What's 🔥 in Enterprise IT/VC #362

What's ahead in Q4 from LPs and VCs (Origins Podcast) - more shutdowns?, hard choices for seed funds?, net new company funding 🔥, default 1st 10 in office, TVPI vs. DPI

The latest episode of the Origins Podcast co-hosted by friends Beezer Clarkson (LP extraordinaire from Sapphire Ventures) and Nick Chirls (Notation Capital, pre-seed creators) is finally out. We recorded it on Friday afternoon of Labor Day weekend so I kind of forgot what we talked about but just listened this week and thought I’d share as it’s pretty juicy and dare I say it, spot on. Seyonne Kang, Partner at Stepstone is also on the show and if you don’t know Stepstone, you should, as it manages >$140B of LP capital investing in PE and VC along with directs.

If you want a quick synopsis as a founder raising your first round or a seed founder looking to do an A, here’s what I had to say (transcript from clip below)

Beezer Clarkson

So, let's get into it. So I've given you guys time to think through what you think's gonna happen. It's q4, everyone's been waiting for q4 23. The world's gonna get better. And I'm just going to start you off by saying it might not be better, but it's definitely busier. And who wants to pick up on that thread and tell me what you're seeing?

Ed Sim

Yeah, I'm happy to pick up on the busier/better thread. Look, I mean, I spend my time partnering with founders who are just getting started, as I say, day one at incorporation, and we were kind of quiet over, you know, a couple quarters last year if you know Beezer and then in the last two quarters, I think we've done six net new lead kind of rounds.

All of them are pretty competitive, by the way as well. So what I'm seeing is that at that stage, there's been really not much of a slowdown other than last year for a little bit. And a lot of the multistage firms are popping in everywhere, right? So what is that telling you again, you've got these billion dollar funds and make an option bets all over again, all over the place, Nick, your probably seeing the same thing as well.

And there's two kinds of rounds happening right now, which once again, is kind of, kind of not that different from before. There's that one to $2 million round where the founder just wants to test things out. And then there's that 5 million plus round the five to $8 million round for that second or third time founder. And so from my perspective, the we'll call it the pre-A round market is as robust as ever. I'd say the challenge for many companies is that there's been a lot of seed companies that have been funded that just don't have the traction to get a round done, right, because investors are really looking for kind of that momentum when they come and write a check. And I think there's gonna be a lot of companies that are stuck, so they're gonna be stuck with either existing seed firms, writing extension checks, to maybe buy more ownership in their best winners, or having that hard conversation of like, Hey, if you can't get a round done, we should probably think about you know, how to find a home.

So those things are all happening concurrently. And you know, the backlog in terms of meetings when I talked to some later stage investors their all jammed for the next two weeks already. These meetings were set up a couple of weeks ago, and so everyone's already kind of getting into the queue. So there's a lot of activity right now. But as I said, from the seat perspective, it is as robust as ever

There is so much more depth and some spicy takes when it comes to what happens to all of the overpriced, inefficient 🦄, can an AI fund raise capital from LPs, and how LPs look at DPI being manufactured vs. TVPI and digging into what’s real.

The conclusion is that the market is one of the haves and have nots - it’s pretty binary. Here’s one more clip on why it’s easier for multi-stage firms to write checks into net new cos super early vs. coming into one of the dozens of seed funded startups that are doing ok, but not great - the tweeners are the ones where seed funds need to figure where to put the chips on table and go all in or help find a soft landing - clip here.

Switching gears and back to one of my favorite topics, sales, this post from Ryan at RepVue shows how hard it is for reps at smaller companies to hit quota, especially in these economic times as buyers are consolidating vendors and looking to buy from the safe choice. This is also why I go back to my point from a previous post - if you want to hire the best reps as Rep 1, 2, and 3, you have to pay them. Set lower quotas, higher commissions and adjust over time.

More on paying your early reps and how to set the right bar:

What's 🔥 in Enterprise IT/VC #355

Founders as everyone recognizes that PLG is not magic + you eventually need to sell, do yourself a favor and don't be cheap w/your first sales reps.

Set a lower quota so they can make lots 💰💰💰.

On plan, let them double their base or more w/upside + kickers. Adjust quotas over time as you build more repeatability but kiss of death is thinking that higher quota in your financial model equals higher sales - models aren't real life.

If things go right, you want your startup to be place where best sales folks want to join vs. being branded as the place to never make money.

As always, 🙏🏼 for reading and please share with your friends and colleagues. Also 🙏🏼 for my friends in Israel for peace and a swift end to this conflict.

