What’s 🔥 in Enterprise IT/VC #392

Raising a Series A is the hardest it's been in over 4 years but the Series B crunch is also coming - what to do when you're stuck...

Today’s issue is sent from 30k feet as I’m on my way to the west coast for RSA or rather RS-AI next week. Stay tuned as I’ll share some of the sights, sounds, and scuttlebutt from where the world of security gathers for a few days of hand-to-hand combat 🪖.

Switching gears, I know many were holding their breath this past week to see if the Big 3 Cloud Providers would deliver, and deliver they did. Growth from the Big 3 is reaccelerating, optimization is finally over, and net new workloads are coming online with much of it powered by new AI pilots and AI pixie dust - it’s still early but promising!

Cloud Giants Update:

AWS (Amazon): $100B run rate growing 17% YoY (last Q grew 13%)

Azure (Microsoft): ~$76B run rate (estimate) growing 31% YoY (last Q grew 28%)

Google Cloud (includes GSuite): $38B run rate growing 28% YoY (last Q grew 26%, neither are cc)

Jamin BallThe question is if this reacceleration is flowing down to the rest of the industry? Well beneath the headlines of cloud growth and AI startup funding at insane valuations, the reality is that for most founders it’s still really F%*$ing hard out there. In fact, it’s brutal. Data from Peter Walker at Carta corroborates some of this.

In fact, in Q1 it was the hardest it has ever been for companies to raise an A round.

As I mentioned last month, it’s easier to raise with an idea at Inception versus having some traction but not 🔥 📈.

Looking deeper at the data, I see an even bigger problem though.

