the next 15 years and beyond.And Google:

"One way to think about it is when you go through a curve like this, the risk of underinvesting is dramatically greater than the risk of overinvesting"It’s the same message from Meta:

"It's hard to predict how this will trend multiple generations into the future, but at this point, I'd rather risk building capacity before it is needed rather than too late, given the long lead times for spinning up new inference projects"Here’s why CapX is also going up - the cost to train each new foundational model will be 10X the prior one 🤯! Great news is that since Meta is open sourcing Llama, we will all benefit from this expenditure.

Despite the insane amount of CapX and long payout curve, there are early pockets of excitement, just not big enough yet to show Wall Street that $1 Trillion of CapX is worth it. First, as you all know my mantra, there is no AI in the enterprise without AI security, and I’m 🔥 up to share that portfolio co Protect AI just closed a $60M Series B Financing at a $460M valuation led by Evolution Equity.

GenAI also works insanely well for coding - just look at the GitHub CoPilot numbers from the Microsoft earnings transcript.

Now on to developer tools. GitHub Copilot is by far the most widely adopted AI-powered developer tool.

Just over two years since its general availability, more than 77,000 organizations from BBVA, FedEx, and H&M to Infosys and Paytm have adopted Copilot up 180% year over year. And we're going further with Copilot Workspace, we offer Copilot native end-to-end developer productivity across plan, build, test, debug, and deploy cycle. Copilot is driving GitHub growth all up. GitHub's annual revenue run rate is now $2 billion.

Copilot accounted for over 40% of GitHub's revenue growth this year and is already a larger business than all of GitHub was when we acquired it. We are also integrating generative AI across Power Platform, enabling anyone to use natural language to create apps, automate workflows or build a website. To date, over 480,000 organizations have used AI-powered capabilities in Power Platform, up 45% quarter over quarter. In total, we now have 48 million monthly active users of Power Platform, up 40% year over year.Yes, we lost $2.9 Trillion of market cap yesterday and Wall Street is impatient on AI revenue, but if anything, you should all know, stay the course, we will have a series of mini bubbles, but in the long run, this platform shift is one of the most important that we will ever experience. Builders will keep building and real investors will keep investing wisely…

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#pretty solid advice when it comes to being acquired - I don’t agree with all but definitely these are many of the upfront considerations - for me one of most important concepts is that every founder should get to know who their potential partners/acquirers are well in advance of any M&A transaction…build those relationships super early

#hey it’s the Olympics and no better place to find amazing stories of perseverance and inspiration, check this out - I can watch this a dozen times over…

