What’s 🔥 in Enterprise IT/VC #397

The death of hypergrowth + high growth publicly traded enterprise software cos = Opportunity?

Looking at this chart was still the big shocker for me this past week.

Following last week's turmoil in the SaaS sector, which saw numerous stocks take a hit, the fear persists with the revelation that no publicly traded enterprise software companies are expected to see growth exceeding 30% in the upcoming year. But amidst this carnage, I see opportunity.

All of those late-stage private 🦄 who saw growth slow down from >100% to 25-50% are now attractive once again as compared to the public markets! Why would anyone buy a new IPO at 30% growth burning cash if they could buy much larger scale public companies growing faster and generating real cash flow. Well guess what? Those companies no longer exist. We no longer have publicly traded enterprise software companies growing >40% as of 6 months ago and no more >30%. I expect we will see more IPOs in the next 6+ months after the election and perhaps with another rate cut. Those 🦄 who course corrected quickly to aim for 30%+ growth and are at or near cash flow breakeven now look super attractive again to Wall Street 🤞🏼. The opportunity to earn premium multiples are here again.

A great example is Netskope which just released some of its numbers which are super compelling!

Netskope Surpasses $500 Million in ARR, Continues to Take Share as More Enterprises Seek Market-Leading Security and Network Performance from Netskope's Unified SASE Platform

Among many notable achievements helping fuel its growth, Netskope's company accolades and financial milestones to this point include the following:

*Grew customer base to over 3,400 customers worldwide, including 4 of the 5 largest Fortune 500 financial services companies, 4 of the 6 largest Fortune 500 healthcare companies, 4 of the 5 largest Fortune 500 telecommunications companies, and 2 of the 4 largest Fortune 500 retail companies that have adopted Netskope One capabilities

*Surpassed $500 million in annual recurring revenue (ARR) at scale, with growth outpacing the SASE market

*Delivered critical AI capabilities in data and threat protection, safe enablement of generative AI applications, and numerous other areas, with more than 30% of Netskope customers having already fully implemented tools from SkopeAI, the suite of AI and machine learning solutions applied throughout the Netskope One platformSwitching gears, I wanted to share this cover story profile that Iain Martin wrote about me and my 28 year journey as an inception partner for enterprise software founders. Unfortunately, it’s behind a paywall but let me share an excerpt or two as I can tell you there were lots of ups and downs in this journey. Click the pic below for the thread and links to the article.

The hangover from the 2008 financial crisis meant that Boldstart would begin with just a $1 million fund—but it now manages over $800 million of assets. Sim credits seeing his own parents’ determination, and spending a college summer selling Cutco knives door to door, for the drive that helped him grind through the lean years. “It took six or seven years of what I called ‘the annual no-call’ to get our first institutional investor,” he said, referring to his yearly attempts to call LPs, even when he thought he’d get turned down.

Founders typically see Sim’s own work ethic firsthand when they take a Boldstart check. “The guy hustles. He’s like the number one business development person for my company,” Swanson said. “He’s always bringing value.”

Much of Sim’s support is focused on the founder. “I probably talk to Ed everyday,” said Dimitri Sirota, founder of security and privacy platform BigId, where Sim sits on the board. “He’s got an emotional connection to the founders and I’ve always considered that he was there in our corner.”Also, Ian Swanson, co-founder and CEO of Protect AI shares how we partnered together starting in late 2021. This is true Inception Investing and glad to see Forbes recognize it as a thing? (LinkedIn post here)

Congrats to my friend and Protect AI investor / board member Ed Sim for being on this year's Forbes Midas Seed List for the third time in a row! Ed and boldstart ventures team truly are leaders in "inception investing". Let me share a story... First, what is inception investing?

