What’s 🔥 in Enterprise IT/VC #396

Enterprise software & AI - the future is already here, it's just not evenly distributed

“The future is already here. It’s just not evenly distributed yet”

Wiliam Gibson

It has been one of the most brutal weeks for enterprise software stocks, with several iconic companies forecasting slower growth ahead, despite emphasizing the potential of AI. Earnings calls frequently mentioned macroeconomic headwinds and contract delays, but the crucial issue remains: Is the deceleration in software growth due to macroeconomic factors, or is it a consequence of AI advancements? Let's explore this further.

First, Salesforce had its first revenue miss in 73 quarters dating back to February of 2006! Before moving on, let’s just absorb this for a bit.

To give you more historical context (Bloomberg)

Salesforce Inc. shares dropped the most in almost two decades after projecting the slowest quarterly sales growth in its history, renewing concerns that the company will be left behind in the artificial intelligence boom.

Revenue will rise as much as 8% to $9.25 billion in the period ending in July, the San Francisco-based company said Wednesday in a statement. That would be the first quarter of single-digit sales growth for Salesforce in its almost two decades as a publicly traded company. The stock fell 20% to $218.01 at the close Thursday in New York, the biggest single-day decline since July 2004.

Notice the comment on “renewing concerns that the company will be left behind in the artificial intelligence boom.”

Let’s also look at the billings growth - look at that forecast - 3%, the lowest it has ever been.

Reading through the earnings transcript (from WSJ) we also see this:

What happened? During the company’s earnings call Wednesday—between 35 utterances of the word “incredible” by Chief Executive Marc Benioff—other Salesforce executives described an environment in which major deals are taking longer to close, if they close at all.

“We saw compression on many deals that we ultimately ended up getting done,” said President Brian Millham, “but they got smaller when we ultimately closed them.”

Smaller deals aren’t great news for a software company now generating nearly $36 billion in annual revenue. Especially when much-larger Microsoft is now expanding its business at a faster rate, thanks in part to burgeoning demand for its generative artificial-intelligence services. The future is not evenly distributed as foundational infrastructure cos like Nvidia for chips, Dell for servers, and Microsoft for cloud continue to accelerate growth while SaaS application cos like Salesforce and Workday are actually slowing down despite promises of GenAI in the future. And Wall Street is impatient.

But some on Wall Street are starting to make the connection. In a note to clients Thursday, Brian Schwartz of Oppenheimer said that “the slowdown in enterprise software spending likely reflects AI crowding out investments and slower hiring.”

