What's 🔥 in Enterprise IT/VC #372

On pattern recognition in venture and startups

For many years, I’ve been a huge fan of the writings and research of Michael Mauboussin, Wall Street research analyst and author of Expectations Investing, The Success Equation and many other best-selling books on investing.

This week he released an awesome paper called Pattern Recognition which is a must-read.

This report is about the powers and perils of pattern recognition. Investors and investment organizations regularly cite pattern recognition as the basis for action. While it can be extremely powerful and useful when applied appropriately, it can also be highly misleading and furnish fuel for overconfidence when used inappropriately.

This is something I think about a lot and know I can get trapped at times by the past. I expanded on this topic last month around our AGM and you can find that post here.

Back to Michael’s paper, here’s where it applies to the world of venture capital and startups:

If stability and feedback are essential to successful pattern recognition, instability and unclear links between cause and effect show where pattern recognition fails. Robin Hogarth, a cognitive psychologist, distinguishes between “kind” and “wicked” environments. In kind environments, outcomes are indicative of the quality of the process and feedback is accurate and plentiful. In wicked environments, outcomes are a poor or misleading reflection of process because causal links are blurred.

Expert agreement is one way to assess the validity of intuitive expertise. In kind environments, experts tend to agree on cues and the appropriate decisions that follow. For example, chess masters are likely to identify similar moves as attractive.

In wicked environments, the views of experts often vary substantially. For instance, the one-year forecasts of the level of long-term interest rates by economists are not much different from random. Predictions of stock market returns by strategists and executives also tend to be poor.

Startups are clearly built in wicked environments and the earlier you are, the harder it is to apply pattern recognition.

This is also the time that it is easiest to miss the next big thing as all you have is the founders sitting in front of you, their story, and your past experiences to guide your decision. As these companies grow and scale, applying pattern recognition is much easier as the environment becomes “kinder” and there is more data to evaluate and analyze.

Many fundamental investors rely on pattern recognition as part of their decision-making process. They create plausible stories informed by their experience and memory. But it is important to consider how pattern recognition works to understand its applicability.

Pattern recognition is more effective in stable environments where cause and effect are clear and participants are trained using timely and accurate feedback. This applies in many domains, including sports, music, and chess. Participants in these areas can develop intuitive expertise, an unconscious sense of recognition that leads to superior performance.

Pattern recognition tends to fail in domains where causality and feedback are limited. But that does not stop decision makers from feeling the sense of pattern recognition. Our mental apparatus allows us to see patterns that truly exist as well as to see them when they do not exist.

Distinguishing between experience and expertise is crucial. All experts have experience but not all with experience are experts. The defining feature of an expert is having a predictive model that works. Ample research shows that expert predictions in social, political, and economic realms are poor. Expert views tend to correlate in realms where expert prediction is effective.

This shortcoming is more a reflection of the domain than of the person and underscores the importance of understanding the boundaries of useful prediction. But our minds are keen to go out of bounds, imposing patterns where none exist or acquiescing to our gut reaction even when we know that using explicit analysis can help correct a decision error.

So when you’re sitting in front of the next crazy idea, check yourself, and rather than think about all the things that can go wrong, think about what needs to go right, how that could happen, and if so, how big this could potentially be. It’s these opportunities that can create the outlier returns your fund needs, but also the ones where pattern recognition can cause you not to make that investment.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Founders - how Vimcal got it done - worth a read 👇🏼

Nail it, then scale it - more money can’t accelerate your path to product market fit - also check out last week’s What’s 🔥 for a Google Doc on going back to First Principles Building from Inception

Competing against internally developed tools - from our boldstart ventures Operating Partner Anna Debenham, formerly product + employee #4 at Snyk

For many products, their main competitor isn’t another company but an internally-developed tool. This is particularly true of developer tools, and I have a theory that this will only get more challenging as AI reduces the time and effort required to build viable solutions internally…

Enterprise Tech

👇🏼 🔥 up for Sergei, Eli and whole Atomic Jar team - 🧵 with link to TechCrunch and original boldstart “why we invested” post

from TechCrunch:

AtomicJar was seemingly a high-flying early-stage startup with a hefty (by today’s standards) $25 million Series A last January. It was building a commercial container testing platform, based on a popular open source project — always a nice combination. It would seem it was time to find product-market fit and take off, but instead the startup decided to combine forces with Docker, the company that invented the notion of containers.

Today, Docker announced it was acquiring AtomicJar and making the 19 employees part of its new testing division. While the two companies didn’t discuss the purchase price, it was enough to take a well-capitalized startup with lots of potential off the market.

Docker CEO Scott Johnston said that the company has been building a comprehensive set of build, test and deploy services on the Docker platform aimed at developers, working on projects before they go into production. By acquiring AtomicJar, the company is essentially buying the testing part of this equation.