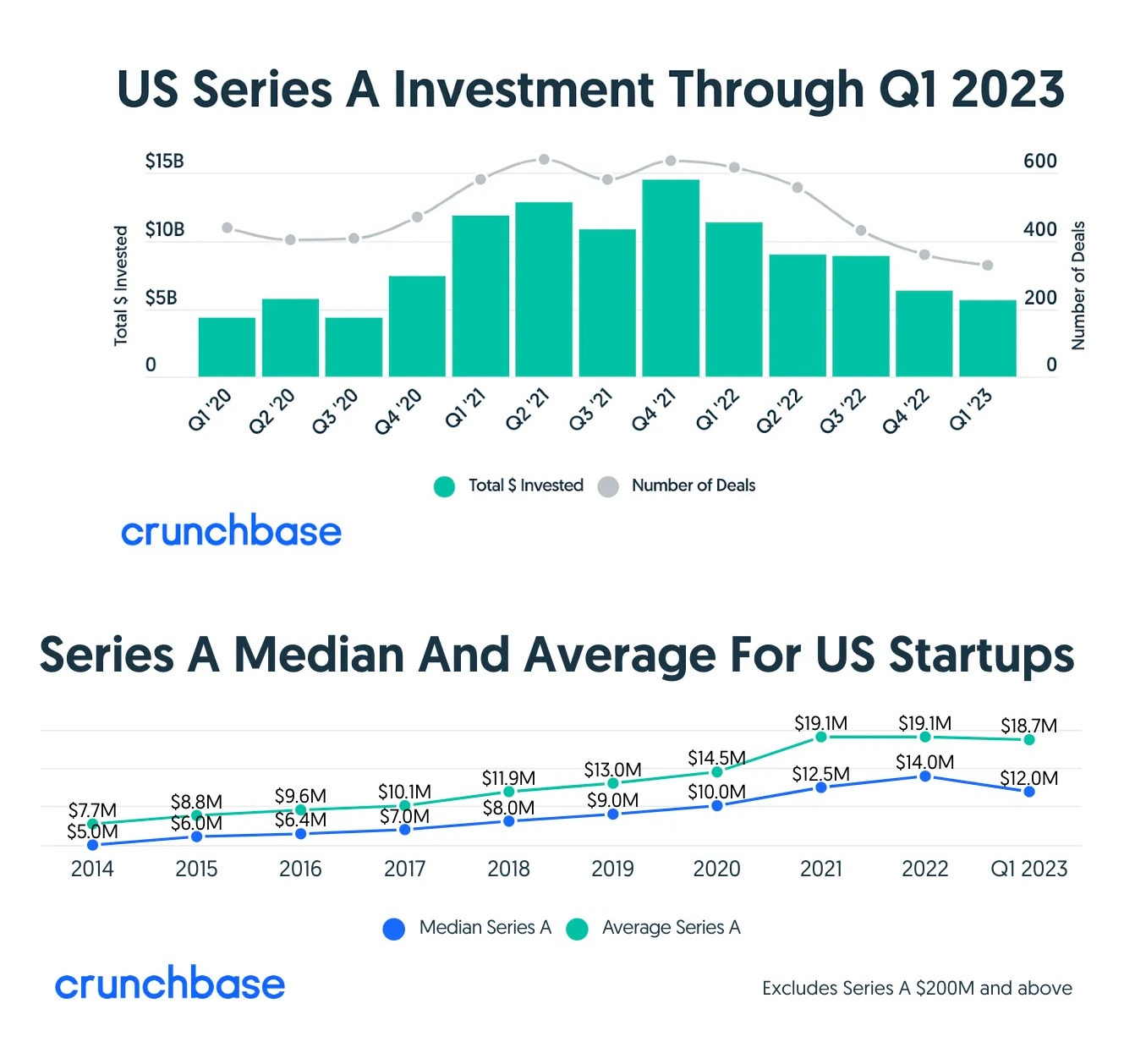

As you can see from crunchbase, Series A financings by quarter peaked at the end of 2021 and continued into early 2022.

Many of these A rounds were preemptive, pre-revenue Series A rounds with infinite multiples with high prices. Look at the Series A median price rise from $7M in 2017 to $14M in 2022, just five years later. Given the size of these rounds, many of these companies will not have to raise for well over 2 years which is why I believe the great reckoning will start happening at the end of this year. Based on discussions with many investors, there are still way too many companies post-Series A startups who are still far from hitting product market fit and a repeatable sales model.

This is the beginnings of the mass extinction event that Tom Loverro wrote about.

PREDICTION: There's a mass extinction event coming for early & mid-stage companies. Late '23 & '24 will make the '08 financial crisis look quaint for startups. Below I explain when, why & how it will start & offer *detailed advice to founders* on surviving the looming die-off. /1

Read 🧵It sucks, but it’s healthy. Too many me-too startups were funded and burned capital inefficiently with a business model of raising more capital at higher valuations fueled by VCs who are also responsible for this.

So what’s one to do when stuck in this rut? Do you take the tried-and-true wisdom to get to CF breakeven no matter what? Yes, of course you have to make sure burn is managed, and you’re not cutting your runway. However, there is an even bigger question you need to ask yourself. Is your business and product a must-have or a nice-to-have? Do I as a founder want to continue beating my head against the wall growing a business that offers a nice-to-have product where churn is high, and there is no sense of urgency to buy? If I cut my burn but continue doing what I’m doing, what will that look like in 2-3 years? What does winning in my current market look like and is this worth the effort? If the answer is no, always try to maximize value today and look for a buyer. The problem is the line is now out the door as corp dev departments are overwhelmed by opportunities to acquihire teams. If you as a founder were ahead of the curve, you were already building those potential partner/buyer relationships over the years, and it will be easier for you to find an exit.

If the acquisition path doesn’t work, and you’ve already stopped the bleeding, continue preserving your cash and get out your whiteboard. Imagine you are now an Inception stage startup with a core team you’ve battled with over the last few years and raised a brand-new round of $7-10M round (or whatever cash you preserved from your Series A). What would you do with that and what would you build? Is this exciting to you and your team? Will your investors support you on your journey or would they rather have a return of capital? If the former, then LFG. After all we are undergoing one of the greatest platform shifts in history with AI infused in all enterprise software. No one gets points for working the hardest especially if the outcome will just be meh if you are successful. Think differently, and you may have a better chance to catch lightning in a bottle then just soldiering on out of pure obligation.

This is also where having a great, honest and open relationship with your investor helps. During the ZIRP era characterized by preemptive term sheets, the world was transactional versus relationship driven. Investors and founders did not really have time to get know each other when FOMO ruled the day. Every investor is amazing when things are going well, but what happens when it doesn’t go well? These are the tough times now, and this is where having the right board members and investors matter. In fact, I can’t tell you the number of founders who have told me they’ve been abandoned by their lead investor but sometimes that is better than the alternative where one is constantly pushing you to do the wrong things.

