What's 🔥 in Enterprise IT/VC #369

Selling what's on the 🚚 vs. the one more feature trap - importance of the right ICP

Happy Thanksgiving 🦃 to all those who celebrate and like in years past, I hope you’ve had cherished time with family, friends, and loved ones. This is always a nice time to take a pause, reflect on the past year, and think about all that you are grateful for 🙏🏼.

Switching gears, top of mind for many seed founders is raising that next round in 2024. This post is for those who are still struggling to find their ICP (ideal customer profile), who have a product, no shortage of customer interactions, but always feel that something is missing.

For many technical, product-focused founders the answer to closing more deals is quite easy - let’s just add another feature. This is a death trap and one you must avoid - Jen Abel nails it below.

For technical founders building your way out of a problem is always the easiest, but what’s often overlooked is the idea of selling what’s on the 🚚. Yes, what if you changed the heuristic and rather than start with what my product doesn’t have, focus on what you do have and whether or not you are targeting the right persona, solving a problem for that user, and are messaging correctly.

I’ll give you a great example for developer tools. I remember in the early days of Snyk we were faced with an existential crisis - does Snyk go narrow and deep or wide and shallow? The decision was based on whether or not Snyk should only focus on Node users and go so deep that the product would not only find vulnerabilities but also offer the automatic fix. The alternative was to cover more languages and alert developers on the vulnerabilities but offer no fix.

While the answer may seem obvious, the issue is that when talking to CISOs, they wanted more coverage and our competitor at the time offered that. We were missing out on the big deals. But the users, the developers could care less about Ruby or Java or other languages - they would rather not know a vulnerability even existed as it would cause more work to fix. Snyk’s value proposition of creating “developer friendly security” naturally meant we needed to not only find, but fix the issue. Our ICP was always the developer and while those early conversations with CISOs were illuminating, we knew it wasn’t the LT path. It wasn’t a product or feature issue, it was an ICP issue, and I can promise you if we started listening to those CISOs in the early days, Snyk would not exist today.