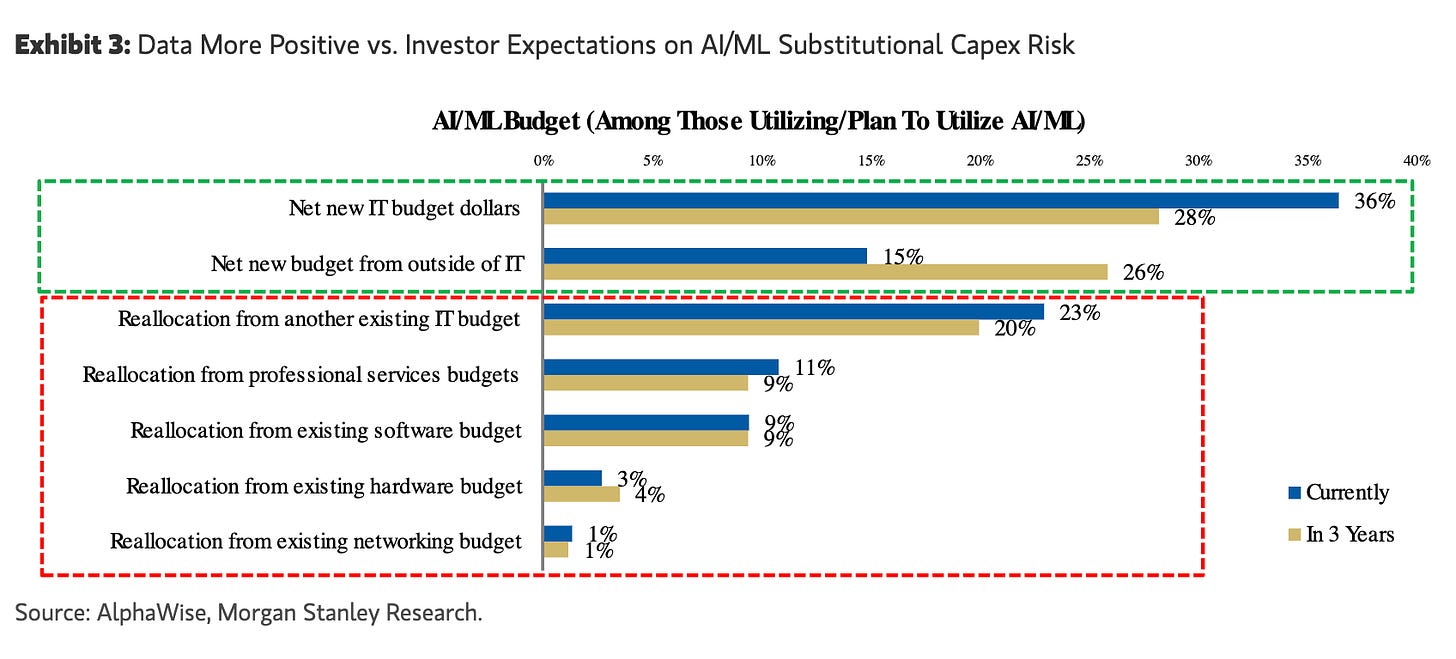

Brad Zelnick of Deutsche Bank went further. “While bulls might be willing to look through the disappointment given ‘it’s just a Q1,’ we believe these results raise more meaningful questions around the adoption curve and ultimate monetization of genAI for seat-based SaaS companies,” he wrote Thursday. The BVP Nasdaq Emerging Cloud Index fell 3.4% Thursday, as Salesforce is seen as a bellwether for the group.To further this point, here’s some data from the latest Morgan Stanley Alphawise Survey:

Dollars for AI coming from a combination of new and existing budgets, largely accruing to MSFT in early days, but some indications of broadening out.

One of the most common questions we have been getting is where incremental budget dollars come from for AI and whether traditional budgets are at risk. Similar to our latest CIO survey, ~50% of AI spend is expected to come from outside of traditional IT budgets, today and in the next three years, a positive for expansion of overall IT budgets as labor savings opportunities from AI are explored. The remaining ~50% is coming from a combination of existing budgets, a headwind we are perhaps seeing today in our CIO survey where spend indications have not yet reaccelerated. Microsoft, unsurprisingly, continues to be the biggest beneficiary of AI spend today, but that is expected to broaden out slightly. As shown in Exhibit 21, data security, services and talent are the priorities in AI spending right now, something that makes sense given the largely incremental initiative that is being taken by enterprises. We believe this should benefit VRNS and PANW.50% of these dollars for new AI spend will come from outside of IT focusing on jobs to be done while the other 50% seems to be a reallocation which can be a headwind for some SaaS application companies.

Another enterprise software company that got crushed this past week is UiPath which dropped 30% in one day 🤯.

Keith Weiss, Morgan Stanley analyst, shared his thoughts in his most recent research report:

The bull case, UiPath took the opportunity to de-risk the forward outlook, which conservatively reflects the macro volatility during the end of the quarter continues, execution issues prove more tactical and changing sales incentives improves large multi-year deal momentum quickly, new product cycles are not meaningfully factored into the guidance and could bring more new and existing customers back to the table in the 2H driving upside to estimates on a go forward basis.