This is startup and venture capital life. No risk, no reward. The mortality rate for startups will go back up, and if you’re going to go down, at least go down swinging 🥊. It was too easy for a while, and nature is finally healing itself.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

#must watch 🍿 launch video, aspirational, powerful from Brian Chesky AirBnB - not enterprise but love the boldness - “Step into your imagination. Introducing Icons”

#this is how you run a private beta program from Karri Saarinen, founder of Linear - need to carefully select who you onboard first and then learn from them before onboarding next batch vs. opening to unwashed masses. As Gaurav Vohra notes this is how Superhuman (a portfolio co) did it in the early days. I’ll even go one step further and I remember the team onboarding the first few hundred users bespoke and in person!

When we were rolling out @linear back in private beta days, every week I would pick the most motivated (based on their answers) & fitting people (used the stack we supported, small companies) from the waitlist manually and sent them this email I had saved as Superhuman template.

Inviting all 10,000 people on the waitlist seemed wasteful for me. The product wouldn't work for majority of the folks at that point, I would just burn our reputation and seemed we would just get lot of the same feedback if everyone joins at the same time.

Spreading the invites over a year we could get feedback this weeks cohort and then fix the issues. Next week we would get feedback on different issues from new a cohort. Slack used a similar approach in the early days.

Never understood why startups try to do big launches for unpolished or early products#No matter how big you get, weekly demo days can help keep that hacker culture (Jared Palmer - Vercel)

One of the best things we do @vercel is have 45m open “demo day” meeting on Fridays. Anyone, across product, design, engineering, ops, and GTM, can signup to show & tell in ~5m slots. localhost/polished slides are discouraged, live demos only. We started the meeting to prep for one of our conferences, but we’ve kept it going for over a year now. It’s awesome.#Some startups take a bit longer to bake and mature before they hit their inflection point 🚀 and Clay, a portfolio company, is a great example. Here’s Kareem Amin’s interview with Nasdaq sharing the journey from building a programmable spreadsheet to Enterprise Tech 30 - all about customer love. It now offers superpowers for outbound sales - AI powered data enrichment and automated personalized outreach. Watch here…

#HWPO - Hard Work Pays Off - want to be like Jensen Huang at Nvidia? There are no shortcuts and you have to love what you do (Insider)

Enterprise Tech

#what’s next after coding copilots? Github 🤯

After sharing an early glimpse at GitHub Universe last year, today, we are reimagining the nature of the developer experience itself with the technical preview of GitHub Copilot Workspace: the Copilot-native developer environment. Within Copilot Workspace, developers can now brainstorm, plan, build, test, and run code in natural language. This new task-centric experience leverages different Copilot-powered agents from start to finish, while giving developers full control over every step of the process...

With Copilot Workspace we will empower more experienced developers to operate as systems thinkers, and materially lower the barrier of entry for who can build software...

Video here#Dan Shipper from Chain of Thought got his hands on Github Coplot Workspace and says “the next popular programming language is English”

If GitHub Copilot is like autocomplete, GitHub Copilot Workspace—currently in limited technical preview—is like an extremely capable pair programmer who never asks for coffee breaks or RSUs.

It’s a tool that lets you code in plain English from start to finish without leaving your browser. If you give it a task to complete, Copilot Workspace will read your existing codebase, construct a step-by-step plan to build it, and then—once you give the green light—it’ll implement the code while you watch...

It’s definitely not yet at a point where I can hand it a vague notion of a complex feature and have it be built end-to-end like I might expect a human programmer to do. But it could dramatically speed up many of the tasks involved in creating that feature, if it’s used properly.

Putting those quibbles aside, though, CW is a step in the direction of the future. English is becoming a programming language. You’ll still have to understand and use scripting languages like Python or Javascript, or lower-level languages like C.

But most software will probably start as sentences written into an interface like CW’s.#Only the Paranoid Survive - “Microsoft’s OpenAI investment was triggered by Google fears, emails reveal” (The Verge)

Microsoft invested $1 billion in OpenAI in 2019 because it was “very worried” that Google was years ahead in scaling up its AI efforts. An internal email, titled “Thoughts on OpenAI,” between Microsoft CTO Kevin Scott, CEO Satya Nadella, and co-founder Bill Gates reveals some of the high-level discussions around an investment opportunity in the months before Microsoft revealed the partnership.

The email was released on Tuesday as part of the ongoing US Justice Department antitrust case against Google, Business Insider reports.