Scaling Startups

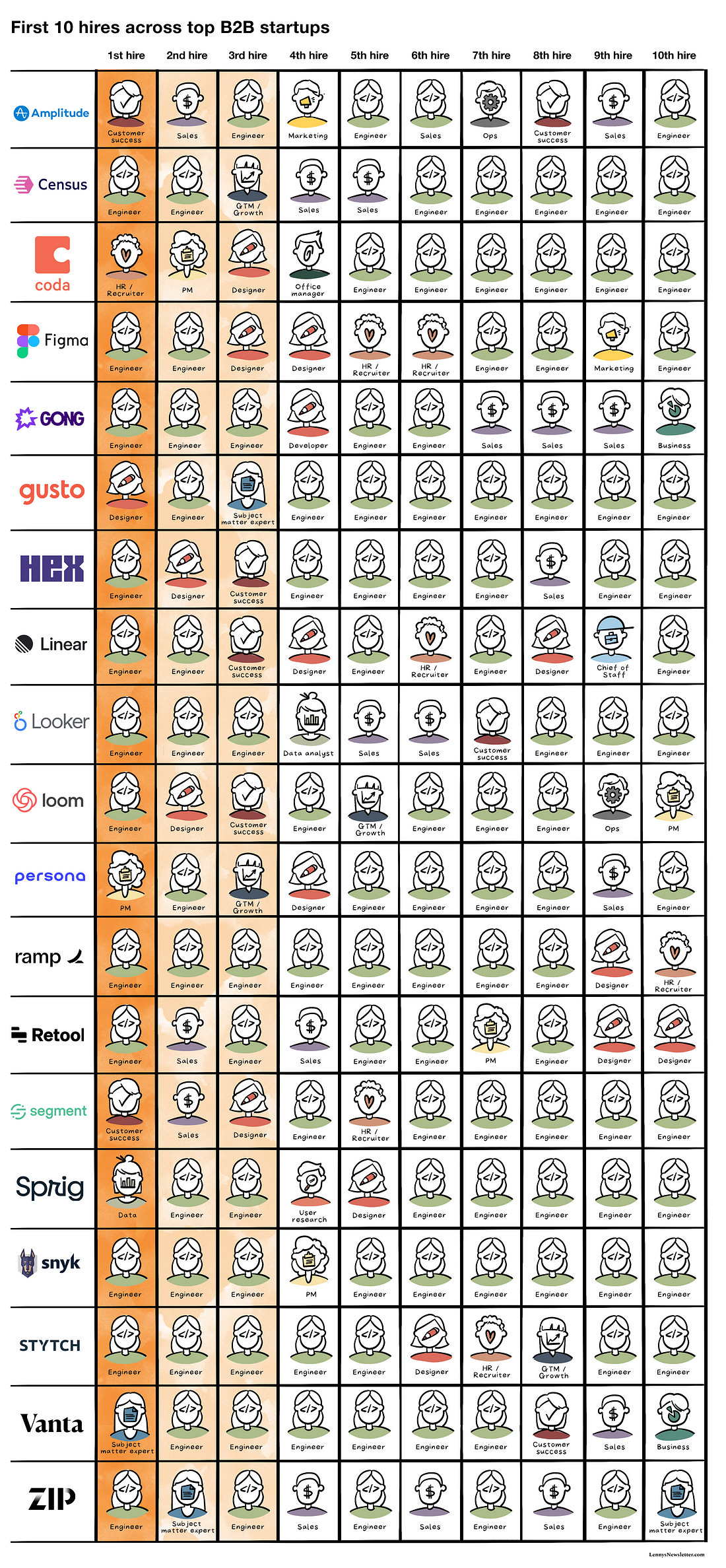

👇🏼 1st 5 hires, then next 5 mission critical for startup success + setting culture. Who r they? I also spy our @Boldstartvc Operating Partner @anna_debenham

as #4 hire @snyksec as product - great to have her on team + sharing knowledge from inception to scale w/founders.

Must read from Lenny Rachitsky and here’s a clip on that from the Origins podcast on default first 10 back in office, not every day, but at least a few days a week!

Our Operating Partner Anna Debenham mentioned above crushes it with another post in her boldstart DevFirst Founders Toolkit in helping founders how to prioritize feature requests and avoid recency bias

Enterprise Tech

Great benchmarking data for cloud software cos from Iconiq’s Growth Enterprise Five - I pulled a few relevant slides - as you look at quarterly trends just think that many thought that these charts would continue growing 📈 in perpetuity.

YoY ARR Growth for >$100M down from peak of 85% to 45% 🤯

Look at trend for cos >$100M as Median NDR has dropped from 135% to 109%

If you’re looking to AI-enable an enterprise app, I highly recommend starting with Phillip Carter’s straight talk on his experience launching Query Assistant for Honeycomb in the Observability space - All the Hard Stuff Nobody Talks About When Building Products with LLMs). Cool part is now we have the results in his latest post - “So We Shipped an AI Product, Did it work?.

Like many companies, earlier this year we saw an opportunity with LLMs and quickly (but thoughtfully) started building a capability. About a month later, we released Query Assistant to all customers as an experimental feature. We then iterated on it, using data from production to inform a multitude of additional enhancements, and ultimately took Query Assistant out of experimentation and turned it into a core product offering. However, getting Query Assistant from concept to feature diverted R&D and marketing resources, forcing the question: did investing in LLMs do what we wanted it to do?

