What’s 🔥 in Enterprise IT/VC #402

What are the implications when there are only 72 public enterprise software companies worth >$5B + there are still >1,500 🦄?

My preamble this week is short as I want all you to read this great deck from Avenir Growth Capital “What’s Wrong with SaaS?!”

At Avenir, we’re optimistic about the future of software- but keenly aware that the sector has struggled lately.

This 45-page deck is our answer to a question echoing through the venture ecosystem and beyond: “What’s Wrong with SaaS?!”

Read more from Jared Sleeper...Here’s the exec summary:

EXECUTIVE SUMMARY

I. Software remains a significant sector with hundreds of high-quality businesses. Within it, Saas has suffered in recent years primarily due to deteriorating fundamentals, NOT a change in the valuation paradigm. The dearth of software IPOs is due to mismatched expectations, NOT a "shuttered IPO market." Today's private high-growth software companies can and (in our view) probably should IPO.

II. The simplest explanation for deteriorating fundamentals is that we've passed the center of the Saas S-curve and incremental revenue will be harder to come by going forward at the sector level. So far, SaaS companies have responded to this by spending more, leading to deteriorating sales efficiency and underperformance. What management teams have referred to as "tough macro" is likely a "new normal."

III. Though growth will be harder to come by, it will still be meaningful. Al represents a promising new product development vector, and incumbents will generally be beneficiaries. Either way, SaaS companies have a long way to go before they are run in a financially sound way - multiples for the group could well be higher in a few years based on improving profitability and financial discipline.For all of the enterprise startups funded over the years, the fact remains, only 72 public software companies have valuations >$5B!!! In addition, the large majority were created pre-2010. To give you a sense of the mismatch between private and public markets, there are now >1,500 🦄 so that is a lot of inventory to work through.

The bigger point is that investors need to sharpen their pencils and portfolio models. Once upon a time 10+ years ago, having a portfolio company reach a $1B valuation was an incredible, outlier outcome. Then in the ZIRP era, the goalposts moved as VCs adjusted terminal values in their models thinking that the one $2-3B outlier was possible in each portfolio and then that became $5B as 🦄 after 🦄 was created. This led to investors paying up well ahead of revenue and earnings and then it all changed. It turns out that $5B valuations while nice on paper requires real companies with real revenue and profitability. The chart above shows that we are back to thinking that building a portfolio with a $5B exit is even an aberration so perhaps we all have to sharpen our pencils and fund and build towards $1-2B outcomes again, which is super hard!

The downstream effects are enormous. This impacts fund sizing or the number of ginormous outcomes funds need to deliver returns the LPs want. Or this could indicate more ownership needed in the 1-2 outliers a fund has. And many are also going earlier in the race to be first to get ownership and pole position to keep investing in winners over time which the data continues to show here 👇🏼

In addition, when it comes to AI, either the valuations we are all paying for those AI companies are warranted as the market significantly expands and these new AI-powered companies take significant market share or gravity takes hold again. Only time will tell, and I for one believe the answer is both, more nuanced, and one must enter the arena and battle, place calculated bets in amazing founders and go for it!

Here’s a few more slides/thoughts:

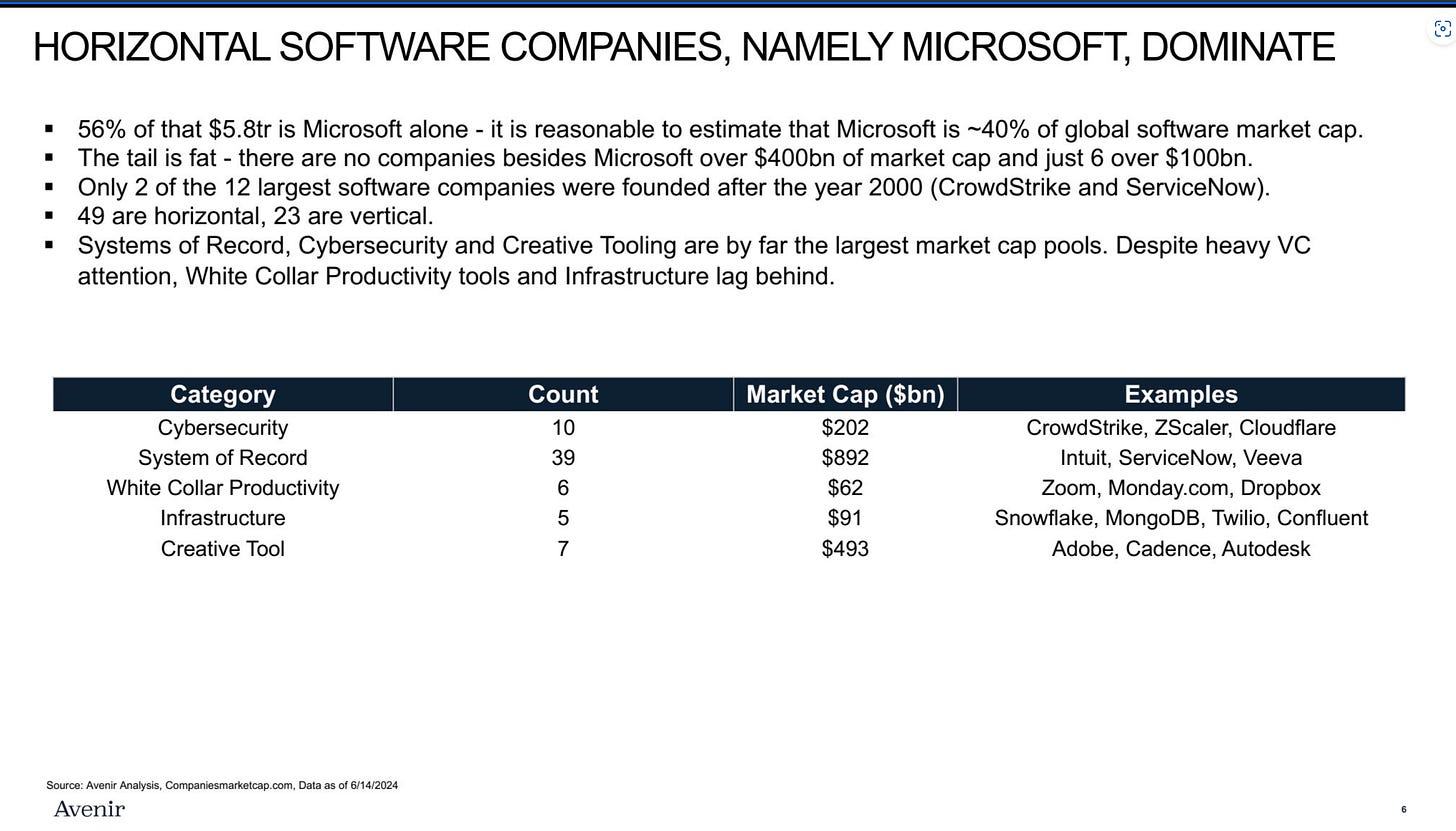

Amongst the 72 companies, it’s even more concentrated as 56% of total market cap is Microsoft and only 2 of the 12 largest software cos were founded after the year 2000 (CrowdStrike + ServiceNow).

Here’s the S-curve that Avenir talks about which shows the COVID bump in growth but normalization now. Looks like we are back to 15% and declining growth but yes, the pie is pretty damn large!

The question of course is if AI provides some tailwinds. There is some hope but according to the survey most think that the large majority of benefits will accrue to incumbents.

Once again, the answer is more nuanced than that and in some categories the answer is a resounding yes and in others, I would equally say a resounding no.

Finally, here’s where the money is going.

This all aligns with the most recent Morgan Stanley CIO Survey.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#what’s happening for many a 🦄 founder who has not hit scale yet

I had a chat last night with a billion-dollar SaaS founder/CEO. He's raised $200M at a $2B valuation in 2021.

Living the high life in SF with a crazy house and a Porsche 911. On the surface, it seems like he has it all and living the dream.

But he called me out of the blue at 11p last night to vent.

It’s been 9 years since he started the company although people think it's overnight success.

Last two years have been brutal.

He’s sprinting to profitability. Layoffs. Now navigating the AI landscape.

He goes: “I hope we can compete in an OpenAI world”

I could practically hear his uncertainty crackling through the phone.

Four years ago, he had a full head of blonde hair. Today, it’s mostly gray. He looks like Obama post-presidency.

Then he dropped the bombshell, “I’m running a zombie company. I don’t know if we’ll ever IPO. Hopefully, we sell, and I get a 1-3x return for investors. I feel stuck.”

This is the dirty secret of Silicon Valley...

Read rest here#from the founder/CEO of Vercel - so many nuances on the scaleups perspective from orgs getting too bloated, to over indexing on sales, but point is, speed and shipping product matters at all stages

Startups die by lack of product-market fit

Scaleups die by lack of product velocity#Speed once again…from Elon

xAI contracted for 24k H100s from Oracle and Grok 2 trained on those. Grok 2 is going through finetuning and bug fixes. Probably ready to release next month.

xAI is building the 100k H100 system itself for fastest time to completion. Aiming to begin training later this month. It will be the most powerful training cluster in the world by a large margin.

The reason we decided to do the 100k H100 and next major system internally was that our fundamental competitiveness depends on being faster than any other AI company. This is the only way to catch up.