“We are multiple years behind the competition in terms of machine learning scale,” Scott writes in his June 12th, 2019, email to Nadella and Gates. He details how it took six months for Microsoft engineers to replicate Google’s BERT language model and get it trained “because our infrastructure wasn’t up to the task.”#Q, Amazon’s GenAI-powered assistant in Andy Jassy (CEO) own words

Roughly 18 years later, we’re trying to solve another 70-30-like misalignment for developers, where developers are telling us that they’re spending roughly 70% of their time on repetitive and tedious tasks and code.

Today, we’re launching the general availability of Amazon Q, the world’s most capable GenAI-powered assistant for accelerating software development and leveraging companies’ internal data—and that aims to remove much of the muck of repetitive and tedious coding and data tasks for developers and employees at large.

On the software development side, Q doesn’t just generate code, it also tests code, debugs coding conflicts, and transforms code from one form to another (today, developers can save months using Q to move from older versions of Java to newer, more secure and capable ones; in the near future, Q will help developers transform their .net code as well). Q Agents does multi-step planning and reasoning to allow developers to string together multiple requests and have Q implement them...

More here...#AI, AI, AI

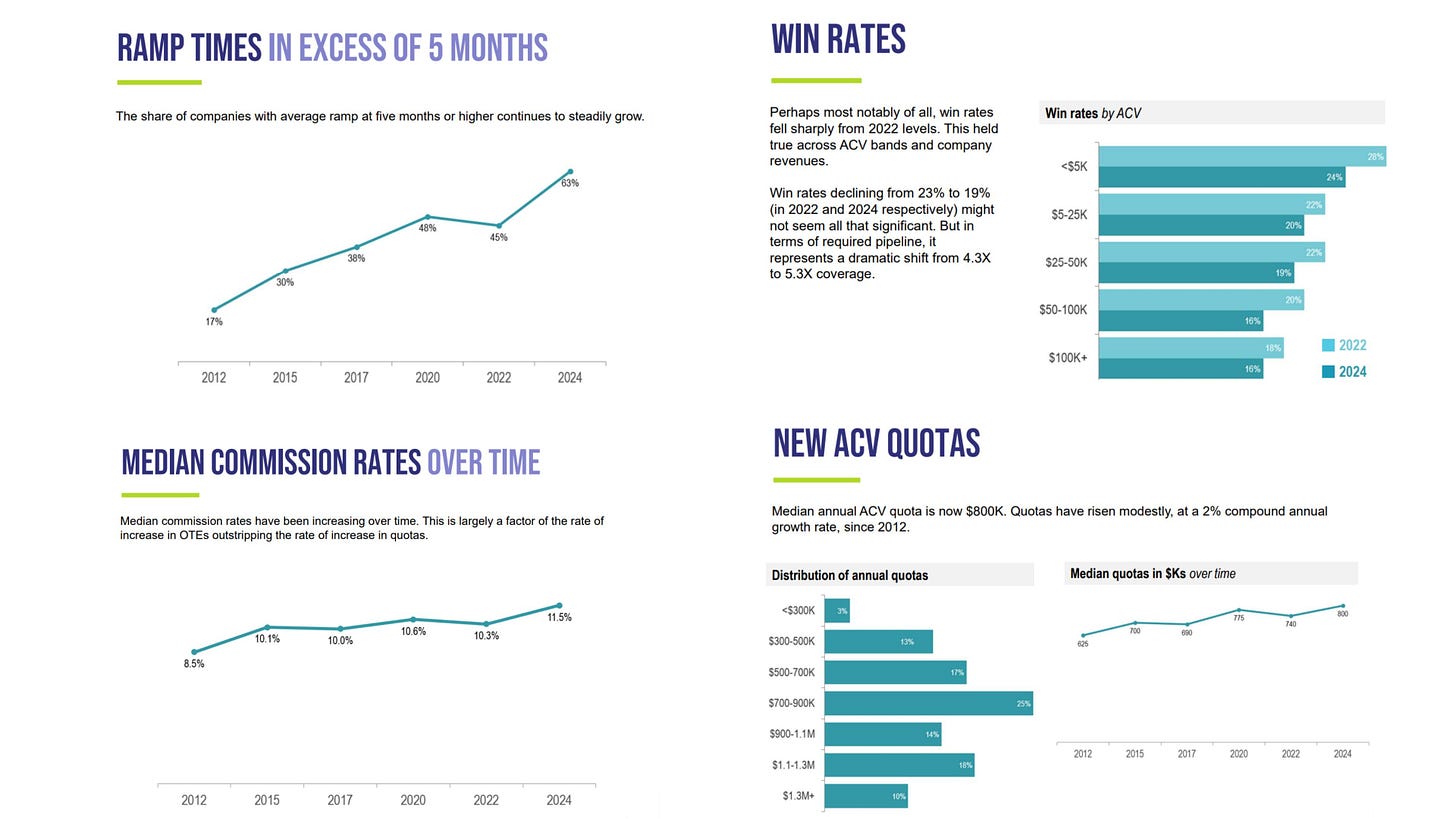

#Matt Harney from SaaSletter shared this AE productivity report from his latest edition (data from The Bridge Group) - notice Win Rates which declined from 23% to 19% from 2022 which while seemingly not that significant, it represents a dramatic shift in pipeline coverage needed from 4.3X to 5.3x

#Must read on How AI Apps Make Money/Pricing (Kyle Poyar - Growth Unhinged)

Pricing trends for 40 leading AI apps

Five findings stood out to us:

Limited pricing innovation—seven-in-ten have a subscription model and very few offer pure usage-based or pay-as-you-go pricing.

Most companies are charging based on the number of users—consistent with the notion of AI apps as “copilots” (assist people) rather than digital “workers”.

Free versions are extremely popular for initial adoption—one-in-two have a free plan, another one-in-five offer a free trial.

There’s a “Good-Better-Best” paradigm in terms of packages/tiers.

Varying degrees of pricing transparency—two-in-three have public pricing.#always love Kelsey Hightower’s takes on infrastructure software

Infrastructure as code is complex because infrastructure is complex. You have two choices: automation or abstraction.