The bear case, UiPath has seen customer count decline for three consecutive quarters, net revenue retention rate shows no rate of change improvements despite declining for nine quarters, management is beginning to point to GenAI driving customer hesitation which emboldens the bearish view that core process automation will be cannibalized by GenAI technologies over the coming years, and the valuation floor on P/E and EV/FCF basis is coming into question on the significant margin cuts and signal to re-invest. While we are encouraged by UiPath's transparency on the challenges in the business and its swift actions to respond to those challenges, we believe that it will take time for results to show and to inspire investor confidence again.I’m not picking on UiPath at all as any founder that can build a startup like this, create a whole new market, and scale beyond $1B ARR is absolutely incredible. However, I’m also sharing this because not all incumbents with data moats will win and frankly UiPath has an innovator’s dilemma as I frankly believe many of these larger automation deals can be delivered for much cheaper with GenAI and agentic workflows. There is zero incentive for UiPath to cannibalize itself at the moment until it has to. There will be lots of opportunities for startups who can move fast, price appropriately, and deliver value. It will be interesting to watch how UiPath evolves, and while I hope they come out on top, it does beg the question, what other public 🦍 are potentially up for disruption?

The future is already here, it’s just not evenly distributed. Just look at C3AI…

Here’s the silver lining - it’s still early to tell who is going to win. The public market reaction to Salesforce and UiPath and others is extreme, and in the long run, data moats will matter. That being said, this is exactly the moment in history that every startup should be 🔥 up for - the opportunity to completely disrupt incumbents with better, faster, and cheaper offerings. Here’s one final comment from the Veeva earnings call:

Believe they are seeing their customers' IT departments put off big sw investments as they figure out GenAI - what is it capable of? where might it be applied within what we do? how do we go about it? etc. Just interesting because sw companies have broadly been missing / lowering, they all are citing "macro" but "macro" is totally fine (so replace "macro" with "software demand"), and this is the first company to point out that AI is just getting all the attention for now (so the CRM or ERP upgrade can wait).It’s not the macro causing delays in enterprise sales, it’s the “what the hell is GenAI going to do for us so let’s not rush into any more long-term contracts” that’s the real reason. Hesitation is good for startups, and trust me, many of these IT departments are reviewing tons of next-gen products before buying or renewing expensive large software co products.

This is why companies like Poolside with limited proofpoints are in discussions to raise at a $2B pre-money valuation along with rumors of Perplexity raising at a $3B valuation on $20M of ARR and fast growth. Yes, these valuations are insane, and the amount of 💰 chasing the next big thing is absolutely astounding. There will clearly be some massive winners who create more value than all of the losers, but the road is going to be littered with thousands of startups that get killed. Put your helmet 🪖 on, this is the opportunity we’ve all been waiting for!

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#Steve Jobs on great ideas and products (Keshav)

One of the things that really hurt Apple was after I left, John Sculley (former Apple CEO) got a serious disease. It's a disease I've seen other people get too. It's the disease of thinking that a great idea is 90% of the work, and if you just tell all these other people, 'Here's this great idea,' then, of course, they can go off and make it happen. The problem with that is there's a tremendous amount of craftsmanship between a great idea and a great product.

As you evolve that great idea, it changes and grows. It never comes out like it starts because you learn a lot more as you get into the subtleties. You also find there are tremendous trade-offs that you have to make. There are certain things you can't make electrons, plastic, glass, factories, or robots do. As you get into all these things, designing a product is keeping 5,000 things in your brain, these concepts, and fitting them all together, continuing to push to fit them together in new and different ways to get what you want.

Every day, you discover something new that is a new problem or a new opportunity to fit these things together a little differently, and it's that process that is the magic.#👇🏼 Meghan Reynolds from Altimeter captures what’s happening from LP side (those who invest in venture funds) and much of what I’ve written about in prior issues…yet, we still see $200M inception rounds and coding copilot cos raise at $1-2B valuations with no revenue

Heard from VC LPs this week:

Skepticism in:

- LLM investments: valuation, exit path, and ultimate revenue model

- Valuation of AI & software deals, in general

Enthusiasm for:

- Long term AI opp set

- public tech

- VC funds w/ DPI & observable discipline#Well said by Dan Shipper (full article here)

I've been writing for a while about our shift from a knowledge economy —where you're compensated based on what you know —to an allocation economy, where you're compensated based on your ability to allocate the resources of intelligence.

