What's 🔥 in Enterprise IT/VC #377

Who would have that thought that enterprise would become too sexy - from 15 to 416 🦄 in 10 years 🤯

Besides just organizing my thoughts from the week, one of my other reasons for writing What’s 🔥 in Enterprise IT/VC over 7 years ago was to shed more light and excitement around enterprise software. To that end, it was quite shocking 🤯 to see Aileen Lee’s data-driven look at unicorns 🦄, a coin she termed over 10 years ago.

Let me repeat, there were only 15 enterprise 🦄 representing 39% of the total number and only 20% of the overall market cap of all 🦄. 10 years later, we have an over 27x increase in the total number of enterprise 🦄 at 416 which make up almost 80% of the overall 🦄 value.

So yes, we have a problem. As I mentioned in last week’s newsletter, we now have 10 of each in every category with many 1 product companies who aren’t IPOable and many 1 feature companies who just are not worth what they are worth. In addition, this slide from Aileen’s presentation should get your attention now👇🏼 - once upon a time capital efficiency was the name of the game for enterprise software companies with a 27X Valuation/Equity Raised ratio and now it’s just like consumer 🫢!

To quote Aileen Lee from Cowboy Ventures:

In the past decade, tech lost its capital efficiency edge. Formerly impressive enterprise company capital efficiency of 26x plummeted to 7x, putting it in-line with consumer co efficiency (despite typically higher margins and customer retention), which also dropped from 11x to 7x. Given many unicorns are currently overvalued, even 7x is likely inflated.

In other words, investors would have been better off investing in public superunicorns like Salesforce, Amazon,and Microsoft, up 8x, 9x, and 9x respectively in the decade, than in many companies in our current unicorn herd.

Be careful what you wish for! Maybe it was much nicer when no one was paying as much attention to enterprise software companies? Or perhaps we will get VCs to be contrarian again and run for the hills from enterprise leaving the rest of us die-hards to do our work efficiently?

Here’s Aileen’s conclusion:

We also learned macroeconomic factors and capital efficiency matter. The massive influx in private capital funded lots of companies. But capital efficiency declined, which will erode financial outcomes, given how many are still ‘papercorns.’

The cycle is not over. The venture ecosystem will feel the impact, and benefit from these lessons, in years to come as more layoffs, down rounds and shutdowns impact founders, employees and investors.

We learned that the laws of gravity are still in full force and everything is not just 📈 because we say it is. Capital efficiency always matters even though we lost our minds for quite some time during the ZIRP era. Yes, there will be more pain ahead.

Last week, investing legend Howard Marks wrote an essay titled “Easy Money” that perfectly captures the state of 🦄 and enterprise software companies, which were essentially on moving sidewalks.

In Sea Change, I likened the effect of low interest rates to the moving walkway at the airport. If you walk while on it, you move ahead faster than you would on solid ground. But you mustn’t attribute this rapid pace to your physical fitness and overlook the contribution from the walkway.

In much the same way, declining and ultra-low interest rates had a huge but underrated influence on the period in question. They made it:

easy to run a business, with the stimulated economy growing unabated for more than a decade;

easy for investors to enjoy asset appreciation;

easy and cheap to lever investments;

easy and cheap for businesses to obtain financing; and

easy to avoid default and bankruptcy.

In short, these were easy times, fueled by easy money. Like travelers on the moving walkway, it was easy for businesspeople and investors to think they were doing a great job all on their own. In particular, market participants got a lot of help in this period as they rode the 10-year-plus bull market, the longest in U.S. history. Many disregarded the benefits that ensued from low interest rates. But as one of the oldest investment adages says, we should never confuse brains with a bull market.

Like Howard says we all looked pretty smart the last 10 years with the number of Unicorns hitting 80% of value of overall index. The next few years will separate the good from the great as the moving sidewalks come to a full stop.

For many years, I felt like we were all pushing a rock up a hill with the idea that enterprise startups delivers repeatable value and growth, but I am still shocked at how quickly and how far the pendulum swung from consumer to enterprise. The question we need to all ask ourselves is if dominant entrenched players in enterprise will prevent ginormous liquid outcomes similar to consumer cos who were gateways and controlled access to users. IMO, the answer is no, but the cost of selling due to competition and vendor consolidation has skyrocketed as seen in Aileen’s report resulting in similar capital efficiency as consumer cos. And what that means once again is if larger platform cos have the installed customer base, if customers are consolidating vendors, then yes, we will see many smaller one feature or one product companies get acquired.