“Inception Investing means engaging with founders well before they incorporate, helping them battle test and iterate those ideas, helping them pre-sell some of the initial hires, and leading those rounds upon company formation so founders can run fast out of gates and not spend months trying to raise capital.” – Ed Sim

I've known Ed and his partner Eliot Durbin for 10+ years... and relationships in this industry matter!!! I bumped into Ed and Ellen Chisa at David Hornik's Lobby Capital conference where leaders of enterprise technology network and discuss the latest trends.I’m so 🙏🏼 to have the opportunity to partner with amazing founders looking to create new industries and also to share my ramblings with you every week. As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#the state of venture capital fund performance from Mercedes Bent, Lightspeed

#from author Ryan Holiday

“Be satisfied with even the smallest progress," Marcus Aurelius said.

You’re never going to be perfect—there is no such thing. You’re human. So instead, aim for progress, even the smallest amount.#and author Robert Greene - be bold!

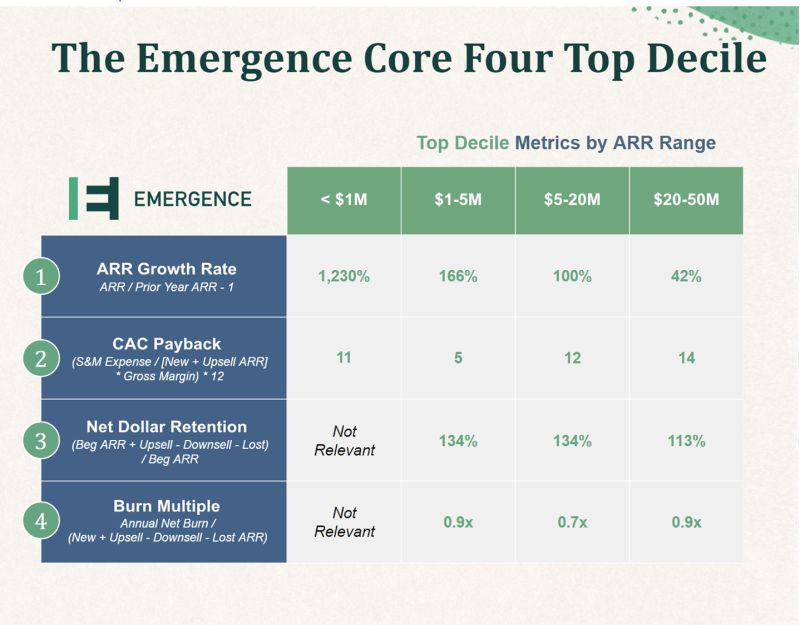

Your timidity infects people with awkward energy, elicits embarrassment. Doubt springs up on all sides. Boldness destroys such gaps.#Must read Beyond Benchmarks report from Emergence Capital covering performance benchmarks and what’s latest in AI…

Huge difference between Top Quartile and Top Decile!

#This post has gone viral with 2.5M views already - “The End of Software” from Chris Paik, makes lots of comparisons to media industry and how user generated content drove cost to zero - totally disagree with this narrative but worth a read…Enterprises will pay for software that is secure, reliable, maintained, trustworthy etc and AI will help unleash lots more software to do more things but won’t drive the cost to zero like media

Enterprise Tech

#❤️, must watch Ted talk, “12 Predictions for the future of technology” from investing legend Vinod Khosla - billions of agents running around on the Internet doing things for humans, from the practice to the science of medicine…some big thoughts!