Oracle is a great company and there is another company that shows promise also involved in that OpenAI GB200 cluster, but, when our fate depends on being the fastest by far, we must have our own hands on the steering wheel, rather than be a backseat driver.Enterprise Tech

#What is the future of software development in a world powered by AI?

👇🏼 read on for Guy Podjarny’s vision on AI Native Software Development. Super excited for boldstart to be partnered from Inception with Guy a 3rd time starting with Blaze (sold to Akamai), then Snyk (last round at $7.4B), and now Tessl!

#🤯 from Tae Kim, Senior Writer Barron’s

Anthropic’s CEO Dario Amodei says compute is more than 80% of their expenses on a podcast. Salaries of 600 employees are much smaller expenseTae follows that up with this tweet

Anthropic’s CEO Dario Amodei says AI models now cost $100 million to build. There are already $1 billion models in training. He thinks $10 billion to $100 billion models will happen by 2025, 2026, or 2027. [Tae: How many GPUs is that?]#AWS catching up fast - take a look at the just announced AWS App Studio - “App Studio is a generative artificial intelligence (AI)-powered service that uses natural language to create enterprise-grade applications in minutes, without requiring software development skills.”

#why we should all train our own LLMs? Worth a read…

#can transformer models keep delivering exponential results? Kevin Scott CTO of Microsoft says yes (watch here) - more complicated things will become possible as we scale up…

Microsoft CTO Kevin Scott says despite what some people think, scale will keep making AI models better in every way and the next generation will be proof of that#why 💰 keeps going to cybersecurity startups - 2 massive hacks just this week alone, one just disclosed - ATT again and a new ransomware attack on Rite Aid

ATT

Breaking: hackers stole call and text records for "nearly all" AT&T customers. Shows which phone numbers a customer called or texted. A staggering and unprecedented data breach. Data usually only available to authorities; now hackers got itRiteaid

"While having access to the Riteaid network we obtained over 10 GB of customer information equating to around 45 million lines of people's personal information. This information includes name, address, dl_id number, dob, riteaid rewards number. Suddenly at the end of negotiations once we both came to an agreement they stopped communications. From this it is obvious that the Riteaid leadership don't value the safety of it's customers sensitive details. "#hacking satellites? (Fast Company)

If space systems such as GPS were hacked and knocked offline, much of the world would instantly be returned to the communications and navigation technologies of the 1950s. Yet space cybersecurity is largely invisible to the public at a time of heightened geopolitical tensions.

Cyberattacks on satellites have occurred since the 1980s, but the global wake-up alarm went off only a couple of years ago. An hour before Russia’s invasion of Ukraine on February 24, 2022, its government operatives hacked Viasat’s satellite-internet services to cut off communications and create confusion in Ukraine.#agentic workflows in customer support, sure the initial deflection is great but when you get to multi-step workflows querying different databases and making intelligent decisions it’s so much more powerful 🤯 - this is what’s coming next

#AI startup Hebbia raised $130M at a $700M valuation on $13 million of profitable revenue 😲 - now that’s a multiple (TechCrunch)

Hebbia, a startup that uses generative AI to search large documents and respond to large questions, has raised a $130 million Series B at a roughly $700 million valuation led by Andreessen Horowitz, with participation from Index Ventures, Google Ventures and Peter Thiel.

In an interview with TechCrunch, Sivulka, who is the startup’s sole founder and CEO, declined to comment on Hebbia’s revenue or profitability. But he said that the startup’s revenue grew by 15x over the last 18 months

from Hebbia blog:

I’m incredibly proud of the Hebbia team. Over the last 18 months, we grew revenue 15X, quintupled headcount, drove over 2% of OpenAI’s daily volume, and laid the groundwork for customers to redefine how they work.#robots and robotic LLMs on 🔥 🤖 - Skild raises $300M round and emerges from stealth at $1.5B valuation

Skild AI launched out of stealth mode Tuesday by announcing a $300 million funding round led by Jeff Bezos’ fund and Japan’s Softbank Group that will help the Pittsburgh-based startup build what it calls a “general-purpose brain” for a variety of robots.

The company, founded in May 2023 by Carnegie Mellon University professors Deepak Pathak and Abhinav Gupta, says that it has trained its AI model on more data than its competitors, while building a system that could be retrofitted to existing hardware.

