What’s 🔥 in Enterprise IT/VC #387

Top 10 Takeaways from Enterprise Founder's Day - the AI sales wedge is now table stakes...

Happy Easter 🐰 to those who celebrate, and here’s to the founders and execs grinding out the last day of the Q1! Speaking of sales, we finally put together our “Top 10 Takeaways from Enterprise Founder’s Day - Going Back to Basics Building Startups from Inception” and here they are:

Just Ship Sh** — Really Really Fast

Keep zooming in

Know what “early” signals you’re looking for

Sell before you build

Pricing isn’t final or monolithic

That said, there’s a few pricing best practices…

Think above and below the line

Your first ten customer contracts are about more than price

Figure out the AI workflow first, then the details

Suffering is part of the experience — often on all fronts at once

The ZIRP era is over and pumped that founders are building back from basics. We are going to have an incredible class of startups that emerge out of 2024 for sure. If you want the context behind the bullets, you can read them here.

Speaking of Enterprise Founder’s Day, one other sales nugget that emerged over and over revolved around AI. Yes, it’s a buzzword in venture capital circles but also now becoming table stakes as an entry point in any sales process for a young startup. Enterprises want to know, what’s your AI story, especially in a world of consolidating budgets as you can see below.

IT budgets are tight, vendor consolidation is happening, and meetings are hard to get. But, there is always an opening for AI. In fact, enterprises expect some kind of AI story from any startup.

I've talked to many of the largest IT buyers and if you ask about priorities, the question everyone asks is how is AI going to impact my budget, team, work?

If you're a founder + want to start a sales cycle, show the future.

Yes, it's a wedge, but I can promise you if you don't have an answer to how AI will change the course of "choose your problem" we do know some tiny startup will.

Everyone wants to do more with less. This is real, it's happening. Although the budgets say the ramp on AI spend is coming, I'd say many of those surveys are also more focused on enterprises building net new GenAI apps and does not include all existing purchases. It is hard to deny the fact that every enterprise software co on the planet is incorporating AI features both big and small.

Bottom line - AI is table stakes and you will have a hard time getting any interest for your software without a story around it. That will get your foot in the door and then it's all on you to deliver the goods with the whole product solution.

Kubecon EU was AI AI AI

RSA Security will be AI AI AI

It's still the first inning, there are lots of problems to solve, hallucinations, AI security, attribution, etc but make no mistake, it will get your foot in the door.

Sell the product, Market the vision.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

👇🏼 This from boldstart ventures Operating Partner Anna Debenham is 🔥 - she led of one of the highest rated sessions at our Enterprise Founder’s Day last week on “Product Market Fit (PMF) for Inception stage startups” - read more here 👇🏼

10 years in and it’s never too late to close your biggest deal to date! Congrats Rahul and Superhuman (portfolio co)!

You’re never too old to start a company - great story on Morris Chang, who founded TSMC at age 55 (WSJ)

The world’s most valuable tech companies were founded in dorm rooms, garages and diners by entrepreneurs who were remarkably young. Bill Gates was 19. Steve Jobs was 21. Jeff Bezos and Jensen Huang were 30.

But what might just be the world’s most invaluable company was founded by Morris Chang when he was 55 years old. Never has anyone so old created a business worth so much as Taiwan Semiconductor Manufacturing Company, known simply as TSMC, the chip manufacturer that produces essential parts for computers, phones, cars, artificial-intelligence systems and many of the devices that have become part of our daily lives.

But he wasn’t successful despite his age. He was successful because of his age.

As it turns out, older entrepreneurs are both more common and more productive than younger founders. And nobody personifies the surprising benefits of mid-life entrepreneurship better than Chang, who had worked in the U.S. for three decades when he moved to Taiwan with a singular obsession.

“I wanted to build a great semiconductor company,” he told me.

Startup shutdowns 📈 from Pete Walker Carta

The pace of startup shutdowns has increased to start 2024.

Among startups on Carta that have raised at least $5million in priced equity, 61 shut down in January and February of this year.

That's more than the total that closed up shop in Q4 2023 and we haven't added in March yet.

Some more dispiriting figures:

• January was the highest month of startup shutdowns on Carta for Seed-stage, Series A, and Series B companies. For Series C and beyond, the worst month was February.

• More startups that had raised at least $10M shut down in the first two months of 2024 than did in Q4 2023 (prior record quarter).

• More startups that had raised at least $20M shut down in the first two months of 2024 than did in Q4 2023 (prior record quarter).

• Worst 2-month period for Fintech, SaaS, Healthtech, and Medical Device shutdowns in all of Carta data.

Enterprise Tech

Calling all dev tools founders - from Ian Jennings at Dashcam:

This is such a hard problem for devtools. No login = no customer interaction or profiling. Add a login and you add developer friction.

Missed Kubecon Europe? Have no fear, the always awesome Kubecon top 10 🔑 takeaways from Daniel Bryant is here 👇

Great post on developer marketing from Lee Robinson (VP Product at Vercel)

Most companies get developer marketing wrong. Developer marketing is about building trust. It's about showing how to build great products with your technology.

How can I improve my developer marketing?

Don’t publish content you wouldn’t share yourself.

Always consider how you can build developer trust. It’s not a one-time transaction. It’s reflected in every product and marketing decision you make.

When something sucks with your product, own it. Don’t try to hide the failure. Lean into it. Bring the community along for the continuous iteration of your product. “You told us this was bad, and we fixed it”. Follow up with people after you ship…

🤯 👇🏼 must watch - “The most mindblowing part of this demo: in the original footage, Nik is speaking German! So the English and Spanish you hear in this video are both AI-generated translations of his German (with his original voice and intonations).”