... things that might slow down predictions

*Incumbent resistance

*Politicians capitalizing on fear for personal / populist gain

*Tech failures or delays

*Financial market conditions may kill a good idea

*Anti-tech sentiment

*Luddites hijacking the would-be advocate

*A few bad Al-related outcomes that get sensationalized

*Left field events

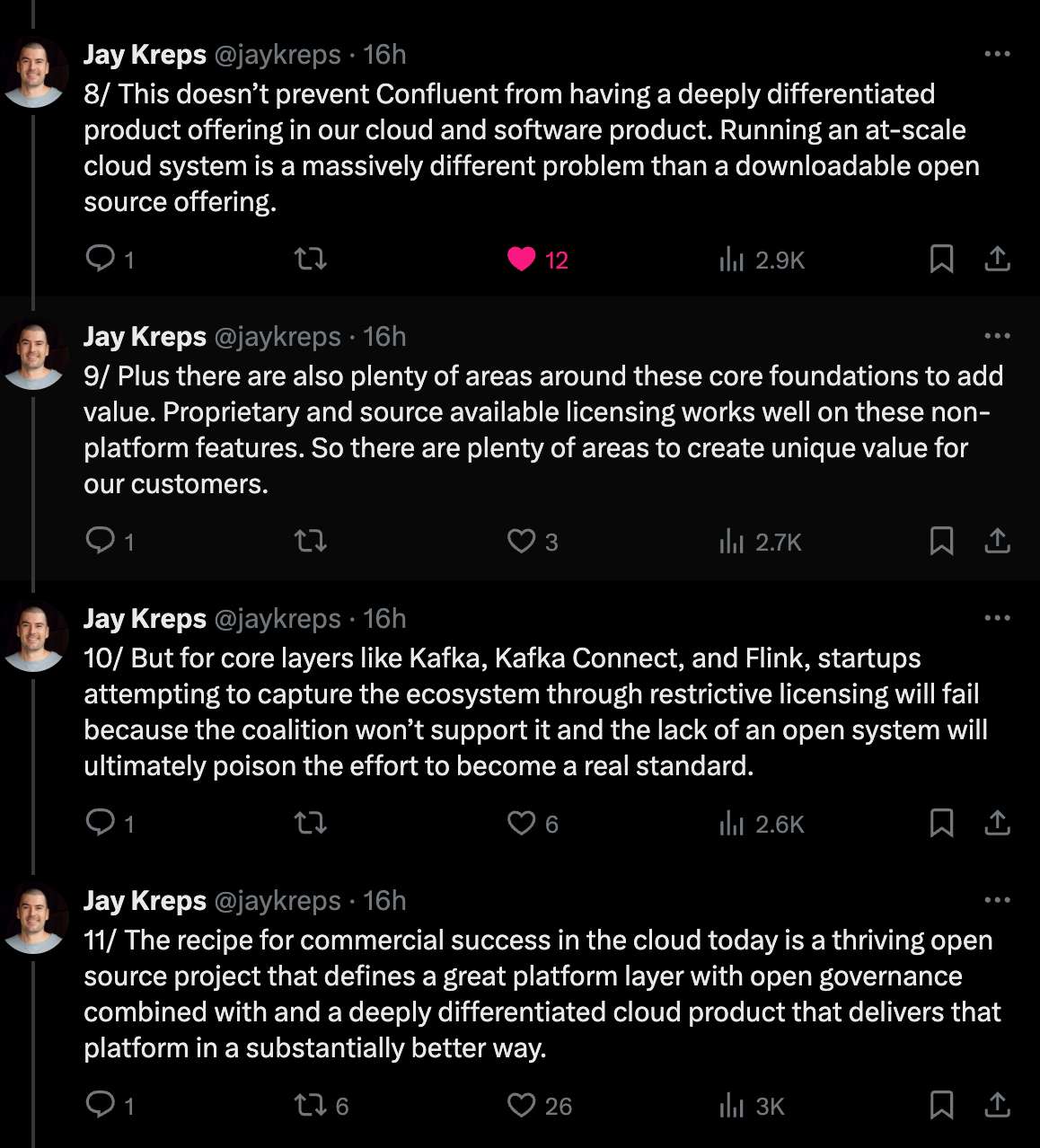

*Instigators/entrepreneurs may not show up to make it happen#the latest open source drama in streaming data infrastructure land - I encourage you to check out Jay Kreps from Confluent’s full 🧵 and so agree with below…

#cool to see ecosystem in Paris built on top of Mistral LLM but can’t say many of these are companies…

Mistral is France’s answer to OpenAI. And it’s all open source.

They just threw Paris’s largest ever AI hackathon. 1,000+ hackers applied to build what’s possible with open source LLMs.