In an allocation economy, we become "model managers" learning to scope and delegate tasks for models to do rather than doing them ourselves, in many cases. My thesis is that the same skills that human managers have to learn - how to delegate, when to get into the details, how to develop taste-become increasingly important and widespread in this new world.

🧵 here...Enterprise Tech

#State of Enterprise Tech Spending from Battery Ventures for Q1 is out - some bullish signs despite what we saw reported from Salesforce and UiPath this week

* After a long period of market uncertainty, we are seeing enthusiastic signals from buyers, 55% of whom plan to increase their budgets. And compared to Q3 2023, twice as many buyers plan to increase budget by 10% or more – a jump from 4 to 8%.

* There was a notable shift in spending priorities among buyers, many of whom are now intently focused on AI and data-related technologies. Survey respondents plan to deploy an estimated $1.5B on these technologies over the next five years and the vast majority of buyers – 84% – plan to increase spending on AI/ML tools.

* Beyond spending on technology, we’re seeing a more positive outlook on hiring, a potential indicator of enterprise willingness to allocate budget for projects, development and tooling. The number of organizations looking to slow down or enter a hiring freeze has dropped to 34% from 46% this time last year.

* Nearly half of enterprise buyers (45%) are interested in exploring what new vendors have to offer when it comes to AI copilot capabilities. Employee productivity and customer service are the use cases that buyers cited as most compelling for AI copilot adoption.#👇🏼 Clem of Hugging Face shares the state of AI infra startups…

Line is getting longer esp. for AI infra.

Some huge outcomes will be created no doubt with the gains far exceeding the losses but there will be lots of roadkill along the way. So choose wisely…

#What’s after coding copilots? 💯 that coding only scratches the surface for what’s next in the development lifecycle - coding co-pilots will be a massive market but a bloodbath competition wise - many smart founders I know are thinking about what come’s after (ZDNet)

"Developers on average spend anywhere between 10% and 25% of their time writing code," Gartner's Bhat and his co-authors wrote. "The rest of the time goes into reading specifications, writing documentation, doing code reviews, attending meetings, helping co-workers, debugging preexisting code, collaborating with other teams, provisioning environments, troubleshooting production incidents, and learning technical and business concepts -- to name just a few."

Integrating AI with "all phases of the DevOps feedback loop -- plan, code review and development, build, test, deploy, monitor, measure -- increases collaboration in teams and positively improves results," SAS's Dickerson pointed out. With planning, "AI can make the project management process more efficient by autogenerating requirements from user requests, detecting non-aligned timelines, and even identifying incomplete requirements."

Dickerson said AI can also handle the heavy-lifting processes in code review and development: "Not only can AI offer developers suggestions for autogenerating boilerplate code, it can also contribute to the code review process. This approach amplifies collaboration between teams and can lead to more innovation, faster time-to-market, and better alignment with business objectives."#Corinne Riley from Greylock has a great overview called Code Smarter, Not Harder sharing some of the sentiment above…

The elephant in the room is the challenge of going after GitHub Copilot, which already has considerable distribution and mindshare (congratulations to Devin who just secured their own partnership with Microsoft). Startups are working around this by looking for pockets of differentiation in which to ground their wedge. For example, Codeium is taking an enterprise-first approach, while Codium is starting with code testing and reviewing and expanding from there.

We also believe there is a strong opportunity for tools going after tasks like code refactoring, code review, and software architecting. These can be more complex as they not only require a larger surface area of understanding within the code, but also an understanding of a graph of knowledge between different files, knowledge of external libraries, understanding of the business context, the end-usage patterns of the software, and the complex selection of tools.

#If interested in diving deeper, I also wrote about much of the above in What’s 🔥 #379 in February: “thinking about second order effects for startups in a world where 50% or more code is written by AI?”