Combine this with multiple compression, slower overall growth for all companies at scale, and one needs to ask what this looks like for the venture capital industry overall. I’m biased, but IMO Inception investing is the best place to be and one must think about a world where a $3B outcome is as big as one can get instead of $6B one which means ownership and fund size truly matters.

I continue to believe that this will be one of the best classes of startups as only the die-hard founders who are slightly crazy 😜 will start a company today, there will be less me-toos in every single category, access to higher quality talent is better than ever before, AI-infused in all software and operations will help create ground-breaking new companies which are more efficient, and finally, founders and investors have the religion again - nail it before you scale it, stay lean and mean and capital efficiency ALWAYS Matters!

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Another banger of a post from our Operating Partner Anna Debenham, employee #4 at Snyk with product expertise - “How to run a great demo when you’re not a sales person” - also just love the tie on Sparky!

Is this true? Where we are in the cycle? Read this, absorb it. The answer is DPI or return of cash and in long run, go early, own as much as you can or go home…

💯 👇🏼 from Brad Stulberg - author of Master of Change

The people who achieve big and audacious goals are rarely obsessed with achieving big and audacious goals. They are focused on the path, on the process. They weather ups and downs. They take small, consistent steps knowing that big gains come from compounding effort over time.

Founders, VCs, enlightening overview from over 100 managers for what to expect in 2024 - thanks to Samir Kaji from Allocate who put this together and 🙏🏼 to be included in this - get the report here

We recently polled nearly 100 fund managers and limited partners to get their quotes on what they expect to see in 2024 and beyond, across a variety of topics, including:

- Fundraising climate for VC funds

- Limited Partner Trends

- Trends in AI

- What might fundraising look like for companies?

- Mark downs, and fallen unicorns.

- Opportunities and reasons for optimism

- Early Stage trends

- M&A and IPO thoughts❤️ this

Find time to celebrate the wins! Was awesome to get together with Atomic Jar co-founders Sergei Egorov and Eli Aleyner last night along with Michael Yamnitsky from Insight (missing Jon Rosenbaum from Insight) and my partner Eliot Durbin. As I like to tell founders, this is the first of many you will do and can’t wait to see what you learn going through an IPO process at scale at Docker. 🙏🏼 to Sergei and Eli for letting us partner on the journey. More on the exit here from TechCrunch!

Enterprise Tech

And they say that the AI isn’t that great? Watch this to the end, just a minute.

On Meta’s AGI ambitions and Llama 3 will offer coding, also shows a glimpse into war on talent for deep AI researchers who want to work on ambtious projects (The Verge)

Here, Zuckerberg is saying the quiet part aloud. The battle for AI talent has never been more fierce, with every company in the space vying for an extremely small pool of researchers and engineers. Those with the needed expertise can command eye-popping compensation packages to the tune of over $1 million a year. CEOs like Zuckerberg are routinely pulled in to try to win over a key recruit or keep a researcher from defecting to a competitor.

“We’re used to there being pretty intense talent wars,” he says. “But there are different dynamics here with multiple companies going for the same profile, [and] a lot of VCs and folks throwing money at different projects, making it easy for people to start different things externally.”

Meta is training Llama 3 now, and it will have code-generating capabilities, he says. Like Google’s new Gemini model, another focus is on more advanced reasoning and planning abilities.

“Llama 2 wasn’t an industry-leading model, but it was the best open-source model,” he says. “With Llama 3 and beyond, our ambition is to build things that are at the state of the art and eventually the leading models in the industry.”