Here are the finalists from the @MistralAIx @cerebral_valley hackathon in Paris (🧵):#always love old posts revisited - here VC vet Rory O’Driscoll with Scale Ventures shares some timeless lessons

#one of key points from last week’s What’s 🔥 #396 was that the SaaS red wedding could also be a net positive for startups:

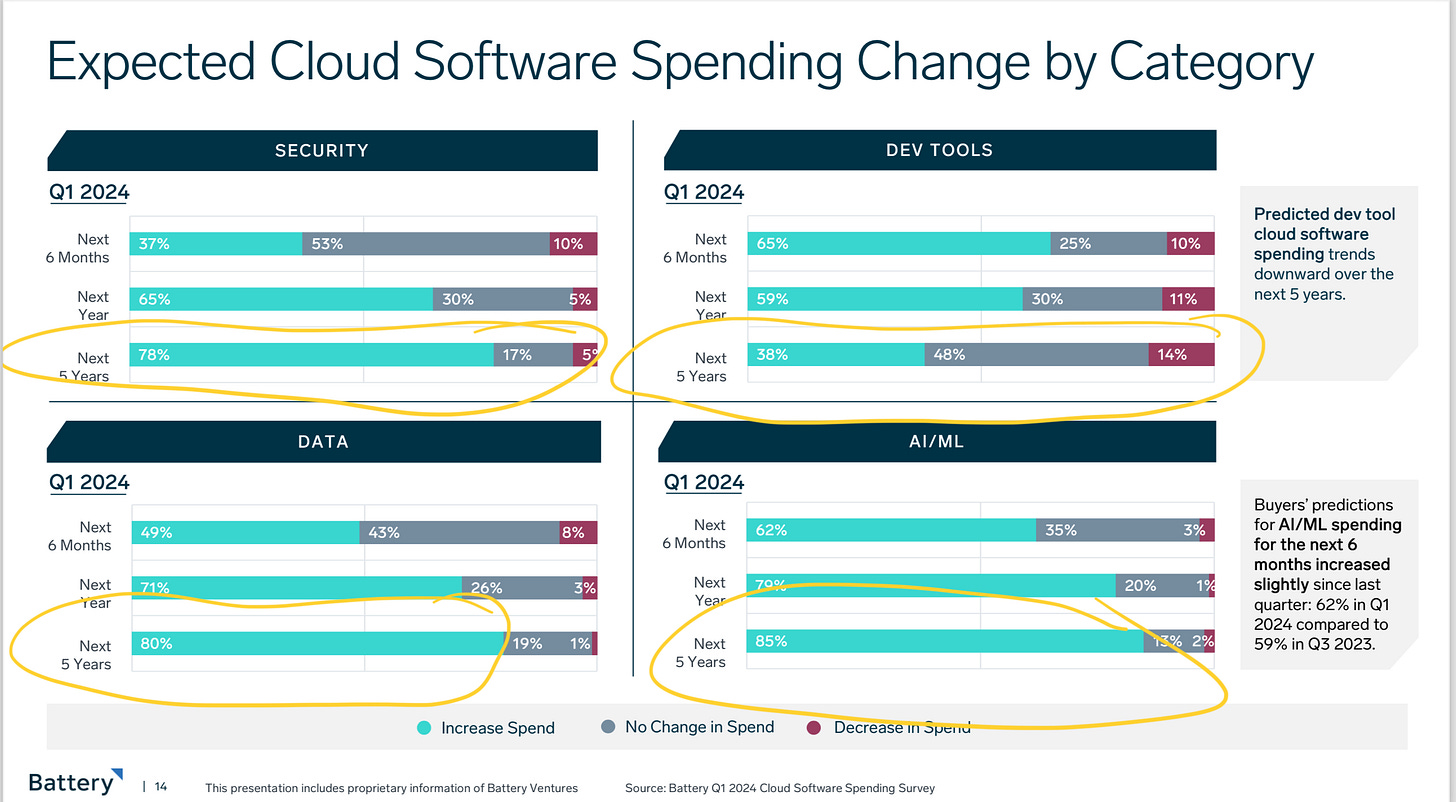

It’s not the macro causing delays in enterprise sales, it’s the “what the hell is GenAI going to do for us so let’s not rush into any more long-term contracts” that’s the real reason. Hesitation is good for startups, and trust me, many of these IT departments are reviewing tons of next-gen products before buying or renewing expensive large software co products.#I finally had a chance to dive deeper into the Battery Q1 CIO spending survey and found a few interesting nuggets:

On average, 45% of organizations are looking toward new vendors to bring a wave of disruption within enterprises looking for vendors built for the age of Al.AI is a wedge and opportunity for startups to disrupt incumbents and anecdotally from my portfolio along with surveys, we see AI can be an insertion point and wedge into large enterprises.