How to get unstuck from hitting a major milestone and getting to $100M ARR with growth slowing - IMO, I’d add missing a product cycle, losing aggressiveness to the reasons I’ve seen

Lightspeed/Fortune Cyber 60 along with what’s top of mind for CISO budgets - congrats to port cos Protect AI (AI security) in early stage category and Snyk (dev first security) in late stage category

on the LLM Hallucination problem - it’s the greatest feature, not a bug

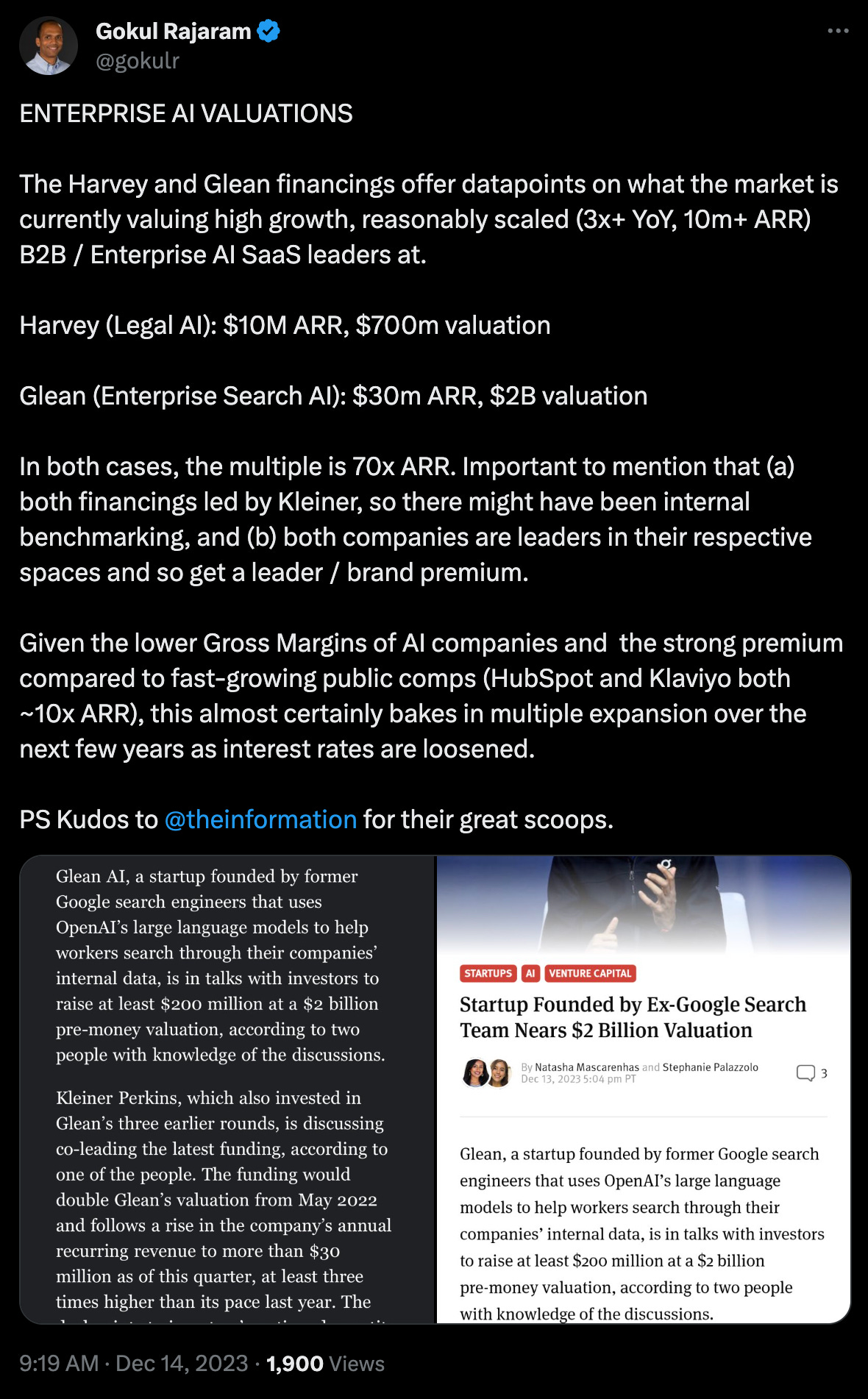

Growth is back…for select few enterprise AI (trailing multiples but still super high)

Handy cheat sheet for Retrieval Augmented Generation (RAG) and different methods to improve query accuracy - also slides here

Crypto is way back with rates projected to come down next year and a focus on solving real problems, not just trading worthless tokens

Well done by Salesforce - from CEO of AI Division - worth a look at how easy..

Super excited for future of OSS models and edge computing - will unleash whole new world of possibilities - Ethan Mollick

I have now run one of the more powerful, open source LLMs (Mistral 7B) directly on my iPhone.

No internet needed. It isn’t very fast but that is already being solved. Consider the implications: almost anything can soon be imbued with local “intelligence”

A lot of possibilities.

Markets

More about the sequencing over time from all product to GTM and finding that right balance but it is costing more to land those customers…

Huuuuuuge Week…

I’ve been working in finance for 15 years and this was one of the craziest I have EVER seen!

Let’s recap!

- S&P rallies +2.7% now only 1.6% away from RECORD high!

- DOW & NASDAQ 100 hit all-time highs

- FED holds rates unchanged

– expects 3 rate cuts in 2024

- FED member John William goes on CNBC and says “premature” to be thinking about March rate cut

- Volatility hits a 4-year LOW

- Retail investors are buying the most stocks since March 2022

🤯 - Jon Erlichman

2023 valuations:

Nvidia: $1.2 trillion

Intel: $180 billion

2003 valuations:

Intel: $220 billion

Nvidia: $3 billion