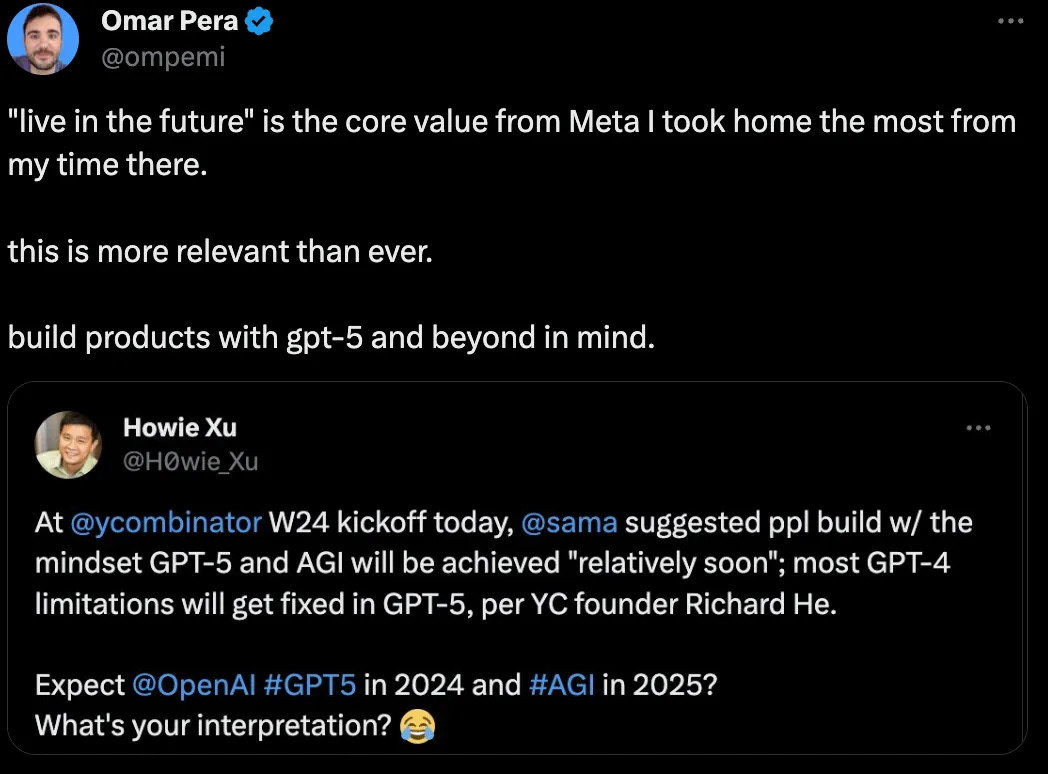

Learnings from Meta as it applies to AI - Omar was co-founder of Reply AI, bought by port co Kustomer

If Marc Benioff says this, then you should watch the Davos Sam Altman panel on what’s next

Blown away by Sam Altman’s visionary take on AI's future at Davos. It feels that GPT-5's upcoming leap in sophistication signals a transformative era. The full panel offers a brilliant glimpse into tomorrow's tech: Watch the full panel here: https://youtube.com/live/JHPzQRTsb4A?si=h20PoGnX13GsUtd_

🤯Why is cybersecurity always #1 or 2 on CIO charts? Perfect example of why JPM's cybersecurity budget is $600M 💰 and keeps growing 📈 (from Davos, CNN)

JPM Chase now fights off about 45 billion attempts a day by hackers to infiltrate its systems. That’s double what it was last year, highlighting the escalating cybersecurity challenges the bank and other Wall Street titans are facing.

Congrats to portfolio co Snyk on acquisition #9 as it extends its platform for developer first security! Snyk acquires Helios to bolster its AppSec platform (TechCrunch)

from Deutsche Bank Research - 2024 Software Outlook

M&A should be a supporting force for valuations, particularly for those down market given dry powder with both financial sponsors and larger software platforms (we do contend strategics will lean more in the direction of smaller deals to tuck-ins).

Cloud marketplaces will become even more prevalent in 2024 as our CIO and industry conversations indicate this is becoming a preferred buying channel for organizations. We see this benefiting the hyperscalers and those vendors that are embracing this newer channel over traditional two- tier distribution and even direct procurement in many cases.

Must read from my Partner Ellen Chisa - Enabling Magicians, Not Magic ✨

Rethinking AI in Product Features

Holy Quantum! JPMorgan latest to pile into quantum upstart with $5B valuation

- Banking giant believes Quantinuum key to optimizing investment portfolios

"Financial services has been identified as one of the first industries that will benefit from quantum technologies," said Lori Beer, global CIO for JPMorgan Chase, in a statement. "As such, we have been investing in quantum research and our team of experts – led by Dr. Marco Pistoia – have made groundbreaking discoveries, partnering with quantum computing leaders like Quantinuum."

As we've seen in the fintech arena with things like FPGAs, only a narrow advantage over conventional systems is required to generate profits and therefore justify the investment.

JPMorgan, for its part, is already investigating ways to do just that. In a paper published by the financial institution last summer, researchers explored the application of future fault tolerant quantum systems on optimization problems.

The idea here was to use quantum systems to optimize investment portfolios while also accounting for the litany of regulatory constraints. These exercises were then applied as part of a proof of concept on Quantinuum's H-series accelerators, though it appears fault tolerant — that is to say error correcting — quantum systems will be required to fully realize an advantage.

Markets

5 minute interview Chuck Robbins, CEO of Cisco at Davos - still early with AI in enterprise, killer apps yet to be determined, we’ll still do tech and talent acquisitions especially in AI…

Read investing legend Howard Marks latest essay “Easy Money”