#💯

#how 44 leading tech companies price their AI products…

Enterprise Tech

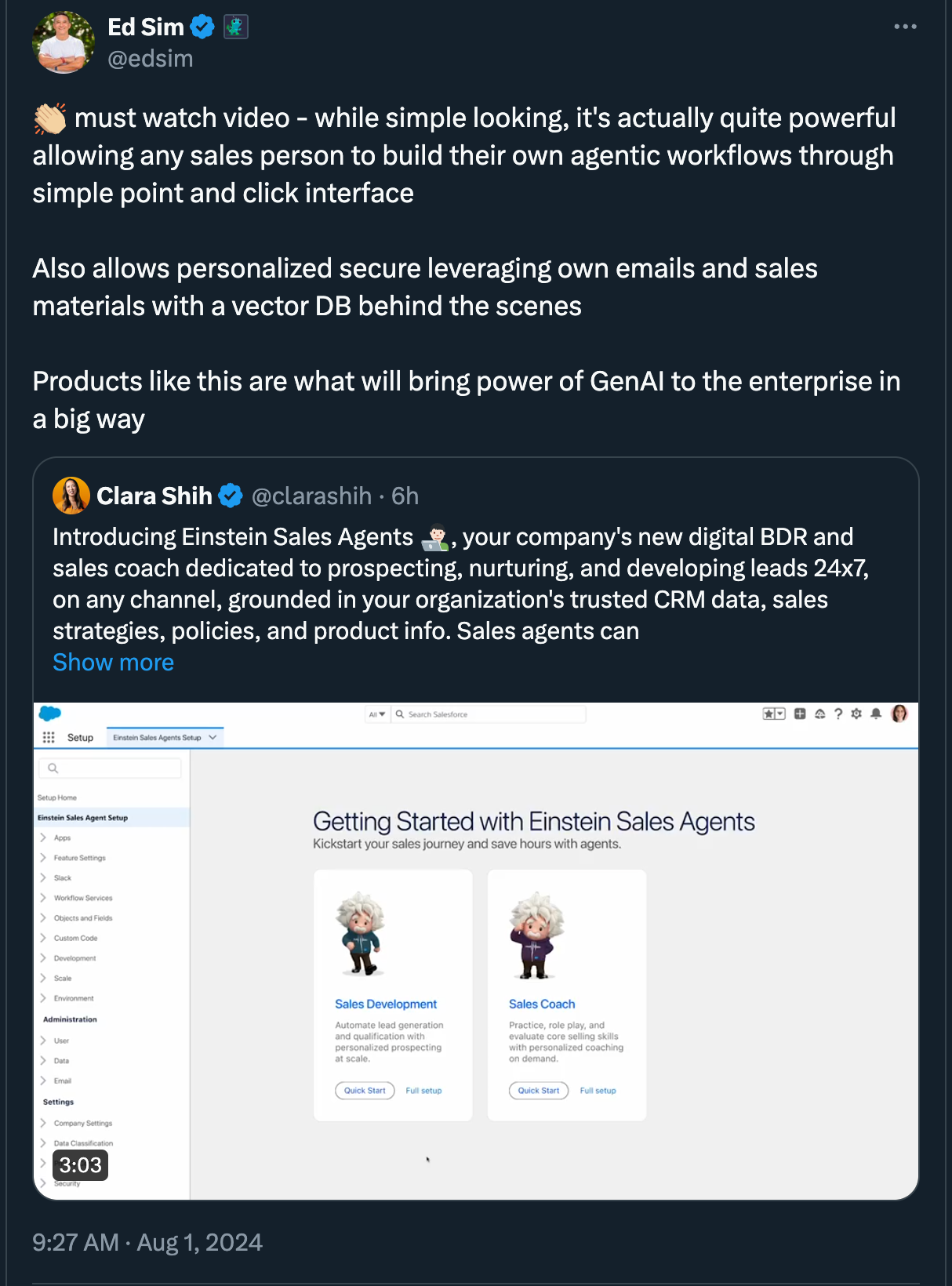

#Salesforce is doing a great job bringing power of AI and agentic workflow to regular business users - must watch video as products like this that will unleash next wave of AI value - workflows!

#Cato Networks in SASE cybersecurity market announced crossing $200M in ARR, doubling from, $100M ARR in 2 years - here are others who have reported over $100M ARR in past (according to Cyburger)- I would also add BigID to this list for Israeli cybersecurity cos

Pretty crazy

Private Israeli cyber companies* that reported $100m+ ARR 👇

Who did I miss and who is next in line??

Armis

Axonius

Cato Networks

Checkmarx

Clarity

Cybereason

Snyk

Transmit Security

Wiz

(* strong Israeli presence/affinity)#yes, ransomware is a massive business 🤯 - one $75M payment, up almost double from largest 3 years ago

Cybercriminals gravitate towards ransomware attacks for one simple reason: money. According to ransomware statistics compiled by Varonis, the largest ransom payout was in 2021 when insurance giant CNA Financial reportedly paid an astonishing $40 million. However, the latest Zscaler ThreatLabz ransomware report suggests that this deplorable record has now been broken. Coming in at nearly twice as much, the Zscaler researchers said they found evidence of a $75 million ransom paid by an undisclosed victim earlier this year. Say hello to the Dark Angels.#a16z market map for AI powered sales intelligence apps - it’s a super thoughtful post and I encourage you to read the full version here

#hot take from Gergely - agree or disagree? Definitely a bold launch from Tezi which blew up on social so the company does have people paying attention!

#Nvidia’s next big thing - robotics

Speaking at the annual Special Interest Group on Computer Graphics and Interactive Techniques (SIGGRAPH) event in Denver, Colorado, Nvidia CEO Jensen Huang announced several new services designed to bridge the gap between the digital and physical worlds.

Per Huang:

“The next wave of AI is robotics and one of the most exciting developments is humanoid robots. We’re advancing the entire NVIDIA robotics stack, opening access for worldwide humanoid developers and companies to use the platforms, acceleration libraries and AI models best suited for their needs.”

The company’s big announcement at SIGGRAPH was the early-access availability of its suite of robotics development tools. These include a visual agent training ground, an AI model workflow management system, and a nifty development system that allows humans to demonstrate complex functions via teleoperation.#and here it is, Delta is suing CrowdStrike and Microsoft - astonishingly CrowdStrike is down another 9.5% on Tuesday meaning that its market cap has dropped from $83.4B pre-software update to $57B, 📉 an astonishing $26.4B. The WSJ added that the tech outage cost Delta $500M.

#what’s next when it comes to Developer Tools and AI (2024 Developer Survey from Stack Overflow)

Check out the “interested in using” where 13.2% are using AI for reviewing code now but 40.9% are interested…many other areas also jump off the page

#As mentioned in last week’s What’s 🔥, just a matter of time (from The Verge) “Microsoft calls for Windows changes and resilience after CrowdStrike outage”

Microsoft appears to be starting the conversation about moving security vendors out of the Windows kernel.#Musings on building a Generative AI product from LinkedIn Eng Team - as you read the full post here, you can understand the tradeoffs between accuracy, speed, and cost and how LI thinks about it

#all startups who build and train their own models eventually end up with the only folks who can continue to pay massive CapX to keep iterating - now Character.AI ends up back at Google in another non-acquisition licensing deal which is an acquisition (The Information)

Google has agreed to pay a licensing fee to chatbot maker Character.AI for its models and will hire its cofounders and many of its researchers, the companies said.

Character’s leaders told staff on Friday that investors would be bought out at a valuation of about $88 per share. That’s about 2.5 times the value of shares in Character’s 2023 Series A, which valued the company at $1 billion, they said.Markets

#well this aged well 🤣 - here’s Rich Handler, CEO of Jefferies, saying the IPO window is open. Everything changed since his post from earlier in the week. However, he’s not wrong once we get through this mini-crisis, just need to get through the election, avoid a recession with some rate cuts, and eventually, I do believe that the public markets will be hungry again for more enterprise software cos who are in high/hyper growth mode (>30% and >40% NTM growth) as none exist in the market now other than OneStream which just went public (read more from What’s 🔥 #402

#Jamin’s always informative chart on the big cloud giants

Well said! It’s easy to overreact and demand results from what is still pretty new (AI) way ahead of schedule. To your point, the mini bubbles are good, it’ll polish the technology into critical parts of great solutions. These bubbles will also filter out the “Ai for X” vs “we use AI to solve X, Y, Z problems that enterprises are faced with every day” which exactly what we all need.