#Reflections on the past 4 years in AI with Alexandr Wang, founder of $14B Scale AI - compute, data, what’s next

1/ Today is the 4th anniversary of the original GPT-3 paper—"Language Models are Few-Shot Learners"

Some reflections on how the last 4 years have played out, and thoughts about the next 4 years

🧵 here#this is a huge win for OpenAI - besides the enterprise roll out, OpenAI getting access to PWC’s enterprise customers is huge along with being built into any custom applications. This truly allows OpenAI to continue to fend off Microsoft in the enterprise where the channel conflict is real.

PricewaterhouseCoopers will become the largest customer and first reseller of OpenAI’s enterprise product, as part of a new deal the two companies announced Wednesday.

PwC said it would roll out ChatGPT Enterprise, the version of ChatGPT aimed at large companies, to its 75,000 U.S. employees and 26,000 U.K. employees, totaling over 100,000 licenses for the artificial intelligence product.

Both companies declined to share financial terms of the deal.

The accounting and consulting giant last year announced plans to invest $1 billion in generative AI, the technology behind ChatGPT, in its U.S. operations over three years. Wednesday’s deal is an evolution of that, said Joe Atkinson, PwC U.S.’s vice chair and chief products and technology officer. A PwC spokesperson said the OpenAI agreement is part of the initial $1 billion investment.#OpenTofu, the open source alternative to Terraform continues to build momentum as Oracle switched to OpenTofu and now Grafana - one of founding members of OpenTofu is Env0, a port co, so I’ve had a front row seat 🍿

#for builders, this is a great read from O’Reilly “What We Learned from a Year of Building with LLMs (Part I)”

# The Information has the scoop again - Perplexity the AI search engine in talks to raise at $3 Billion valuation

Bessemer Venture Partners is in talks to lead a $250 million investment in Perplexity, a developer of an artificial intelligence-powered search engine, at a $3 billion valuation, according to a person familiar with the matter. The new valuation would be triple what the San Francisco-based startup was valued at earlier this year.

Perplexity’s search product offers concise answers that, unlike OpenAI’s ChatGPT, come with linked source citations. Investors have been entranced by Perplexity’s rapid pace of growth. The company is generating over $20 million in annual recurring revenue from subscriptions to the product, up from $3 million in October, The Information reported. Still, it faces an uphill battle. It competes with Google and OpenAI, which is developing a search product powered by Microsoft’s Bing that, like Perplexity’s search app, will be able to search the web and cite its sources.#about your remote workers - this is insane 🤯 (Unusual Whales)

Thousands of North Koreans stole Americans’ identities and took remote-work tech jobs at Fortune 500 companies, DOJ has said.Markets

#Simply stunning from Dan Primack at Axios - “Vista Equity writes off PluralSight value, after $3.5 billion buyout” after 3 years, can’t service the debt - no one is immune

#from CJ Gustafson of Mostly Metrics…

Stock based comp is the silent valuation killer.

I sampled 25 random companies for their stock based comp dilution in FY23:

🧵 here...

A company diluting its share count by 4% annually vs. diluting by 2% could see a 20% lower valuation on a per-share basis over a 20-year period.#Grafana Labs, enterprise infra 🦄 and monitoring software co, raising at a flat valuation of $6B from 2 years ago - IMO this is a huge win (Forbes - Kenrick Cai)

Grafana Labs, a cloud computing startup which makes software for monitoring and visualizing databases, is raising a new funding round at a flat valuation of $6 billion, multiple sources told Forbes.

The fundraise is being led by existing backers Lightspeed Venture Partners and GIC, the Singaporean sovereign wealth fund, according to three sources. It comes as a combination of primary and secondary funding, per two of the people. The round has not been finalized and terms may still change, sources said, but two investors familiar with the fundraising said the company had discussed raising around $300 million to $400 million.

The company, which ranked no. 18 on Forbes’ Cloud 100 last August, said at the time that it had crossed $150 million in annualized revenue earlier in 2023. That figure has since grown to around $250 million, five of the sources said. A company source said Grafana Labs is hoping to slightly improve its $6 billion valuation, which it achieved with a $240 million funding round in April 2022 — a price tag never disclosed by the company, but reflected by startup tracker PitchBook and confirmed by sources.