Speaking of voice this is just as groundbreaking - just imagine all of the voice

phishing attacks on the horizon - also Forbes story on its $50M Series B

👀 Those AI multiples

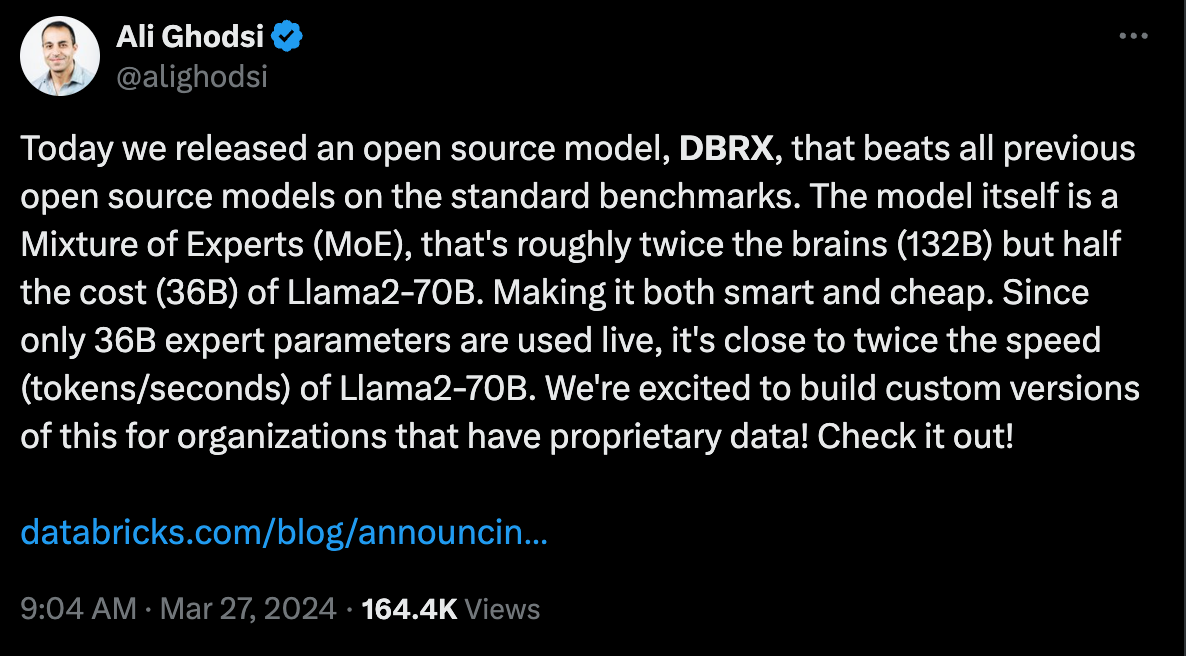

🤯 Databricks now ready to IPO as it rounds out its amazing platform with its own killer LLM

👀 And it only took Databricks 2 months and <$10M to build their own LLM (from Clem at Hugging Face)

Just $10M and two months to train from scratch a GPT3.5 - Llama2 level model. For context, it probably cost 10-20x more to OAI just a year ago!

The more we improve as a field thanks to open-source, the cheaper & more efficient it gets!

All companies should now train their own models to build their internal AI capabilities and compete!👇🏼 covers much of what I’ve been thinking and writing about over last year - read 🧵 - multi-model world, open source, budget to 📈 in next year and more. As mentioned previously, most GenAI apps are for internal purposes first to work out tweaks before deploying to customers

Markets

The bar for IPOs from Diana Doyle, Managing Director Morgan Stanley (The Information)

What are the qualities of companies that are distinguishing themselves as IPO or public market ready?

Doyle: Ideally 30% to 40%–plus growth with revenue, for a traditional software company, $200 million–type plus. Investors want to see either profitability today or a real line of sight to profitability within the next, say, four quarters. They want to see companies that are a market leader and who offer something different. For companies that meet that profile, the investor enthusiasm is going to be highest, in addition to companies who have an AI direct story that investors can understand and articulate.

There are already so many things in the public markets that investors can choose from and buy. To come out with an IPO story, you want to give something to investors that they don’t already have access to buy. The biggest thing that’s missing from the public markets right now is growth. Over 50% of the tech companies out there are growing below 10%; only 5% of tech companies are even growing more than 40%. If you’re a company preparing to go public and can show sustainable growth, the market is in an environment right now where investors are willing to lean in for growth, they want to see profitability, and they want to see some minimum standard of efficiency.Along those lines, Rubrik, the data security company, is expected to file for IPO next week - will the floodgates open again?

Rubrik Inc., a cloud and data security startup backed by Microsoft Corp., is planning to file as soon as next week for an initial public offering, according to people familiar with the matter.

Details of the company’s plans, including the timing, could still change, said the people, who asked not to be identified discussing confidential information. A spokesperson for Palo Alto, California-based Rubrik declined to comment.

Microsoft made an equity investment in Rubrik in 2021 in a financing round that valued the startup at $4 billion, according to data provider PitchBook. Rubrik, whose backers also include Bain Capital Ventures, Lightspeed Venture Partners, Greylock Partners and Khosla Ventures, has raised $1.18 billion to date, the PitchBook data shows.

The $10MM it cost Databricks to train the DBRX LLM needs a footnote, as they almost certainly would not have been able to do this had it not been for the purchase of Mosaic for $1B.