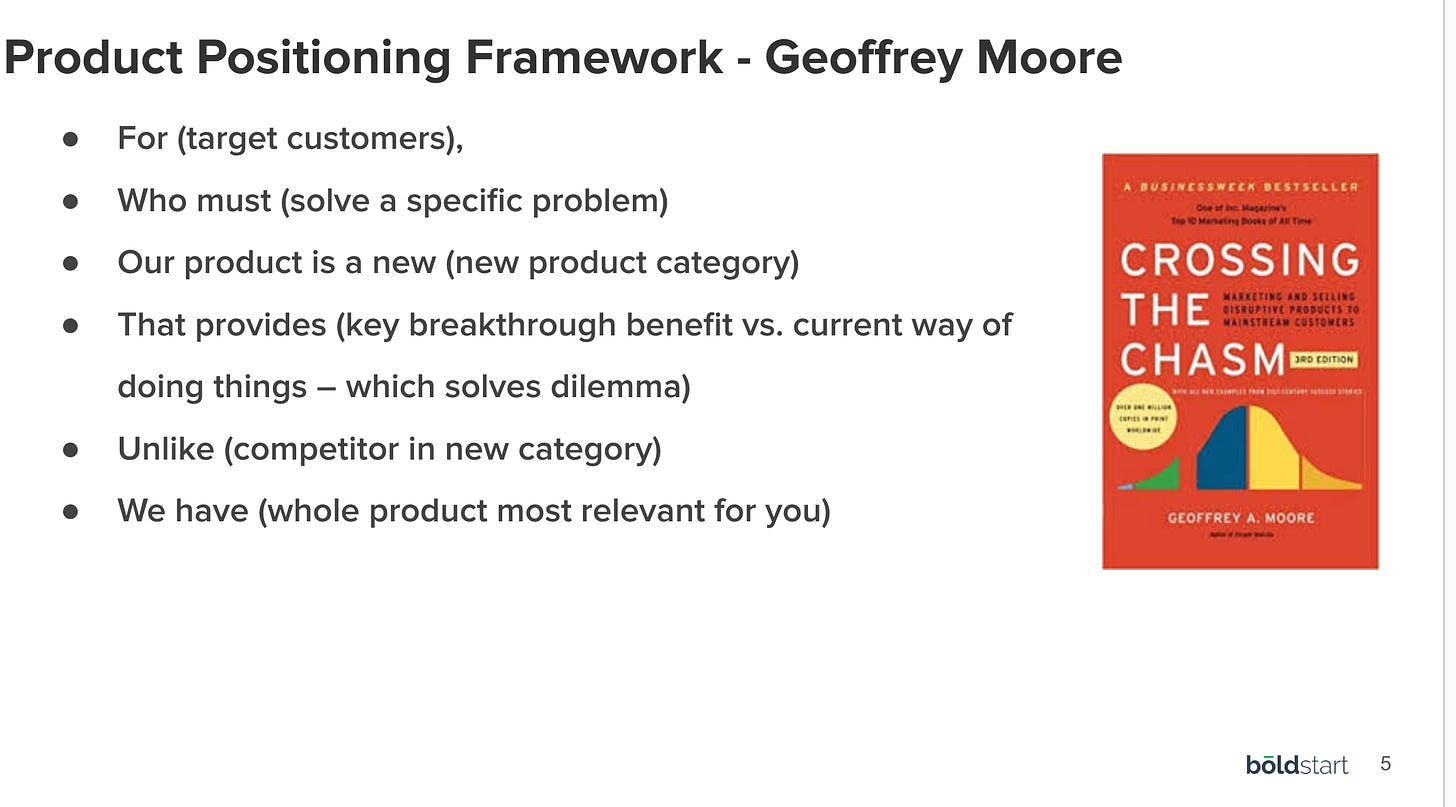

What this comes down to is a product marketing exercise and a back to basics approach. Here’s a slide deck I presented a couple years ago on “Breaking into your first enterprise IT account”

Sounds relatively easy, but many times I see founders skipping the “for” and “who”. The best founders I know start with several different personas or “fors” and “whos” and learn and iterate from those. They are amazing at saying No to the wrong potential customer and 🤔 through what the perfect representative sample of customer type by size or industry or user could look like. They are relentlessly focused on learning from both users who ❤️ the product and also users who churn. They understand the idea of having insane customer love before skipping steps and scaling. They focus on quality of the first few users versus quantity.

I often refer to the importance of product velocity and momentum as 🔑 indicators of early success for a startup but often overlooked is the rate of founder learning. When it comes the search for PMF, founder learning is often manifested in the speed to hone the core value proposition and pitch as the best founders are able to find signal from noise and iterate quickly and multiple times before PMF. So much goes into that succinct value proposition.

There is no easy answer for a lack of customer traction, but my one suggestion before you commit to the idea that you are one feature away from success, go back to the basics and first ask if this is the right user or customer. If you believe you have that nailed, try multiple messages and keep learning from every interaction. You may have the right product today but for the wrong user. Or you simply may just have a cool technology in search of a problem to solve in which case you should start completely over.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

More thoughts on boards

Brian Halligan, co-founder of Hubspot shares what an ideal board can look like - he nails many of my thoughts and once again 🔑 here is VCs can be excellent board members (see last week’s What’s 🔥 for more on boards)

Steve Jobs at his finest from The Startup Archive (click for video)

Steve Jobs explains the importance of both thinking and doing

“The doers are the major thinkers. The people who really create the things that change this industry are both the thinker-doer in one person.”

This is applicable outside of tech too, and he uses Leonardo da Vinci as an example:

Enterprise Tech

Great slide from Francis…but, startup founders remember it’s super hard to get Accenture + others interested to build a practice around your product - it takes time but if you get the machine rolling you will find that your product may be included in a bakeoff between both consultants for a win no matter what

It’s all about the data!

The other side of AI - “UnitedHealth uses AI model with 90% error rate to deny care, lawsuit alleges” - For the largest health insurer in the US, AI's error rate is like a feature, not a bug (Ars Technica)

AI on the edge - just a matter of time, cars, phones, sensors…

Just discovered, silently, Qualcomm Snapdragon 8gen 3 already supported 10b language model running locally on your smartphone. Guess it may not be too far away from having a GPT-4 quality model locally in your pocket 🤔

How it starts from the AI Safety side…link to Hacker News here

It will only get worse - AI deep fake voice calls

Markets

Huge reminder - the markets are smart - Nvidia crushes earnings again (CNBC) and stock is down 👇🏼

Nvidia’s revenue grew 206% year over year during the quarter ending Oct. 29, according to a statement. Net income, at $9.24 billion, or $3.71 per share, was up from $680 million, or 27 cents per share, in the same quarter a year ago.

The company’s data center revenue totaled $14.51 billion, up 279% and more than the StreetAccount consensus of $12.97 billion. Half of the data center revenue came from cloud infrastructure providers such as Amazon, and the other from consumer internet entities and large companies, Nvidia said.

Healthy uptake came from clouds that specialize in renting out GPUs to clients, Kress said on the call.

How Thoma Bravo gets its “take private” buyouts focused 👇🏼

Crucial advice for seed founders eyeing the next round in 2024! The Snyk example emphasizes the importance of staying true to your ICP despite external pressures. It's a reminder that a back-to-basics approach and effective product marketing are game-changers. Thanks for sharing your insights! 🌱💼