🧵 here#Congrats to Aiden Cuniffe and Optic, a portfolio co, on its acquisition by Atlassian

Welcoming Optic, an API documentation and management tool, to Atlassian

Together, Atlassian and Optic will make it easier for every engineering team to discover APIs, ship reliable services faster, and improve software health within a single internal developer platform

Optic will be integrated into Compass, Atlassian’s developer experience platform. This empowers Atlassian to provide every engineering organization with native API documentation and governance directly in Compass.

Compass + Optic = comprehensive developer experience platform

Adding Optic to Compass will accelerate our ability to empower engineering teams and improve productivity by helping developers to find the documentation they need and ship faster.#Speaking of RS-AI next week, two of my portfolio cos rolled out some AI powered features. First off Snyk, launched its AppRisk ASPM platform

Today, Snyk made available an edition of its application security posture management (ASPM) tool for assessing application risks that provides more context into how code has been written and its role within the application environment.

Manoj Nair, chief product officer for Snyk, said Snyk AppRisk Pro leverages artificial intelligence (AI) and machine learning to provide deeper insights into how applications have been constructed. Snyk AppRisk Pro, for example, can trace insecure portions of deployed applications all the way back to the specific code components.And dope.security was written up in Forbes for its CASB Neural, an LLM-based DLP

Traditional CASB solutions often rely on rule-based systems, such as regular expressions and pattern matching, to identify sensitive data. These systems depend heavily on manually configured rules, which can be both complex and prone to generating false positives.

Dope's solution instead uses LLMs to analyze and understand the content of files stored and shared via SaaS platforms. This AI-driven approach allows CASB Neural to identify and classify sensitive data with higher accuracy and significantly fewer false positives.#The Rise Of Application Security Posture Management (ASPM) Platforms (Resilient Cyber - Chris Hughes in collaboration with Francis Odum, author of The Software Analyst)

#🤣 Real life Simpsons generated by AI - pretty amazing

Markets

#so much for the news of Wiz buying Lacework - “Wiz deal to acquire Lacework collapses: (CTech)

The companies recently signed a Letter of Intent with the aim of completing a deal for around $150-200 million. However, negotiations fell through in the due diligence process. Lacework was valued at $8.3 billion in 2021