The short answer is... mostly. Query Assistant correlates with some extremely positive activation metrics and it’s inexpensive to run, thanks to OpenAI’s reasonable pricing. However, it doesn’t correlate strongly with every product activation metric we hoped it would, and although adoption is higher than we thought it would be, it isn’t as high as we hoped it could get. Overall though, it continues to be a worthy addition to the Honeycomb platform and we’re excited to continue investing in LLMs moving forward. Let’s dig into a few lessons learned, insights captured, and things we’ll continue to tweak!

What’s time to certain ARR milestones for median SaaS cos vs BVP $100M ARR Centaurs?

On the heels of Hashicorp changing its OSS licensing, OSS co Pulumi just raised a $41M Series C round to build the best Infrastructure as Code platform

We’ve had a year of exciting milestones – surpassing 150,000 end users in our community, 2,000 customers, and 100 employees – and look forward to many more to come. The future is full of cloud, and yet incredibly bright!

Over 2,000 customers have chosen Pulumi Cloud for their infrastructure as code needs. Many more companies build on our open source, including over half of the Fortune 50. And we estimate that our community recently surpassed 150,000 happy and productive end users.

Regarding OSS, 🔑 point is that Pulumi was thoughtful and intentional from start about relationship between OSS and commercial…which in this case means Cloud

We also bet big on open source. Open source is in our entire team’s DNA. We honestly felt it was table stakes that something so fundamental to how we write code and build platforms be open source. This builds trust, helps to foster an ecosystem and community of openness, and enables new scenarios that we couldn’t have even imagined. We paired our open source technology with a great Pulumi Cloud SaaS that 2/3rds of our end users elect to use simply because it’s the easiest, most reliable, and most secure way to adopt Pulumi at scale. Because we were very thoughtful, intentional, and smart about the relationship between our open source and commercial products, we can stand confidently by our open source heritage forever.

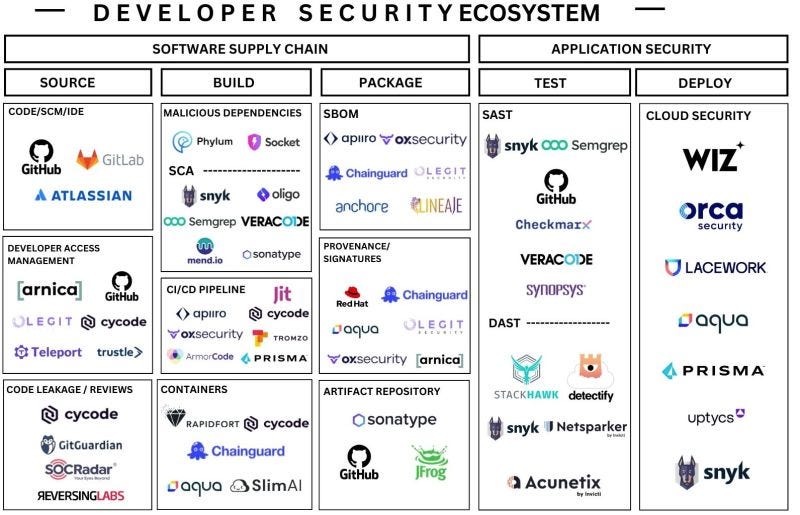

Francis Odum shares his well researched market map for the Developer Security Ecosytems - great to see a few boldstart portfolio cos on this with Snyk in multiple categories, Slim in Containers and Jit in CI/CD

🤯 Clorox Warns of a Sales Mess After Cyberattack (WSJ)

Cleaning giant says quarterly sales will drop at least 23% and it will post a deep loss after intrusion disrupted its business

This is absolutely massive - here’s the raw data from the filing:

AI Security in spotlight as NSA to Open AI Security Center

"AI security is about protecting AI systems from learning, doing and revealing the wrong thing," he said.

"We must build a robust understanding of AI vulnerabilities foreign intelligence threats to these AI systems and ways to encounter the threat in order to have AI security," he said. "We must also ensure that malicious foreign actors can't steal America's innovative AI capabilities to do so."

Markets

Must watch interview with legendary investor Howard Marks - Interest rates - sea change - easy money era over - good listen to remind us what macroeconomic issues drive capital allocation from bonds, stocks, and alternative assets

The two Honeycomb posts about building with LLM's are some of the more honest takes on that experience that I've seen. I'm currently a founding member at a generative AI startup, and I've been working with ML since 2018, when I started leading an ML solutions team at AWS. My co-founders (who are experts in NLP and have been working with state of the art neural network architectures like transformers for many years) have long said that the future will be smaller LLM's trained for specific purposes. This is exactly what my company is doing, and it greatly reduces the complexity of prompt engineering and retrieval augmented generation because you can show the model many specific examples during pre-training, instruction training and fine-tuning. This means you don't have to put examples into the prompt itself, which greatly reduces the impact of context window limits. Of course, training LLM's (even ones with far fewer parameters than the models from OpenAI, Google, or Anthropic) is hard, so many companies are going to have to build on the 3rd party foundational models, at least in the near term.

Thanks for including the time to ARR chart.

Downloadable slides with it + more are here:

https://www.saasletter.com/p/saas-benchmarks-historical