“The large-scale model we are building demonstrates unparalleled generalization and emergent capabilities across robots and tasks, providing significant potential for automation within real-world environments,” Mr. Pathak said in a statement. “We believe Skild AI represents a step change in how robotics will be scaled, and has the potential to change the entire physical economy.”#learning from Lori Beer, CIO of JPMorgan Chase, and her $17B, yes BILLION, budget (Ron Miller - TechCrunch)

Lori Beer, global CIO at JPMorgan Chase, oversees a massive IT operation that’s bigger than many companies. It involves a 63,000-person team worldwide and a $17 billion yearly budget (at last count), which was about 10% of JPMorgan’s overall revenue last year. It’s moving $10 trillion (that’s a 10 with 12 zeros after it) every single day and is the largest U.S. bank in terms of deposits and online customers.

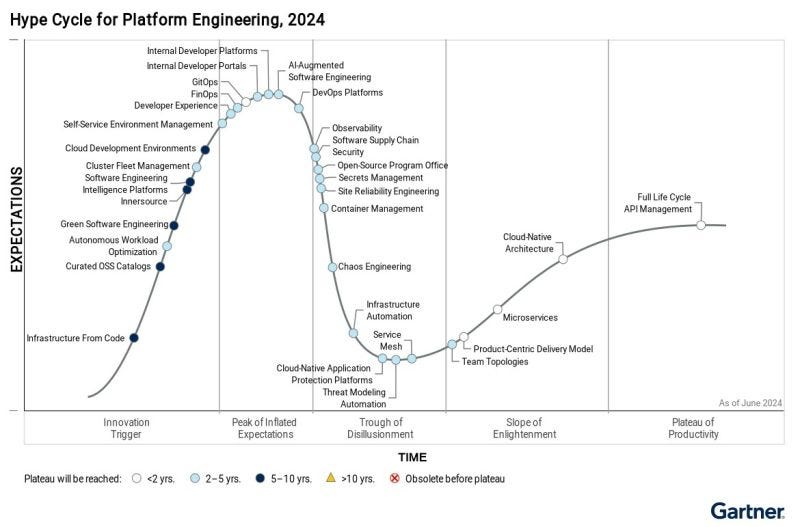

And she actually made sure JPMorgan was well set up for generative AI several years before it burst into the mainstream, making sure the company had its data house in order so it could work with large language models. “It was over three years ago that we laid out an AI data strategy and AI strategy,” she said. That involved forming an operating committee to align the data strategy and cloud strategy in part because the most advanced data management capabilities are in the cloud. “So we sort of got a bit ahead of that train,” she said.#for all dev tools founders, this new Gartner Hype Cycle for Platform Engineering from Manju Bhat covers it all from developer enablement, building apps secure by design, effective and efficient software delivery, navigating complexity of cloud-native architecturs, and supporting team structures

#must-read summaries of the “Here's a summary from AI Engineer (aiDotEngineer) World’s Fair 2024 — Keynotes & CodeGen Track” ++ (🧵 here)

• Alex Albert, Head of Developer Relations at Anthropic, drew parallels between the adoption of electricity in the industrial revolution and the current integration of Al into products. He cautioned against simply "tacking on" Al features and advocated for a ground-up redesign of products with Al at their core.

• Harrison Chase, CEO of LangChain, discussed the evolution of LLM-powered agents, highlighting the need for custom cognitive architectures and robust infrastructure. He announced the launch of LangGraph Cloud, a platform designed to provide production-ready agent APls with features like persistence, task queues, and breakpoint support.

• The Multimodality track showcased the expanding capabilities of Al beyond text, encompassing vision, audio, and real-time interaction. Speakers demonstrated innovative applications in areas like education, voice Al agents, and real-time world generation, emphasizing the importance of speed, architectural flexibility, and user-centric design in multimodal Al products.#AI cannibalization of seat count in enterprise software? Deutsche Bank in a recent research report shared this about NICE from its June 11 Analyst Day (full NICE presentation here)

NICE (NICE, Not Covered) provided a similar case study at their recent analyst day. In the chart below, the company spotlighted a 1,000 seat customer spending $53mn on its contact center ($50mn of which was in labor).

Despite a ~25% reduction in seat count (to ~750) after adopting AI/

automation solutions which enabled greater labor efficiency, the company

was able to grow its revenue with this customer by 50%, to $4.5mn.

This is while the customer was subsequently able to reduce its total annual CX costs by over 20% (to $42mn, given the reduction in labor costs).#Can’t wait for this movie! Trailer 👇🏼

Markets

#IPO Watchlist: The cybersecurity startups most likely to go public (Pitchbook) - great to see portfolio cos Snyk and BigID on the list with Wiz, Cato and others

#RPA or robotic process automation was going to eat the world of software and enterprises in 2018 and UiPath was the darling of the industry executing at scale, going public and growing to over $1B of revenue…but AI is coming for it, and it’s been a rough year for the company as stock is down 50% this year and it’s cutting another 10% of its workforce after CEO Rob Enslin resigned…(CNBC)