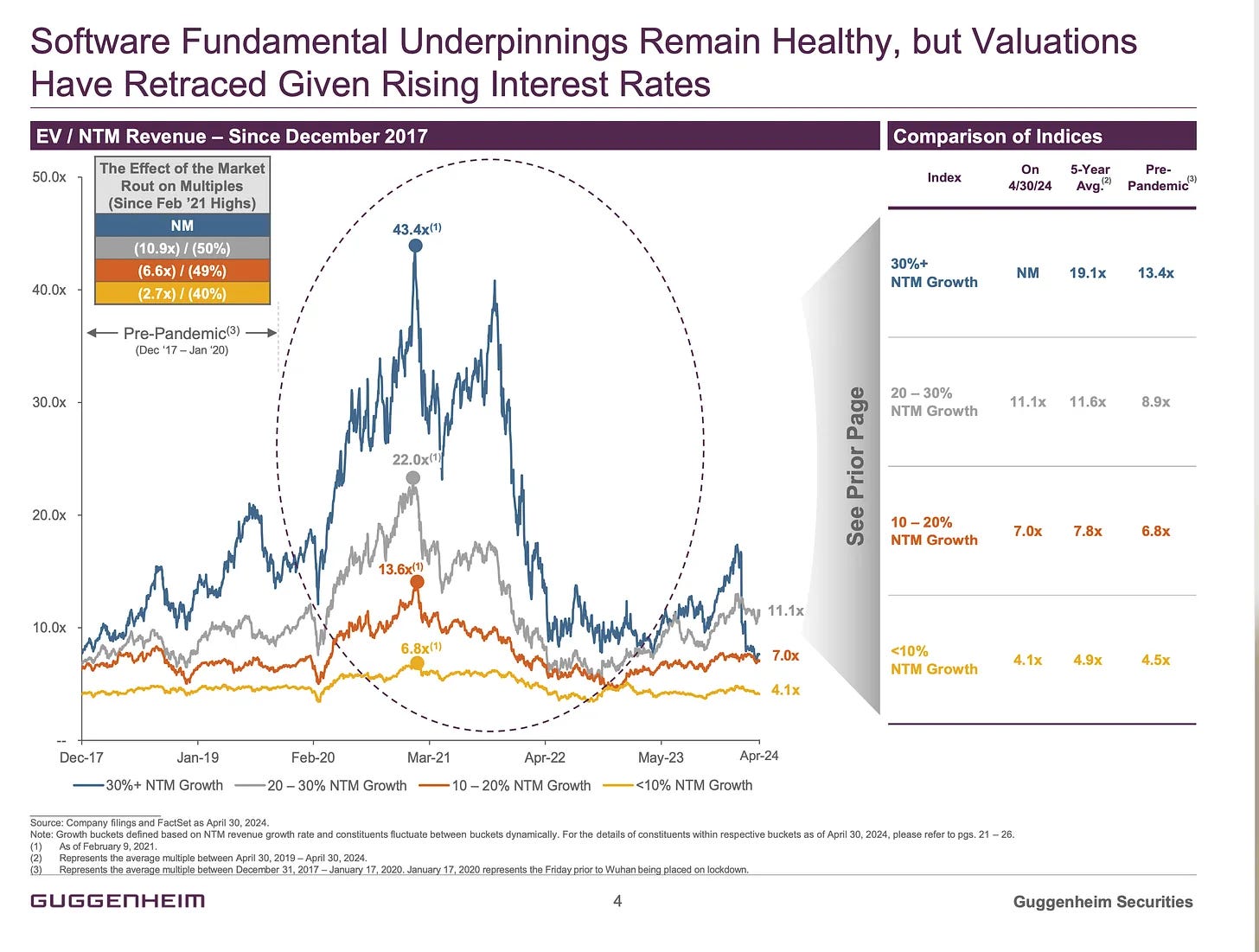

Cloud security decacorn Wiz will not acquire American cloud security company Lacework, Calcalist has learned. The companies recently signed a Letter of Intent, but the deal fell through during the comprehensive due diligence process. The transaction was valued at approximately $150-200 million, with Lacework’s $800 million in cash reserves to have been distributed among the company's investors.#Software multiples 🤯 - this chart from my friend Rob Bartlett at Guggenheim Securities says it all. Not only are multiples back to pre-pandemic levels, if you look at the top right of the chart, there is a NM for 4/30/24 meaning there are now ZERO, let me repeat ZERO, publicly traded enterprise software companies forecasted to grow >30% in NTM (next twelve months).

Thanks for the mention.

The full Bridge Group sales metrics report is here

https://blog.bridgegroupinc.com/saas-inside-sales-metrics