Here is one other slide that caught my eye - look at 5 year ahead forecasts on spend and DevTools in particular 📉

Matt Harney from SaaSletter breaks down the Battery report with key slides on X 🧵 here

#the bear case on AI from Chris Mims WSJ - as you know, it’s both for me, in the long run it’s absolutely transformational, and in short run we have a massive bubble that will pop

These factors raise questions about whether AI could become commoditized, about its potential to produce revenue and especially profits, and whether a new economy is actually being born. They also suggest that spending on AI is probably getting ahead of itself in a way last saw during the fiber-optic boom of the late 1990s—a boom that led to some of the biggest crashes of the first dot-com bubble.#AI in the enterprise as Alex Karp from Palantir sees it

He said Palantir’s large language model “is much more like a chemistry experiment.”

“The outgrowth of which is something that is useful when refined. And the refinement of that for your enterprise happens in what we call our ontology, which is where we impose the logic of your business on the large language model in the security and intellectual logic of your business,” he said

Karp criticized the hype around large language models, likening their enterprise use to “self-flagellation” due to high costs and low output. He highlighted Palantir's approach to managing these models to transform enterprises, cut costs, and improve efficiency.

Despite initial skepticism, he noted that various sectors, including construction, healthcare, and the military, are now successfully using these models to enhance operations and convert non-technical staff into technical experts.

“What does it mean for Palantir? It means we are sitting on the only thing that actually creates a quantifiable transformational value in an enterprise. Yes, it is not understood well, because everybody understands the problem incorrectly,” he stated.Markets

#Cybersecurity keeps delivering as Crowdsrike crushes earnings - here’s CEO George Kurz’ LI post:

Wow… another great quarter in the books. The Falcon platform continues consolidating point products and delivering on our mission of stopping breaches. CrowdStrike’s record Q1 FY25 results exceeded expectations: record Q1 net new ARR of $212 million +22% YoY, Q1 ending ARR of $3.65 billion +33% YoY, and $322 million of free cash flow with a FCF rule of 68.

We saw success with organizations of all sizes consolidating on our single platform. We have the winning solutions: Falcon Cloud Security to protect the multi-cloud AI revolution, Identity Protection to stop human-based compromise, and LogScale Next-Gen SIEM to disrupt the legacy SIEM market.

Thank you to our customers, CrowdStrikers and partners for their dedication to our mission. Our AI-native platform wins at scale - every geography, every market segment, and every solution area. CrowdStrike is AI-native cybersecurity. We stop breaches. Full results: https://lnkd.in/gp8U2NUM

#A great primer on what makes Crowdstrike so special from Ivanka Delveska, CIO of Spear

#Snowflake got the end around as Databricks buys Tabular Data for $1-2B (CNBC)

Databricks is buying Tabular, a small startup that helps companies optimize data they store in the cloud with the Apache Iceberg format.

The news comes in the middle of Snowflake’s summit, where the publicly held company made its own Iceberg-related announcement.

Snowflake and Confluent were also bidding on Tabular.#Those security breaches aren’t helping Snowflake either (TechCrunch)

Snowflake’s security problems following a recent spate of customer data thefts are, for want of a better word, snowballing.

After Ticketmaster was the first company to link its recent data breach to the cloud data company Snowflake, loan comparison site LendingTree has now confirmed its QuoteWizard subsidiary had data stolen from Snowflake.

“We can confirm that we use Snowflake for our business operations, and that we were notified by them that our subsidiary, QuoteWizard, may have had data impacted by this incident,” Megan Greuling, a spokesperson for LendingTree, told TechCrunch.#😲 Carta’s valuation to be cut by $6.5 billion in upcoming secondary sale (TechCrunch)